Executive summary:

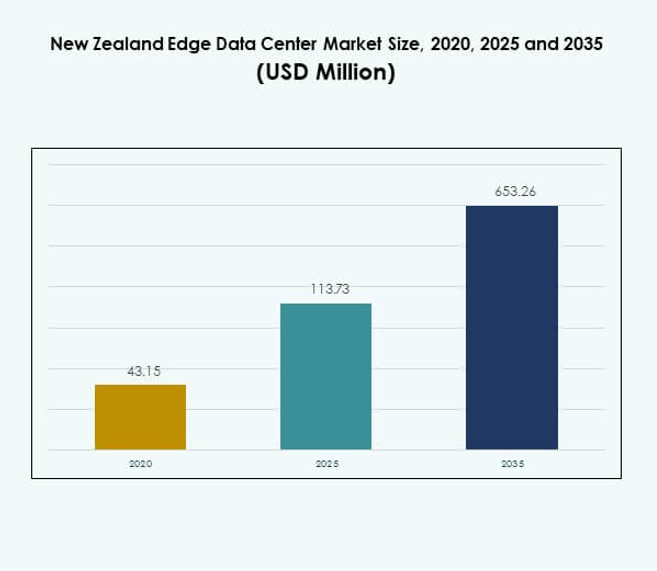

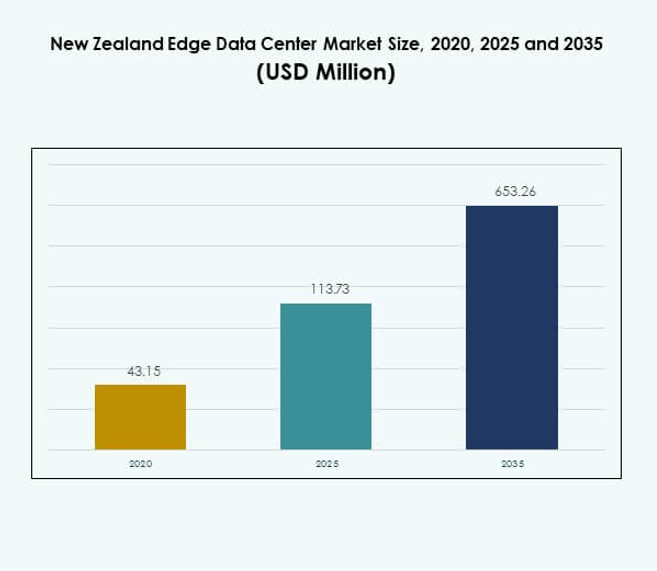

The New Zealand Edge Data Center Market size was valued at USD 43.15 million in 2020 to USD 113.73 million in 2025 and is anticipated to reach USD 653.26 million by 2035, at a CAGR of 18.92% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| New Zealand Edge Data Center Market Size 2025 |

USD 113.73 Million |

| New Zealand Edge Data Center Market, CAGR |

18.92% |

| New Zealand Edge Data Center Market Size 2035 |

USD 653.26 Million |

The market is expanding due to rising cloud migration, AI-driven workloads, and increasing edge deployments. Telecom operators and hyperscalers are investing in advanced network infrastructure to reduce latency and support real-time applications. It is becoming strategically important for businesses and investors as enterprises adopt modular, scalable, and energy-efficient facilities. Strong government support and sustainable design standards are further accelerating infrastructure growth and digital transformation.

North Island leads the market due to strong fiber infrastructure, enterprise presence, and network readiness. South Island is emerging with growing investments in modular facilities and renewable energy integration. Rural regions are slowly expanding connectivity corridors, driven by targeted infrastructure projects. This regional shift strengthens the country’s position as a strategic digital hub in Oceania.

MARKET DRIVERS

Rising Demand for Low-Latency Infrastructure to Support Real-Time Applications

The expansion of cloud computing, AI workloads, and IoT deployments is accelerating the need for localized infrastructure. The [New Zealand Edge Data Center Market] benefits from enterprises requiring faster processing near the data source. It enables businesses to deliver seamless experiences for gaming, video streaming, and mission-critical applications. Telecom operators are expanding edge nodes to reduce latency and boost network resilience. Investors see strong potential in real-time services, smart manufacturing, and autonomous operations. Strong fiber connectivity supports scaling of advanced services across industries. This demand drives new construction of modular and containerized facilities. Edge expansion strengthens the country’s strategic digital position in Oceania.

- For instance, Amazon Web Services (AWS) officially launched its New Zealand Asia Pacific (Auckland) Region in September 2025, featuring three Availability Zones and a commitment to serve local customers including AMP New Zealand, Kiwibank, One New Zealand, and TVNZ with secure, low-latency cloud infrastructure. The new region is designed to give organizations lower-latency access to AWS services and meets local data residency requirements.

Expanding Digital Transformation Initiatives Across Key Industry Verticals

Digital transformation strategies are creating new infrastructure needs across manufacturing, healthcare, BFSI, and retail. The [New Zealand Edge Data Center Market] supports these verticals through high-performance computing close to users. It improves application responsiveness and enhances security for sensitive data. Financial institutions adopt distributed infrastructure to meet compliance and performance needs. Healthcare uses edge nodes to support telemedicine and remote diagnostics. Retailers optimize inventory, payments, and personalization through edge analytics. This adoption drives steady investment in scalable data center models. Strong ecosystem growth attracts domestic and global technology players.

Government Policies and Regulatory Support Strengthening Network Modernization

Strong regulatory clarity encourages infrastructure deployment in the country. The [New Zealand Edge Data Center Market] aligns with government programs that promote digital connectivity and secure cloud adoption. It benefits from investments in submarine cable systems, high-speed backbone networks, and green energy. Authorities support sustainable and efficient IT infrastructure. Public-private partnerships enhance regional network coverage and connectivity. Such frameworks attract hyperscalers and local providers to deploy edge sites. Standardized policies reduce compliance burdens and improve operational certainty. This creates a supportive environment for infrastructure scalability.

- For instance, the Southern Cross NEXT subsea cable, owned by a consortium including Spark New Zealand, was launched for service in July 2022, connecting Auckland with Sydney, Los Angeles, Fiji, Tokelau, and Kiribati. The cable expanded New Zealand’s international connectivity with a design capacity of 72 Tbps, bolstering digital infrastructure access and resilience across the country in direct alignment with continuing government-backed digital modernization efforts.

Increasing Adoption of Green and Energy-Efficient Data Center Infrastructure

Sustainability has become a strategic priority in infrastructure development. The [New Zealand Edge Data Center Market] reflects growing investment in energy-efficient cooling, renewable integration, and power optimization. It helps operators meet ESG goals while reducing operating costs. Edge deployments use advanced power usage effectiveness metrics to lower emissions. Enterprises prefer sites with clean energy sourcing and modular designs. Strong emphasis on green certification attracts global operators. This focus on energy efficiency improves market competitiveness. Sustainable innovation strengthens long-term infrastructure resilience.

MARKET TRENDS

Integration of AI-Optimized Infrastructure Across Edge Nodes

The deployment of AI-ready infrastructure is transforming edge capabilities. The [New Zealand Edge Data Center Market] is seeing rapid integration of GPU clusters, liquid cooling, and AI accelerators to handle complex workloads. It supports predictive maintenance, autonomous vehicles, and machine learning applications. Telecom firms and hyperscalers collaborate to build AI-ready zones. This transformation enables businesses to process and analyze data locally. It drives faster decision-making and operational agility. Growing AI demand positions edge nodes as critical strategic assets. This trend shapes the future of decentralized computing in the region.

Growing Role of Modular and Prefabricated Data Center Design

Demand for modular edge deployments is increasing due to flexibility and speed. The [New Zealand Edge Data Center Market] is adopting containerized designs for faster rollout and reduced capital costs. It enables quick scaling in urban and rural zones with minimal disruption. Modular solutions reduce construction timelines and improve deployment efficiency. Vendors are offering prefabricated units with integrated power, cooling, and security systems. Businesses gain better control over capacity and redundancy. Investors find this model attractive for distributed applications. This design trend supports strong market expansion.

Strong Momentum in Hybrid and Multi-Cloud Architecture Integration

The need for hybrid and multi-cloud infrastructure is accelerating edge deployments. The [New Zealand Edge Data Center Market] is shifting toward architectures that combine on-premise and public cloud capabilities. It enables better workload distribution and data localization. Enterprises adopt these models to enhance operational flexibility and avoid vendor lock-in. Telecom operators support this trend through advanced connectivity solutions. Hybrid setups improve resilience and disaster recovery capabilities. Businesses leverage this approach for sensitive and latency-critical workloads. The growing hybrid infrastructure trend supports long-term digital transformation goals.

Strategic Expansion of Edge Interconnection and Connectivity Ecosystems

Edge interconnection is becoming a key strategic priority for operators. The [New Zealand Edge Data Center Market] benefits from new submarine cables, high-capacity backbones, and distributed peering points. It strengthens cross-border connectivity with Australia and Asia Pacific hubs. Carriers and colocation providers expand network fabrics to meet enterprise demands. Interconnection improves content delivery and lowers operational costs. Enterprises gain better performance through localized routing. This strategic trend positions the country as a critical connectivity hub. It strengthens competitiveness within the regional digital ecosystem.

MARKET CHALLENGES

Limited Scalability of Existing Infrastructure in Rural and Remote Zones

The [New Zealand Edge Data Center Market] faces infrastructure concentration around urban hubs, creating capacity gaps in rural zones. It requires significant investment to extend networks to less developed regions. Limited power availability and fiber coverage restrict expansion opportunities. Enterprises struggle to maintain consistent service quality in remote areas. It raises operational costs and delays deployment timelines. Smaller providers face financial constraints in network expansion. Lack of redundancy in certain areas creates reliability concerns. Overcoming these infrastructure limitations demands strong collaboration between private and public stakeholders.

Shortage of Skilled Workforce and Rising Deployment Costs

The [New Zealand Edge Data Center Market] experiences pressure from a lack of specialized technical talent. It affects data center operations, cybersecurity, and advanced infrastructure management. Rising construction and energy costs add complexity to project execution. Smaller firms face barriers to entering the market due to high capital needs. Skilled labor shortages lead to delayed installations and longer maintenance cycles. Operators rely on limited external expertise for advanced systems. Cost fluctuations impact the financial feasibility of edge expansions. Addressing these challenges requires training initiatives and cost optimization strategies.

MARKET OPPORTUNITIES

Strong Potential for Strategic Partnerships and Global Investments

The [New Zealand Edge Data Center Market] offers attractive opportunities for telecom providers, hyperscalers, and infrastructure investors. It benefits from growing interest in cloud expansion and cross-border connectivity. Partnerships with global firms accelerate network modernization. Investors see the country as a strategic entry point into Oceania. It supports flexible deployment through modular construction models. Strategic alliances boost competitive positioning for domestic players. Global integration creates a stronger foundation for sustainable growth. This opportunity aligns with the country’s long-term digital infrastructure goals.

Rising Edge Adoption in Emerging Industry Verticals

The [New Zealand Edge Data Center Market] is poised to benefit from increasing adoption in healthcare, manufacturing, retail, and logistics. It supports advanced use cases such as predictive analytics and real-time monitoring. Industry-specific edge deployments enhance operational agility and security. Enterprises can reduce costs while meeting compliance standards. Telecom operators gain new revenue streams from industry-tailored services. Expansion in verticals creates diversification opportunities for providers. This vertical growth supports steady market development and broader infrastructure resilience.

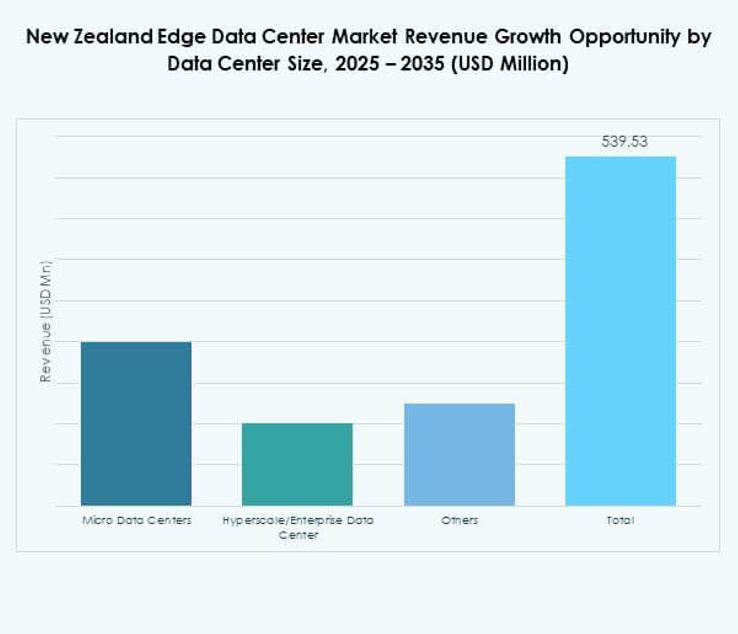

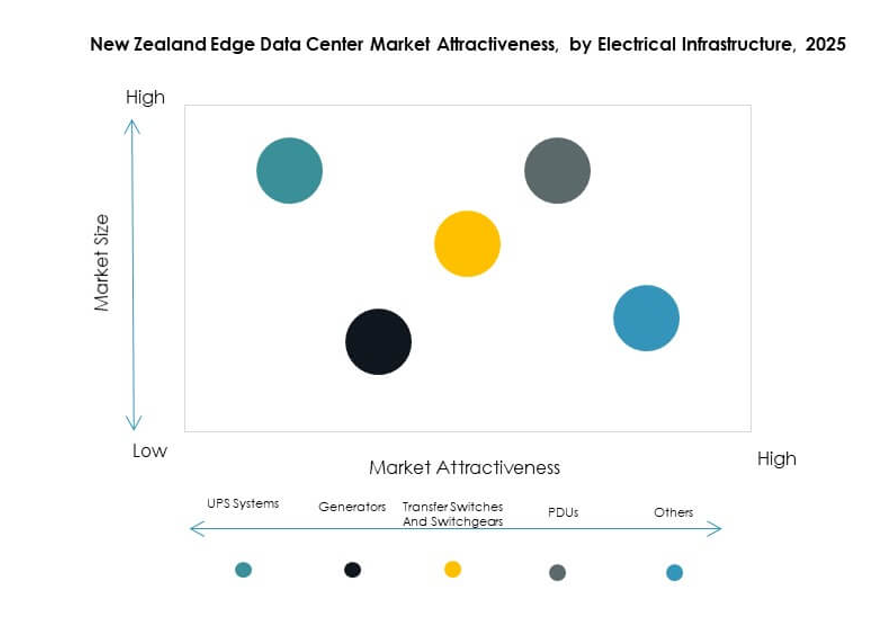

MARKET SEGMENTATION

By Component

Solution dominates the [New Zealand Edge Data Center Market] with a significant market share. Advanced power systems, cooling, and management software drive its adoption. Businesses prioritize integrated infrastructure for performance, reliability, and energy efficiency. Service offerings are expanding with managed solutions and maintenance contracts. Vendors focus on automated management platforms to reduce downtime. Strong solution demand accelerates network edge deployment. This segment attracts both domestic and global providers. It remains a critical enabler for sustainable growth.

By Data Center Type

Colocation edge data center leads the [New Zealand Edge Data Center Market] with a strong share. Enterprises prefer shared facilities for cost efficiency and scalability. Providers offer advanced interconnection, security, and uptime assurance. Managed and cloud edge centers are gaining traction from SMEs and startups. Enterprise data centers remain essential for regulated industries. Diverse facility types create a balanced ecosystem. Providers compete through service differentiation and performance. This segment’s strength reflects its strategic flexibility for multiple industries.

By Deployment Model

Hybrid deployment holds the highest share in the [New Zealand Edge Data Center Market]. Enterprises seek flexibility to manage sensitive and distributed workloads. Hybrid setups offer control, scalability, and cost optimization. On-premises models remain relevant in security-driven applications. Cloud-based models expand rapidly through telecom-led initiatives. Vendors integrate management tools to support hybrid orchestration. This model aligns with evolving enterprise strategies. Hybrid deployment strengthens disaster recovery and performance capabilities.

By Enterprise Size

Large enterprises dominate the [New Zealand Edge Data Center Market] due to high data processing needs. They invest in infrastructure to support AI, cloud, and analytics. SMEs show growing adoption through managed services. Flexible pricing and modular solutions support SME entry. Large firms shape demand for advanced security and compliance. This dominance reflects established IT budgets and global connectivity needs. SMEs contribute to distributed growth across sectors. Diverse enterprise demand supports long-term market stability.

By Application / Use Case

Power monitoring leads the [New Zealand Edge Data Center Market] due to efficiency and reliability priorities. Enterprises focus on real-time energy use tracking and optimization. Asset and capacity management follow with strong adoption. Environmental monitoring supports compliance and performance. BI and analytics gain traction in data-driven industries. Use cases expand across telecom, manufacturing, and healthcare. Advanced application management drives infrastructure standardization. Strong use case diversity enhances operational agility.

By End User Industry

IT and telecommunications dominate the [New Zealand Edge Data Center Market] with the largest share. Operators expand infrastructure to support 5G, AI, and multi-cloud services. BFSI and healthcare follow with strong compliance and latency requirements. Retail and e-commerce adopt edge for faster service delivery. Aerospace and energy sectors invest in secure, resilient nodes. Diverse industries drive widespread network adoption. This end-user mix strengthens market resilience and investment confidence. It reflects growing demand across critical and emerging sectors.

REGIONAL INSIGHTS

North Island – Strong Market Leadership Supported by High Urban Concentration

North Island holds 64% share of the [New Zealand Edge Data Center Market], driven by strong fiber infrastructure and urban density. It hosts major facilities in Auckland and Wellington, supported by large enterprise clusters. Telecom operators and cloud providers invest heavily in expanding edge nodes. The region offers stable power supply and strong network interconnection. Its economic activity creates sustained demand for low-latency services. It remains the strategic center for most large-scale deployments. Strong leadership in connectivity strengthens its regional dominance.

South Island – Emerging Regional Hub with Infrastructure Expansion

South Island accounts for 27% share of the [New Zealand Edge Data Center Market], supported by growing infrastructure investments. Christchurch and Dunedin are becoming key edge deployment locations. Regional development focuses on modular and containerized designs for faster deployment. Strong renewable energy availability supports sustainable growth. Enterprises use these facilities for distributed workloads and disaster recovery. Strategic location enhances operational flexibility. The region’s expansion reflects its growing role in the national digital ecosystem.

- For instance, Datacom’s Gloucester data center in Christchurch operates at 1 MW capacity and is certified as powered by 100% renewable energy under the New Zealand Energy Certificate System (NZECS), using hydro, wind, and geothermal sources.

Other Regions – Developing Connectivity Corridors and Edge Opportunities

Other regions contribute 9% share of the [New Zealand Edge Data Center Market]. It is supported by public and private projects aimed at improving connectivity. Rural zones benefit from targeted network expansion initiatives. Operators deploy smaller edge nodes to address latency issues. Regional growth improves digital inclusion and enterprise service reach. These developments create new investment prospects for telecom providers. Progressive expansion supports a more balanced infrastructure landscape nationwide.

- For instance, Spark operates regional and edge data centers in Waikato and Bay of Plenty, offering carrier-neutral connectivity and local cloud services, while Datacom runs data centers in Hamilton and Wellington that support distributed workloads with high-availability connections.

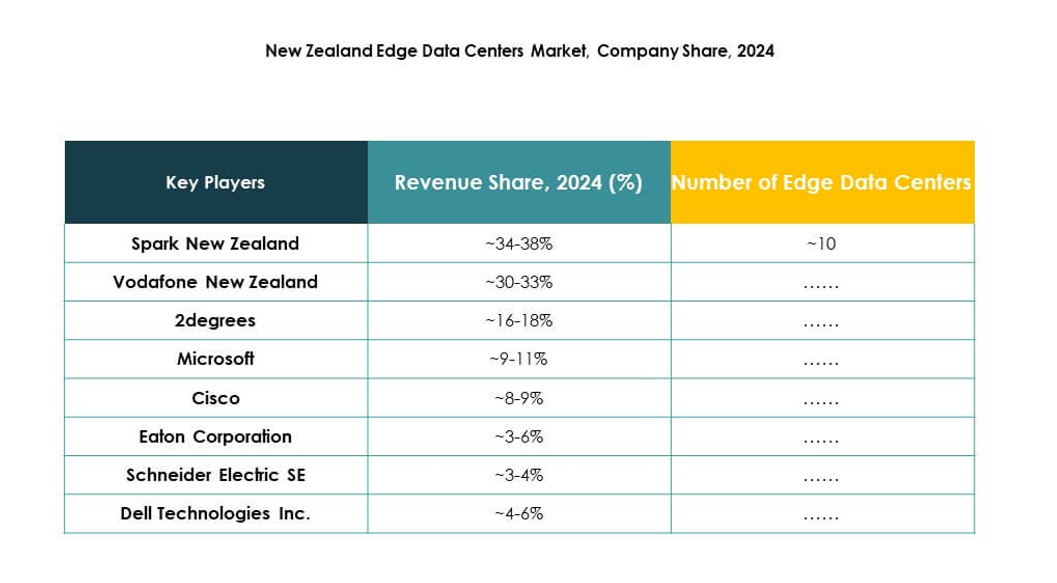

Competitive Insights:

- Spark New Zealand

- Vodafone New Zealand

- 2degrees

- Vocus Group

- Trustpower

- Fujitsu

- Cisco

- Eaton Corporation

- Dell Technologies Inc.

- Microsoft

- VMware

- Schneider Electric SE

- Rittal GmbH & Co. Kg

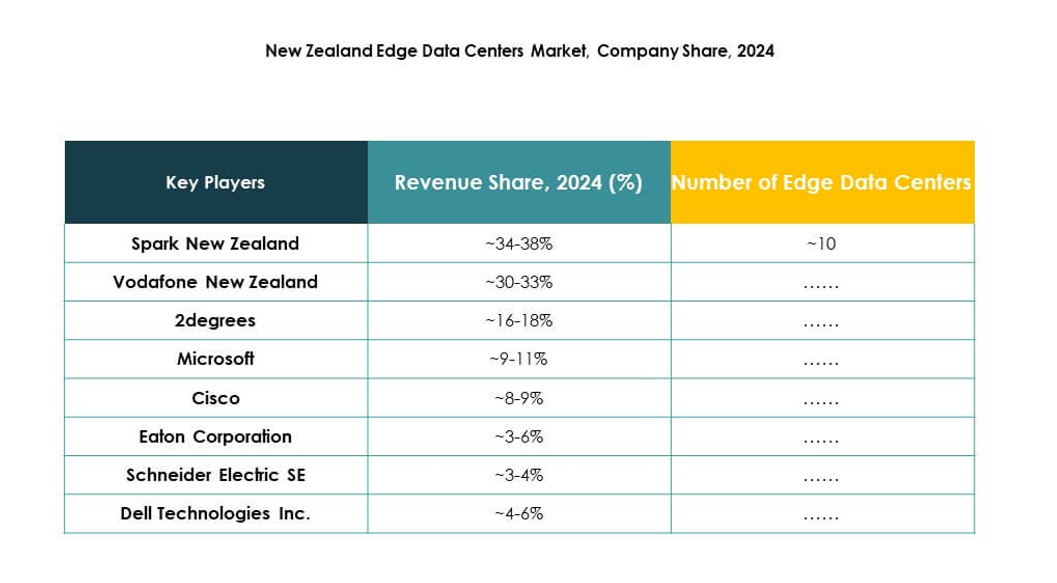

The [New Zealand Edge Data Center Market] features strong competition among telecom operators, cloud providers, and infrastructure vendors. It is shaped by strategic partnerships, capacity expansions, and technology integration. Local players like Spark New Zealand, Vodafone, and 2degrees strengthen their positions through network modernization and low-latency service delivery. Global technology leaders such as Microsoft, Cisco, and Schneider Electric drive innovation with hybrid and edge solutions. Equipment suppliers like Eaton and Rittal focus on energy-efficient power and cooling systems. Competition emphasizes modular designs, connectivity, and sustainable infrastructure. Companies aim to secure enterprise clients, optimize cost structures, and expand their geographic reach through advanced service offerings.

Recent Developments:

- In August 2025, Spark New Zealand announced the sale of a 75% interest in its data centre business to Pacific Equity Partners, an Australian private equity firm. This move values Spark’s data centre division at up to NZ$705 million and is aimed at accelerating infrastructure growth, with plans to expand to more than 130MW of capacity in response to cloud and AI demand in New Zealand.

- In August 2025, Spark New Zealand announced it has entered into an agreement to sell a 75% interest in its data center business to Pacific Equity Partners (PEP), one of Australia’s prominent private capital managers. This transaction, valued at up to NZ$705 million, is structured to support Spark’s accelerated rollout of edge and hyperscale data center capacity nationwide.

- In June 2025, 2degrees and Datacom unveiled a strategic ‘preferred supplier’ partnership focused on bringing integrated ICT services to enterprise and public sector clients across New Zealand. This partnership enables both companies to jointly offer managed IT, cloud, cyber security, networking, and mobile solutions, aiming to provide customers with seamless digital transformation and better access to local and global cloud providers.