Executive summary:

The Brazil Edge Data Center Market size was valued at USD 182.95 million in 2020 to USD 421.13 million in 2025 and is anticipated to reach USD 1,994.49 million by 2035, at a CAGR of 16.68% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Brazil Edge Data Center Market Size 2025 |

USD 421.13 Million |

| Brazil Edge Data Center Market, CAGR |

16.68% |

| Brazil Edge Data Center Market Size 2035 |

USD 1,994.49 Million |

The market growth is driven by rapid digital transformation, widespread 5G adoption, and increasing IoT integration. Rising demand for low-latency infrastructure supports the shift toward localized processing and scalable networks. Enterprises and hyperscalers view edge deployments as critical for improving operational efficiency and ensuring data compliance. These factors make the Brazil Edge Data Center Market a strategic focal point for long-term investments.

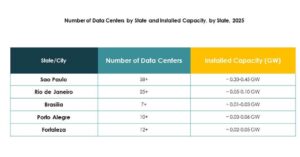

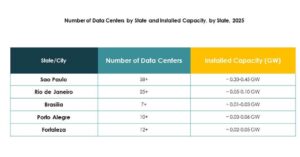

Southeast Brazil, led by São Paulo and Rio de Janeiro, dominates the market due to robust infrastructure, strong connectivity, and enterprise concentration. The North and Northeast regions are emerging with increased investments and improved network reach. This geographic expansion supports broader digital inclusion and drives infrastructure diversification across the country.

Market Drivers

Rising Data Localization Requirements Strengthening Edge Infrastructure Deployment Across Industries

Tightening data protection rules are driving the need for localized processing capacity. Enterprises aim to reduce latency while meeting regulatory obligations, pushing investment toward distributed infrastructure. 5G integration supports high-performance applications across smart manufacturing, e-commerce, and financial services. Edge infrastructure enables faster delivery of digital services, enhancing customer experience. Businesses view this shift as vital for operational resilience. Investors see stable returns due to long-term demand for low-latency networks. The Brazil Edge Data Center Market benefits from this environment. It supports a robust ecosystem for enterprise transformation.

- For instance, ODATA announced in March 2025 the construction of its new DC SP04 data center in Osasco, São Paulo, with a capacity of 48 MW and an investment exceeding USD 450 million. This facility introduces the Delta Cube (Delta³) cooling system, enabling power densities of up to 50kW per rack supporting the intense processing and localization requirements driven by tighter data protection regulations.

Accelerated Digital Transformation Driving Enterprise Demand For Edge Connectivity Solutions

Expanding enterprise adoption of digital tools is creating sustained pressure on network infrastructure. Organizations require faster data access to support automation, analytics, and real-time processing. The demand for edge connectivity grows as enterprises expand their digital operations. Improved processing near the source ensures reduced network congestion and better efficiency. This model aligns with critical industries like telecom and finance. Investors recognize the strategic value of scalable edge systems. The Brazil Edge Data Center Market attracts capital for infrastructure modernization. It creates a foundation for long-term business competitiveness.

Expansion Of AI, IoT, And 5G Ecosystems Increasing Infrastructure Integration Needs

Rapid development of AI, IoT, and 5G networks is transforming network architectures. Companies require distributed facilities to handle increasing data volume and speed demands. Edge infrastructure supports these technologies by enabling faster analysis and localized computing. This shift improves operational agility and real-time insights. Industries like healthcare and logistics benefit from reduced delays in critical data flow. Enterprises integrate edge systems to support automated decision-making. The Brazil Edge Data Center Market evolves with this trend. It builds a reliable base for next-generation digital ecosystems.

- For instance, Scala Data Centers announced plans in September 2024 to build “Scala AI City” in Eldorado do Sul, Brazil, commencing with an initial investment of USD 500 million. The facility will deploy sustainable, high-density data centers supporting rack densities up to 150 kW for AI, IoT, and 5G applications, with eventual expansion anticipated to reach 4.7 GW capacity.

Strategic Business And Investment Momentum Enhancing Market Expansion Potential

Private and public investments in infrastructure drive sustained market growth. Stakeholders prioritize projects that enhance resilience and support digital expansion. Partnerships between global hyperscalers and regional providers improve deployment capacity. Enterprises see edge as essential for scaling their digital services in competitive sectors. The market’s maturity attracts new entrants focused on specialized solutions. Strong demand for connectivity boosts infrastructure upgrades in urban and emerging areas. The Brazil Edge Data Center Market stands as a strategic investment target. It positions businesses for stronger technological leadership.

Market Trends

Integration Of Sustainable And Energy-Efficient Design Practices In Edge Facilities

Green design is becoming a key trend in infrastructure planning. Operators adopt advanced cooling technologies and renewable energy sources to reduce operational costs. Low PUE targets reflect growing emphasis on sustainable data operations. Enterprises favor providers with strong environmental performance. This shift aligns with global ESG commitments and customer preferences. Renewable energy partnerships support long-term power availability. The Brazil Edge Data Center Market incorporates these sustainable strategies. It aligns with global green infrastructure development goals.

Growing Demand For Modular And Scalable Edge Infrastructure Solutions

Modular design supports faster deployment and improved cost efficiency. Operators prefer flexible builds that can scale with traffic demands. Containerized edge units allow expansion without major construction delays. Telecom and enterprise customers rely on modular structures for operational agility. Scalability reduces risks tied to changing workloads and digital transformation speed. Investors favor infrastructure models that offer flexible returns. The Brazil Edge Data Center Market moves toward such scalable approaches. It supports dynamic growth across multiple verticals.

Adoption Of AI-Driven Automation And Predictive Management Tools

Operators increasingly use AI to optimize facility performance and reduce downtime. Predictive tools enhance power usage, environmental control, and security. Automated systems detect performance gaps before they impact service delivery. This approach lowers operational risks and increases infrastructure uptime. Businesses value these tools for improved cost control and reliability. AI integration aligns with the sector’s push toward intelligent infrastructure. The Brazil Edge Data Center Market reflects this shift to automated management. It supports more efficient and stable operations.

Edge Interconnection Ecosystems Expanding Regional And Global Network Reach

Interconnection between regional edge sites creates stronger network resilience. Providers focus on integrating multiple edge nodes to support critical services. This connectivity boosts efficiency for cloud and telecom workloads. Growing enterprise demand drives expansion beyond major urban centers. It enhances service reach for e-commerce, finance, and content distribution sectors. Partnerships among carriers and hyperscalers strengthen network reach. The Brazil Edge Data Center Market gains momentum from this interconnection trend. It becomes a key hub for distributed infrastructure.

Market Challenges

Infrastructure Limitations And High Initial Investment Restricting Rapid Deployment

Building distributed infrastructure requires significant upfront capital. Smaller providers struggle with funding and regulatory compliance costs. Limited grid capacity and land access slow down new site rollouts. Supply chain gaps create delays in equipment delivery and project timelines. High setup costs reduce participation from mid-size operators. These constraints limit nationwide coverage and operational flexibility. The Brazil Edge Data Center Market faces pressure to balance cost and expansion. It must address financing gaps to maintain growth momentum.

Regulatory Complexities And Talent Shortages Hindering Operational Efficiency

Complex data protection laws create additional compliance burdens for operators. Navigating these rules requires legal expertise and advanced security frameworks. Limited availability of skilled professionals complicates implementation of modern edge systems. The shortage of specialized technical talent impacts service reliability. Security concerns over distributed networks further raise operational challenges. Operators face delays in scaling infrastructure across regions. The Brazil Edge Data Center Market must overcome these barriers. It requires coordinated industry and policy efforts to sustain competitiveness.

Market Opportunities

Growing Investments In Edge Infrastructure To Support National Digital Expansion

Increased public and private investments create strong opportunities for network expansion. New facilities aim to serve emerging regions with strong demand for digital services. Enterprises view edge infrastructure as a key enabler of real-time applications. Strong connectivity upgrades drive faster adoption in financial, retail, and telecom sectors. Partnerships accelerate rollout and improve resource utilization. The Brazil Edge Data Center Market benefits from these investments. It positions the country as a regional digital infrastructure hub.

Integration With Emerging Technologies Creating New Revenue Streams

AI, IoT, and 5G applications generate opportunities for specialized edge services. Operators can develop sector-focused offerings for smart cities, telemedicine, and fintech. Localized processing enhances performance for advanced applications. Demand for secure and scalable solutions fuels rapid adoption. Enterprises seek trusted partners to manage growing workloads. The Brazil Edge Data Center Market leverages these shifts. It opens diverse monetization avenues for providers and investors.

Market Segmentation

By Component

Solutions hold the largest share due to rising demand for integrated infrastructure platforms. Enterprises prioritize reliable hardware and software stacks that support scalable deployment. These solutions enable faster processing, lower latency, and better data control. Service demand grows with managed offerings and specialized maintenance contracts. Vendors focus on integrated packages for operational ease. The Brazil Edge Data Center Market sees strong traction in solution-led growth. It reflects enterprise preference for comprehensive edge infrastructure systems.

By Data Center Type

Colocation edge data centers lead due to their flexibility, lower cost, and multi-tenant design. Businesses use colocation facilities to reduce capital expenditure and scale quickly. Managed and cloud-edge facilities also show steady growth. These types attract enterprises seeking agility and reduced infrastructure management burden. Colocation enables regional expansion for global hyperscalers. The Brazil Edge Data Center Market benefits from rising colocation adoption. It strengthens competitive dynamics among operators.

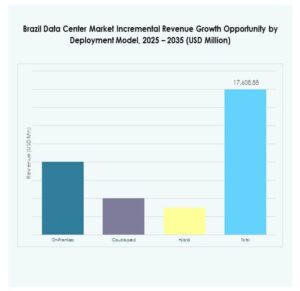

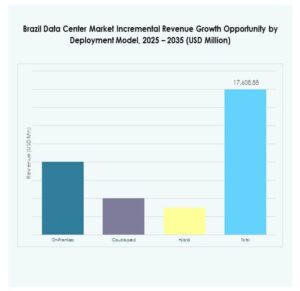

By Deployment Model

Hybrid deployment dominates due to its balance of control and scalability. Enterprises combine on-premises infrastructure with cloud platforms for flexibility. This model supports regulatory compliance and efficient data management. Cloud-based deployments gain traction in sectors prioritizing agility. On-premises remains important for critical applications. Hybrid architecture suits industries with dynamic workloads and strict governance. The Brazil Edge Data Center Market reflects this deployment mix. It supports resilient and adaptable enterprise operations.

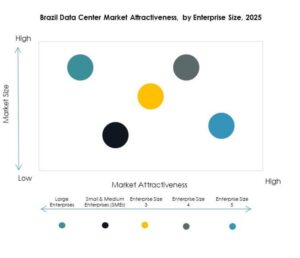

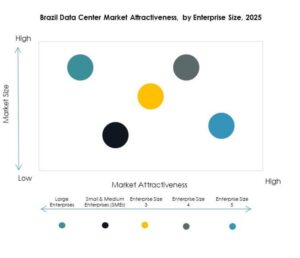

By Enterprise Size

Large enterprises hold the dominant share due to strong infrastructure budgets and data processing needs. These organizations drive demand for advanced, scalable, and secure edge platforms. SMEs adopt modular deployments to remain cost-efficient and competitive. Flexible pricing models and managed services support SME participation. Larger players lead in investment volume and project scale. SMEs contribute to wider geographic coverage and service diversification. The Brazil Edge Data Center Market gains balanced growth through both segments. It builds a broad and resilient customer base.

By Application / Use Case

Power monitoring leads due to its role in operational efficiency and reliability. Edge sites require advanced tools to optimize energy use and maintain stability. Capacity management and environmental monitoring follow closely with increased automation. BI and analysis applications grow with rising data-driven strategies. Asset management adoption expands across manufacturing and retail sectors. Applications drive differentiated service offerings and revenue diversification. The Brazil Edge Data Center Market sees steady application-layer innovation. It reinforces infrastructure performance and enterprise value.

By End User Industry

IT and telecommunications lead due to high connectivity and service delivery demands. BFSI follows with strong security and performance requirements. Healthcare, retail, and energy sectors accelerate adoption to support critical operations. Aerospace and defense invest in secure and resilient networks. Other industries contribute to overall ecosystem expansion. Edge plays a vital role in improving uptime and compliance. The Brazil Edge Data Center Market benefits from multi-sector adoption. It secures long-term demand for distributed infrastructure.

Regional Insights

Southeast Region Leading With Strong Digital Infrastructure And 42% Market Share

Southeast Brazil remains the dominant subregion due to high concentration of enterprises and robust connectivity. São Paulo and Rio de Janeiro drive demand for advanced infrastructure. Strong telecom networks and hyperscaler presence support rapid deployment. Enterprises choose this region for its stable energy supply and skilled workforce. It continues to attract investments in high-density edge nodes. The Brazil Edge Data Center Market gains its highest growth momentum here. It solidifies the region’s role as a national digital core.

- For instance, Equinix expanded its SP4 data center in São Paulo in February 2021 with a US$59 million investment, increasing total colocation space by more than 65% an addition of 3,838 square meters and 1,025 cabinets making it the most interconnected data center in Latin America and a critical hub for digital exchange and hyperscaler interconnection.

South Region Expanding With Emerging Investment Projects And 27% Market Share

The South region shows steady infrastructure expansion driven by growing enterprise activity. Urban centers like Curitiba and Porto Alegre support localized data distribution. New deployments focus on modular and energy-efficient builds. This subregion attracts partnerships between telecom operators and hyperscalers. Strong economic development supports long-term growth of digital ecosystems. The Brazil Edge Data Center Market strengthens its reach in this subregion. It establishes a reliable edge connectivity layer for enterprises.

- For instance, V.tal, a neutral digital infrastructure provider, began construction in September 2023 on V.OA, its first edge data center in the South region (Porto Alegre, Rio Grande do Sul), designed for 6 MW capacity and 400 racks, with an investment of R$250 million (US$50.6 million); this project brings edge infrastructure and reduced latency to southern Brazil’s digital ecosystem.

North And Northeast Regions Gaining Momentum With 31% Combined Market Share

North and Northeast regions show rising interest from investors and service providers. Digital inclusion programs and expanding connectivity fuel infrastructure growth. Investments aim to improve edge coverage in underserved areas. Renewable energy sources support sustainable deployments in these regions. This expansion creates opportunities for telecom and content providers. The Brazil Edge Data Center Market diversifies its geographic base here. It builds resilience and nationwide coverage through balanced regional development.

Competitive Insights:

- Local Telecom Operators

- American Tower

- Huawei Technologies

- Equinix

- Digital Realty

- EdgeConneX

- Fujitsu

- Cisco

- Eaton Corporation

- Dell Technologies Inc.

- Microsoft

- VMWare

- Schneider Electric SE

- Rittal GmbH & Co. KG

- Others

The competitive landscape of the Brazil Edge Data Center Market features strong participation from global infrastructure leaders and domestic telecom operators. It is shaped by advanced colocation capabilities, modular edge deployments, and strategic partnerships. Global players focus on expanding footprint through hyperscale-ready edge sites, while local operators strengthen regional coverage with network-driven solutions. Many providers emphasize low-latency infrastructure, energy efficiency, and security to meet growing enterprise demand. Competitive intensity remains high due to accelerated investments in AI and 5G-ready architectures. Vendors pursue mergers, acquisitions, and capacity expansions to secure long-term positioning. This landscape favors firms with strong integration capabilities and localized service delivery.

Recent Developments:

- In October 2025, Eletrobras, a leading Brazilian power company, announced plans to develop its first data center in Campinas, marking its debut initiative in the edge and cloud data infrastructure sector in Brazil. This step reflects Eletrobras’ expansion into digital infrastructure beyond its traditional energy focus, with intentions to play a significant role in the rapidly evolving Brazilian data center landscape.

- In October 2025, ZTE participated in Futurecom 2025 in São Paulo, unveiling its “Efficient AI DC, Flexible Expansion” edge data center solution for the Brazilian market. The new solutions featuring expanded G6 server lines in partnership with Intel are specifically designed for enterprise virtualization, AI/high-performance computing, and 5G multi-access edge computing markets across Brazil.

- In September 2025, Netmore Group entered into an agreement to take over the commercial operations of the LoRaWAN network previously run by American Tower Corporation in Brazil. Through this acquisition, Netmore will now oversee network management, customer relations, and service delivery across the region, building on its earlier purchase of Everynet, which had partnered with American Tower to provide nationwide IoT coverage.

- In August 2025, Huawei Technologies launched the latest Xinghe Intelligent Network portfolio for Latin America at the Huawei Network Summit in São Paulo, Brazil. The new product suite includes solutions for campus, wide area, and data center networks, featuring built-in AI computing capabilities and comprehensive network security features tailored for AI-driven enterprises in the region.