Executive summary:

The Vietnam Data Center Thermal Management Market size was valued at USD 59.02 million in 2020, increased to USD 135.20 million in 2025, and is anticipated to reach USD 511.57 million by 2035, at a CAGR of 14.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Vietnam Data Center Thermal Management Market Size 2025 |

USD 135.20 Million |

| Vietnam Data Center Thermal Management Market, CAGR |

14.13% |

| Vietnam Data Center Thermal Management Market Size 2035 |

USD 511.57 Million |

Strong digitalization across finance, telecom, and cloud services is driving demand for high-density data centers in Vietnam. Operators are adopting advanced thermal technologies like liquid cooling, AI-driven airflow control, and hybrid systems. These innovations improve energy efficiency and ensure reliable performance under growing compute loads. Businesses see thermal systems as critical to uptime and service delivery. For investors, the market offers long-term opportunities aligned with Vietnam’s digital economy and energy efficiency goals.

Ho Chi Minh City leads the market due to its strong infrastructure, data traffic, and hyperscale presence. Hanoi and northern regions are expanding through public-private initiatives and enterprise adoption. Central cities like Da Nang and Can Tho show rising potential as edge computing and telecom services spread. Vietnam’s regional growth pattern supports both centralized hyperscale and decentralized modular data center models, creating diverse thermal infrastructure demand.

Market Dynamics:

Market Drivers

Surging Demand for High-Density Computing Across Cloud and Enterprise Data Hubs

Vietnam’s rapid digitalization has increased the deployment of high-density computing racks across cloud and enterprise setups. These installations generate significant heat loads, demanding efficient thermal control. Enterprises are adopting direct-to-chip and rear-door heat exchangers to support intensive AI, machine learning, and big data workloads. Liquid-based cooling gains traction in hyperscale facilities to reduce power use and increase rack efficiency. The Vietnam Data Center Thermal Management Market benefits from these technology shifts that prioritize thermal reliability. Market players invest in scalable and modular cooling systems. Upgrading infrastructure with low-PUE solutions is a strategic priority for data center operators. Businesses need thermal infrastructure that ensures 24/7 uptime while managing energy consumption. Efficient cooling supports competitive positioning for domestic and international cloud services.

- For instance, Boyd announced in September 2025 the expansion of its Bac Ninh facility to 800,000 sq ft to scale up production of liquid cooling components, including direct-to-chip CDUs and cold plates, supporting AI data centers with rising thermal densities.

Government Push for Digital Transformation and Green Infrastructure

National programs like “Make in Vietnam” and the Digital Economy Plan 2030 encourage data center development aligned with green energy goals. Energy-efficient cooling is essential to meet Vietnam’s commitments under COP26 and the national energy transition roadmap. These regulatory shifts promote investment in sustainable infrastructure and environmental compliance. The Vietnam Data Center Thermal Management Market aligns with policy goals favoring low-emission technologies. Authorities support the use of smart BMS, AI-driven DCIM, and hybrid cooling units. Regulatory clarity boosts confidence among global investors planning hyperscale or colocation projects. Cooling efficiency plays a critical role in enabling project approval and ongoing license renewals. Eco-conscious facility designs help reduce operational costs and meet ESG benchmarks. It creates opportunities for cooling vendors with green-certified product portfolios.

- For instance, Viettel IDC opened Vietnam’s largest green data center in Hoa Lac in late 2025, designed for AI workloads, integrating advanced cooling to support 230,000 servers with a roadmap to reach 17,000 racks, fully aligned with national digital and green infrastructure mandates.

Edge Computing Growth and Latency-Critical Applications in Tier-2 Cities

Digital services expand rapidly beyond Ho Chi Minh City and Hanoi into cities like Da Nang, Can Tho, and Hai Phong. Regional demand for edge computing in education, healthcare, and smart city platforms fuels micro data center deployment. Thermal management becomes vital in these smaller, modular setups that lack traditional infrastructure. Compact liquid or hybrid cooling systems ensure temperature control in dense environments. The Vietnam Data Center Thermal Management Market gains from this demand for decentralized cooling solutions. Edge sites require remote monitoring and predictive maintenance capabilities. Thermal vendors offer plug-and-play modules tailored to regional needs. Reliable cooling extends asset life and improves energy ratios. Strategic expansion into Tier-2 cities provides vendors with recurring service and retrofit opportunities.

Enterprise and Financial Sector Driving Demand for Mission-Critical Infrastructure

Vietnam’s financial services, telecom, and e-commerce sectors are scaling digital platforms that require secure, always-on IT infrastructure. Enterprises modernize legacy facilities and partner with colocation providers for faster deployment. Cooling plays a central role in supporting uptime guarantees and service level agreements. The Vietnam Data Center Thermal Management Market supports SLA-compliant infrastructure via N+1 or N+N cooling redundancy. Financial institutions demand systems with automated failover and performance tracking. Vendors respond with AI-based air and liquid cooling options tuned for fault-tolerant environments. Facilities with optimized thermal management attract banking, fintech, and insurance clients. This raises market visibility and draws further private investment. Enterprise-grade thermal solutions remain a high-margin segment for system integrators and OEMs.

Market Trends

Adoption of AI-Powered Cooling Optimization for Performance and Energy Efficiency

AI-based thermal management is becoming standard across new-generation data centers. These systems optimize fan speeds, coolant flow, and airflow distribution in real-time. AI reduces overcooling and improves Power Usage Effectiveness (PUE). The Vietnam Data Center Thermal Management Market sees rising use of AI modules integrated into BMS and DCIM dashboards. Operators configure systems to learn seasonal trends and server load patterns. Machine learning allows predictive thermal failure alerts. This increases equipment uptime and decreases maintenance overhead. Cooling decisions rely less on human inputs and more on dynamic data. Investors favor facilities with automated systems that reduce operating costs over time.

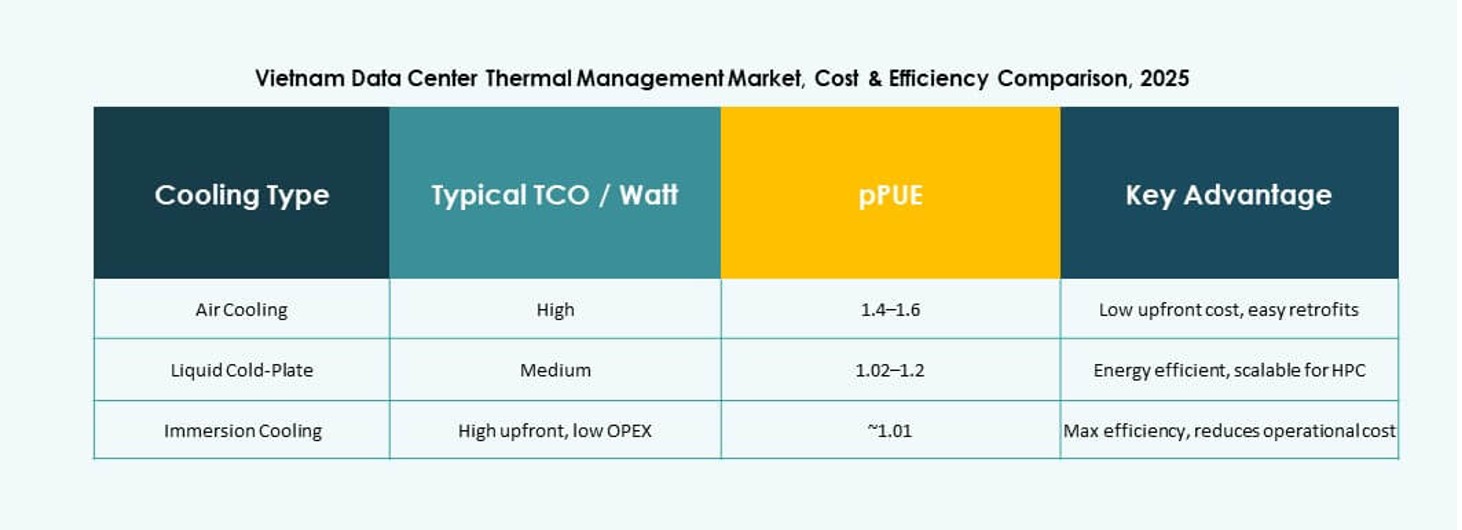

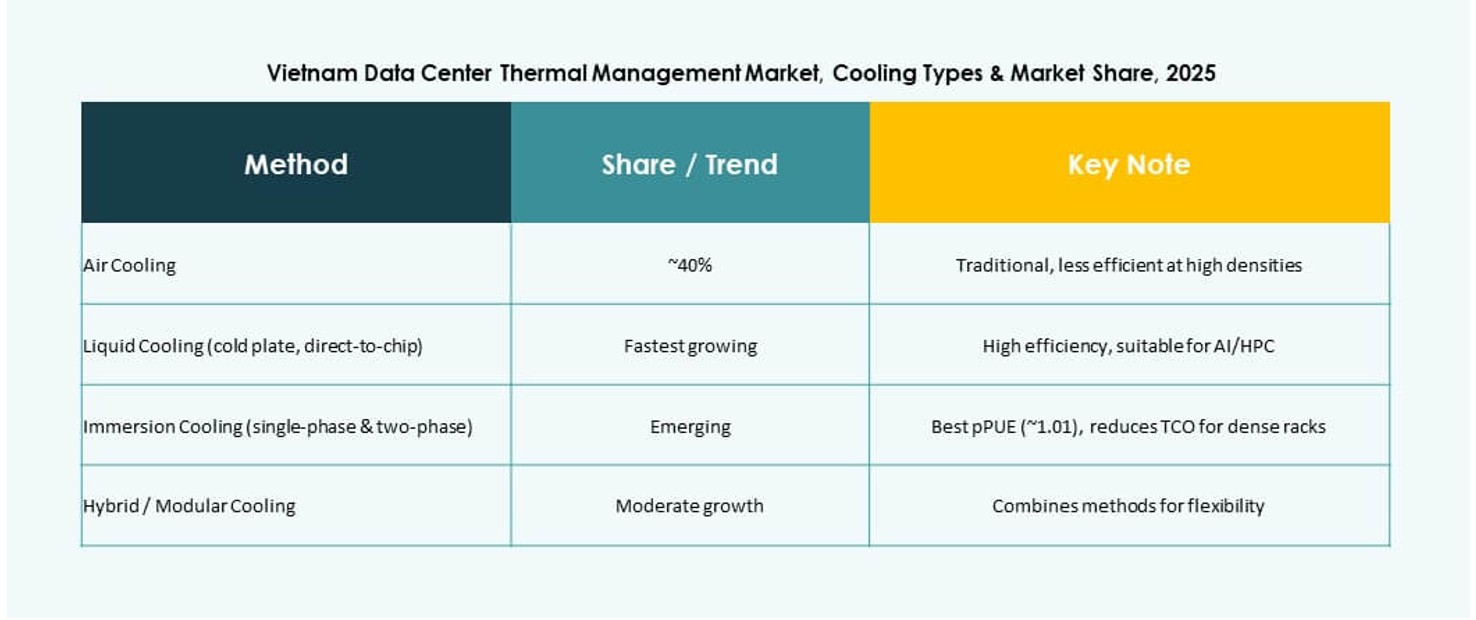

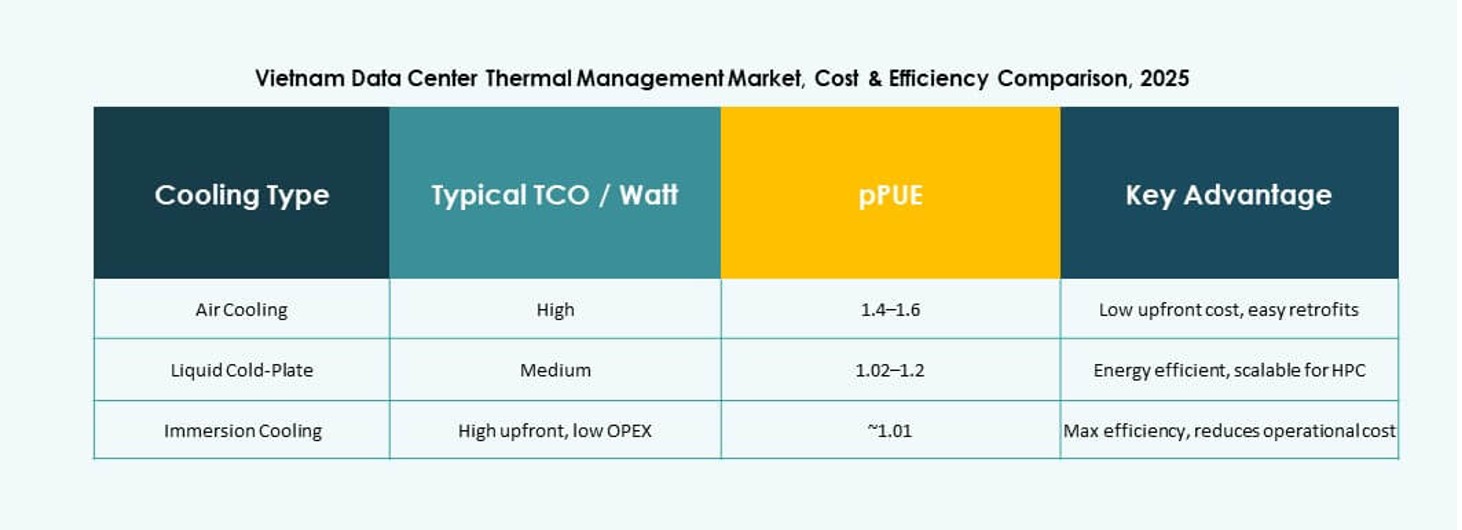

Use of Liquid Immersion and Direct-to-Chip Cooling in High-Rack-Density Projects

Next-gen facilities with high rack power densities above 30 kW increasingly adopt liquid cooling methods. Direct-to-chip and immersion cooling help manage heat output from GPUs and AI accelerators. These technologies reduce the physical footprint of cooling units. The Vietnam Data Center Thermal Management Market integrates these systems in AI-ready and HPC deployments. Chillers and rear-door heat exchangers are adapted to accommodate high-pressure liquid loops. Facilities achieve higher performance density without raising floor-level temperatures. Cooling system OEMs design modular immersion tanks to retrofit existing racks. Thermal vendors also offer leak detection and dielectric fluid management software.

Rise in Modular Data Center Builds and Integrated Thermal Systems

Modular data center builds accelerate deployment time and improve space utilization. These facilities demand compact, pre-engineered thermal systems with scalable performance. In the Vietnam Data Center Thermal Management Market, modular cooling is embedded into row or rack-level designs. Integrated units include airflow controls, sensors, and AI software for thermal balancing. System integrators deliver containerized setups with cooling pre-installed, ready for plug-and-play deployment. It streamlines project timelines and reduces construction overhead. Modular units also allow easy expansion when rack densities increase. This trend attracts telecom firms, smart city operators, and disaster recovery zones.

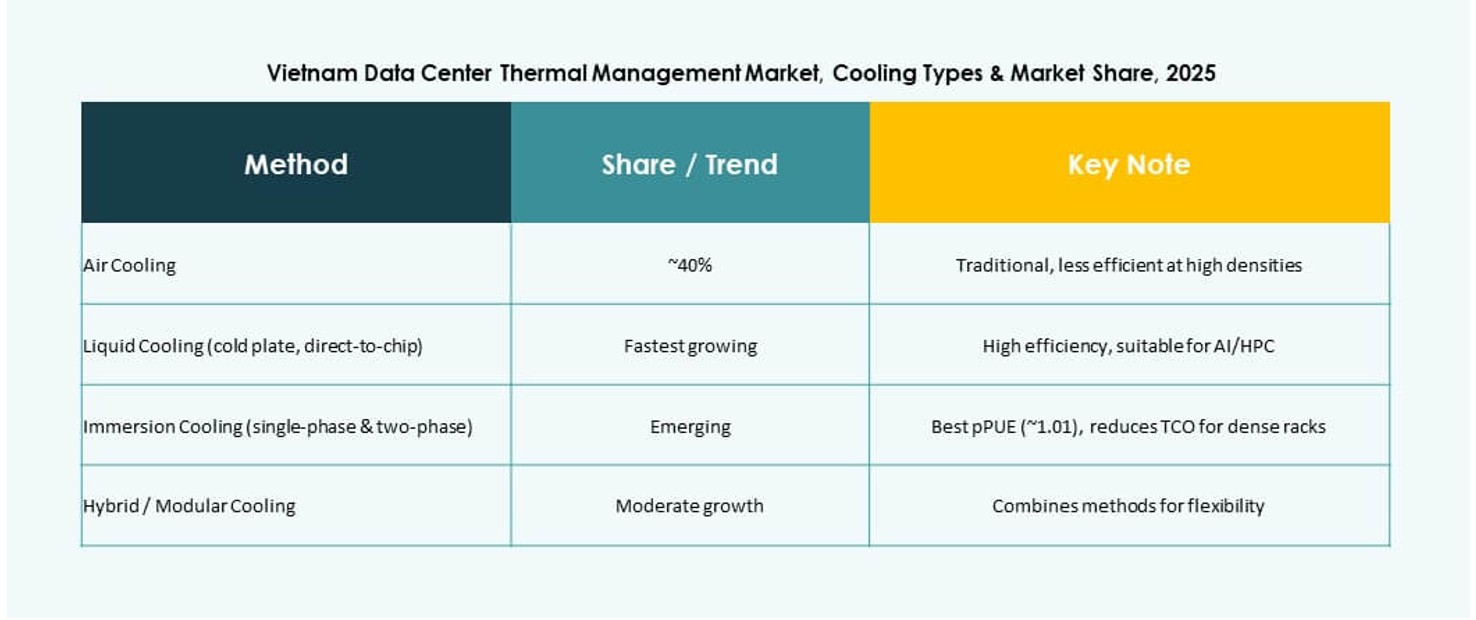

Hybrid Cooling Strategies to Meet Diverse Workload and Site Conditions

Facilities no longer rely on single cooling types. They deploy hybrid combinations of air-based and liquid-based cooling systems for greater flexibility. The Vietnam Data Center Thermal Management Market is shifting to such blended approaches to optimize both cost and performance. Sites use chilled water in high-density zones and hot aisle containment elsewhere. Cooling designs factor in seasonal humidity and ambient conditions. Hybrid systems allow operators to manage PUE across different workload zones. This reduces reliance on chillers during cooler months. Vendors offer dynamic control software that coordinates multiple cooling sources based on real-time data.

Market Challenges

High Operational Costs and Complexity of Liquid Cooling Integration

While liquid cooling supports dense computing, its integration brings high upfront costs and engineering complexity. Facility managers face design limitations due to space constraints, piping requirements, and fluid containment. Existing facilities must undergo costly retrofitting to support direct-to-chip or immersion cooling. The Vietnam Data Center Thermal Management Market must address workforce shortages in specialized installation and fluid handling. Custom cooling loops require certified technicians and safety systems. Downtime risk during integration increases project reluctance. ROI depends on long-term performance and energy savings, which may take years to materialize. Financial planning must account for higher maintenance frequency and fluid replacement schedules.

Energy Infrastructure Limitations in Secondary Cities and Remote Areas

Expanding data center footprints into Tier-2 and Tier-3 regions presents power reliability issues. Limited grid stability and backup supply options constrain cooling system performance. The Vietnam Data Center Thermal Management Market sees bottlenecks in deploying advanced cooling where energy infrastructure remains underdeveloped. Cooling redundancy must be balanced with power availability. Operators are cautious in adopting energy-intensive liquid cooling in areas with high outage risk. Diesel-based backup systems raise carbon emissions and undermine green goals. Regulatory support for clean energy zones remains inconsistent. Vendors face slow adoption cycles outside core metro areas due to these energy gaps.

Market Opportunities

Green Cooling Technologies Align with ESG Investment and Carbon Goals

Investors and data center operators prioritize ESG-aligned infrastructure. Energy-efficient cooling solutions help meet carbon reduction targets and attract green capital. The Vietnam Data Center Thermal Management Market sees strong interest in evaporative systems, free cooling, and AI-based controls. Vendors offering green-certified products gain preferred vendor status in new builds. Thermal solutions with low-GWP refrigerants and modular performance scaling open large revenue pools across hyperscale and edge builds.

Service-Based Cooling Models and Retrofit Upgrades Drive Aftermarket Growth

Service-led models—such as Monitoring-as-a-Service and predictive maintenance—offer recurring revenue opportunities. Many data centers seek cooling upgrades to meet new compliance and workload demands. The Vietnam Data Center Thermal Management Market benefits from this demand for retrofits, upgrades, and lifecycle services. Integrators bundle services with sensor-driven diagnostics and cloud dashboards. This supports long-term thermal reliability and improves asset longevity.

Market Segmentation

By Data Center Size

Large data centers dominate the Vietnam Data Center Thermal Management Market due to hyperscale investments from cloud providers and global telecom firms. These facilities prioritize efficient cooling across thousands of racks. Medium-sized facilities are expanding in banking and enterprise sectors, while small data centers see traction in government and edge applications. Growth is fastest in medium and large segments due to rising digital workloads and regional data localization mandates.

By Cooling Technology

Air-based cooling remains widely adopted, with hot/cold aisle and rear-door exchangers being standard in enterprise setups. However, liquid-based cooling, particularly direct-to-chip systems, sees growing demand in high-density deployments. Hybrid systems combining both methods gain preference in multi-zone environments. Thermoelectric and phase-change methods remain niche but show potential in compact and edge facilities. The market leans toward liquid systems for long-term energy savings and rack performance.

By Component

Hardware holds the highest share due to its direct role in thermal transfer. This includes chillers, fans, heat exchangers, and distribution piping. Software and services segments grow as operators prioritize automation and remote control. The Vietnam Data Center Thermal Management Market sees rising demand for AI modules, CFD tools, and integrated dashboards that boost performance and reduce manual intervention across thermal environments.

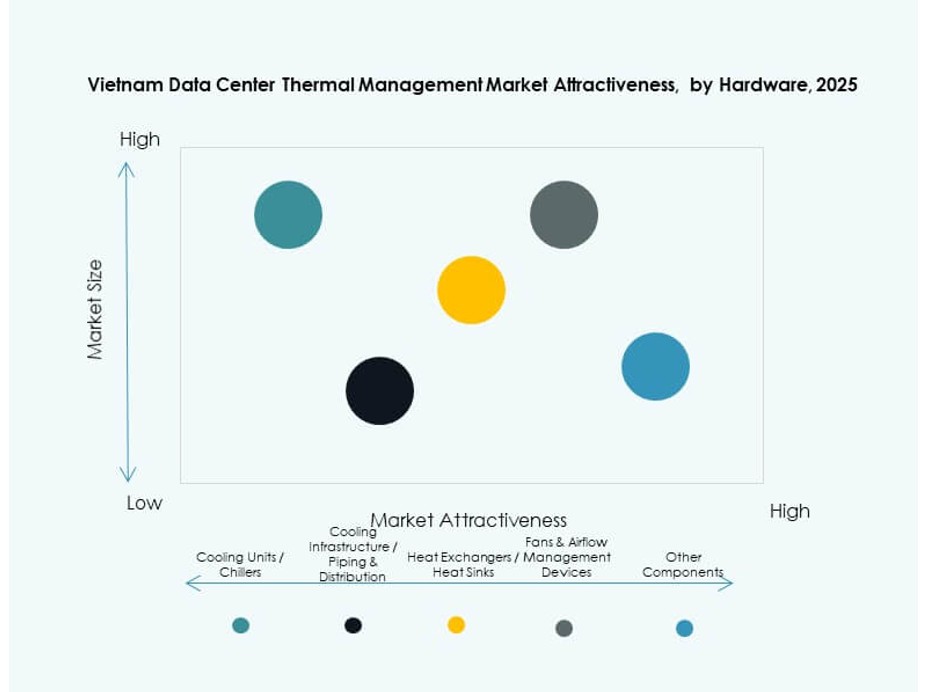

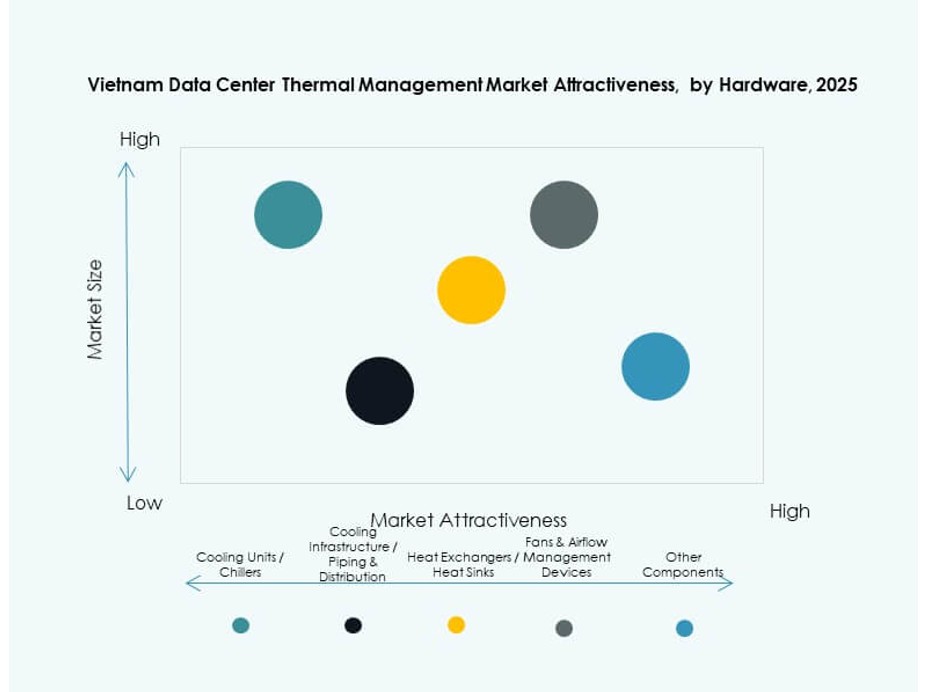

By Hardware

Cooling units and chillers dominate the hardware segment, followed by airflow devices and piping systems. Facilities prefer high-efficiency units with modular designs for scalability. Heat sinks and exchangers are essential in both air and liquid-based systems. Vendors innovate in energy-efficient components with IoT and sensor integration. Component demand correlates directly with rack density and workload types deployed in the facility.

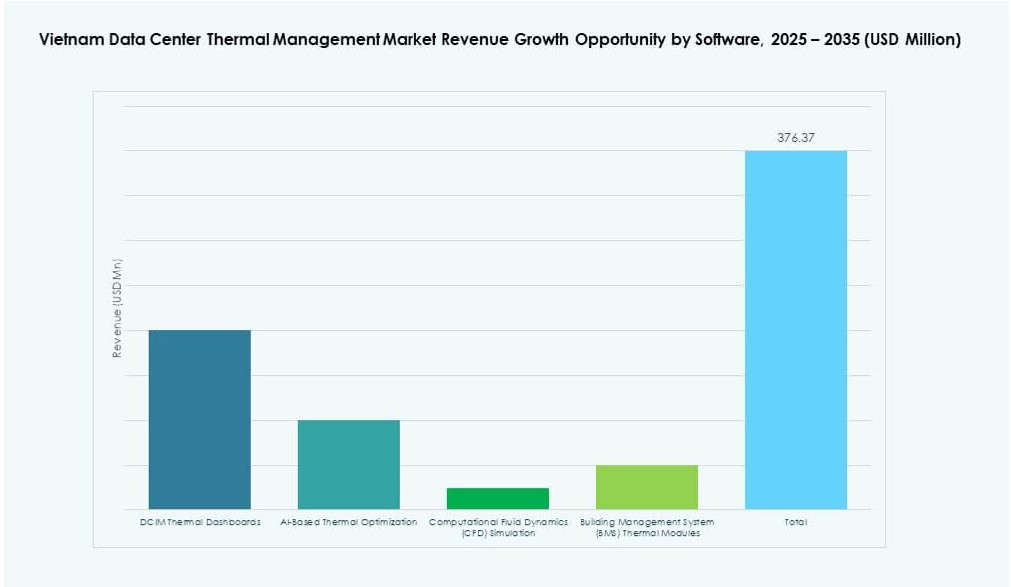

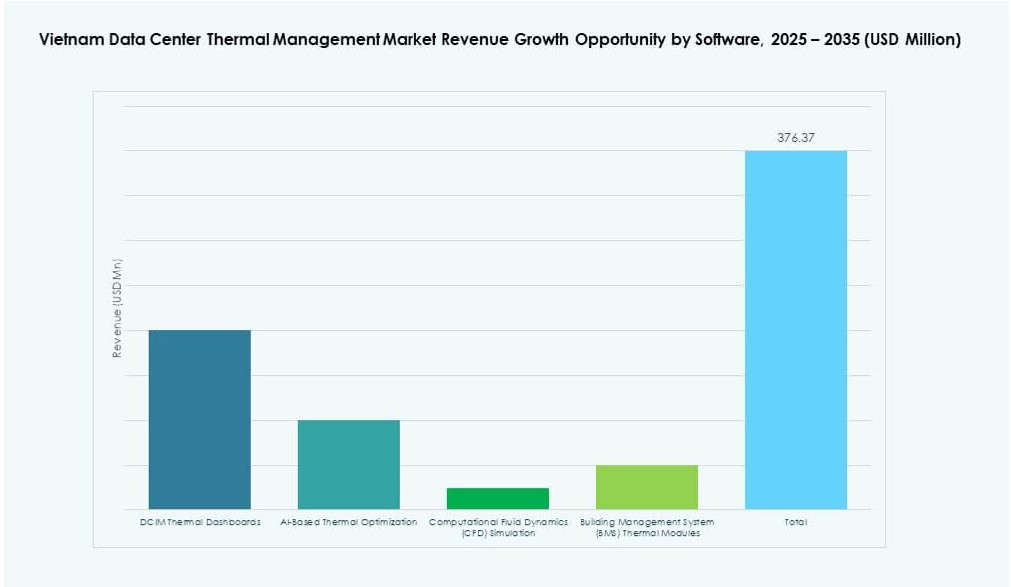

By Software

DCIM dashboards remain the most adopted thermal software tool, providing real-time visibility and alerts. AI-based optimization tools grow rapidly as they support autonomous cooling decisions. CFD simulation helps plan thermal layout and validate airflow designs before construction. BMS modules enable centralized facility control, combining temperature, humidity, and energy data. Software helps improve energy scores and reduce cooling overhead.

By Services

Preventive maintenance and installation hold a large market share as facilities require continuous operational uptime. Monitoring-as-a-Service and retrofit upgrades are expanding due to aging infrastructure and ESG compliance needs. Operators prefer service bundles with IoT diagnostics, performance logs, and predictive alerts. The Vietnam Data Center Thermal Management Market gains from this recurring demand. Vendors differentiate through rapid response SLAs and value-added service layers.

By Data Center Type

Hyperscale data centers lead the market, followed by enterprise and colocation facilities. Colocation providers integrate advanced thermal infrastructure to attract clients with SLA guarantees. Edge and micro data centers grow in rural areas and telecom deployments, demanding compact, efficient cooling solutions. Each type has distinct thermal needs based on workload, rack density, and client expectations. Tailored thermal strategies drive vendor success across segments.

By Structure

Room-based cooling remains dominant in legacy facilities, while row-based and rack-based systems grow in modern builds. Rack-based cooling is preferred for high-density zones with AI workloads. Row-based systems suit modular builds and edge setups. The Vietnam Data Center Thermal Management Market trends toward decentralized cooling for flexibility. Vendors offer scalable products compatible with all three structures to meet changing project needs.

Regional Insights

Southern Vietnam Dominates Due to Ho Chi Minh City’s Strong Infrastructure and Investments

Southern Vietnam holds over 48% market share, led by Ho Chi Minh City’s concentration of enterprise headquarters, financial institutions, and hyperscale facilities. Infrastructure readiness, fiber availability, and investor incentives attract international data center operators. Cooling vendors gain from strong project pipelines and early adoption of liquid and hybrid systems. Clients demand high-efficiency thermal units with remote diagnostics. Sustainability-focused retrofits also drive revenue in this subregion. It remains the primary thermal technology testing ground in Vietnam.

- For instance, in December 2025, Evolution Data Centers partnered with HTC International Telecommunication JSC to develop AI‑ready hyperscale data centers in Hanoi and Ho Chi Minh City, delivering high‑performance and sustainable infrastructure for power‑intensive cloud and AI workloads.

Northern Vietnam Expanding with Government-Led Smart Infrastructure and Enterprise Growth

Northern Vietnam accounts for nearly 33% share, centered around Hanoi and Hai Phong. The region sees public-private partnerships in smart city and e-government platforms. Enterprise IT expansion drives demand for modular and energy-efficient thermal systems. The Vietnam Data Center Thermal Management Market grows in this region with strong public sector influence. Vendors supply air-based and liquid systems for government and education clients. Construction of new industrial parks adds future cooling project opportunities.

Central Vietnam and Emerging Tier-2 Cities Gaining Traction in Edge Deployments

Central Vietnam, including Da Nang and Can Tho, holds 19% market share. These cities support the growth of edge and regional data centers for telecom and content delivery. Facilities here prioritize compact and easily deployable cooling systems. Rising digital services, including smart healthcare and regional e-commerce, drive demand. The Vietnam Data Center Thermal Management Market sees long-term opportunity in these emerging zones. Thermal vendors expand partnerships with regional integrators and ISPs to serve decentralized infrastructure growth.

- For instance, in April 2025, Da Nang International Data Centre JSC began constructing an 18.5 MW Tier III-certified data center in the Da Nang Hi-Tech Park, with capacity for 1,000 racks, designed to support AI and cloud workloads through high-performance cooling and infrastructure partnerships with China Mobile International, FPT International Telecom, and VNPT.

Competitive Insights:

- Vertiv Group Corp.

- Schneider Electric

- Daikin Industries Ltd.

- Delta Electronics, Inc.

- LG Electronics

- Mitsubishi Electric Corporation

- Fujitsu Limited

- NTT Facilities

- Johnson Controls International plc

- Airedale International Air Conditioning Ltd.

The Vietnam Data Center Thermal Management Market features a mix of global and regional players competing across cooling hardware, software, and services. Vertiv and Schneider Electric lead with integrated solutions spanning room, row, and rack cooling. Daikin, Mitsubishi Electric, and Johnson Controls dominate HVAC and chiller segments with scalable systems. Delta and LG focus on energy-efficient cooling for high-density setups. Fujitsu and NTT Facilities offer thermal infrastructure for enterprise and telecom data centers. It supports innovation through AI-based controls, liquid cooling, and predictive maintenance. Vendors differentiate by offering localized support, modular solutions, and green-certified systems aligned with ESG mandates. Strategic collaborations with hyperscale and colocation providers enhance market reach and long-term contracts.

Recent Developments:

- In December 2025, Evolution Data Centers partnered with HTC International Telecommunication JSC (HITC) to develop data centers in Vietnam, supporting advanced thermal management needs amid growing infrastructure demands.

- In November 2025, Viettel IDC inaugurated its 14th data center, Vietnam’s largest green facility optimized for AI workloads, featuring advanced cooling and a total capacity contributing to 230,000 servers nationwide. This expansion supports Viettel’s roadmap to reach 17,000 racks by end-2025.

- In September 2025, Boyd announced plans to expand its manufacturing facility in Bac Ninh, Vietnam, doubling capacity to 800,000 square feet to boost production of liquid cooling solutions for AI data centers, addressing rising demands for compute, power, and thermal density