Executive summary:

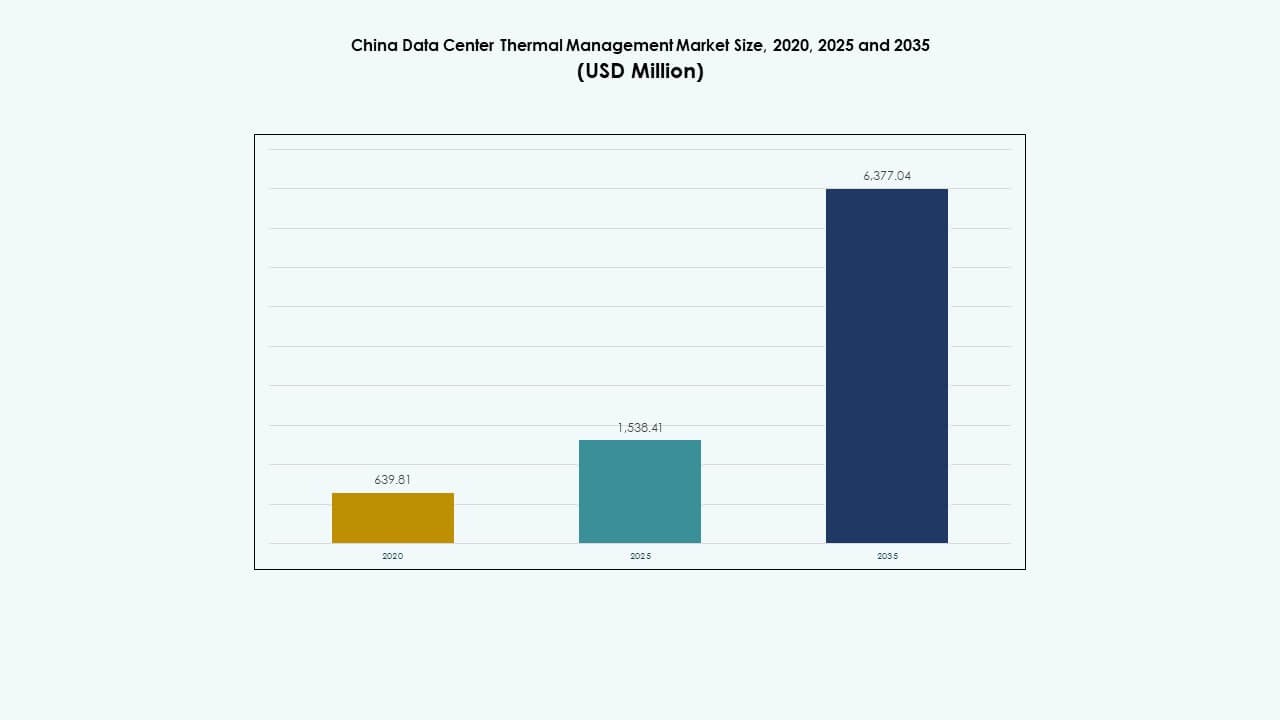

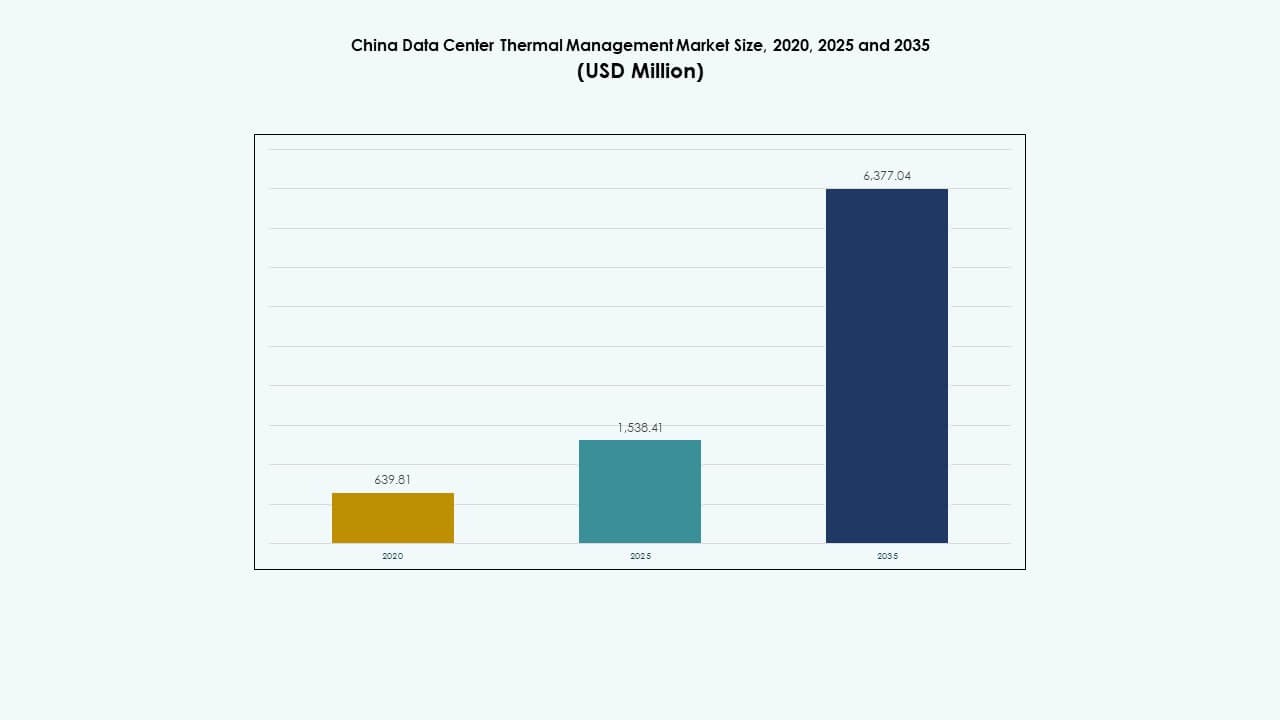

The China Data Center Thermal Management Market size was valued at USD 639.81 million in 2020, increased to USD 1,538.41 million in 2025, and is anticipated to reach USD 6,377.04 million by 2035, at a CAGR of 15.10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| China Data Center Thermal Management Market Size 2025 |

USD 1,538.41 Million |

| China Data Center Thermal Management Market, CAGR |

15.10% |

| China Data Center Thermal Management Market Size 2035 |

USD 6,377.04 Million |

Growing deployment of high-density AI and HPC servers is transforming the thermal landscape across China’s digital infrastructure. Government policies enforcing lower PUE thresholds push operators to adopt liquid cooling, hybrid systems, and AI-powered airflow optimization tools. Hyperscale facilities increasingly integrate direct-to-chip and immersion cooling to control rising power loads. The market gains further momentum from the “Eastern Data, Western Computing” policy, which redirects compute demand to climate-friendly inland provinces. These shifts drive long-term strategic relevance for thermal solution providers and investors.

Eastern China dominates the market due to its dense concentration of enterprise and colocation data centers. Cities like Beijing, Shanghai, and Hangzhou lead adoption due to digital transformation, AI deployments, and regulatory pressure. Western and northern provinces such as Guizhou and Inner Mongolia emerge as thermal innovation zones due to colder climates and renewable energy access. Southern hubs like Shenzhen and Guangzhou remain key due to ongoing hyperscale cloud expansion and urban edge deployments.

Market Dynamics:

Market Drivers

Strong Policy Push for Energy Efficiency and National PUE Targets Across Tier I and Tier II Data Centers

The China Data Center Thermal Management Market benefits from a clear regulatory push aimed at reducing energy consumption. National mandates such as the MIIT’s 2021 action plan enforce an average PUE of below 1.5 by 2025. Data centers in Beijing and Shanghai face even stricter city-level targets. Operators have adopted high-efficiency cooling systems to comply with these evolving norms. Liquid and hybrid cooling technologies gain traction across hyperscale projects. Local governments incentivize the integration of renewable energy and sustainable design. These policies create significant commercial opportunity for thermal system manufacturers. It helps investors identify stable revenue pipelines tied to compliance-driven upgrades. Businesses operating in the space gain strategic advantage by aligning with government directives.

- For example, China’s green data center action plan mandates that newly built large and ultra‑large data centers must achieve a PUE below 1.3 by 2025, encouraging the use of advanced cooling technologies and energy‑efficient designs. This requirement aligns with national targets to improve data center energy performance and reduce carbon intensity.

Adoption of High-Density Compute Loads Driven by AI and HPC Workloads Across Major Chinese Hubs

The surge in artificial intelligence, machine learning, and high-performance computing pushes thermal infrastructure limits. GPU-dense server racks emit significantly more heat compared to legacy systems. China’s cloud majors and AI start-ups are scaling large training clusters across core regions. To maintain thermal stability, data centers deploy advanced cooling such as immersion and direct-to-chip systems. Traditional air cooling fails to meet efficiency benchmarks for these AI-dense environments. Market vendors innovate rapidly to support 20–30 kW per rack density scenarios. The China Data Center Thermal Management Market grows alongside rising heat load densities. These technology shifts create demand for adaptive, modular, and scalable thermal systems. Investors find value in firms with strong liquid cooling capabilities.

Expansion of Hyperscale Data Center Investments Under National “Eastern Data, Western Computing” Strategy

China’s national strategy decentralizes compute load from coastal cities to interior provinces. Provinces like Gansu, Guizhou, and Inner Mongolia are attracting hyperscale projects with favorable power pricing and land availability. These new data center hubs require purpose-built cooling designs suited for colder climates and lower humidity. Operators implement ambient air economizers and rear-door heat exchangers for energy-efficient performance. The relocation trend reduces pressure on coastal power grids and aligns with renewable power integration. The China Data Center Thermal Management Market evolves to support large-scale, region-specific cooling deployments. This geographic rebalancing expands the vendor ecosystem and drives demand for region-optimized thermal hardware. Strategic investors seek to back suppliers positioned near inland hyperscale zones.

- For instance, China’s “Eastern Data, Western Computing” initiative establishes national computing hubs in western provinces to shift data processing away from the east. These hubs leverage renewable energy and cooler climates to improve energy efficiency and support stricter PUE targets.

Integration of Smart Controls and AI-Driven Optimization Systems for Cooling Performance Enhancement

Thermal management now extends beyond hardware and includes software-defined intelligence. China’s leading colocation and enterprise players adopt AI-driven cooling platforms that manage energy dynamically. Systems such as DCIM, BMS modules, and CFD tools analyze airflow and automate fan speeds. These tools improve thermal efficiency while reducing power costs. Real-time sensors capture rack temperatures, and predictive analytics fine-tune cooling load allocation. The China Data Center Thermal Management Market benefits from this convergence of IT and OT systems. Software-defined infrastructure transforms traditional cooling into an adaptive, intelligent system. It creates long-term stickiness for vendors offering both hardware and intelligent optimization layers.

Market Trends

Increased Deployment of Rear-Door and In-Rack Liquid Cooling Across High-Performance Facilities

Rear-door heat exchangers and in-rack liquid cooling systems gain popularity in Chinese hyperscale and AI data centers. These setups remove heat at the source, lowering the need for traditional room-wide airflow. They are favored for compute-dense environments where air cooling cannot sustain efficient temperatures. Chinese operators like Alibaba and Tencent implement rear-door systems to support high-density training clusters. These units integrate directly into racks, providing localized heat extraction. The China Data Center Thermal Management Market reflects growing demand for these form factors. They also reduce energy use by minimizing chilled water distribution loss. Their modular nature fits edge and containerized setups.

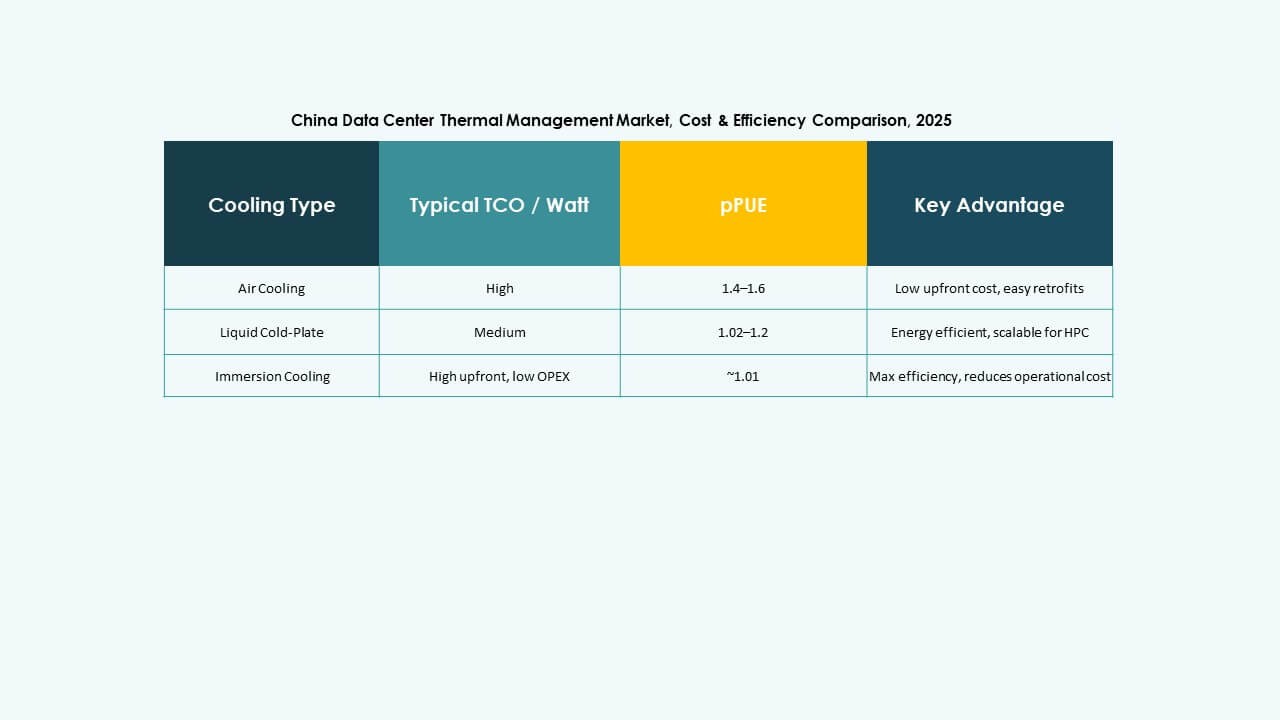

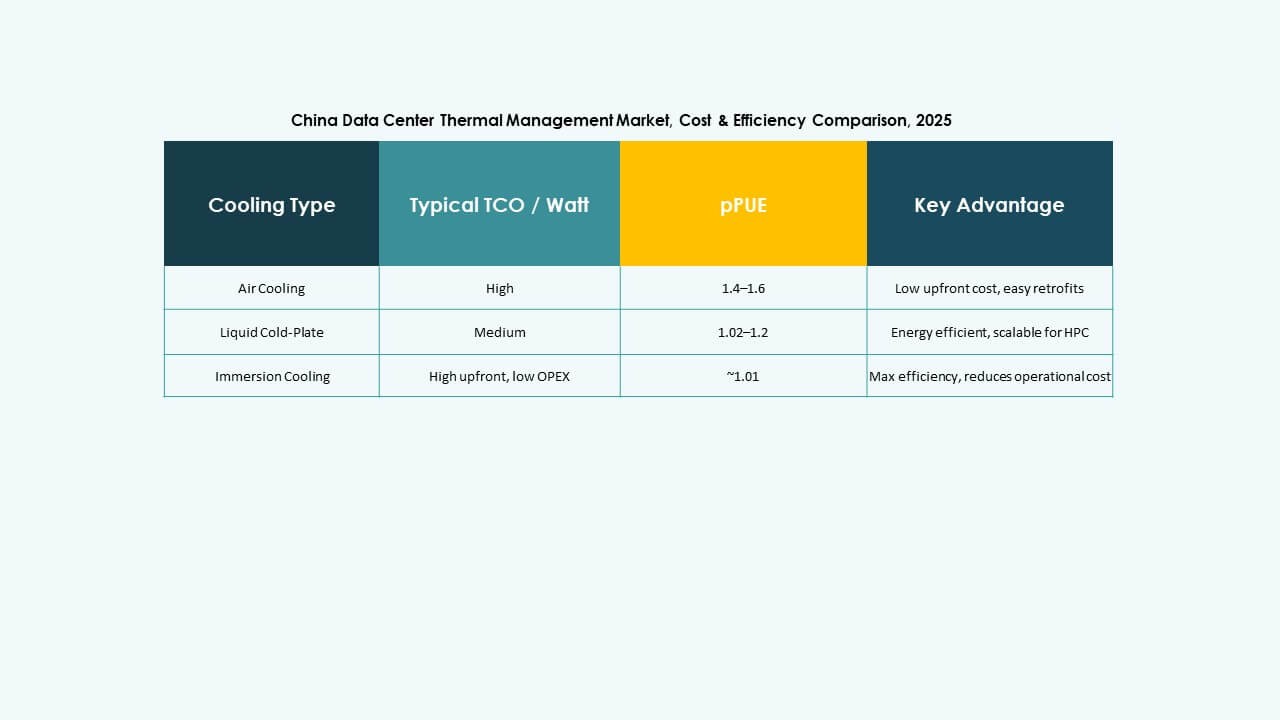

Rising Adoption of Immersion Cooling for Extreme-Density AI and Blockchain Data Centers

Immersion cooling sees increased deployment across high-power environments such as cryptocurrency mining, AI labs, and research centers. Entire servers are submerged in thermally conductive, non-electrically reactive liquids. This method eliminates fans and dramatically improves energy efficiency. Startups and global players enter the market with single-phase and two-phase solutions. China’s blockchain operators favor immersion for lowering OPEX and improving hardware lifespan. The China Data Center Thermal Management Market integrates these designs into hyperscale retrofits. Technical benefits include silent operation and higher power density per square meter. Deployment costs remain high but long-term savings drive adoption.

Smart Thermal Management Platforms That Use Predictive Analytics for Cooling Optimization

AI and machine learning tools enhance the precision of thermal load distribution across large campuses. Predictive models forecast cooling needs based on workload type, time of day, and climate conditions. Operators use these insights to preemptively reduce or increase cooling in specific zones. Integrated platforms control fan speeds, adjust airflow patterns, and track cooling unit performance. The China Data Center Thermal Management Market embraces these software advancements for operational reliability. These systems reduce downtime risk and extend hardware life. Domestic and global firms offer modular software that layers on top of existing infrastructure. Scalability and vendor-neutral design boost their appeal.

Data Center Retrofits Driving Growth in Hybrid Cooling Infrastructure Across Urban Facilities

Urban data centers in China face spatial constraints that limit full cooling system overhauls. Instead, operators adopt hybrid models blending existing air-cooled setups with liquid systems. Direct-to-chip cooling or rear-door exchangers retrofit into racks, improving performance without structural redesign. This trend supports flexible upgrades in cities like Beijing, Guangzhou, and Hangzhou. The China Data Center Thermal Management Market captures this demand through compact and stackable cooling units. Hybrid designs offer a bridge between legacy and next-gen cooling. Vendors supplying modular components stand to gain from this gradual transition. These deployments also help firms meet new regulatory efficiency standards.

Market Challenges

High Initial Capital Expenditure for Liquid-Based and Immersion Cooling Technologies

Liquid cooling systems offer high efficiency but demand substantial upfront investment. Specialized equipment, installation labor, and custom plumbing elevate setup costs. Immersion cooling setups further increase capital requirements with sealed tanks and dielectric fluids. Smaller operators delay adoption due to long ROI timelines. Vendors must offer financing options or phased deployments to ease the burden. The China Data Center Thermal Management Market faces slower penetration among mid-sized data centers due to this barrier. It limits market diversification and keeps advanced systems concentrated among hyperscalers. Cost-sensitive firms hesitate to invest despite long-term energy savings.

Lack of Skilled Technical Workforce for Next-Gen Cooling Deployment and Maintenance

New thermal technologies require specialized training for safe and efficient operation. Field technicians must understand fluid dynamics, pressure regulation, and immersion system handling. China’s data center boom outpaces the training of cooling-focused personnel. Regional players struggle to find talent for complex thermal projects. The China Data Center Thermal Management Market needs stronger collaboration between vendors and vocational institutions. Limited expertise leads to suboptimal installation or inefficient configuration. Delays in project timelines and higher maintenance errors raise operational risk. Bridging this skills gap is essential to support high-density cooling adoption.

Market Opportunities

Western China’s Emerging Data Center Zones Offer Favorable Climate and Renewable Energy Access

New data center corridors in regions like Gansu, Guizhou, and Inner Mongolia offer natural cooling benefits. These areas maintain lower ambient temperatures, reducing dependence on mechanical cooling. Hydropower availability enables low-emission operations. The China Data Center Thermal Management Market finds opportunities to localize thermal systems for these climates. Vendors focusing on passive and ambient cooling gain first-mover advantage. Government support further de-risks project financing in these zones.

Export and Partnership Opportunities with Southeast Asia and Middle East Data Center Operators

Chinese cooling vendors explore outbound opportunities in emerging digital economies. Nations like Indonesia, UAE, and Saudi Arabia seek affordable and scalable thermal systems. The China Data Center Thermal Management Market can export modular hardware and software packages. Partnerships with international colocation firms enable footprint expansion. Regional customization and cost competitiveness drive overseas growth.

Market Segmentation

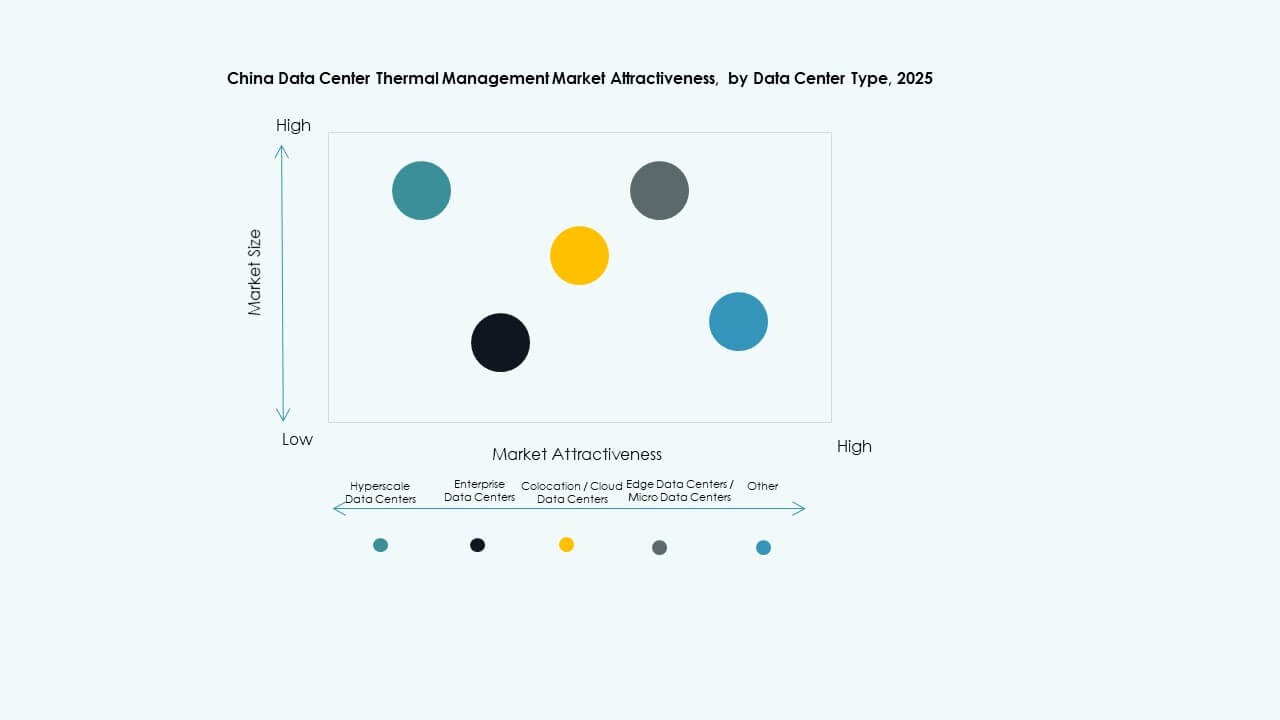

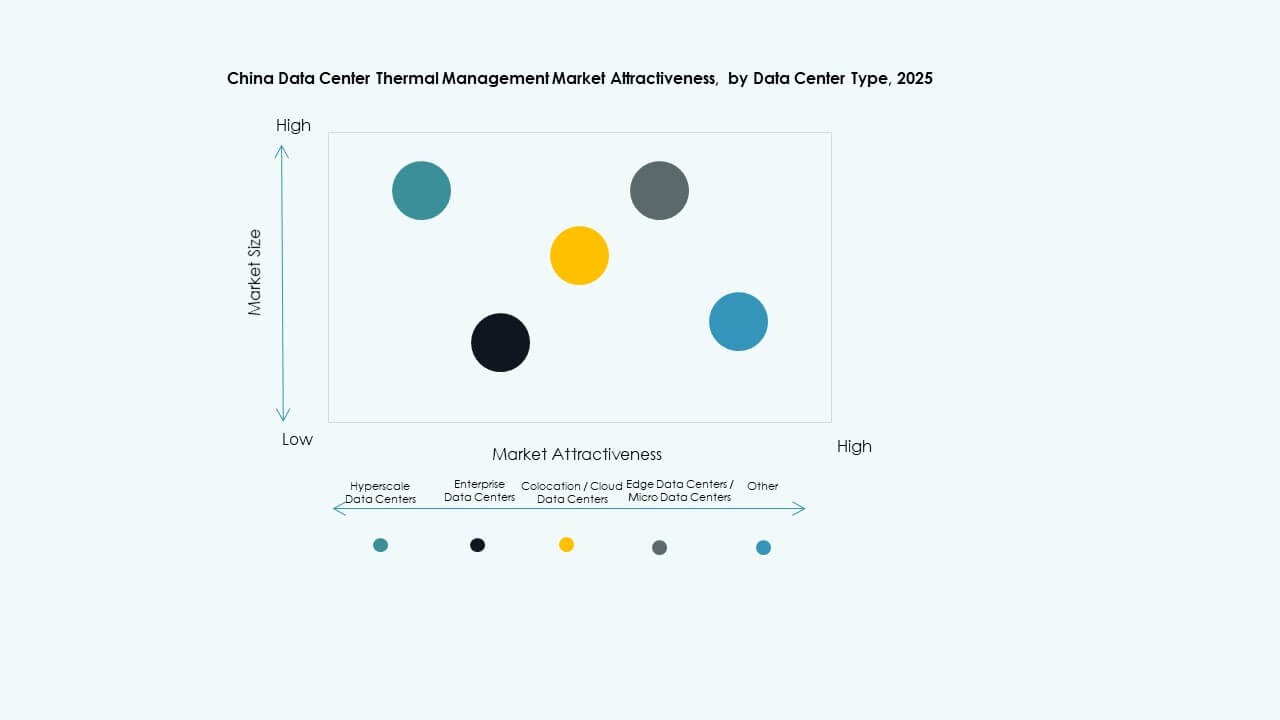

By Data Center Size

Large data centers dominate the China Data Center Thermal Management Market due to hyperscale investments by cloud providers. These facilities operate at 20 kW or more per rack and require high-efficiency, scalable cooling. Medium data centers also grow steadily, driven by enterprise adoption of hybrid cloud strategies. Small data centers contribute less market share but benefit from retrofit-friendly, modular cooling systems supporting urban edge deployments.

By Cooling Technology

Air-based cooling remains dominant in traditional setups, especially hot/cold aisle and direct air solutions. However, liquid-based cooling is growing fast, particularly direct-to-chip and immersion cooling in AI-heavy environments. Hybrid systems gain traction in retrofits and transitional sites. Rear-door liquid cooling is favored for GPU-rich environments, while thermoelectric and phase-change are niche innovations with high potential in edge and micro data centers.

By Component

Hardware leads the segment, accounting for the largest share in the China Data Center Thermal Management Market. Cooling units, fans, and heat exchangers are in constant demand. Software is growing due to DCIM, AI optimization, and CFD tools becoming essential in high-density environments. Services such as commissioning, maintenance, and upgrades gain momentum due to infrastructure aging and changing regulatory demands.

By Hardware

Cooling units and chillers take the highest share, followed by heat exchangers and airflow devices. Fans and piping systems are critical in both legacy and modern builds. Growth is driven by compact, modular hardware solutions. Other components like rack-level coolant loops and variable-speed fans gain demand from performance-driven operators.

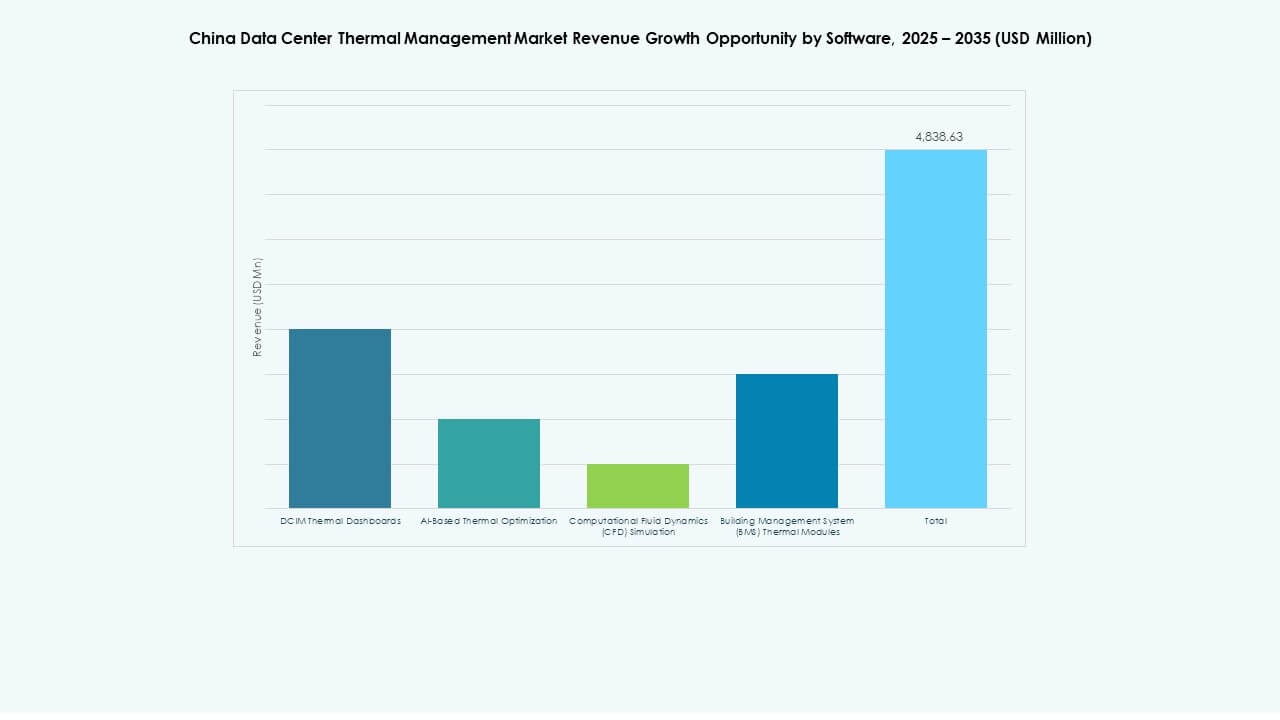

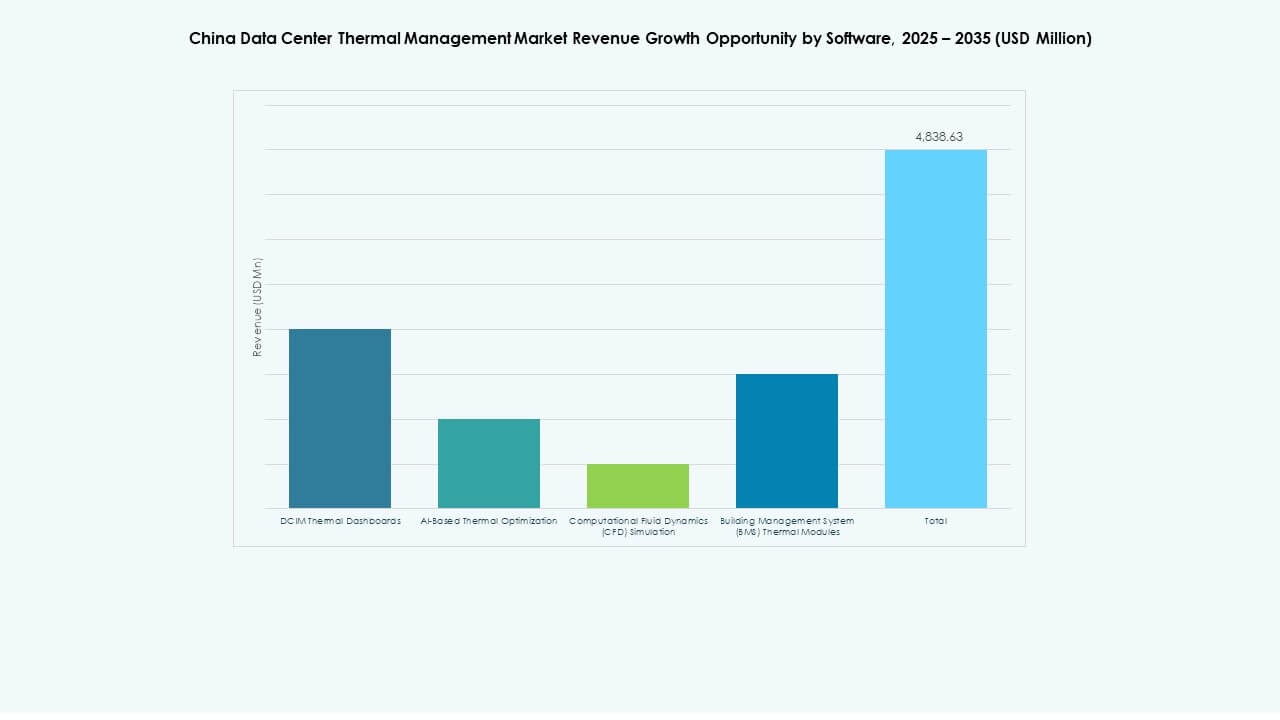

By Software

AI optimization and DCIM dashboards lead software adoption for real-time control and energy savings. CFD simulation is used in design stages for airflow planning. BMS modules are important in smart building integration. Growth is driven by software’s ability to lower cooling cost and improve uptime. It turns passive systems into intelligent networks.

By Services

Preventive maintenance and installation services dominate, especially across hyperscale and urban colocation sites. Retrofits and monitoring as a service grow as operators seek vendor-managed thermal oversight. Upgrades become essential in older sites shifting to AI or cloud applications. Vendors providing bundled service contracts secure recurring revenue.

By Data Center Type

Hyperscale facilities account for the largest share in the China Data Center Thermal Management Market, driven by public cloud expansion. Colocation and cloud data centers follow with steady investments from domestic and foreign providers. Enterprise and edge deployments grow due to AI and IoT adoption in manufacturing and logistics. Other types include government and research facilities with unique thermal needs.

By Structure

Room-based cooling remains common in legacy builds, but rack-based and row-based systems lead in efficiency and space optimization. Rack-based solutions support high-density compute and AI workloads. Row-based systems allow targeted airflow in modular zones. The trend shifts towards structure-integrated systems rather than room-wide setups.

Regional Insights

Eastern China Dominates Market Share Due to High Density of Colocation and Enterprise Data Centers

Eastern China, including provinces like Jiangsu, Zhejiang, and cities like Shanghai and Beijing, accounts for over 40% of the China Data Center Thermal Management Market. These regions host the majority of enterprise IT infrastructure and colocation facilities. High population density, proximity to corporate headquarters, and better connectivity drive concentration. The demand for advanced thermal systems rises with increasing rack densities and low PUE compliance mandates. Major players operate large campuses with AI workloads, pushing the need for advanced liquid and hybrid systems.

- For instance, Castrol and Schneider Electric opened a liquid cooling co-laboratory in Shanghai in April 2025, combining cooling liquids with Cooling Distribution Units to enhance heat dissipation efficiency.

Northern and Southern China Emerge as Growth Zones with Increased Government Support and AI Expansion

Northern regions like Hebei and Tianjin and southern hubs like Shenzhen and Guangzhou jointly hold around 35% market share. These regions benefit from strong tech sector presence and data policy reforms. Southern China sees rapid hyperscale growth, while northern zones align with national compute resource redistribution. Both regions prioritize AI data center rollout, creating demand for high-performance cooling systems. Ambient conditions vary, prompting custom cooling solutions based on local temperature and humidity profiles. Urban retrofit projects in these areas support modular and rack-based thermal designs.

- For instance, Schneider Electric launched its EcoStruxure™ Pod Data Centers in 2025, supporting up to 1 MW per pod with integrated liquid cooling to meet high-density AI cluster requirements. The modular design enhances deployment flexibility for accelerated compute workloads.

Western and Central China Offer Strategic Expansion Potential with Cooling-Friendly Climate Conditions

Western and central provinces such as Guizhou, Gansu, and Chongqing collectively contribute roughly 25% to the China Data Center Thermal Management Market. These areas are targeted in the “Eastern Data, Western Computing” policy for sustainable data processing. Lower ambient temperatures support air economization, while available land eases hyperscale development. Renewable energy availability enhances appeal for green data centers. Operators deploy indirect evaporative and passive cooling systems. Market growth here aligns with national carbon neutrality goals and cross-regional infrastructure investments.

Competitive Insights:

- Vertiv Group Corp.

- Schneider Electric

- Daikin Industries Ltd.

- Delta Electronics, Inc.

- Huawei Technologies Co., Ltd.

- Johnson Controls International plc

- Mitsubishi Electric Corporation

- Munters Group AB

- Rittal GmbH & Co. KG

- Airedale International Air Conditioning Ltd.

The competitive landscape in the China Data Center Thermal Management Market shows strong rivalry among global and local players with diverse expertise. Vertiv and Schneider maintain high share through comprehensive thermal portfolios tailored to hyperscale customers. Daikin and Delta focus on energy efficient hardware and local service networks. Huawei integrates thermal solutions with digital infrastructure stacks for enterprise clients. Johnson Controls and Mitsubishi Electric bring broad HVAC capabilities into data center segments. Munters and Rittal serve niche high‑density needs with modular systems. Airedale pushes product upgrades in mid‑sized facilities. Firms invest heavily in R&D to refine liquid, hybrid, and AI‑enabled controls. Partnerships with cloud and colocation firms drive installation pipelines. Players also pursue service contracts to secure recurring revenue streams and enhance client retention.

Recent Developments:

- In November 2025. Daikin Applied, a unit of Daikin Industries Ltd., acquired Chilldyne, a specialist in negative pressure liquid cooling for high-performance AI data centers. The deal complements prior acquisitions and bolsters Daikin’s portfolio for hyperscale data centers with direct-to-chip cooling integration.

- In November 2025, LG Electronics partnered with Flex to co-develop modular cooling solutions combining LG’s air and liquid cooling infrastructure with Flex’s power and IT systems. This collaboration targets thermal challenges in AI-era gigawatt-scale data centers.

- In November 2025, Eaton Corporation signed a definitive agreement to acquire Boyd Thermal, a leader in high-performance liquid cooling, for $9.5 billion. The acquisition addresses surging AI data center heat demands by merging Boyd’s cooling tech with Eaton’s power management expertise.

- In August 2025. Daikin Industries Ltd. acquired Dynamic Data Centers Solutions, Inc. (DDC Solutions), a leader in innovative cooling technologies for AI data centers. This move enhances Daikin’s competitiveness in the data center market by integrating DDC’s server rack-level air conditioning and real-time power management systems.

- In March 2025, Schneider Electric unveiled NVIDIA-joint reference designs for 132 kW liquid-cooled AI racks, supporting high-density computing in China’s growing data center infrastructure.