Executive summary:

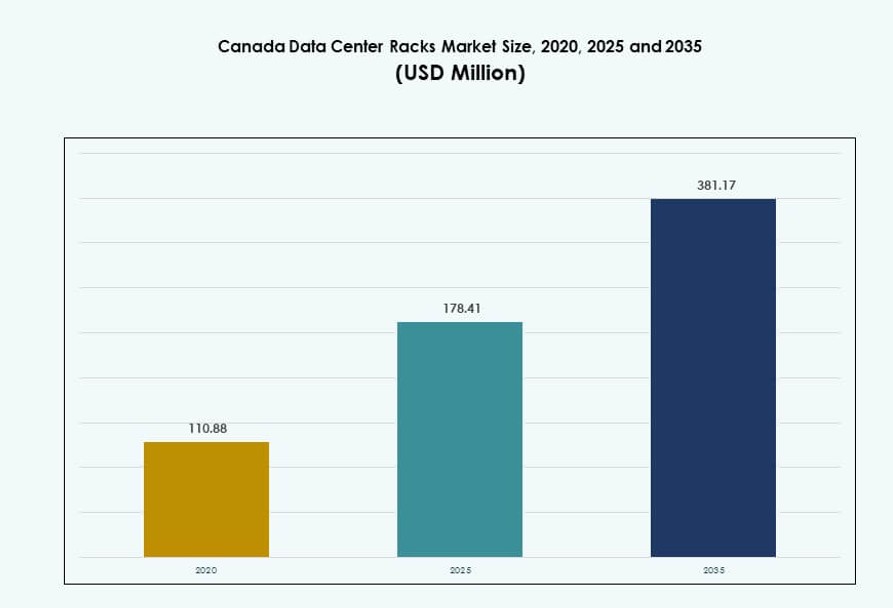

The Canada Data Center Racks Market size was valued at USD 110.88 million in 2020 to USD 178.41 million in 2025 and is anticipated to reach USD 381.17 million by 2035, at a CAGR of 7.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Canada Data Center Racks Market Size 2025 |

USD 178.41 Million |

| Canada Data Center Racks Market, CAGR |

7.84% |

| Canada Data Center Racks Market Size 2035 |

USD 381.17 Million |

The market is growing steadily due to strong demand for AI-ready infrastructure, high-density server configurations, and edge computing rollouts. Enterprises and cloud providers are investing in scalable, energy-efficient rack systems to support hybrid and AI workloads. Adoption of liquid-cooled and intelligent rack solutions is increasing, driven by thermal challenges and sustainability goals. Government-backed digitization, data localization mandates, and hyperscaler expansion reinforce rack-level upgrades. These shifts make the market a strategic focus for vendors and investors targeting long-term infrastructure growth.

Ontario leads the market due to its dense enterprise landscape and concentration of hyperscale data centers. Quebec follows with its renewable energy advantage and growing colocation ecosystem. Western provinces like Alberta and British Columbia are emerging due to edge facility deployments and rising regional IT demand. Northern zones are seeing interest from public sector and telecom providers for modular, remote-ready installations. The geographic diversity supports multi-tiered rack infrastructure adoption across Canada.

Market Dynamics:

Market Drivers

Widespread Adoption of AI and HPC Is Accelerating Demand for High-Density Rack Infrastructure

The Canada Data Center Racks Market is gaining momentum due to surging deployment of AI and high-performance computing. These workloads require high-density, power-intensive rack systems to support GPU clusters and rapid data processing. Operators are turning to 48U and above racks that can handle over 30 kW per rack. Direct liquid cooling integration into these racks is rising to manage thermal challenges. This trend enables faster time-to-market for enterprises in banking, healthcare, and research. High-density infrastructure allows co-location providers to boost revenue per square foot. It also helps in maximizing floor space while lowering operational risks. Rack vendors benefit from demand for pre-integrated, modular solutions that reduce setup delays.

- For instance, NVIDIA’s DGX H100 system delivers up to 32 petaFLOPS of FP8 performance using eight H100 GPUs, with each unit drawing approximately 10.2 kW of power. Operators deploying multiple DGX H100 systems in high-density racks are prioritizing 48U configurations that support over 30 kW per rack.

Government Digital Policies and Cloud Expansion Strengthen Strategic Importance of Rack Infrastructure

National data sovereignty laws and provincial data hosting regulations are fueling domestic data center builds. The Canada Data Center Racks Market benefits directly from local cloud zone expansion by major hyperscalers. Firms like AWS, Microsoft, and Google continue to expand footprints across Ontario and Quebec. Local operators are scaling rack infrastructure to meet compliance and capacity requirements. Government-backed digitization programs in healthcare, defense, and education need secure, scalable hosting. This creates long-term demand for high-reliability cabinet racks. It helps investors secure recurring infrastructure returns through leasing models. Operators are also partnering with public agencies to host critical infrastructure locally.

Rising Deployment of Edge and Modular Facilities Is Reshaping Rack Design Priorities

Edge data centers across remote or underserved regions drive demand for compact, pre-integrated rack systems. These modular racks are designed for plug-and-play deployment, especially in telecom and industrial settings. The Canada Data Center Racks Market sees increasing preference for ruggedized and power-optimized formats. Telecom operators and ISPs deploy network racks in edge facilities to support 5G and IoT. These use shallow-depth and smaller width racks to conserve space. Rapid deployment timelines push demand for factory-built rack assemblies. Modular rack integration accelerates commissioning and reduces onsite technical labor. These trends open opportunities for Canadian manufacturers and system integrators.

- For instance, Nokia’s AirScale platform supports cloud-native 5G deployments with low-latency and high-throughput capabilities, enabling edge network functions across Canada. It is widely adopted by telecom operators to enhance 5G radio access and deliver scalable, software-defined performance in macro and edge environments.

Growing Sustainability Pressure Boosts Transition Toward Energy-Efficient and Liquid-Cooled Racks

Operators face rising pressure to improve energy efficiency and reduce emissions per workload. This is pushing the Canada Data Center Racks Market toward low-PUE configurations. High-efficiency PDUs, airflow containment, and rack-level cooling systems are gaining traction. Liquid cooling adoption is growing in hyperscale and AI-focused racks. Integration of sensors, real-time monitoring, and rack-level automation is increasing. These innovations help optimize energy use and support ESG goals. It also enables better rack utilization rates and uptime. Investors and hyperscalers view energy-efficient rack deployments as a key differentiation factor. Rack vendors are innovating in airflow, form factor, and cooling interface designs.

Market Trends

Shift Toward OCP-Compatible Racks for Hyperscale Deployments Is Driving Standardization

Hyperscalers are standardizing infrastructure to optimize scale, efficiency, and supply chains. The Canada Data Center Racks Market is seeing rapid adoption of Open Compute Project (OCP)-based rack formats. These enable faster deployment and hardware interoperability across vendors. Operators are sourcing OCP racks with integrated power, cooling, and cable management. It simplifies data hall design and minimizes customization. Major operators prefer these standards to streamline operations across regions. Local integrators align product offerings to OCP compatibility to tap into hyperscale contracts. These standard formats also lower total cost of ownership over the rack’s lifecycle.

Rack-Level Intelligence Integration Is Enhancing Monitoring and Predictive Maintenance

Smart racks equipped with sensors, PDUs, and thermal monitoring tools are gaining ground. These enable real-time visibility into temperature, humidity, and power consumption. The Canada Data Center Racks Market is shifting toward intelligent infrastructure that supports predictive failure detection. Smart systems alert operators to hotspots or unbalanced loads. They also optimize energy use through automated cooling adjustments. Advanced analytics provide operational insights and reduce downtime risk. Vendors offer digital twin capabilities to simulate rack-level scenarios. Intelligent rack adoption is becoming a key factor in Tier III and Tier IV facility builds.

Increased Rack Customization for AI Workloads and Specialized Hardware Needs

AI-specific infrastructure needs have prompted the rise of racks designed around GPU and ASIC densities. The Canada Data Center Racks Market is adapting to these needs with custom airflow and weight-bearing designs. Racks must handle heavy GPU nodes and ensure even thermal distribution. Vendors offer pre-configured units optimized for NVIDIA and AMD systems. Some hyperscalers demand racks with rear-door heat exchangers for dense AI deployments. Power distribution also requires upgrade to support higher amperage at rack level. These specialized racks are critical to support generative AI training and inferencing.

Growing Role of Co-location Facilities Is Shaping Demand for Flexible Rack Solutions

Enterprise shift toward hybrid cloud increases demand for co-location hosting. The Canada Data Center Racks Market is witnessing growth in rack demand driven by shared facilities. Operators need cabinets with modular layouts to support mixed-density requirements. Flexible rack formats allow customers to scale without reconfiguring physical space. Lockable cabinets and compartmentalized designs are preferred for tenant security. Co-lo operators seek racks that allow quick install and energy metering per tenant. Standardization helps reduce service delays and improve rack turnaround times. The trend also supports enterprise clients migrating from legacy on-prem setups.

Market Challenges

High Operating Costs and Energy Constraints Limit Adoption of High-Density Rack Solutions

Canada’s colder climate reduces cooling loads, but overall energy costs remain high in many provinces. Power availability, especially in urban hubs like Toronto, puts pressure on operators. The Canada Data Center Racks Market faces challenges in deploying 30–60 kW racks that require liquid cooling or rear-door exchangers. Smaller operators lack capital for retrofitting legacy facilities. High cost of integrating new PDUs and heat management systems delays upgrades. Limited access to skilled technicians increases commissioning complexity. Permitting timelines and grid readiness also impact rack rollout schedules. These factors slow adoption of advanced rack formats.

Supply Chain Dependencies and Import Delays Impact Rack Component Availability

Canada relies heavily on U.S. and Asian imports for rack components like rails, PDUs, and structural steel. Global supply chain disruptions caused by logistics delays or tariffs impact inventory and timelines. The Canada Data Center Racks Market remains exposed to sourcing bottlenecks for OCP-compatible hardware. Lead times for custom racks stretch over months, impacting hyperscaler timelines. Domestic manufacturing capacity is limited, especially for high-precision assemblies. Certification and quality testing for imported systems further slow deployments. These issues create pricing pressures and contract penalties for system integrators.

Market Opportunities

Strong Growth in Edge and Remote Deployments Opens New Demand for Modular Racks

Remote northern provinces and rural telecom zones require localized compute and storage. The Canada Data Center Racks Market benefits from edge deployments that need compact, easy-to-install racks. These racks support network aggregation, rural healthcare, and government services. Demand for IP-rated and vibration-resistant designs is growing. It creates long-term opportunity for Canadian OEMs focused on modular innovation.

Expansion of Hyperscale and AI Cloud Zones Creates Demand for High-Capacity Rack Solutions

Hyperscalers continue to invest in multi-availability zone clusters across Ontario, Quebec, and Alberta. The Canada Data Center Racks Market is poised to serve demand for 48U+ racks with advanced cooling. These high-capacity racks align with AI and ML deployments at scale. Strong ecosystem of system integrators positions Canada to attract foreign direct investments in rack-heavy infrastructure.

Market Segmentation

By Rack Type

Cabinet racks dominate the Canada Data Center Racks Market due to their high security, airflow control, and suitability for high-density applications. Open frame racks serve smaller or internal environments where accessibility is prioritized. Others include wall-mounted or specialized enclosures, but these hold a minor share. Cabinet racks remain preferred by hyperscalers, government, and BFSI operators who prioritize physical security and modular growth.

By Rack Height

42U racks are the standard height deployed across most enterprise and co-location facilities, driving the largest share. Racks above 42U are gaining share in hyperscale deployments supporting GPU clusters and dense compute. Below 42U racks are used in edge or compact installations with limited vertical space. The Canada Data Center Racks Market shows a transition toward taller racks to maximize space use per square foot.

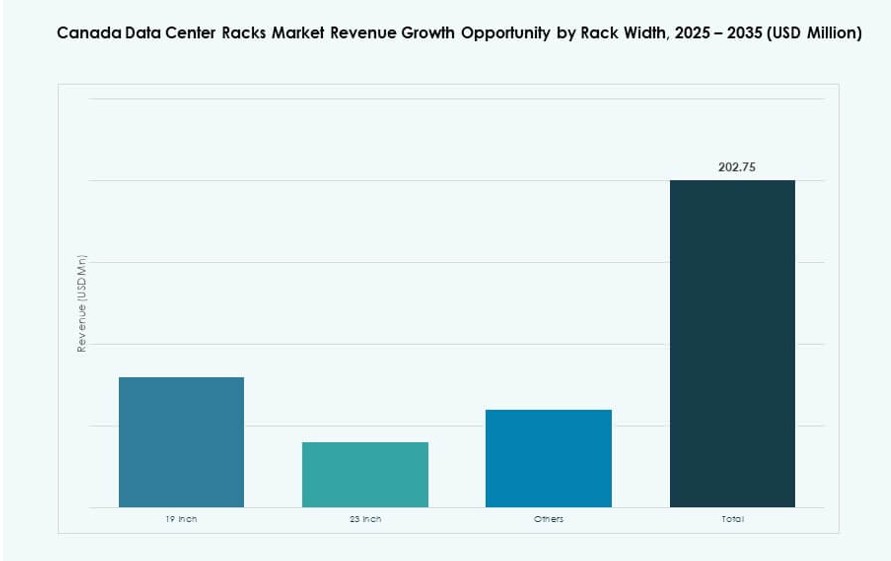

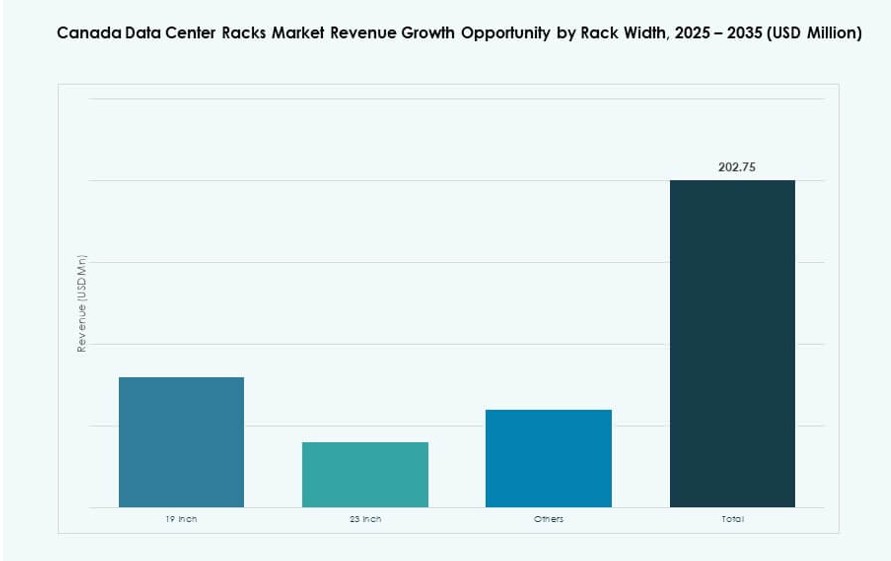

By Width

19-inch racks are the industry standard and continue to hold the largest share in Canada. These racks offer the widest compatibility with IT equipment, making them ideal across all verticals. The 23-inch category serves telecom and some high-density cooling setups. Other formats are niche and used in customized deployments. The 19-inch width remains dominant in the Canada Data Center Racks Market due to its global interoperability.

By Application

Server racks hold the majority share given the rise in AI servers, enterprise workloads, and cloud-native infrastructure. Network racks serve telecom, content delivery, and core routing functions, especially in edge or interconnect environments. The Canada Data Center Racks Market continues to see stronger investment in server racks, aligned with growth in AI, cloud computing, and private infrastructure rollouts.

By End-User

Large data centers lead demand due to investments from hyperscalers and government-backed cloud initiatives. Small and mid-sized data centers are growing with regional edge builds and secondary hosting zones. The Canada Data Center Racks Market remains favorable for large-scale projects, though smaller data centers increasingly adopt standardized, scalable rack systems.

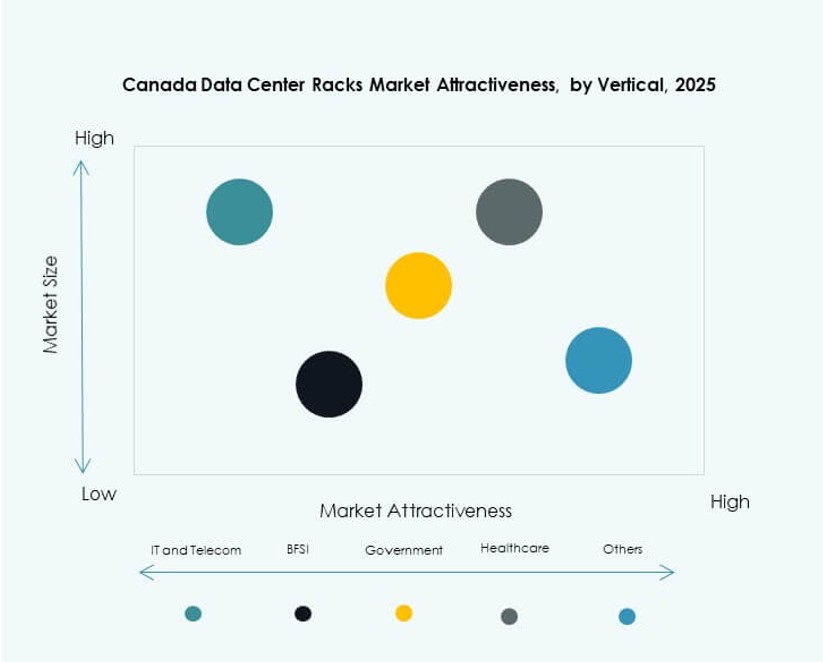

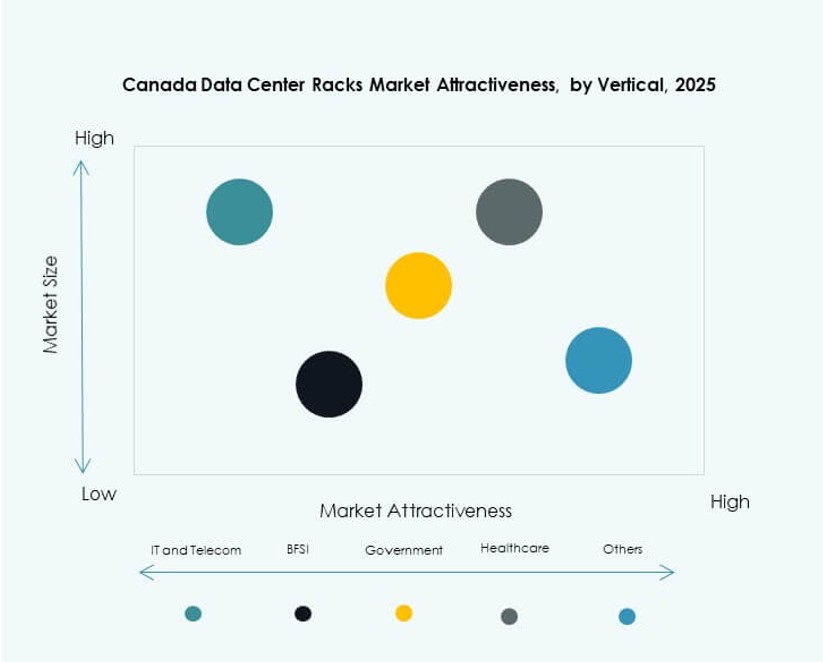

By Vertical

IT & Telecom holds the largest share driven by telco cloud, AI infrastructure, and content streaming growth. BFSI and government & defense follow due to compliance, data localization, and digital initiatives. Healthcare and energy sectors are emerging users for medical AI and grid monitoring. Retail, with growing e-commerce backend needs, also supports demand. The Canada Data Center Racks Market sees diverse adoption across these verticals with IT & Telecom at the forefront.

Regional Insights

Ontario Holds the Largest Share Due to Financial Sector Density and Hyperscale Footprint

Ontario leads the Canada Data Center Racks Market with over 42% share. Toronto’s role as the financial and enterprise services hub drives this dominance. Multiple hyperscalers and co-location providers operate in and around the Toronto metro area. Ontario benefits from better connectivity, skilled labor, and power access. Its early AI infrastructure rollouts support demand for high-density racks. The province continues to attract government and private cloud investments.

- For instance, Yondr Group broke ground on its first Canadian data center, a three‑story, 27 MW facility in Toronto, with construction starting in January/February 2025 to support digital infrastructure growth and cloud and AI workloads. The project is slated to reach ready‑for‑service by mid‑2026 and follows the company’s global expansion into key markets.

Quebec Emerges as a Strategic Region with Renewable Energy and Lower Power Costs

Quebec holds about 30% share in the Canada Data Center Racks Market. Operators prefer this region due to hydroelectric power, tax incentives, and data sovereignty compliance. Montreal’s data center ecosystem continues to grow with strong investment in edge zones. Lower energy rates enable deployment of power-hungry GPU workloads and cooling-intensive rack formats. Quebec’s strong digital infrastructure supports demand from both enterprise and hyperscale clients.

Western Provinces and Northern Zones See Growing Interest for Edge and Disaster Recovery Needs

Regions like Alberta and British Columbia together account for nearly 20% of the market. Vancouver’s proximity to U.S. West Coast and Alberta’s expanding tech sector create localized demand. Operators deploy racks in edge data centers serving telecom, oil, and public sector clients. The rest of Canada, including Northern provinces, shows rising interest in modular racks. These serve government, satellite communications, and mission-critical services in remote zones. The Canada Data Center Racks Market benefits from this shift in deployment strategy.

- For instance, Coloware expanded its presence at the 151 Front Street West carrier hotel in Toronto in April 2024, increasing its colocation footprint in one of Canada’s most connected data center hubs. The expansion supports greater edge connectivity and access to cloud, network, and peering ecosystems at this major interconnection point.

Competitive Insights:

- Hammond Manufacturing

- Primex Manufacturing

- Sysracks

- AMCO Enclosures

- Belden Inc.

- Chatsworth Products

- Cisco Systems, Inc.

- Dell Inc.

- Eaton

- Hewlett Packard Enterprise (HPE)

The Canada Data Center Racks Market features a mix of global OEMs and strong regional manufacturers competing across modularity, cooling integration, and rack customization. Hammond Manufacturing and Primex lead the domestic space, offering enclosures tailored to Canadian data center standards. Dell, HPE, and Cisco dominate enterprise-grade cabinet racks through bundled IT infrastructure solutions. Vertiv, Eaton, and Schneider Electric drive competition in power-integrated and high-density racks. Players like Sysracks and AMCO Enclosures offer scalable designs for mid-sized and edge deployments. It remains a fragmented market, where product innovation, availability, and integration with AI-ready infrastructure influence purchasing decisions. Partnerships with colocation and hyperscale providers play a key role in expanding local footprints and capturing demand in new edge zones.

Recent Developments:

- In December 2025, InfraRed Capital Partners launched Qu Data Centres, a new Canadian digital infrastructure platform built around nine facilities acquired from Rogers Communications. The launch brings a national footprint across Calgary, Edmonton, London, Ottawa, and Toronto with up to 49 MW of capacity. Qu offers sovereign colocation, cloud, and connectivity services for enterprise, government, hyperscale, and AI workloads.

- In August 2025, Vertiv completed the acquisition of Great Lakes Data Racks & Cabinets, a U.S.–based custom rack solutions manufacturer. This move enhances Vertiv’s portfolio for enterprise, edge, and hyperscale AI infrastructure by adding pre‑engineered and customizable rack enclosures.