Executive summary:

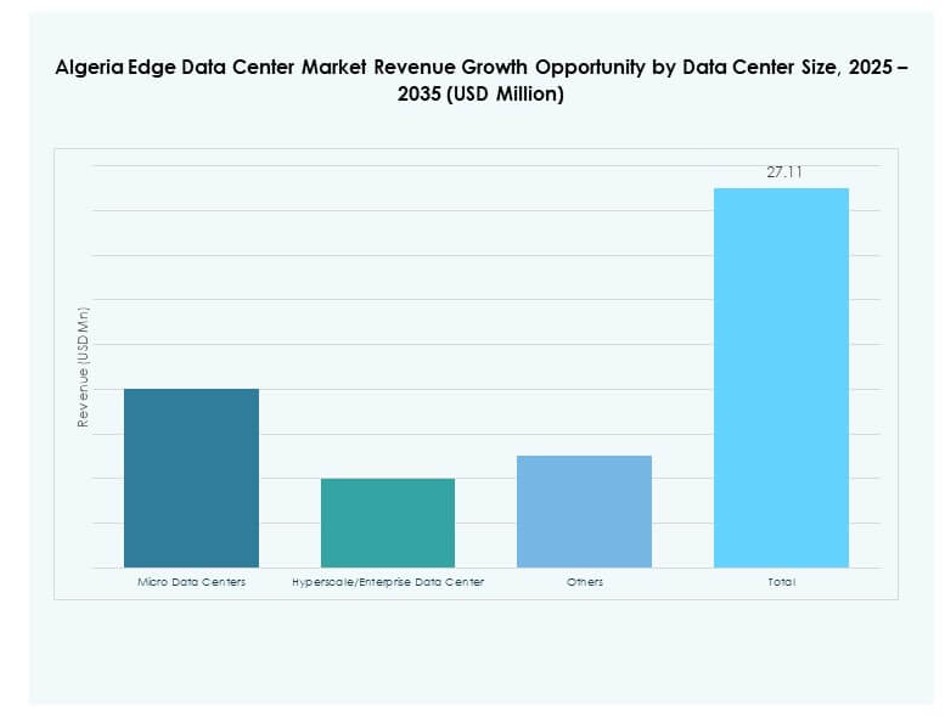

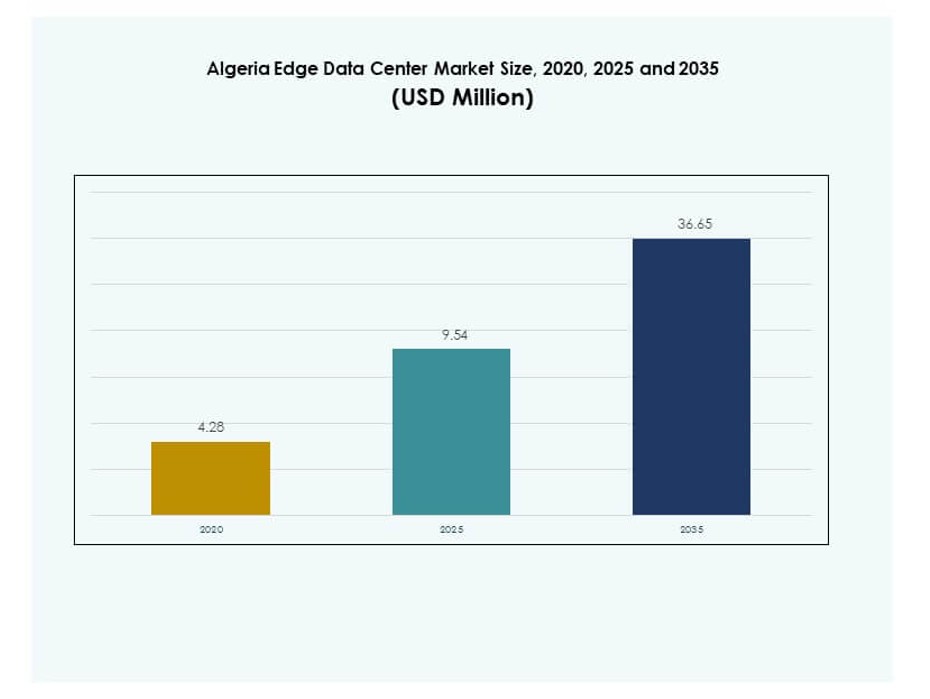

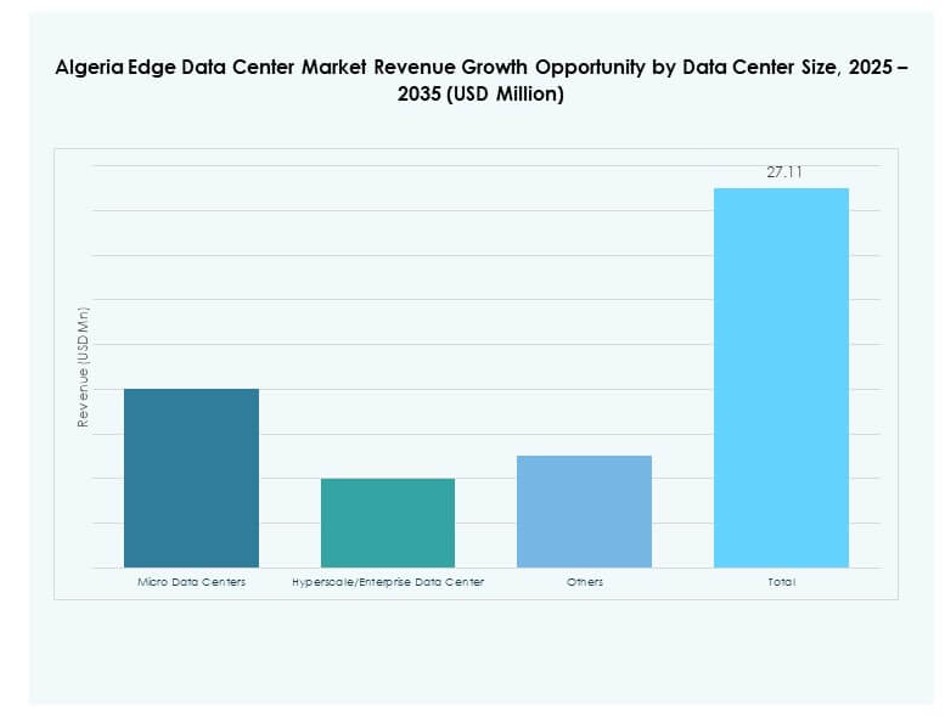

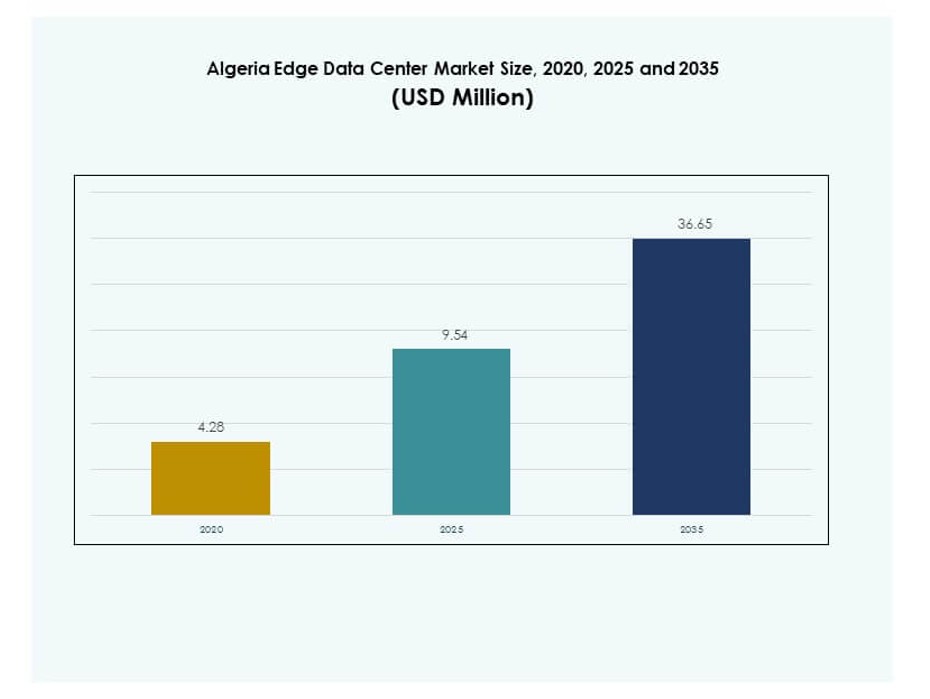

The Algeria Edge Data Center Market size was valued at USD 4.28 million in 2020, reached USD 9.54 million in 2025, and is anticipated to reach USD 36.65 million by 2035, at a CAGR of 14.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Algeria Edge Data Center Market Size 2025 |

USD 9.54 Million |

| Algeria Edge Data Center Market, CAGR |

14.26% |

| Algeria Edge Data Center Market Size 2035 |

USD 36.65 Million |

Strong 5G expansion, rising AI adoption, and growing demand for localized compute power are driving infrastructure development. Telecom operators, global technology providers, and the government are investing in scalable edge facilities to improve network resilience and enable faster data processing. This shift strengthens operational efficiency for enterprises and enhances strategic investment opportunities in digital infrastructure.

The northern region leads the market due to its strong fiber connectivity, urban infrastructure, and strategic proximity to Europe. The central region is gaining momentum through industrial expansion and IoT adoption, while the southern region is emerging with increasing renewable energy projects and modular deployments. This geographic distribution reflects a balanced national growth strategy.

Market Drivers

Market Drivers

Expanding 5G Infrastructure and High-Speed Connectivity Stimulating Edge Deployments

Widespread investment in advanced 5G networks is a major growth driver for the Algeria Edge Data Center Market. Telecom operators are deploying edge facilities to reduce latency and improve content delivery for enterprises and consumers. It supports cloud migration, IoT integration, and real-time analytics. High-speed connectivity encourages enterprises to adopt distributed computing models. It enables faster data exchange between devices and networks. Strategic deployments near urban hubs help optimize data flow and network reliability. Businesses gain operational flexibility and cost savings. Investors view this infrastructure buildout as a stable, high-return opportunity.

- For instance, in June 2025, the Algerian government officially launched a national 5G technology tender, targeting urban centers, smart cities, Industry 4.0, and digital health. The provisional licenses for 5G were scheduled to be awarded by July 3, 2025, with operators required to meet international standards for edge connectivity and network performance in major urban hubs.

Rising Demand for Data Localization and Sovereignty Strengthening National Infrastructure

Government policies mandating local data hosting are accelerating investments in edge infrastructure. Enterprises require local processing to comply with security, privacy, and regulatory frameworks. It supports critical sectors like banking, telecom, and public services. Localized infrastructure boosts national digital resilience and lowers cross-border dependency. Strong regulatory clarity attracts foreign and domestic capital. Technology firms prioritize regional hosting to build trusted services. This focus on sovereignty ensures stronger compliance control. The trend supports Algeria’s long-term digital transformation vision and strengthens investor confidence.

- For instance, Algeria’s Law on Audiovisual Activity, enacted in December 2024, mandates that online audiovisual services and electronic press providers must be hosted exclusively on physical infrastructure within Algeria using the .dz domain. This legal enforcement strengthened local edge data center investments and ensures government-mandated data localization for public services, media, and financial platforms.

Growth in AI, IoT, and Industrial Digitalization Driving Edge Infrastructure Expansion

Adoption of AI, IoT, and Industry 4.0 is fueling edge computing growth across industries. Real-time data processing at the network edge enables efficient factory automation, smart grid management, and connected health applications. It improves application performance and reduces operational delays. Edge architecture supports mission-critical workloads for enterprises. IoT sensor proliferation increases network demand for localized compute power. AI-driven analytics enhances decision-making at scale. Industrial digitization encourages hyperscalers and local operators to invest in modern infrastructure. The sector becomes attractive for infrastructure funds and strategic investors.

Strategic Enterprise Transformation and Cloud Integration Accelerating Edge Deployments

Large enterprises are rapidly shifting toward hybrid IT architectures combining on-premises and cloud-based systems. It allows seamless workload management, improved security, and cost optimization. Edge deployments ensure efficient data traffic control and enhanced business continuity. Enterprises in telecom, BFSI, and healthcare are leading this transition. Edge infrastructure offers faster application response and improved end-user experiences. Cloud integration drives new service offerings and innovation cycles. Investors view hybrid edge ecosystems as critical to future enterprise IT models. This shift solidifies market potential and scalability.

Market Trends

Surging Investment in Prefabricated and Modular Edge Data Centers

The Algeria Edge Data Center Market is witnessing growing interest in modular and prefabricated data centers. These facilities enable rapid deployment and scalability for edge applications. Prefabricated solutions lower construction time and capital costs. It supports flexible deployments across urban and remote regions. Telecom companies and hyperscalers prefer modular infrastructure to meet demand surges. Standardized designs simplify maintenance and expansion. These units also enhance power efficiency and thermal management. The trend reflects a strategic focus on cost optimization and operational agility.

Emergence of AI-Ready Infrastructure for Advanced Compute Workloads

Enterprises are investing in AI-optimized data centers designed to handle high-performance compute workloads. It enables real-time analytics, machine learning inference, and low-latency applications. Hyperscalers deploy AI accelerators, GPUs, and smart routing systems to increase efficiency. AI-driven infrastructure strengthens digital capabilities in healthcare, finance, and retail. It also supports national digitalization goals through automation. Edge platforms are becoming critical for decentralized AI processing. This evolution enhances business competitiveness and investor appeal. The focus on AI-ready facilities marks a significant technology shift.

Increasing Partnerships Between Telecom Operators and Cloud Providers

Collaboration between telecom operators and cloud service providers is transforming the edge ecosystem. It enables shared infrastructure models and lowers network expansion costs. Integrated edge-cloud platforms offer enterprises more reliable, scalable services. It strengthens telecom capabilities in digital services and network optimization. Joint ventures support fast deployment of localized compute capacity. Strategic alliances improve coverage across underserved regions. This trend increases service availability and accelerates regional market development. It aligns with enterprise demand for flexible and secure cloud-edge integration.

Focus on Energy Efficiency and Renewable Integration in Edge Deployments

Sustainability is emerging as a central design principle for edge facilities. Operators are adopting renewable power sources and advanced cooling systems to reduce carbon emissions. It aligns with global green data center strategies. Energy-efficient designs lower operational costs and improve reliability. Sustainability goals also attract ESG-focused investments. Advanced monitoring ensures optimal power utilization. Clean energy integration supports stable and long-term growth. This trend reflects growing alignment between technology innovation and environmental responsibility.

Market Challenges

Infrastructure Gaps and Power Supply Constraints Affecting Deployment Scalability

The Algeria Edge Data Center Market faces significant hurdles due to infrastructure limitations. Many regions still experience unstable grid power, limiting site reliability. It increases operational costs through backup generation and maintenance. Limited fiber coverage restricts deployment to urban zones, slowing rural expansion. Infrastructure gaps affect latency performance and service quality. Complex permitting processes add delays to construction timelines. These factors discourage smaller players from entering the market. Scaling beyond major cities requires coordinated investment and regulatory streamlining. Addressing infrastructure bottlenecks remains critical for market growth.

Regulatory Complexity and Cybersecurity Concerns Impacting Investor Confidence

Strict compliance requirements and fragmented regulations create challenges for operators. Enterprises must navigate data residency, security mandates, and licensing requirements. It raises compliance costs and delays market entry. Cybersecurity risks increase due to higher data volumes processed at the edge. Security gaps expose networks to operational disruptions. Inconsistent regional standards complicate cross-border data flow. These issues affect investor trust and project financing. Strengthening cybersecurity frameworks and regulatory alignment is essential. Clear policies can improve market entry conditions and support long-term stability.

Market Opportunities

Rising Private Sector Participation and Infrastructure Investments Creating Growth Avenues

Private investments are expanding rapidly, creating strong opportunities in the Algeria Edge Data Center Market. Telecom, cloud providers, and infrastructure funds are entering strategic partnerships. It supports faster deployments and advanced service offerings. High data demand from enterprises drives sustained revenue potential. Competitive positioning improves through localized services. The increasing private capital inflow strengthens ecosystem resilience. Investors find opportunities in scalable infrastructure and energy-efficient solutions. Market liberalization enhances long-term investment attractiveness.

Strong Potential for Regional Edge Hubs Supporting AI and IoT Ecosystems

Algeria is well-positioned to emerge as a strategic regional edge hub. It offers proximity to Europe and Africa, supporting cross-border connectivity. Edge hubs can enhance digital trade, cloud interconnection, and real-time applications. It aligns with regional AI and IoT adoption goals. Enterprises benefit from reduced latency and improved operational control. Edge infrastructure also supports smart city programs. These factors create a favorable investment environment for global and regional operators. The trend fosters sustainable ecosystem development.

Market Segmentation

By Component

Solutions dominate the Algeria Edge Data Center Market with the largest revenue share. Strong demand for scalable storage, network infrastructure, and compute power drives this segment. Enterprises prioritize robust solutions to support critical edge workloads. Services are gaining traction with managed operations, maintenance, and support. Service providers offer value-added services for hybrid deployments. The growth of AI and IoT accelerates solution adoption. Strong performance and security features support enterprise transformation. This segment remains a core focus for operators and investors.

By Data Center Type

Colocation edge data centers hold the highest share due to strong demand from enterprises seeking cost-efficient infrastructure. These facilities enable flexible capacity and reduce capital expenditure. Managed and cloud edge data centers follow with rapid growth. It reflects rising adoption of hybrid IT strategies. Enterprise data centers continue to support specialized workloads. The growth of regional connectivity strengthens colocation facilities’ role in network optimization. Scalability and shared resource models enhance market attractiveness. Operators focus on expanding these facilities across key cities.

By Deployment Model

Hybrid deployment models dominate the Algeria Edge Data Center Market with the largest share. Enterprises prefer hybrid strategies for flexibility, security, and cost efficiency. On-premises models are widely used in regulated industries with strict data control needs. Cloud-based models gain traction for AI, IoT, and analytics workloads. Hybrid environments support workload mobility and better resource allocation. Enterprises use hybrid architecture to achieve resilience and performance. Investors view hybrid deployments as scalable and profitable. This model aligns with future enterprise infrastructure trends.

By Enterprise Size

Large enterprises lead the market, driven by strong capital capacity and advanced IT needs. They invest in hybrid edge infrastructure to support mission-critical workloads. SMEs show growing adoption with cloud-based and managed service models. It reduces upfront costs and improves agility. Large enterprises drive demand for secure, high-performance facilities. SMEs adopt flexible pay-as-you-go strategies. This segmentation creates opportunities for diverse service models. Edge infrastructure plays a strategic role in enterprise digital transformation.

By Application / Use Case

Power monitoring leads the market with the largest share due to strong energy efficiency demands. Asset and capacity management follow closely, supporting infrastructure optimization. Environmental monitoring is growing as sustainability becomes a key priority. Business intelligence and analytics support real-time decision-making. Enterprises seek applications that reduce downtime and enhance performance. It aligns with operational goals across industries. These use cases drive investments in edge technologies. Scalability and flexibility remain major selection criteria for adopters.

By End User Industry

IT and telecommunications dominate the Algeria Edge Data Center Market due to heavy data traffic and 5G deployments. BFSI follows with growing data sovereignty and security needs. Healthcare shows rapid adoption for real-time patient data processing. Retail and e-commerce leverage edge infrastructure for customer experience optimization. Energy and utilities adopt edge for smart grid applications. Aerospace and defense focus on secure and mission-critical deployments. Diverse industry adoption strengthens market depth and long-term stability.

Regional Insights

Northern Region Leading with High Market Concentration and Infrastructure Readiness

The northern region holds 47.2% share of the Algeria Edge Data Center Market. This region benefits from strong fiber networks, proximity to Algiers, and government digital initiatives. Urban centers host the majority of colocation and hybrid edge facilities. Investors favor the region due to reliable power and regulatory clarity. Telecom operators deploy advanced edge hubs to support AI and 5G. The area’s infrastructure readiness drives faster adoption among enterprises. The concentration of demand and supply strengthens its leadership position.

- For instance, in February 2025, Algérie Télécom partnered with Huawei to deploy a 400G WDM all-optical backbone network, boosting high-speed and low-latency connectivity for digital services, with nationwide coverage directly supporting urban colocation facilities and enabling robust infrastructure for AI and 5G adoption.

Central Region Gaining Momentum Through Expanding Industrial and IoT Adoption

The central region accounts for 31.5% share, supported by expanding industrial zones and IoT adoption. Smart manufacturing and logistics sectors are driving demand for edge capacity. Enterprises deploy modular data centers to support local processing. Strong collaboration between public and private entities accelerates infrastructure development. Telecom operators expand networks to reduce latency and improve coverage. Strategic location supports better connectivity to northern hubs. The region is becoming a key growth contributor in the national edge ecosystem.

- For instance, in March 2025, the Algerian government broke ground on an AI-focused data center in Oran, designed to provide advanced computing resources for researchers, startups, and academic institutions, with direct support from Huawei on digital transformation initiatives in the region.

Southern Region Emerging as a Growth Frontier with High Infrastructure Potential

The southern region holds 21.3% share and is emerging as a promising market. It benefits from expanding renewable energy projects and government incentives for infrastructure development. Modular and prefabricated edge facilities are being deployed in energy and utility sectors. Telecom providers focus on improving coverage to support enterprise connectivity. Investors view this region as a frontier for long-term expansion. Growth in industrial activities and smart projects strengthens demand for edge computing. This region plays a strategic role in balanced national digital growth.

Competitive Insights:

- Algérie Telecom

- Djaweb

- Mobilis

- Africa Data Centres

- Groupe Télécom Algérie

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Fujitsu

- Cisco

- SixSq

- Microsoft

- VMWare

- Schneider Electric SE

- Rittal GmbH & Co. KG

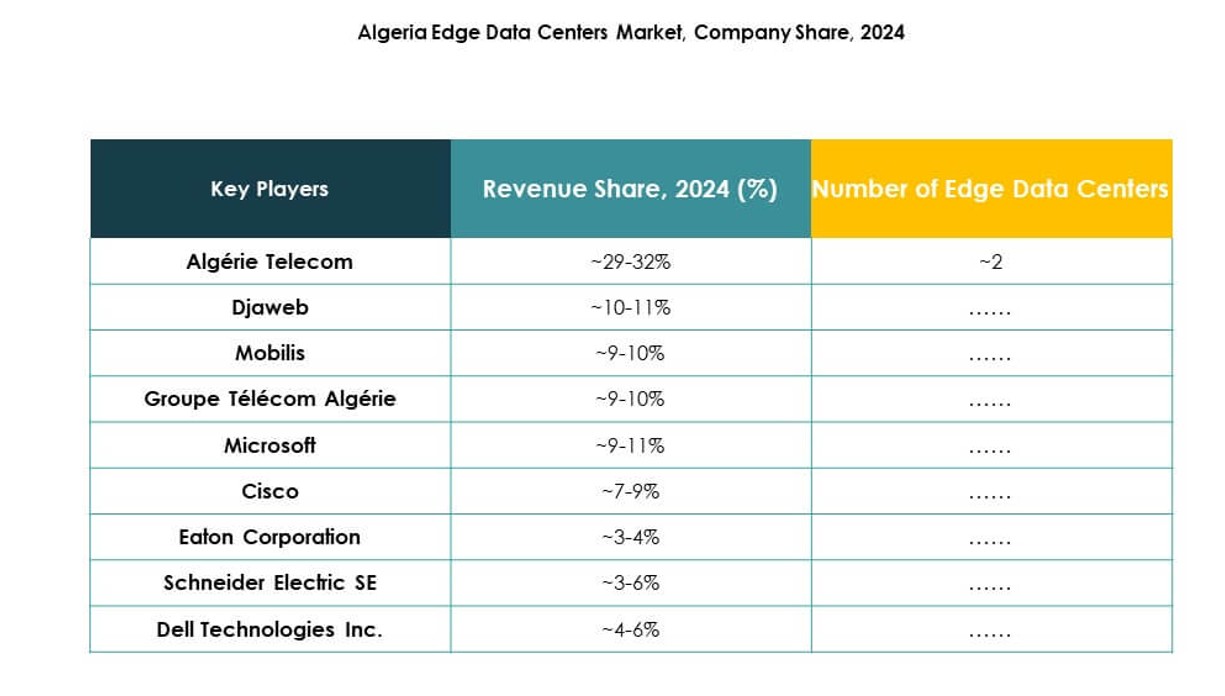

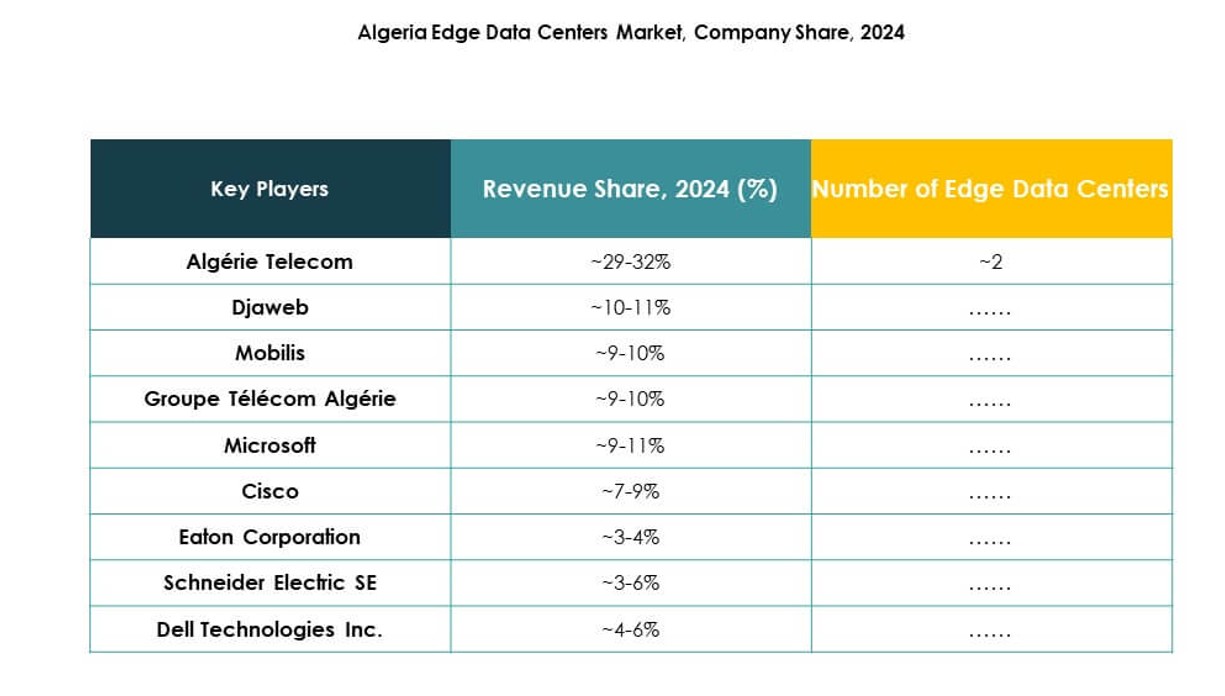

The competitive landscape of the Algeria Edge Data Center Market is shaped by a mix of domestic telecom operators and global technology providers. Algérie Telecom, Djaweb, and Mobilis dominate network infrastructure and regional deployments. Africa Data Centres and EdgeConneX expand edge capabilities through scalable colocation models. Eaton, Dell, Fujitsu, and Cisco strengthen power, compute, and networking solutions. Global software vendors like Microsoft and VMWare drive hybrid and cloud-edge integration. Schneider Electric and Rittal lead infrastructure efficiency and modular design. It reflects a balanced ecosystem where local operators ensure reach, while global firms drive innovation, sustainability, and capacity scaling. This dynamic fosters competitive pricing, rapid deployment, and continuous technological advancement.

Recent Developments:

- In July 2025, Sparkle and Algérie Télécom signed a memorandum of understanding (MoU) at the Italy-Algeria Business Forum to establish a new subsea cable linking Italy and Algeria. This project aims to enhance Algeria’s international connectivity, strengthen its data infrastructure, and support the deployment of edge data centers by improving link redundancy and reducing latency in data flows between Europe and North Africa.

- In June 2025, Eaton Corporation and Siemens Energy forged a partnership to accelerate modular data center construction through integrated power and cooling solutions. The initiative focuses on grid-independent power systems combining gas turbines and battery storage to enable faster, more sustainable data center deployment worldwide, including in emerging African markets like Algeria.

- In April 2025, Mobilis completed successful 5G trials in Algiers, achieving speeds up to 1.2 Gbps. The company announced that a full commercial rollout of 5G services across the country will begin in the second half of 2025, marking a significant step toward Algeria’s digital transformation objectives.

- In March 2025, the Algerian government initiated the construction of an AI-focused data center in Oran, designed to provide computing resources for startups, researchers, and educational institutions. The project, supported by Huawei, will be instrumental in Algeria’s plan to make AI contribute up to seven percent of GDP by 2027.

- In February 2025, Algérie Télécom partnered with Huawei to launch a 400G WDM national backbone project aimed at enhancing high-speed connectivity across Algeria. The initiative is part of the country’s ongoing effort to boost network capacity and accelerate the digital economy. The project provides a resilient backbone infrastructure to support emerging sectors like e-commerce, cloud computing, and smart cities.

Market Drivers

Market Drivers