Executive summary:

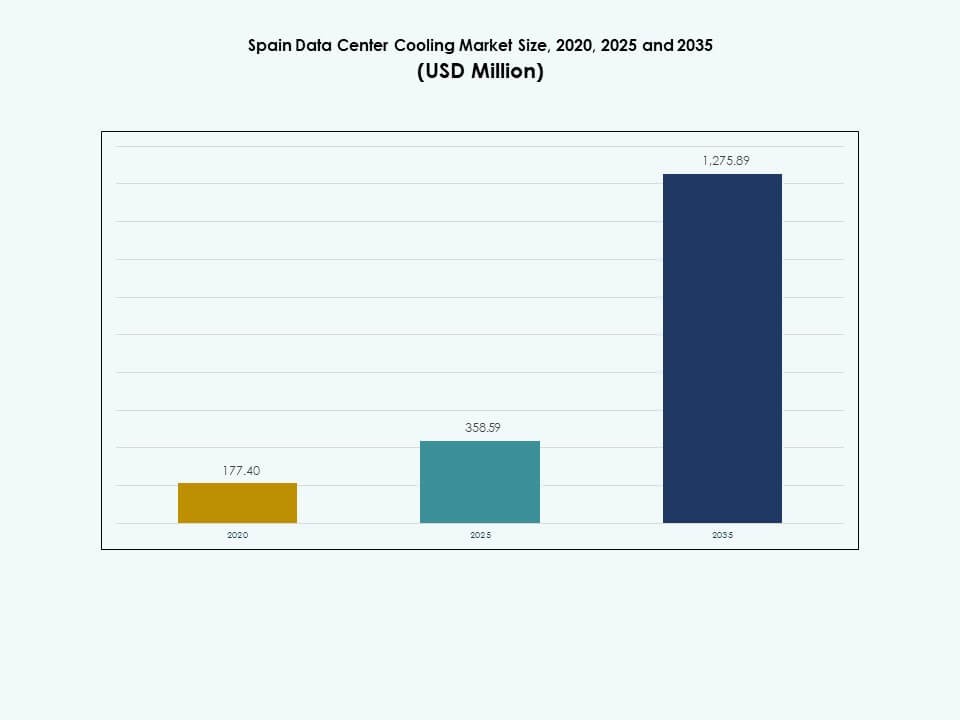

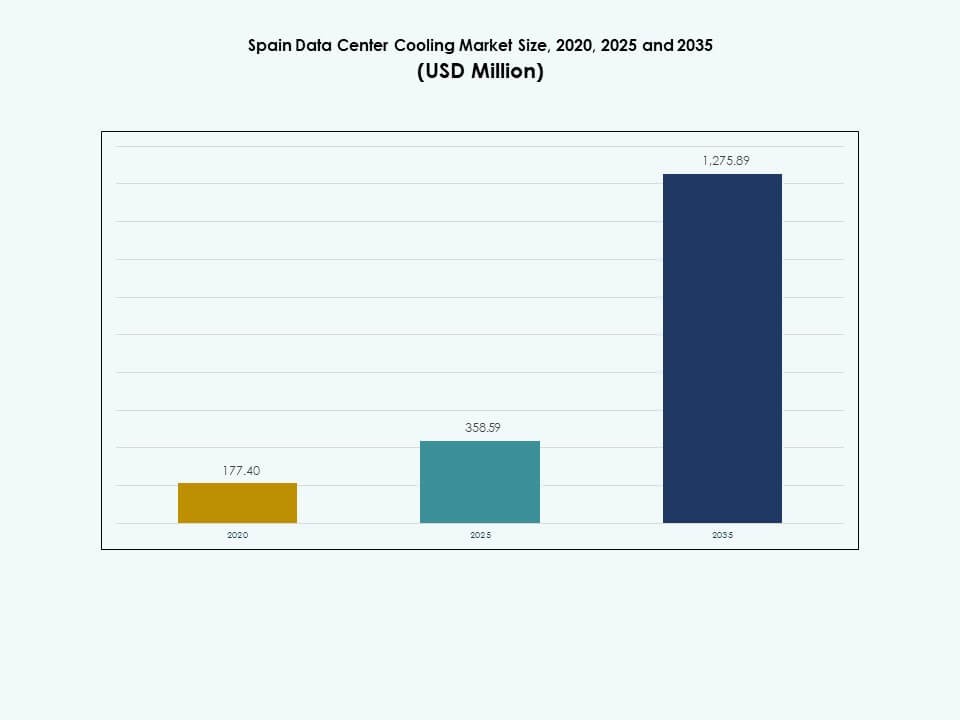

The Spain Data Center Cooling Market size was valued at USD 177.40 million in 2020 to USD 358.59 million in 2025 and is anticipated to reach USD 1,275.89 million by 2035, at a CAGR of 13.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Spain Data Center Cooling Market Size 2025 |

USD 358.59 Million |

| Spain Data Center Cooling Market, CAGR |

13.50% |

| Spain Data Center Cooling Market Size 2035 |

USD 1,275.89 Million |

Rising data workloads, dense compute racks, and continued cloud expansion strengthen demand across the Spain Data Center Cooling Market. Operators adopt liquid cooling, advanced airflow systems, and AI-driven thermal controls to support stable performance. Innovation reshapes thermal strategies for hyperscale and colocation projects, while efficiency goals push investment toward low-energy systems. Businesses and investors prioritize these upgrades to secure reliable operations, lower operating costs, and meet sustainability expectations.

Central Spain remains the dominant region due to strong connectivity and a large concentration of hyperscale and colocation developments. Northeastern areas emerge as growth zones supported by expanding enterprise workloads and new digital infrastructure. Southern regions and island clusters show rising activity driven by edge deployments and sector-specific data center needs. These geographic shifts support broader nationwide demand for advanced cooling solutions.

Market Drivers

Strong Digitalization, Cloud Growth, and Rising Thermal Loads in Spain’s Data Hubs

The Spain Data Center Cooling Market benefits from fast digital adoption across enterprises. Cloud providers expand capacity in Madrid and other hubs to serve local demand. High rack densities raise heat loads and push operators toward advanced cooling. It supports stable uptime for telecom, banking, and public services. Investors recognize strong demand visibility from digital policy support. Businesses seek energy efficient solutions to reduce operating expenditure. The focus on scalable infrastructure keeps large and mid-size facilities active. It creates a clear link between digital growth and cooling upgrades.

- For example, in October 2024, EDGNEX Data Centers by DAMAC announced a new AI-ready data center campus in Madrid with a planned 40 MW power capacity designed for high-density compute and cooling challenges, directly serving hyperscale and public-sector workloads.

Shift Toward High-Efficiency, Low-PUE Cooling Architectures for Competitive Advantage

Operators pursue low power usage effectiveness targets to stay competitive. The Spain Data Center Cooling Market therefore favors solutions with strong energy savings. Providers adopt efficient chillers, free cooling, and optimized airflow layouts. New builds integrate real-time control to match cooling output with IT loads. That approach supports long contract wins with cloud and colocation clients. Lower energy use improves margins in a market with rising power costs. Sustainability metrics influence site selection and design choices. It positions efficient cooling as a strategic lever for profitability.

- For example, Digital Realty’s 2024 sustainability disclosures confirm that energy-efficiency initiatives across its European portfolio, including Spain, are expected to deliver annual electricity savings of 42,400 MWh. The reports also state that several facilities hold LEED and BREEAM certifications and operate with PUE levels in the 1.25–1.35 range. These metrics come directly from Digital Realty’s official sustainability and impact reports.

Integration of Smart Controls, AI, and Monitoring into Cooling Infrastructure

Vendors embed smart sensors and AI control into modern cooling systems. The Spain Data Center Cooling Market gains from better visibility on thermal risk. Operators use data models to adjust fan speeds, valve positions, and setpoints. That approach reduces human error and improves response to load shifts. AI tools support predictive maintenance on compressors, pumps, and chillers. Lower unplanned downtime improves service-level commitments to enterprise clients. Smart platforms integrate with DCIM tools to coordinate power and cooling. It turns thermal management into a data-driven discipline for operators.

Regulatory Pressure, Renewable Targets, and ESG Commitments Shaping Investment

European and national climate goals push data centers toward greener designs. The Spain Data Center Cooling Market aligns with policies that favor efficient infrastructure. Operators choose low-GWP refrigerants and designs that support heat reuse. ESG reporting drives firms to document energy and water performance. Banks and investors favor assets with credible sustainability roadmaps. That preference improves funding access for efficient data center projects. Cooling choices influence site permits, local approvals, and community support. It makes sustainable thermal strategies central to long-term asset value.

Market Trends

Migration from Traditional DX Systems to Liquid and Hybrid Cooling Topologies

Operators move away from legacy direct expansion units toward advanced setups. The Spain Data Center Cooling Market sees interest in liquid and hybrid designs. High-density racks for AI and HPC demand direct-to-chip or rear-door solutions. Hybrid systems combine air and liquid loops to balance cost and complexity. Vendors package modular units that support stepwise density upgrades. Colocation providers promote high-density zones as premium offerings. That trend supports flexible cooling paths across mixed tenant profiles. It marks a structural shift from basic room systems to rack-level precision.

Growing Adoption of Modular, Prefabricated, and Scalable Cooling Blocks

Developers favor modular builds that shorten deployment timelines. The Spain Data Center Cooling Market benefits from prefabricated cooling skids and plants. These blocks arrive tested and integrate quickly with site infrastructure. Modular units let operators match capacity with contract pipelines. Phased investments reduce stranded capacity risk in volatile demand cycles. Vendors offer standard blocks that still allow local customization. Such designs support expansion in land-constrained urban areas. It encourages a repeatable, industrial approach to data center delivery.

Rising Focus on Water Efficiency, Air Economization, and Alternative Heat Management

Water use faces scrutiny from regulators and communities in Spain. The Spain Data Center Cooling Market therefore moves toward low-water technologies. Operators evaluate adiabatic systems, dry coolers, and advanced air economizers. Some sites explore heat export schemes to nearby buildings or districts. That model improves local acceptance and supports ESG reporting. Vendors optimize coils and controls to minimize water while keeping performance. Designs shift toward holistic resource efficiency rather than power alone. It turns cooling strategy into a key part of water stewardship.

Expansion of Edge, Colocation, and Industry-Specific Micro Data Centers

Enterprises deploy more regional and edge locations to cut latency. The Spain Data Center Cooling Market reflects this through small, distributed sites. Edge nodes require compact, reliable cooling tailored to constrained spaces. Retail, transport, and manufacturing environments demand robust enclosures. Colocation firms offer smaller footprints for regional workloads. Vendors respond with integrated racks that include cooling and monitoring. These solutions support fast rollout for 5G and IoT use cases. It widens demand beyond large campuses into a diverse site portfolio.

Market Challenges

High Energy Costs, Retrofit Constraints, and Capital Intensity for Advanced Cooling

Energy prices remain a structural concern in Spain. The Spain Data Center Cooling Market must absorb power cost volatility. Operators upgrading legacy sites face tight space and layout constraints. Retrofitting liquid or aisle containment requires careful planning and downtime risk. Capital intensive chillers and control systems challenge smaller operators. Financing can be difficult for projects without long-term anchor tenants. Payback periods depend on stable occupancy and reliable energy savings. It forces buyers to balance cutting-edge solutions with budget discipline.

Talent Shortages, Regulatory Complexity, and Technology Integration Risks

Specialized skills for advanced cooling design remain limited. The Spain Data Center Cooling Market feels this gap in engineering resources. Complex projects require coordination between mechanical, electrical, and IT teams. Evolving regulations on refrigerants and environmental impact add uncertainty. Vendors and operators must track standards across European and local frameworks. Integration of AI and automation introduces cybersecurity concerns. Legacy control systems can resist modern platform upgrades. It creates execution risk for projects that push new technology boundaries.

Market Opportunities

Growth of AI, Cloud, and HPC Workloads Creating Demand for Innovative Cooling

AI training, analytics, and HPC workloads require far higher rack densities. The Spain Data Center Cooling Market can supply advanced solutions for these needs. Vendors that offer liquid, hybrid, and rear-door systems gain a clear edge. Hyperscale and colocation providers seek partners with strong design expertise. Service models around optimization, monitoring, and lifecycle support create new revenue. Investors can back platforms aligned with high-density contracts. It positions innovators to capture premium segments with strong growth potential.

Sustainable Cooling, Regional Expansion, and Value-Added Service Ecosystems

Spain’s climate targets and renewable build-out favor efficient designs. The Spain Data Center Cooling Market can anchor projects in green energy regions. Heat reuse, low-water systems, and low-GWP refrigerants open funding doors. Regional cities seeking digital investment welcome efficient data center projects. Service providers can bundle maintenance, advisory, and performance guarantees. Partnerships with utilities and municipalities unlock district energy links. It allows cooling firms to move from equipment vendors to long-term solution partners.

Market Segmentation

By Component: Solution and Services Driving Integrated Cooling Value Propositions

By component, solutions hold the larger share with hardware and software platforms. The Spain Data Center Cooling Market relies on chillers, air units, controls, and containment. These elements form the backbone of thermal performance for hyperscale and enterprise sites. Services, including consulting and lifecycle support, show faster momentum. Customers expect design validation, commissioning, and continuous optimization. The mix of solutions and services supports outcome-based engagements. Vendors that bundle both components gain better renewal and upsell prospects. It strengthens long-term relationships across the data center lifecycle.

By Data Center Cooling Solution: Precision, Chillers, and Liquid Cooling as Performance Pillars

Air conditioners and precision air conditioners remain widely deployed in existing sites. The Spain Data Center Cooling Market still depends on these units for room-level control. Chillers and air handling units lead large campus deployments with centralized capacity. Liquid cooling gains traction in high-density zones and AI-focused projects. Other niche solutions support micro data centers and constrained locations. The diversity of solutions allows tailored designs for each workload profile. Vendors with complete portfolios can serve both retrofit and greenfield demand. It aligns solution choice with density, climate, and cost targets.

By Service: Installation, Support, Consulting, and Maintenance as Critical Enablers

Installation and deployment services shape early project outcomes. The Spain Data Center Cooling Market needs high quality commissioning to meet design targets. Support and consulting services help operators refine layouts and control logic. Clients request audits that identify hotspots and inefficiencies over time. Maintenance services protect investments through regular inspection and upgrades. Predictive and remote maintenance models gain popularity in larger fleets. Service providers that combine field expertise with analytics stand out. It turns service capability into a competitive differentiator for vendors.

By Enterprise Size: Large Enterprises and SMEs with Distinct Cooling Priorities

Large enterprises and hyperscale operators drive most installed capacity. The Spain Data Center Cooling Market must meet strict uptime and efficiency benchmarks here. These customers favor advanced systems with strong monitoring and redundancy. SMEs, including regional providers and enterprises, look for simple, reliable platforms. They demand compact footprints and clear cost control. Vendors design scalable solutions that can start small and grow with demand. Service partners play a key role in supporting SME deployments. It broadens addressable demand across multiple enterprise tiers.

By Floor Type: Raised and Non-Raised Floors Shaping Cooling Strategies and Retrofits

Raised floors remain common in legacy and many colocation facilities. The Spain Data Center Cooling Market uses such layouts for underfloor air distribution. Non-raised floors appear more in newer, modular designs. These rely on overhead or in-row airflow paths. Each floor type shapes containment options and retrofit complexity. Vendors must adapt ducting, cable paths, and unit placement for both designs. Raised floors support traditional cold aisle models, while non-raised favor row solutions. It requires flexible engineering to deliver optimal airflow in each setting.

By Containment: HAC, CAC, and Open Layouts Driving Thermal Efficiency Choices

Hot aisle containment, cold aisle containment, and open raised floor areas coexist. The Spain Data Center Cooling Market increasingly adopts containment for energy efficiency. Raised floor with hot aisle containment often suits high-density zones. Cold aisle containment fits sites aiming to protect intake air quality. Some legacy halls still operate without full containment, accepting lower efficiency. Upgrades focus on doors, baffles, and blanking panels to improve separation. Operators evaluate containment type based on layout and existing hardware. It positions airflow management as a cost-effective efficiency lever.

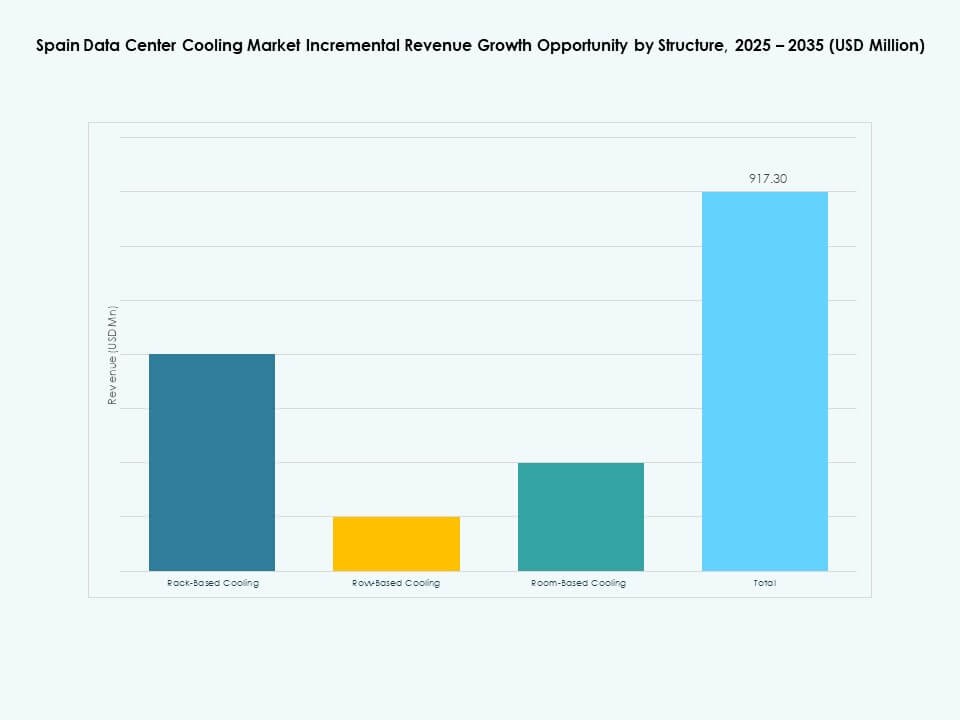

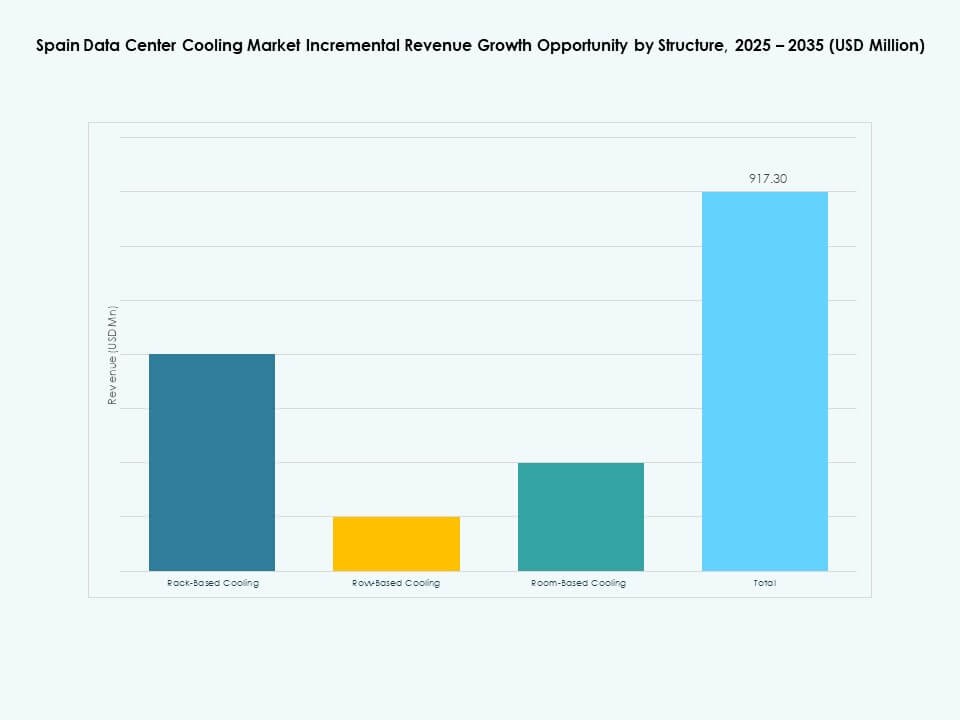

By Structure: Rack-, Row-, and Room-Based Cooling for Different Deployment Models

Rack-based cooling serves the highest density and AI-focused environments. The Spain Data Center Cooling Market uses these solutions where rack loads spike. Row-based cooling balances cost and control for many colocation halls. Room-based systems remain common in older facilities and smaller enterprise sites. Each structure type trades precision against simplicity and capital cost. Operators may mix types within a single facility to match workload needs. Vendors design modular products that slot into each structural model. It enables gradual transitions from room systems toward finer-grained control.

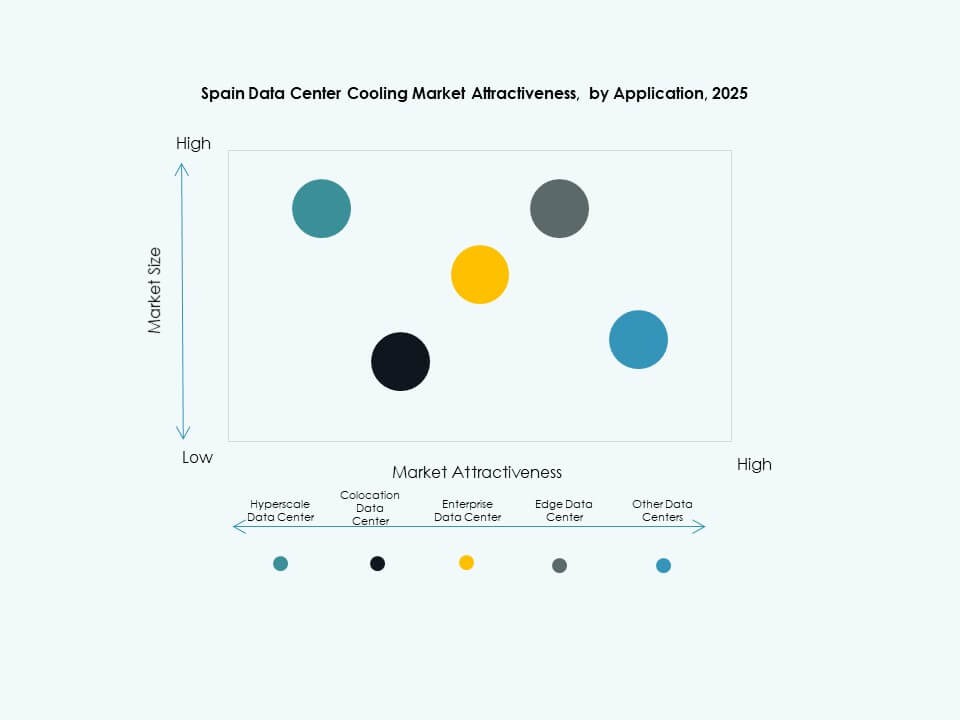

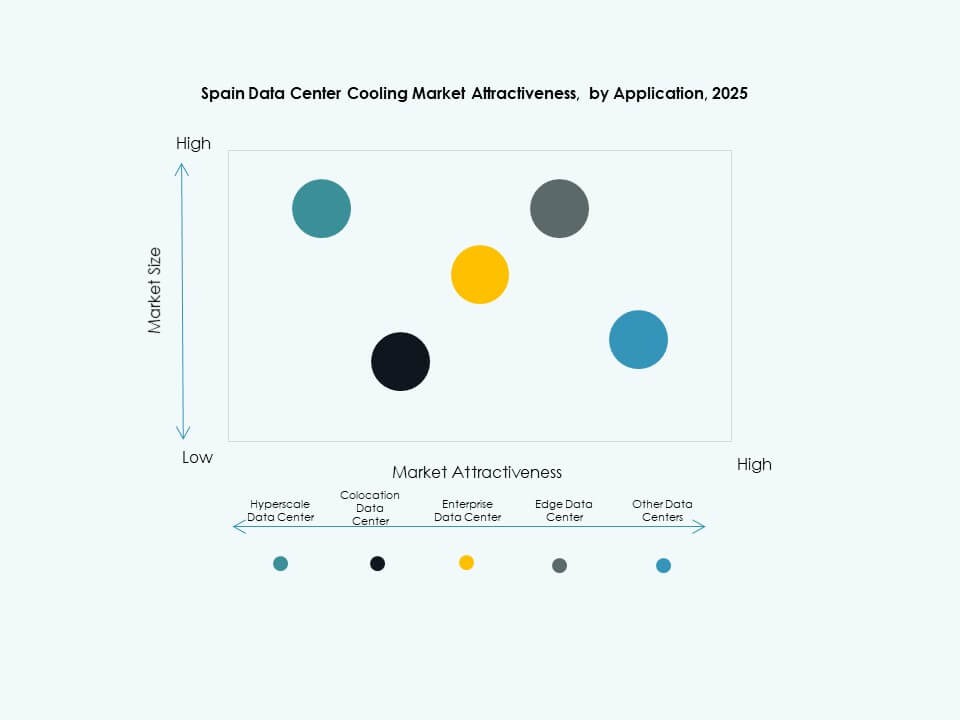

By Application: Hyperscale, Colocation, Enterprise, Edge, and Other Data Centers

Hyperscale data centers drive the largest share of cooling investment. The Spain Data Center Cooling Market supports large cloud and content providers. Colocation facilities add demand from diverse tenants across sectors. Enterprise data centers maintain investment where compliance or latency needs apply. Edge data centers expand near users and infrastructure nodes. Other data centers, such as government or research sites, add specific requirements. Each application segment demands tailored redundancy and efficiency levels. It creates a wide spectrum of design briefs for cooling vendors.

By End-User: Telecom, IT, Retail, Healthcare, BFSI, Energy, and Other Sectors

Telecom and IT remain the leading end-users by capacity. The Spain Data Center Cooling Market also serves BFSI, retail, and healthcare workloads. These sectors require strict uptime and compliance with data regulations. Energy firms and industrial users add compute for operations and analytics. Other sectors, including media and public services, contribute steady growth. Vertical needs influence redundancy design and service expectations. Vendors position sector-specific solutions and references to win deals. It links cooling demand directly with Spain’s broad digital transformation.

By Region: Global Context Framing Spain’s Role Within Wider Data Center Investment

Within global segmentation, Europe competes with North America and Asia-Pacific. The Spain Data Center Cooling Market fits into this European cluster. Spain draws regional workloads that need EU data residency and strong connectivity. North America still holds the largest installed base and innovation pace. Asia-Pacific records rapid greenfield growth, especially for hyperscale sites. Latin America, Middle East, and Africa remain emerging markets with rising demand. It places Spain as a growing node in a multi-regional digital network.

Regional Insights

Central Spain and Madrid Corridor as the Primary Data Center and Cooling Hub

Central Spain, led by the Madrid corridor, captures the highest share of capacity, estimated near one half of national demand. The Spain Data Center Cooling Market here benefits from strong fiber, power, and cloud presence. Hyperscale and large colocation projects cluster around key industrial zones. Cooling systems favor efficient chillers, containment, and smart controls. Developers prioritize grid access and renewable power contracts. Central locations also support regional connectivity across the Iberian Peninsula. It positions Madrid as the anchor for future high-density investments.

Eastern and Northeastern Spain Including Catalonia as a Growing Secondary Cluster

Eastern and northeastern Spain, including Catalonia, hold a significant share, often viewed near one third of the national market. The Spain Data Center Cooling Market in this subregion benefits from strong enterprise activity and logistics links. Barcelona and nearby areas attract edge and colocation investments. Operators explore free cooling where climate and design allow it. Proximity to subsea cables and cross-border routes supports regional roles. Local demand from media, tourism, and services adds workload diversity. It turns this corridor into a balanced mix of core and edge sites.

- For instance, Equinix’s new BA2 facility in Barcelona, set to go live in Q1 2024, is designed for LEED certification, with an official commitment to operate using 100 percent renewable energy; the site provides 3.41 MW of IT power capacity in a 2,500 square meter facility according to public project announcements and local press confirmation in 2024.

Southern and Northern Spain, Islands, and Emerging Regional Edge Locations

Southern and northern Spain, along with island territories, jointly account for the remaining share, generally under one fifth of capacity. The Spain Data Center Cooling Market in these areas focuses on edge and sector-specific sites. Coastal cities host facilities that serve ports, tourism, and regional services. Climate conditions drive interest in efficient, low-water cooling solutions. Islands require resilient designs due to power and space constraints. Smaller facilities still adopt modern controls to cut energy usage. It extends data center and cooling growth beyond traditional metropolitan hubs.

- For example, in February 2024, Azora and Core Capital announced an investment exceeding €500 million to develop six edge data centers across Spain and Portugal. Official statements confirm that the planned facilities will provide more than 60 MW of total capacity. The initiative is being developed through their platform, Quetta Data Centers, as outlined in company and industry disclosures.

Competitive Insights:

- Schneider Electric

- Vertiv Group Corp.

- Carrier

- Johnson Controls International plc

- Mitsubishi Electric Corporation

- STULZ GmbH

- Airedale International Air Conditioning

- Rittal GmbH & Co. KG

- Modine Manufacturing Company

- CoolIT Systems

Spain Data Center Cooling Market features a mix of global HVAC majors and specialist vendors. Schneider Electric and Vertiv anchor the premium end with integrated power and cooling portfolios. Carrier, Johnson Controls, and Mitsubishi Electric compete strongly in large chiller and CRAC deployments. STULZ and Airedale focus on precision cooling and custom engineered units for high density halls. Rittal and Modine expand presence through rack and row based solutions. CoolIT Systems and Green Revolution Cooling push liquid and immersion technologies for AI and HPC loads. Competition centers on efficiency metrics, lifecycle cost, and service coverage. Vendors seek advantage through local partnerships, modular offerings, and sustainability credentials. It creates a landscape where technology depth and execution capability matter more than pure hardware scale.

Recent Developments:

- In February 2025, Vertiv partnered with Oxigen to deliver scalable, energy-efficient cooling technologies including the Vertiv Liebert AFC chiller and Liebert CRV row-based cooling for Spain’s largest new data center. The partnership also integrates Vertiv’s power management and real-time monitoring software, supporting sustainable operations powered by 100% renewable energy.

- In July 2025, STULZ GmbH launched a new production facility for advanced liquid cooling systems in Hamburg, focusing on supporting AI-driven and high-performance data centers across Europe, including Spain. The expansion enables quicker innovation cycles for custom cooling solutions such as the CyberCool CMU, a precise control unit for liquid cooling infrastructure.