Executive summary:

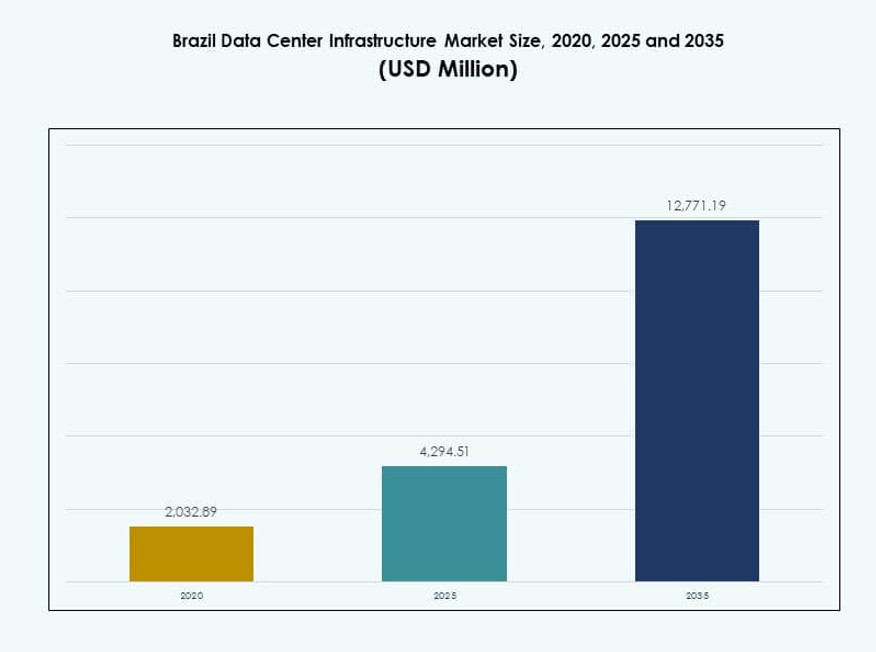

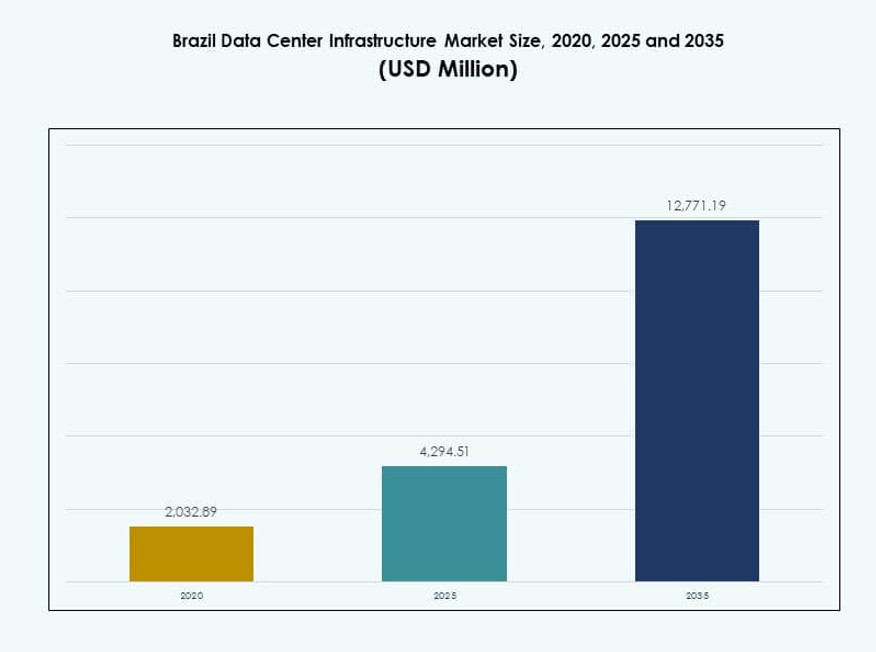

The Brazil Data Center Infrastructure Market size was valued at USD 2,032.89 million in 2020, reached USD 4,294.51 million in 2025, and is anticipated to reach USD 12,771.19 million by 2035, at a CAGR of 11.43% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Brazil Data Center Infrastructure Market Size 2025 |

USD 4,294.51 Million |

| Brazil Data Center Infrastructure Market, CAGR |

11.43% |

| Brazil Data Center Infrastructure Market Size 2035 |

USD 12,771.19 Million |

Market growth is driven by rapid cloud adoption, AI deployment, and rising data consumption. Enterprises shift toward hybrid IT models and modular data center designs to enhance scalability and reduce latency. Liquid cooling, BESS, and prefabricated systems are gaining traction. These innovations align with sustainability goals and operational efficiency. The market holds strategic importance for global hyperscalers, telecom operators, and investors looking to access Latin America’s growing digital economy.

Southeast Brazil leads the market with strong infrastructure, reliable power, and dense enterprise demand, especially in São Paulo and Rio de Janeiro. Southern and Central-West regions are emerging, fueled by edge deployments and public sector digitization. Northern and Northeastern areas offer greenfield potential due to rising connectivity, land availability, and government incentives supporting regional IT inclusion.

Market Dynamics:

Market Drivers

Strong Cloud Adoption and Digital Transformation Initiatives Across Key Sectors

Public and private enterprises in Brazil continue shifting workloads to cloud platforms. Cloud-native startups, banks, retailers, and telecom firms fuel steady demand for new infrastructure. The Brazil Data Center Infrastructure Market benefits from enterprise cloud transformation strategies that require modern, scalable, and resilient data environments. AI, big data, and machine learning workloads drive hardware upgrades and capacity expansion. Public cloud investments from hyperscalers like AWS, Microsoft, and Google expand regional access and redundancy. Stronger local content hosting rules and compliance regulations create further momentum. This trend enhances service quality and ensures latency-sensitive applications run efficiently. Enterprise cloud migration strategies reinforce long-term infrastructure spending.

- For instance, Itaú Unibanco migrated 99% of its private cloud and 20% of its distributed platform from 19,000 servers to AWS, achieving a 99% reduction in delivery-to-production lead time. Cloud-native startups, banks, retailers, and telecom firms fuel steady demand for new infrastructure.

Rising Investments in Energy-Efficient and Modular Infrastructure for Scalability

Operators in Brazil are investing in energy-efficient systems and modular data center designs to reduce operational risk. Technologies such as indirect evaporative cooling and lithium-ion BESS improve power efficiency and uptime. Investors see the Brazil Data Center Infrastructure Market as a scalable, long-term play aligned with sustainable goals. Growing preference for modular construction reduces build timelines and supports rapid deployment. EPC and turnkey models dominate new project execution, allowing standardization across regions. Increasing rack densities require better airflow, smart PDUs, and efficient containment systems. New sites deploy Tier III+ standards for fault tolerance and service reliability. Energy efficiency now defines competitive positioning across core data hubs.

Strategic Focus on Telecom-Backed Edge Infrastructure to Serve Underserved Regions

Edge data center rollout is accelerating across Brazil’s interior and emerging cities. Telecom providers lead efforts to build low-latency infrastructure to support 5G, IoT, and video streaming. The Brazil Data Center Infrastructure Market gains regional depth as providers address bandwidth constraints and support mobile network densification. Enterprises seek edge hubs for hybrid workloads, especially near industrial zones and logistics corridors. Government programs supporting digital inclusion in remote areas drive edge node deployment. Lower land costs and tax incentives attract operators to interior regions. Distributed IT architecture reduces network congestion and latency. Telcos and tower companies are integrating modular edge pods to maintain high availability.

Policy Push, Connectivity Corridors, and Government Incentives Bolster Infrastructure Growth

Government-led initiatives such as MCTIC’s strategic ICT programs and broadband corridors create favorable ground for new data centers. Brazil’s digital economy roadmap emphasizes digital sovereignty, requiring more local storage and compute capacity. The Brazil Data Center Infrastructure Market aligns with national infrastructure development efforts tied to Industry 4.0 and AI strategies. Multilateral financing from BNDES and development banks supports green data center projects. Tax incentives in designated free zones improve the business case for developers. Connectivity improvements via new subsea cables and terrestrial fiber grids enhance cross-border access. Policy certainty, foreign investor protection, and strategic positioning in Latin America boost market confidence.

- For instance, BNDES approved R$200 million in financing for Scala Data Centers to acquire critical equipment for data center expansion in Brazil, supporting infrastructure growth and modernization.

Market Trends

Rapid Growth in Hyperscale Developments to Support Cloud, AI, and SaaS Expansion

Hyperscale data centers are expanding rapidly in São Paulo and Rio de Janeiro metro areas. Demand for high-density racks and scalable power solutions grows alongside AI workloads and multi-cloud needs. The Brazil Data Center Infrastructure Market supports hyperscale deployments from Microsoft, AWS, Google Cloud, and Oracle. These projects incorporate modular pods, smart PDUs, and AI-enabled monitoring. Power usage effectiveness (PUE) targets below 1.4 drive architectural changes. Hyperscale facilities often operate within 20–50 MW IT load brackets, favoring regional interconnect hubs. These hubs enhance latency performance for SaaS, video, and gaming platforms. Hyperscalers are adopting closed-loop cooling and renewable sourcing strategies.

Colocation Providers Introducing Liquid Cooling and AI-Based Energy Optimization

Liquid cooling adoption rises as GPUs and AI servers push traditional systems beyond thermal limits. Providers in Brazil trial rear-door heat exchangers and immersion cooling for high-density zones. Colocation players in the Brazil Data Center Infrastructure Market upgrade facilities with sensor-based thermal controls. AI-based energy optimization platforms reduce cooling and power waste. These technologies support client demands for ESG-aligned infrastructure. Liquid cooling systems increase space efficiency and prolong hardware lifespan. Operators integrate CFD simulation and thermal mapping tools during retrofits. Energy cost volatility prompts interest in grid-interactive infrastructure with battery storage. Liquid cooling readies facilities for generative AI compute demand.

Surge in Data Center Interconnect (DCI) Networks to Improve Redundancy and Reach

Operators are expanding DCI networks across Brazil’s core metros and into secondary markets. DCI links enhance data availability, service continuity, and cloud region connectivity. The Brazil Data Center Infrastructure Market supports these interconnect expansions with metro fiber rollouts and carrier-neutral facilities. Enterprises prefer multicloud and hybrid cloud environments with seamless east-west traffic flow. High-bandwidth DCI networks reduce application latency and support cross-site failover. Interconnection hubs attract fintechs, banks, content players, and e-commerce firms. Redundant routing and software-defined networking strengthen service SLAs. Regional IXPs and peering exchanges gain prominence as traffic volumes increase.

Growing Adoption of Prefabricated and Modular Solutions for Faster Time-to-Market

Developers prefer prefabricated systems to meet short deployment windows. These modular systems include pre-engineered electrical, mechanical, and IT components. The Brazil Data Center Infrastructure Market leverages these factory-built modules to reduce on-site construction risk. Modular deployments enable standardized builds across hyperscale and edge portfolios. EPC and design-build firms offer containerized data halls for quick rollouts. Developers use modularity to phase capacity expansion in sync with demand. Modules also support retrofits and space-constrained sites. Factory testing and plug-and-play integration improve deployment reliability. Project timelines drop by up to 30% using offsite fabrication methods.

Market Challenges

Energy Availability Constraints and Grid Reliability Risk Long-Term Expansion Plans

Power supply stability remains a concern in several Brazilian regions. Developers face risks from grid outages, voltage fluctuations, and transformer capacity shortages. The Brazil Data Center Infrastructure Market depends heavily on local utilities and substation access. Delays in securing utility approvals hinder project timelines. Operators deploy dual feeds, UPS, and BESS to reduce downtime risk. However, these increase CAPEX and OPEX in Tier II and Tier III cities. Renewable sourcing helps long-term stability, but intermittency remains a technical barrier. The transition to distributed energy resources is uneven across subregions.

Permitting Delays, Bureaucracy, and Environmental Regulations Slow Project Delivery

Complex permitting structures and local-level bureaucracy slow project execution in Brazil. Environmental licensing often requires lengthy evaluations, especially for greenfield developments. The Brazil Data Center Infrastructure Market faces location-specific construction rules across states. Developers must engage with multiple regulatory bodies for land, energy, and water permits. These layers increase time-to-market and project overhead. Even modular projects face challenges if not aligned with local zoning laws. Delays in fiber access approvals and road clearances also affect project staging. Stakeholder coordination becomes critical to prevent regulatory delays.

Market Opportunities

Edge Infrastructure Growth in Secondary Cities and Interior Regions Offers Greenfield Potential

Secondary cities across Brazil offer attractive greenfield development prospects for edge and regional data centers. Regions with emerging digital economies need low-latency IT infrastructure to support content, IoT, and enterprise workloads. The Brazil Data Center Infrastructure Market can scale edge capacity through modular deployments and telecom partnerships. These regions benefit from lower land and power costs. Strategic partnerships with local governments support expansion into these underserved zones.

Green Data Center Adoption Drives Demand for Renewable Energy and Sustainable Designs

Sustainability mandates push operators toward green building certifications and renewable energy procurement. New data centers in Brazil integrate solar, wind, and hydro sources with battery storage for continuous power. The Brazil Data Center Infrastructure Market supports long-term ESG targets through innovation in energy-efficient cooling and modular construction. Developers explore carbon-neutral design pathways aligned with investor expectations. These trends open opportunities for equipment vendors and design firms specializing in sustainable solutions.

Market Segmentation

By Infrastructure Type

Electrical infrastructure dominates the Brazil Data Center Infrastructure Market due to high demand for reliable power systems. It accounts for the largest share, driven by utility upgrades, UPS, and BESS deployments. Mechanical infrastructure follows with increasing focus on efficient cooling systems. IT & network infrastructure sees steady growth as servers and switches upgrade to handle AI and cloud workloads. Civil/structural and modular building systems grow in parallel to speed up construction and standardize builds across new sites.

By Electrical Infrastructure

UPS and BESS systems lead in adoption under the electrical segment, ensuring uninterrupted power during outages. Power distribution units (PDUs) are essential to manage high-density workloads. Transfer switches and grid tie-ins are critical in Tier III and Tier IV facilities. Utility service upgrades remain a long-term priority to support power-hungry infrastructure. This segment benefits from CAPEX-heavy investments in new data center campuses across São Paulo and emerging metro zones.

By Mechanical Infrastructure

Cooling units such as CRAC and CRAH dominate the mechanical segment due to Brazil’s warm climate. Chillers, both air- and water-cooled, are deployed in large hyperscale and colocation facilities. Containment systems such as hot/cold aisles help reduce energy consumption and improve airflow. Pump and piping systems support chilled water loops in legacy and retrofit facilities. Operators prioritize modular cooling to scale capacity in phases.

By Civil / Structural & Architectural

Superstructure and modular building systems account for the largest share in this segment. Steel and concrete frames enable resilient construction in seismic and flood-prone regions. Building envelopes use thermally efficient walls and roof systems. Modular designs with raised floors and suspended ceilings improve airflow and cable routing. Prefabricated systems reduce on-site labor dependency and allow faster time-to-market.

By IT & Network Infrastructure

Servers and storage devices drive the highest share in this segment, followed by racks and networking gear. Demand for AI and cloud-native infrastructure drives continuous upgrades in compute capacity. Optical fiber and structured cabling ensure high-speed data transfer within and between facilities. Colocation and enterprise data centers deploy modular racks for flexibility and density optimization.

By Data Center Type

Colocation data centers hold the largest share due to third-party hosting demand and scalability. Hyperscale centers are growing quickly in urban zones to support cloud platforms. Enterprise data centers persist for regulated industries like banking and healthcare. Edge data centers emerge across regional cities to meet low-latency demand. Each type serves different end-user needs, driving ecosystem diversity.

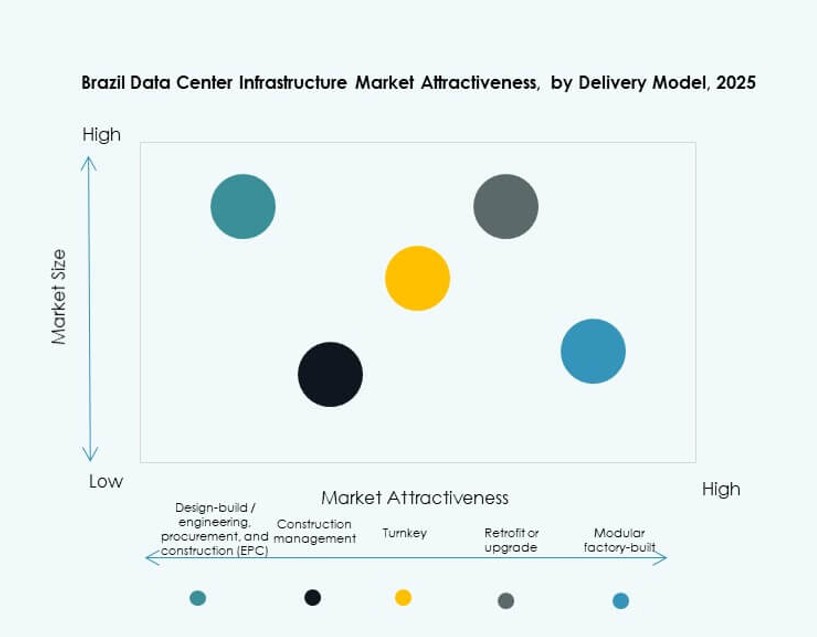

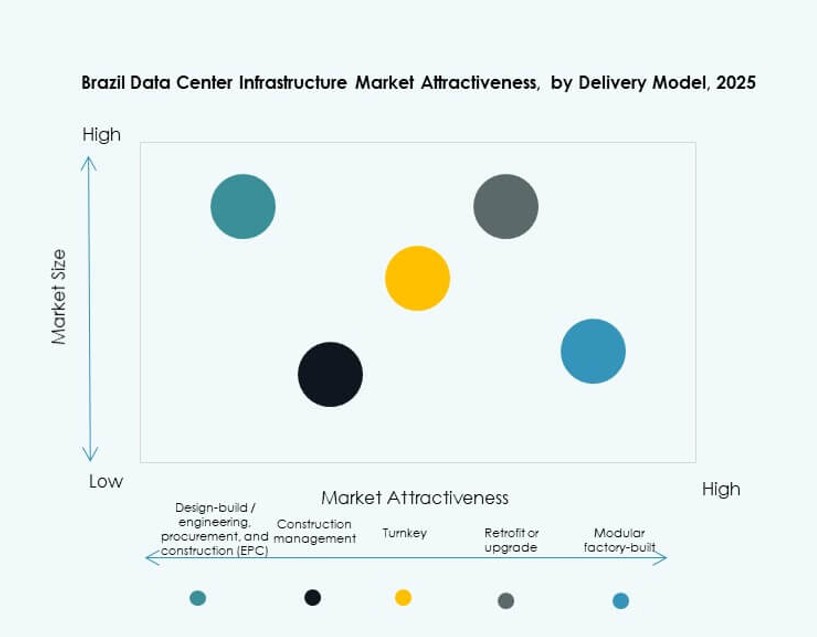

By Delivery Model

Turnkey and design-build/EPC models dominate delivery due to standardization and project speed. Modular factory-built systems are gaining momentum for edge and distributed deployments. Construction management is used in large custom projects. Retrofit/upgrade projects are frequent in Tier II cities, improving legacy infrastructure.

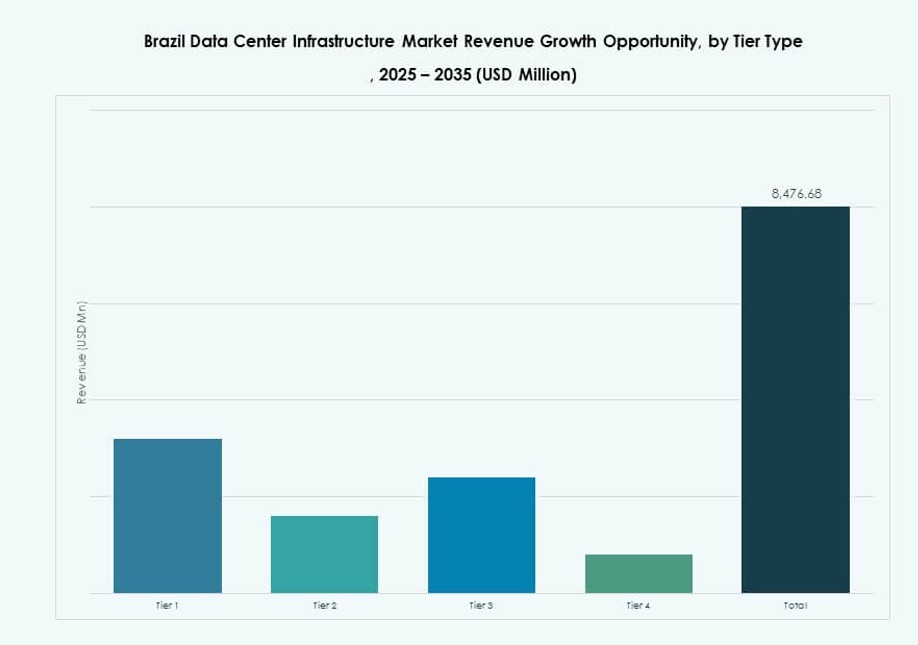

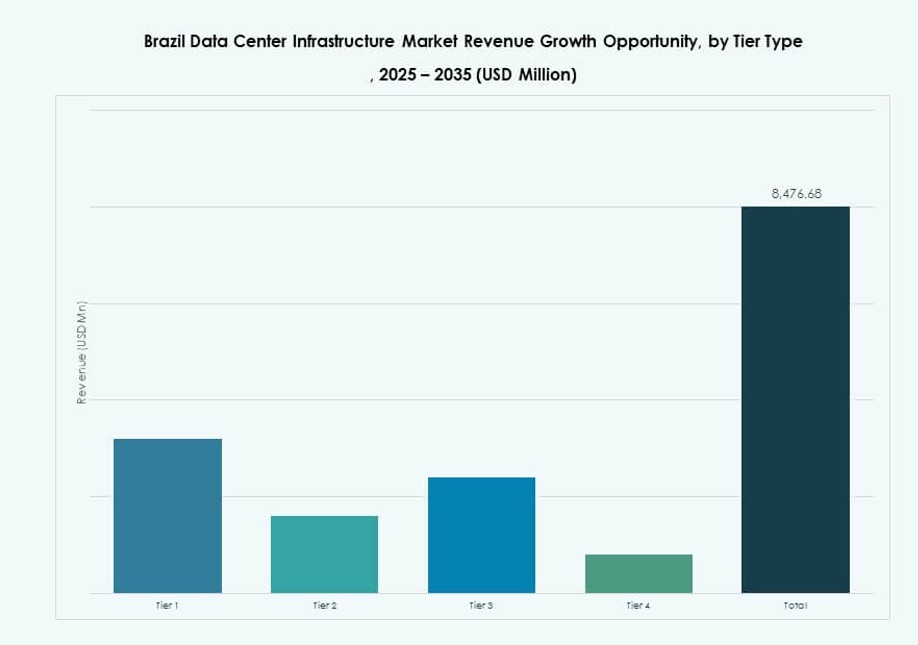

By Tier Type

Tier III data centers dominate the Brazil Data Center Infrastructure Market with widespread adoption for uptime and redundancy. Tier IV facilities are growing in fintech and hyperscale use cases. Tier I and Tier II centers exist in small towns or for non-critical workloads. Growth in Tier III+ reflects enterprise demand for resilience with cost optimization.

Regional Insights

Southeast Brazil Dominates with Over 58% Market Share Led by São Paulo and Rio

Southeast Brazil leads the market with over 58% share, driven by São Paulo’s role as a financial and tech hub. São Paulo’s connectivity, talent pool, and energy infrastructure support hyperscale and colocation deployments. Rio de Janeiro adds depth with enterprise and government hosting needs. The Brazil Data Center Infrastructure Market sees heavy foreign investment in this subregion due to policy certainty and scalability. Connectivity corridors and subsea cable landings reinforce regional dominance. High demand density in Southeast ensures sustained infrastructure buildouts.

- For instance, Ascenty operates São Paulo 1 with 6 MW total power across 37,670 ft².

Its São Paulo 2 facility delivers 14 MW total power within 86,000 ft², supporting high‑density enterprise and cloud workloads.

South and Central-West Regions Emerge as Fast-Growing Edge and Regional Hubs

South Brazil, including Curitiba and Porto Alegre, accounts for 14% share and sees rising edge deployments. Regional government incentives and manufacturing sector digitization drive demand. Central-West Brazil, including Brasília and Goiânia, contributes around 11% and gains from public sector digitization. Telecom providers deploy micro data centers near smart agriculture zones. Edge growth reflects broader infrastructure planning across interior cities. New campuses in these areas use modular and containerized builds for speed and cost control.

North and Northeast Regions Offer Untapped Growth Potential Through Connectivity Expansion

The North and Northeast regions together account for under 10% market share but offer greenfield potential. These regions face power reliability challenges but benefit from growing telecom presence. Government programs for digital equity and cloud availability zones target underserved populations. Infrastructure upgrades in these areas aim to support national edge architecture. The Brazil Data Center Infrastructure Market can expand here with public-private partnerships and state-level incentives. Latency-sensitive services and content delivery networks support demand growth in these zones.

- For instance, Ascenty’s São Paulo campus expansions, like SPO05 adding to a 47 MW total with 40,000 m² area, enable scalable connectivity for underserved northern zones via national networks.

Competitive Insights:

- Scala Data Centers

- Ascenty

- ODATA Data Centers

- Equinix, Inc.

- Vertiv Group Corp.

- Schneider Electric

- Huawei Technologies Co., Ltd.

- Hewlett Packard Enterprise (HPE)

- Cisco Systems, Inc.

- IBM

The Brazil Data Center Infrastructure Market features a competitive mix of global vendors and regional specialists. It is shaped by hyperscale developers, colocation leaders, and infrastructure equipment providers. Scala, Ascenty, and ODATA lead capacity expansion across Tier III and IV facilities. Global firms like Equinix, Cisco, and Huawei offer integrated solutions spanning servers, cooling, and networking. Vendors compete on energy efficiency, scalability, and Tier certification. Schneider and Vertiv dominate power and cooling equipment, while HPE and IBM focus on compute and hybrid cloud enablement. Domestic players secure edge deployments and government-linked projects through local partnerships. Competitive differentiation comes from modular construction, renewable sourcing, and strong interconnect ecosystems. Strategic alliances, ESG alignment, and latency optimization define positioning across urban and interior markets.

Recent Developments:

- In October 2025, Equinix expanded operations in Brazil as a priority market, with eight data centers operational, a ninth under construction, and five real estate areas acquired for future growth.

- In May 2025, Patria Investimentos launched Omnia, a hyperscale data center platform with an initial $1 billion investment targeting Brazil, Mexico, and Chile, focusing on cloud computing and AI trends.

- In March 2025, ODATA announced the launch of its new DC SP04 data center in Osasco, São Paulo, with over USD 450 million investment and 48 MW capacity.

- In February 2025, Tecto completed its $110 million Mega Lobster facility in Fortaleza, adding 20 MW of capacity to support enterprise and hyperscale needs.