Executive summary:

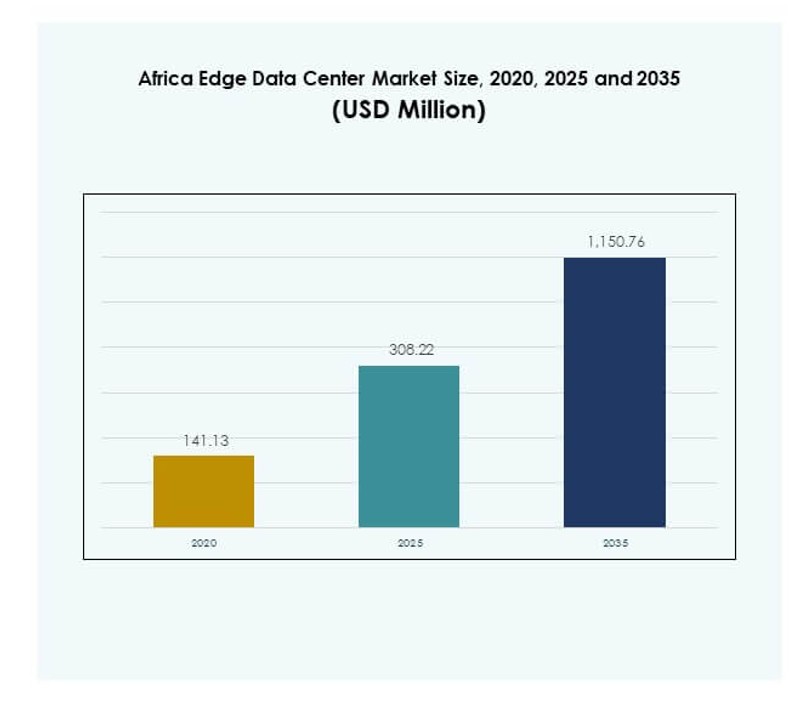

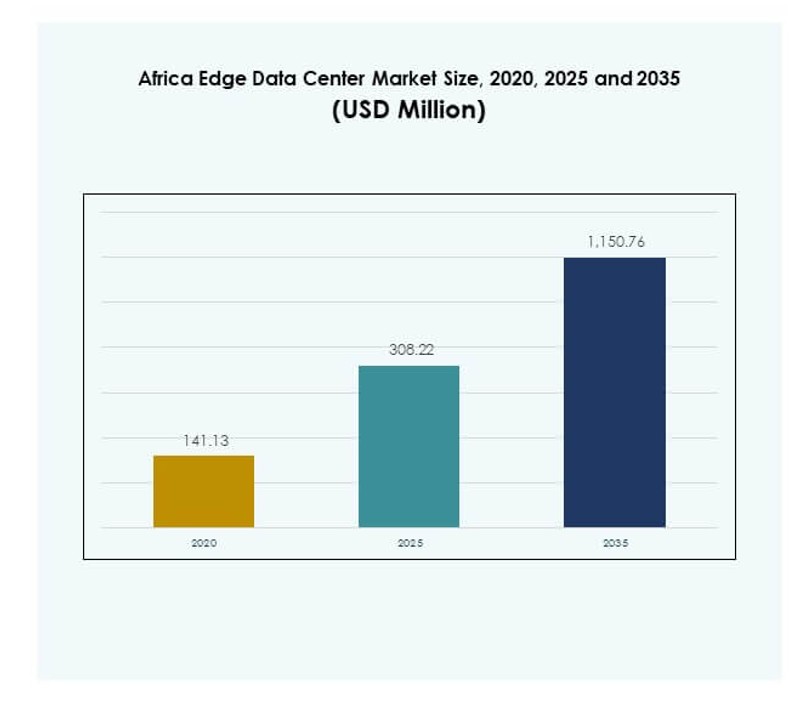

The Africa Edge Data Center Market size was valued at USD 141.13 million in 2020, reached USD 308.22 million in 2025, and is anticipated to reach USD 1,150.76 million by 2035, at a CAGR of 13.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Africa Edge Data Center Market Size 2025 |

USD 308.22 Million |

| Africa Edge Data Center Market, CAGR |

13.93% |

| Africa Edge Data Center Market Size 2035 |

USD 1,150.76 Million |

Strong momentum in digital transformation drives rapid adoption of edge computing infrastructure. 5G deployment, IoT integration, and AI-powered applications push enterprises to move data processing closer to end users. Modular and scalable designs support cost-efficient rollouts. Public–private investments strengthen network coverage and operational resilience. It creates a strategic platform for businesses and investors seeking long-term digital infrastructure growth and advanced service delivery.

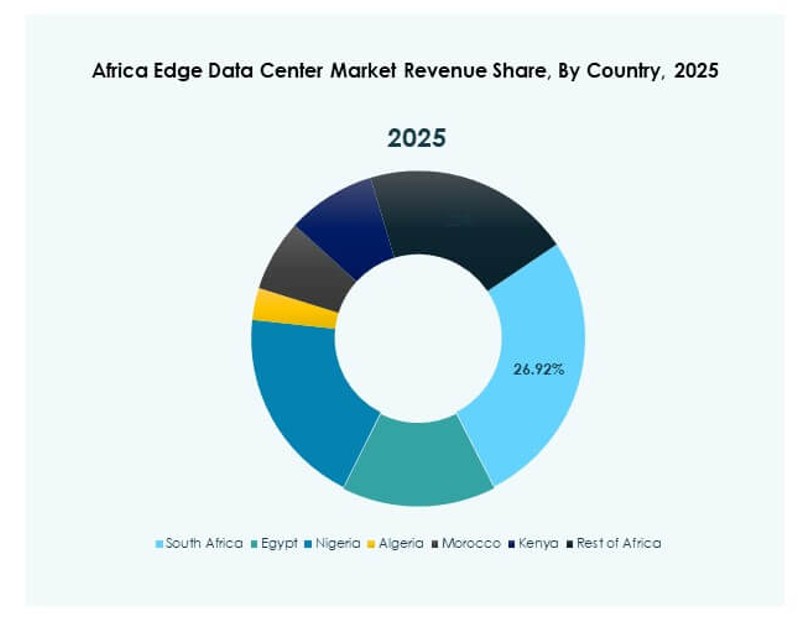

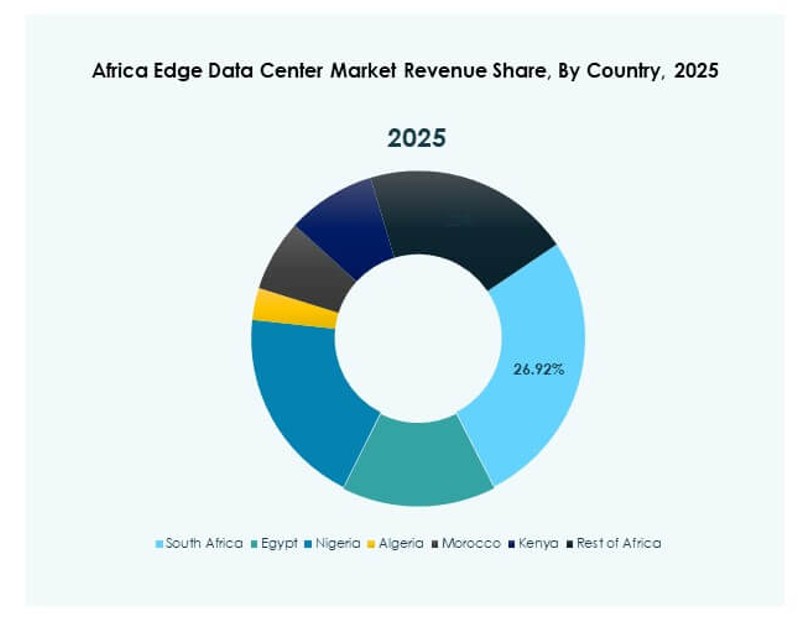

South Africa leads the market due to its advanced telecom networks, strong cloud ecosystem, and early investments in edge facilities. Nigeria and Kenya emerge as growth hubs supported by expanding connectivity and startup ecosystems. North African economies build capacity through government initiatives and regional partnerships. This geographic distribution reflects a balanced expansion of edge infrastructure across leading and emerging markets in Africa.

Market Drivers

Rising Adoption of Edge Computing to Support Low-Latency Digital Services

The Africa Edge Data Center Market is gaining strong traction through rapid adoption of edge computing. Telecom operators and hyperscalers build edge facilities to reduce latency and improve network efficiency. High-speed connectivity supports smart city programs, remote work models, and real-time applications. Enterprises seek distributed infrastructure to process data closer to end users. Cloud providers expand their footprint to meet demand for localized compute power. Governments encourage private investment to strengthen digital networks. The growing ecosystem improves service reliability and performance. Investors view edge infrastructure as a critical enabler of future digital transformation across multiple industries.

Expansion of AI, IoT, and 5G Deployments Across Key Urban Hubs

The integration of AI, IoT, and 5G networks accelerates demand for scalable edge capacity. Urban regions witness rising smart infrastructure investments to manage data-intensive applications. Enterprises use edge nodes to reduce traffic congestion in centralized data centers. 5G rollouts enable fast, stable, and low-latency connectivity for automation, logistics, and manufacturing. Smart surveillance, autonomous transport, and e-health rely on edge architecture. Data sovereignty requirements push localized data processing. It strengthens national digital resilience and operational continuity. These technology shifts create a strong growth environment for infrastructure providers, integrators, and solution developers across the continent.

- For example, in November 2024, MTN South Africa and ZTE launched a 5G-A public experience in Cape Town, achieving a record download speed of 9.2 Gbps. In 2025, MTN completed South Africa’s first 5.5G network trial in Johannesburg, reaching 8.6 Gbps peak speed and earning an OpenSignal award for 5G availability at 11.5%.

Growing Strategic Investments and Public–Private Partnerships

Strong capital inflows into the African digital infrastructure market support rapid growth. Governments form partnerships with hyperscalers and telecom giants to build large-scale edge facilities. Investors target locations with strong connectivity potential and stable energy supply. Strategic collaboration accelerates rollout of edge sites near industrial zones and urban clusters. Funding focuses on modular, scalable designs to meet future demand. Infrastructure funds and development banks support long-term projects. These initiatives increase coverage and improve quality of service. It positions the region as a strategic digital hub for edge services and next-generation connectivity solutions.

- For example, PAIX Data Centres announced the expansion of its Accra, Ghana, facility to 1.2MW in May 2024, making it one of the largest in the country. The upgraded site supports cloud providers, ISPs, and enterprises, and delivers state-of-the-art cooling, energy efficiency, and reliability for mission-critical digital applications.

Rising Demand from Industry Verticals for Distributed Infrastructure

Industries across BFSI, healthcare, manufacturing, and retail demand distributed computing capacity. Edge architecture supports secure data processing, faster transactions, and real-time analytics. Enterprises shift workloads closer to their operations to gain faster insights. This infrastructure enables efficient disaster recovery and operational resilience. Distributed edge networks reduce downtime and optimize energy use. Sectors dependent on time-sensitive data, such as healthcare and finance, benefit from localized computing. The expansion of connected devices drives further capacity needs. It creates a favorable environment for solution vendors and infrastructure developers targeting high-value industry verticals.

Market Trends

Deployment of Modular and Scalable Edge Infrastructure Models

The Africa Edge Data Center Market is witnessing rising adoption of modular edge designs. Operators deploy prefabricated and containerized edge units to reduce installation time. This model lowers upfront investment and accelerates project timelines. Scalable designs allow operators to expand capacity with rising demand. Rural and semi-urban regions benefit from flexible rollouts. Enterprises prefer modular models to reduce operational risks. Local governments support modular strategies to extend digital access. It drives broader geographic coverage and aligns with rapid connectivity goals.

Strong Momentum Toward Renewable Energy Integration in Edge Facilities

Data center operators focus on integrating renewable power sources to ensure sustainable operations. Solar, wind, and hybrid systems supply clean energy to edge sites. This transition aligns with global energy efficiency goals. Operators reduce grid dependency and improve energy cost control. Green power investments strengthen brand reputation and attract ESG-focused funding. Renewable-powered edge facilities offer stable and resilient uptime. Governments encourage clean energy projects through favorable policies. It positions edge infrastructure as a sustainable backbone of digital development.

Rise of AI-Driven Data Center Management and Automation

AI technologies optimize data center management and operational visibility. Intelligent control systems monitor cooling, power, and network performance in real time. Predictive maintenance reduces downtime and lowers operating costs. Automated systems improve response times and increase efficiency. Data centers use AI to balance energy consumption and resource allocation. Operators gain better forecasting capabilities for capacity planning. AI enhances operational precision and reduces manual interventions. It creates smarter, more efficient edge infrastructures supporting critical workloads.

Regional Telecom Network Expansion and Fiber Backhaul Enhancement

Telecom operators expand fiber networks and backhaul capacity to support dense edge deployments. Network upgrades increase data transmission speeds and improve service quality. Countries invest in submarine cables and terrestrial fiber to strengthen connectivity. Operators leverage strong network foundations to enable real-time processing. Dense network coverage supports IoT applications and immersive technologies. Upgraded infrastructure enhances last-mile connectivity in underserved areas. Fiber and 5G backbone improvements build a strong base for edge expansion. It enables seamless integration of next-generation digital services across industries.

Market Challenges

Limited Energy Infrastructure and High Power Costs

The Africa Edge Data Center Market faces critical challenges related to energy reliability and cost. Several countries experience unstable power supply and high grid tariffs. Operators depend on diesel generators or hybrid solutions to maintain uptime. High operating costs limit rapid deployment of large-scale facilities. Limited renewable integration slows progress toward sustainable targets. Infrastructure gaps increase downtime risks during peak load periods. Energy security remains a key barrier for hyperscale expansion. It raises the total cost of ownership for investors and service providers.

Regulatory Fragmentation and Slow Digital Policy Harmonization

The absence of unified regulatory frameworks creates compliance complexity across regions. Different countries follow varied data protection, energy, and telecom policies. This fragmentation slows cross-border deployment and capacity planning. Investors face operational uncertainty due to shifting regulations. Limited clarity on tax incentives and land access delays projects. Cross-border fiber connectivity projects encounter bureaucratic hurdles. It restricts seamless infrastructure scaling and ecosystem growth. A stable, harmonized policy environment remains essential for sustained expansion of the market.

Market Opportunities

Rising Investments in AI, IoT, and Industry 4.0 Applications

The Africa Edge Data Center Market offers strong growth opportunities through AI, IoT, and automation adoption. Manufacturing, healthcare, and logistics sectors deploy smart technologies that require localized data processing. Edge architecture supports predictive analytics, real-time monitoring, and adaptive control systems. Governments encourage digital transformation initiatives that drive private investments. It strengthens the regional innovation ecosystem and creates high-value opportunities for operators, equipment vendors, and service providers targeting advanced industry use cases.

Strategic Expansion into Underserved and Emerging Markets

The demand for edge infrastructure is expanding in emerging economies and underserved regions. Operators target secondary cities and rural zones with modular edge facilities. Improved connectivity bridges digital divides and unlocks new customer segments. Public and private funding supports large-scale deployments. Infrastructure developers gain early-mover advantage through fast rollouts. Telecom expansion and smart city initiatives create sustainable growth paths. It enhances geographic reach and drives strategic diversification for market participants.

Market Segmentation

By Component

Solutions dominate the Africa Edge Data Center Market with a major share, driven by rising demand for advanced power, cooling, and network systems. Enterprises prioritize robust solutions to ensure performance, reliability, and security. Vendors innovate modular systems that reduce installation time and operational cost. Services grow steadily due to demand for managed operations, remote monitoring, and lifecycle management. This mix enables scalable and sustainable infrastructure, making solutions the backbone of rapid edge expansion across key industries.

By Data Center Type

Colocation edge data centers lead the market with the highest share due to their flexibility and cost advantages. Enterprises prefer shared facilities to reduce capital expenditure and scale quickly. Managed data centers grow with rising demand for outsourcing. Cloud and edge data centers gain traction among digital-native firms. Enterprise data centers remain vital for mission-critical workloads. Other smaller formats serve specific local needs. This segment’s expansion supports the distributed infrastructure model required for low-latency services.

By Deployment Model

Hybrid deployment models dominate the market as enterprises combine on-premises infrastructure with cloud capacity. This approach enhances operational flexibility and data control. On-premises deployments serve regulated sectors requiring high security. Cloud-based solutions grow with startups and service providers. Hybrid adoption ensures optimal cost control and performance. Operators integrate edge infrastructure with hybrid strategies to enhance scalability. It accelerates service delivery across industries and geographies. Hybrid deployment remains the preferred model for long-term digital growth.

By Enterprise Size

Large enterprises hold the leading share, driven by complex infrastructure requirements and high IT spending. They adopt edge systems for real-time analytics, security, and resilience. SMEs are rapidly increasing adoption through cost-effective and modular deployments. Access to managed services enables smaller firms to scale operations efficiently. Growing digital transformation among SMEs strengthens the ecosystem. Large enterprises act as anchor tenants in colocation facilities. This balance between enterprise segments drives broad-based market expansion.

By Application / Use Case

Power monitoring dominates this segment with the largest share, driven by the need for energy efficiency and reliability. Asset and capacity management solutions see strong uptake for optimizing operations. Environmental monitoring supports sustainability and regulatory compliance goals. Business intelligence and analysis solutions enhance decision-making capabilities. Enterprises integrate multiple applications within edge environments to improve performance. This diverse use case landscape underpins demand for flexible and intelligent infrastructure solutions.

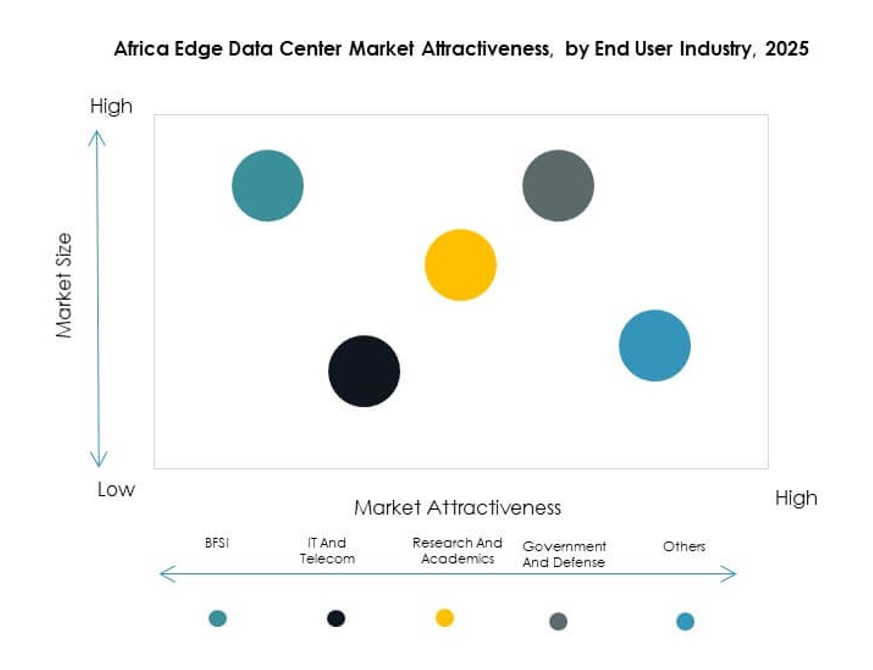

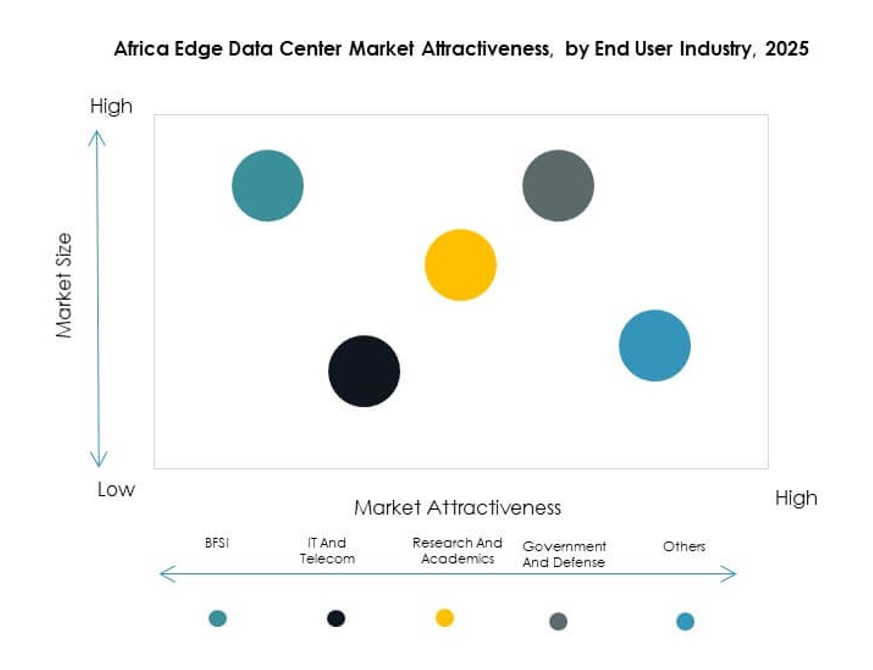

By End User Industry

IT and telecommunications lead the market, contributing the largest share due to network expansion and data traffic growth. BFSI relies on edge for secure and fast transactions. Healthcare integrates edge for patient monitoring and telemedicine. Retail and e-commerce use it to optimize customer experience. Aerospace and defense deploy edge for secure, mission-critical operations. Energy and utilities benefit from smart grid applications. This strong multi-industry base ensures consistent market demand across applications.

Regional Insights

Southern Africa: Established Digital Hub with Strong Market Leadership (38%)

Southern Africa holds 38% of the Africa Edge Data Center Market, making it the regional leader. South Africa anchors this position through mature telecom networks, submarine cable connections, and a strong cloud ecosystem. Major data center operators invest in edge capacity around Johannesburg and Cape Town. Stable policy frameworks and energy infrastructure attract hyperscalers and investors. High urbanization levels support dense digital service adoption. It maintains a competitive edge through early infrastructure deployments and robust enterprise demand.

- For instance, Teraco completed the phase 2 expansion of its JB4 Bredell Campus data center in Johannesburg in August 2025, making it Africa’s largest single-site data center with a total 50MW of critical IT power load across 14 data halls and 80,000 m², now supporting hyperscale cloud and AI workloads with advanced liquid cooling systems.

West Africa: Fastest-Growing Subregion with Expanding Connectivity (29%)

West Africa captures 29% market share, driven by rapid connectivity upgrades and growing digital ecosystems. Nigeria, Ghana, and Côte d’Ivoire lead edge deployments through private and public investments. Telecom network expansion strengthens backbone infrastructure for edge computing. High mobile penetration and startup growth accelerate demand. Governments support smart city initiatives that boost infrastructure development. This region’s fast growth attracts international operators seeking early-mover advantages. It positions West Africa as a major growth engine in the coming decade.

East and North Africa: Emerging Hubs with Strategic Growth Potential (33%)

East and North Africa collectively hold 33% of the market, with Kenya, Egypt, and Morocco leading deployments. These regions benefit from favorable geographic positioning and strong international connectivity links. Governments focus on digital economy programs to stimulate investment. Enterprises deploy modular edge facilities to serve local industries and logistics hubs. Stable political environments enhance investor confidence. Regional growth strengthens Africa’s role in global digital supply chains. It supports balanced development of edge networks across the continent.

- For instance, OVHcloud opened its first Local Zone Edge location in Rabat in partnership with Maroc Datacenter in May 2024, allowing latency-sensitive cloud services and establishing new compute and storage infrastructure locally to support real-time analytics for Moroccan enterprises.

Competitive Insights:

- Teraco (Digital Realty)

- Africa Data Centres

- MTN

- MainOne

- Eaton Corporation

- Dell Technologies Inc.

- Compass Datacenters

- Fujitsu

- American Tower

- Cisco

- Microsoft

- Schneider Electric SE

- Rittal GmbH & Co. KG

The Africa Edge Data Center Market reflects strong competition between telecom operators, hyperscalers, and infrastructure solution providers. It is shaped by strategic expansions, modular facility deployments, and integration of renewable power systems. Leading firms such as Teraco, Africa Data Centres, and MTN strengthen their regional positions through network integration and large-scale edge site rollouts. Technology leaders including Cisco, Microsoft, and Dell drive innovation in compute, automation, and hybrid connectivity. Infrastructure providers such as Schneider Electric and Eaton focus on energy efficiency and grid resilience. This competitive mix accelerates service diversification, creates multi-operator ecosystems, and positions Africa as a strategic digital hub for future connectivity and cloud services.

Recent Developments:

- In October 2025, Cameroon’s ST Digital announced the opening of a new data center in Côte d’Ivoire, marking a significant step in regional edge infrastructure expansion and positioning the company to provide advanced cloud and data services for West Africa’s growing connectivity needs.

- In August 2025, MTN Business entered into a major partnership with Powerfleet, a global leader in Artificial Intelligence of Things (AIoT) SaaS solutions. The alliance aims to scale AIoT adoption across MTN’s enterprise operations, boosting digital transformation and data-driven efficiency for African businesses.

- In June 2025, Africa Data Centres, a part of Cassava Technologies, announced a commercial partnership with Blue Turtle. This deal enables expanded product portfolios and an improved market presence, including a further expansion of Africa Data Centres’ footprint. In addition, the company recently launched its ADC Channel program, supporting colocation and ecosystem partnership opportunities that allow members to broaden their market reach.

- In April 2025, Raxio Group received a $100 million investment commitment from the International Finance Corporation (IFC) to construct new facilities in Ethiopia, Angola, and Côte d’Ivoire, supporting the group’s ambition to develop carrier-neutral edge data centers and foster regional data sovereignty across the continent.