Executive summary:

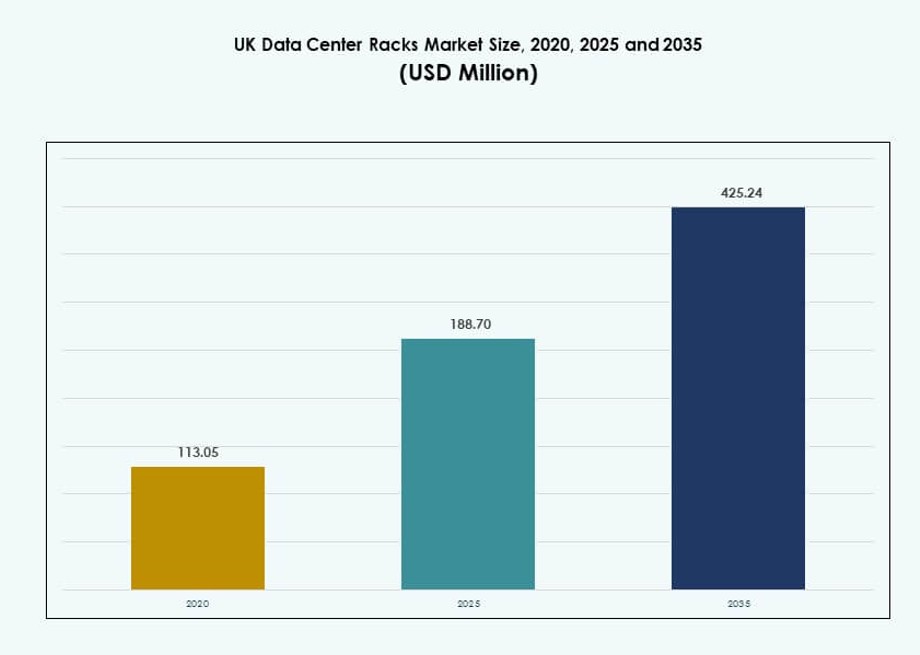

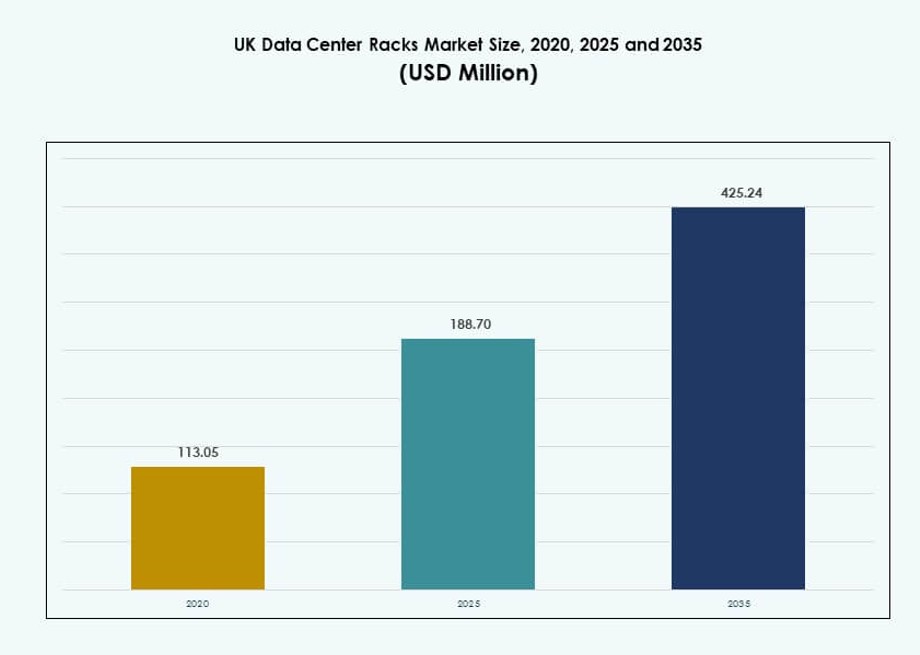

The UK Data Center Racks Market size was valued at USD 113.05 million in 2020 to USD 188.70 million in 2025 and is anticipated to reach USD 425.24 million by 2035, at a CAGR of 8.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| UK Data Center Racks Market Size 2025 |

USD 188.70 Million |

| UK Data Center Racks Market, CAGR |

8.41% |

| UK Data Center Racks Market Size 2035 |

USD 425.24 Million |

The market is witnessing strong growth driven by the rising deployment of high-density racks to support AI, edge, and cloud workloads. Organizations are adopting intelligent racks with built-in telemetry, airflow optimization, and enhanced power distribution to meet evolving performance and sustainability targets. Innovations in liquid cooling, modular designs, and rack-level energy monitoring are gaining traction. These shifts are strategic for hyperscalers, colocation providers, and enterprises aiming for scalable, efficient infrastructure. The UK Data Center Racks Market plays a critical role in enabling digital infrastructure upgrades across sectors.

London leads the market due to its concentration of hyperscale data centers, financial institutions, and connectivity hubs. The South East region follows, supported by enterprise clusters and academic research centers. Regions such as Manchester, Birmingham, and Leeds are emerging as edge and colocation growth zones. These areas benefit from lower real estate costs, regional digital investments, and expanding public-sector IT infrastructure. The UK Data Center Racks Market reflects both centralized hyperscale dominance and regional infrastructure expansion.

Market Dynamics:

Market Drivers

Rapid Integration of High-Density Rack Architectures to Support Advanced AI and GPU Workloads

The UK Data Center Racks Market benefits from the rising need for high-density infrastructure to support AI and GPU-based workloads. Organizations are shifting to 48U and above racks to increase space utilization and compute density. This trend is further encouraged by growing demand for deep learning applications and generative AI deployments. Rack systems now support direct-to-chip liquid cooling and enhanced airflow management. These upgrades improve power usage effectiveness and performance for demanding environments. Investors view these innovations as long-term enablers of digital transformation. The UK Data Center Racks Market reflects broader enterprise IT strategies around scalability and future-ready infrastructure. Businesses rely on next-generation racks to improve uptime, optimize energy use, and reduce latency across cloud platforms.

- For instance, Vertiv supports rack densities exceeding 100 kW through its 360AI portfolio, launched in 2024–2025, designed for AI workloads using GPUs like NVIDIA H100. Its 52U VR Rack and PowerDirect Rack systems offer direct-to-chip liquid cooling and high-load capacity, enabling reliable deployment in high-density environments.

Digital Transformation Across Public and Private Sectors Elevates Rack Infrastructure Demand

Enterprise digitization across BFSI, healthcare, and public services fuels rack infrastructure demand. Secure data handling, real-time processing, and centralized workloads require robust and scalable rack solutions. Large-scale digitization initiatives drive continuous upgrades in storage, compute, and network racks. Public cloud providers also adopt customized rack formats to align with regional compliance standards. Energy-efficient racks are vital in green data centers, supporting sustainability goals. Market players integrate tool-less mounting, cable management, and pre-integrated PDUs for rapid deployment. The UK Data Center Racks Market benefits from long-term contracts and hyperscaler expansions. Its infrastructure plays a vital role in enabling reliable cloud services and critical digital operations.

Growth in Edge Data Centers Driving Modular and Compact Rack Configurations

Edge deployments across industrial, telecom, and retail sectors drive demand for compact, modular racks. These are essential for distributed sites requiring localized processing, especially in latency-sensitive applications. Micro and modular data centers use pre-fabricated rack designs that combine compute, storage, and networking into single frames. These configurations reduce installation time and operating costs for remote sites. Mobile racks are increasingly used in temporary deployments and field-based IT operations. The UK Data Center Racks Market sees this as a key trend, linking digital equity with infrastructure reach. Edge locations depend on rack scalability, cooling efficiency, and network flexibility. This shift unlocks new investment avenues across Tier II and Tier III cities.

Evolving Data Center Design Principles Focused on Power Optimization and Space Efficiency

Next-generation data center design emphasizes flexible, future-ready racks to accommodate power-intensive devices. Racks are engineered to support greater cable density, airflow optimization, and load-bearing capacity. Standardization through OCP and EIA frameworks allows global interoperability and streamlined procurement. Vendors integrate software-defined power distribution to optimize rack-level energy usage. This reduces heat load and enhances operational efficiency. Smart rack systems with sensors offer real-time monitoring of power draw, temperature, and physical security. The UK Data Center Racks Market reflects these evolving principles by supporting Tier III+ facilities across key regions. These enhancements improve business continuity, reduce total cost of ownership, and align with evolving ESG targets.

- For instance, Rittal’s TS IT 48U racks, OCP-compliant since 2024, support 1,200kg dynamic loads with RiZone sensors tracking power usage to 0.5% accuracy.

Market Trends

Increased Adoption of Intelligent Racks Featuring Embedded Monitoring and Environmental Sensors

Intelligent racks with real-time telemetry are gaining traction in UK data centers. Operators prefer embedded sensors for temperature, humidity, airflow, and door access. These features help monitor rack health and prevent downtime through predictive alerts. Smart racks integrate with DCIM platforms for centralized visibility and control. Built-in power metering helps optimize energy consumption and reduce operational risks. These capabilities are vital in Tier III and Tier IV environments. The UK Data Center Racks Market reflects this shift toward intelligent infrastructure. Enterprises value the automation and insights gained through rack-level analytics.

Customized Rack Solutions for Hyperscalers with Pre-Integrated Cooling and Power Modules

Hyperscale cloud providers require tailored racks to fit proprietary hardware and dense configurations. Rack systems are now custom-built with integrated PDUs, cable trays, and cooling units. These reduce deployment timelines and simplify procurement logistics. Rack dimensions often go beyond traditional 42U to support AI-focused GPU clusters. Some vendors offer pre-certified solutions aligned with OCP or Open19 standards. These designs improve airflow and ensure optimal power distribution. The UK Data Center Racks Market supports these needs across multiple hyperscale zones. Providers prioritize modularity and rapid rollout over legacy form factors.

Colocation Providers Standardizing on Multi-Tenant Compatible Racks with Higher Load Ratings

Colocation vendors in the UK are standardizing rack formats to serve multi-tenant configurations efficiently. Cabinets are built to support diverse client hardware, dense power loads, and cable complexity. Adjustable rails, lockable doors, and structured airflow paths are common. Load capacities now exceed 1,200 kg to accommodate heavy equipment. These features ensure adaptability for mixed workloads across tenants. Some vendors offer white-label options with rack branding and isolation features. The UK Data Center Racks Market enables this shift, aligning with rising colocation demand. Operators value consistency, modularity, and fast provisioning cycles.

Wider Availability of Eco-Friendly Rack Materials and Energy-Saving Designs

Sustainable rack manufacturing is becoming a key procurement consideration. Vendors now offer racks made with recycled steel, aluminum, and low-emission coatings. Modular parts reduce material waste and simplify end-of-life recycling. Cable management and airflow optimization reduce cooling loads. Smart PDUs cut idle power draw, boosting rack-level efficiency. These designs support green certifications like LEED or BREEAM. The UK Data Center Racks Market reflects the growing emphasis on ESG compliance. Enterprises and service providers align procurement strategies with climate goals.

Market Challenges

Space Constraints and Aging Infrastructure in Legacy Facilities Limit Large-Scale Rack Modernization

Many data centers in urban UK regions operate within constrained real estate. Upgrading to larger or denser racks often requires floor plan changes, power upgrades, and airflow redesign. Legacy facilities lack overhead clearance, underfloor cooling, or sufficient weight-bearing capacity. Retrofitting becomes costly, especially for operators managing mixed-generation hardware. Power limitations restrict deployment of 48U+ racks or liquid-cooled systems. Smaller sites cannot accommodate future workloads like GPU clusters without significant rebuilds. The UK Data Center Racks Market faces limitations due to legacy data center architecture. Operators must balance innovation with retrofit feasibility and cost.

Long Lead Times for Rack Components and Import Dependencies Impact Procurement Flexibility

Supply chain issues and component shortages affect rack availability across the UK market. Custom enclosures, cable assemblies, and PDUs often face extended lead times. Vendors depend on offshore manufacturing, especially for specialized cooling modules and busbar systems. Shipping delays and trade regulations increase total cost and complexity. Local customization is limited due to lack of large-scale fabrication facilities. Delays impact data center buildouts, leading to lost business or SLA risks. The UK Data Center Racks Market contends with these procurement disruptions. Enterprises seek faster, locally sourced options to mitigate delays.

Market Opportunities

Government Investments in Regional Digital Infrastructure Open New Avenues for Rack Deployments

UK government digital programs and smart city projects create strong demand for localized data infrastructure. Edge zones and government cloud services drive small-scale rack deployments. Regional councils seek energy-efficient rack systems to power education, transport, and e-governance platforms. These areas offer new contracts to vendors who can meet security and compliance standards. The UK Data Center Racks Market gains traction from regional digitization efforts and incentives for green IT infrastructure.

Growth in AI, 5G, and Cybersecurity Spurs Demand for High-Capacity, Secure Rack Systems

Emerging workloads such as AI, 5G slicing, and real-time analytics require high-performance racks. Secure racks with locking systems and tamper alerts are in demand for sensitive data. Telecom and defense verticals lead this shift. The UK Data Center Racks Market offers opportunities for vendors with solutions designed for compute-intensive and regulated environments.

Market Segmentation

By Rack Type

Cabinets dominate the UK Data Center Racks Market, driven by secure enclosures and compatibility with diverse hardware. They offer greater cable management and airflow control, supporting dense workloads. Open frame racks see use in low-risk or lab environments. Others include wall-mounted and portable types, often used in edge or branch setups.

By Rack Height

42U racks hold the largest share, balancing height, weight capacity, and cooling needs. Operators favor them for compatibility with existing infrastructure. Below 42U is common in edge deployments and space-constrained sites. Above 42U is growing in hyperscale and AI use cases where density is critical.

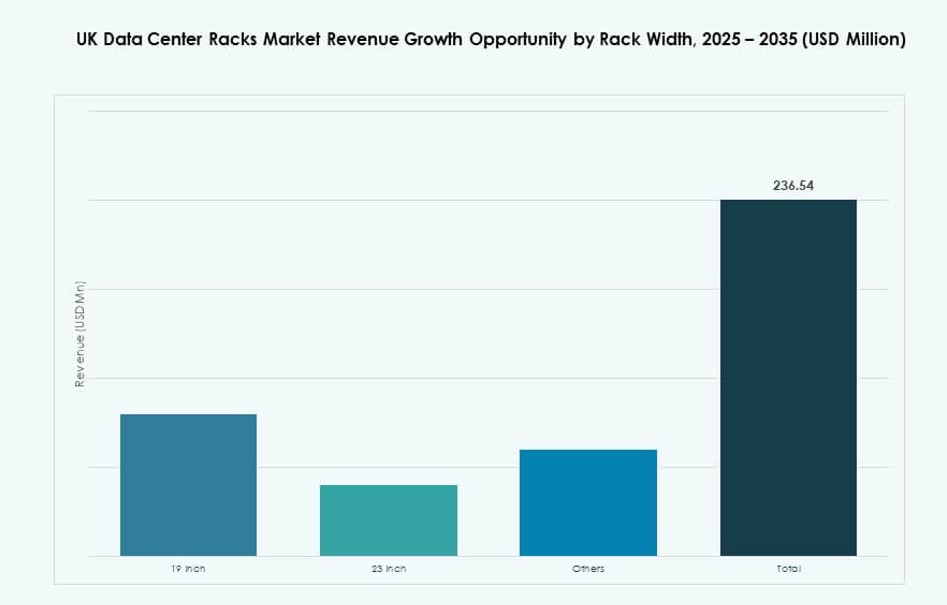

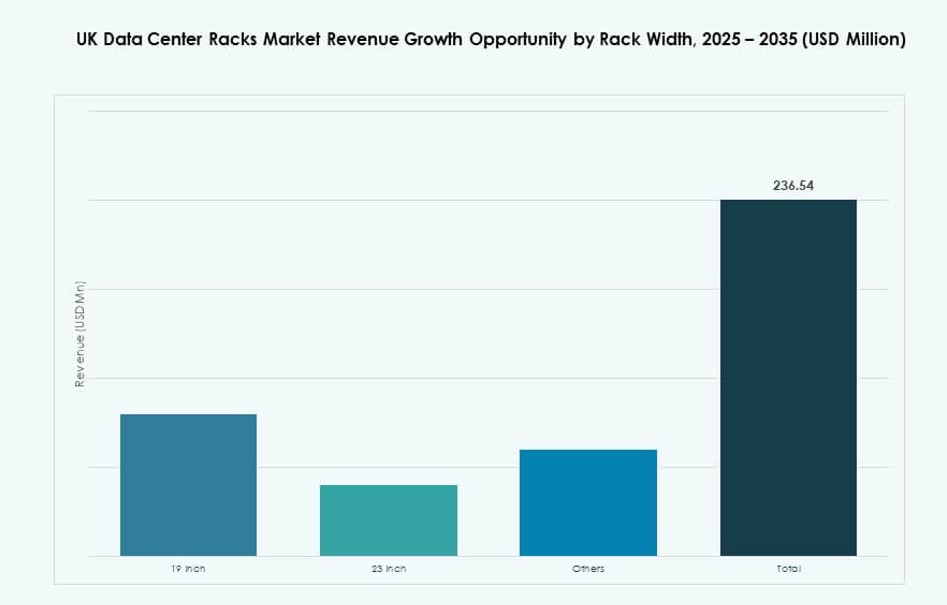

By Width

19-inch racks dominate due to widespread industry use and standardization. They accommodate most server and network equipment. 23-inch racks support wider devices in telecom or HPC use cases. Other formats include custom widths for specialized cooling or integration setups.

By Application

Server racks lead the market as compute density grows across enterprise and cloud setups. These racks support virtualization, cloud computing, and AI workloads. Network racks follow, enabling secure cable routing and switch integration. Both types remain essential to scalable infrastructure.

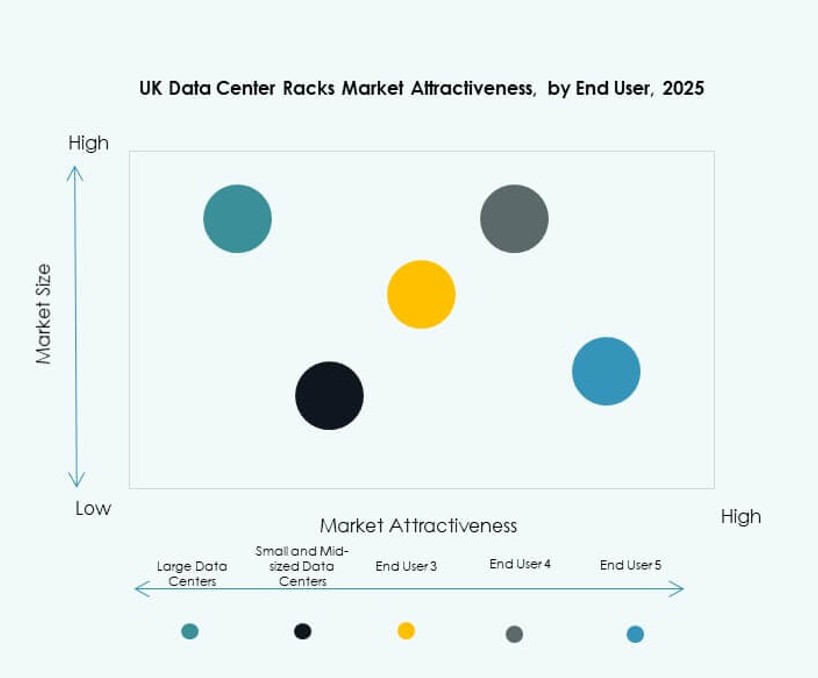

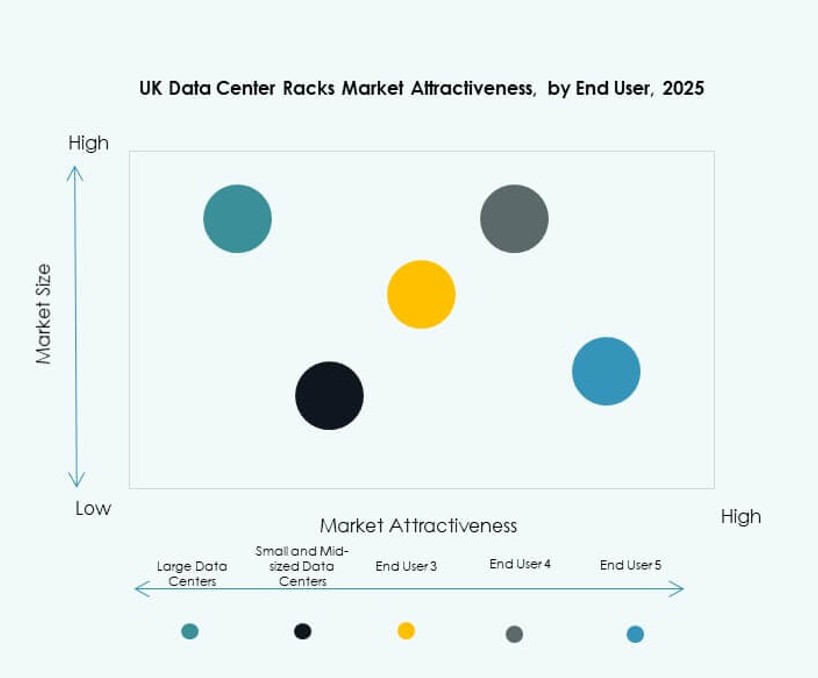

By End-user

Large data centers dominate due to massive storage, compute, and AI demands. Hyperscalers and telecom hubs require thousands of racks per site. Small and mid-sized data centers show steady growth across government, retail, and healthcare sectors.

By Vertical

IT & Telecom is the top vertical, with widespread rack use in data transport, cloud hosting, and edge nodes. BFSI and healthcare follow, driven by regulatory storage needs. Government, energy, and retail also expand, integrating digital operations with secure rack infrastructure.

Regional Insights

London Leads with 42% Market Share Driven by Hyperscale and Financial Cloud Infrastructure

London dominates the UK Data Center Racks Market with 42% share, supported by hyperscale clusters and financial institutions. The city hosts the largest volume of colocation and public cloud deployments. Its dense fiber networks, regulatory strength, and proximity to major financial centers drive rack deployment. Vendors offer high-density racks tailored for AI, cloud, and FinTech. London remains the core of Tier III and Tier IV data center investments.

- For instance, Equinix’s LD6 data center in Slough, near London, operates as a large-scale colocation facility serving financial and cloud customers. The site offers around 16 MW of customer power and supports rack power densities typically ranging from 4 kW to 15 kW per rack, enabling flexible high-density deployments.

South East Region Holds 27% Share with Strong Enterprise and Research-Driven Data Growth

The South East region captures 27% market share, powered by innovation clusters and public sector cloud needs. Oxford, Cambridge, and Reading lead with enterprise IT campuses and research institutions. Energy-efficient rack systems are adopted to meet academic compute workloads. Rack demand is also growing in regional colocation centers supporting universities and e-governance applications. The UK Data Center Racks Market reflects this diversity in public-private workload profiles.

Midlands and Northern Regions Emerging with 21% Share Due to Edge Zones and Cost Benefits

The Midlands and North account for 21% market share, driven by expanding edge zones and lower operating costs. Cities like Manchester, Leeds, and Birmingham attract cloud providers with scalable sites and renewable power access. Local councils invest in smart infrastructure, triggering rack demand in modular deployments. The UK Data Center Racks Market in these regions benefits from land availability, utility incentives, and demand for decentralized compute infrastructure.

- For instance, AWS’s London region extends edge infrastructure to Manchester-area sites with modular racks supporting low-latency services, leveraging scalable power and connectivity for decentralized cloud deployments

Competitive Insights:

- Schneider Electric

- Vertiv Group

- Rittal GmbH & Co. KG

- Eaton

- Legrand

- Cisco Systems, Inc.

- Dell Inc.

- Hewlett Packard Enterprise (HPE)

- Panduit Corp.

- Chatsworth Products

The UK Data Center Racks Market remains highly competitive, with global and regional vendors focusing on innovation, scalability, and energy efficiency. It is led by Schneider Electric, Vertiv, and Rittal, which offer a wide range of intelligent, modular, and liquid-cooled rack solutions. Tier I players compete on rack density, airflow design, and software integration, targeting hyperscale and enterprise deployments. Mid-tier vendors such as Panduit, AMCO Enclosures, and Chatsworth serve niche and modular segments. Market consolidation is visible through strategic acquisitions, ecosystem partnerships, and joint ventures. Customization for cloud-native, AI, and edge environments strengthens vendor positioning. Players continue investing in sustainable rack materials, predictive monitoring, and service bundles to expand their footprint in the UK Data Center Racks Market.

Recent Developments:

- In November 2025, Schneider Electric introduced its EcoStruxure Rack Solutions designed for high‑density AI and accelerated compute applications. These rack systems support EIA, ORV3, and NVIDIA MGX modular standards, offering reliable performance for modern data centers and enhanced adaptability for dense workloads.

- In August 2025, Vertiv completed the acquisition of Great Lakes Data Racks & Cabinets, a U.S. manufacturer of customized rack enclosures, seismic cabinets, and cable management systems. This strategic acquisition expands Vertiv’s rack solution offerings and enhances its ability to serve high‑density compute environments including colocation and enterprise sites.

- In March 2025, Pulsant acquired SCC’s data center facilities in Birmingham and Fareham, boosting its UK portfolio to 12 sites. The move strengthens Pulsant’s position in colocation and edge computing rack deployments. It reflects ongoing consolidation trends for scalable rack infrastructure.