Executive summary:

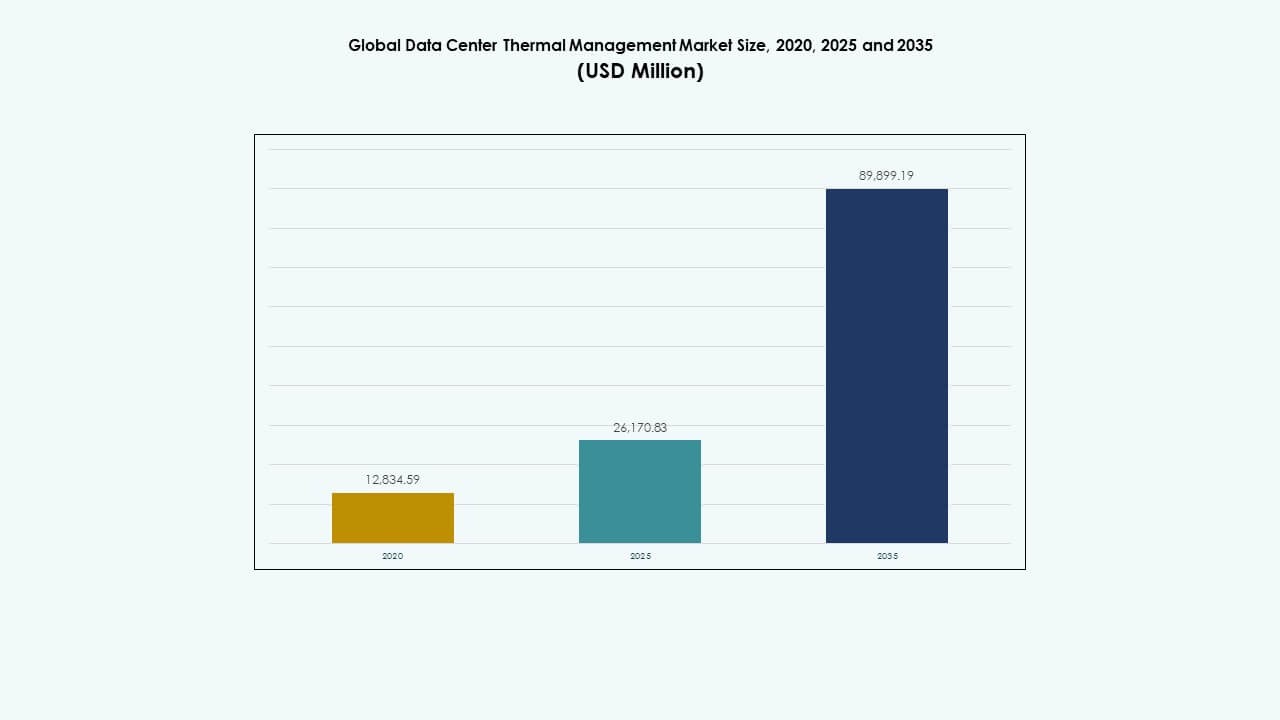

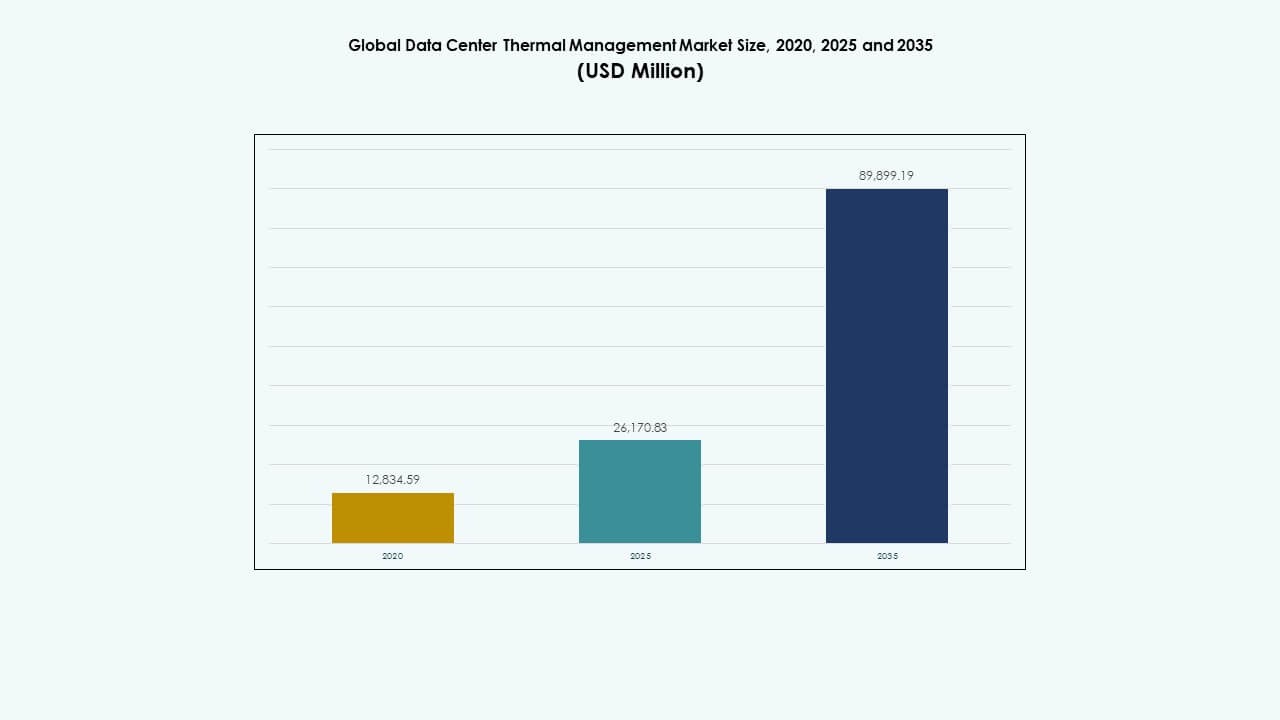

The Global Data Center Thermal Management Market size was valued at USD 12,834.59 million in 2020 and USD 26,170.83 million in 2025 and is anticipated to reach USD 89,899.19 million by 2035, at a CAGR of 13.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Data Center Thermal Management MarketSize 2025 |

USD 26,170.83 Million |

| Data Center Thermal Management Market, CAGR |

13.06% |

| Data Center Thermal Management Market Size 2035 |

USD 89,899.19 Million |

Rapid adoption of high-performance servers and edge computing fuels demand. Efficient thermal solutions avoid overheating and downtime. Innovations in liquid cooling, aisle containment, and AI-guided HVAC systems improve energy use and capacity. Greater sustainability goals push investors toward efficient cooling infrastructure. Growth in hyperscale data centers gives strategic value to thermal management vendors. This trend favors both operators and cloud service providers.

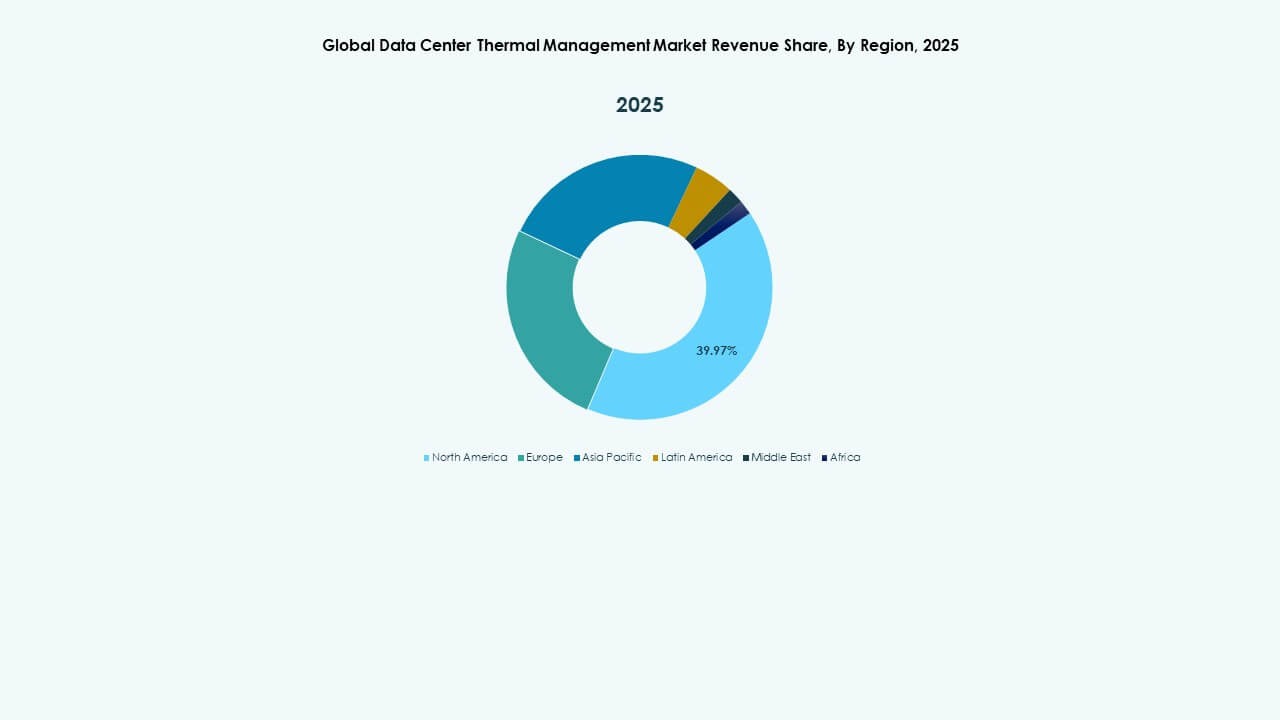

North America leads market thanks to large cloud operators and established data infrastructure. Europe remains stable with upgrades in existing centers. Asia Pacific shows rapid expansion because of rising internet use and green data center projects in India and Southeast Asia. Middle East and Africa emerge slowly as regional cloud adoption grows. Regional diversity helps spread demand across matured markets. This trend opens global investment potential for providers.

Market Dynamics:

Market Dynamics:

Market Drivers

Rising Density of Data Centers and Need for Efficient Cooling Systems

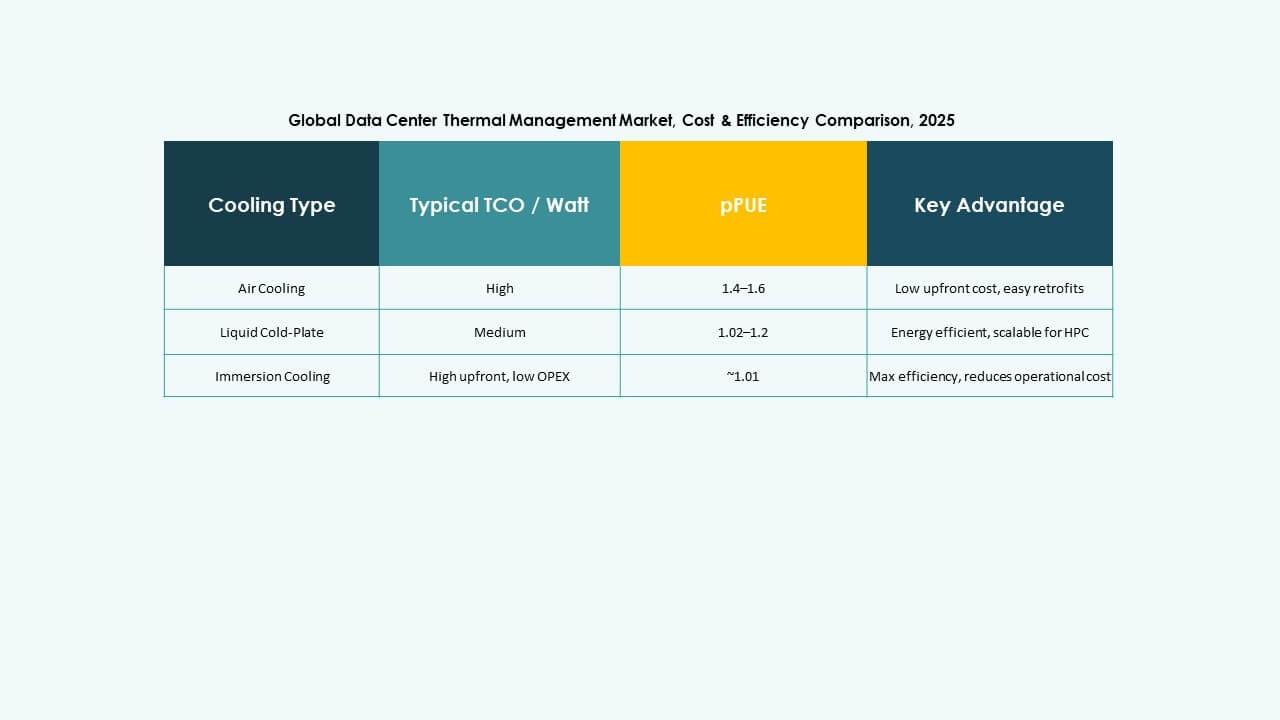

The Global Data Center Thermal Management Market grows with the rising density of high-performance computing and AI servers. It faces rising heat loads that demand advanced liquid and air cooling technologies. Operators focus on reducing power usage effectiveness (PUE) through optimized airflow and smart containment solutions. Companies adopt precision cooling units to maintain stable temperatures across large server racks. The rise of hyperscale and edge facilities pushes efficiency improvements. Liquid immersion and rear-door heat exchangers gain strong traction in energy-conscious regions. This shift lowers operational costs and carbon footprints. Investors view efficiency-focused data centers as resilient, long-term assets. The shift reinforces sustainable technology strategies worldwide.

- For instance, Microsoft began piloting next-generation data centers in August 2024 that use chip-level liquid cooling within a closed-loop system, completely eliminating water use for cooling. These facilities can save over 125 million liters of water per data center each year, supporting Microsoft’s sustainability goals to improve energy and water efficiency in AI-driven operations.

Adoption of Advanced Cooling Technologies Enhancing Energy Optimization

Adoption of AI-integrated cooling systems drives major efficiency gains in modern facilities. Predictive maintenance and IoT sensors support adaptive airflow and real-time monitoring. The Global Data Center Thermal Management Market benefits from greater automation and digital twins that simulate cooling performance. High-density rack environments demand scalable, modular systems that adjust to fluctuating loads. Vendors integrate machine learning to track energy use and detect anomalies. Smart control systems balance humidity and airflow for uniform cooling. These innovations enhance reliability across critical infrastructure networks. Enterprises see direct cost reductions and uptime stability. It ensures steady operational continuity and equipment longevity.

- For instance, Meta’s Prineville data center uses AI-driven cooling systems that dynamically optimize airflow, achieving a Power Usage Effectiveness (PUE) of about 1.09 among the lowest in the industry enhancing energy efficiency through real-time control and thermal optimization.

Sustainability Goals Driving Green Cooling Infrastructure

Global sustainability mandates influence corporate decisions on cooling systems and designs. Data center operators pursue eco-friendly cooling solutions to meet ESG compliance. The Global Data Center Thermal Management Market aligns with renewable integration and carbon reduction targets. Free cooling, liquid immersion, and adiabatic systems cut water and power usage. Firms develop circular models where waste heat powers nearby facilities. Green innovation attracts government incentives and investor interest. These trends position data centers as leaders in environmental technology. Vendors compete to offer sustainable and cost-effective cooling solutions. The shift toward clean energy enhances long-term business resilience.

Expansion of Hyperscale and Edge Facilities Boosting Infrastructure Demand

The expansion of hyperscale and edge data centers fuels the need for agile thermal systems. Edge locations with space constraints rely on compact and efficient units. The Global Data Center Thermal Management Market benefits from hybrid models balancing liquid and air-based technologies. Firms build scalable solutions adaptable to future computing needs. Telecom integration supports low-latency cooling operations at distributed nodes. Modular cooling enables faster deployment in emerging markets. Operators leverage thermal analytics to maintain uptime in remote environments. This expansion reshapes energy planning and operational strategies. The trend supports sustained capital inflows from global investors.

Market Trends

Market Trends

Integration of AI and Machine Learning in Cooling Optimization

AI and machine learning reshape cooling system management through automation and prediction. Smart controls optimize fan speeds and adjust refrigerant flow dynamically. The Global Data Center Thermal Management Market adopts data-driven intelligence to reduce inefficiency. Operators employ digital twins for virtual simulations of thermal dynamics. Predictive models identify equipment stress points before failure. These innovations boost equipment life and minimize energy waste. Vendors integrate cloud-based analytics platforms for real-time monitoring. Automated systems enhance sustainability performance across facilities. The trend reflects the shift toward intelligent infrastructure management.

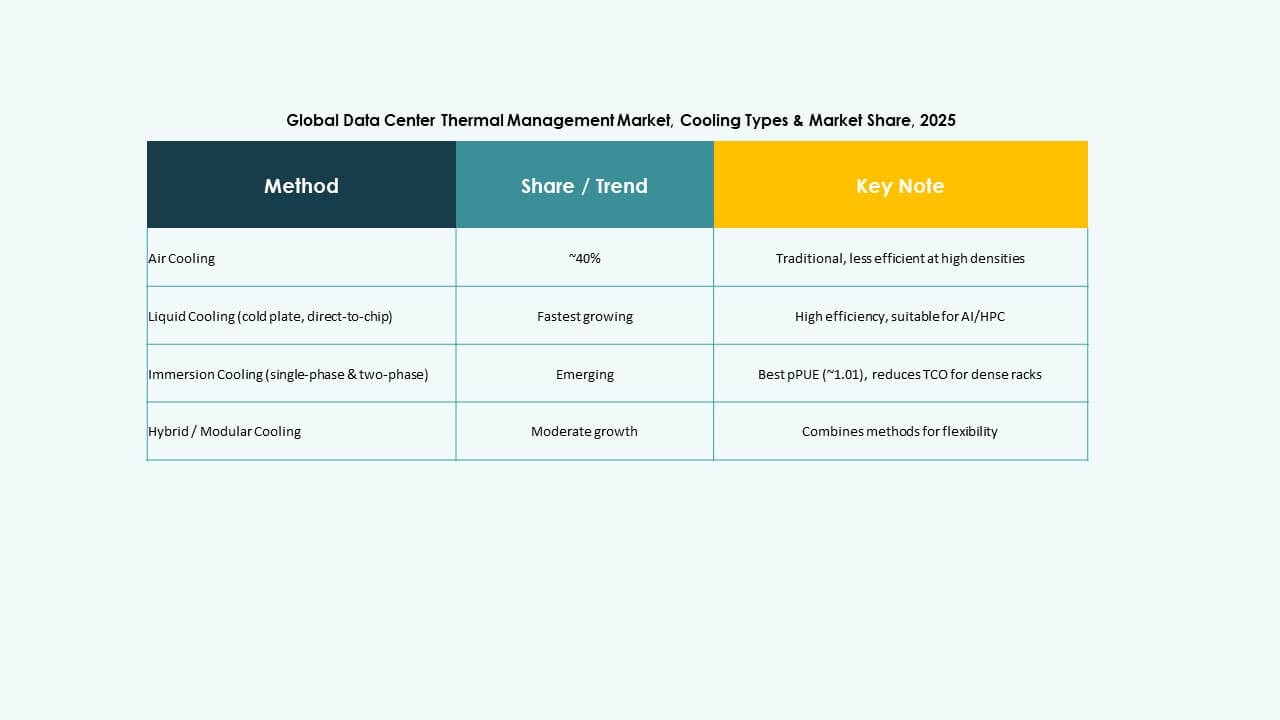

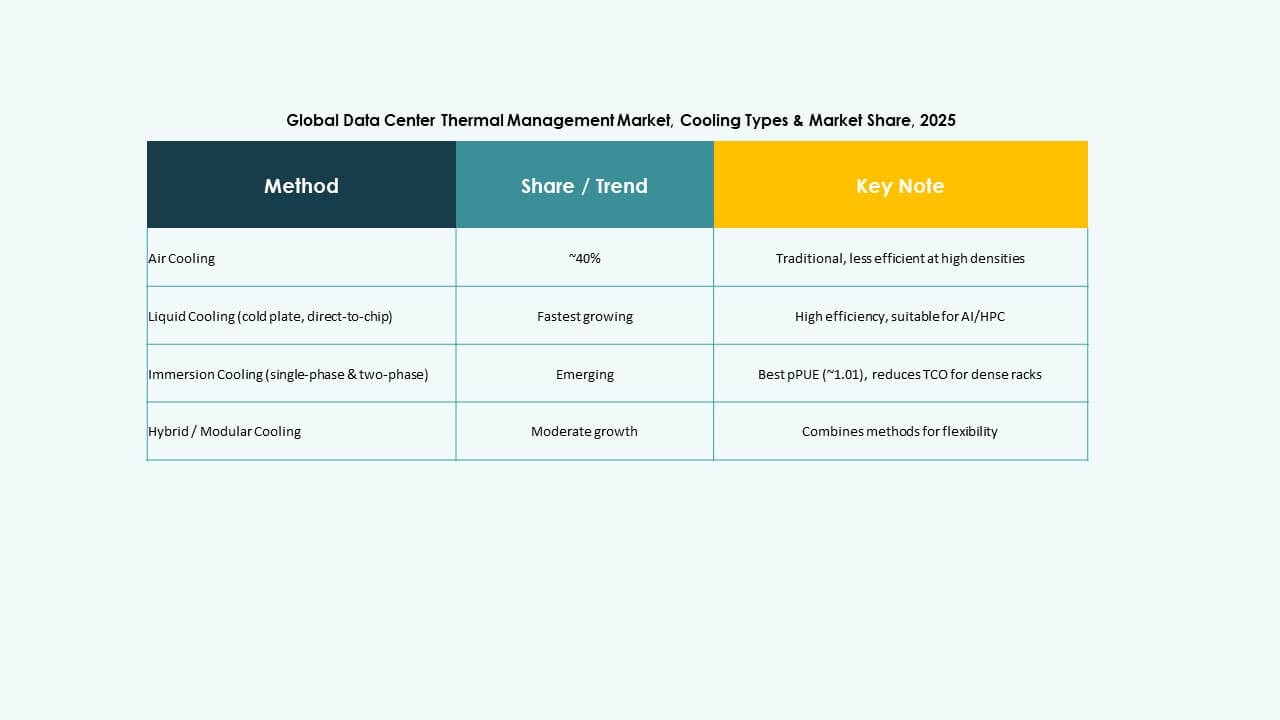

Shift Toward Liquid and Immersion Cooling Technologies

Liquid and immersion cooling technologies replace traditional air-based systems for high-density workloads. Their efficiency in managing intense heat attracts hyperscale operators and AI clusters. The Global Data Center Thermal Management Market gains momentum through this technological transformation. Liquid cooling enables smaller data footprints with greater performance reliability. Manufacturers develop modular immersion tanks for flexible scaling. Reduced water use and noise levels strengthen environmental compliance. Partnerships between hardware and cooling firms expand innovation pipelines. Immersion solutions improve chip performance and minimize thermal throttling. This trend accelerates adoption in HPC and AI-driven centers.

Growing Focus on Modular and Scalable Cooling Solutions

Rapid deployment of digital infrastructure boosts demand for modular cooling units. Prefabricated cooling pods enable faster installation with reduced engineering costs. The Global Data Center Thermal Management Market adapts to distributed and hybrid environments. Enterprises prioritize flexible systems that scale with computing demand. Modular designs simplify upgrades without service interruption. Vendors design compact cooling modules for containerized data centers. The approach reduces total cost of ownership over time. It supports regional deployments across diverse climate conditions. The model ensures consistent performance with evolving IT loads.

Adoption of Renewable-Powered Cooling Infrastructure

Rising energy consumption drives operators to integrate renewables with cooling systems. Facilities source solar, wind, or hydro power to cut grid dependency. The Global Data Center Thermal Management Market reflects this shift through innovative hybrid systems. Thermal storage and geothermal technologies improve efficiency in stable environments. Vendors align with corporate sustainability commitments through clean energy use. Governments promote renewable-linked data centers through tax credits and policy support. Cooling equipment manufacturers adapt designs for lower energy draw. It drives regional partnerships focused on sustainable growth. This movement enhances the environmental reputation of global operators.

Market Challenges

High Initial Investment and Complexity in Integration

Complex design requirements and high capital costs challenge large-scale deployments. Many enterprises struggle with balancing cost efficiency and advanced thermal solutions. The Global Data Center Thermal Management Market faces difficulty due to legacy infrastructure limitations. Integrating liquid or hybrid systems into existing centers requires major retrofits. Budget constraints slow adoption in small and mid-size enterprises. Technical expertise shortages delay smooth implementation. Vendors must offer flexible financing models to reduce entry barriers. The rising cost of materials further impacts adoption timelines. These challenges restrict the pace of modernization in some regions.

Environmental and Regulatory Pressures on Energy Consumption

Stringent emission norms and sustainability reporting requirements create operational pressure. Cooling systems consume a major portion of total data center power. The Global Data Center Thermal Management Market contends with evolving global efficiency benchmarks. Regions impose strict rules on water and refrigerant use. Firms must upgrade equipment frequently to comply with new standards. Non-compliance risks reputational and financial penalties. Achieving carbon neutrality demands large investments in research and technology. Vendors must balance innovation with cost-effective environmental solutions. These factors drive the search for smarter and cleaner cooling options.

Market Opportunities

Market Opportunities

Rising AI, Edge, and HPC Workloads Creating Demand for Thermal Innovation

The growth of AI, machine learning, and edge workloads opens new design opportunities. High-density computing environments demand advanced heat removal methods. The Global Data Center Thermal Management Market benefits from scalable, smart cooling systems. Vendors offering adaptive liquid or hybrid cooling can secure long-term contracts. Edge networks create room for compact modular units across cities. This evolution supports localized and sustainable operations. Innovation in phase-change materials and smart fluids enhances efficiency. Energy-efficient data centers attract new institutional investors. The trend drives collaboration between IT and HVAC specialists.

Government Incentives and Green Infrastructure Investments

Government policies promoting green data infrastructure support strong market prospects. Incentives for low-carbon cooling technologies improve industry profitability. The Global Data Center Thermal Management Market gains traction in countries prioritizing ESG compliance. Public-private partnerships enable technology pilots for next-generation cooling. Utility providers offer rebates for energy-efficient designs. Urban development plans include renewable-powered facilities to lower emissions. These conditions strengthen collaboration among equipment makers and real estate developers. It ensures stable growth in both advanced and developing economies. The policy momentum encourages long-term industry transformation.

Market Segmentation:

Market Segmentation:

By Data Center Size

Large data centers dominate the Global Data Center Thermal Management Market with over 55% market share due to massive computing loads from hyperscale and cloud operations. Their high rack density demands advanced liquid and hybrid cooling systems to control heat efficiently. Medium-sized facilities adopt modular air-based solutions to balance cost and scalability, while small data centers focus on compact and energy-efficient units. The growing number of enterprise expansions and colocation hubs further accelerates demand for flexible, high-capacity cooling infrastructure in large-scale environments.

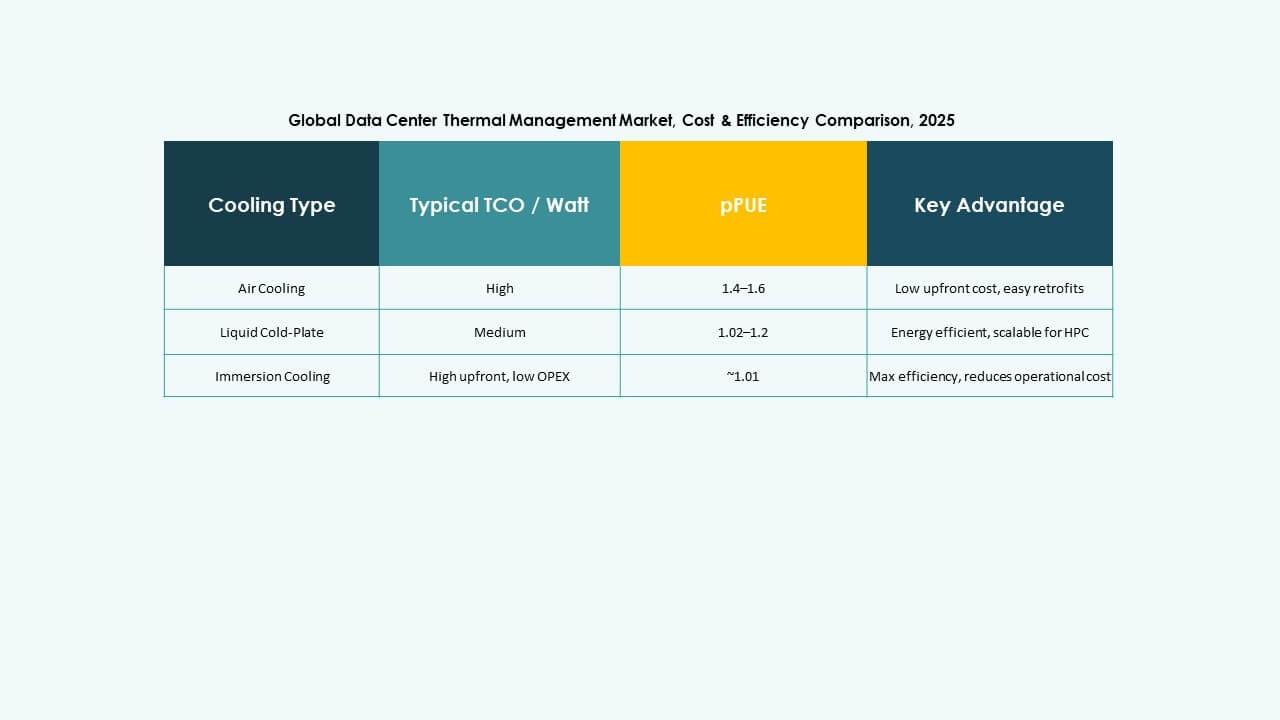

By Cooling Technology

Air-based cooling remains the most widely used technology, holding nearly 48% share of the Global Data Center Thermal Management Market owing to its cost-effectiveness and easy retrofit capability. Liquid-based cooling is the fastest-growing category, driven by increasing deployment in high-performance computing and AI workloads. Immersion and direct-to-chip methods enhance efficiency in dense racks. Hybrid systems combining both air and liquid technologies are gaining traction among hyperscale operators. The shift toward sustainable operations encourages innovation in phase-change and thermoelectric cooling methods for improved thermal control.

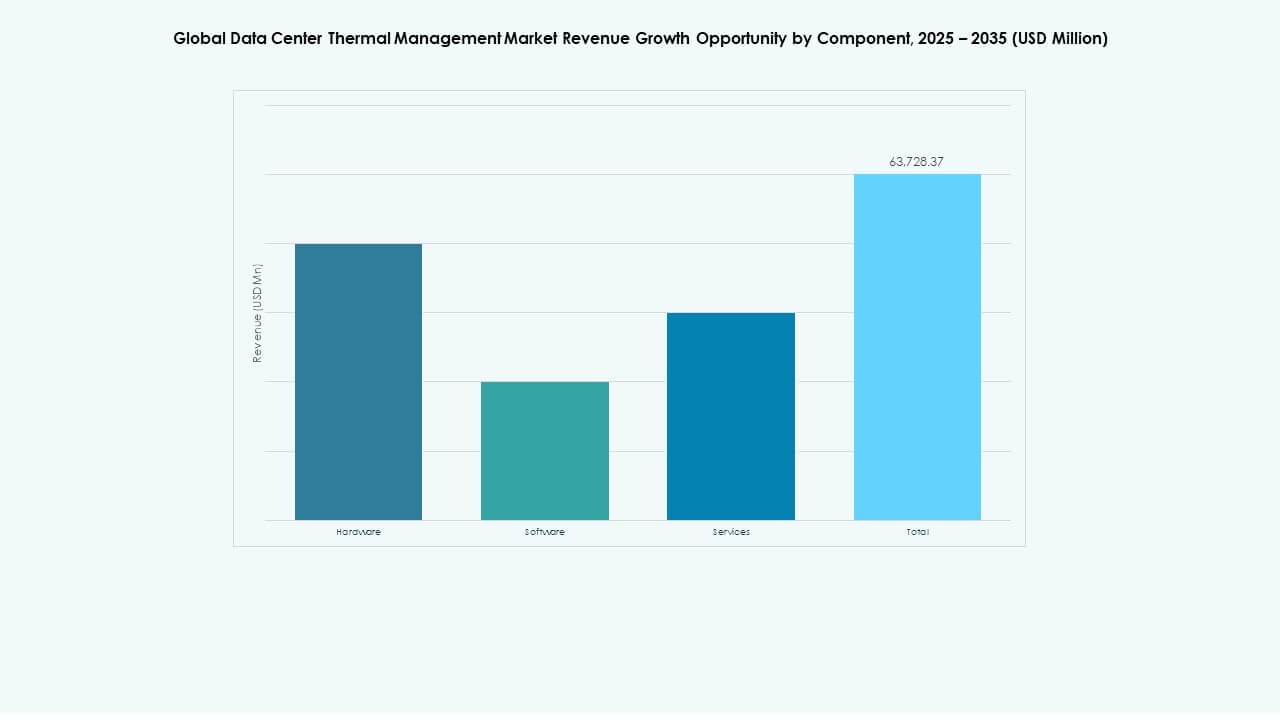

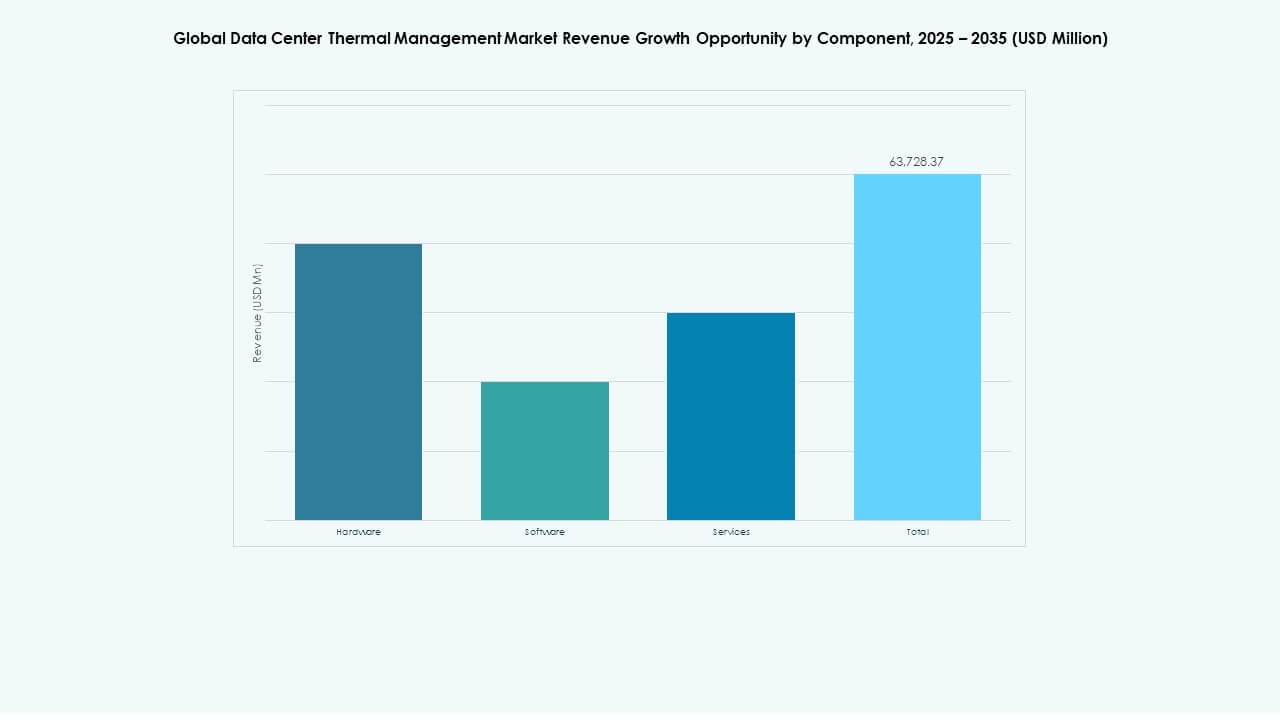

By Component

Hardware components lead the Global Data Center Thermal Management Market with an estimated 60% share due to the extensive use of chillers, heat exchangers, and airflow systems. Rising demand for efficient cooling infrastructure in hyperscale and colocation facilities drives hardware investments. Software solutions are gaining prominence for their role in real-time monitoring and optimization. Service segments such as preventive maintenance and upgrades ensure system longevity. The growing adoption of digital twin and AI-driven software platforms enhances thermal visibility and operational performance across modern data centers.

By Hardware

Cooling units and chillers represent the largest segment within hardware, accounting for nearly 40% of total revenue in the Global Data Center Thermal Management Market. These systems are essential for maintaining consistent operating conditions in large facilities. Heat exchangers and fans contribute significantly to air and liquid cooling configurations. Piping and distribution systems support complex cooling layouts in multi-rack setups. Advancements in compact heat sinks and energy-efficient fan technologies reduce power use. Vendors emphasize modular, scalable hardware to align with evolving data center architectures.

By Software

AI thermal optimization software dominates the software segment in the Global Data Center Thermal Management Market due to its precision in adjusting cooling loads dynamically. DCIM thermal dashboards integrate real-time monitoring and data visualization for operators. CFD simulation tools help design airflow and heat distribution models that enhance planning accuracy. BMS thermal modules coordinate environmental controls within large facilities. The adoption of predictive analytics and machine learning improves fault detection and operational efficiency. Software-based control systems play a central role in achieving sustainable cooling outcomes.

By Services

Preventive maintenance holds the leading position within the service category of the Global Data Center Thermal Management Market. Continuous monitoring ensures stable system performance and reduces downtime risks. Installation and commissioning services remain vital for large-scale deployment. Monitoring as a Service gains popularity with remote management capabilities. Retrofits and upgrades drive long-term efficiency improvements in aging data centers. Vendors increasingly offer customized service packages to extend equipment life and optimize energy use. The service landscape supports operational excellence and regulatory compliance across facilities.

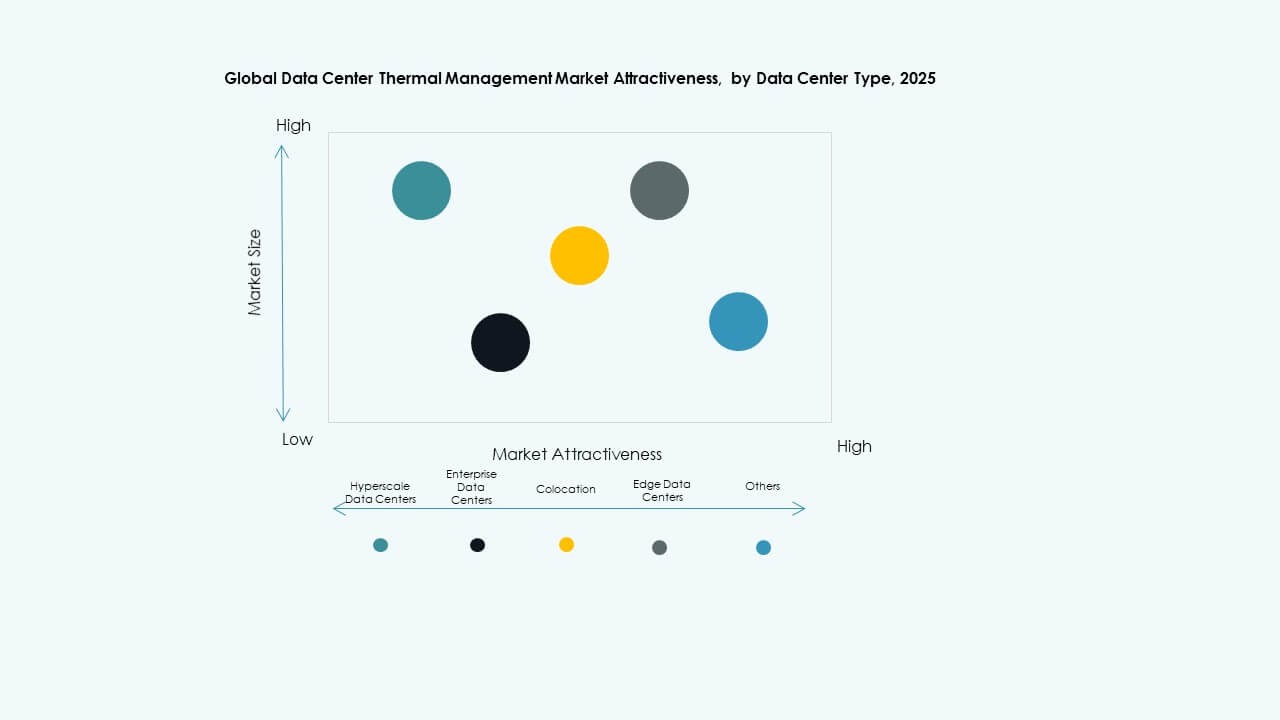

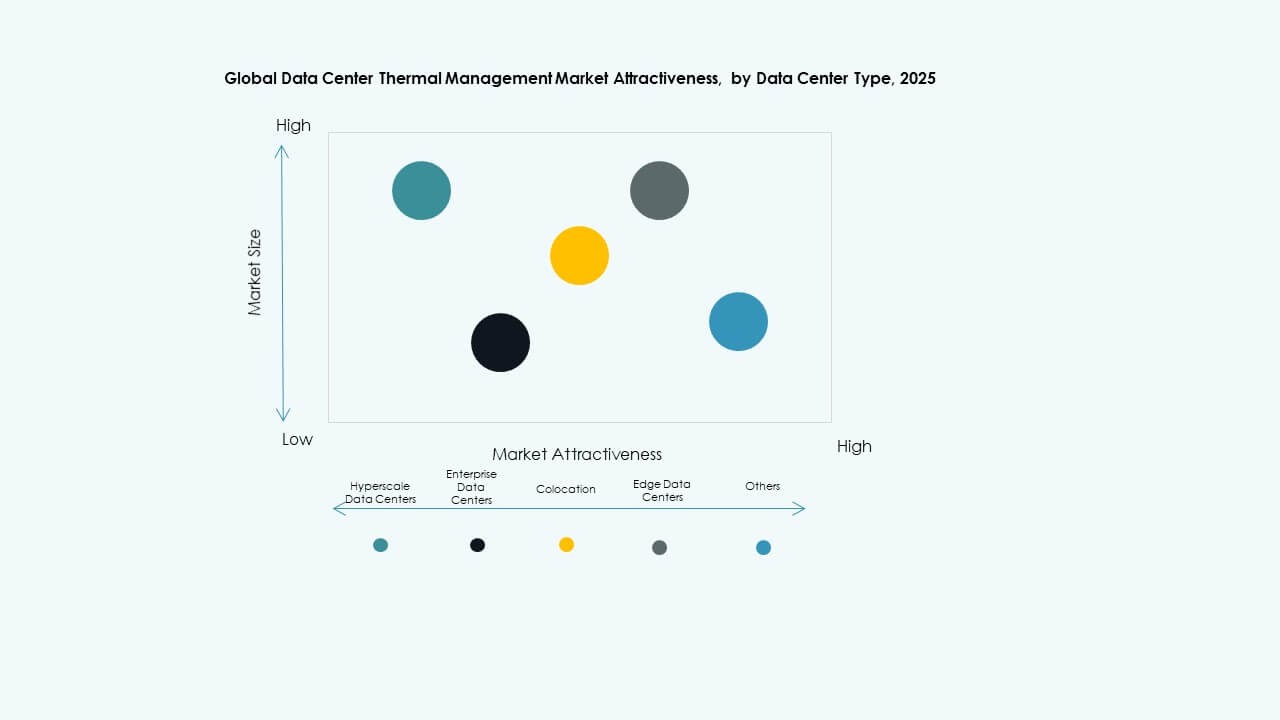

By Data Center Type

Hyperscale data centers dominate the Global Data Center Thermal Management Market with more than 50% share, driven by major cloud and AI service providers expanding globally. These facilities demand advanced liquid and hybrid cooling systems to manage high heat densities. Enterprise data centers rely on modular air-based systems for cost efficiency. Colocation providers invest in flexible cooling setups to serve diverse client workloads. Edge and micro data centers are emerging rapidly to support 5G networks and IoT applications, requiring compact yet reliable thermal management systems.

By Structure

Room-based cooling holds a significant portion of the Global Data Center Thermal Management Market, widely used in large enterprise and hyperscale facilities. Rack-based cooling is rapidly expanding due to liquid cooling adoption in dense computing environments. Row-based systems offer flexibility and precise airflow control, making them ideal for modular and colocation centers. The structural configuration determines efficiency and scalability in data centers. Operators prefer hybrid layouts integrating multiple cooling structures to maintain performance under dynamic loads. This balance optimizes both energy consumption and thermal distribution.

Regional Insights:

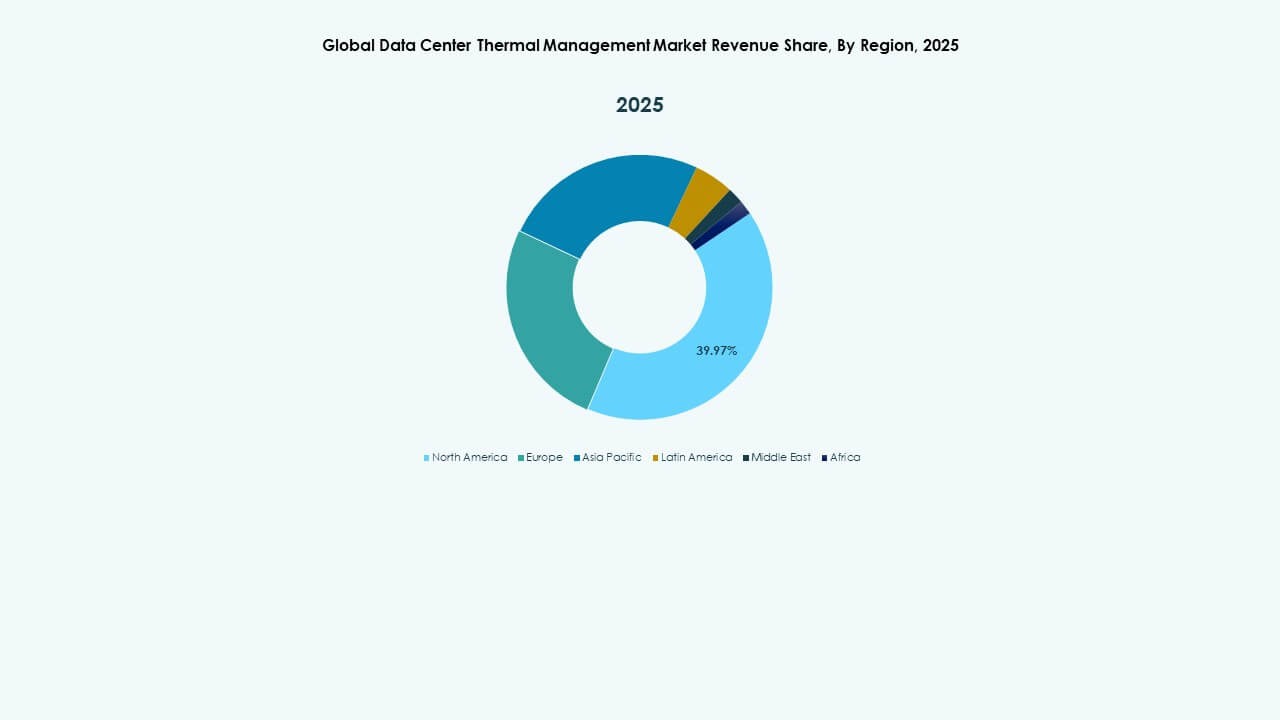

North America

The North America Global Data Center Thermal Management Market size was valued at USD 5,264.75 million in 2020, USD 10,460.48 million in 2025, and is anticipated to reach USD 35,730.43 million by 2035, at a CAGR of 13.00% during the forecast period. North America holds about 40% of the total market share, led by the U.S. It benefits from a mature digital infrastructure and a high concentration of hyperscale facilities. It drives innovation through AI-based thermal analytics and liquid cooling adoption. Leading operators integrate renewable-powered systems to reduce energy intensity. High rack densities in AI and cloud workloads elevate demand for hybrid cooling solutions. Investment from major cloud providers accelerates new construction across the region. Sustainability-focused designs align with national energy policies and ESG targets. This dominance reflects North America’s leadership in technology and capital-intensive data center operations.

Europe

The Europe Global Data Center Thermal Management Market size was valued at USD 3,566.73 million in 2020, USD 6,807.03 million in 2025, and is anticipated to reach USD 21,926.41 million by 2035, at a CAGR of 12.34% during the forecast period. Europe accounts for around 28% of the global market share, driven by strong environmental regulations and data compliance standards. Operators in Germany, the UK, and the Netherlands invest heavily in low-emission and water-efficient cooling systems. It emphasizes free cooling and adiabatic systems to align with energy efficiency goals. The region advances adoption of circular energy models using waste heat recovery. Data center clusters in Northern Europe benefit from cooler climates, reducing energy costs. Companies implement AI-driven management tools for predictive maintenance. Regulatory frameworks such as the EU Green Deal foster investment in sustainable designs. These initiatives strengthen Europe’s position as a leader in energy-efficient infrastructure.

- For instance, Equinix’s Frankfurt data centers use AI-driven cooling optimization that has improved energy efficiency by about 9%, while Interxion’s Amsterdam facility, part of Digital Realty, employs advanced free-cooling and groundwater systems to lower energy consumption and reduce reliance on mechanical cooling throughout the year.

Asia Pacific

The Asia Pacific Global Data Center Thermal Management Market size was valued at USD 2,836.44 million in 2020, USD 6,595.05 million in 2025, and is anticipated to reach USD 25,526.88 million by 2035, at a CAGR of 14.39% during the forecast period. Asia Pacific holds approximately 22% market share and is the fastest-growing regional segment. Expansion of hyperscale data centers in China, India, Japan, and South Korea drives the demand for advanced cooling systems. Rapid urbanization and digital transformation fuel large-scale cloud infrastructure investments. It benefits from government-backed green data center initiatives to improve energy efficiency. Liquid cooling and modular solutions are expanding in new facilities to manage high computing workloads. Vendors target emerging economies with cost-effective, scalable systems. Regional growth is reinforced by strong 5G and AI integration. The pace of technological advancement secures Asia Pacific as a key global growth engine.

- For instance, Alibaba Cloud has deployed immersion cooling technology in its data centers to enhance energy efficiency and support high-density AI workloads, while also introducing modular data center designs that combine liquid and air cooling to accelerate large-scale facility deployment and reduce operational costs.

Latin America

The Latin America Global Data Center Thermal Management Market size was valued at USD 639.16 million in 2020, USD 1,282.37 million in 2025, and is anticipated to reach USD 4,000.51 million by 2035, at a CAGR of 11.98% during the forecast period. Latin America captures about 6% of the total market share, led by Brazil, Chile, and Mexico. It benefits from increasing cloud adoption and regional investments in colocation centers. Operators adopt compact, energy-efficient air and hybrid cooling technologies to handle rising workloads. The market expands through multinational partnerships and renewable energy projects. Local governments promote sustainable digital infrastructure to support economic diversification. Challenges include inconsistent power supply and limited technical expertise. Vendors focus on modular deployments to reduce costs and complexity. Growing digital transformation and cloud-based services continue to strengthen regional infrastructure development.

Middle East

The Middle East Global Data Center Thermal Management Market size was valued at USD 345.25 million in 2020, USD 672.59 million in 2025, and is anticipated to reach USD 1,856.42 million by 2035, at a CAGR of 10.56% during the forecast period. The region contributes roughly 3% to the global market share, supported by large-scale investments in UAE, Saudi Arabia, and Israel. Harsh climatic conditions drive adoption of specialized liquid and evaporative cooling systems. It experiences rising interest in hyperscale and colocation centers linked to cloud expansion. Governments encourage energy-efficient infrastructure as part of national digitalization plans. Local firms adopt advanced control systems to improve operational reliability. Investments from global tech companies enhance regional capacity and standards. The trend toward smart city projects creates new demand for sustainable data centers. This growth fosters innovation in cooling design for high-temperature environments.

Africa

The Africa Global Data Center Thermal Management Market size was valued at USD 182.25 million in 2020, USD 353.31 million in 2025, and is anticipated to reach USD 858.54 million by 2035, at a CAGR of 9.30% during the forecast period. Africa holds about 2% of the total market share, reflecting its early-stage growth phase. Increasing investments in Nigeria, South Africa, and Kenya are building new digital infrastructure. It benefits from expanding telecom connectivity and cloud adoption. Operators focus on compact modular data centers with energy-efficient cooling to counter unstable power conditions. Regional governments and private firms collaborate to enhance local data hosting capacity. Vendors introduce scalable solutions tailored to low-resource environments. Training initiatives support workforce development in maintenance and system optimization. Africa’s market is positioned for gradual, sustainable expansion across emerging economies.

Competitive Insights:

- Airedale International Air Conditioning Ltd.

- Asetek, Inc.

- Daikin Industries Ltd.

- Delta Electronics, Inc.

- Huawei Technologies Co., Ltd.

- Johnson Controls International plc

- Schneider Electric

- Stulz GmbH

- Trane Technologies plc

- Vertiv Group Corp.

The Global Data Center Thermal Management Market features intense competition among multinational players focusing on energy-efficient, scalable, and intelligent cooling systems. It is shaped by ongoing innovation in liquid cooling, AI-driven monitoring, and modular infrastructure design. Vertiv, Schneider Electric, and Stulz lead through global service networks and integrated product portfolios. Asetek and Delta Electronics expand in high-density and immersion cooling applications. Daikin and Johnson Controls strengthen their positions through smart HVAC and sustainability-driven systems. Vendors pursue partnerships with hyperscale operators to meet environmental targets and data load challenges. Continuous product innovation, R&D investment, and sustainability commitments define competitive differentiation in this evolving market.

Recent Developments:

- In October 2025, Asetek, Inc. signed a long-term agreement with an undisclosed returning customer, a leading provider of high-quality computers and components for the PC gaming community, for the supply of high-end liquid cooling solutions based on the Ingrid technology platform, featuring a minimum volume commitment estimated at $35 million over the first two-year term starting shipments in Q2 2026.

- In August 2025, Daikin Industries Ltd. entered into a definitive agreement to acquire Dynamic Data Centers Solutions, Inc. (DDC Solutions), a San Diego-based specialist in cooling systems for AI data centers, through its subsidiary Daikin Applied Americas Inc., to enhance its portfolio with individual server cooling technologies and expand in the North American AI data center market.

- In March 2025, Vertiv Group Corp. partnered with Tecogen Inc., a U.S.-based clean energy company, to deploy Tecogen’s natural gas-powered chiller technology in Vertiv’s global data center solutions, aiming to address power limitations and support large-scale AI deployments with advanced cooling.

- In February 2025, Airedale International Air Conditioning Ltd., operating as Airedale by Modine, secured $180 million in orders for data center cooling systems from a leading AI infrastructure developer, providing high-capacity equipment designed for scalable, cost-effective, and sustainable solutions in large-scale, building-optimized data centers.

Market Dynamics:

Market Dynamics: Market Trends

Market Trends

Market Opportunities

Market Opportunities Market Segmentation:

Market Segmentation: