Executive summary:

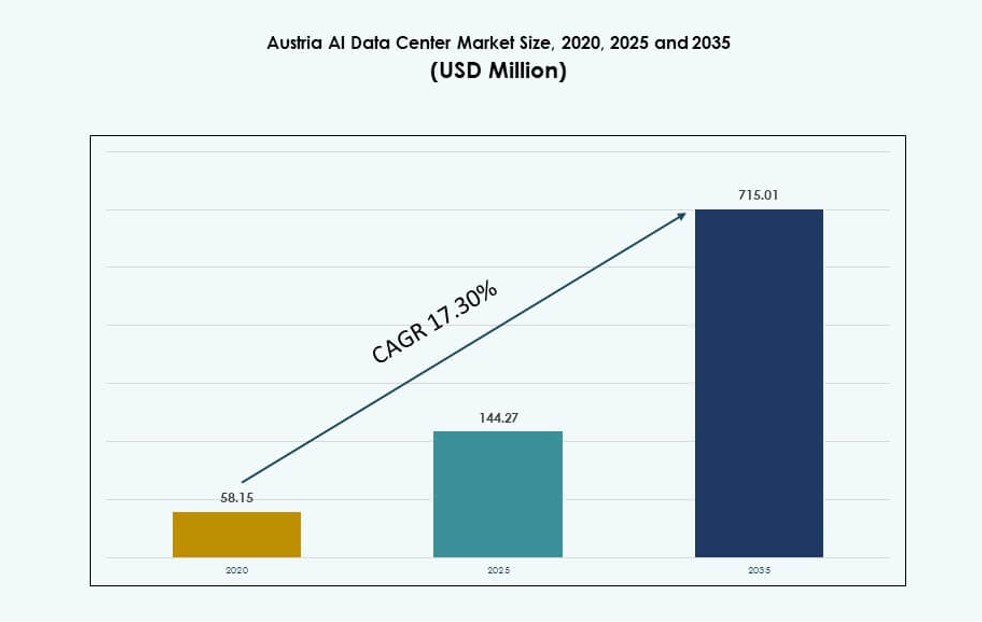

The Austria AI Data Center Market size was valued at USD 58.15 million in 2020 to USD 144.27 million in 2025 and is anticipated to reach USD 715.01 million by 2035, at a CAGR of 17.30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Austria Pacific AI Data Center Market Size 2025 |

USD 144.27 Million |

| Austria Pacific AI Data Center Market, CAGR |

17.30% |

| Austria Pacific AI Data Center Market Size 2035 |

USD 715.01 Million |

Growing demand for AI workloads, sovereign cloud platforms, and sustainable data center designs is reshaping Austria’s digital infrastructure landscape. Enterprises seek high-density compute environments to support machine learning, NLP, and generative AI. National policies on digital innovation and strict data residency rules are accelerating local infrastructure investments. Businesses prioritize low-latency, AI-ready deployments for critical applications. Operators integrate GPU clusters and AI orchestration layers across new facilities. Innovation from cloud providers and domestic firms fuels competition and service upgrades. Austria’s AI data centers enable faster insights and operational efficiency. It serves as a strategic backbone for enterprise transformation and public-sector AI deployment.

Vienna leads the market with strong interconnection, hyperscale activity, and policy alignment. It hosts the bulk of the country’s AI-ready infrastructure. Salzburg and Linz are emerging as secondary hubs due to rising regional AI demand and lower deployment costs. These cities attract mid-size operators and industry-focused AI deployments. Graz and Innsbruck show early-stage potential driven by university research and smart city programs. Austria benefits from central access to Germany, Switzerland, and Eastern Europe. It strengthens the country’s position as a regional AI compute and data exchange hub.

Market Dynamics:

Market Drivers

Surging Demand for High-Density Compute Supporting AI and Next-Gen Workloads

The Austria AI Data Center Market benefits from rising AI adoption in enterprise workflows, including analytics, automation, and inference. Demand for high-density GPU clusters and accelerated compute nodes is increasing. Organizations across BFSI, telecom, and manufacturing seek dedicated infrastructure for model training and real-time decisioning. Businesses are investing in AI-native platforms requiring specialized cooling and power delivery. This demand accelerates new facility development tailored to AI workloads. Operators are integrating rack-level liquid cooling and low-latency interconnects. AI is reshaping data center design from the core to the edge. Investment activity is rising from both domestic and international players. It positions Austria as a central AI compute hub in the region.

- For instance, Electric Power Systems (EPS) launched timber pre‑fabricated data center pods capable of 10–40 kW capacity in October 2025, offering sustainable, modular high‑density compute infrastructure suitable for AI workloads.

Expansion of Digital Transformation Strategies Across Public and Private Sectors

Austria’s national digital strategies encourage AI integration across healthcare, education, and transportation. Public-private partnerships fund research centers and advanced infrastructure zones. Enterprise demand for automation and personalized services increases AI model training requirements. High compute availability is now central to operational performance. Businesses prioritize data residency and regulatory compliance, boosting domestic capacity. The Austria AI Data Center Market gains importance in supporting sovereign AI development. Strategic initiatives align with EU-level digital and green transformation goals. AI-readiness has become a core factor in IT procurement. This ecosystem drives growth across colocation and cloud deployments.

- For instance, AI Factory Austria (AI:AT) launched in March 2025 with EU EuroHPC funding to build state‑of‑the‑art computing infrastructure, enabling companies to train larger AI models efficiently.

Integration of Energy-Efficient Systems and Sustainability-Driven Infrastructure

Sustainability remains a top priority in data center planning and operations. Austria’s abundant renewable energy, especially hydroelectric power, supports green AI infrastructure. Operators deploy energy-efficient cooling systems and optimize PUE through advanced monitoring tools. Liquid-cooled GPU racks reduce heat output and boost performance. Certifications such as ISO 50001 and green building standards guide facility design. The market attracts hyperscale investments due to low-carbon energy access. AI workloads align with sustainability objectives by optimizing resource use. Intelligent power management systems ensure operational efficiency. It enables enterprises to scale AI while meeting ESG targets.

Strengthening Cross-Border Connectivity and Edge Compute Networks

Austria’s central European location enables strong cross-border data exchange across Germany, Switzerland, and Eastern Europe. Edge networks expand in secondary cities to reduce latency and support real-time AI applications. Businesses leverage hybrid and multi-cloud environments to distribute AI processing. Data center operators enhance peering capacity and direct cloud connectivity. Vienna remains the national hub with Tier III and IV-certified facilities. Interconnection density allows seamless workload distribution across AI clusters. Emerging cities offer cost advantages and growing enterprise footprints. It supports AI-driven service delivery in finance, logistics, and e-government. The Austria AI Data Center Market plays a critical role in regional AI compute alignment.

Market Trends

AI-Specific Data Center Design Featuring GPU-Optimized and Liquid-Cooled Racks

The Austria AI Data Center Market is seeing rapid adoption of AI-centric infrastructure tailored to high-performance computing. Operators deploy racks supporting 30–50 kW densities, often with direct-to-chip or immersion cooling. Traditional airflow systems are being replaced by advanced liquid-based solutions. Modular designs help scale GPU clusters with minimal downtime. Facilities now integrate DCIM tools optimized for AI training telemetry. High-throughput networking infrastructure supports petabyte-scale data exchange. Vendors focus on ready-to-deploy AI stacks with validated hardware-software integrations. It encourages enterprises to shift from generic compute to AI-optimized hosting models. Design optimization enhances speed, efficiency, and sustainability.

Rise in Demand for Sovereign AI Infrastructure and Data Localization Compliance

Data localization regulations are shaping AI infrastructure development in Austria. Enterprises, especially in healthcare and finance, require localized training environments. Compliance with GDPR and national data residency laws drives investment in in-country AI hosting. Data centers respond with secure zones and compliance-ready architectures. Encryption at rest, access controls, and audit features become standard. Sovereign AI requires control over data flow, storage, and compute operations. Hyperscalers and colocation providers now offer sovereign cloud services for training and inference. The Austria AI Data Center Market aligns infrastructure with legal frameworks. It enables AI development without compromising regulatory obligations.

Growth in GPU-as-a-Service Models and Elastic AI Compute Platforms

AI-as-a-Service is reshaping capacity delivery models across Austria. GPU-as-a-Service platforms allow dynamic resource allocation for training and inferencing. Enterprises subscribe to shared clusters hosted within national borders. Elastic models offer flexibility, reducing capex for AI adoption. Operators integrate orchestration tools to manage multi-tenant AI workloads. Platform providers bundle compute with toolkits for data prep, model tuning, and monitoring. Pricing models support burst workloads and steady-state inference. The Austria AI Data Center Market supports this shift with infrastructure that enables real-time scaling. Businesses reduce time-to-AI while maintaining operational control.

AI-Driven Facility Operations Using Predictive Maintenance and Smart Optimization

AI is not only the workload but also the operational enabler in data centers. Operators adopt AI-driven tools to manage energy use, thermal flow, and workload distribution. Predictive maintenance reduces downtime by identifying hardware failures in advance. Smart controls optimize cooling, UPS load, and generator performance. AI-enhanced BMS and EMS systems deliver granular insights. Data centers achieve lower PUE and higher reliability using real-time optimization. Vendors offer AI-native management layers that improve response time. The Austria AI Data Center Market benefits from internal efficiency gains. It improves service quality and lowers lifecycle costs.

Market Challenges

High Initial Capital Costs and Infrastructure Readiness Delays Across Edge Locations

Building AI-ready data centers demands large upfront investment. High-density racks, liquid cooling systems, and specialized GPUs raise procurement costs. Infrastructure buildout timelines extend due to design complexity and regulatory clearances. Power availability and grid interconnection issues impact secondary and edge locations. Local permitting delays add uncertainty for greenfield projects. Skilled workforce shortages slow deployment of advanced systems. Rural and mid-tier cities lack the robust connectivity required for edge AI deployment. The Austria AI Data Center Market faces hurdles in balancing regional rollout with ROI. Operators need capital efficiency and long-term usage guarantees to de-risk expansion.

Regulatory Ambiguity in AI-Specific Compliance and Environmental Impact Norms

The AI ecosystem lacks standardized regulations on compute transparency and carbon accounting. Evolving EU-level policies around digital sovereignty, AI ethics, and energy use add complexity. Operators must adapt to changing emission thresholds and workload categorization. Environmental rules differ across federal and municipal jurisdictions, creating compliance ambiguity. Large-scale AI centers may face scrutiny for energy use even with green sourcing. Difficulty in quantifying AI workloads’ externalities limits policy clarity. Vendors face pressure to justify resource use in high-density deployments. The Austria AI Data Center Market must address these legal uncertainties. Long-term viability depends on clear, harmonized frameworks.

Market Opportunities

AI Innovation Hubs, Academic Partnerships, and Startup Ecosystem Expansion

Austria’s universities and AI research centers offer collaboration opportunities for data center operators. Vienna, Linz, and Graz host clusters focused on AI research, training, and simulation. Data center providers can partner with institutions to offer AI infrastructure on demand. The Austria AI Data Center Market supports academic experimentation and early-stage innovation. Access to scalable GPU compute fosters entrepreneurship and model iteration.

Rising Cross-Border AI Projects and Regional Integration With EU Compute Networks

Austria’s position enables integration into larger EU AI infrastructure networks. Operators can serve multi-country AI training requirements with low-latency performance. Government-backed initiatives promote shared compute, boosting regional demand. The Austria AI Data Center Market is positioned to become a key link in EU-wide AI workloads. Interoperable frameworks open doors for international collaboration and scaling.

Market Segmentation

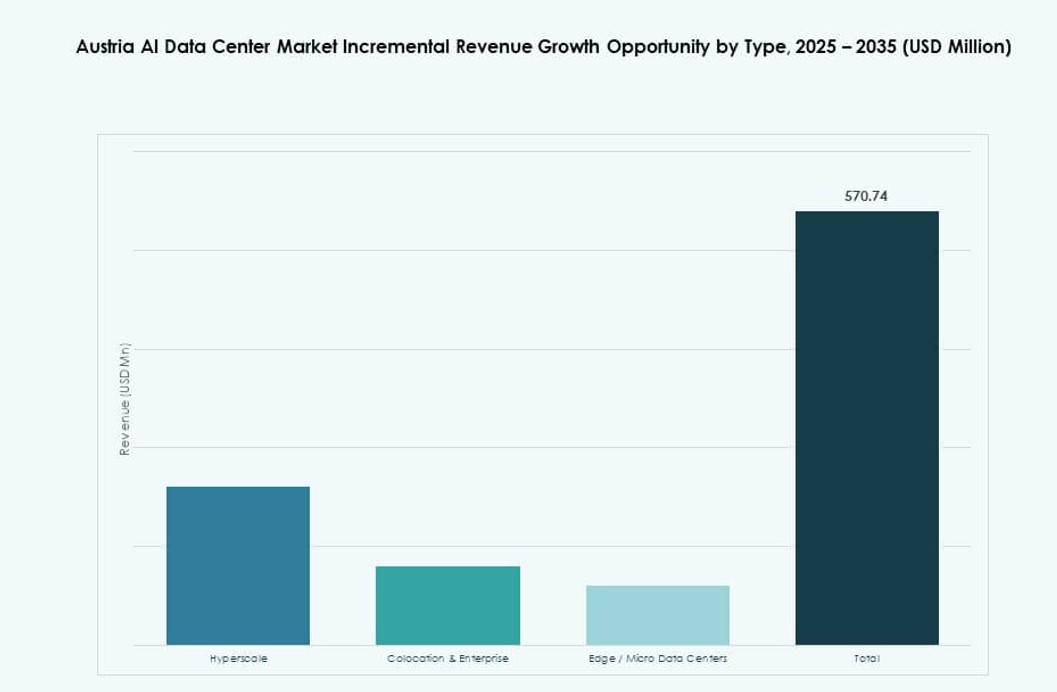

By Type

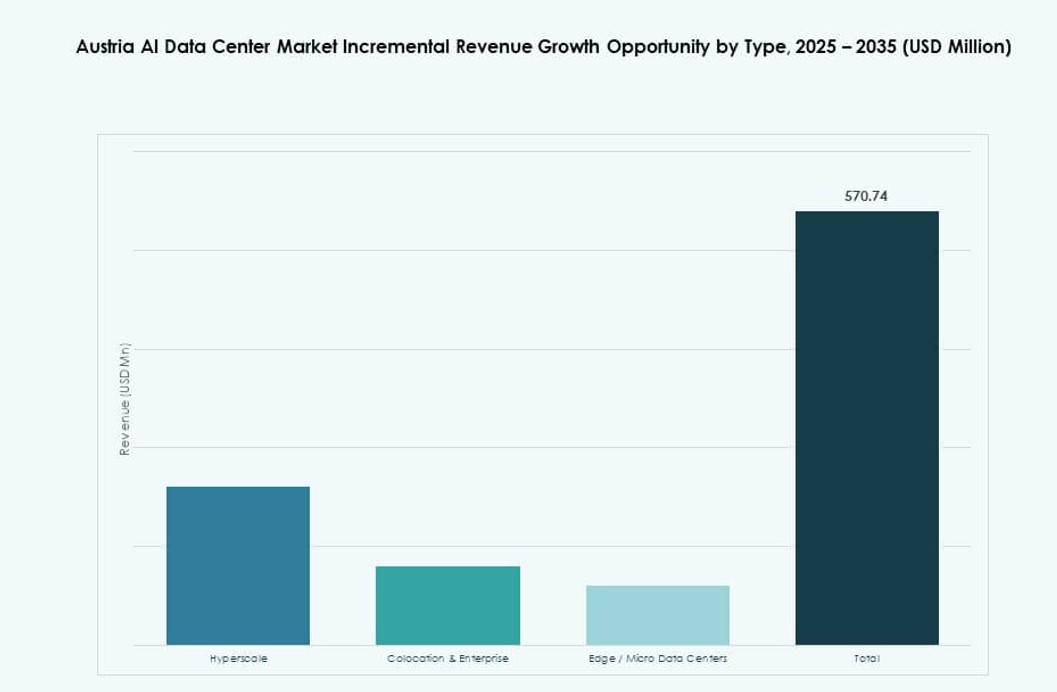

The hyperscale segment dominates the Austria AI Data Center Market, driven by demand for scalable AI training and high-volume inference capacity. Operators focus on building large, modular campuses optimized for GPU clustering. Colocation and enterprise deployments follow, supporting regulated sectors and private AI development. Edge/micro data centers are emerging for real-time analytics and localized model execution. Growth in edge AI applications strengthens the long-term potential of this segment.

By Component

Hardware holds the largest market share due to AI’s high demand for GPUs, accelerators, and cooling systems. Facilities are upgrading to support high-rack power densities and advanced chipsets. Software and orchestration platforms gain traction for AI workload scheduling, management, and observability. The services segment supports design, integration, and ongoing AI infrastructure operations. Each layer plays a key role in supporting AI deployment at scale.

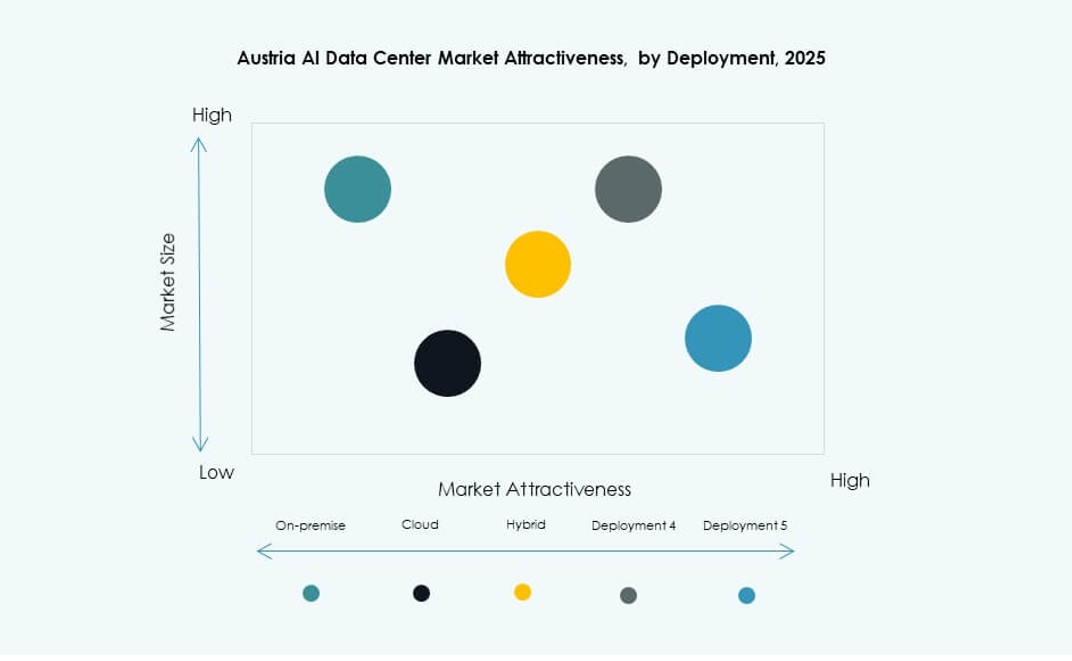

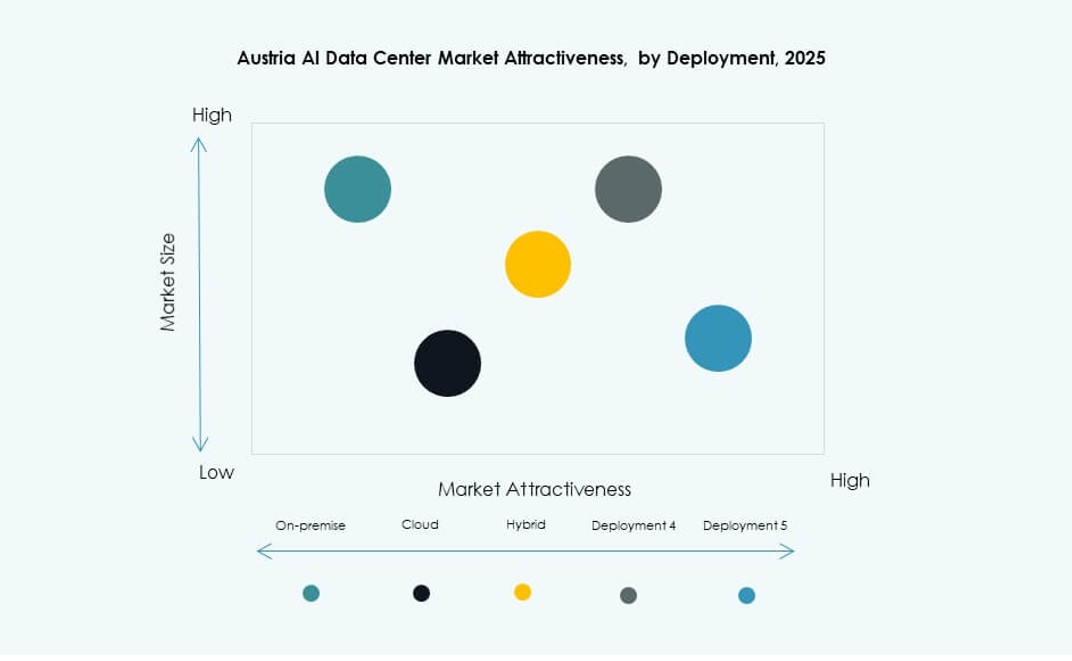

By Deployment

Hybrid deployment leads in the Austria AI Data Center Market, as enterprises seek to balance control, performance, and scalability. Cloud deployment is expanding due to on-demand GPU provisioning and lower upfront cost. On-premise remains relevant in regulated industries requiring complete data governance. Hybrid models provide flexibility to optimize cost and compliance. This deployment mix reflects Austria’s maturing enterprise AI strategies.

By Application

Machine learning (ML) leads application segments, supporting structured and unstructured data processing across industries. Generative AI (GenAI) grows rapidly, fueled by enterprise chatbot, image generation, and code synthesis use cases. NLP supports language translation, customer service, and sentiment analysis. Computer vision is applied in smart surveillance, quality control, and healthcare diagnostics. The “others” category includes robotics and forecasting models gaining adoption.

By Vertical

The IT and telecom vertical leads due to heavy investment in AI-driven automation and service optimization. BFSI follows with AI in fraud detection, risk modeling, and customer personalization. Healthcare is expanding due to imaging diagnostics and predictive analytics. Retail leverages AI for supply chain and personalization. Media & entertainment use cases in content generation are growing. Manufacturing and automotive use AI in quality control and autonomous systems. Other sectors adopt AI incrementally with targeted deployments.

Regional Insights

Vienna Metropolitan Region Dominates with Over 60% Market Share

Vienna leads the Austria AI Data Center Market, holding over 60% of the market share. The city offers strong power grid reliability, dense connectivity, and access to top-tier universities. High regulatory clarity and green energy availability make it ideal for AI-ready infrastructure. Major global and regional operators have established presence near Vienna. It serves as the core interconnection hub for domestic and cross-border traffic. Strategic location and data sovereignty needs reinforce Vienna’s lead.

- For instance, Digital Realty operates multiple Vienna facilities with over 118,000 ft² and 220,000 ft² of colocation space, supporting more than 185 customers and enhancing the city’s interconnection ecosystem

Linz and Salzburg Emerge with 20% Combined Share as Secondary Hubs

Linz and Salzburg account for about 20% of the market, serving regional enterprises and public sector projects. These cities benefit from lower land costs and supportive municipal policies. Emerging industrial AI use cases drive localized compute demand. Data centers in these areas support hybrid deployments and regional edge requirements. Linz’s industrial base and Salzburg’s smart city initiatives create early traction. It enables AI deployment closer to source systems.

- For instance, Google has advanced plans for a data center near Linz in Kronstorf, with groundwork underway and planning submissions made in 2025, signaling a strategic build‑out outside Vienna.

Graz, Innsbruck, and Other Provinces Hold 20% Market Share and Future Potential

Graz, Innsbruck, and other provinces collectively represent 20% of the Austria AI Data Center Market. These regions are in early development stages but show promise for edge and academic-linked infrastructure. AI innovation programs and university research clusters support future growth. Infrastructure gaps, such as power provisioning and connectivity, still limit scale. Incentives and public-private models could accelerate deployment. It creates opportunity for distributed AI compute networks.

Competitive Insights:

- ANEXIA

- Next Layer

- A1 Digital

- Digital Realty Trust

- Equinix

- Microsoft (Azure)

- Amazon Web Services (AWS)

- Google Cloud / Alphabet

- Dell Technologies

- NVIDIA

The Austria AI Data Center Market features a mix of local, regional, and global players driving innovation, capacity expansion, and specialized AI infrastructure. Local firms like ANEXIA, A1 Digital, and Next Layer focus on colocation, enterprise-grade hosting, and national compliance support. Hyperscale leaders such as AWS, Google Cloud, and Microsoft Azure are investing in GPU-optimized infrastructure to meet growing enterprise demand. Equinix and Digital Realty offer scalable interconnection and hybrid platforms across Vienna and secondary cities. NVIDIA plays a critical role through hardware acceleration and ecosystem partnerships. It creates a competitive landscape marked by AI-native services, sustainability initiatives, and cross-border integration. Operators are differentiating through AI workload orchestration, renewable energy use, and sovereign hosting capabilities.

Recent Developments:

- In October 2025, fragmentiX announced the construction of the LEND AI DataCentre near Salzburg. Developed in partnership with DELL Technologies, this high-security facility emphasizes data sovereignty, sustainability via local hydropower, and AI applications unique to Europe.

- In August 2025, Microsoft expanded its Austria East datacenter region to support Microsoft 365 data residency locally, offering full local storage and processing for Power Platform, Dynamics 365, and collaboration tools with integration into the EU Data Boundary framework.

- In July 2025, Microsoft launched a new Austrian Azure cloud region in Vienna that enables local cloud and AI services for enterprises and public sector clients, enhancing data sovereignty and compliance within Austria.

- In December 2024, Anexia purchased a small hydropower plant in Styria, Austria, to generate sustainable electricity for its data centers, including support for AI workloads amid growing energy demands in the region.

- In March 2024, AtlasEdge acquired a Vienna data center site. The purchase establishes the company’s presence in Austria’s key connectivity hub, with plans to expand it to a 10MW facility by Q3 2026