Executive summary:

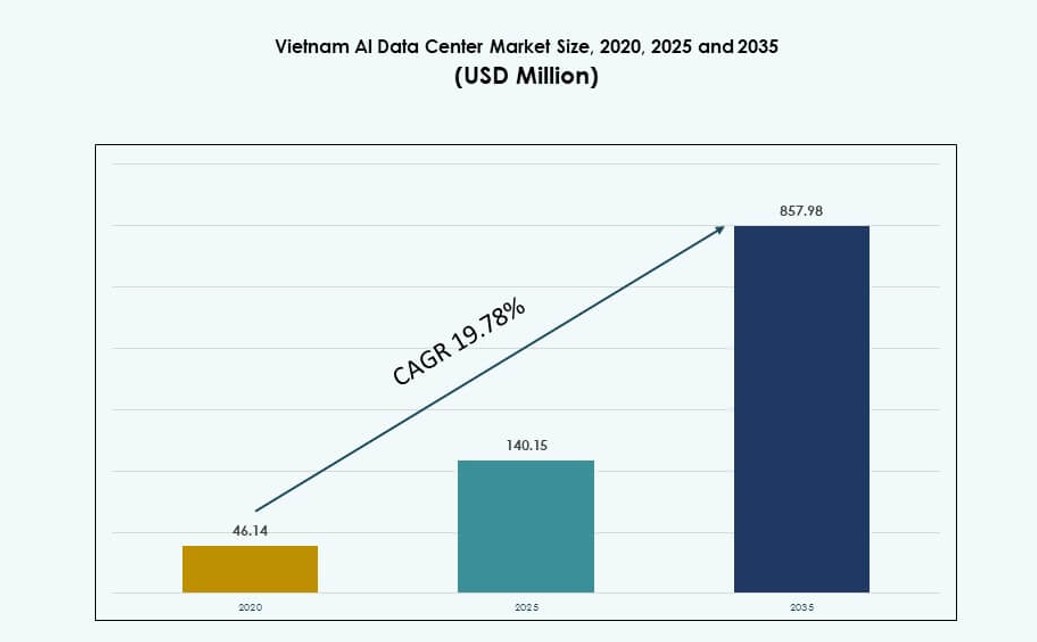

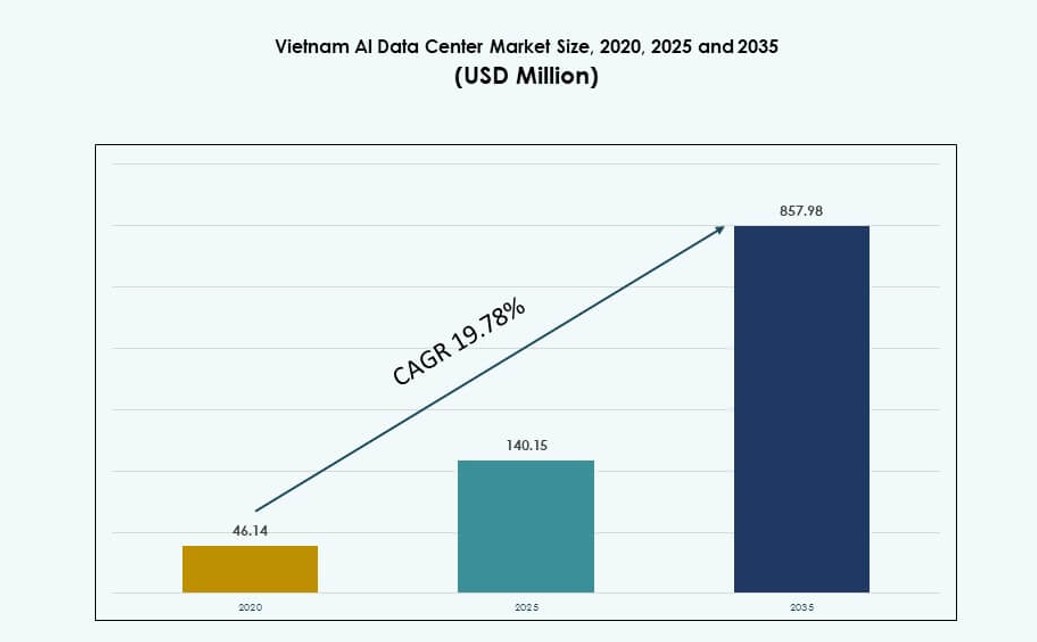

The Vietnam AI Data Center Market size was valued at USD 46.14 million in 2020 to USD 140.15 million in 2025 and is anticipated to reach USD 857.98 million by 2035, at a CAGR of 19.78% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Vietnam AI Data Center Market Size 2025 |

USD 140.15 Million |

| Vietnam AI Data Center Market, CAGR |

19.78% |

| Vietnam AI Data Center Market Size 2035 |

USD 857.98 Million |

Vietnam’s AI data center market is gaining momentum due to rising demand for AI computing, edge deployments, and cloud integration across sectors. Enterprises are investing in digital transformation while telecom providers expand high-performance infrastructure for real-time analytics. Government-led initiatives, new hyperscale projects, and smart city programs are driving capacity expansion. The market plays a vital role in enabling sovereign AI capabilities and improving compute access for domestic and regional use cases.

Ho Chi Minh City leads the market with strong infrastructure, industrial demand, and large-scale data center developments. Northern Vietnam is emerging, with Hanoi and Bac Ninh attracting public sector AI and cloud activity. Central Vietnam is developing edge-ready capacity for logistics, ports, and mid-size enterprises. Each region benefits from tailored infrastructure growth based on industry density, policy support, and connectivity improvements.

Market Dynamics:

Market Drivers

Rapid Expansion of Cloud Infrastructure and Enterprise Digitalization in Vietnam

Cloud adoption across public and private sectors continues to accelerate digital transformation in Vietnam. Enterprises are shifting core applications to AI-optimized cloud platforms to increase efficiency. Demand for scalable infrastructure capable of handling real-time analytics and large-scale AI models is surging. The Vietnam AI Data Center Market gains momentum from rising investments in edge and core data hubs. Telecom operators and global cloud players are scaling regional capacity to meet low-latency demands. Enterprise workloads in finance, e-commerce, and logistics are driving AI-specific deployments. The market enables businesses to build AI capabilities with local compliance. It provides strategic infrastructure for regional business expansion and digital competitiveness. Government support through smart city and Industry 4.0 programs strengthens long-term infrastructure planning.

- For instance, Viettel’s Hoa Lac Data Center is described as Vietnam’s largest data center, housing 60,000 servers and over 2,400 racks on 21,000 m² of floor space, with a total power capacity of 30 MW and design targeted at AI and high‑performance computing workloads.

Government Policy Support and National AI Strategy Driving Infrastructure Investments

Vietnam’s national AI strategy aims to position the country among the top AI hubs in Southeast Asia by 2030. The government provides tax incentives and digital transformation funding to attract hyperscalers and tech investors. Key ministries are integrating AI in governance, public services, and transportation. These policy directions create stable demand for AI data processing and storage. The Vietnam AI Data Center Market benefits from this public-private alignment on innovation. Growth in e-governance, citizen services, and surveillance applications is encouraging localized AI deployment. Strategic zones like Saigon Hi-Tech Park serve as testing grounds for AI-powered infrastructure. Such hubs attract global solution providers building regional data center presence. Domestic infrastructure firms are expanding to meet compliance with AI-ready design and security standards.

5G Rollout and AI-Edge Synergies Accelerating Distributed Compute Demand

Vietnam’s 5G commercialization enhances connectivity for high-bandwidth, low-latency AI workloads across industries. The fusion of 5G and AI is reshaping network planning, traffic optimization, and autonomous systems. Edge data centers are emerging to support use cases in smart manufacturing, video analytics, and autonomous logistics. The Vietnam AI Data Center Market supports this shift with localized micro and edge facility growth. Telecom firms are integrating AI at the edge to enhance network self-healing and traffic management. It enables service providers to monetize 5G through AI-powered offerings for enterprises. AI adoption at the edge reduces latency in critical decision-making. Manufacturing and energy sectors are integrating edge-AI to optimize production and grid operations. This trend fosters demand for smaller, AI-specialized edge infrastructure.

Rise in AI Workloads from BFSI, Healthcare, and E-Commerce Platforms

Data-driven sectors like banking, healthcare, and e-commerce are scaling AI initiatives in fraud detection, diagnostics, and personalization. These applications require high-performance GPUs and resilient compute infrastructure. The Vietnam AI Data Center Market addresses this demand through GPU-dense colocation and hybrid environments. E-commerce firms are using AI to optimize logistics and automate customer interactions. Banks are deploying AI for real-time transaction monitoring and credit risk scoring. Healthcare providers adopt AI for imaging analysis, diagnosis support, and resource allocation. AI demand is pushing service providers to upgrade thermal management, rack design, and power densities. The surge in inference and training workloads is influencing facility architecture and energy sourcing. The market supports digital leaders in achieving scalable AI innovation within Vietnam.

- For instance, Viettel currently operates 15 data centers across Vietnam with a combined capacity of 87 MW and has announced plans to expand to 24 data centers by 2030 with total capacity of 560 MW, providing the high‑density, scalable infrastructure required for AI workloads across BFSI, healthcare, and e‑commerce platforms.

Market Trends

Shift Toward Liquid Cooling and High-Density Rack Deployment

Vietnamese data centers are embracing high-density rack deployments to support power-intensive AI workloads. Traditional air cooling methods no longer meet thermal demands of modern GPUs. Operators are introducing direct-to-chip liquid cooling systems to reduce energy waste. These upgrades help sustain AI model training environments with efficiency and reliability. The Vietnam AI Data Center Market incorporates modular designs to adapt to evolving thermal profiles. Facilities now support 20–50 kW per rack, with some planning for 100 kW configurations. This trend allows more processing within the same footprint. Green cooling initiatives align with ESG goals for enterprise clients. Thermal innovation is becoming a core differentiator in AI-ready colocation facilities.

Rise of AI-Ready Modular and Prefabricated Data Center Builds

Operators are deploying prefabricated modules to rapidly scale AI data infrastructure. Modular builds reduce deployment time and allow flexibility in power and cooling configurations. This trend is visible in both hyperscale and edge facilities across Vietnam. The Vietnam AI Data Center Market benefits from modularity in space-constrained urban areas. It supports on-demand scaling aligned with fluctuating AI workload patterns. Prefabricated modules improve sustainability through standardization and material efficiency. These builds support rapid rollout of edge intelligence nodes in industrial parks and ports. Investors and operators use this model to de-risk capital allocation in smaller AI markets. It also improves compliance with design, safety, and redundancy standards.

Growing Use of Renewable Power and Green Certification in AI Data Centers

Vietnamese data center operators are investing in green power to meet client sustainability targets. Solar and wind sourcing is increasing, especially in southern provinces. The Vietnam AI Data Center Market reflects a transition toward low-emission operations. Operators seek green certifications like LEED and EDGE to attract ESG-conscious tenants. AI-specific workloads heighten scrutiny on carbon intensity of compute. Renewable energy power purchase agreements (PPAs) are becoming common in new builds. Some facilities adopt waste heat recovery for nearby industrial processes. Green initiatives also attract international firms aligning with corporate climate commitments. This trend fosters a competitive edge in regional cloud and AI hosting.

Expansion of AI-as-a-Service Offerings Driving Infrastructure Demand

Cloud providers and local MSPs are offering packaged AI services across sectors. These include NLP models, computer vision APIs, and training platforms for enterprises. The Vietnam AI Data Center Market supports this model with high-availability compute infrastructure. SaaS and PaaS vendors deploy inference engines closer to end users to reduce latency. AI-as-a-Service helps SMEs adopt AI without owning infrastructure. This model drives repeat workloads in colocation and hybrid setups. Operators are co-developing vertical AI tools with cloud partners. Banking, media, and manufacturing firms are early adopters. It diversifies the revenue model for data center operators beyond traditional hosting.

Market Challenges

Power Infrastructure Constraints and High-Density Deployment Complexities

Power availability remains a critical constraint for large-scale AI data centers in Vietnam. Aging grid infrastructure and inconsistent regional capacity planning limit large deployments. High-density racks needed for AI generate thermal loads exceeding legacy facility limits. Operators face challenges integrating liquid cooling and high-capacity power distribution in existing sites. The Vietnam AI Data Center Market faces hurdles in securing long-term power purchase agreements. Grid stability in industrial zones is inconsistent during peak load hours. Backup infrastructure like batteries and diesel gensets add to capital and environmental costs. Securing renewable power sources with guaranteed uptime remains limited. These issues require proactive collaboration between utilities, regulators, and operators.

Limited Local Talent Pool and AI-Specific Facility Design Capabilities

Vietnam faces a shortage of AI infrastructure architects and data center engineers skilled in GPU optimization. Many local operators lack experience in building or managing AI-focused facilities. This impacts project timelines and design decisions critical for performance efficiency. The Vietnam AI Data Center Market requires specialized skills in thermal, electrical, and workload orchestration domains. Operator partnerships with global cloud vendors help close the skill gap. However, knowledge transfer and retention remain slow. Recruiting and training engineers to manage AI training clusters is challenging. Delays in facility certification and performance validation impact go-live schedules. Developing a talent pipeline aligned to AI infrastructure is essential for long-term growth.

Market Opportunities

Surge in Edge AI Infrastructure for Smart City and Industrial Zones

Smart city initiatives and digital industrial zones are driving demand for AI-powered edge data centers. These facilities process real-time data for surveillance, traffic control, and predictive maintenance. The Vietnam AI Data Center Market will benefit from this shift through modular and distributed deployments. Edge facilities create new service models for AI workload delivery.

Strategic Partnerships with Global Cloud and AI Technology Leaders

Vietnam’s growing digital economy attracts hyperscalers and AI leaders for local alliances. Joint ventures and colocation deals are unlocking new data center capacity. The Vietnam AI Data Center Market enables infrastructure scaling aligned to regional expansion goals. These partnerships accelerate investment, technology transfer, and AI platform localization.

Market Segmentation

By Type

Hyperscale facilities dominate the Vietnam AI Data Center Market due to rising demand from global cloud and AI providers. These facilities offer scale, redundancy, and high-capacity infrastructure for AI training and inference. Colocation and enterprise segments are growing steadily, especially among financial and retail sectors. Edge or micro data centers are gaining traction in manufacturing parks and logistics hubs. The hyperscale segment leads in revenue share, driven by international cloud partnerships and domestic digital policy support.

By Component

Hardware remains the largest revenue-generating segment, led by demand for GPUs, accelerators, high-density racks, and cooling systems. AI-specific workloads require robust hardware architecture to support scalable training and inference operations. The software and orchestration segment is growing due to demand for AI workload management, containerization, and automation. Services contribute to integration, managed operations, and consulting. The Vietnam AI Data Center Market is hardware-heavy, but software-led differentiation is increasing among operators.

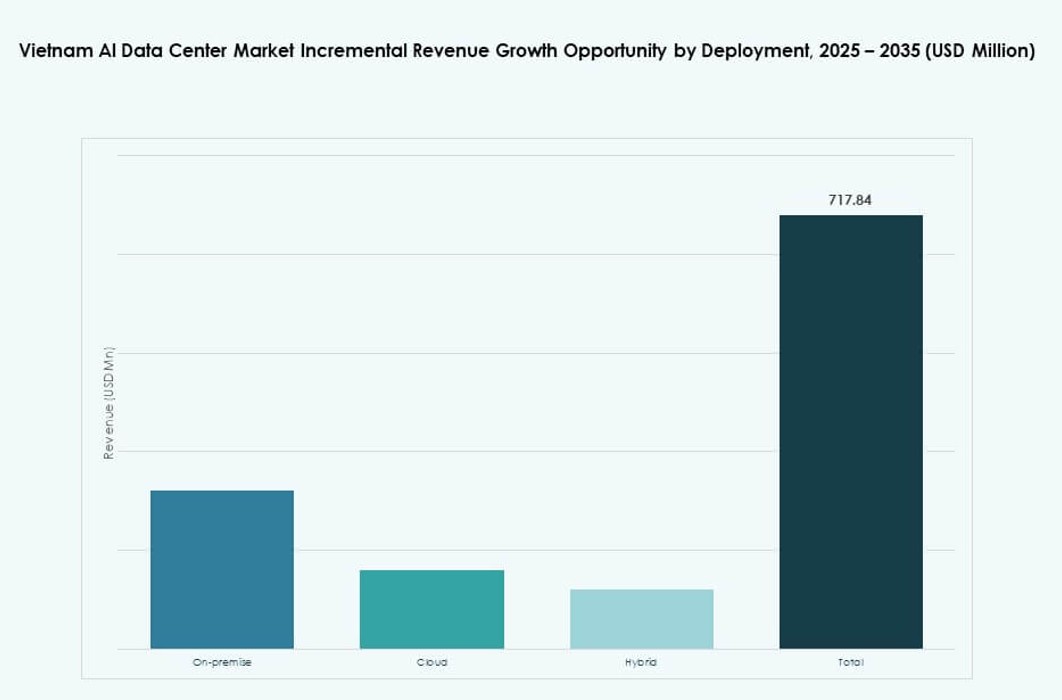

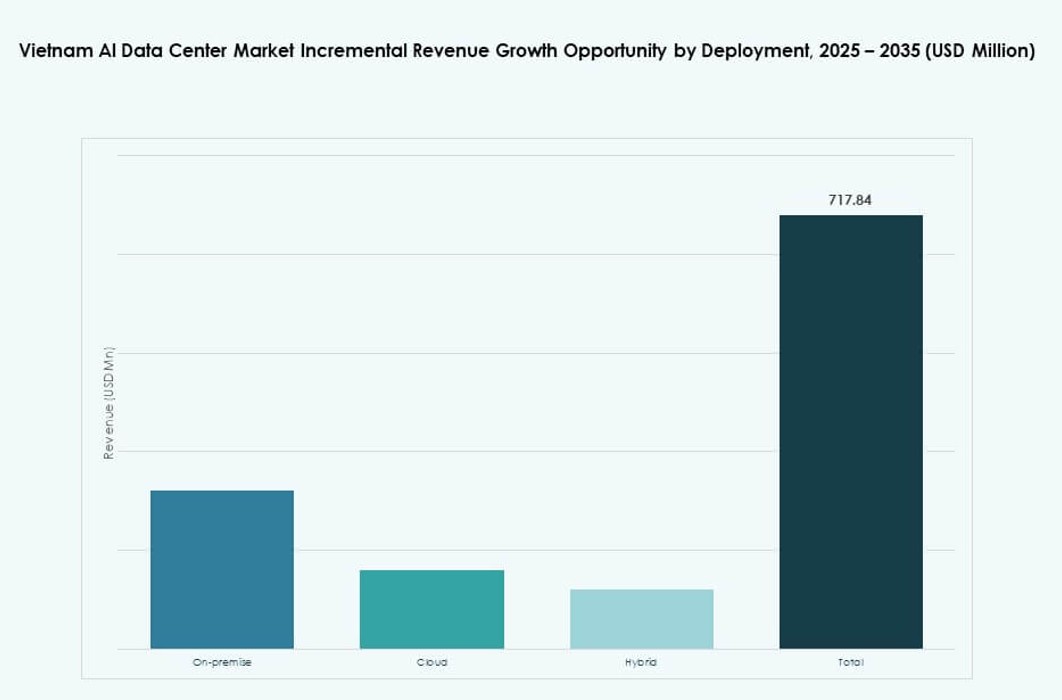

By Deployment

Hybrid deployment is emerging as the dominant model, blending on-premise control with cloud scalability. Enterprises prefer hybrid setups for data sovereignty, security, and application flexibility. Cloud deployment is rising in adoption across startups and AI-first platforms. On-premise deployment still exists in regulated sectors like banking and defense. The Vietnam AI Data Center Market is transitioning toward hybrid-first strategies to meet AI’s dynamic compute and storage needs.

By Application

Machine Learning (ML) dominates application share, driven by its use in e-commerce, banking, and operations optimization. Generative AI (GenAI) is emerging fast due to language translation, image generation, and customer service automation. NLP adoption is strong in Vietnamese language modeling for chatbots and voice assistants. Computer Vision (CV) finds use in surveillance, smart traffic, and factory automation. The Vietnam AI Data Center Market shows growing application diversity, with GenAI as a high-growth sub-segment.

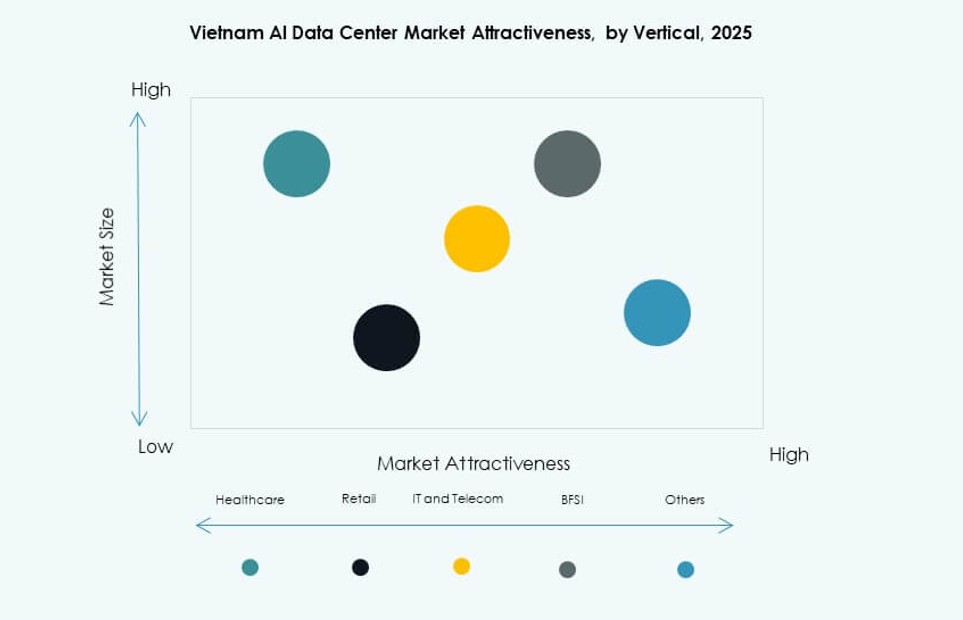

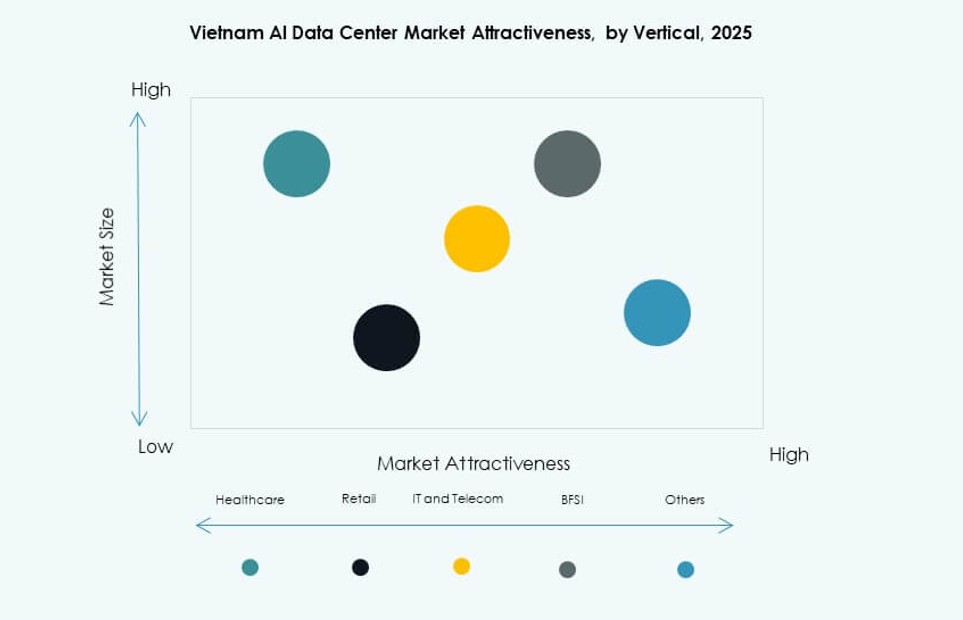

By Vertical

IT and Telecom lead the vertical segmentation due to infrastructure scale and AI integration into core networks. BFSI is a key adopter of AI for fraud detection, credit scoring, and customer analytics. Retail and e-commerce invest in personalization, demand forecasting, and logistics automation. Healthcare uses AI for diagnostics, imaging, and scheduling. Manufacturing and media verticals are rising fast in edge and GPU-rich deployments. The Vietnam AI Data Center Market sees strong sectoral traction from digitally mature industries.

Regional Insights

Southern Vietnam: Ho Chi Minh City Leads in Hyperscale and Colocation Development

Southern Vietnam holds the largest market share at approximately 42% in the Vietnam AI Data Center Market. Ho Chi Minh City is the primary hub due to strong enterprise presence and robust telecom infrastructure. Most hyperscale and international cloud deployments focus on this region. Its proximity to major industrial parks and port logistics enhances data center utility. Strategic investment zones and tech parks provide incentives for new builds. Strong demand from retail, logistics, and financial services supports consistent growth.

- For instance, NTT’s Ho Chi Minh City 1 Data Center in Saigon Hi‑Tech Park is a five‑story facility providing 6 MW of critical IT load over 3,100 m² of server rooms (around 1,200 racks), 15 km from the city center, designed to Tier III standards to serve multinational IT and financial services workloads.

Northern Vietnam: Hanoi and Bac Ninh Driving Edge and Government AI Workloads

Northern Vietnam accounts for nearly 36% market share and is expanding fast with government-driven digital projects. Hanoi hosts critical e-governance, healthcare, and public sector AI workloads. Bac Ninh and surrounding provinces attract data center builds supporting electronics and manufacturing hubs. The region’s connectivity and power availability are improving with infrastructure upgrades. Local operators collaborate with ministries to offer sovereign AI services. Education and R&D institutions in the north also contribute to AI workload demand.

Central Vietnam: Emerging Digital Infrastructure Cluster with Industrial Edge Growth

Central Vietnam contributes around 22% market share and is emerging with industrial edge deployments. Cities like Da Nang and Quy Nhon are attracting mid-scale data centers due to economic diversification policies. These areas offer cost advantages in land, labor, and power. AI adoption in ports, tourism, and logistics supports localized edge infrastructure. The Vietnam AI Data Center Market finds growth potential in this region through government-backed innovation zones. Rising fiber and power investments enhance viability for AI-ready sites.

- For instance, in Da Nang, a newly launched AI and data hub project has been announced with an investment of about 200 million USD, designed to international Tier III standards and interconnected with national backbone fiber to support smart‑city, port logistics, and tourism analytics workloads for Central Vietnam.

Competitive Insights:

- Viettel IDC

- FPT Telecom Data Centers

- CMC Telecom

- Equinix

- Digital Realty Trust

- Amazon Web Services (AWS)

- Microsoft (Azure)

- Google Cloud / Alphabet

- NVIDIA

- Hewlett Packard Enterprise (HPE)

The Vietnam AI Data Center Market is shaped by strong domestic operators and expanding global hyperscalers. Local firms like Viettel IDC, FPT Telecom, and CMC Telecom lead in compliant infrastructure and proximity to government and enterprise clients. Global players such as AWS, Microsoft, and Google Cloud are scaling capacity to support AI workloads and cloud services. Infrastructure vendors like NVIDIA and HPE provide AI-optimized compute and cooling solutions, enhancing market competitiveness. Equinix and Digital Realty strengthen colocation capabilities through regional partnerships. The market supports hybrid and edge AI deployments, giving operators with modular and liquid cooling expertise a performance edge. It fosters a dynamic landscape where local access, energy strategy, and AI hardware integration determine competitive positioning.

Recent Developments:

- In January 2026, Create Capital Vietnam and Haimaker.ai launched a $1 billion joint venture to build a nationwide network of AI-focused data centers.

- In December 2025, state-owned VNPT established subsidiary VNPT AI and launched the VNPT-Qualcomm Excellence Center for AI-driven R&D in intelligent devices and computing platforms.

- In November 2025, KBC signed a partnership agreement with Accelerated Infrastructure Capital (AIC) and VietinBank to develop a 10-hectare AI-integrated data center at Tan Phu Trung Industrial Park in Ho Chi Minh City, with a nearly $2 billion investment and 200 MW IT load capacity.

- In August 2025, CMC Telecom secured approval for its $250 million CMC Hyperscale Data Center in Ho Chi Minh City’s Saigon Hi-Tech Park and signed a $1 billion strategic partnership with Samsung C&T to transform it into a regional AI hub with 30 MW initial capacity expandable to 120 MW.