Executive summary:

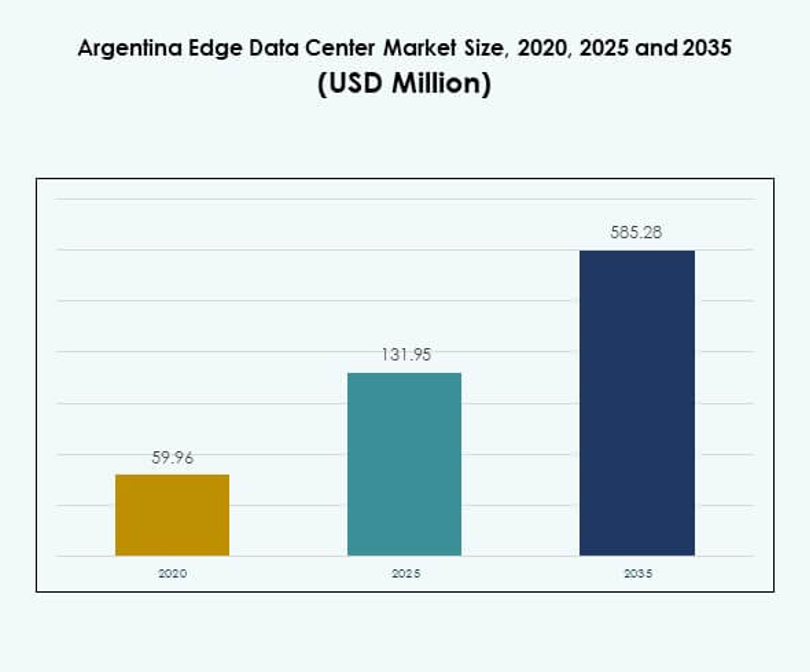

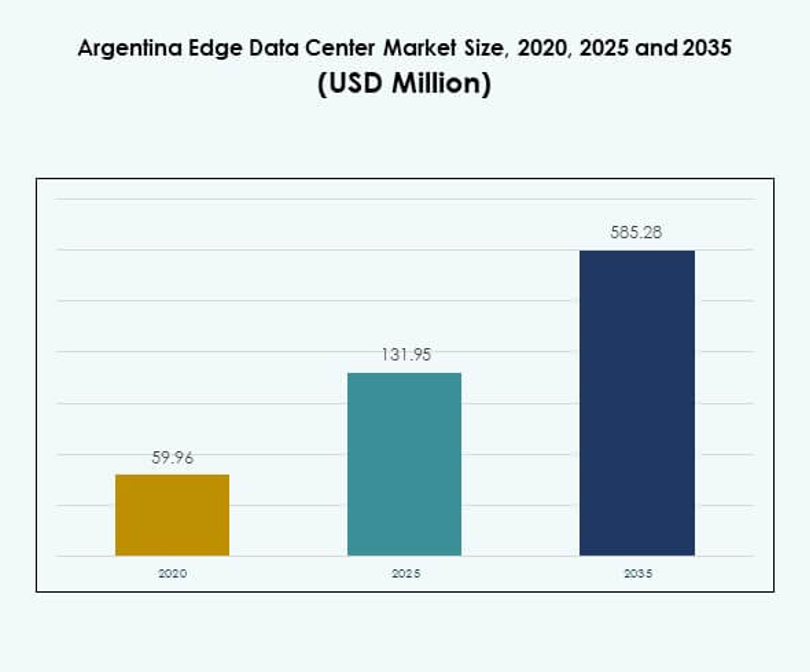

The Argentina Edge Data Center Market size was valued at USD 59.96 million in 2020 to USD 131.95 million in 2025 and is anticipated to reach USD 585.28 million by 2035, at a CAGR of 15.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Argentina Edge Data Center Market Size 2025 |

USD 131.95 Million |

| Argentina Edge Data Center Market, CAGR |

15.93% |

| Argentina Edge Data Center Market Size 2035 |

USD 585.28 Million |

Strong digital transformation and increasing demand for low-latency services are driving the market. Enterprises are shifting workloads closer to users, supported by rapid cloud adoption, 5G deployment, and IoT integration. Strategic investments from global and local players are strengthening infrastructure and creating opportunities for efficient, scalable edge solutions. The market is becoming a key hub for investors seeking advanced infrastructure growth.

Buenos Aires leads the market due to strong connectivity, advanced fiber infrastructure, and high enterprise concentration. Central regions are emerging as attractive locations supported by rising industrial activity and improving network reach. Northern and Southern areas are developing with new infrastructure initiatives and growing edge adoption in underserved zones. This creates a balanced foundation for nationwide market expansion.

Market Drivers

Rapid Adoption of Digital Transformation and Distributed IT Infrastructure

The Argentina Edge Data Center Market is expanding through widespread digital transformation across key industries. Enterprises are shifting workloads to localized infrastructure to reduce latency and improve operational resilience. It is helping organizations deploy AI and IoT applications with higher speed and efficiency. Government and private investments in fiber networks are creating a robust foundation for edge expansion. Financial services, telecom, and retail sectors are leading this shift with strong digitization strategies. Edge nodes are enabling smarter connectivity, reliable data processing, and real-time insights. Investors are viewing Argentina as a strategic hub for next-generation computing infrastructure. Strong market fundamentals continue to attract new capital and partnerships.

Expansion of Cloud Ecosystems and Integration of Advanced Computing Technologies

Cloud providers are scaling local presence to meet increasing enterprise demand. Edge and cloud convergence is transforming the delivery of applications and digital services. It enhances operational agility while improving compliance with local data regulations. The rising use of 5G technology is boosting demand for edge nodes near urban centers. Enterprises are adopting hybrid deployment models to achieve lower latency and greater control. Local service providers are building partnerships with hyperscalers to strengthen computing ecosystems. AI-driven automation and monitoring tools are improving performance and operational transparency. This trend is reinforcing Argentina’s digital infrastructure growth and long-term market stability.

Rising Demand for Low-Latency Applications Across Critical Industries

Low-latency connectivity is becoming a competitive advantage for enterprises across telecom, finance, and manufacturing. Edge networks are bringing computation closer to users, improving real-time decision-making. It reduces dependency on distant cloud centers and improves service reliability. Sectors like fintech, e-commerce, and logistics are investing in edge nodes for transaction security and user experience. Smart city initiatives are pushing municipalities to adopt localized computing frameworks. Industrial IoT platforms are also driving demand for faster, more reliable processing layers. This creates new business opportunities for investors and infrastructure developers. Strong enterprise adoption is establishing a solid base for sustained market growth.

- For example, Mercado Libre improved its payment experience by integrating AWS IoT Core, successfully reducing the payment processing time from 8 seconds to under 1 second for high-volume transaction peaks. This achievement directly enhanced operational efficiency and customer satisfaction through AWS-powered low-latency infrastructure as of January 2025.

Supportive Government Initiatives and Strong Private Sector Investments

National digital strategies are accelerating edge infrastructure development in Argentina. Regulatory programs support network modernization and rural connectivity improvements. It creates favorable conditions for public-private partnerships and global investment inflows. Telecom operators are expanding fiber optic coverage and deploying micro data centers. Energy and utility players are aligning with sustainability goals to support efficient deployments. Tech companies are investing in modular and containerized edge facilities for faster rollout. These initiatives are improving competitiveness and service delivery across industries. A clear policy direction and rising investment volumes are driving stronger market momentum.

- For instance, YPF Luz operates Argentina’s largest private power generation network with an installed capacity of 3.4 GW, supplying 9.3% of the national electricity, and plays a key role in expanding renewable energy infrastructure.

Market Trends

Rising Deployment of Modular and Containerized Edge Data Centers

Modular infrastructure is gaining traction due to fast deployment timelines and lower upfront costs. Edge facilities are moving closer to urban and semi-urban areas to support growing digital demand. It enables operators to scale quickly and respond to dynamic enterprise needs. Standardized modules offer flexible capacity and ease of integration with existing networks. Telecom operators are adopting modular solutions to extend coverage in underserved zones. Energy-efficient designs are lowering operational expenses for operators. Market players are using prefabricated builds to meet strict time-to-market goals. This trend is shaping how digital infrastructure gets built in the country.

Growing Integration of Renewable Energy and Green Data Center Solutions

Sustainability is influencing infrastructure planning and operational models. Energy-efficient systems are becoming central to new edge deployments in Argentina. It is supporting national goals for reduced carbon emissions and sustainable growth. Data center operators are investing in advanced cooling technologies and renewable power. Hybrid power solutions are reducing long-term energy costs and improving reliability. Investors are prioritizing green certifications to attract enterprise clients and global partnerships. Edge facilities are adopting efficient energy storage systems for consistent power delivery. The shift toward clean energy integration is reinforcing long-term market competitiveness.

Emergence of AI and Automation for Network Optimization and Resource Management

Artificial intelligence is transforming how edge networks operate and scale. AI tools are enabling predictive maintenance and dynamic workload allocation. It improves energy efficiency, reduces downtime, and enhances operational transparency. Automation is allowing real-time optimization of power, cooling, and capacity resources. Service providers are integrating AI platforms to meet rising customer expectations. AI-based analytics is helping operators make smarter investment and capacity decisions. This trend is strengthening operational resilience and reducing maintenance costs. Strategic use of AI is positioning edge networks as key enablers of advanced applications.

Expanding Role of 5G Networks and IoT in Edge Computing Growth

The deployment of 5G infrastructure is pushing edge adoption in high-demand sectors. Telecom operators are accelerating investments to enable low-latency services nationwide. It supports applications in autonomous vehicles, smart factories, and digital healthcare. Enterprises are combining 5G and IoT to build advanced connected ecosystems. Edge facilities are processing real-time data streams more efficiently than centralized cloud centers. This helps improve responsiveness and scalability for critical operations. Industries are using these networks to unlock new revenue models and service capabilities. The 5G rollout is becoming a major enabler for distributed infrastructure expansion.

Market Challenges

High Capital Expenditure and Operational Cost Barriers for Edge Deployments

The Argentina Edge Data Center Market faces funding and cost-related constraints. Edge infrastructure requires significant investment in network buildout, power systems, and security. It often delays project timelines and limits smaller players from entering the market. Operational costs remain high due to energy pricing and technical maintenance needs. It creates pressure on profitability and pricing strategies for service providers. High capital intensity also affects scalability and geographic coverage. Investors seek longer payback cycles, which slows market expansion. Overcoming these barriers requires policy support, cost optimization technologies, and innovative financing models.

Regulatory Complexity, Connectivity Gaps, and Technical Skill Shortages

The regulatory environment remains fragmented and inconsistent across jurisdictions. It complicates planning, permitting, and licensing processes for edge deployments. Limited high-speed network coverage outside urban areas restricts potential expansion. It impacts deployment timelines and overall infrastructure efficiency. Technical skill shortages also slow adoption and increase dependence on foreign expertise. Smaller operators struggle with compliance costs and lack of standardization. This creates an uneven competitive landscape and slows nationwide coverage. Addressing these issues is critical to achieving sustainable and inclusive market growth.

Market Opportunities

Strategic Positioning of Argentina as a Regional Edge Infrastructure Hub

The Argentina Edge Data Center Market offers significant opportunities through its geographic and economic position. Argentina can act as a regional connectivity bridge for Latin American enterprises. It is attracting attention from hyperscalers, telecom operators, and infrastructure investors. Buenos Aires serves as a central gateway for network interconnection and service expansion. Local operators can scale through strategic partnerships with global players. Strong enterprise demand is increasing the need for colocation and edge nodes. This creates favorable conditions for long-term capital inflows. Strengthening connectivity links can help position Argentina as a digital infrastructure leader in the region.

Rising Potential for Enterprise Adoption in Underserved and Emerging Areas

Underserved zones present strong potential for edge network expansion. It enables industries to achieve low-latency connectivity and better user experiences. Local governments are supporting initiatives to build new digital corridors. Infrastructure investments in energy and connectivity are improving project feasibility. Tech service providers can capture new segments by offering customized edge solutions. Energy-efficient and modular designs help reduce barriers to market entry. Expanding into new regions can create fresh revenue streams and competitive advantages. Strong enterprise interest is creating a favorable environment for long-term opportunity development.

Market Segmentation

By Component

Solution dominates this segment with a significant market share due to strong enterprise adoption. It supports critical functions like real-time data processing, network security, and power optimization. Services play a growing role in infrastructure management and support, enabling efficient operations. Integration of AI, automation, and monitoring platforms is strengthening overall performance. Service providers are focusing on support, maintenance, and upgrades for scalability. Enterprises prefer integrated solutions to ensure seamless connectivity and performance. Managed service contracts are gaining popularity among large organizations. This structure supports stronger operational control and flexibility.

By Data Center Type

Colocation edge data centers hold the largest share in this segment. They offer flexible, scalable infrastructure for enterprises without heavy upfront investment. Managed and cloud edge centers are rising due to hybrid network demands. Enterprise-owned data centers continue to support mission-critical workloads. It enables businesses to maintain control and compliance in regulated sectors. Colocation hubs attract investment from hyperscalers and telecom providers. Flexible pricing models are expanding their appeal across industries. This diversity in data center types is strengthening Argentina’s overall edge ecosystem.

By Deployment Model

Hybrid deployment leads this segment with strong adoption across multiple industries. It provides greater control, security, and scalability compared to single-model structures. Cloud-based deployments follow closely due to flexibility and cost efficiency. On-premises models remain relevant in sectors with strict compliance and security needs. It enables organizations to manage sensitive workloads with precision. Enterprises are integrating edge nodes into hybrid networks for better workload distribution. This approach supports operational agility and enhanced user experiences. The trend is driving more investments in hybrid solutions.

By Enterprise Size

Large enterprises dominate the segment due to strong financial capacity and early adoption. They deploy edge infrastructure to support AI, IoT, and 5G applications. SMEs are adopting modular edge solutions to remain competitive in digital markets. It allows smaller players to leverage advanced technology without major capital costs. Tailored service offerings are expanding SME participation. Edge platforms are enabling more efficient operations for both segments. Scalable pricing and support models are driving broader enterprise adoption. This balance creates a healthy competitive structure across business sizes.

By Application / Use Case

Power monitoring leads this segment with strong integration in industrial and commercial facilities. It supports operational efficiency, cost optimization, and reliability. Asset management and capacity monitoring follow closely due to their role in real-time operations. Environmental monitoring is growing due to sustainability targets and regulatory focus. BI and analytics help enterprises make faster, smarter decisions. It is improving resource allocation and performance across distributed networks. Demand for application diversity is strengthening market depth. This wide application base is making edge infrastructure central to enterprise operations.

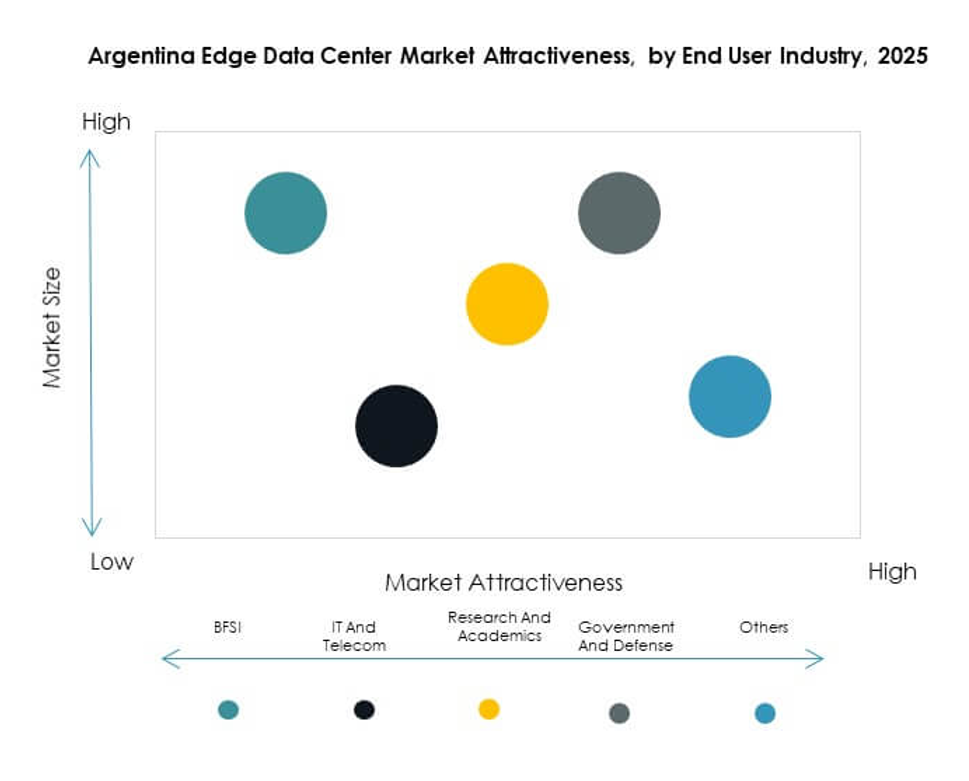

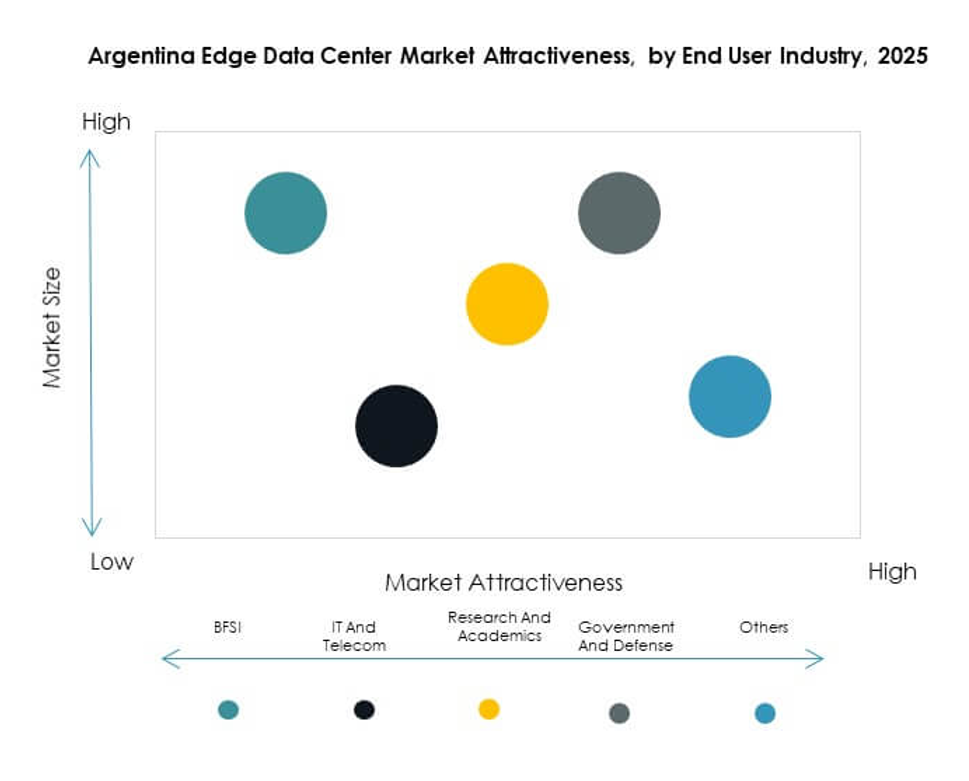

By End User Industry

IT and telecommunications dominate this segment with the highest market share. BFSI and retail sectors are expanding investments to enhance transaction security and customer experience. Healthcare is adopting edge nodes to support connected health platforms and patient data protection. Energy and utilities are integrating edge systems to monitor distributed assets. Aerospace and defense require real-time processing for mission-critical applications. It drives strong adoption of secure and high-performance infrastructure. This broad industry base is creating strong growth potential across multiple verticals.

Regional Insights

Buenos Aires Region: Leading Subregion with Strong Digital Infrastructure

Buenos Aires holds the largest market share at 56% due to its advanced digital ecosystem. The city has high fiber penetration, strong enterprise presence, and hyperscaler investments. It offers reliable connectivity, making it an ideal hub for edge deployments. It benefits from high demand across financial, telecom, and retail sectors. Strong government and private partnerships accelerate infrastructure modernization. Buenos Aires attracts major investments in colocation and modular data center facilities. This dominance is establishing it as a core digital gateway for the region.

- For instance, Claro Argentina invested US$30 million to build a 1,300 m² modular data center at 77 Brasil Street in Buenos Aires, designed to meet Tier III standards, strengthening the city’s digital infrastructure capacity.

Central Region: Emerging Edge Cluster with Expanding Connectivity

The Central region holds a 27% share of the Argentina Edge Data Center Market. This area is witnessing rising deployment of modular edge facilities and telecom infrastructure upgrades. It is becoming a preferred zone for logistics, manufacturing, and industrial operations. Fiber network expansion is improving connectivity and service delivery reliability. Enterprises are exploring hybrid models to meet rising regional demand. Tech service providers are establishing local partnerships to support expansion strategies. This region is positioned as a growing contributor to the national edge ecosystem.

- For instance, Telecom Argentina announced plans to expand its 5G network from 550 to 750 active sites by the end of 2025 and upgrade its 16 national data centers to 10 MW capacity each to support enterprise workloads and strengthen national connectivity.

Northern and Southern Regions: Developing Areas with Growth Potential

Northern and Southern regions together account for 17% of the total market share. These areas are emerging zones with strong government focus on connectivity programs. It benefits from lower deployment costs and growing energy infrastructure. Regional enterprises are adopting edge computing to support local operations and rural development. Infrastructure projects are improving digital accessibility and service coverage. This creates opportunities for operators targeting underserved zones. The regions are gradually becoming important for national network expansion and long-term edge growth.

Competitive Insights:

- Local Telecom Providers

- Smaller Local Colocation Providers

- Huawei Technologies

- Equinix

- Digital Realty

- EdgeConneX

- Fujitsu

- Cisco

- Eaton Corporation

- Dell Technologies Inc.

- Microsoft

- VMWare

- Schneider Electric SE

- Rittal GmbH & Co. Kg

- Others

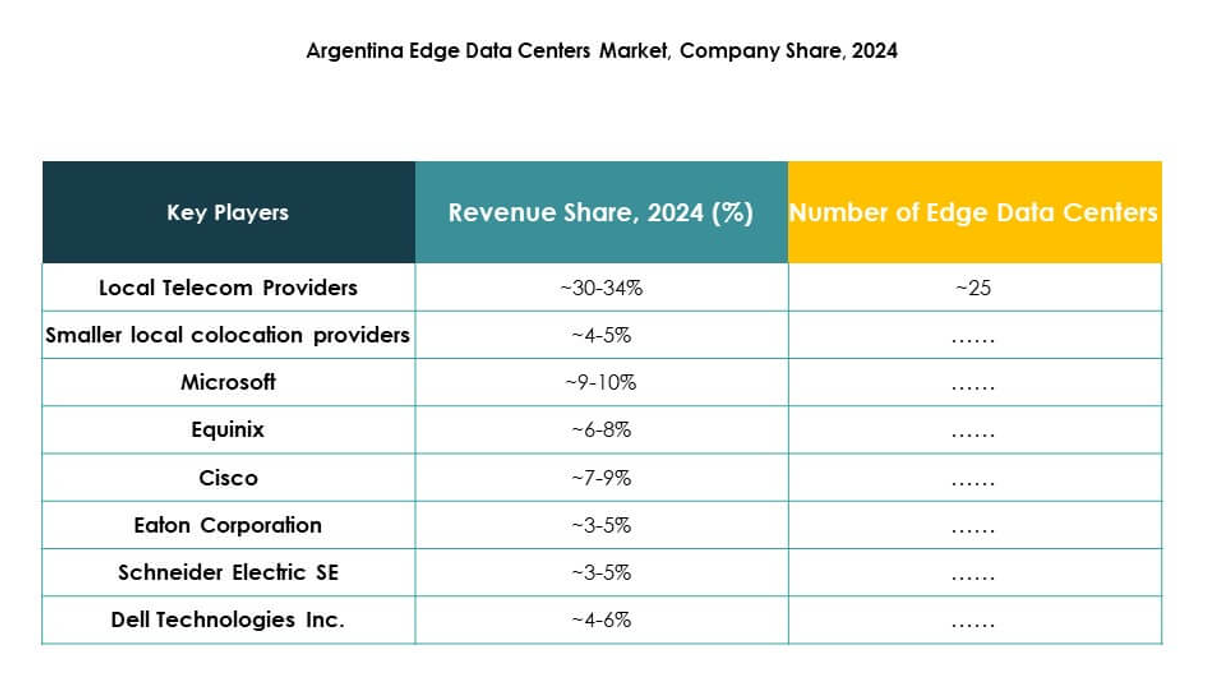

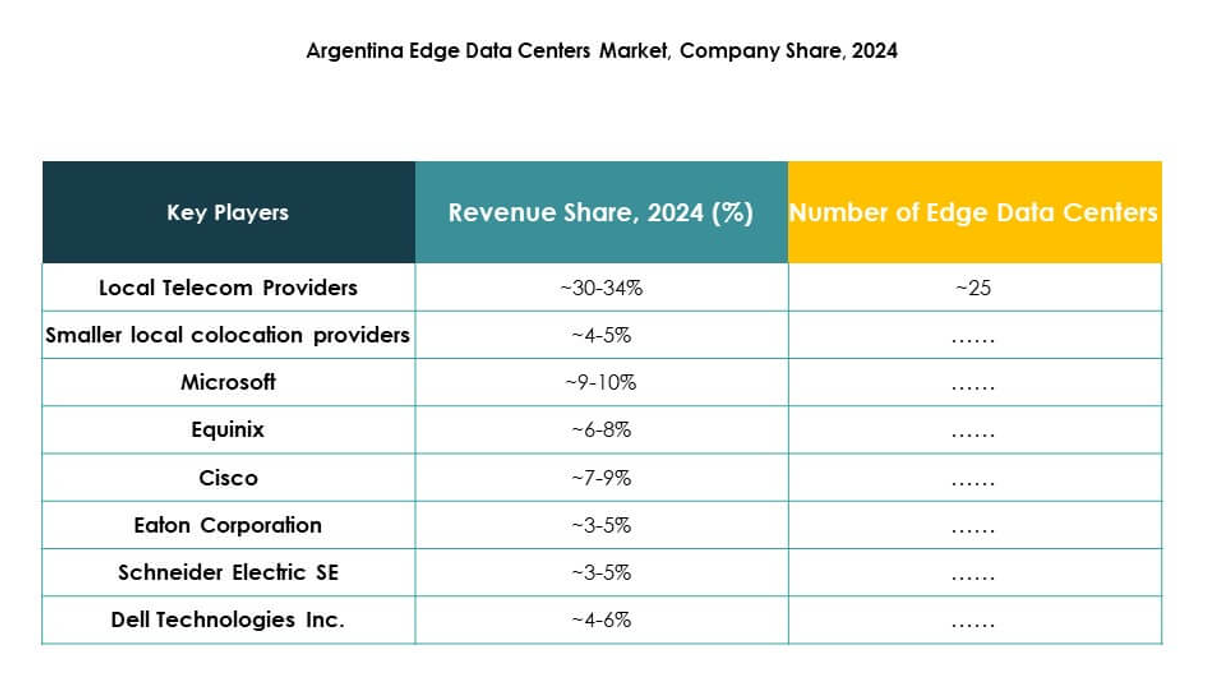

The competitive landscape of the Argentina Edge Data Center Market is defined by a mix of global leaders and strong local operators. It is witnessing rapid infrastructure expansion led by companies focusing on modular, scalable, and energy-efficient solutions. Global providers like Equinix, Digital Realty, and Huawei are strengthening their presence through partnerships and colocation investments. Local telecom operators and colocation providers are playing a key role in regional coverage and low-latency service delivery. Technology firms such as Cisco, Fujitsu, and Dell Technologies are driving innovation in network, power, and automation. Schneider Electric and Eaton are supplying critical power and infrastructure solutions to support uptime and energy efficiency. The market remains competitive with active capacity expansion, strategic alliances, and product development initiatives.

Recent Developments:

- In August 2025, Cirion Technologies announced the expansion of its BUE1 Data Center in Buenos Aires, Argentina, emphasizing its commitment to innovation and enhanced regional connectivity. This expansion is aimed at supporting digital transformation in the market by providing advanced and scalable edge data center solutions for local enterprises and international clients.

- In October 2024, Argentina’s G2K announced plans to launch a new 10MW data center facility in Buenos Aires in 2025, with an initial investment of $20 million, aimed at scaling quickly to meet anticipated growth in demand for local data center and hosting services.