Executive summary:

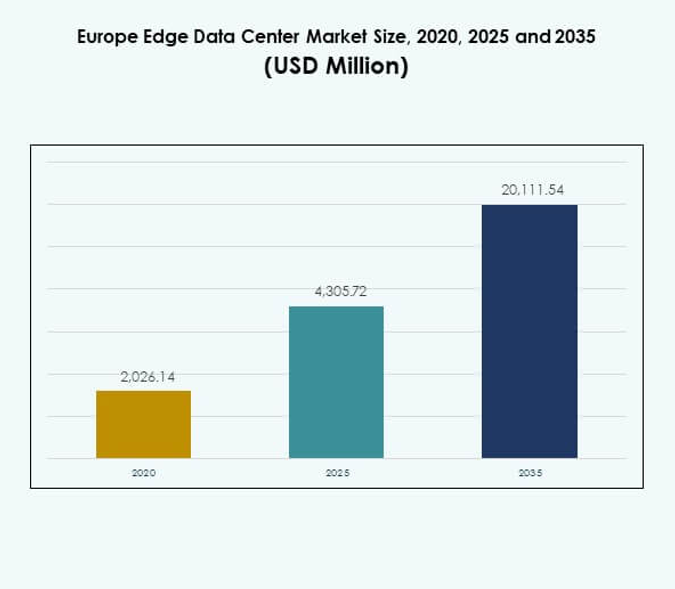

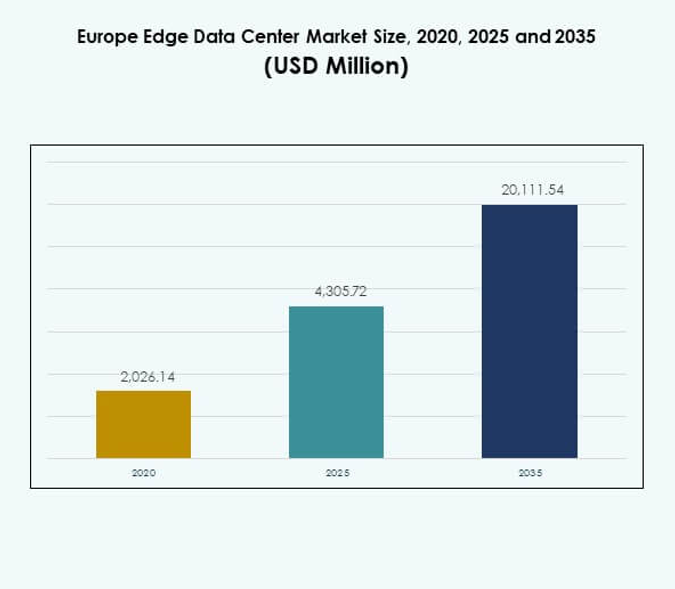

The Europe Edge Data Center Market size was valued at USD 2,026.14 million in 2020, grew to USD 4,305.72 million in 2025, and is anticipated to reach USD 20,111.54 million by 2035, at a CAGR of 16.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2025 |

| Forecast Period |

2025-2035 |

| Europe Edge Data Center Market Size 2025 |

USD 4,305.72 Million |

| Europe Edge Data Center Market, CAGR |

16.53% |

| Europe Edge Data Center Market Size 2035 |

USD 20,111.54 Million |

The market growth is driven by rapid digital transformation, expanding 5G networks, and the increasing need for low-latency data processing. Enterprises are investing in edge computing to enhance performance, enable real-time analytics, and support AI-driven operations. Continuous innovation in modular infrastructure and energy-efficient designs is shaping the future of data management. The market holds strategic importance for investors as it underpins Europe’s evolving digital economy and enterprise modernization initiatives.

Western Europe leads the regional landscape with a strong presence of hyperscale operators and established connectivity networks. The UK, Germany, and France remain key markets due to advanced digital infrastructure and high cloud adoption. Northern and Southern European countries are expanding edge deployments through telecom-led initiatives and smart city projects, while Eastern Europe emerges as a growth hub supported by improving power infrastructure and increasing enterprise IT investments.

Market Drivers

Rising Demand for Low-Latency Data Processing and Cloud Integration

The Europe Edge Data Center Market is growing due to the increasing need for faster data processing and reduced latency. Businesses require real-time insights for AI, IoT, and digital services, driving investment in edge infrastructures near end-users. Enterprises are adopting cloud-edge integration to manage workloads efficiently and improve application performance. Telecom operators are expanding edge nodes to support 5G deployment, improving connectivity for smart cities. This trend is transforming traditional IT infrastructure into a distributed model. Investors view this expansion as a critical step toward digital competitiveness. It strengthens network resilience and operational flexibility for regional businesses.

Technological Innovations Driving Infrastructure Efficiency and Scalability

Advanced technologies such as liquid cooling, modular systems, and AI-based workload optimization are reshaping infrastructure standards. Companies are adopting intelligent automation to monitor power, temperature, and capacity in real time. The integration of renewable energy sources is reducing operational costs and improving sustainability scores. Edge data centers now support flexible configurations, making them suitable for both hyperscale and micro-scale operations. Vendors focus on containerized solutions to achieve scalability and reduce setup time. It creates a strategic advantage by minimizing downtime and operational risks. This innovation-led expansion attracts both enterprise and institutional investments across Europe.

- For example, Vertiv’s Liebert DSE system is the world’s most widely deployed pumped refrigerant economization technology, installed at over 8,500 data center sites globally. It delivers mechanical PUE as low as 1.03, improving energy efficiency while eliminating water usage in cooling operations.

Accelerating Digital Transformation Across Industries and Enterprises

Industries such as retail, healthcare, and manufacturing are embracing digital tools that rely on real-time computing. Edge networks enable faster decision-making and secure data exchange between connected devices. The Europe Edge Data Center Market benefits from rising adoption of Industry 4.0 and autonomous systems. Businesses are optimizing customer experiences through localized data analytics. This shift enhances efficiency and competitiveness in global operations. IT leaders view edge deployment as a bridge between centralized cloud and on-premises systems. It supports innovation ecosystems and strengthens digital sovereignty across European economies.

Strategic Importance for Businesses and Investment Growth Potential

Investors and enterprises recognize edge facilities as strategic assets for digital transformation. The market’s decentralization supports operational agility and reduces reliance on distant cloud servers. Financial institutions, telecoms, and hyperscale providers are investing heavily in infrastructure expansion. The growth aligns with EU policies promoting digital sustainability and regional data security. Companies gain value through cost optimization and faster service delivery. The Europe Edge Data Center Market attracts global funding for smart city, AI, and autonomous vehicle projects. It represents a key enabler of Europe’s next-generation connectivity and digital infrastructure goals.

- For example, in August 2025, BT Group and AWS signed a new five-year partnership. This deal leverages AWS cloud services with BT’s UK network to enhance edge computing for enterprise and public sector clients.

Market Trends

Expansion of AI-Optimized and Autonomous Edge Networks

AI-driven automation is redefining how edge networks manage workloads, security, and energy use. Data centers now integrate predictive analytics for capacity and traffic management. Operators deploy autonomous systems to ensure uptime and prevent failures. The Europe Edge Data Center Market benefits from these advancements, enhancing network responsiveness. Intelligent cooling and self-healing systems improve sustainability. Businesses rely on AI-enabled edge analytics for real-time decision-making. This trend reduces operational complexity and supports scalable, adaptive infrastructure. It strengthens the competitive positioning of service providers across Europe.

Growing Adoption of Modular and Prefabricated Edge Facilities

Enterprises are shifting toward modular designs that allow quick deployment and scalability. Prefabricated data centers enable faster installation and lower upfront costs. Vendors focus on standardized designs to ensure flexibility and energy efficiency. The Europe Edge Data Center Market reflects rising demand for modular construction in both urban and remote regions. Modular systems are well-suited for telecom and industrial applications where space is limited. The trend accelerates market expansion by reducing operational downtime. It supports sustainable infrastructure growth and adaptive capacity management across diverse industries.

Increased Emphasis on Renewable Energy and Sustainability Goals

Operators are integrating renewable energy to reduce carbon emissions and align with EU climate targets. Companies invest in solar, wind, and hydrogen-based power systems for clean operations. Energy efficiency metrics such as PUE are becoming key performance indicators. The Europe Edge Data Center Market benefits from this transition to low-carbon infrastructure. Data center designs increasingly adopt closed-loop cooling and battery energy storage. Sustainability initiatives improve brand reputation and attract green investors. The trend drives long-term cost efficiency while supporting Europe’s environmental goals. It marks a shift toward cleaner, smarter, and resilient edge infrastructure.

Rising Partnerships Between Telecom Providers and Cloud Companies

Collaboration between telecom and cloud providers is expanding network reach and data processing efficiency. Telecom companies leverage partnerships to host distributed edge nodes near consumers. Cloud vendors integrate services to support hybrid architectures and localized workloads. The Europe Edge Data Center Market experiences growth from these synergistic alliances. Joint ventures focus on improving interconnectivity and customer service reliability. The integration supports advanced use cases such as AR/VR and connected vehicles. It strengthens the ecosystem for next-generation digital services. These partnerships drive innovation and market expansion across Europe.

Market Challenges

High Infrastructure Costs and Complexity in Network Integration

Building and maintaining edge facilities require significant capital investment and complex infrastructure management. Power, cooling, and security systems must meet high operational standards across dispersed sites. The Europe Edge Data Center Market faces hurdles in aligning connectivity and interoperability among various providers. Small and medium enterprises often find deployment cost-prohibitive. Managing multi-location data synchronization adds to operational strain. Limited availability of skilled technical professionals further slows implementation. It challenges market scalability despite rising digital demand. Ensuring consistent performance across regions remains a persistent obstacle for stakeholders.

Regulatory Compliance and Data Sovereignty Constraints

Strict European data protection and sustainability regulations increase compliance costs for operators. Varying national policies on data residency complicate cross-border operations. The Europe Edge Data Center Market must balance scalability with adherence to the EU’s digital sovereignty goals. Companies face difficulties managing diverse legal frameworks while maintaining operational efficiency. Energy usage reporting and emission standards demand constant monitoring. It adds complexity to infrastructure management and vendor coordination. Security and privacy obligations require continual investment in advanced encryption systems. These constraints limit speed of expansion and increase operational expenditure.

Market Opportunities

Expansion of 5G Networks and IoT Ecosystem Integration

The rollout of 5G across Europe creates significant potential for localized edge deployments. Telecom operators and enterprises are investing in edge nodes to support ultra-low latency applications. The Europe Edge Data Center Market benefits from strong adoption of IoT devices across healthcare, retail, and manufacturing sectors. It enables real-time monitoring, analytics, and automation. The convergence of AI and IoT provides a scalable business model for infrastructure providers. These opportunities drive ecosystem collaboration and stimulate regional economic development.

Government-Led Digital Infrastructure Investments and Green Data Initiatives

European governments are supporting data localization and sustainable digital expansion. Funding programs target green energy adoption and advanced cooling solutions. The Europe Edge Data Center Market aligns with EU digital resilience and energy transition goals. Public-private partnerships promote faster deployment of localized computing hubs. It fosters innovation while addressing environmental objectives. Growing interest from global investors encourages further R&D in automation and efficient architecture design. This focus strengthens Europe’s leadership in sustainable data infrastructure growth.

Market Segmentation

By Component

The solution segment holds the dominant share driven by strong demand for networking, cooling, and power systems. Services such as maintenance and monitoring follow, supported by managed service adoption. The Europe Edge Data Center Market benefits from continuous investment in integrated solution offerings. Companies prioritize modular hardware and AI-based management systems to enhance uptime and efficiency.

By Data Center Type

Colocation edge data centers dominate the segment, capturing significant market share due to flexibility and cost-effectiveness. Enterprises prefer shared facilities to reduce capital expenditure and improve scalability. The Europe Edge Data Center Market gains traction from hyperscalers expanding hybrid and micro-edge operations. Managed and cloud-edge models are witnessing fast growth in telecom and enterprise verticals.

By Deployment Model

The hybrid deployment model leads due to the combination of on-premises control and cloud scalability. Enterprises use hybrid systems to manage workloads and ensure data compliance. The Europe Edge Data Center Market benefits from rising integration between public cloud providers and private infrastructure. It offers resilience, flexibility, and improved disaster recovery capabilities for enterprises.

By Enterprise Size

Large enterprises dominate the market due to higher budgets for infrastructure modernization and security. SMEs are adopting edge solutions gradually to optimize operational efficiency. The Europe Edge Data Center Market experiences increasing participation from mid-sized firms leveraging managed service models. It supports digital transformation while minimizing infrastructure ownership costs.

By Application / Use Case

Power monitoring remains the leading application segment supported by demand for efficient energy usage. Environmental monitoring and asset management are also gaining traction due to sustainability initiatives. The Europe Edge Data Center Market emphasizes predictive analytics for optimizing facility performance. BI and analysis applications enhance decision-making for enterprise operations.

By End User Industry

The IT and telecommunications segment holds the largest market share supported by cloud expansion and 5G rollout. BFSI and retail sectors are adopting edge for secure, low-latency transactions. The Europe Edge Data Center Market sees growing adoption in healthcare for real-time diagnostics and data processing. Energy and utilities also utilize edge for grid monitoring and smart infrastructure management.

Regional Insights

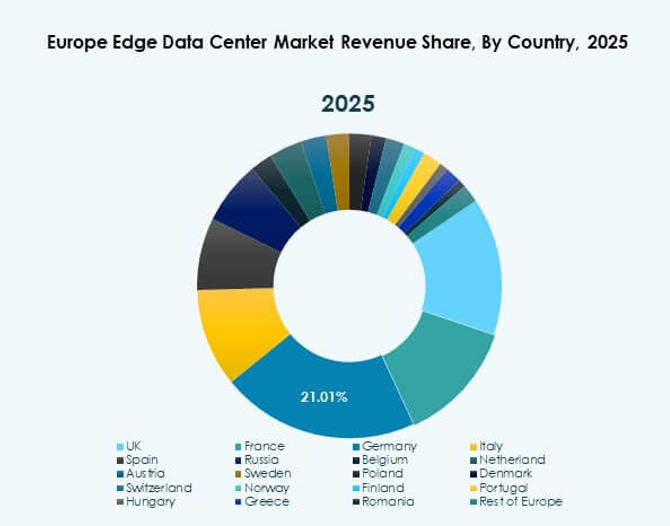

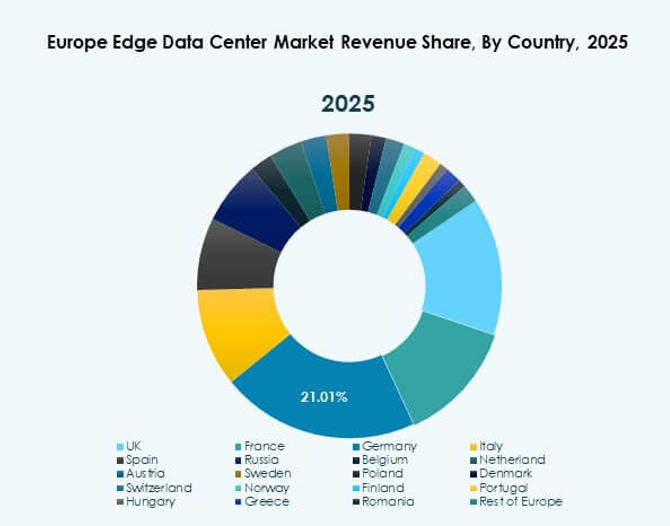

Western Europe: Established Market with Strong Digital Infrastructure

Western Europe dominates the Europe Edge Data Center Market with a 48% share. The UK, Germany, and France lead through robust cloud adoption and advanced connectivity networks. High data consumption and enterprise modernization initiatives strengthen regional growth. Telecom operators and hyperscale providers are expanding edge nodes to improve latency and bandwidth. Governments support sustainability through renewable power and energy-efficient systems. It remains the core hub for innovation, investment, and strategic partnerships.

- For instance, Deutsche Telekom deployed a 5G network and an edge data center at the Volkswagen port terminal in Emden, Germany in August 2024—enabling autonomous car logistics for more than 1 million vehicles handled annually at the site and digital twin creation using LiDAR sensors.

Northern and Southern Europe: Rapid Expansion through 5G and Cloud Adoption

Northern and Southern Europe collectively account for 32% of the market share. Countries like the Netherlands, Italy, and Spain are investing in hybrid infrastructure and 5G deployment. Regional data center operators focus on modular facilities and renewable energy integration. The Europe Edge Data Center Market experiences demand from retail, logistics, and BFSI sectors. Governments provide incentives for data localization and digital infrastructure. It drives consistent growth in these subregions supported by technological readiness.

Eastern Europe: Emerging Market with Strategic Investment Potential

Eastern Europe holds a 20% share of the market, representing strong potential for future growth. Countries such as Poland, Czech Republic, and Hungary are emerging as data center investment destinations. Affordable land, improving energy grids, and growing enterprise IT adoption attract foreign investors. The Europe Edge Data Center Market benefits from rising partnerships in colocation and telecom sectors. Governments are aligning policies to support digital transformation. It positions Eastern Europe as a promising region for infrastructure expansion and innovation.

- For instance, Data4 Group inaugurated its first Polish data center campus in Jawczyce, near Warsaw, on May 23, 2023, with a total planned capacity of 60 MW and IT space of 15,000 m² across four facilities backed by local government and international investors.

Competitive Insights:

- 365 Operating Company

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Compass Datacenters

- Fujitsu

- American Tower

- Cisco

- SixSq

- Microsoft

- VMware

- Schneider Electric SE

- Rittal GmbH & Co. KG

The Europe Edge Data Center Market features strong competition among established technology providers, infrastructure specialists, and cloud service companies. It is driven by rapid investments in modular edge facilities, energy-efficient power systems, and 5G connectivity. Schneider Electric SE, Eaton, and Rittal lead in infrastructure solutions, focusing on advanced power and cooling systems. Microsoft, Cisco, and VMware dominate software and cloud integration segments, enhancing operational agility for enterprises. EdgeConneX and Compass Datacenters emphasize localized deployments and sustainability-driven models. American Tower and 365 Operating Company expand through strategic acquisitions and regional partnerships. Fujitsu and SixSq focus on hybrid computing and AI-based edge services, strengthening Europe’s distributed data ecosystem.

Recent Developments:

- In September 2025, Cisco launched the Sovereign Critical Infrastructure portfolio for Europe, a configurable hardware and software suite that enables high levels of digital autonomy, compliance, and security for edge data centers, and is designed specifically for government and regulated sectors across the continent.

- In August 2025, VMware, under Broadcom, introduced major product launches at VMware Explore 2025, including Private AI Services for VCF and Tanzu Data Intelligence aimed at enterprise AI adoption, expanded edge computing capabilities, and tools to support sustainability and compliance in European edge environments.

- In June 2025, Eaton Corporation revealed a partnership with Siemens Energy to deliver a modular gas-powered solution tailored for data centers, offering scalable on-site power capabilities to accelerate data center construction and enhance grid-independent energy supply options throughout Europe.

- In January 2024, EdgeConneX entered a global partnership with EQT Infrastructure to build and operate high-powered, purpose-built data centers, expanding further into new European markets to support hyperscale and edge requirements for cloud and AI workloads.