Executive summary:

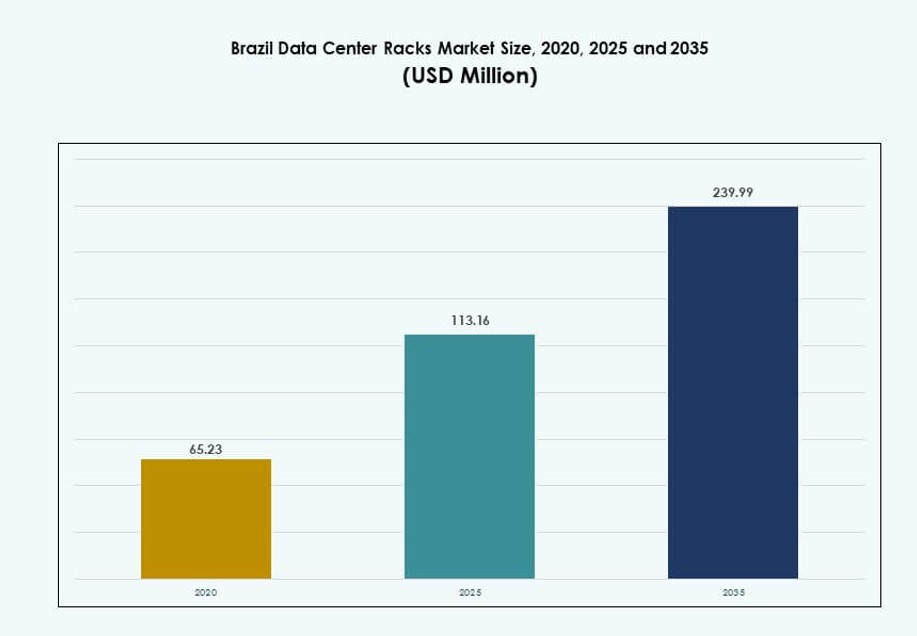

The Brazil Data Center Racks Market size was valued at USD 65.23 million in 2020 to USD 113.16 million in 2025 and is anticipated to reach USD 239.99 million by 2035, at a CAGR of 7.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Brazil Data Center Racks Market Size 2025 |

USD 113.16 Million |

| Brazil Data Center Racks Market, CAGR |

7.76% |

| Brazil Data Center Racks Market Size 2035 |

USD 239.99 Million |

Rising demand for cloud services, AI workloads, and digital transformation across industries is driving rack deployment in Brazil. Enterprises and colocation providers are adopting cabinet racks to manage high-density compute and improve airflow management. Liquid cooling adoption is expanding, pushing vendors to offer rack systems with integrated thermal features. The shift toward intelligent racks with sensor-based monitoring reflects a move to automation and control. Innovation in cable management and structural flexibility supports rapid deployment cycles. For investors, it offers access to a growing infrastructure layer tied to enterprise modernization and regulatory hosting needs. Brazil’s strategic push for localized IT also strengthens demand.

The Southeast region dominates due to dense hyperscale development in São Paulo and Rio de Janeiro, driven by enterprise IT and colocation growth. Strong fiber connectivity and power infrastructure give these cities an edge. The South and Central-West regions are emerging with edge data centers and localized compute nodes supporting agribusiness and public sector needs. Northern and Northeastern cities are gaining traction through digital inclusion efforts and new fiber routes. Rack deployments are expanding to enable low-latency access and resilient infrastructure nationwide. These geographic shifts are reshaping rack demand across diverse deployment environments.

Market Dynamics:

Market Drivers

Hyperscale Growth Driving Demand for High-Capacity Rack Infrastructure in Urban Zones

The Brazil Data Center Racks Market is experiencing strong demand driven by hyperscale data center expansion in São Paulo and Rio de Janeiro. Operators are increasing rack counts to support larger IT loads across AI, cloud, and analytics. Global providers are customizing rack designs to fit high-density and liquid-cooled workloads. Deployment speed, modularity, and energy performance have become key procurement criteria. Businesses are shifting toward flexible containment systems to manage rising thermal output. Government policies supporting domestic hosting further boost local capacity investments. Rack infrastructure now plays a central role in data center scaling decisions. Investors view this segment as critical to achieving energy and space efficiency. It represents a foundational layer in Brazil’s maturing digital infrastructure ecosystem.

- For instance, Scala Data Centers brought online the SGRUTB8 facility at its Tamboré Campus in São Paulo in April 2024 with 24 MW capacity supporting up to 100 kW per rack densities for AI/ML workloads via liquid cooling designs.

Edge Deployments and 5G Expansion Creating New Use Cases for Distributed Rack Systems

Edge computing continues to drive new rack demand in Tier II cities like Campinas, Salvador, and Fortaleza. Telecom operators and content delivery networks require smaller, localized facilities for real-time processing. This leads to rack deployments optimized for compact formats and variable cooling. Modular micro data centers with pre-integrated racks are gaining traction across industrial zones. Businesses seek edge capacity to reduce latency and support time-sensitive applications. 5G rollouts push infrastructure closer to end-users, reinforcing demand for scalable rack units. The Brazil Data Center Racks Market benefits from this architectural shift in IT distribution. Rack flexibility and space-saving designs offer value in constrained environments. These edge use cases open opportunities for targeted rack solutions.

- For instance, AWS expanded its edge locations in Fortaleza alongside its São Paulo cloud region by 2024, enabling low-latency 5G processing in compact rack-optimized facilities across Northeast Brazil.

Digital Transformation Across Sectors Boosting Demand for Standardized and Scalable Rack Infrastructure

Brazilian enterprises are undergoing rapid digital transformation in sectors like BFSI, retail, and healthcare. This transition demands scalable rack-based infrastructure to support virtualized workloads. Standardization is becoming a priority across IT rooms and core facilities. Rack vendors are aligning solutions with industry-specific power and cable management needs. Businesses prioritize operational simplicity, energy savings, and long-term scalability. Colocation providers are also expanding rack offerings to meet hybrid cloud needs. The Brazil Data Center Racks Market aligns with national goals to improve IT agility. Rack deployments are now part of strategic infrastructure planning across multiple verticals. This positions the market as a key enabler of enterprise modernization.

Regulatory Compliance and Data Sovereignty Encouraging In-Country Infrastructure Build-Outs

Data localization rules and privacy mandates are driving in-country infrastructure investments. Government and financial institutions require secure, sovereign environments for sensitive data. Rack-based facilities provide a controlled architecture suited for these needs. Providers focus on high-availability designs with integrated monitoring at the rack level. Regulations increase the volume of colocation and private cloud deployments inside Brazil. This supports long-term demand for energy-efficient, standardized rack systems. The Brazil Data Center Racks Market is positioned as a core element of regulatory compliance strategies. Rack-level designs are evolving to support zero-trust models and segmented workloads. Investors are aligning with local policy trends by funding regional rack deployments.

Market Trends

Adoption of Liquid Cooling Driving Redesign of Rack Infrastructure Across Hyperscale Deployments

Operators are integrating liquid cooling to support AI and GPU-heavy workloads, prompting redesigns in rack structure. Traditional airflow-based racks struggle to meet thermal limits of dense compute. Vendors are now offering liquid-ready rack enclosures with sealed tubing and rear door heat exchangers. Hyperscalers are testing rack units capable of managing over 50 kW loads. This trend enhances thermal efficiency and aligns with Brazil’s sustainability goals. The Brazil Data Center Racks Market reflects this transition with growing orders for customized, high-density formats. Rack innovation plays a key role in achieving lower PUE targets. Liquid cooling shifts procurement toward future-ready modular rack frames.

Rising Interest in Smart Racks with Integrated Sensors and Remote Monitoring Capabilities

Smart rack systems with real-time monitoring are gaining popularity among managed service providers and enterprises. These racks feature sensors for temperature, humidity, airflow, and security. Operators value the ability to control environments down to the rack level. Integration with DCIM platforms supports predictive maintenance and fault isolation. Businesses seek rack-level transparency to align with SLAs and compliance audits. The Brazil Data Center Racks Market sees growing deployment of intelligent racks in colocation environments. Remote management reduces downtime and increases efficiency across large facilities. Smart racks are also helping reduce labor dependence through automation.

Growth in Modular Data Centers Accelerating Adoption of Prefabricated Rack Units

Brazil is witnessing increased adoption of modular data centers, especially in industrial parks and remote areas. Prefabricated solutions enable faster deployment of rack-based IT capacity. Rack units are pre-assembled with PDUs, containment, and cabling for plug-and-play installation. This model appeals to logistics, mining, and manufacturing sectors seeking reliable on-site computing. Vendors offer modular rack enclosures tailored for containerized builds. The Brazil Data Center Racks Market aligns with this trend by supplying standardized rack formats. Deployment efficiency and transportability are key value drivers. Prefab racks shorten timelines and improve ROI for decentralized IT setups.

Cloud Edge Partnerships Expanding Rack Deployment Across Tier II and Tier III Locations

Cloud providers are partnering with local ISPs and colocation firms to build edge nodes closer to end-users. These joint ventures result in new rack installations in emerging cities. Rack deployments now support federated cloud models, CDNs, and telco infrastructure. Shared facilities use high-density cabinet racks to optimize floor space and reduce latency. This boosts demand for energy-efficient, cable-managed, and secure rack enclosures. The Brazil Data Center Racks Market supports such partnerships with adaptable, scalable systems. Localized rack growth reinforces the country’s digital inclusion goals. These deployments enhance edge-to-core performance across the national network.

Market Challenges

High Energy Costs and Power Infrastructure Gaps Hindering Rack Density Expansion

Power costs in Brazil remain among the highest in the region, impacting data center economics. High-density rack systems require stable, low-cost electricity to be viable. Many regions face grid instability and limited redundant power infrastructure. This slows the adoption of advanced rack designs supporting AI and HPC workloads. Operators hesitate to deploy racks rated above 30 kW without guaranteed backup. The Brazil Data Center Racks Market must balance density goals with power feasibility. Energy availability constraints often force design compromises or deployment delays. Rural regions face additional cost barriers due to long-distance energy transmission.

Limited Local Manufacturing and Supply Chain Disruptions Affect Rack Procurement and Customization

The domestic ecosystem for precision rack manufacturing remains underdeveloped in Brazil. Imports dominate the market, especially for smart and liquid-cooled rack variants. Global logistics disruptions have caused delays in customized rack shipments. Local assembly lacks scale and access to advanced materials. Customization options remain limited for sector-specific needs like healthcare or BFSI. The Brazil Data Center Racks Market faces challenges in achieving price and lead time optimization. Service providers often must choose between faster delivery or technical customization. These limitations restrict innovation and slow adoption of next-generation racks.

Market Opportunities

Expansion of Tier II City Infrastructure Creating Demand for Rack-Based Edge and Colocation Facilities

Operators are investing in new facilities across cities like Recife, Manaus, and Goiânia. These regions seek low-latency services for e-commerce, gaming, and telecom. Rack deployments are rising to support distributed IT models and hybrid workloads. Vendors offering compact, efficient rack formats will gain market share. The Brazil Data Center Racks Market can leverage this shift by targeting regional buildouts. New rack contracts will emerge from partnerships with local governments and digital service providers.

AI and HPC Workloads Unlocking Demand for Customized, Liquid-Cooled Rack Solutions

AI model training and inference workloads need racks designed for dense GPU configurations. Brazilian enterprises are adopting AI in agriculture, logistics, and finance. This drives need for racks with integrated cooling and structured cabling. Vendors providing 50 kW+ racks or liquid-cooled enclosures will gain adoption. The Brazil Data Center Racks Market is positioned to support this growth wave with tailored solutions. These rack systems will become core assets in AI-focused data center designs.

Market Segmentation

By Rack Type

Cabinet racks dominate the Brazil Data Center Racks Market due to their security, scalability, and cable management advantages. Open frame racks see use in private facilities where access and airflow are priorities. Cabinet racks are preferred by colocation and hyperscale operators handling multi-tenant deployments. Their design suits high-density, mission-critical operations across BFSI and cloud services. Other rack types serve niche use cases like broadcast or industrial IT rooms, contributing a smaller share of the market.

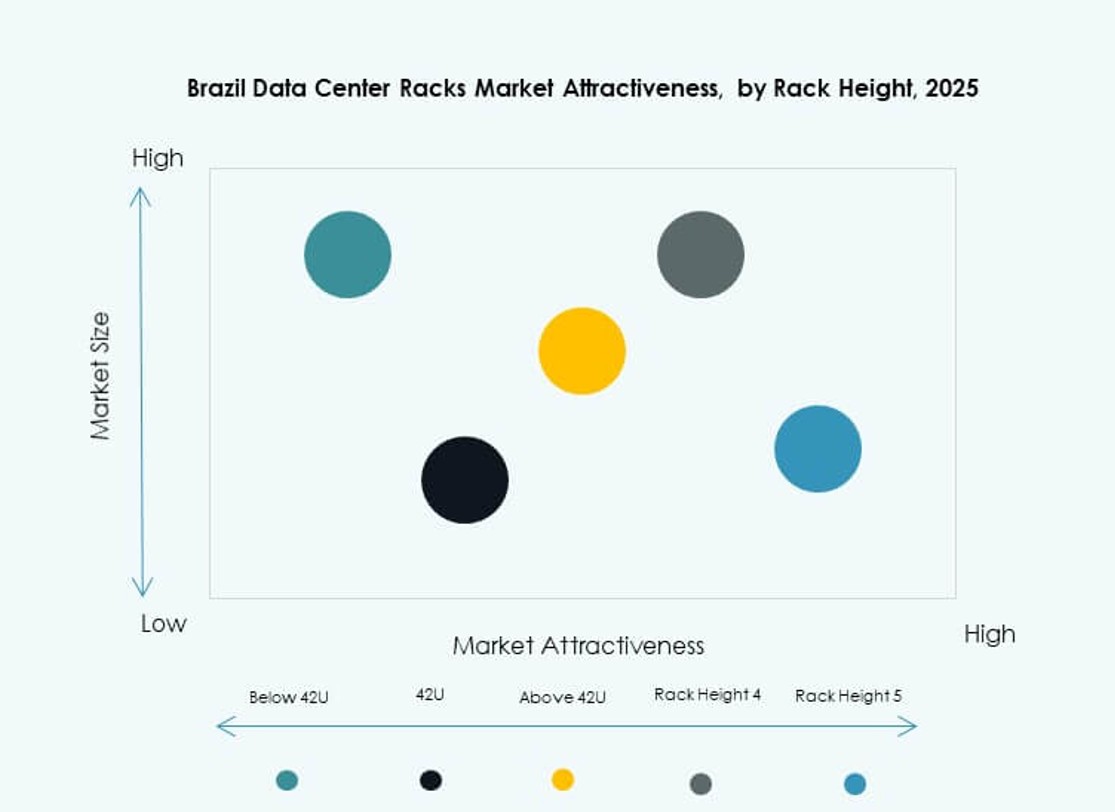

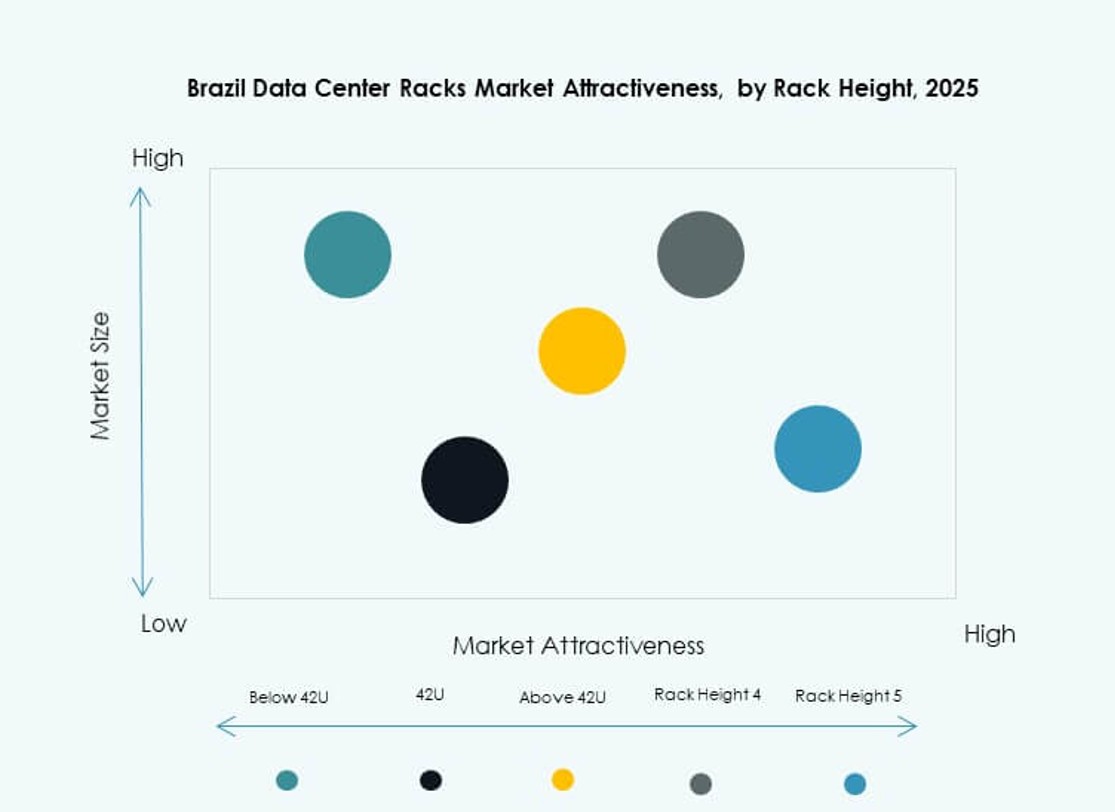

By Rack Height

42U racks are the most widely used height segment, offering a balance between capacity and accessibility. Below 42U racks are used in edge deployments and compact server rooms where space is limited. Above 42U racks are gaining ground in large-scale facilities supporting high-density servers and AI workloads. The Brazil Data Center Racks Market favors 42U racks due to standardization and wide equipment compatibility. This height supports flexible power and cable distribution needs across environments.

By Width

The 19-inch rack width remains the industry standard and accounts for the majority of installations in Brazil. It supports compatibility with most network and server equipment. The 23-inch width is used in telecom and legacy environments requiring broader cable management. Other widths have minimal presence and cater to specialized use. The Brazil Data Center Racks Market aligns with global best practices by continuing to adopt 19-inch systems across most deployments.

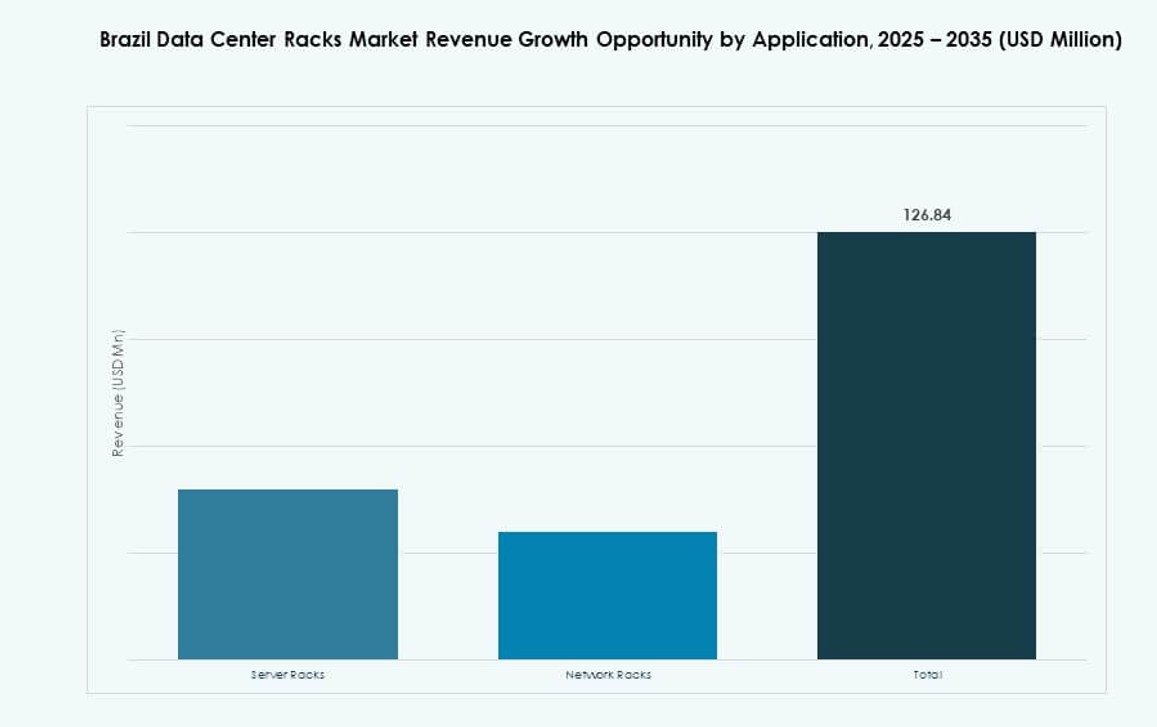

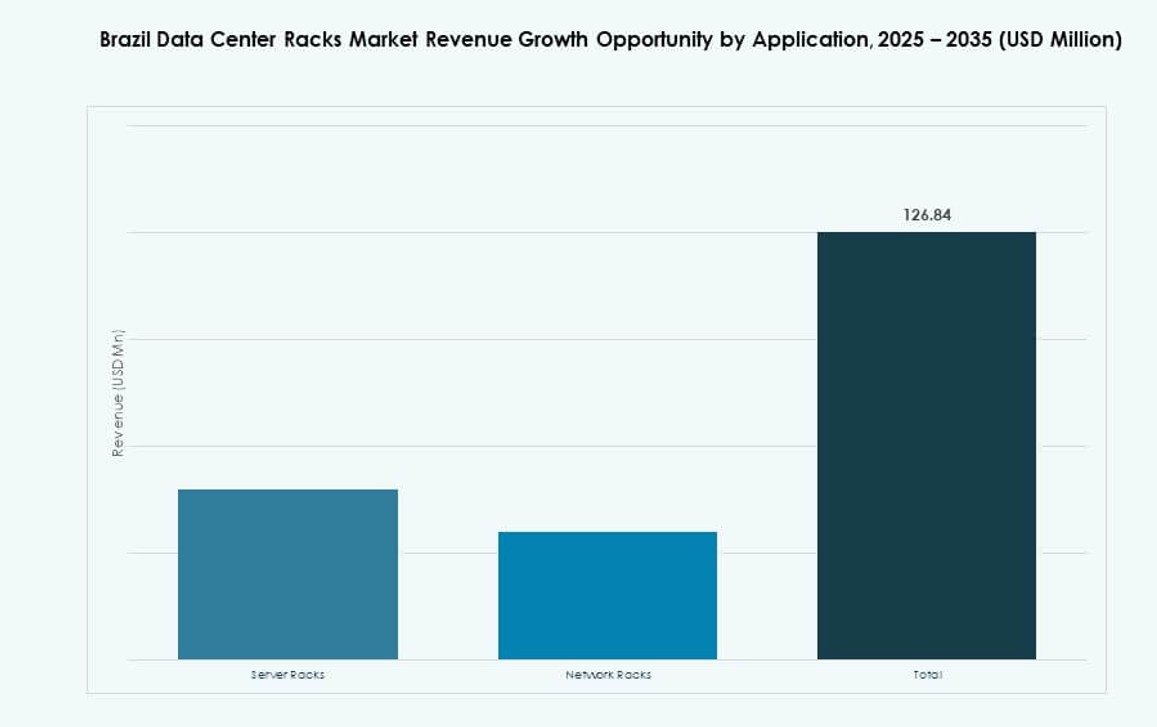

By Application

Server racks hold the dominant share in the Brazil Data Center Racks Market, supporting core compute and storage functions. Network racks are critical for switch and connectivity setups, especially in telecom environments. The demand for high-performance server racks is rising with cloud, AI, and virtualization growth. Network racks maintain steady demand due to 5G rollout and fiber expansions. Both segments will evolve to support higher power and thermal requirements over time.

By End-user

Large data centers lead in rack consumption due to hyperscale and colocation facility investments. They deploy thousands of racks annually to support growing customer demands. Small and mid-sized data centers contribute to localized needs, including retail and healthcare IT. These facilities adopt standardized rack solutions to reduce operational complexity. The Brazil Data Center Racks Market sees higher revenue contribution from large data centers, driven by scale and recurring expansion cycles.

By Vertical

IT & telecom is the leading vertical, driven by cloud growth, 5G deployment, and carrier-neutral facility expansion. BFSI ranks second, investing in secure, high-availability rack systems for digital services. Government and defense sectors deploy racks for regulated and sovereign workloads. Retail and healthcare are emerging verticals adopting edge infrastructure. The Brazil Data Center Racks Market aligns with these vertical needs by offering specialized, scalable rack formats that match power, space, and compliance criteria.

Regional Insights

Southeast Region Leads with 48.5% Market Share Due to São Paulo and Rio de Janeiro Data Center Hubs

The Southeast dominates the Brazil Data Center Racks Market, housing major metro data centers and cloud zones. São Paulo drives rack demand with high-density and hyperscale installations. Rio de Janeiro follows due to media, financial, and telecom activity. It remains the country’s innovation hub for IT services and multitenant deployments. Strong power infrastructure and connectivity make it ideal for large-scale rack operations. Global providers prefer this region for latency-sensitive deployments and disaster recovery.

- For instance, AWS committed $1.8 billion in September 2024 to expand its São Paulo cloud region, deploying thousands of high-density racks supporting up to 50 kW per rack for hyperscale AI and cloud workloads.

South and Central-West Regions Account for 27.3% of the Market with Growing Edge and AI Infrastructure

The South region, including Porto Alegre and Curitiba, is growing due to industrial and e-commerce activity. Central-West cities like Brasília and Goiânia are expanding public cloud and enterprise hosting demand. These areas adopt micro data centers and edge formats using compact rack systems. Education, agritech, and logistics sectors are accelerating their IT footprint. The Brazil Data Center Racks Market supports this regional growth with tailored deployments. Rack shipments are increasing across secondary cities with local tech ecosystems.

North and Northeast Regions Hold 24.2% Share, Driven by Connectivity Projects and Government Digitization

Regions like Recife, Salvador, and Manaus are emerging due to improved fiber connectivity and federal digitization projects. Government-funded e-services require in-country hosting, prompting localized rack installations. Edge facilities now support smart city and fintech applications. Local operators deploy secure racks to handle mixed workloads across remote zones. The Brazil Data Center Racks Market benefits from policy-driven infrastructure mandates. Future growth depends on extending reliable power and cooling to these distributed environments.

- For instance, V.tal inaugurated its Mega Lobster facility in Fortaleza in October 2025, with a 20 MW capacity, supporting around 1,000 racks at 10 kW density. Integrated with a submarine cable landing station and 450,000 km of fiber, the site supports smart city and 5G-connected applications with renewable energy and advanced cooling systems.

Competitive Insights:

- Schneider Electric

- Vertiv Group

- Rittal

- Eaton

- Legrand

- Cisco Systems, Inc.

- Dell Inc.

- Hewlett Packard Enterprise (HPE)

- Delta Cabines

- Racksys

The Brazil Data Center Racks Market is characterized by a mix of global infrastructure providers and regional manufacturers competing across high-density and edge deployment segments. Global players like Schneider Electric, Vertiv, and Rittal lead in liquid-cooled and modular rack systems tailored for hyperscale and hybrid environments. Local firms such as Delta Cabines and Racksys cater to national demand with customizable, cost-effective solutions aligned with Brazil’s regulatory and design standards. Many global vendors collaborate with domestic assemblers for faster delivery and compliance. Cloud adoption, colocation growth, and edge expansion continue to influence procurement patterns. Players focus on innovation in thermal management, rack-level monitoring, and AI-ready architectures. Market positioning depends on product flexibility, supply chain resilience, and vertical-specific integration. It reflects growing emphasis on scalable, energy-efficient, and compliant rack solutions.

Recent Developments:

- In November 2025, Schneider Electric unveiled a new line of data center infrastructure solutions that enhance rack-level power distribution, thermal management, and scalable deployment. The portfolio targets high-density AI and accelerated compute applications with integrated power and cooling innovations.

- In November 2025, Vertiv introduced the PowerDirect Rack 33kW, a next‑generation rack‑level power delivery system that improves energy efficiency and scalability for modern data centers. This product focuses on optimizing rack power distribution while maintaining compatibility with existing AC infrastructures.

- In August 2025, Vertiv completed the acquisition of Great Lakes Data Racks & Cabinets for approximately $200 million. This deal strengthened Vertiv’s position in the rack enclosure segment, adding custom rack designs, seismic cabinets, and advanced cable management systems to its portfolio.