Executive summary:

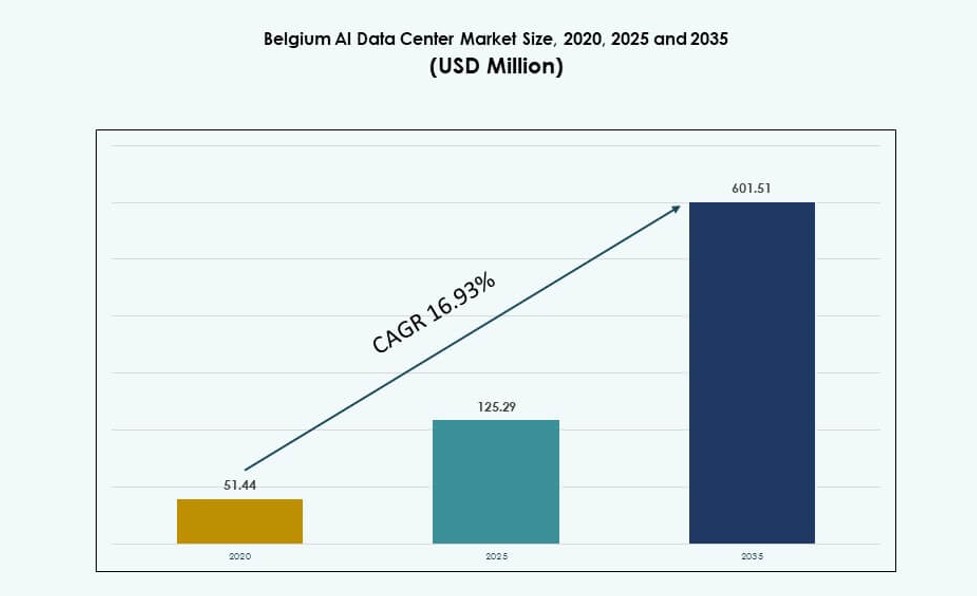

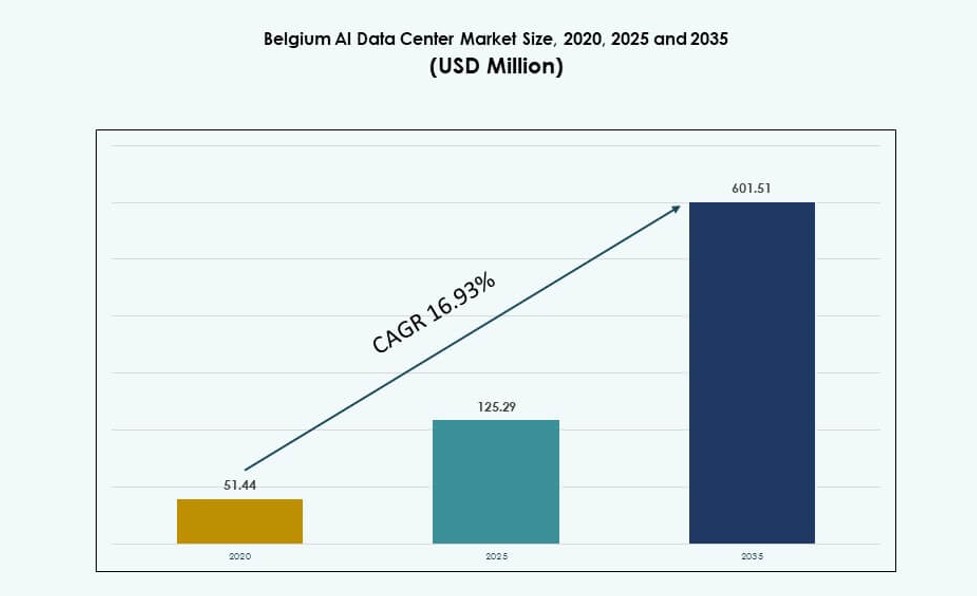

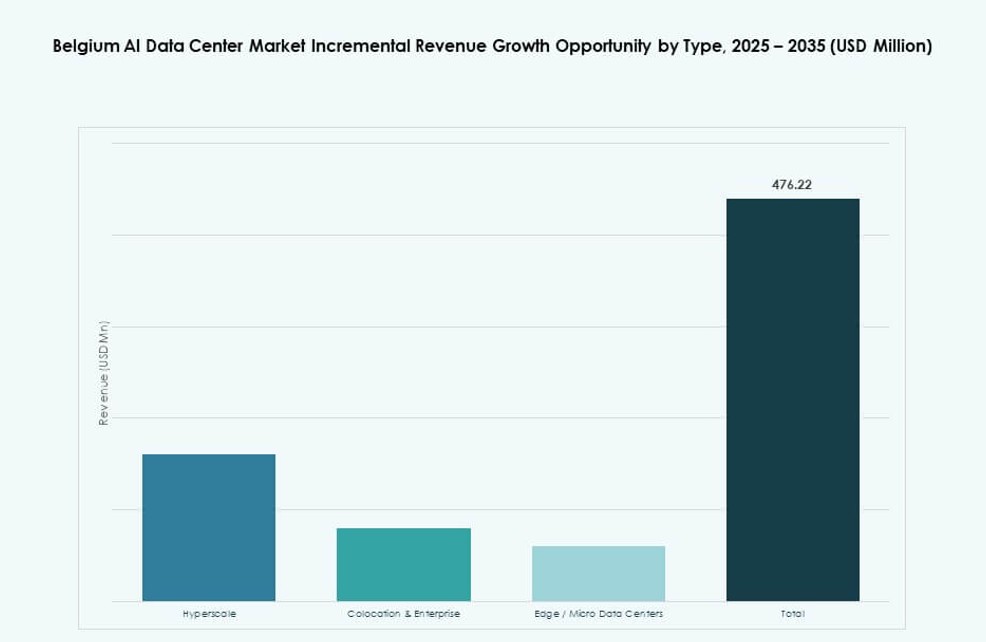

The Belgium AI Data Center Market size was valued at USD 51.44 million in 2020 to USD 125.29 million in 2025 and is anticipated to reach USD 601.51 million by 2035, at a CAGR of 16.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Belgium AI Data Center Market Size 2025 |

USD 125.29 Million |

| Belgium AI Data Center Market, CAGR |

16.93% |

| Belgium AI Data Center Market Size 2035 |

USD 601.51 Million |

The market is driven by surging demand for high-performance computing, AI training clusters, and hybrid cloud infrastructure. Enterprises are rapidly adopting machine learning and NLP applications across sectors, creating pressure on data center operators to provide AI-optimized infrastructure. Growth is supported by liquid cooling technologies, scalable power systems, and orchestration platforms tailored to AI workloads. It enables real-time inference, data-intensive operations, and sovereign deployments. Government incentives for energy efficiency and regional compliance also attract hyperscalers and enterprise clients. This makes the Belgium AI Data Center Market a strategic asset for digital transformation and innovation leadership.

Flanders holds the dominant share due to its strong industrial base and high network connectivity. Brussels follows with substantial demand from government, financial services, and AI policy organizations. Wallonia is an emerging region, driven by public investment in edge AI and distributed infrastructure. It supports use cases in mobility, manufacturing, and smart grids. National fiber routes and proximity to EU data flows make Belgium a hub for cross-border AI workloads. Each subregion plays a specific role in shaping deployment models across the Belgium AI Data Center Market.

Market Dynamics:

Market Drivers

High-Density AI Workload Adoption Demands Advanced Infrastructure Readiness and Energy Optimization

The Belgium AI Data Center Market is expanding due to rising demand for high-density compute systems. AI workloads need low-latency performance and GPU-based compute clusters, which drive data center innovation. Operators are investing in advanced cooling systems and high-performance interconnects to manage power and thermal loads. Belgium’s energy regulations push efficiency across AI-focused infrastructure. Businesses demand sustainable solutions to meet ESG goals and reduce TCO. It supports deployment of smart power management and modular designs. Infrastructure built to handle complex AI operations improves competitiveness. The market enables enterprises to scale AI capabilities with minimal downtime. Strong regulatory support encourages strategic capital investments.

Government Digital Strategy and Public-Private Partnerships Strengthen National AI Infrastructure Base

Belgium’s national digital plan supports cloud and AI expansion with coordinated investments and R&D incentives. Strategic partnerships between tech firms and public agencies have accelerated infrastructure rollouts. Brussels and Flanders benefit from programs promoting data center development aligned with AI. Government-backed initiatives offer grants and green energy incentives, improving long-term ROI. These policies help attract foreign hyperscalers seeking regulatory clarity and digital maturity. It creates a favorable policy environment for large-scale AI deployments. AI readiness is now a national priority, with emphasis on compute power, data sovereignty, and security. The Belgium AI Data Center Market benefits from stable governance and targeted tech investment. Strategic alignment of policy and infrastructure drives investor confidence.

- For instance, Microsoft officially opened the Azure Belgium Central region in November 2025 with three data centers around Brussels, bringing local cloud and AI infrastructure to Belgian organizations with low‑latency, resilient services.

Enterprise and Sector-Specific AI Integration Across BFSI, Healthcare, and Telecom Sectors

AI integration across key verticals fuels data center demand from financial services, healthcare, and telecom operators. BFSI institutions leverage AI for fraud detection, risk analytics, and chatbot automation. Healthcare players need high-speed computing for diagnostics, imaging, and personalized treatment models. Telecoms use AI in network optimization and predictive maintenance. This sectoral AI adoption pushes demand for specialized infrastructure with scalable capacity and low-latency performance. Belgium’s strong enterprise base contributes to long-term AI infrastructure needs. The Belgium AI Data Center Market meets growing demand for secure, high-speed, sector-specific workloads. AI-centric use cases increase need for GPU clusters, fast storage, and orchestration tools. Growth across industries reinforces data center expansion.

- For instance, KBC Bank uses AI and machine learning models in its fraud detection systems and digital banking services, enhancing threat detection and customer experience within its secure IT infrastructure in Belgium.

AI-Centric Cloud Migrations and Hybrid Architectures Are Creating Long-Term Infrastructure Commitments

Enterprises shifting AI workloads from legacy systems to cloud and hybrid platforms are fueling market expansion. Cloud-native AI tools require robust backend infrastructure with high throughput and regional compliance. Operators deploy AI-optimized platforms supporting containerized environments and orchestration via Kubernetes and OpenStack. Hybrid models dominate in sectors balancing cost, performance, and sovereignty. Belgium’s data protection regulations shape AI deployments within national boundaries. Long-term contracts for cloud AI support stability in capacity planning. It creates predictable growth pipelines for colocation and cloud providers. The Belgium AI Data Center Market plays a critical role in supporting this transition. AI workloads become a core driver of IT architecture shifts across verticals.

Market Trends

Liquid Cooling Technologies and Thermal Management Upgrades Gaining Traction in High-Density Racks

Thermal loads from GPUs and AI accelerators push operators to deploy liquid cooling solutions. Direct-to-chip and rear-door heat exchangers are being installed in AI clusters. These technologies support rack densities above 30 kW while reducing energy consumption. Belgium’s sustainability goals accelerate adoption of green cooling systems. Operators partner with OEMs to retrofit facilities for AI-readiness. It allows deployment of next-gen AI hardware with thermal safeguards. The Belgium AI Data Center Market sees rising demand for immersion cooling in AI pods. This shift supports carbon reduction goals while enabling high-density scale-up. Cooling efficiency becomes central to infrastructure decisions.

Rise of Sovereign AI and Edge Compute Integration Across Decentralized Sectors

Data localization and sovereign cloud initiatives drive edge AI deployments across public services and industrial zones. Edge-ready nodes now include AI accelerators for real-time processing. Sectors like manufacturing, logistics, and healthcare use edge AI for operational insights. Belgium’s telecom networks support distributed architectures with low latency. Operators are embedding AI processing at regional POPs to reduce backhaul costs. It enhances responsiveness for time-critical applications. The Belgium AI Data Center Market includes both centralized and distributed infrastructure models. Edge integration supports AI deployments closer to data sources. Sector-specific demand for localized AI compute will continue rising.

AI-As-A-Service Expansion Driving Demand for Flexible Infrastructure Models

AI-as-a-Service platforms are gaining momentum among mid-sized enterprises and startups. These services reduce upfront capital needs while offering scalable compute power. Operators in Belgium deploy flexible infrastructure models to support multi-tenant AI workloads. White-label GPU clouds, shared AI clusters, and containerized environments are increasingly adopted. It supports broader access to AI across organizations with limited IT budgets. The Belgium AI Data Center Market supports this trend with on-demand infrastructure and metered usage models. It improves customer acquisition and facility utilization for operators. Demand for tailored, flexible AI services shapes future capacity strategies.

Cross-Border AI Integration Creating Regional Hub Potential for Belgium

Belgium’s central EU location and strong fiber connectivity make it a hub for cross-border AI deployments. AI training and inference workloads increasingly move across borders via secure interconnects. Brussels and Antwerp are emerging as connectivity-rich zones linking France, Netherlands, and Germany. Operators market Belgium’s location as ideal for multi-country AI architectures. It encourages hyperscalers and AI startups to use Belgium as a base for regional operations. The Belgium AI Data Center Market gains from being embedded in Western Europe’s AI ecosystem. It supports data center clustering around subsea cables, IXPs, and R&D centers. Regional collaboration drives infrastructure planning.

Market Challenges

Power Grid Constraints, Energy Policy Complexity, and Renewable Integration Delays

Energy availability and regulatory complexity challenge expansion of AI-optimized facilities in Belgium. Grid stability concerns delay new project approvals, especially for high-density deployments. Belgium’s fragmented energy governance between regions slows renewable integration. Power purchase agreements (PPAs) face permitting bottlenecks and limited flexibility. It raises project risk for hyperscalers seeking long-term renewable guarantees. AI clusters demand continuous, scalable power with minimal variance. The Belgium AI Data Center Market must navigate these hurdles to maintain momentum. Operators need clearer pathways for energy contracting, renewable sourcing, and grid interconnection. Long-term planning hinges on predictable power economics and reliability.

Land Use Regulations, Urban Density, and Community Opposition Impact Deployment Timelines

Land availability is limited in urban zones with high demand for AI data center infrastructure. Zoning restrictions and environmental reviews extend lead times for new builds. Community pushback in dense areas like Brussels complicates expansion plans. It increases cost and regulatory overhead for operators. Balancing proximity to end-users with local concerns requires site-specific negotiations. AI infrastructure often requires retrofit of older facilities or rural edge expansion. The Belgium AI Data Center Market faces delays tied to public opposition and real estate constraints. Operators adopt modular or underground formats to reduce footprint and secure approvals. Urban complexity drives interest in suburban and edge zones.

Market Opportunities

Growing Role of Belgium as a Regional AI Hub for Western Europe and R&D-Driven Growth Potential

Belgium is well-positioned to serve as a Western European AI hub, supported by cross-border fiber, multilingual talent, and research institutions. Its proximity to major EU capitals enables low-latency AI services across borders. It creates new opportunities for operators to attract EU-wide AI clients seeking regional deployment. Research parks and academic institutions offer testing grounds for AI solutions. The Belgium AI Data Center Market benefits from this convergence of location, talent, and connectivity.

Rising AI Adoption in Manufacturing, Mobility, and Healthcare Offers Deep Vertical Expansion

Vertical-specific AI deployment creates strong demand for customized infrastructure solutions. Belgium’s advanced manufacturing sector, smart mobility pilots, and healthcare institutions are adopting AI for real-time insights. It presents opportunities for co-located, secure, and compliant AI clusters. The Belgium AI Data Center Market stands to benefit from ongoing digital transformation across these verticals. Strong sectoral demand supports localized expansion and modular deployment models.

Market Segmentation

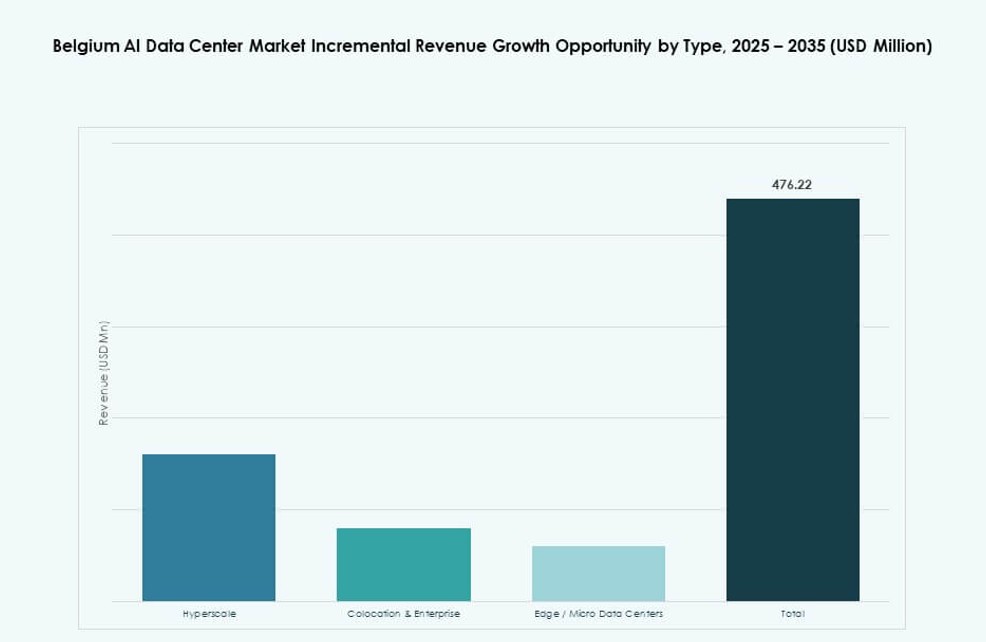

By Type

The hyperscale segment dominates the Belgium AI Data Center Market, driven by global cloud providers and growing AI workloads. Hyperscale operators are deploying large GPU clusters for training and inference at scale. Colocation and enterprise data centers are expanding AI-ready space with modular designs. Edge and micro data centers are growing in logistics and healthcare. Edge deployments enable low-latency AI applications near end-users. Hyperscale accounts for the largest share, but edge is gaining momentum.

By Component

Hardware holds the largest share in the Belgium AI Data Center Market due to investment in GPUs, switches, and power systems. Facilities prioritize high-density compute nodes, liquid cooling, and AI networking gear. Software and orchestration tools are growing rapidly with adoption of Kubernetes and AI-specific platforms. Services, including managed AI hosting and GPU-as-a-Service, are emerging. Hardware remains dominant but orchestration tools gain relevance for automation and optimization.

By Deployment

Hybrid deployments lead the Belgium AI Data Center Market, driven by the need to balance data sovereignty, performance, and cost. Enterprises use hybrid models to run sensitive AI models on-premise while using cloud for scale. Cloud-only models are popular among startups and AI-first companies. On-premise retains a niche in regulated sectors. Hybrid infrastructure supports flexible scaling, making it the preferred model for enterprise AI.

By Application

Machine Learning (ML) dominates the Belgium AI Data Center Market, with enterprises applying ML in automation, analytics, and forecasting. Generative AI (GenAI) is growing fast, supported by transformer models and synthetic content tools. NLP supports chatbots and voice analytics across services. Computer Vision (CV) is deployed in healthcare imaging and industrial inspection. ML leads in volume, while GenAI shows rapid expansion and demand for compute-heavy environments.

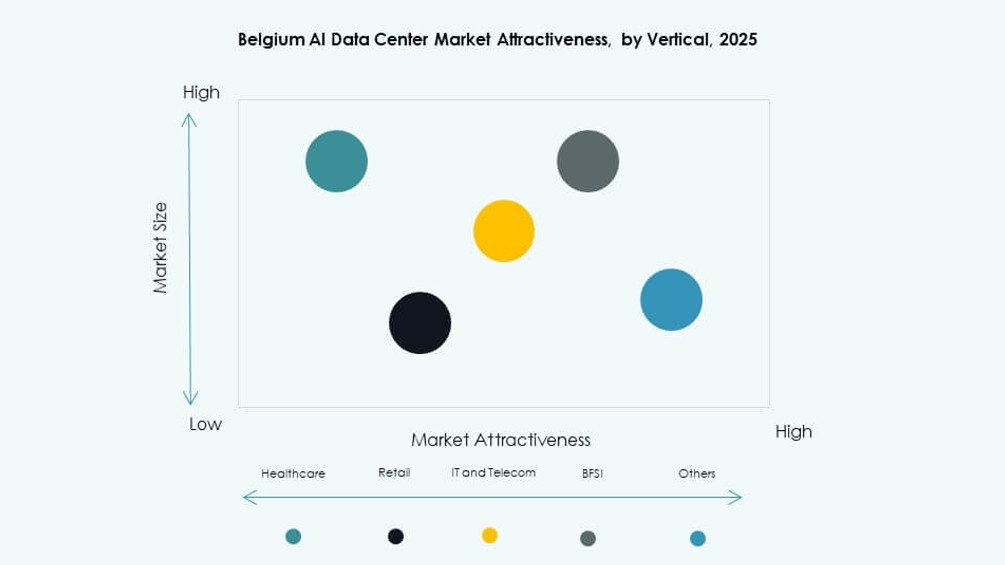

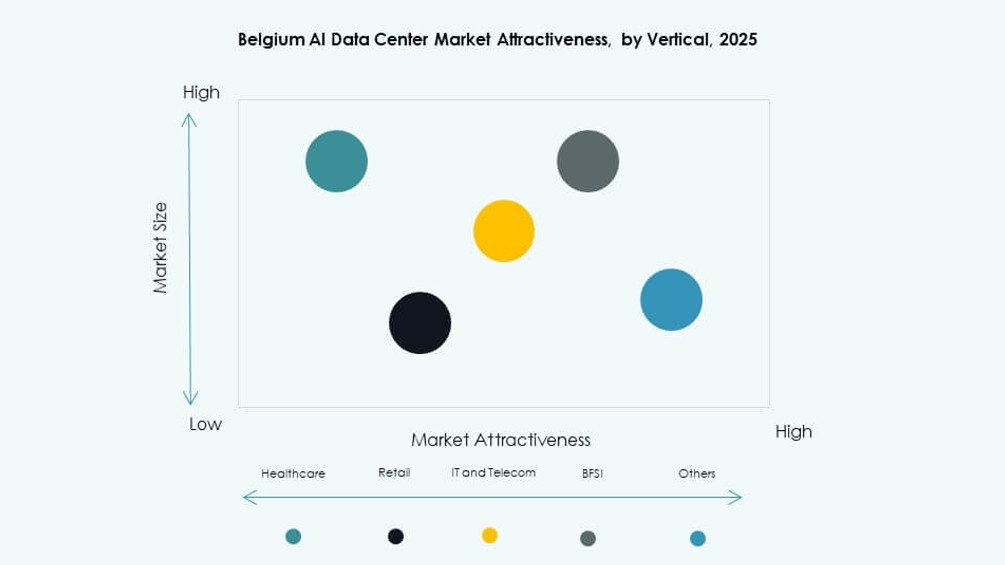

By Vertical

IT and Telecom is the leading vertical in the Belgium AI Data Center Market, driving demand for scalable, low-latency AI compute. BFSI uses AI for real-time risk modeling and fraud detection. Healthcare follows, leveraging AI for diagnostics and patient insights. Manufacturing integrates AI for predictive maintenance and automation. Media and entertainment use AI for content personalization and video processing. IT and Telecom holds the highest share, with BFSI and Healthcare as fast-growing sectors.

Regional Insights

Flanders Leads with Over 48% Share Due to Industrial Base and Strong Network Infrastructure

Flanders dominates the Belgium AI Data Center Market with over 48% market share. The region offers superior digital infrastructure, skilled labor, and access to cross-border fiber networks. Industrial clusters in Antwerp and Ghent deploy AI in logistics, manufacturing, and energy. Public-private partnerships foster tech adoption across smart city programs. It remains the top destination for new hyperscale and colocation builds. AI use cases align with regional economic strengths.

- For instance, BNIX recorded a peak traffic of 520 Gbit/s on November 4, 2024, marking one of the highest levels since the COVID period. This reflects growing digital demand that supports AI workloads and enterprise connectivity across Belgium.

Brussels Region Holds 34% Share with Focus on Government, BFSI, and Enterprise AI Workloads

The Brussels region holds 34% of the Belgium AI Data Center Market, supported by national government functions and BFSI hubs. Institutions and enterprises demand secure AI environments for sensitive data processing. Proximity to EU bodies boosts demand for AI-driven public sector initiatives. It also hosts R&D centers and legal advisory firms driving AI policy discussions. Operators offer Tier III+ facilities for hybrid deployments. Brussels remains vital for enterprise-grade AI.

Wallonia Emerges with 18% Share Focused on Edge AI and Vertical-Specific Deployments

Wallonia accounts for 18% of the Belgium AI Data Center Market. Growth is driven by edge data centers supporting manufacturing, mobility, and energy sectors. Public incentives support infrastructure in Liège and Charleroi. AI deployments are tailored to local industries with real-time processing needs. Limited hyperscale activity shifts focus to modular formats. It serves as a growth frontier for edge and regional AI expansion.

- For instance, Google’s Saint-Ghislain data center in Wallonia supports regional AI and cloud infrastructure and employs over 400 people. The site has been recognized for its energy-efficient operations and plays a key role in Belgium’s digital ecosystem.

Competitive Insights:

- LCL Data Centers

- NRB Group

- Datacenter United

- Microsoft (Azure)

- Amazon Web Services (AWS)

- Google Cloud / Alphabet

- Equinix

- Digital Realty Trust

- Meta Platforms

- CoreWeave

The Belgium AI Data Center Market is shaped by a mix of domestic operators and global hyperscalers. Local firms like LCL Data Centers, NRB Group, and Datacenter United lead in colocation and enterprise services, offering regional compliance and proximity benefits. Hyperscale leaders including AWS, Microsoft Azure, and Google Cloud are expanding GPU-optimized infrastructure to support high-density AI workloads. Global platforms such as Meta and CoreWeave add pressure with investments in AI-specific clusters. It remains a competitive landscape marked by power availability, AI hardware integration, and green certifications. Operators differentiate through hybrid models, sovereign cloud capabilities, and vertical-specific AI support. Network density, latency zones, and R&D partnerships are emerging as strategic levers. Competitive intensity will increase with new liquid-cooled deployments and regional AI cluster formation.

Recent Developments:

- In November 2025, Microsoft launched a new cloud region in Belgium, unveiling three new data centers. The project marks the official launch of the Azure Belgium Central region and enables secure, scalable cloud and AI services hosted locally. Microsoft’s expansion enhances compute availability for enterprise and public sector customers in Belgium.

- In November 2025, imec unveiled “imec.kelis,” an AI data center design and optimization tool. The tool offers analytical performance modeling specifically for AI data center design and workload efficiency, helping architects balance performance and energy concerns.

- In October 2025, Google announced a major €5 billion investment in Belgium to expand its AI and cloud infrastructure through 2027. The investment focuses on expanding data center capacity in Saint‑Ghislain and supporting AI infrastructure growth in Wallonia. Google plans to add around 300 jobs and work with local renewable energy partners to support carbon‑free electricity deals.