Executive summary:

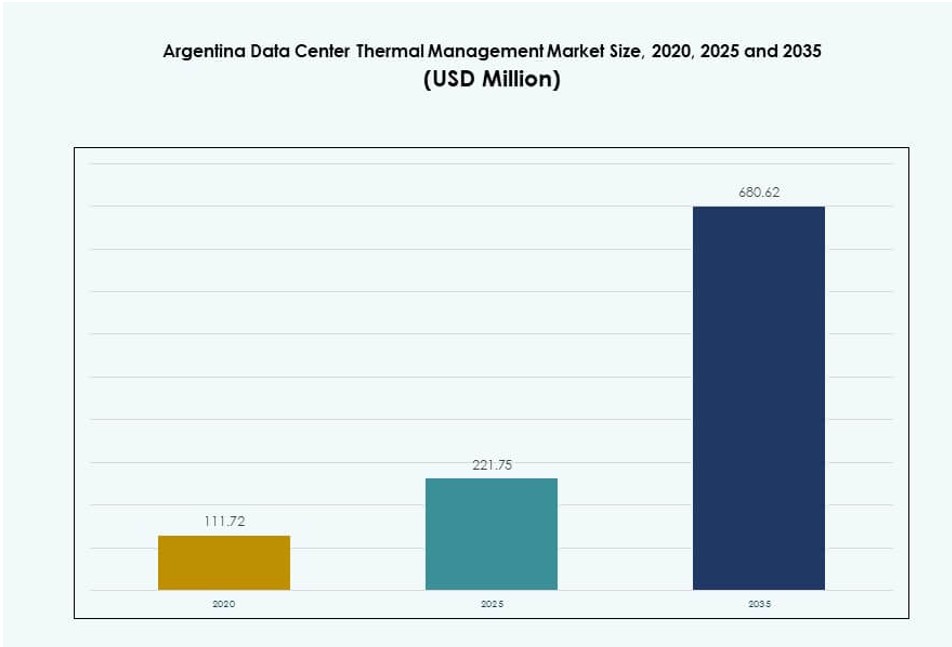

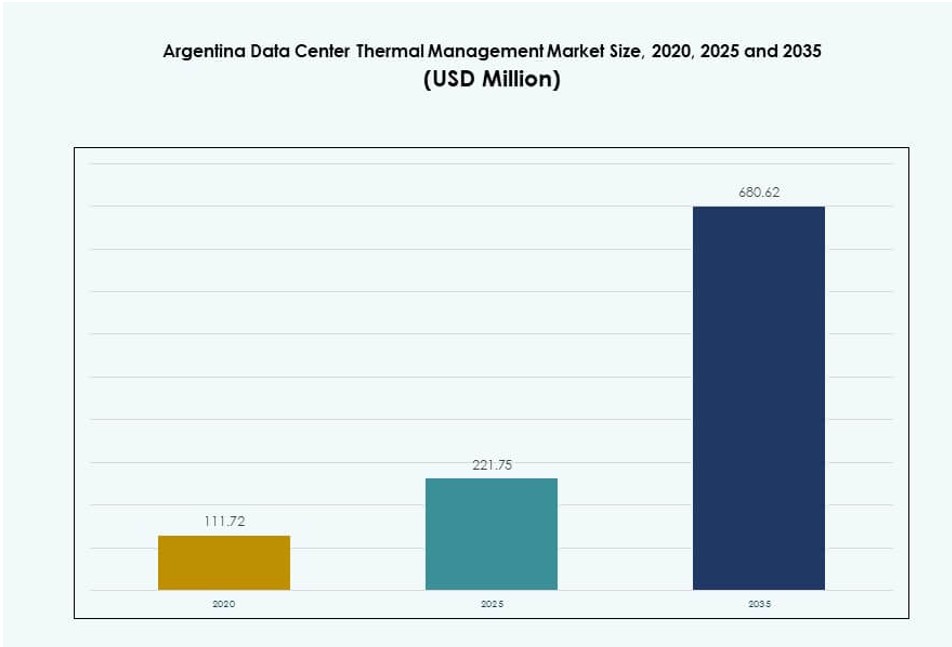

The Argentina Data Center Thermal Management Market size was valued at USD 111.72 million in 2020 to USD 221.75 million in 2025 and is anticipated to reach USD 680.62 million by 2035, at a CAGR of 11.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Argentina Data Center Thermal Management Market Size 2025 |

USD 221.75 Million |

| Argentina Data Center Thermal Management Market, CAGR |

11.80% |

| Argentina Data Center Thermal Management Market Size 2035 |

USD 680.62 Million |

Demand for efficient cooling systems is rising as Argentina’s data center ecosystem expands to support AI, cloud, and high-density compute workloads. Operators are deploying hybrid and liquid-based thermal solutions to address growing rack power densities. Investments in automation and thermal analytics help reduce energy waste and improve system uptime. The market also sees strong momentum from government-led digital initiatives and enterprise modernization programs. For investors, the segment offers growth backed by regulatory focus on energy efficiency and sustainable infrastructure.

Buenos Aires leads in market share due to strong connectivity, high data traffic, and dense enterprise presence. It hosts the largest facilities and attracts most hyperscale and colocation investments. Central regions like Córdoba and Rosario are emerging with enterprise and telecom deployments, supported by local digital initiatives. Southern and border regions show early-stage growth driven by edge computing and rural connectivity programs. These trends shape a geographically diverse market evolution.

Market Dynamics:

Market Drivers

Rapid Shift Toward High-Density Compute Loads Demands Efficient Thermal Solutions

The Argentina Data Center Thermal Management Market is being driven by rising demand for high-performance computing workloads. Growth in AI, machine learning, and GPU-intensive tasks requires efficient thermal strategies. Operators are transitioning from legacy air systems to advanced liquid-based and hybrid technologies. These solutions support rack densities exceeding 40 kW, which are becoming standard across colocation and enterprise deployments. Without optimized cooling, power consumption and thermal hotspots increase sharply. Businesses in Argentina are under pressure to meet uptime and efficiency targets, pushing investment in thermal innovation. Market players are also testing modular and scalable cooling infrastructure for edge-ready deployments. The shift ensures improved performance with sustainable energy use, aligning with green policy frameworks. It also reduces long-term operational risks for investors and operators.

Strong Demand from Cloud and Colocation Segments Fuels Infrastructure Expansion

The rise in data traffic from financial services, e-commerce, and streaming platforms accelerates the need for robust cloud infrastructure. Colocation providers in Argentina are expanding capacity across Tier III and Tier IV-grade facilities. These operators prioritize energy-efficient thermal systems to meet SLAs and reduce PUE levels. Indirect evaporative cooling and containment systems are gaining traction for their low energy use in dry climates. Heat recovery systems are also being piloted in urban campuses. Local firms partner with global vendors to integrate AI-based temperature and airflow control. This enhances predictive maintenance and reduces human errors. The Argentina Data Center Thermal Management Market benefits from rising private and public cloud deployments. It supports data sovereignty while improving access to critical digital services.

Energy Efficiency Regulations and Green Certifications Accelerate System Modernization

Government policies are pushing the adoption of green building codes and energy benchmarks for data centers. Operators aim to meet ISO 50001 energy standards and achieve LEED or Uptime certifications. This is encouraging upgrades from legacy CRAC units to newer air and liquid cooling combinations. Smart controls and AI optimization tools are being embedded into infrastructure planning. Developers focus on reducing energy consumption per kW of IT load. Argentina’s reliance on thermal electricity generation also motivates cooling innovations that offset grid stress. The thermal management market plays a central role in enabling compliance and cost control. Efficiency goals are now central to site selection, vendor selection, and facility design across the country.

- For instance, Vertiv LATAM promotes direct-to-chip liquid cooling to support high-density racks and reduce energy use in data centers. This approach improves efficiency by removing heat directly at the processor level, easing reliance on air-based systems.

Growth in Edge and Regional Data Hubs Spurs Localized Thermal Investments

Edge computing is expanding in second-tier cities to support latency-sensitive applications and regional cloud demands. Telecom operators and service providers are deploying micro and modular data centers with integrated thermal units. These compact sites need flexible cooling solutions tailored for varied climates and space constraints. Rear-door heat exchangers and direct-to-chip systems are ideal for smaller footprints. The Argentina Data Center Thermal Management Market is seeing steady growth in customized thermal modules. This trend supports the digitalization of agriculture, logistics, and public sector services outside Buenos Aires. Investors see edge deployments as low-risk entries into digital infrastructure backed by rising digital adoption. It also decentralizes network load, improving resilience and reliability in underserved regions.

- For instance, liquid immersion cooling offers a space‑efficient way to manage high‑density heat loads by submerging servers in thermally conductive fluid to improve heat dissipation. This approach enhances energy efficiency and reduces reliance on traditional air cooling systems in compact or constrained environments.

Market Trends

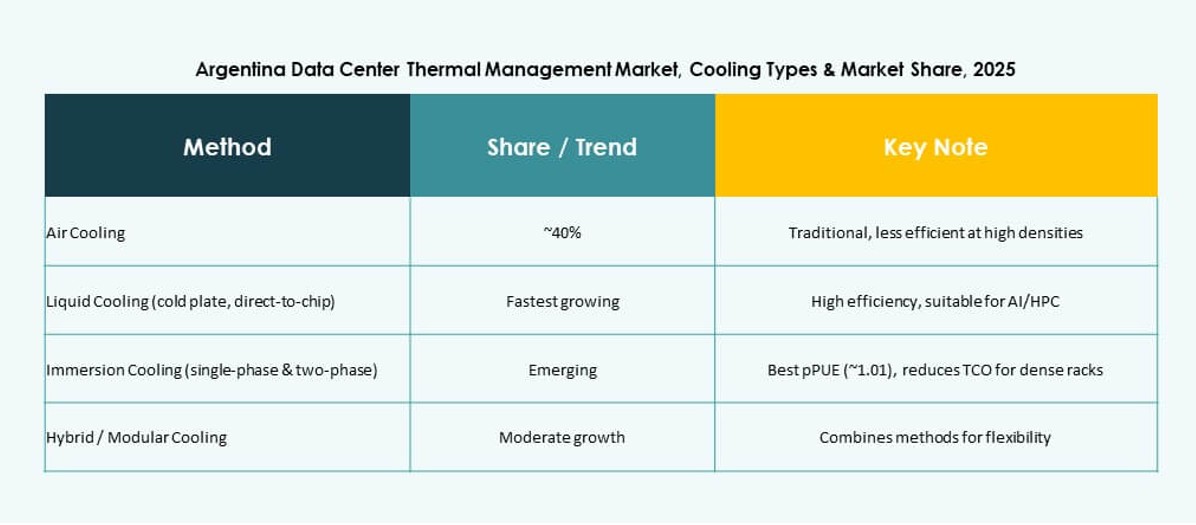

Liquid Cooling Solutions Gain Traction Amid Rising Rack Power Density

Liquid-based thermal technologies are gaining attention for their ability to manage high rack power densities. Direct-to-chip and immersion cooling are increasingly tested in hyperscale deployments. These solutions support AI and HPC environments that exceed 40–50 kW per rack. Operators in Argentina are experimenting with hybrid setups that combine rear-door heat exchangers with chilled water loops. This setup enables better control over localized heat zones. It also supports footprint reduction in high-rack deployments. The Argentina Data Center Thermal Management Market is benefiting from partnerships with global cooling vendors offering modular and scalable systems. Local operators use these technologies to meet sustainability targets while preparing for dense GPU workloads.

AI-Powered Cooling Optimization Tools Improve Real-Time Efficiency

Data centers across Argentina are adopting AI-driven platforms to automate thermal control systems. These tools analyze real-time data from temperature sensors, airflow meters, and IT load points. By adjusting cooling output dynamically, they optimize energy use and avoid overcooling. Vendors integrate AI into Building Management Systems (BMS), enabling predictive fault detection. These solutions also extend component life by avoiding thermal shocks. The Argentina Data Center Thermal Management Market is seeing growing demand for smart infrastructure layers. AI supports better decision-making in maintenance schedules and capacity planning. Operators use it to maintain uptime while reducing manual intervention and operational cost.

Containerized and Modular Cooling Units Cater to Edge and Remote Sites

Modular cooling units are being deployed across Argentina to support new edge data centers and remote ICT infrastructure. These pre-configured systems reduce deployment timelines and provide flexible cooling capacity. Operators favor modularity to adapt to load changes without costly overhauls. In rural or space-constrained regions, containerized cooling units offer easy integration with prefabricated data center designs. The Argentina Data Center Thermal Management Market is evolving to serve this modular trend. Compact chiller units, fan wall systems, and self-contained liquid cooling modules dominate new designs. These systems ensure reliable performance in dynamic edge environments.

Retrofitting Initiatives Strengthen Lifecycle Management of Legacy Facilities

A growing number of facilities in Argentina are investing in thermal retrofits to extend the lifespan of older infrastructure. Operators replace traditional CRAC units with energy-efficient alternatives such as variable speed EC fans and hot aisle containment. In some cases, operators add chilled water loops to improve heat rejection performance. Retrofitting avoids the capital burden of new builds while enhancing system resilience. The Argentina Data Center Thermal Management Market is seeing demand for retrofit kits and upgrade services tailored to specific layouts. Facility owners prioritize retrofits that minimize downtime and require minimal construction changes. These upgrades also enable integration with DCIM and smart controls.

Market Challenges

High Capital Costs and Import Dependency Create Barriers for Advanced Deployments

Argentina faces steep upfront costs for deploying liquid-based and hybrid thermal technologies. Many components such as high-efficiency chillers, immersion tanks, and AI sensors are imported. Currency volatility and high import duties increase the total cost of ownership. Local manufacturing capabilities remain limited for advanced thermal hardware. Some operators delay modernization plans due to cost concerns or financing gaps. The Argentina Data Center Thermal Management Market must address the affordability challenge through local vendor development and public-private support. Limited access to high-efficiency systems risks long-term inefficiency and operational losses. This slows down the rate of energy optimization across the market.

Energy Supply Constraints and Climate Variability Impact System Design and Reliability

Power reliability is a major concern for data center cooling in Argentina. Frequent outages or inconsistent grid quality push operators to rely on diesel or on-site energy systems. Thermal designs must accommodate dual power sources while maintaining N+1 or 2N reliability standards. Seasonal temperature swings—from cold winters to hot, dry summers—further complicate cooling configurations. Dry regions reduce the effectiveness of evaporative systems, while humid zones strain air-based cooling. The Argentina Data Center Thermal Management Market must address these geographic disparities through flexible system design. Overengineering for reliability often leads to increased costs and poor energy efficiency in average weather conditions.

Market Opportunities

Rise of Hyperscale Investments and AI Clusters Creates Need for Liquid Cooling Innovation

Argentina is attracting hyperscale investors, especially in Buenos Aires and northern regions. These deployments demand dense compute capabilities that traditional cooling cannot support. Liquid cooling presents a growth opportunity through localized assembly and regional partnerships. The Argentina Data Center Thermal Management Market stands to benefit from developing tailored solutions for hyperscale deployments. System vendors and service providers can tap this segment by delivering scalable, modular, and AI-ready thermal ecosystems.

Growing Government and Private Sector Focus on Green Infrastructure Standards

Energy efficiency mandates and climate pledges from both public and private sectors are opening up space for green thermal technologies. Projects aiming for Uptime Tier III and LEED Gold certifications require best-in-class cooling solutions. Vendors offering energy-efficient, software-integrated, and upgrade-ready thermal systems have an early-mover advantage. The Argentina Data Center Thermal Management Market offers a platform for sustainable growth through smart, regulation-driven upgrades and eco-certification targets.

Market Segmentation

By Data Center Size

Large data centers dominate the Argentina Data Center Thermal Management Market due to growing cloud and colocation demand. These facilities support dense workloads and need robust, scalable cooling solutions. Medium-sized centers follow, driven by regional enterprise demand. Small data centers contribute a lower share, mostly supporting edge and private workloads. Growth in hyperscale and large colocation investments will continue to lead segment expansion.

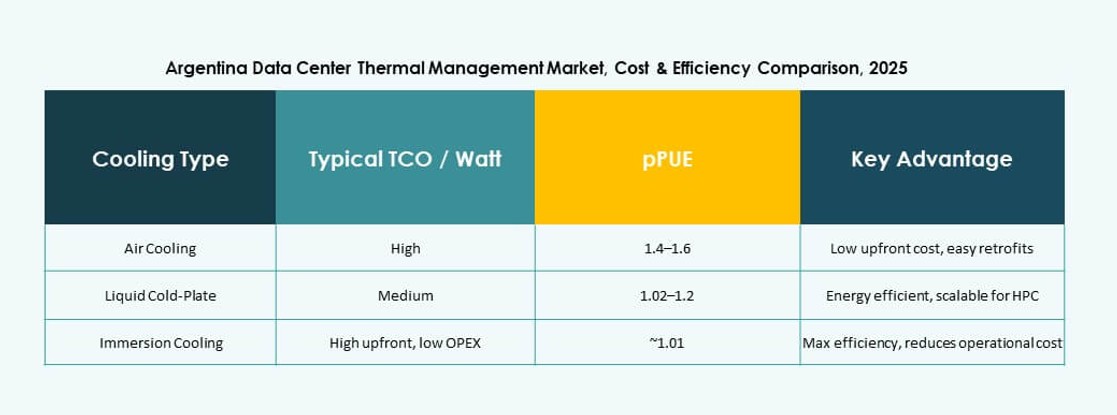

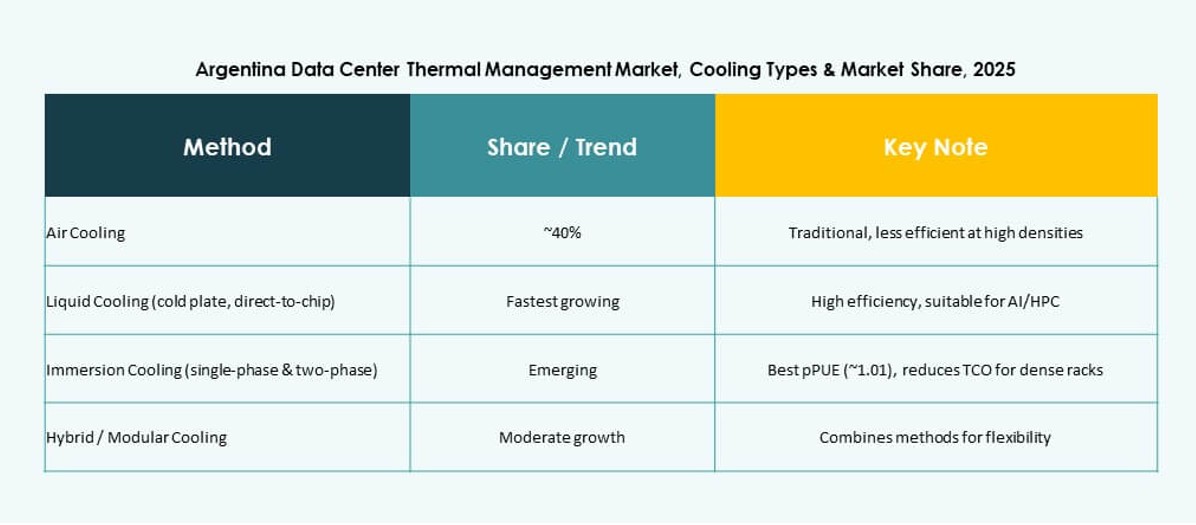

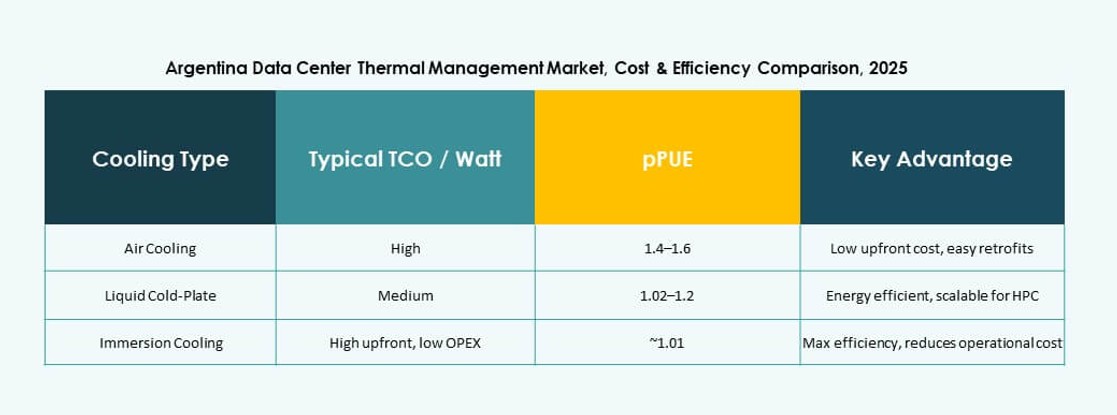

By Cooling Technology

Air-based cooling systems hold the largest share due to familiarity and ease of deployment. Direct air, hot/cold aisle containment, and rear-door heat exchangers are widely used in existing facilities. Liquid-based cooling is the fastest-growing subsegment, with direct-to-chip and immersion methods gaining traction in AI workloads. Hybrid systems are emerging where legacy and new workloads coexist. Thermoelectric and phase-change remain niche, with limited use in high-density zones.

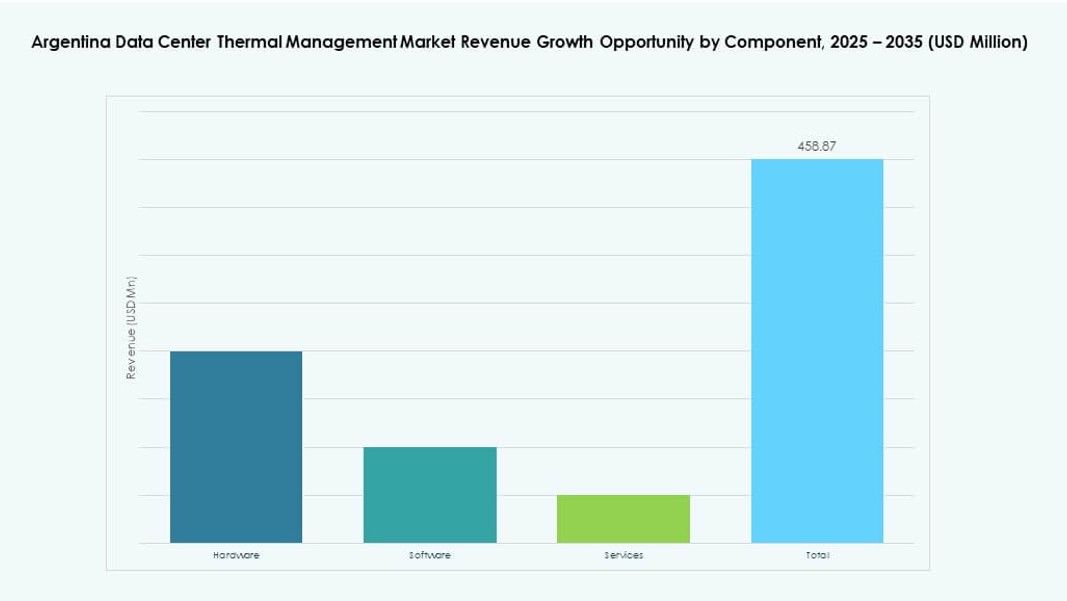

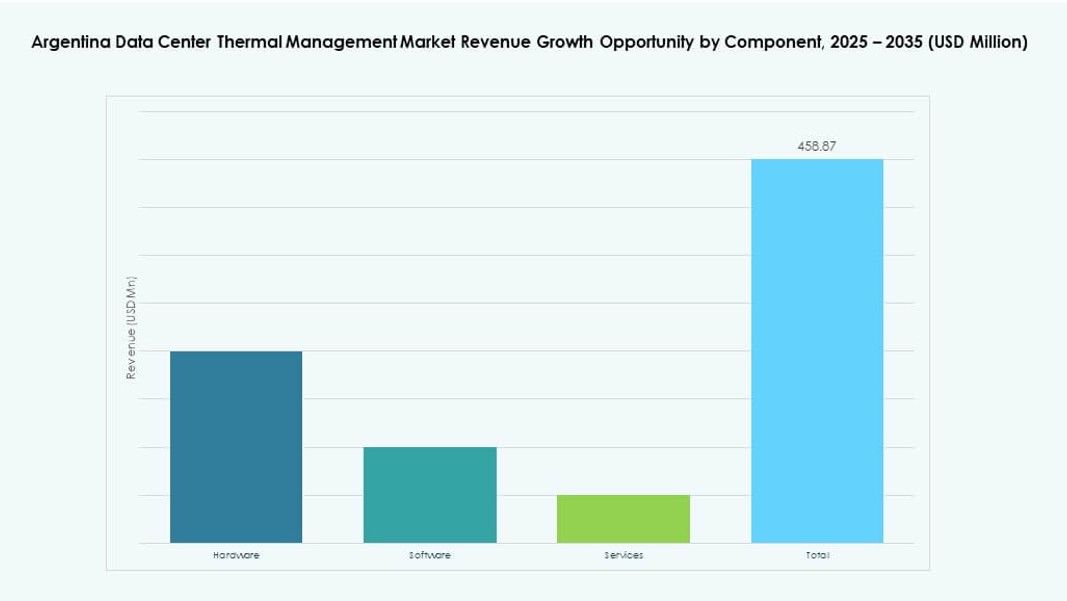

By Component

Hardware dominates component revenue in the Argentina Data Center Thermal Management Market. High capital spend goes into cooling units, distribution networks, and airflow control systems. Software and services segments are gaining ground, with DCIM, AI optimization, and monitoring solutions being bundled with hardware. Software enables dynamic energy optimization, while services ensure uptime, reliability, and compliance. Preventive maintenance and retrofit upgrades are key drivers in the services category.

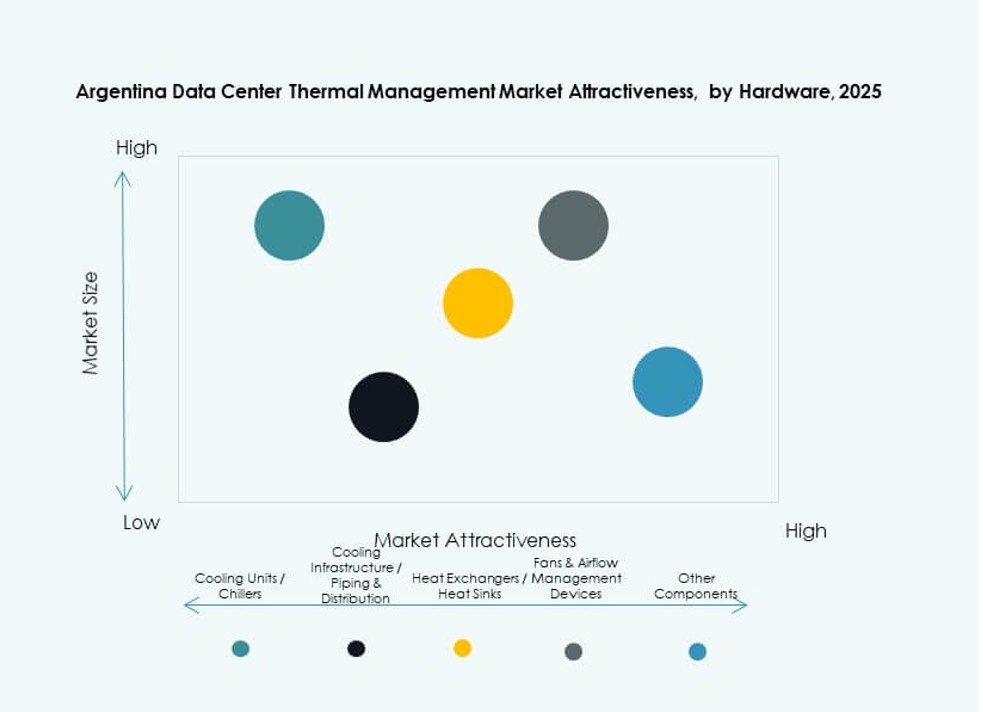

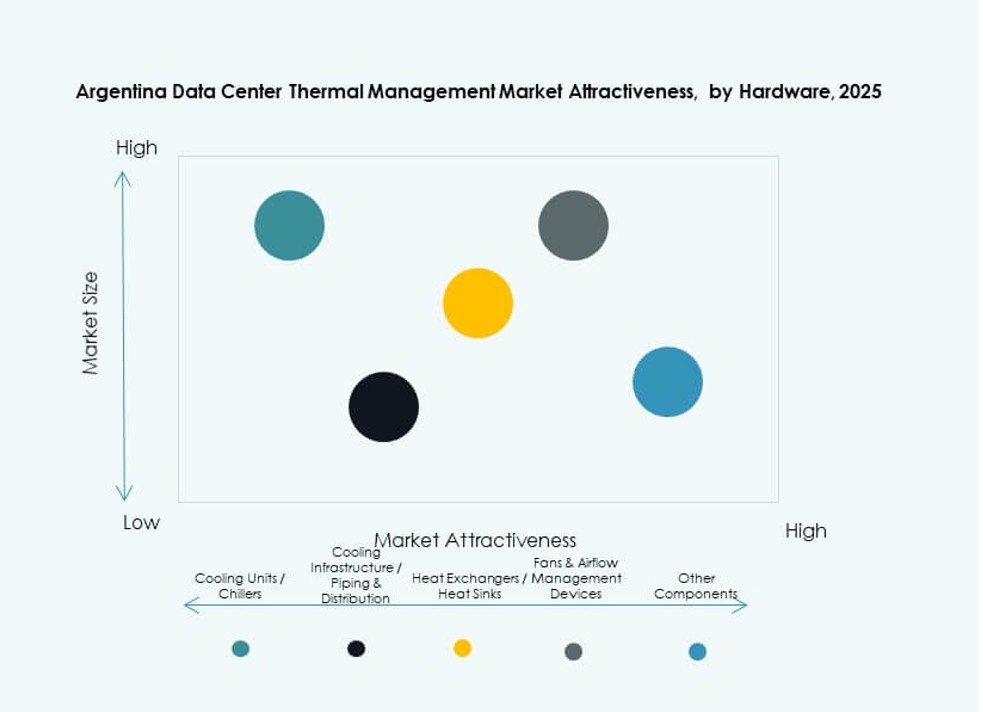

By Hardware

Cooling units and chillers make up the bulk of hardware spend, critical for heat rejection in large facilities. Fans, airflow devices, and heat exchangers follow closely in value. Distribution piping and other components form the supporting backbone of system design. Argentina Data Center Thermal Management Market demand is strongest for high-efficiency, modular hardware. Smart-enabled hardware adoption is also rising to support real-time system control.

By Software

DCIM dashboards remain the most common thermal software layer, helping monitor system performance. AI optimization platforms are gaining traction for predictive and adaptive cooling control. CFD simulation tools support airflow analysis in design and retrofit stages. BMS modules are integrated with cooling systems for facility-wide control. Argentina’s growing need for smart and energy-efficient data centers is fueling demand across software segments.

By Services

Installation and commissioning lead the services category, especially for new builds. Retrofits and upgrades are seeing demand from aging infrastructure in Buenos Aires and other metros. Preventive maintenance ensures consistent performance and uptime. Monitoring-as-a-service is rising with remote management needs. Argentina Data Center Thermal Management Market services are increasingly bundled into long-term SLAs, aligning with managed infrastructure trends.

By Data Center Type

Colocation and cloud facilities dominate demand due to growing outsourcing of IT infrastructure. Hyperscale data centers are gaining share with global players entering Argentina. Enterprise data centers contribute moderate demand, often involving hybrid cooling strategies. Edge and micro data centers are emerging in rural and second-tier cities, needing compact and efficient thermal systems. Other types contribute niche demand tied to telecom and banking.

By Structure

Room-based cooling still dominates legacy facilities due to lower upfront cost and familiarity. Rack-based and row-based structures are gaining adoption in new builds for better control and scalability. These approaches allow targeted cooling for high-density racks. Argentina Data Center Thermal Management Market structure trends favor modularity and adaptability. New deployments often combine multiple structures to optimize performance and space use.

Regional Insights

Buenos Aires Metropolitan Region Leads with Over 65% Market Share in Cooling Demand

The Buenos Aires region dominates Argentina’s data center thermal management market due to its infrastructure maturity, connectivity, and concentration of enterprise demand. It hosts the largest colocation campuses and sees the highest adoption of liquid and hybrid cooling technologies. High power density workloads and hyperscale entries are pushing advanced thermal strategies. Investment activity is high here, attracting global vendors and service providers to establish local partnerships.

- For instance, Cirion Technologies expanded its BUE1 data center by adding more than 2MW of capacity and approximately 160 racks, with facilities prepared for AI workloads featuring energy capacities exceeding 20MW.

Northern and Central Argentina Account for Nearly 20% of Market Activity

Regions like Córdoba, Rosario, and Mendoza represent emerging data center hubs supporting enterprise and telecom infrastructure. These areas benefit from state-level digital initiatives and improving power reliability. Operators are deploying modular data centers with energy-efficient thermal systems tailored to local climate conditions. Air-based and indirect evaporative cooling remains dominant. Growth in fintech, healthcare, and logistics sectors supports steady expansion in this subregion.

Southern Argentina and Border Regions Contribute About 15% but Show Growing Edge Demand

Patagonia and surrounding regions are witnessing small but rising demand driven by edge deployments and rural broadband rollouts. These areas require compact and low-maintenance thermal systems for micro data centers. Containerized cooling units and integrated fan coil systems are increasingly used. The Argentina Data Center Thermal Management Market is slowly expanding in these zones through telecom partnerships and government digital inclusion programs. Cooling solutions are tailored to harsh climates and power constraints.

- For instance, telecom operators in southern Argentina use containerized data centers with integrated cooling to support remote network operations. These modular facilities are designed to operate reliably in harsh climates while enabling faster deployment and simplified thermal control.

Competitive Insights:

- Vertiv Group Corp.

- Schneider Electric

- Daikin Industries Ltd.

- Johnson Controls International plc

- Eaton Corporation

- Mitsubishi Electric Corporation

- NTT Facilities

- Delta Electronics, Inc.

- Trane Technologies plc

The Argentina Data Center Thermal Management Market shows a moderately consolidated structure led by global infrastructure vendors with strong local partnerships. Leading players compete on system efficiency, scalability, and lifecycle support. Many firms offer integrated portfolios that combine cooling hardware, control software, and services. Vertiv and Schneider Electric focus on high-density and liquid-ready architectures for hyperscale demand. Asian manufacturers strengthen presence through cost-competitive HVAC and precision cooling systems. Engineering-led firms such as NTT Facilities differentiate through customized designs and reliability expertise. Competition also centers on retrofit capabilities for legacy facilities. The market favors vendors with strong service networks and compliance expertise. It rewards innovation in energy efficiency and modular deployment models.

Recent Developments:

- In December 2025, Samsung SDS completed its acquisition of FläktGroup, Europe’s largest HVAC company, to advance AI data center cooling technologies and integrate them with Samsung’s AI platforms and building management systems.

- In September 2025, Johnson Controls International plc launched the expanded Silent-Aire Coolant Distribution Unit series, a scalable liquid cooling solution designed for high-density data centers to meet AI-driven thermal demands.

- In August 2025, Daikin Industries Ltd. acquired Dynamic Data Centers Solutions, Inc. (DDC Solutions), a U.S.-based firm specializing in rack-level cooling systems for AI data centers, to bolster its thermal management portfolio through Daikin Applied Americas.

- In December 2024, Vertiv Group Corp. acquired assets and technologies from BiXin Energy Technology Co., Ltd., enhancing its liquid cooling capabilities for high-performance computing and AI workloads in data centers.