Executive summary:

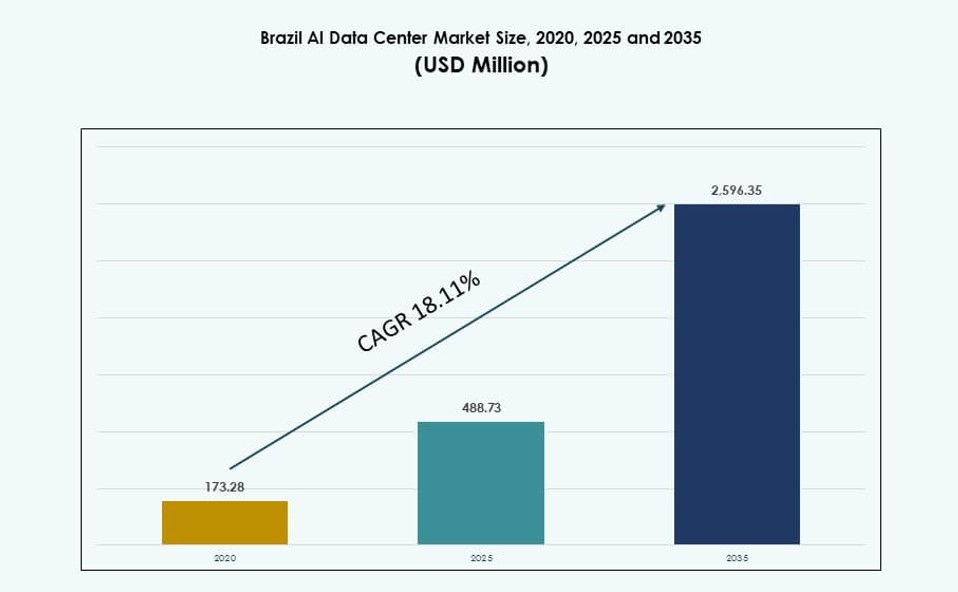

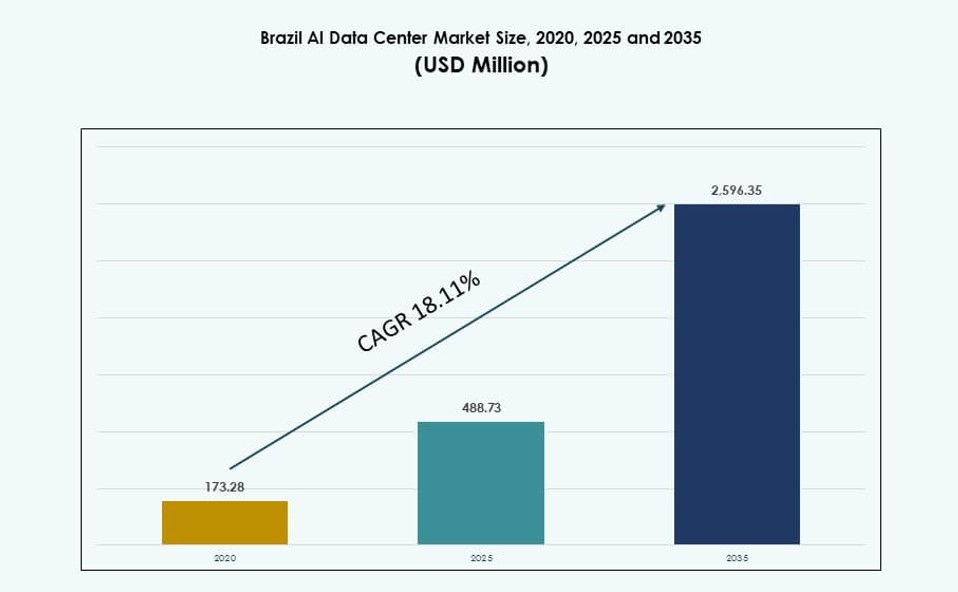

The Brazil AI Data Center Market size was valued at USD 173.28 million in 2020 to USD 488.73 million in 2025 and is anticipated to reach USD 2,596.35 million by 2035, at a CAGR of 18.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Brazil AI Data Center Market Size 2025 |

USD 488.73 Million |

| Brazil AI Data Center Market, CAGR |

18.11% |

| Brazil AI Data Center Market Size 2035 |

USD 2,596.35 Million |

The market is driven by increased adoption of AI applications across financial services, telecom, healthcare, and retail sectors. Rising demand for high-density compute, GPU-accelerated infrastructure, and edge processing is fueling new investments. Hyperscale operators are expanding regional footprints to support AI training and inference workloads. Innovations in liquid cooling and orchestration software are also reshaping design. The market serves as a vital pillar for Brazil’s digital economy, attracting sustained interest from investors and cloud platforms.

Southeast Brazil, led by São Paulo and Rio de Janeiro, dominates the market due to dense enterprise demand and fiber connectivity. Southern regions are emerging with greenfield builds supported by better energy efficiency and land availability. Central-West zones attract government-backed infrastructure deployments. Northern and Northeastern regions, though limited in capacity, show potential through public initiatives and smart city plans targeting future AI edge expansion.

Market Dynamics:

Market Drivers

AI Workload Demands Are Accelerating the Need for High-Performance Compute Infrastructure Across Brazil

The Brazil AI Data Center Market is growing as enterprises expand AI models and adopt data-intensive applications. Businesses require scalable infrastructure to support natural language processing, computer vision, and predictive analytics. High-performance GPUs and purpose-built servers are driving investments in modern compute architecture. Cloud providers and colocation operators are expanding capacity to handle enterprise AI needs. Domestic regulations and data localization laws also influence infrastructure decisions. Energy-efficient AI data centers are becoming central to sustainable operations. Investors are positioning capital to tap long-term digital transformation trends. It plays a vital role in supporting economic modernization and public sector AI deployments.

- For example, Nubank’s engineering team trains AI models with up to 1.5 billion parameters and fine‑tunes them on one billion labeled rows using a 64‑GPU cluster built on NVIDIA H100 accelerators. This setup enables scaled training and efficient model iteration across large financial datasets.

Public-Private Partnerships and Policy Incentives Are Catalyzing AI Infrastructure Growth

Government agencies and state-owned entities are promoting smart city platforms, digital healthcare, and AI-powered public services. These projects need robust backend systems, which push demand for AI-capable data centers. Tax incentives for digital infrastructure and cloud investments attract both foreign and local players. Public-private partnerships are emerging as a key tool to accelerate project timelines. AI startup ecosystems in São Paulo and Campinas drive early-stage demand for GPU-powered infrastructure. The Brazil AI Data Center Market benefits from tech-forward policy frameworks such as the national digital transformation strategy. Greenfield builds are being prioritized in cities with clear environmental compliance protocols. It positions Brazil as a strategic AI infrastructure hub in Latin America.

Surging Cloud and Edge AI Applications Are Reinforcing the Case for Distributed Data Centers

Brazil’s enterprise AI stack is increasingly dependent on low-latency cloud and edge processing. Use cases such as autonomous retail, smart surveillance, and real-time fraud detection require rapid inference. Telecom players and hyperscale cloud providers are investing in edge-ready data centers near urban clusters. AI-enabled edge devices and IoT ecosystems are multiplying across sectors. This shift places pressure on operators to deliver AI compute closer to the data source. The Brazil AI Data Center Market reflects this evolution with a rise in Tier III and micro data centers. National coverage expansion aligns with 5G rollout schedules. It ensures AI systems operate with reliability and minimal downtime.

- For instance, Vivo leads Brazil’s 5G standalone network rollout with national coverage across key urban centers and thousands of active sites, enabling low-latency infrastructure for IoT and AI services. The operator continues expanding edge capabilities to support advanced digital applications.

Digital Transformation in BFSI, Healthcare, and Retail Is Driving AI Data Center Investments

Financial services institutions are deploying AI models for credit risk, fraud analytics, and chatbot automation. Healthcare systems are integrating AI in diagnostics, imaging, and virtual care platforms. Large retail players are leveraging machine learning to personalize services and optimize supply chains. All these sectors require secure, high-throughput AI computing environments. Colocation data centers with AI-ready racks offer cost flexibility for mid-sized enterprises. Cloud-native startups also utilize GPU-as-a-service models from regional cloud zones. The Brazil AI Data Center Market supports sectoral AI acceleration by offering flexible deployment choices. It enables industry players to shift workloads based on real-time processing needs and business cycles.

Market Trends

Rising Adoption of Liquid Cooling Solutions in AI-Centric Data Centers

The growing thermal output of AI workloads is pushing operators toward advanced cooling technologies. Traditional air-cooled systems are insufficient for dense GPU clusters used in model training. Brazil is seeing a gradual uptake of liquid cooling, immersion cooling, and direct-to-chip methods. Operators are retrofitting existing facilities to support these innovations. Liquid cooling improves energy efficiency and rack density, both critical for AI data centers. Vendors are launching modular cooling units tailored for AI environments. Environmental regulations favor such solutions in urban areas with heat dissipation limits. The Brazil AI Data Center Market is at the early phase of this shift, but adoption is expected to scale. It reflects global AI infrastructure design trends.

Shift Toward AI-Ready Zones Within Hyperscale and Colocation Campuses

Data center developers are segmenting space specifically for AI workloads, offering dedicated zones with high-power density. These AI zones support workloads that exceed standard compute requirements. Operators deploy purpose-built racks, smart PDUs, and pre-configured interconnects. Such zones also feature enhanced physical and cybersecurity controls. In Brazil, colocation providers now market AI zones as a service differentiator. AI labs and enterprise R&D units are early adopters of these specialized offerings. The Brazil AI Data Center Market benefits from this segmentation approach, especially in Tier I cities. It enables better workload management, operational safety, and customer alignment.

Integration of Renewable Energy and Battery Storage with AI Workload Management

AI data centers in Brazil are integrating on-site solar, grid-tied wind, and energy storage systems. This helps offset high operational power costs and reduce emissions footprints. Operators align AI inference scheduling with renewable generation peaks. Advanced software manages dynamic load distribution based on real-time energy availability. Green certifications are influencing site selection and financing terms. Investors favor facilities with long-term PPAs or RECs linked to AI operations. The Brazil AI Data Center Market is seeing clean energy become a commercial imperative. It reflects customer preference and government pressure to reduce data center carbon intensity.

Expansion of Regional Fiber Backbones and Low-Latency Interconnects for AI Applications

AI workloads require rapid data transfer between compute nodes, storage systems, and cloud endpoints. Brazil’s telecom sector is expanding fiber optic networks across southern and southeastern states. Submarine cable landings are also enhancing international AI data exchange. Metro fiber routes are being built to connect edge AI zones with central campuses. Network providers offer guaranteed low-latency paths for AI inference and analytics workloads. The Brazil AI Data Center Market is shaped by this network evolution. It improves the viability of distributed AI infrastructure across cities and regions.

Market Challenges

High Power Consumption and Grid Reliability Concerns in AI Infrastructure Expansion

AI training clusters consume significantly more energy than standard enterprise servers. In Brazil, grid reliability varies by region, which complicates uptime commitments. Power purchase agreements for AI data centers are harder to secure in remote areas. Transmission infrastructure also adds delays to greenfield builds. Operators must install backup systems that increase capex. Rising electricity prices reduce the long-term profitability of GPU-intensive sites. The Brazil AI Data Center Market must balance density, sustainability, and cost-efficiency to remain competitive. It requires collaboration with utility providers and regulators.

Limited Availability of Skilled Workforce and AI-Specific Operational Expertise

Managing AI data centers requires a workforce skilled in GPU configuration, thermal dynamics, and orchestration software. Brazil faces a talent shortage in data center operations, which slows commissioning and optimization. AI-specific infrastructure roles are often filled by international staff or trained in-house, increasing ramp-up times. Maintenance complexity also increases with newer technologies such as liquid cooling. This limits the scale at which AI-ready sites can be launched across secondary cities. The Brazil AI Data Center Market needs coordinated training programs and certification pathways. It must also attract overseas expertise to scale efficiently.

Market Opportunities

Enterprise AI Use Cases and Localized Language Models Create New Infrastructure Demand

Corporates are now investing in vertical-specific AI tools like legal document summarizers, clinical imaging assistants, and agri-tech models. Localized AI models using Portuguese datasets require in-country compute for accuracy and compliance. These dynamics increase demand for flexible, regionally compliant infrastructure. The Brazil AI Data Center Market benefits from this shift in workload type. It offers colocation and hybrid deployment options that match enterprise risk profiles.

Hyperscaler Expansion and 5G-Fueled Edge Rollouts Are Unlocking Multi-Tenant Growth

Cloud giants are deepening investments through new availability zones and AI-optimized virtual machines. 5G networks in Tier II cities unlock edge inference use cases across transport, manufacturing, and logistics. Multi-tenant edge data centers with AI-ready modules are entering the market. The Brazil AI Data Center Market sees this as a path to distribute compute and attract new customer segments.

Market Segmentation

By Type

The Brazil AI Data Center Market is dominated by hyperscale facilities, which account for over 60% of total capacity. Hyperscalers lead due to their large-scale training workloads, cloud platform dominance, and capital depth. Colocation and enterprise data centers contribute moderate growth, especially in urban tech corridors. Edge and micro data centers are emerging in sectors like manufacturing and agriculture, driven by real-time AI use cases. Growth in edge facilities will accelerate post-5G rollout.

By Component

Hardware dominates the Brazil AI Data Center Market, driven by demand for high-performance GPUs, accelerators, and AI-specific servers. It holds the largest revenue share due to upfront capex for compute and networking. Software and orchestration tools are growing fast as AI models require dynamic resource scheduling and monitoring. Services such as managed AI hosting and on-demand GPU leasing support small and mid-size enterprises seeking flexible compute.

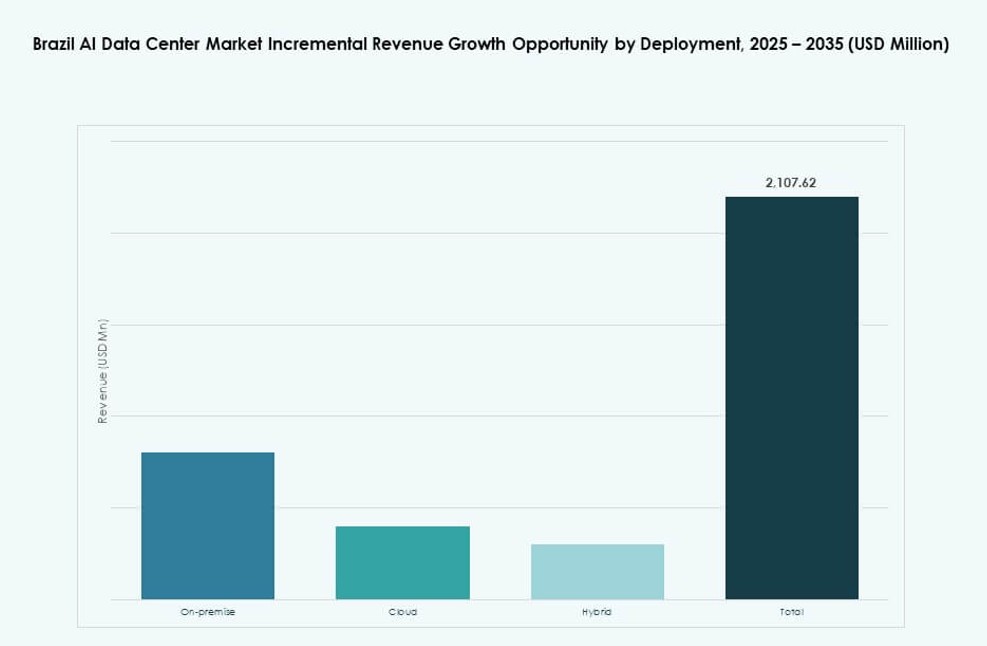

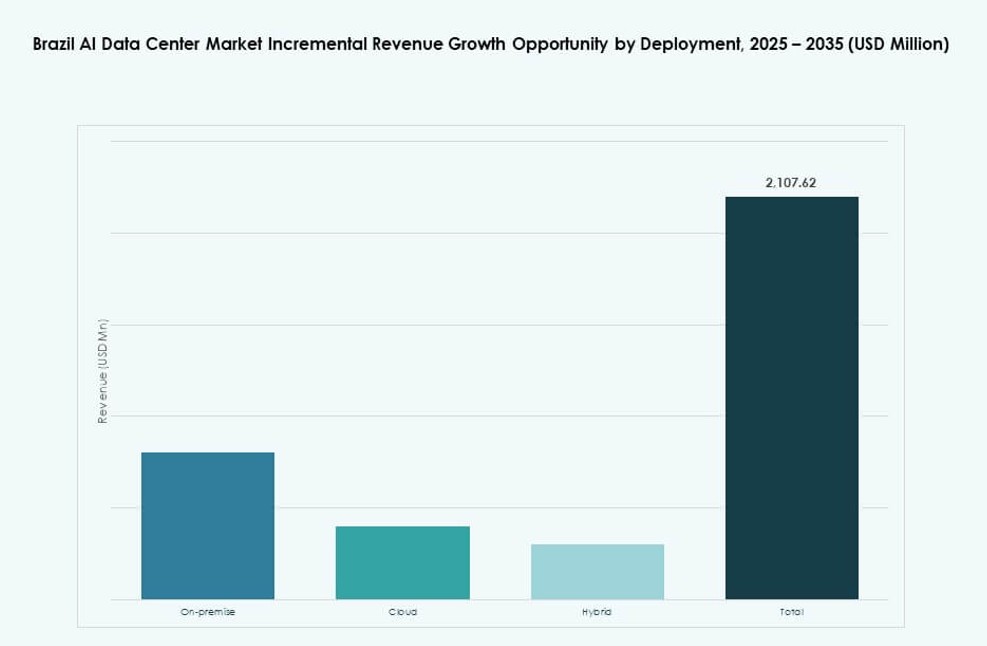

By Deployment

Hybrid deployment is the leading segment, accounting for over 45% of AI workload environments. Enterprises prefer hybrid setups for balancing latency, security, and cost. Cloud-based deployment is growing rapidly, with hyperscalers offering AI-optimized VM instances and managed AI tools. On-premise setups remain strong in BFSI and government sectors, which prioritize compliance and internal data governance over elasticity.

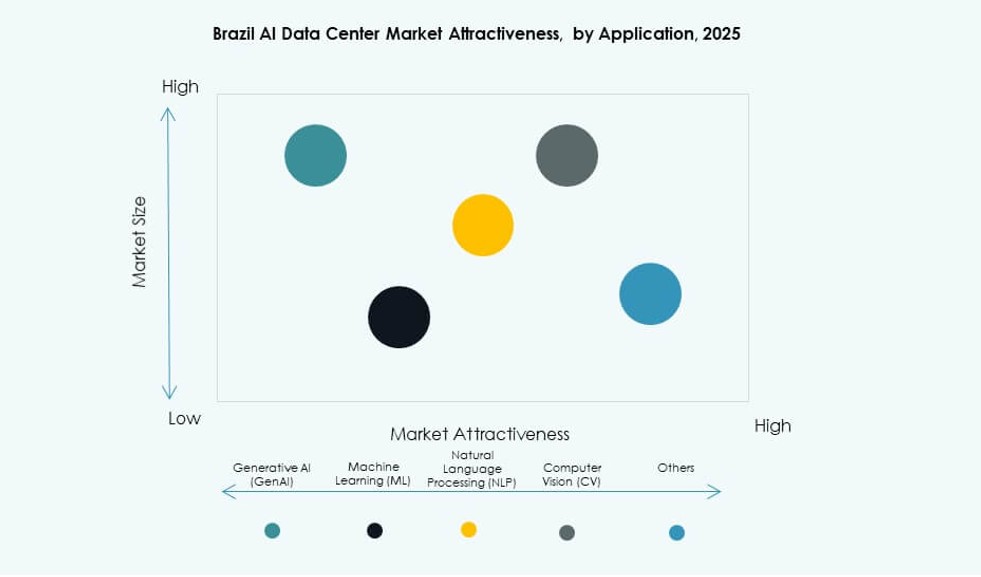

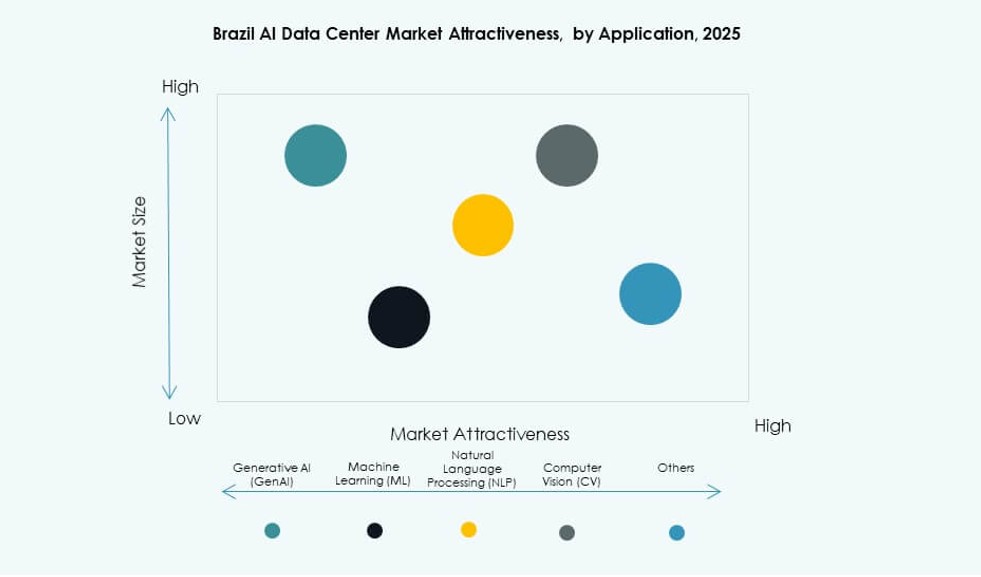

By Application

Machine Learning (ML) dominates the Brazil AI Data Center Market, supporting enterprise analytics, process automation, and business intelligence. Generative AI (GenAI) is the fastest-growing subsegment, especially in legal tech, customer engagement, and media applications. NLP sees traction in public sector and customer service bots. Computer Vision (CV) is growing in retail and manufacturing. Other emerging applications include AI-based robotics, video analytics, and anomaly detection.

By Vertical

IT and Telecom is the dominant vertical, using AI for network optimization, fraud detection, and customer engagement. BFSI is a strong contributor due to advanced risk modeling and AI-backed process automation. Retail uses AI for demand forecasting, personalization, and logistics. Healthcare is expanding fast, especially with diagnostic and imaging workloads. Manufacturing and media sectors adopt AI in quality control and content generation, respectively.

Regional Insights

Southeast Brazil Commands the Largest Share Due to Infrastructure Density and Economic Activity

Southeast Brazil holds approximately 55% of the Brazil AI Data Center Market, led by São Paulo and Rio de Janeiro. These cities are tech hubs with strong enterprise demand and connectivity. Most hyperscale, colocation, and telecom data centers are based here. Financial services, cloud adoption, and AI startup ecosystems drive demand. Power infrastructure and regulatory alignment also favor large builds. It remains the epicenter of AI data center investment.

- For instance, ODATA’s DC SP04 in Osasco, São Paulo, provides 48 MW IT capacity and supports up to 50 kW per rack with Delta³ cooling technology, operating on 100% renewable energy since early 2025.

Southern and Central-West Regions Are Emerging Due to Land Availability and Enterprise Expansion

Southern Brazil accounts for nearly 20% of the market, with Curitiba and Porto Alegre gaining traction. These areas offer low-cost land, better climate, and access to renewable energy. Central-West regions, led by Brasília, contribute around 12% due to federal government IT modernization. Enterprises expand footprints into these zones to reduce congestion and diversify risk. It reflects a shift toward secondary city deployments.

- For instance, Ascenty operates its SP4 data center in the São Paulo region with Tier III design standards and approximately 9.2 MW capacity, supporting enterprise workloads with robust uptime and connectivity. The facility is part of a broader campus expansion to meet growing demand for AI and cloud infrastructure.

North and Northeast Regions Have Low Penetration but Are Strategic for Edge and 5G

The North and Northeast regions jointly account for about 13% of the Brazil AI Data Center Market. These zones face power, fiber, and logistics challenges but offer proximity to emerging urban clusters. 5G deployments and public digital inclusion programs could stimulate AI edge data centers. Operators are monitoring demand for smart city and agritech solutions in these regions. It represents a long-term opportunity for distributed infrastructure buildout.

Competitive Insights:

- Ascenty

- Scala Data Centers

- Elea Digital

- Amazon Web Services (AWS)

- Microsoft (Azure)

- Google Cloud (Alphabet)

- Equinix

- Digital Realty Trust

- NVIDIA

- CoreWeave

The Brazil AI Data Center Market features a dynamic competitive landscape led by regional players and global hyperscale firms. Ascenty and Scala Data Centers operate large-scale facilities catering to cloud and enterprise AI workloads, while Elea Digital strengthens national coverage with edge-ready infrastructure. Global cloud providers such as AWS, Microsoft Azure, and Google Cloud drive public cloud expansion with AI-optimized services. Hardware and GPU leaders like NVIDIA and CoreWeave shape performance benchmarks and scalability. Colocation giants Equinix and Digital Realty are expanding their Brazil footprints to meet rising enterprise AI demand. It reflects a layered ecosystem where cloud, hardware, and colocation leaders are aligning to address sector-specific AI growth, infrastructure modernization, and localized regulatory needs.

Recent Developments:

- In January 2026, Casa dos Ventos and Ascenty signed their largest energy contract to date in Latin America. This agreement, valued at over half a billion dollars, secures about 110 MW of power supply dedicated to data center operations, reinforcing sustainable energy integration. The partnership strengthens Ascenty’s infrastructure with reliable renewable power and supports future AI workload expansion in Brazil.

- In September 2025, Google Cloud launched Trillium TPUs in its Sao Paulo region and Gemini 2.5 Flash on Vertex AI for local data sovereignty. Partnerships with Accenture and Deloitte include new AI experience centers in Brazil to drive regional AI adoption

- In July 2025, Ascenty announced plans to expand its data center footprint in São Paulo, Brazil. The company revealed new facilities in the São Paulo metropolitan area with significant megawatt capacity to meet rising demand. These expansions reflect ongoing investment in core markets to support cloud, AI, and enterprise digital workloads.