Executive summary:

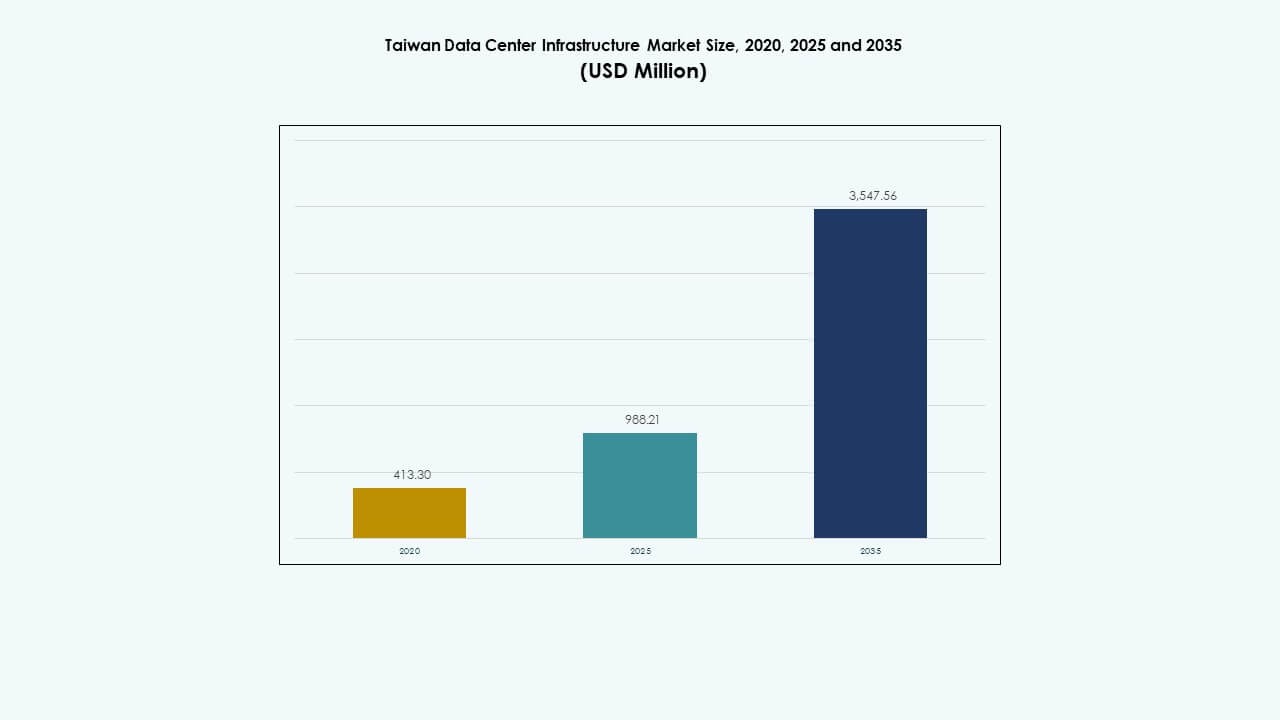

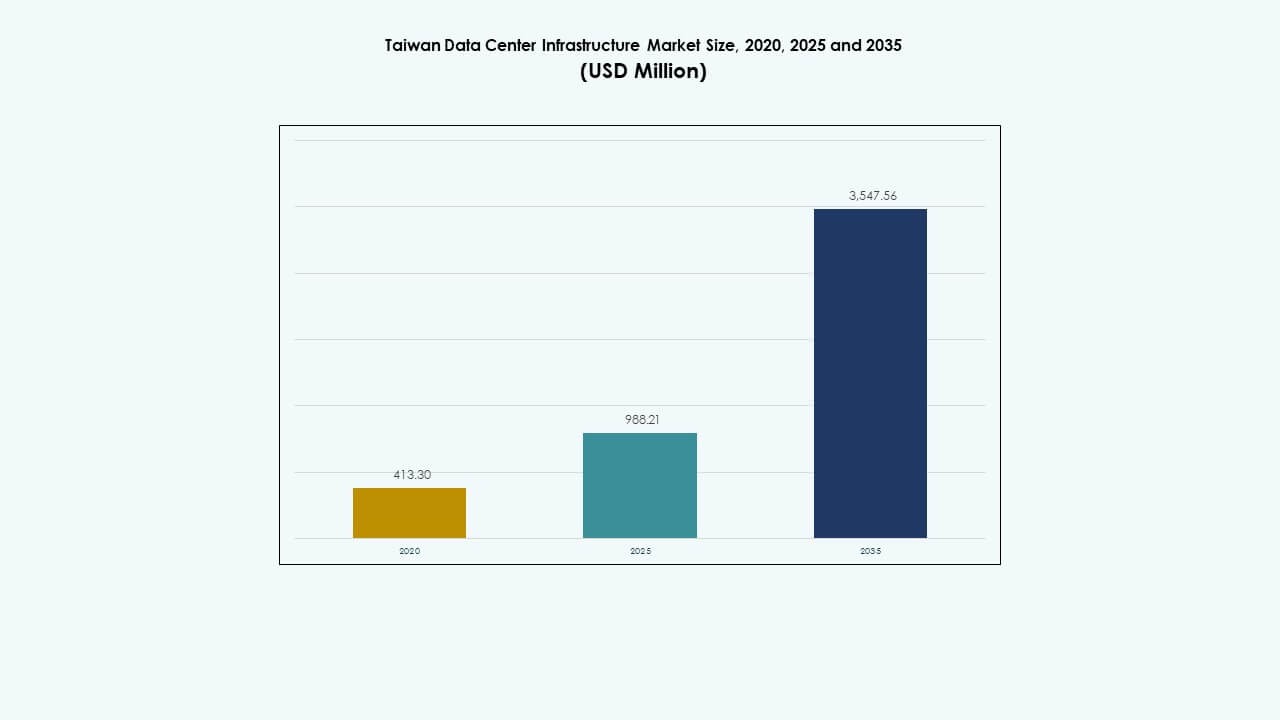

The Taiwan Data Center Infrastructure Market size was valued at USD 413.30 million in 2020, rose to USD 988.21 million in 2025, and is anticipated to reach USD 3,547.56 million by 2035, at a CAGR of 13.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Taiwan Data Center Infrastructure Market Size 2025 |

USD 988.21 Million |

| Taiwan Data Center Infrastructure Market, CAGR |

13.52% |

| Taiwan Data Center Infrastructure Market Size 2035 |

USD 3,547.56 Million |

Taiwan’s data center infrastructure landscape is transforming with rapid adoption of AI workloads, high-density server racks, and advanced liquid cooling systems. Continuous innovation in power and thermal technologies supports this shift, especially in Tier III and IV facilities. Strategic public and private investment accelerates digital infrastructure to meet enterprise cloud migration, regional interconnectivity, and semiconductor-driven compute demand. This evolution makes Taiwan a critical hub for businesses and investors seeking resilient, scalable, and high-performance data infrastructure in Asia.

Taipei leads the market due to its mature telecom networks, dense enterprise base, and carrier-neutral colocation hubs. Hsinchu and Taichung are emerging as vital regions with growing private cloud and edge deployments tied to semiconductor manufacturing zones. Southern cities like Kaohsiung show greenfield potential, driven by available land, port connectivity, and government-backed digital economy projects. This regional mix supports balanced development and diversified demand across Taiwan.

Market Dynamics:

Market Dynamics:

Strategic Push for Digital Economy and Smart Nation Goals Driving Infrastructure Expansion

Taiwan’s national digital policy fosters rapid growth in cloud services, AI, and IoT applications. These advancements require reliable and scalable data infrastructure. Government-backed programs such as DIGI⁺ 2.0 focus on digital innovation, fueling hyperscale and colocation demand. Businesses prioritize local data hosting to reduce latency and comply with evolving cybersecurity rules. The Taiwan Data Center Infrastructure Market gains from this policy support and corporate digital acceleration. Enterprises increase capital expenditure on server deployment and cloud migration. Public and private sectors collaborate to boost ICT capacity. Smart city initiatives across Taipei and Kaohsiung also need regional data hubs.

Rising AI Workloads and High-Performance Computing Needs Accelerating Power and Cooling Investments

The growth in AI training models and big data analytics is raising infrastructure demands significantly. GPU-heavy server loads require dense power distribution and advanced cooling systems. Operators prioritize liquid cooling, high-efficiency UPS, and grid-tied BESS units to support continuous load cycles. The Taiwan Data Center Infrastructure Market sees strong demand from AI-focused firms and academia deploying large-scale compute clusters. Energy intensity per rack has doubled, prompting upgrades in PDUs and thermal design. High-performance clusters also need robust failover systems and transfer switching. These upgrades stimulate both mechanical and electrical infrastructure demand across all tier levels.

Growth in Submarine Cable Connectivity Enhancing Taiwan’s Role as a Regional Data Transit Hub

Taiwan’s geographic location strengthens its position in Asia-Pacific digital interconnectivity. Multiple new submarine cable projects increase bandwidth and international data routing capability. Operators benefit from low-latency links between Japan, Singapore, and the U.S. Taiwan Data Center Infrastructure Market capitalizes on this enhanced connectivity. Large cloud providers view Taiwan as a key interconnection point, supporting demand for carrier-neutral colocation. These upgrades prompt investments in optical fiber backbone, high-capacity switches, and scalable data halls. Telecom players expand neutral internet exchange points, boosting traffic aggregation. Taiwan’s submarine gateway role reinforces long-term hyperscale demand growth.

- For instance, Meta announced the Candle submarine cable in 2025, a 24-fiber pair system spanning 8,000 km connecting Taiwan to Japan, the Philippines, Indonesia, Malaysia, and Singapore with 570 Tbps capacity, set for service in 2028 to boost regional data transit.

Domestic Semiconductor Ecosystem Fuels Private Cloud and Edge Deployments

Taiwan’s leadership in semiconductor fabrication increases the need for edge data centers and secure private cloud systems. Firms like TSMC and UMC deploy private infrastructure for design simulations, supply chain traceability, and operational analytics. The Taiwan Data Center Infrastructure Market supports this shift through modular builds and low-latency edge setups near fabs. Industrial parks across Hsinchu, Tainan, and Taichung see increased demand for localized IT rooms. Edge nodes improve compute access for precision manufacturing and digital twin technologies. Civil and architectural upgrades are tailored to seismic protection, cooling density, and low electromagnetic interference.

- For instance, Taiwan’s TSMC operates its Fab 18 facility in Tainan, which has been producing advanced 3 nm and 5 nm process chips. TSMC’s extensive fab network in Taiwan supports high‑performance computing and semiconductor demand that underpins regional digital infrastructure growth.

Market Trends

Market Trends

Adoption of AI-Optimized Infrastructure Designs Supporting Liquid Cooling and Dense Racks

Data centers in Taiwan adopt AI-ready layouts with denser rack footprints and power-hungry components. Rack densities surpass 30kW, shifting demand from air to liquid-based cooling systems. Cold plate and rear-door heat exchangers are now standard in new builds. Taiwan Data Center Infrastructure Market sees strong uptake in smart rack enclosures with real-time thermal mapping. Data centers opt for open rack architectures to reduce hot spots and improve serviceability. Facility design now integrates AI-based airflow controls and predictive cooling analytics. Operators replace legacy HVAC with scalable cooling platforms.

Green Infrastructure and Renewable Energy Integration Gaining Priority in Facility Design

Environmental concerns and ESG goals reshape infrastructure choices across Taiwan. Operators invest in solar integration, BESS for peak shaving, and efficient HVAC retrofits. Taiwan Data Center Infrastructure Market responds with modular UPS, low-leakage cooling units, and adaptive lighting systems. Renewable PPAs are sought to reduce grid reliance. Tier III and IV facilities add carbon monitoring dashboards. LEED and ISO 50001 certifications guide civil and envelope upgrades. These trends align with investor pressure for greener data operations.

Smart Monitoring and DCIM System Adoption Enhancing Operational Control and Uptime

Operators across Taiwan deploy intelligent monitoring tools to reduce failure risks and manage asset performance. Integration of DCIM platforms with building management systems enhances visibility. Taiwan Data Center Infrastructure Market benefits from demand for sensor-equipped electrical and mechanical components. Operators adopt AI-driven alarms, power metering, and predictive maintenance algorithms. Real-time data on load balancing and airflow helps reduce opex. Network-level automation improves switch failover and routing optimization.

Colocation Providers Shifting Toward Scalable, Modular, and Quick-to-Deploy Facility Models

Colocation players restructure their delivery models to meet client expectations for time-to-deploy and scalability. Modular factory-built components reduce build time by 30–40%. Taiwan Data Center Infrastructure Market sees growing investment in prefab electrical rooms, plug-in UPS modules, and containerized IT suites. Vendors offer configurable layouts based on customer workloads. This shift enables operators to meet hyperscaler requirements and expand quickly in metro zones.

Market Challenges

Market Challenges

Power Supply Constraints and Grid Stability Concerns in High-Density Zones

Taiwan’s growing data infrastructure requires stable, high-capacity grid connectivity. However, local utilities in some metro areas struggle with peak load demands. Frequent power interruptions during summers affect deployment planning. The Taiwan Data Center Infrastructure Market faces challenges in securing priority energy allocation. Operators depend on on-site generators and UPS redundancy for reliability. The government prioritizes grid upgrades, but execution delays impact construction timelines. New facilities require pre-approvals for dedicated substations, slowing time-to-market. Sourcing clean energy remains limited outside of Taipei. Projects in central Taiwan often adopt hybrid generation models to reduce reliance on grid power.

Land Scarcity and Zoning Restrictions Creating Delays for Large-Scale Projects

Urban areas with high demand face zoning restrictions that limit data center footprint expansion. Industrial land near Taipei and Hsinchu is scarce and highly priced. The Taiwan Data Center Infrastructure Market struggles to balance scalability with site availability. Regulatory approvals for heavy mechanical load-bearing and emissions control slow project progress. Earthquake risk adds complexity to civil engineering and architectural design. Developers must invest in seismic base isolation, modular flooring, and reinforced envelope systems. Retrofits are preferred over greenfield builds in urban zones. This limits space efficiency and constrains hyperscaler entry.

Market Opportunities

Rising Demand for AI Cloud and Cross-Border Hosting Services from Regional Players

Asian cloud providers look to Taiwan as a strategic hosting and compute node. Cross-border compliance needs and AI training workloads fuel demand for secure colocation and neutral peering. The Taiwan Data Center Infrastructure Market can capture this momentum by expanding capacity in coastal interconnect zones. Facilities that offer low PUE and rapid deployment will attract regional contracts.

Policy Support for Digital Infrastructure Modernization Boosts Private and Public Investment

Taiwan’s Ministry of Digital Affairs promotes digital sovereignty through cloud-native transformation in the public sector. Grant-based incentives support domestic data infrastructure projects. The Taiwan Data Center Infrastructure Market gains from both enterprise and e-government initiatives requiring secure onshore data centers.

Market Segmentation

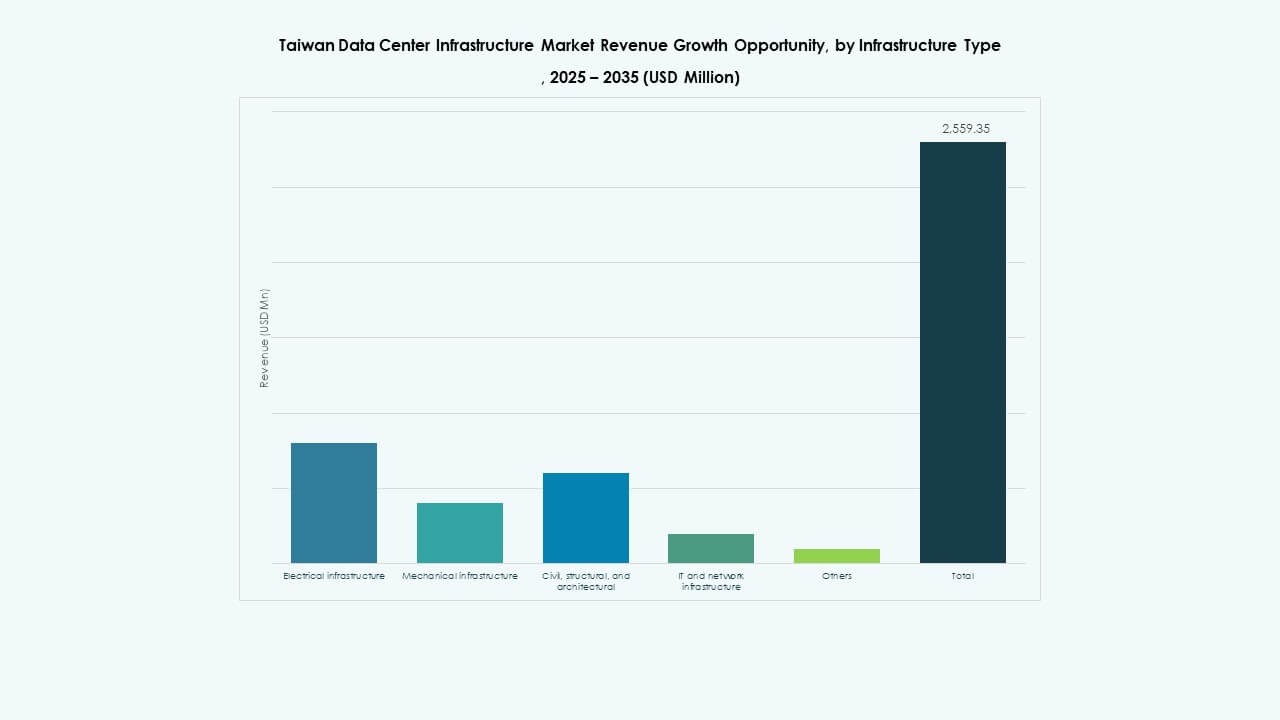

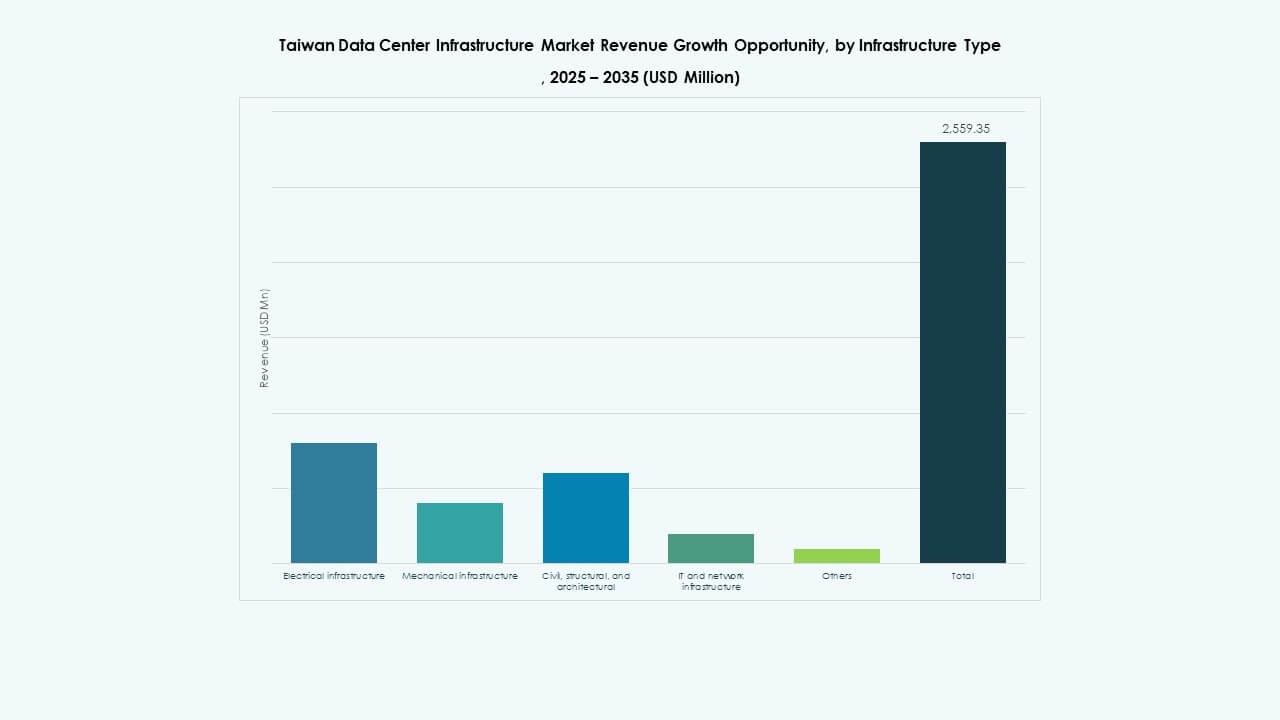

By Infrastructure Type

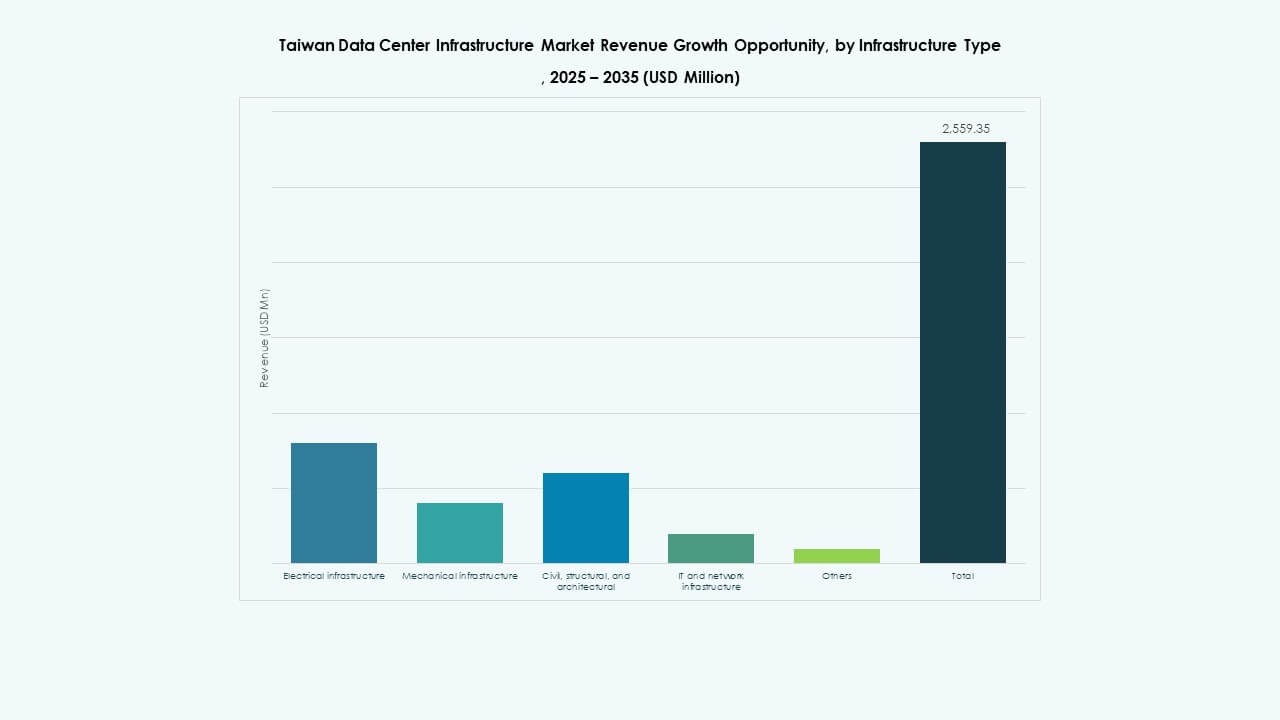

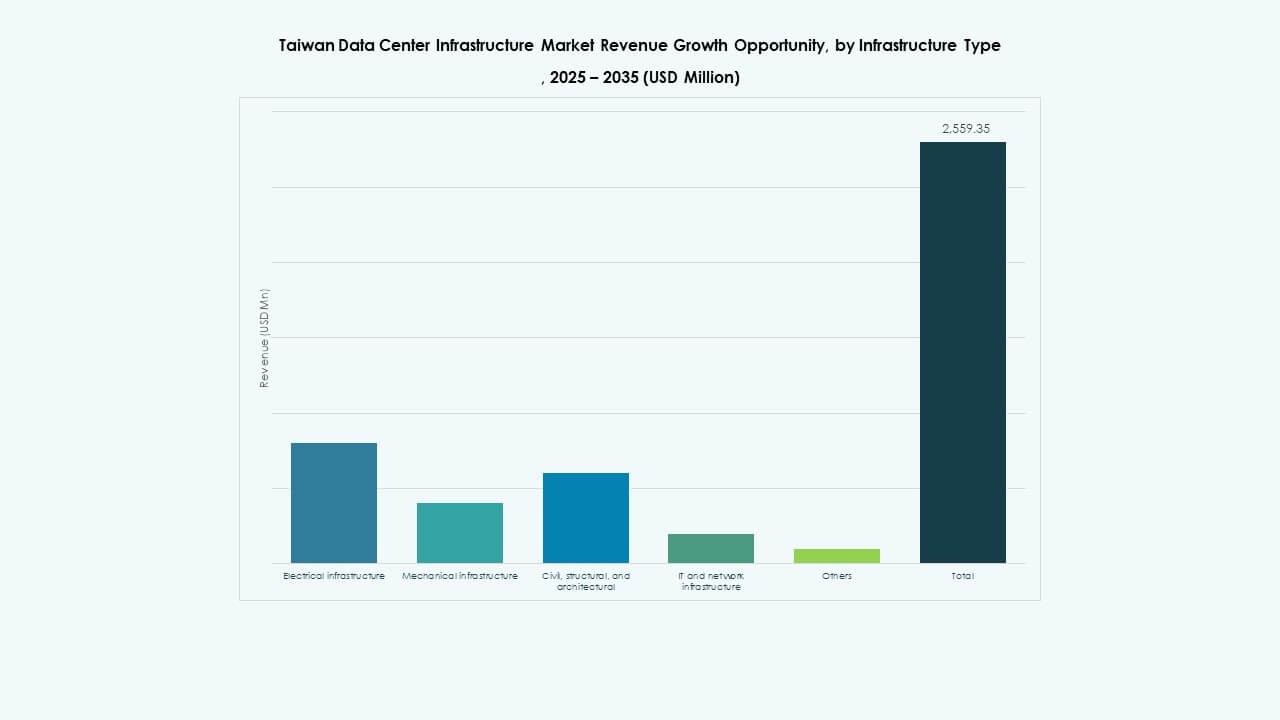

Electrical infrastructure holds the largest share in the Taiwan Data Center Infrastructure Market due to rising power needs of AI and hyperscale setups. Mechanical systems follow, driven by demand for high-efficiency cooling. IT and network upgrades gain traction with software-defined setups and scalable storage.

By Electrical Infrastructure

UPS systems dominate the electrical segment, accounting for over 30% market share due to critical load protection. Battery energy storage systems also grow fast, driven by demand for peak load handling and backup sustainability. Smart PDUs and automated switchgears gain popularity for remote control and resilience.

By Mechanical Infrastructure

Cooling units lead the mechanical segment, driven by high-density AI servers and energy efficiency mandates. Rear-door heat exchangers and cold plate systems become common in new builds. Containment systems also rise in demand for thermal zoning efficiency in high-density server rooms.

By Civil / Structural & Architectural

Superstructures and modular building systems dominate this segment. Earthquake-prone areas drive demand for seismic-resistant construction. Raised floors and precision ceilings support airflow optimization and cabling. Modular design allows phased expansions aligned with compute demand.

By IT & Network Infrastructure

Servers hold the highest share due to compute-intensive AI workloads. Storage systems and network switches also show steady growth with rising data exchange volumes. Racks and enclosures evolve toward smart, sensor-enabled units for thermal and access control.

By Data Center Type

Colocation data centers lead with over 45% market share, supported by enterprise outsourcing and neutral connectivity. Hyperscale data centers grow faster due to AI demand. Edge data centers rise in manufacturing zones like Hsinchu to support real-time industrial applications.

By Delivery Model

Turnkey models remain dominant, preferred for predictable build time and single-vendor accountability. Design-build and modular factory-built models gain share for AI-ready and prefabricated deployments. Retrofit activity rises in metro zones where greenfield space is limited.

By Tier Type

Tier III facilities dominate with over 50% share, balancing availability and cost. Tier IV facilities grow fast in mission-critical use cases such as financial services and national AI labs. Tier I and II builds are limited to smaller edge deployments or industrial parks.

Regional Insights

Taipei Metropolitan Area Dominates with Over 40% Share Due to Dense Enterprise Base

Taipei leads the Taiwan Data Center Infrastructure Market with the highest concentration of enterprise headquarters, tech parks, and financial institutions. It has mature grid connectivity, multiple submarine landing stations, and neutral colocation facilities. High network demand and proximity to client base drive continued investment. Operators expand facilities in Neihu and Nangang to meet colocation and hyperscale growth.

- For instance, Chunghwa Telecom’s 2024 renovation initiative upgraded existing facilities into AI‑ready data centers by enhancing power capacity and cooling efficiency, strengthening its role as Taiwan’s largest data center operator with expanded IT load capacity.

Hsinchu and Taichung Record Strong Growth Due to Semiconductor and Manufacturing Zones

Hsinchu accounts for about 25% share, driven by data needs of fabs and chip design firms. Edge and private cloud deployments are prominent due to latency and data control requirements. Taichung holds around 20% share, boosted by manufacturing clusters and industrial IoT. Local governments support buildouts with tax and zoning incentives.

Southern Taiwan Emerging as Expansion Hub for Greenfield Developments

Kaohsiung and Tainan together contribute over 10% of the market but offer strong greenfield potential. Land availability and port infrastructure attract data center expansions. Projects in this region focus on energy efficiency and modular builds. Government support for smart port and logistics digitalization adds demand for regional compute.

- For instance, Chunghwa Telecom plans a hyperscale facility in nearby Taoyuan supporting at least 12 MW IT load for AI and high‑performance computing. The company is developing a new data center designed to support high‑density compute and AI workloads with advanced power and cooling systems.

Competitive Insights:

- Chunghwa Telecom

- Chief Telecom

- Equinix, Inc.

- Delta Electronics

- Schneider Electric

- Vertiv Group Corp.

- Cisco Systems, Inc.

- Dell Inc.

- ABB

The Taiwan Data Center Infrastructure Market shows strong competition between telecom-led operators and global infrastructure vendors. Domestic telecom firms leverage network control, local compliance strength, and enterprise trust. International colocation providers focus on carrier neutrality, interconnection density, and scalable capacity. Infrastructure vendors compete through power efficiency, thermal reliability, and modular deployment speed. Electrical and cooling specialists strengthen market position through AI-ready designs and energy management systems. IT vendors gain share through integrated server, storage, and networking portfolios. Strategic partnerships between operators and equipment suppliers support rapid facility expansion. Capital strength and execution capability define leadership. Competitive intensity remains high as demand rises for resilient, efficient, and scalable data center assets.

Recent Developments:

Recent Developments:

- In June 2025, Amazon Web Services (AWS) launched its Asia Pacific (Taipei) cloud region, marking its first in Taiwan, accompanied by a $5 billion investment in data centers to support construction and operations

Market Dynamics:

Market Dynamics: Market Trends

Market Trends Market Challenges

Market Challenges Recent Developments:

Recent Developments: