Executive summary:

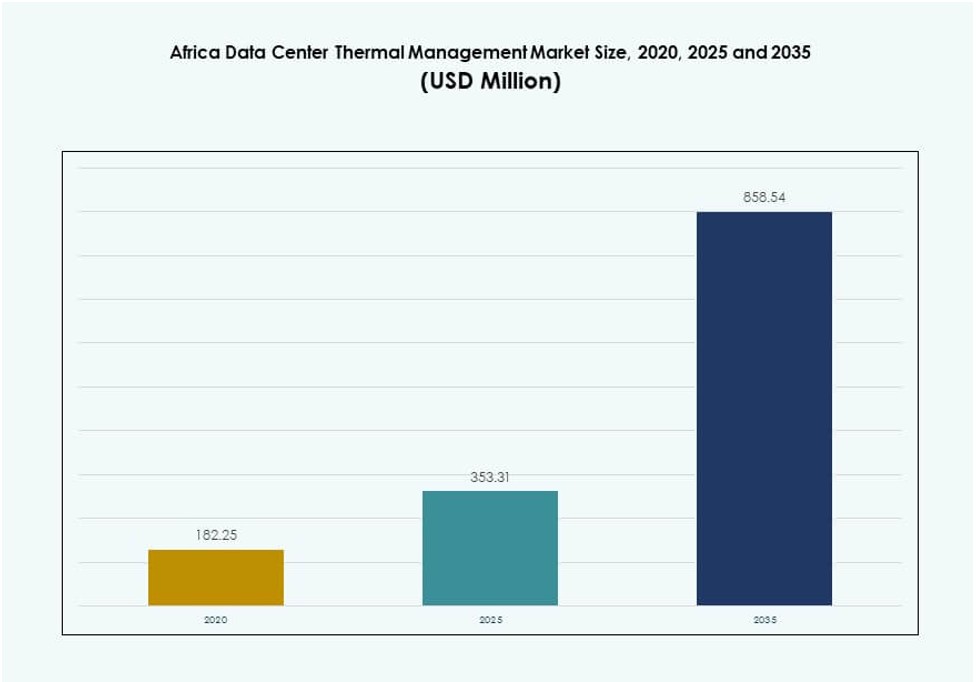

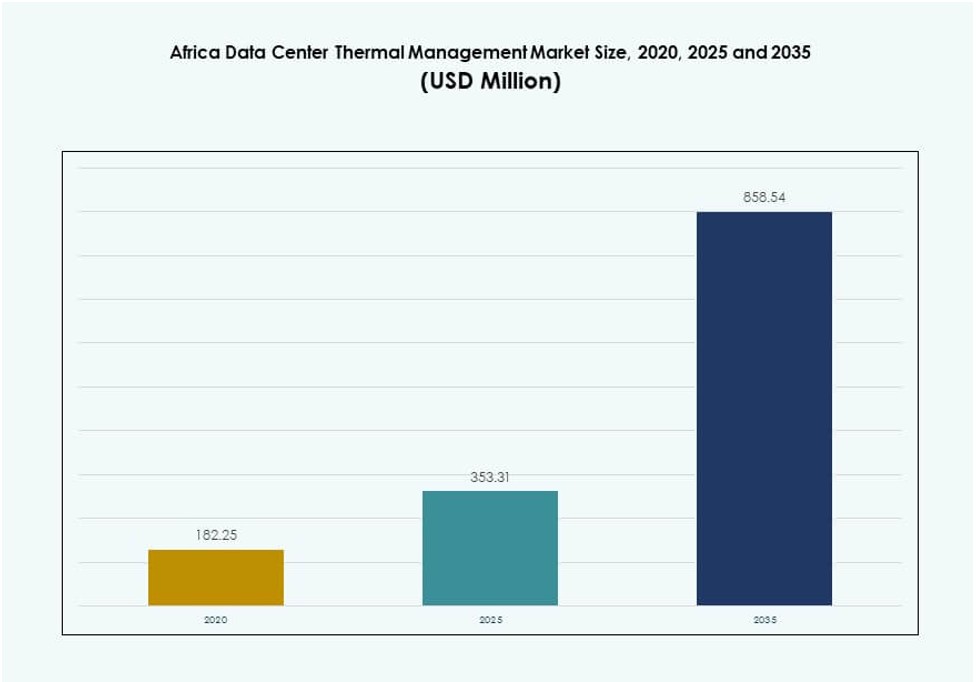

The Africa Data Center Thermal Management Market size was valued at USD 182.25 million in 2020 to USD 353.31 million in 2025 and is anticipated to reach USD 858.54 million by 2035, at a CAGR of 9.30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Africa Data Center Thermal Management Market Size 2025 |

USD 353.31 Million |

| Africa Data Center Thermal Management Market, CAGR |

9.30% |

| Africa Data Center Thermal Management Market Size 2035 |

USD 858.54 Million |

The market is driven by rising investments in hyperscale and colocation data centers, requiring advanced cooling solutions to handle increasing rack density and AI workloads. Operators are shifting toward liquid-based and hybrid systems to improve energy efficiency and uptime. AI-driven thermal automation and modular cooling technologies are gaining traction, aligning with sustainability mandates and operational resilience. This evolution supports long-term cost savings and enhances infrastructure scalability, making the market attractive to global investors and regional enterprises seeking competitive digital infrastructure.

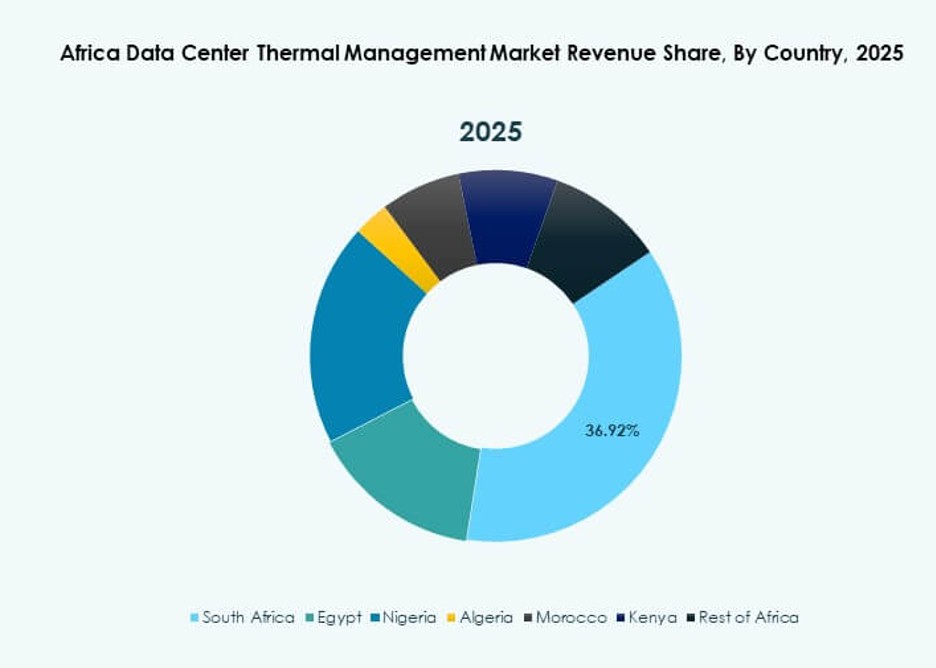

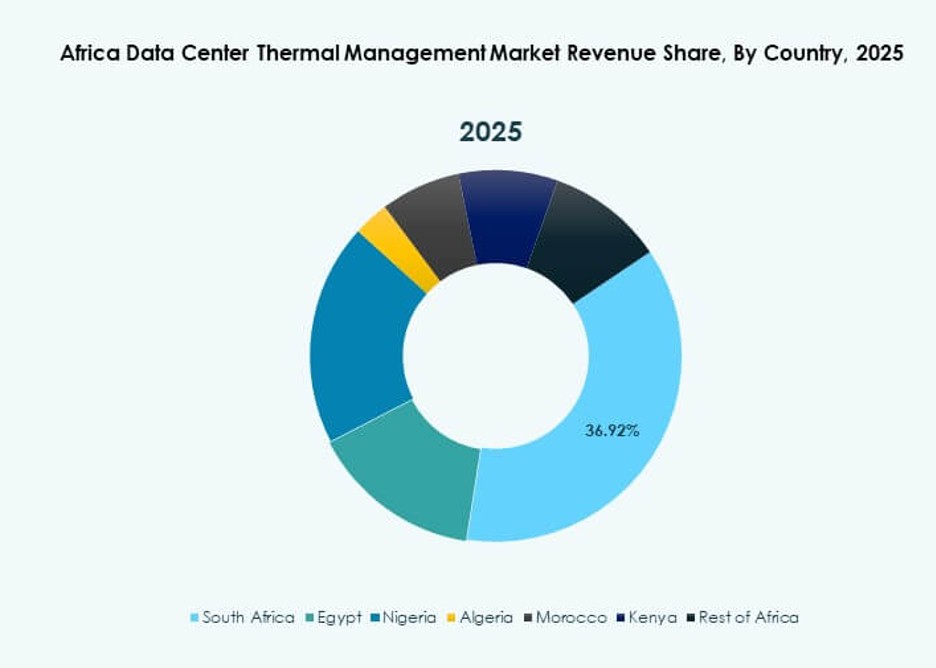

South Africa leads due to its mature data center landscape and strong connectivity infrastructure. Nigeria and Kenya are emerging hubs backed by government digitalization agendas and enterprise cloud adoption. Egypt shows growing traction due to regional positioning and strategic investments. These countries attract major players due to favorable regulatory frameworks, rising demand for local hosting, and increasing data sovereignty needs across the continent.

Market Dynamics:

Market Drivers:

Expansion Of Hyperscale And Colocation Data Center Footprints Across Africa

Rising cloud demand drives hyperscale expansion across major African economies. Global operators build facilities to serve regional workloads. Colocation providers expand capacity to meet enterprise outsourcing needs. These facilities demand efficient thermal control systems. High rack density increases cooling complexity. Operators prioritize reliability under variable grid conditions. The Africa Data Center Thermal Management Market supports stable uptime targets. Investors view this expansion as long-term infrastructure growth. Businesses benefit from scalable digital platforms.

- For instance, Teraco (Digital Realty) starting construction of the JB7 data center in November 2024 with 40 MW critical power capacity via 68 MVA utility supply. Colocation providers expand capacity to meet enterprise outsourcing needs.

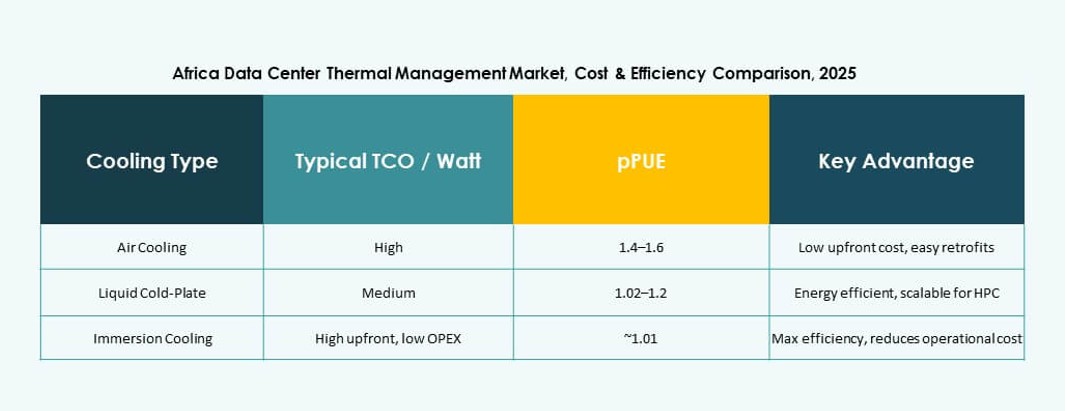

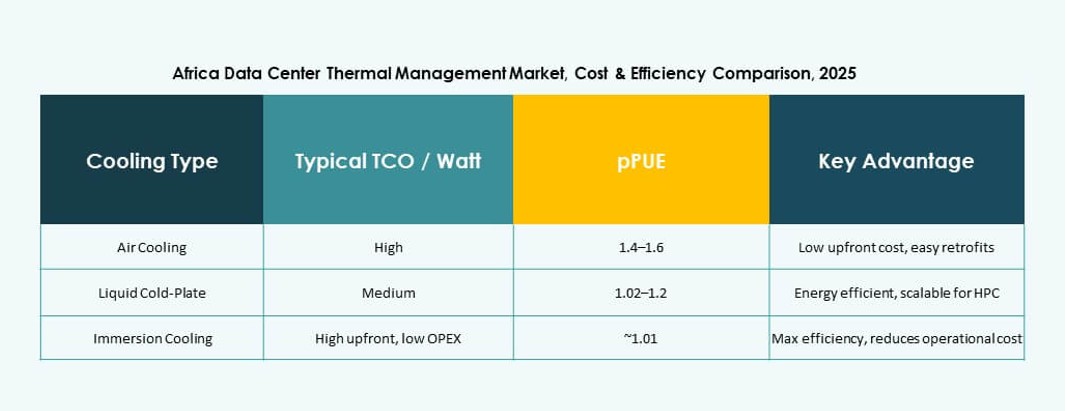

Rising Power Cost Sensitivity And Focus On Energy Efficiency Improvements

Electricity cost volatility pressures data center operating budgets. Operators seek cooling systems with lower power draw. Free cooling gains relevance in suitable climates. Advanced airflow management improves thermal efficiency. Liquid cooling adoption supports higher compute density. The Africa Data Center Thermal Management Market enables cost control strategies. Energy efficiency supports margin protection for operators. Investors favor assets with predictable operating expenses.

Technology Adoption Supporting High-Density And AI-Ready Infrastructure

AI workloads increase heat output per rack. Traditional air cooling faces performance limits. Direct-to-chip and immersion solutions gain attention. Modular cooling designs support phased expansion plans. Automation improves thermal response accuracy. The Africa Data Center Thermal Management Market aligns with AI infrastructure needs. Technology readiness attracts global cloud investment. Enterprises gain performance stability for critical workloads.

Regulatory Pressure And Sustainability Commitments Across Digital Infrastructure

Governments promote energy efficiency standards for data centers. Sustainability targets influence infrastructure design choices. Cooling systems play a central compliance role. Water-efficient technologies gain strategic relevance. Operators report carbon metrics to global clients. The Africa Data Center Thermal Management Market supports ESG alignment. Sustainable assets attract institutional capital. Businesses gain reputational and regulatory advantages.

- For instance, Equinix expanded its LG2.3 data center in Lagos in April 2025, enhancing colocation capacity to support Nigeria’s growing digital infrastructure needs and enterprise cloud adoption.

Market Trends:

Shift Toward Modular And Scalable Cooling Architectures

Operators prefer modular cooling for phased capacity growth. These systems reduce upfront capital exposure. Deployment speed improves project timelines. Standardized modules simplify maintenance planning. Scalability supports uncertain demand patterns. The Africa Data Center Thermal Management Market reflects this structural shift. Vendors design flexible solutions for mixed workloads. Investors value adaptable infrastructure models.

Growing Preference For Hybrid Cooling System Configurations

Facilities combine air and liquid cooling approaches. Hybrid models balance cost and performance needs. Operators optimize systems by workload type. Retrofit potential increases asset lifespan. The Africa Data Center Thermal Management Market supports hybrid integration strategies. This trend reduces technology lock-in risk. Enterprises gain operational flexibility. Vendors expand multi-technology portfolios.

Increased Use Of Intelligent Software For Thermal Optimization

Software-driven controls improve cooling precision. AI-based tools predict thermal load changes. DCIM platforms integrate energy and cooling data. Automation reduces manual intervention needs. The Africa Data Center Thermal Management Market benefits from software penetration. Operational visibility improves decision quality. Investors favor data-driven operations. Operators achieve consistent performance outcomes.

Localization Of Cooling Manufacturing And Service Capabilities

Regional assembly reduces equipment lead times. Local service teams improve uptime response. Cost structures benefit from reduced imports. Partnerships strengthen regional supply chains. The Africa Data Center Thermal Management Market supports localized ecosystems. Governments encourage domestic capability development. Operators gain faster support access. Vendors improve market responsiveness.

Market Challenges:

Infrastructure Constraints And Grid Instability Affecting Cooling Reliability

Power instability disrupts cooling system performance. Backup systems increase capital intensity. Heat stress rises during grid interruptions. Operators must overdesign thermal redundancy. The Africa Data Center Thermal Management Market faces reliability planning challenges. Equipment wear increases under unstable conditions. Investors assess operational risk carefully. Businesses require resilient cooling architectures.

High Initial Capital Costs And Limited Technical Skill Availability

Advanced cooling systems require high upfront investment. Financing remains a constraint for smaller operators. Skilled technicians remain in short supply. Training programs require time and funding. The Africa Data Center Thermal Management Market must address capability gaps. Installation errors increase operational risk. Vendors invest in training partnerships. Market growth depends on skill development.

Market Opportunities:

Expansion Of Edge And Micro Data Centers Across Secondary Cities

Edge deployments increase across underserved regions. Smaller facilities need compact cooling solutions. Modular systems fit constrained spaces. The Africa Data Center Thermal Management Market benefits from edge growth. Telecom and cloud firms drive this opportunity. Latency reduction supports digital services. Investors see distributed infrastructure value. Vendors tailor solutions for edge environments.

Adoption Of Renewable-Integrated And Water-Efficient Cooling Technologies

Renewable energy integration supports sustainable operations. Water scarcity drives dry cooling interest. Innovative designs reduce environmental impact. The Africa Data Center Thermal Management Market aligns with green infrastructure goals. Governments support sustainable investment models. Operators gain long-term cost stability. Investors favor climate-resilient assets. Technology providers expand green portfolios.

Market Segmentation:

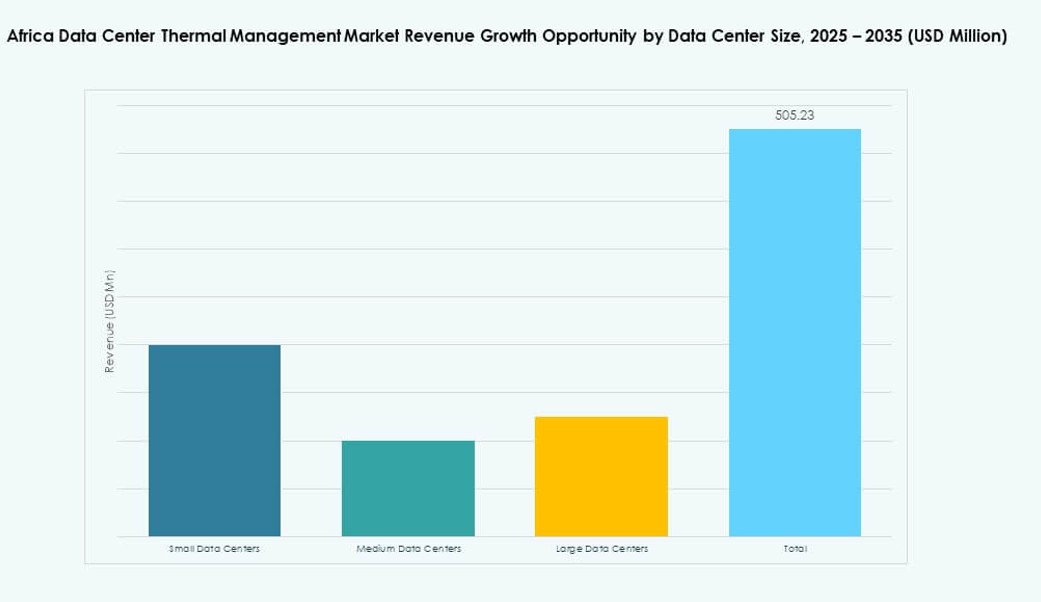

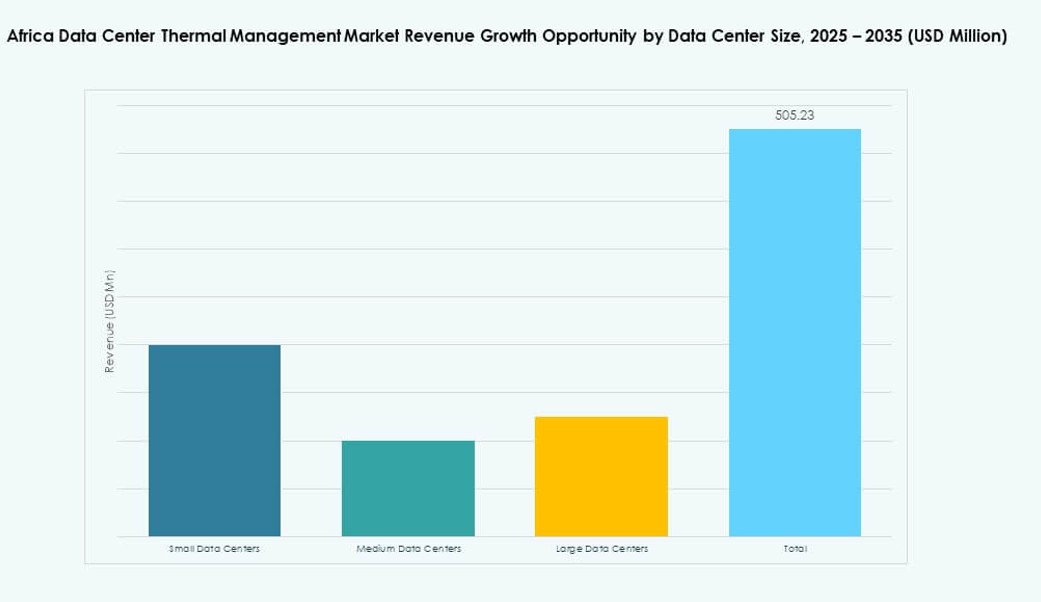

By Data Center Size

Small and medium data centers hold a strong share due to enterprise and edge demand. Large facilities lead capacity additions in hyperscale projects. The Africa Data Center Thermal Management Market sees faster growth in medium-sized facilities. Cost efficiency and modular design drive adoption. Smaller sites favor simplified cooling layouts. Large centers adopt advanced liquid systems. Investment flows favor scalable size categories. Growth aligns with digital service expansion.

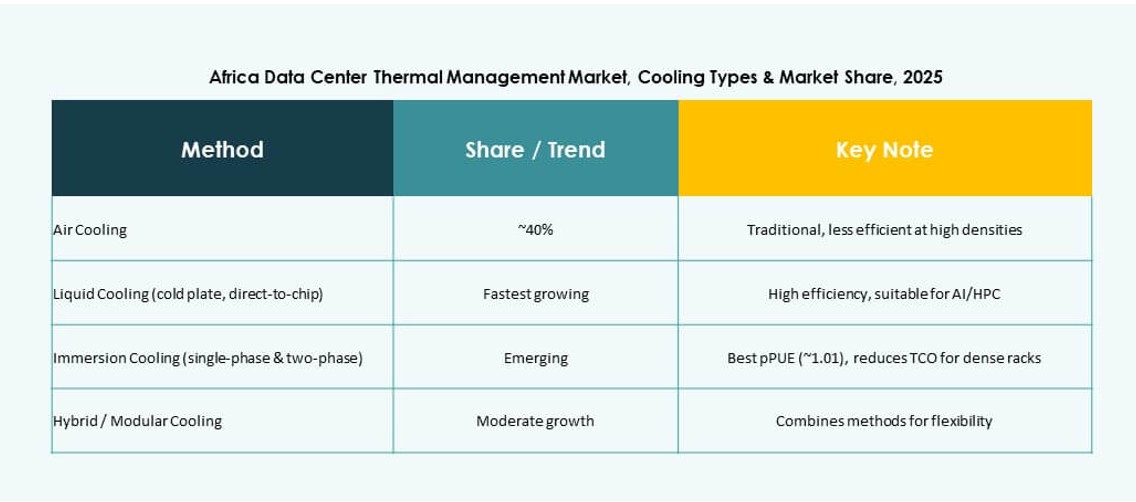

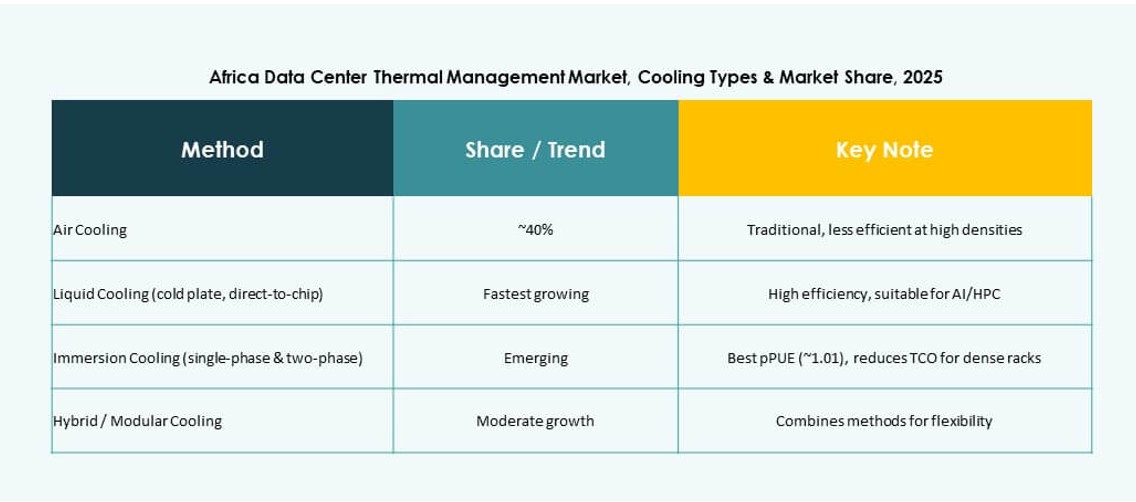

By Cooling Technology

Air-based cooling dominates existing installations due to lower cost. Liquid-based cooling gains share with high-density workloads. Hybrid systems grow fastest across new builds. The Africa Data Center Thermal Management Market reflects mixed technology adoption. Direct-to-chip supports AI deployments. Immersion remains niche but rising. Climate diversity influences technology choice. Efficiency needs shape adoption trends.

By Component

Hardware accounts for the largest revenue share. Software adoption rises with automation needs. Services gain importance during upgrades. The Africa Data Center Thermal Management Market shows balanced component demand. Cooling units lead hardware spending. AI software improves operational control. Service contracts ensure uptime stability. Component integration drives value creation.

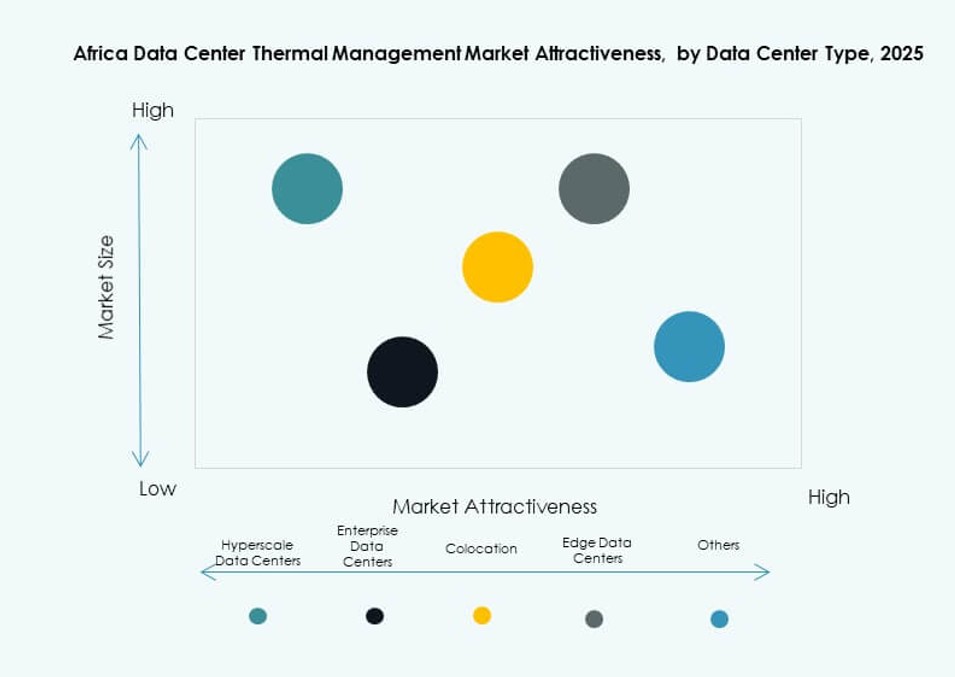

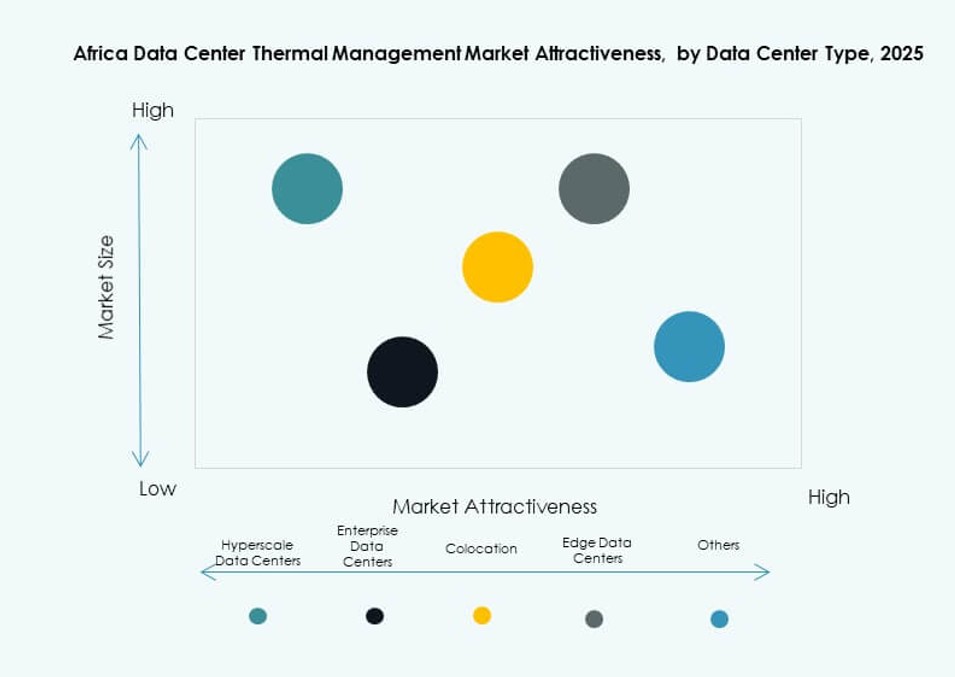

By Data Center Type

Colocation and cloud centers dominate market share. Hyperscale projects drive advanced cooling demand. Enterprise centers maintain steady upgrades. The Africa Data Center Thermal Management Market benefits from diversified demand. Edge facilities grow rapidly in urban clusters. Each type requires tailored cooling strategies. Investment aligns with cloud growth. Technology choice varies by use case.

By Structure

Rack-based cooling leads due to density control. Row-based systems support modular expansion. Room-based setups remain common in legacy sites. The Africa Data Center Thermal Management Market transitions toward rack-focused designs. Precision cooling improves efficiency. Structural choice affects capex planning. Operators favor scalable layouts. Design flexibility supports long-term growth.

Regional Insights:

Southern Africa

Southern Africa holds around 35% market share. South Africa leads due to mature infrastructure. Cloud and colocation hubs concentrate in key metros. The Africa Data Center Thermal Management Market benefits from stable demand here. Power efficiency remains a core focus. Operators invest in advanced cooling upgrades. Investors favor predictable regulatory environments.

West Africa

West Africa accounts for nearly 30% market share. Nigeria leads with rapid digital adoption. New data centers support fintech and telecom growth. The Africa Data Center Thermal Management Market expands with urban demand. Cooling solutions address heat and power challenges. International players enter through partnerships. Growth remains strong across coastal hubs.

- For instance, MainOne’s MDXi Lagos data center uses climate‑optimized cooling systems designed for Nigeria’s hot and humid conditions. The facility supports high‑density enterprise and cloud workloads and serves global hyperscalers through carrier‑neutral infrastructure.

East And North Africa

East and North Africa together hold about 35% share. Kenya and Egypt lead regional expansion. Connectivity projects drive facility development. The Africa Data Center Thermal Management Market gains from strategic locations. Cooling systems support regional data traffic flows. Government support improves investment confidence. Emerging markets show high long-term potential.

- For instance, IXAfrica’s Nairobi data center features energy-efficient cooling infrastructure engineered to support rack densities of up to 30 kW, enabling performance at scale amid rising digital demand in East Africa.

Competitive Insights:

- Vertiv Group Corp.

- Schneider Electric

- Huawei Technologies Co., Ltd.

- Trane Technologies plc

- Daikin Industries Ltd.

- Delta Electronics, Inc.

- Johnson Controls International plc

- Airedale International Air Conditioning Ltd.

- Samsung SDS

- Africa Data Centres

The Africa Data Center Thermal Management Market features intense competition among global OEMs, regional infrastructure providers, and specialized cooling vendors. Vertiv, Schneider, and Huawei lead in air and liquid cooling deployments, while Trane and Daikin support large-scale HVAC systems. Local players and hyperscale data center operators collaborate to customize systems for hot climates and grid variability. AI-based thermal software is becoming a key differentiator. Companies with retrofit capabilities, remote diagnostics, and modular product lines gain traction across small and medium facilities. The market favors firms with regional assembly, faster service response, and compliance with energy efficiency benchmarks. Strategic partnerships and co-engineered solutions further define competitive positioning.

Recent Developments:

- In December 2025, Africa Data Centres partnered with CSSi South Africa to expand cloud and data storage capabilities by integrating CSSi’s high-performance racks and servers into its facilities.

- In November 2025, Orange Morocco launched the “Orange Tech” data center in Casablanca, a 1.5 MW facility equipped for cloud services, AI processing, cybersecurity, and sovereign cloud options.

- In May 2024, Rittal developed a modular cooling system in collaboration with multiple hyperscale data center operators, targeting efficient thermal management solutions for the Africa Data Center Cooling Market.