Executive summary:

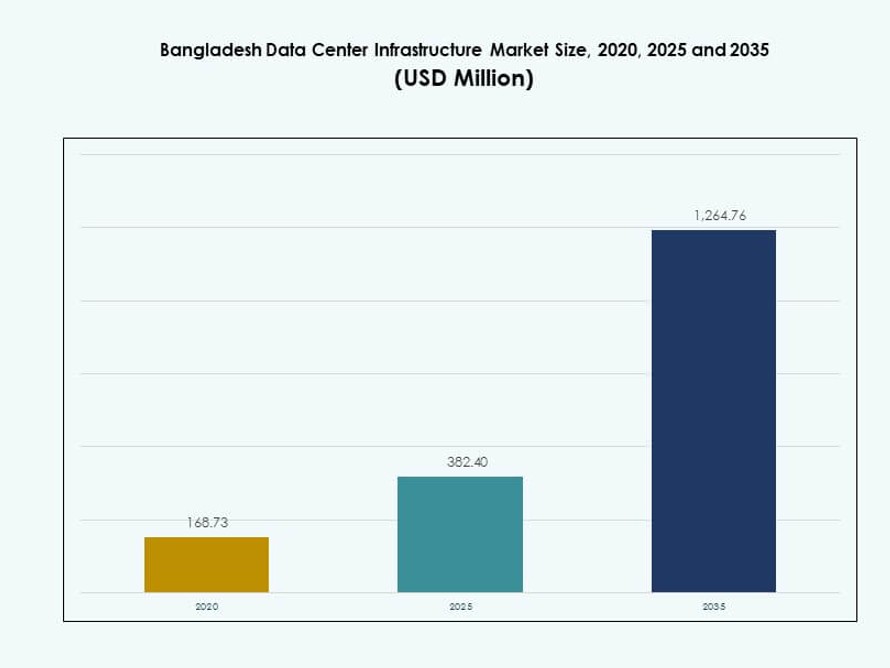

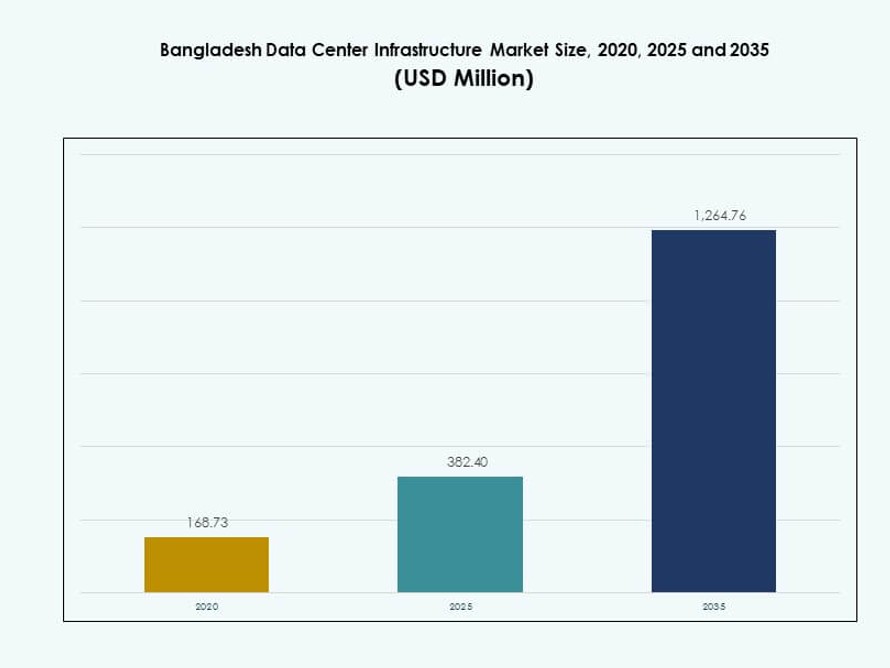

The Bangladesh Data Center Infrastructure Market size was valued at USD 168.73 million in 2020 to USD 382.40 million in 2025 and is anticipated to reach USD 1,264.76 million by 2035, at a CAGR of 12.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Bangladesh Data Center Infrastructure Market Size 2025 |

USD 382.40 Million |

| Bangladesh Data Center Infrastructure Market, CAGR |

12.60% |

| Bangladesh Data Center Infrastructure Market Size 2035 |

USD 1,264.76 Million |

The market is propelled by national digital transformation, rapid cloud adoption, and strong public-private initiatives. Enterprises invest in agile, modular infrastructure to handle data growth, while the government supports sovereign cloud and smart infrastructure programs. Innovations in energy-efficient systems and AI-powered monitoring improve uptime and sustainability. The market plays a central role in delivering scalable, secure services for banks, telecoms, and public sector systems. Its growth aligns with Bangladesh’s digital ambitions and offers long-term returns for infrastructure-focused investors.

Dhaka leads the market due to its high enterprise density, strong fiber backbone, and policy-driven infrastructure rollout. Chattogram is emerging as a key region, driven by port activities, industrial zones, and submarine cable access. Secondary cities like Sylhet and Khulna are witnessing growth from edge deployments that support government outreach and localized digital services.

Market Dynamics:

Market Drivers

Accelerating Digital Transformation Initiatives Across Government and Enterprise Sectors

The Bangladesh Data Center Infrastructure Market benefits from rapid digitalization across public and private sectors. Government projects such as Digital Bangladesh, along with enterprise modernization, push demand for robust digital infrastructure. Core banking platforms, smart governance tools, and e-commerce growth drive the need for secure and scalable data storage. Enterprises now prioritize in-country data processing to comply with evolving data localization policies. This demand supports investment in high-performance servers, power systems, and networking equipment. The market becomes vital for tech startups, telecoms, and financial service providers. These sectors need reliable uptime and low-latency networks to support their digital services. The market serves as a critical enabler for national competitiveness in a global digital economy. For investors, it offers long-term infrastructure returns with increasing scale potential.

- For example, Union Digital Centers (UDCs) were established in over 4,500 union parishads under the Digital Bangladesh initiative to deliver ICT-based public services to rural communities. These centers offer access to hundreds of e-government and private services, improving digital inclusion in underserved areas.

High Demand for Cloud-Based Platforms and Scalable Infrastructure Models

Cloud adoption is reshaping the Bangladesh Data Center Infrastructure Market. Businesses move away from legacy servers toward scalable, cloud-based and hybrid platforms. Global and regional cloud providers are expanding presence through colocation and edge infrastructure partnerships. This shift drives investment in cooling, UPS, and modular power units to maintain operational continuity. IT budgets increasingly focus on cloud-readiness, agility, and faster deployment timelines. Public cloud workloads in healthcare, banking, and education demand high uptime and security compliance. Data centers serve as the critical layer between cloud platforms and end-user services. Investors view this transition as a gateway to recurring revenues and flexible leasing models. It strengthens the position of the market within South Asia’s evolving cloud economy.

- For instance, Grameenphone launched its Tier III Super Core Data Center in Sylhet in January 2024 with 4 MW IT capacity, supporting core network operations for enhanced cloud interoperability.

Strategic Expansion by Telecoms and Global Infrastructure Players

Telecom providers and global tech companies are anchoring growth within the Bangladesh Data Center Infrastructure Market. Leading telecom firms invest in carrier-neutral data centers and submarine cable links to ensure seamless interconnection. These deployments support high-bandwidth use cases such as video streaming, e-learning, and 5G readiness. Infrastructure firms bring technical know-how, energy-efficient systems, and global design standards to local builds. This creates a steady flow of capital and engineering expertise for hyperscale and edge deployments. With bandwidth demand rising exponentially, the role of Tier III and Tier IV data centers is becoming central. The strategic location of Bangladesh along key digital corridors further attracts regional players. This blend of telecom strength and global investment makes the market highly relevant to infrastructure-focused funds.

Growing Importance of Energy-Efficient and Modular Infrastructure Designs

The Bangladesh Data Center Infrastructure Market gains momentum from innovation in modular and energy-efficient design. Operators aim to reduce power usage effectiveness (PUE) by using advanced cooling units, BESS, and smart power distribution. Prefabricated and modular data center models offer quick deployment and scalability, addressing space and cost concerns. These features are critical for enterprises seeking faster time-to-market in new service rollouts. Modular designs also help overcome delays from urban zoning or environmental regulations. Renewable energy integration through hybrid grids and solar backup adds to the green transformation. With sustainability being a key criterion for investor confidence, the market aligns with ESG-focused portfolios. Energy optimization becomes not just a compliance issue but a market differentiator for both colocation and enterprise operators. It reinforces the role of efficient infrastructure in digital Bangladesh’s long-term roadmap.

Market Trends

Rising Deployment of Edge Data Centers to Support Distributed Digital Ecosystems

The Bangladesh Data Center Infrastructure Market shows a sharp rise in edge deployments. Edge data centers reduce latency and improve service reliability for real-time apps like fintech, OTT, and gaming. Operators build micro data centers closer to users in secondary cities to manage regional data loads. This trend reduces pressure on core facilities in Dhaka and lowers transit costs. Containerized edge systems are gaining popularity for being compact, secure, and easy to relocate. Retail, logistics, and telecom sectors adopt edge for last-mile service performance. Edge deployment supports rural digitization and government outreach programs. It helps manage distributed infrastructure across diverse geographies. The market grows more resilient with this decentralized model of digital delivery.

Adoption of AI-Based Monitoring Tools for Predictive Maintenance and Optimization

The integration of AI tools is a growing trend across the Bangladesh Data Center Infrastructure Market. AI-driven monitoring enhances energy use, uptime, and equipment lifecycle through predictive analytics. Operators deploy smart sensors across UPS, HVAC, and fire safety systems to anticipate issues before failure. This ensures proactive maintenance scheduling and avoids unplanned outages. AI tools also track cooling efficiency and airflow balance, helping optimize PUE scores. Cloud-based DCIM systems bring real-time visibility across assets and operations. These features reduce downtime and lower OPEX for large and medium operators. It is especially beneficial for colocation providers offering SLAs to tenants. AI-driven optimization supports sustainable and reliable digital infrastructure expansion.

Growth of Rack Power Density and High-Performance Computing Workloads

Rising demand for AI, video analytics, and machine learning leads to higher rack power density. The Bangladesh Data Center Infrastructure Market reflects this trend with increased adoption of liquid-cooled and high-capacity rack solutions. Traditional 5–8 kW racks are being replaced by 12–20 kW configurations in new builds. This shift needs upgrades in power systems, containment, and thermal management technologies. High-performance servers require improved airflow, BESS, and efficient PDUs to manage peak loads. Colocation centers now promote high-density suites for premium enterprise clients. This trend favors investment in advanced mechanical and electrical systems. It helps operators attract data-heavy workloads while optimizing space. HPC-ready facilities bring revenue diversity and higher asset utilization.

Increased Interest in Green Building Certifications and Renewable Integration

Green building trends influence new facilities within the Bangladesh Data Center Infrastructure Market. Operators now seek LEED or EDGE certifications to showcase sustainability and environmental compliance. These certifications improve project credibility and financing access. Hybrid systems using grid electricity, solar, and battery storage are gaining traction. Sustainable construction methods like recycled materials and modular frames further align with green goals. Government agencies and global clients prefer service providers with verified environmental credentials. Cooling innovations like evaporative and liquid immersion systems also reduce water and energy consumption. The focus on green operations attracts ESG-aligned investors and long-term tenants. It shapes the market’s competitive landscape toward low-carbon infrastructure.

Market Challenges

Limited Access to High-Quality Power and Long-Term Energy Reliability Risks

The Bangladesh Data Center Infrastructure Market faces challenges from inconsistent power quality and grid outages. Frequent voltage fluctuations and poor redundancy in some regions increase reliance on backup power systems. High dependence on diesel generators raises operational costs and environmental concerns. Although BESS adoption is rising, it remains costly for small and mid-sized data centers. Long-term power purchase agreements are limited, hindering renewable energy integration. Infrastructure projects often face delays due to permitting and utility bottlenecks. Load shedding impacts service reliability, especially in Tier I and II cities. These limitations affect scalability and service-level commitments. Investors consider power reliability a key risk factor in project evaluation.

Shortage of Skilled Workforce and Complex Regulatory Navigation

A shortage of experienced professionals slows the adoption of advanced infrastructure systems. The Bangladesh Data Center Infrastructure Market struggles to meet demand for certified technicians, data center architects, and system integrators. Skill gaps limit the use of AI-enabled tools and high-density deployments. Operators must often rely on overseas experts for design and commissioning. Local regulations remain fragmented, delaying land acquisition, environmental clearance, and utility connections. There is no unified framework for data center classification or incentives. Navigating approvals can add cost and time to new projects. These issues create uncertainty for international investors evaluating the market.

Market Opportunities

Public Sector Digitalization and Growing SME Cloud Adoption Drive Future Capacity Expansion

Government-led digital platforms create demand for national infrastructure upgrades. Health records, tax systems, education portals, and municipal services need secure, in-country storage. Simultaneously, SMEs move their operations to cloud platforms, driving demand for edge and colocation capacity. This double-digit growth potential attracts global and regional providers to expand footprints. The Bangladesh Data Center Infrastructure Market is well-positioned to scale rapidly with the right regulatory and power infrastructure support.

Strategic Positioning to Serve Regional Data Transit and Submarine Cable Traffic

Bangladesh’s location offers strong potential to act as a transit hub for South and Southeast Asia. New submarine cable landings and cross-border fiber links can strengthen the country’s digital corridor presence. With Dhaka and Chattogram emerging as key nodes, the Bangladesh Data Center Infrastructure Market holds strategic relevance for international content delivery and financial services routing.

Market Segmentation

By Infrastructure Type

The Bangladesh Data Center Infrastructure Market is led by IT & network infrastructure, driven by rising server and storage deployments. Electrical infrastructure follows closely due to the critical need for power reliability and UPS systems. Mechanical infrastructure shows steady growth as high-density workloads demand efficient cooling. Civil and architectural investments rise with demand for greenfield and modular construction. These segments shape the physical and digital foundation of the country’s expanding digital ecosystem.

By Electrical Infrastructure

Uninterruptible power supply (UPS) systems dominate this segment due to frequent voltage instability in the grid. Battery energy storage systems (BESS) and PDUs are also gaining importance for supporting high-availability setups. Grid connections and transfer switches remain essential for ensuring stable power continuity. Operators prioritize smart, redundant power chains to meet Tier III and Tier IV standards. The electrical infrastructure segment anchors overall facility resilience in the Bangladesh Data Center Infrastructure Market.

By Mechanical Infrastructure

Cooling units such as CRAC and CRAH systems account for a major share in this segment. The rise in rack power density and continuous server operations increase demand for energy-efficient chillers and containment systems. Hot and cold aisle containment is commonly used to reduce airflow inefficiencies. Operators invest in pumps, piping, and heat rejection systems to optimize PUE. The mechanical infrastructure segment becomes critical for facilities aiming to support hyperscale and AI workloads.

By Civil / Structural & Architectural

Modular and prefabricated building systems are gaining traction due to faster deployment timelines and cost efficiency. Raised floors and suspended ceilings are standard in new builds to allow flexible airflow and cable management. Superstructure and envelope design choices impact energy usage and security. Urban zoning challenges drive interest in compact, vertical builds. This segment evolves with the rise of scalable, plug-and-play data center formats.

By IT & Network Infrastructure

Networking equipment, server racks, and structured cabling hold the highest demand in this segment. Enterprises and cloud providers prioritize low-latency and high-bandwidth infrastructure. Storage capacity expands to accommodate video, financial, and medical data workloads. Optical fiber and high-speed switches enable interconnectivity within multi-tenant environments. The Bangladesh Data Center Infrastructure Market sees rapid spending growth in this segment due to rising data intensity.

By Data Center Type

Colocation data centers dominate, supported by growing SME and telecom demand for flexible hosting. Hyperscale data centers are emerging, driven by global providers entering the market. Enterprise data centers continue to serve banks and government institutions. Edge facilities rise in Tier II cities to serve distributed applications. Each type contributes uniquely to the expansion of national capacity.

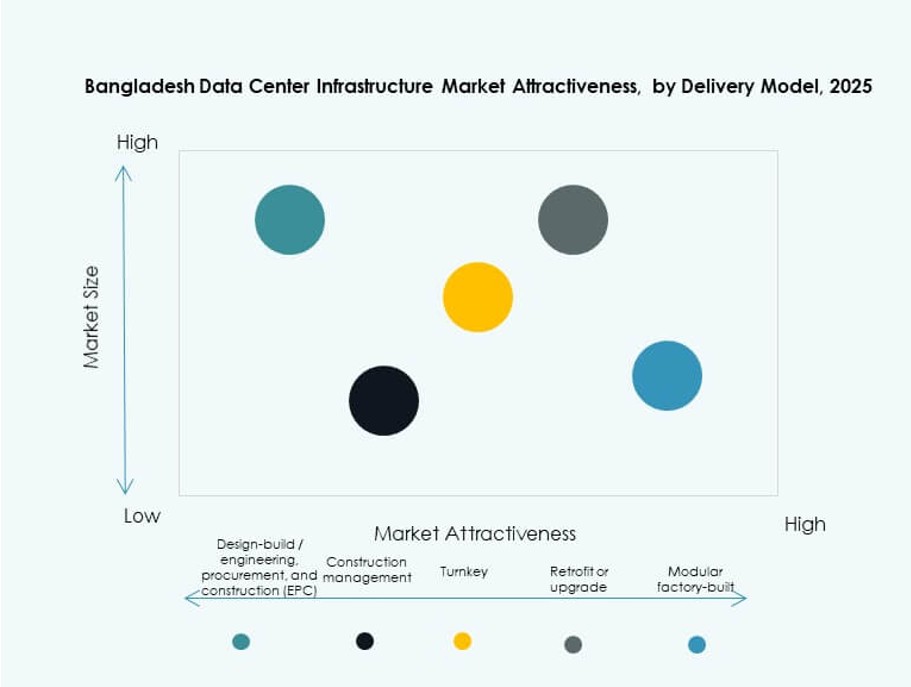

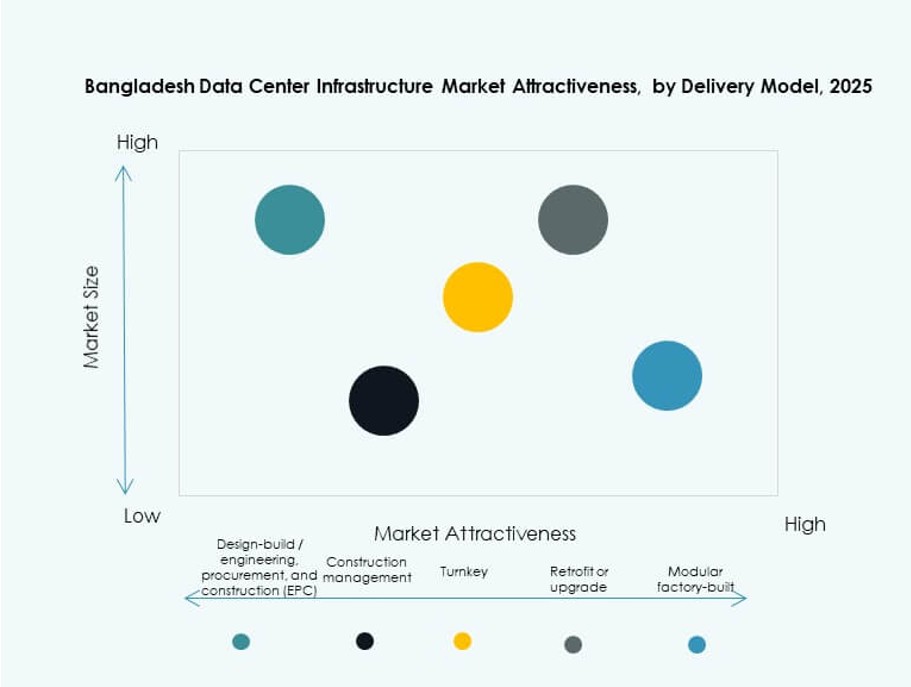

By Delivery Model

Turnkey and design-build models lead, offering speed and control to developers. Retrofit and upgrade models are popular among legacy enterprises shifting to digital-first models. Modular factory-built solutions are gaining ground due to scalability and ease of deployment. Construction management models appear in larger public sector projects. Each delivery model aligns with distinct investor and project profiles.

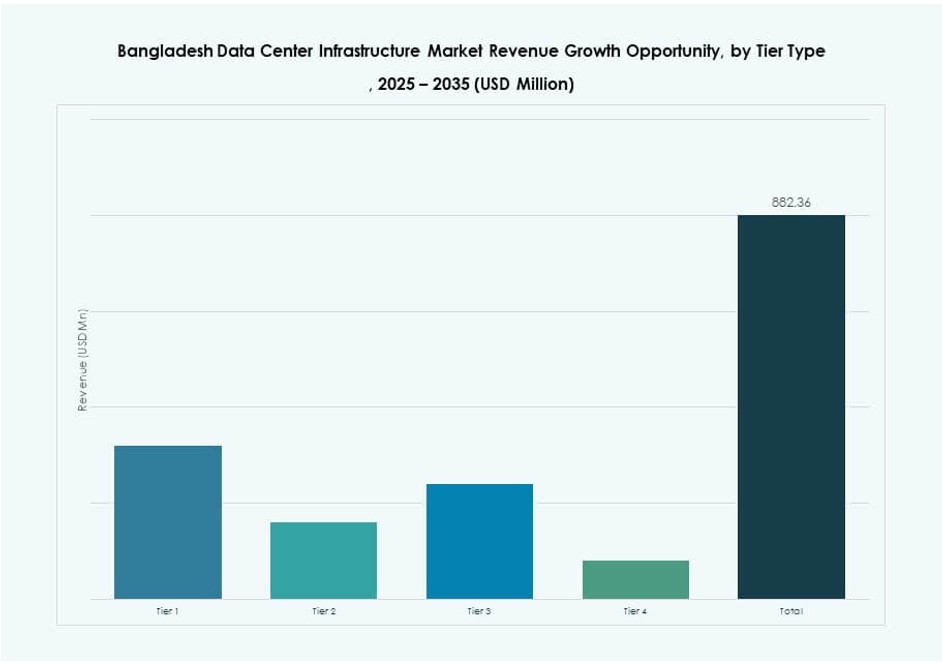

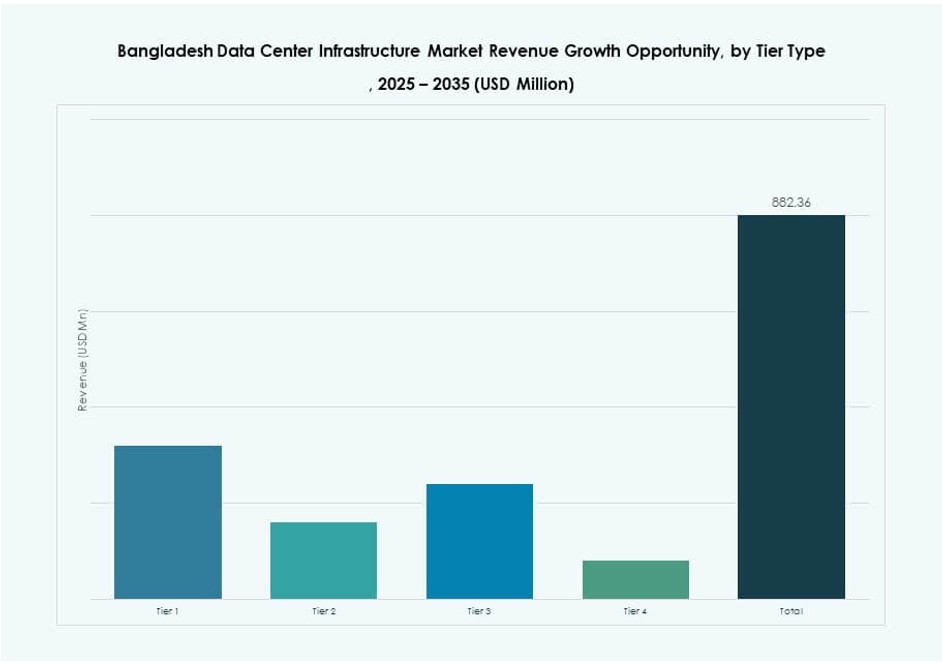

By Tier Type

Tier III data centers lead the Bangladesh Data Center Infrastructure Market due to the balance of cost and reliability. Tier II facilities serve SMEs and regional clients with moderate uptime needs. Tier IV investments are rising in critical sectors like banking and telecom. Tier I presence is limited, reflecting the shift toward higher availability standards. Tier segmentation reflects both client maturity and service expectations.

Regional Insights

Dhaka Remains the Core Hub with Over 65% Market Share Due to High Enterprise and Cloud Activity

Dhaka holds the dominant share in the Bangladesh Data Center Infrastructure Market due to its status as the capital and financial hub. Most large enterprises, telcos, and cloud providers base operations in this region. Power access, fiber connectivity, and data localization needs make it the natural first choice for Tier III and IV facilities. New government and private sector projects are concentrated here. With strong infrastructure, Dhaka continues to lead capacity additions.

- For instance, BDCCL’s Tier IV National Data Center in Kaliakoir, Gazipur, provides 99.995% uptime, supports 604 racks across four halls totaling 8,000 sqm, and offers up to 40 Gbps connectivity via dual redundant fiber links.

Chattogram Emerges with Around 20% Share Driven by Trade, Port Access, and Submarine Cable Proximity

Chattogram ranks second in the Bangladesh Data Center Infrastructure Market, supported by its role in logistics and international trade. Proximity to submarine cable landings and expanding enterprise zones support edge and colocation builds. Urbanization and rising e-commerce in the region make Chattogram attractive for secondary facilities. Power reliability remains a challenge but is improving with targeted upgrades. Its market share is projected to grow steadily.

Sylhet, Rajshahi, and Khulna Regions Share the Remaining 15%, Focused on Edge Deployments and Public Sector Use

These emerging subregions account for a smaller but growing share of the Bangladesh Data Center Infrastructure Market. Government outreach, rural digitization, and distributed healthcare platforms drive demand for edge data centers. Local operators explore containerized and prefabricated models in these regions. Infrastructure constraints still limit large-scale deployments, but planned road and power investments may improve feasibility. Their role in national digital inclusion will shape future growth.

- For instance, Felicity IDC’s data center at Sheikh Hasina Software Technology Park in Jashore is designed to support high-density colocation with a planned capacity of around 550 racks, aiming to serve enterprise and hyperscale demands across Bangladesh.

Competitive Insights:

- Equinix, Inc.

- Delta Electronics

- IBM

- ABB

- Acer Inc.

- Cisco Systems, Inc.

- Dell Inc.

- KIO

- Lenovo

- Schneider Electric

- Vertiv Group Corp.

The Bangladesh Data Center Infrastructure Market features a mix of global technology vendors and specialized infrastructure providers competing across power, cooling, IT, and network segments. Vertiv, Schneider Electric, and ABB lead in critical electrical and mechanical systems, offering UPS, PDUs, and advanced cooling technologies. Equinix and KIO drive global expertise in colocation and hyperscale operations. Cisco, Dell, Lenovo, and IBM provide integrated IT solutions, including servers, networking, and storage. Delta Electronics strengthens its position through modular and energy-efficient systems tailored to local needs. Competition intensifies around modular builds, green energy use, and Tier III and IV deployment standards. Companies invest in regional partnerships, edge-ready solutions, and compliance support to address evolving demand. It remains attractive for new entrants and infrastructure-focused investors targeting high-growth digital economies.

Recent Developments:

- In September 2025, Banglalink launched Bangladesh’s first solar-powered data center in Dhaka to support digital services and align with national renewable energy goals.

- In January 2025, the Asian Development Bank partnered with the Bangladeshi government under a PPP model to establish the country’s first green data center in Chattogram using renewable energy.