Executive summary:

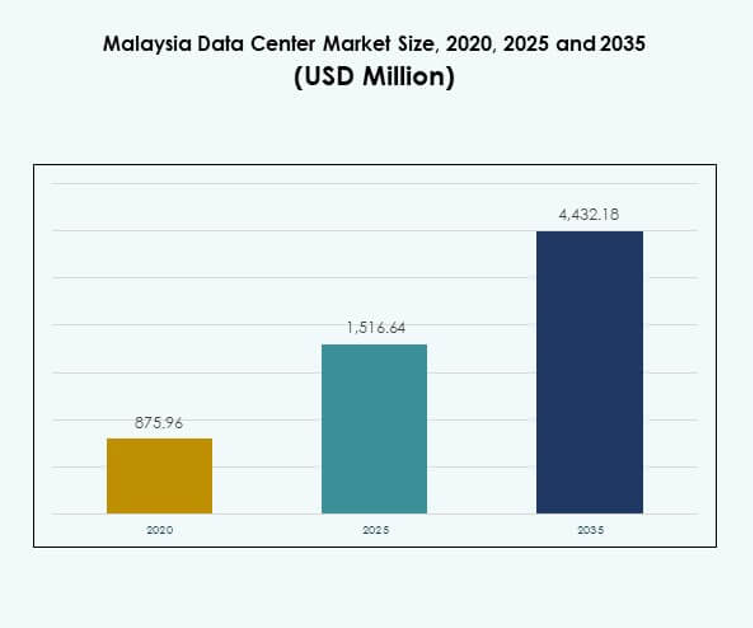

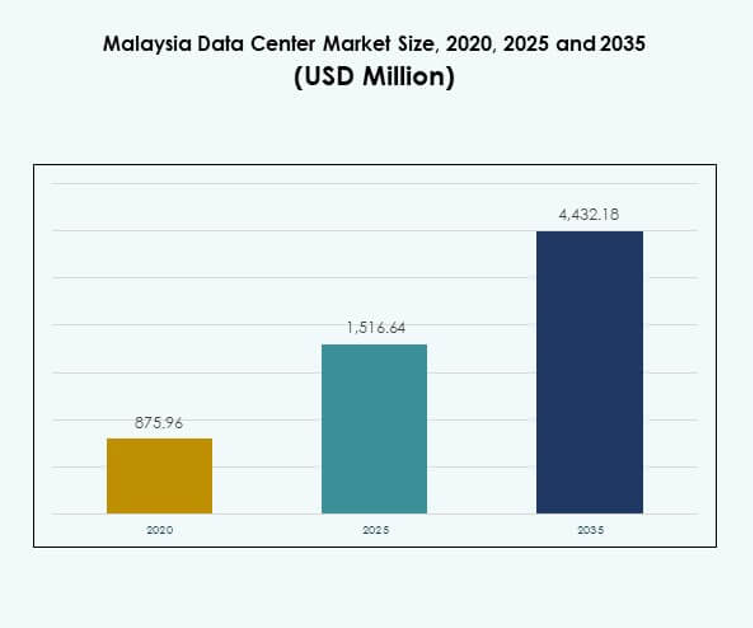

The Malaysia Data Center Market size was valued at USD 875.96 million in 2020 to USD 1,516.64 million in 2025 and is anticipated to reach USD 4,432.18 million by 2035, at a CAGR of 11.25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Malaysia Data Center Market Size 2025 |

USD 1,516.64 Million |

| Malaysia Data Center Market, CAGR |

11.25% |

| Malaysia Data Center Market Size 2035 |

USD 4,432.18 Million |

The market growth is driven by rapid adoption of cloud computing, artificial intelligence integration, and the need for scalable infrastructure. Enterprises focus on hybrid models to improve flexibility and security, while sustainability initiatives encourage investment in energy-efficient systems. The Malaysia Data Center Market plays a strategic role for investors and global enterprises by enabling digital transformation, supporting e-commerce, and strengthening financial and government services across the region.

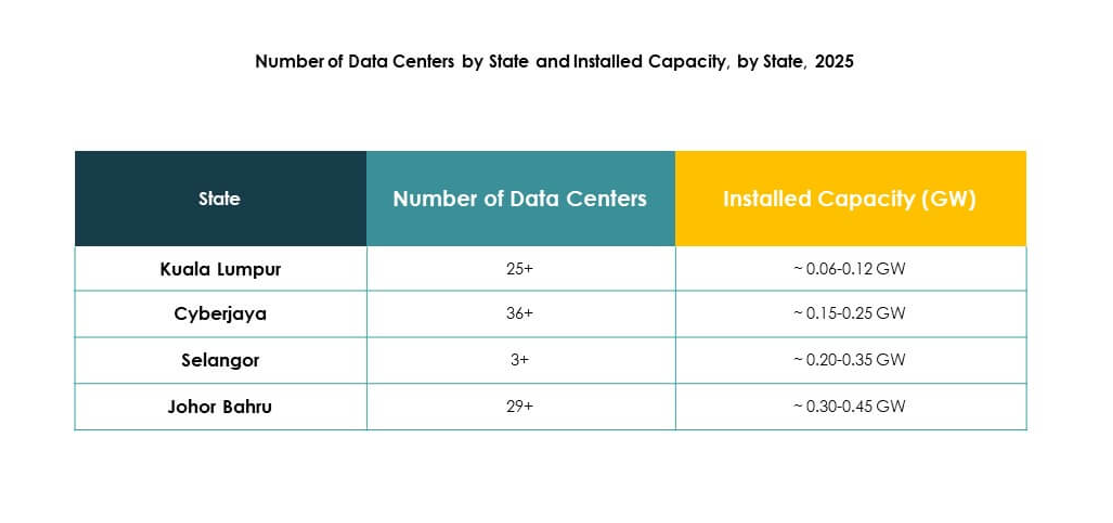

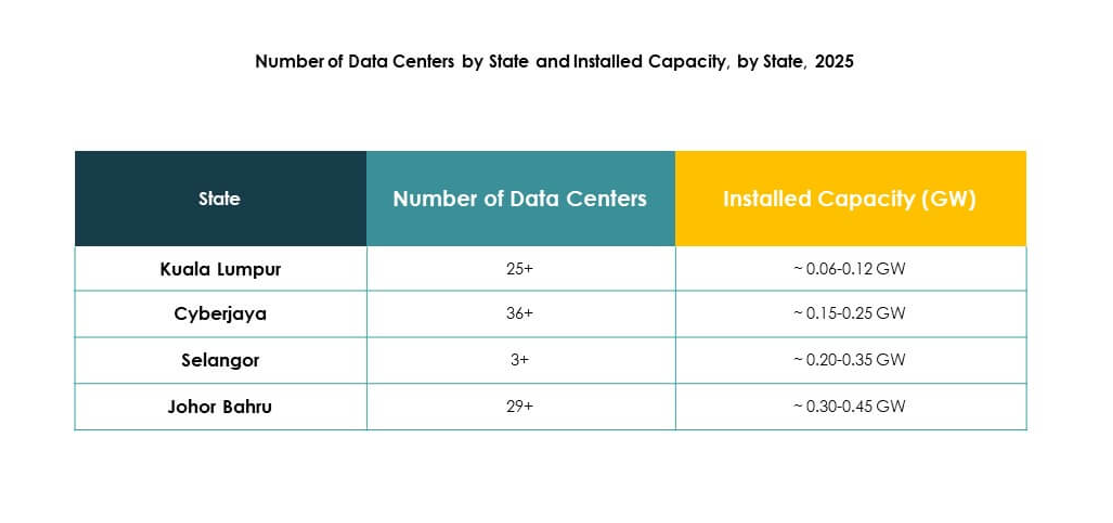

Central Malaysia, including Kuala Lumpur and Selangor, leads with its advanced connectivity and concentration of enterprise demand. Northern Malaysia is emerging due to industrial and manufacturing activity, particularly in Penang. Southern Malaysia is expanding as Johor benefits from cross-border connectivity with Singapore, positioning it as a competitive alternative hub for international operators and investors seeking growth opportunities.

Market Drivers

Rising Cloud Adoption and Enterprise Digitalization Driving Market Expansion

The Malaysia Data Center Market is benefiting from rapid cloud adoption among enterprises. Companies migrate workloads to cloud platforms to improve flexibility and reduce costs. Financial services, e-commerce, and telecom sectors lead this transformation. Growing demand for hybrid and multi-cloud strategies further strengthens infrastructure investments. Enterprises seek low-latency, scalable facilities to manage growing data volumes. Digitalization programs launched by the government reinforce this shift. The presence of global cloud providers accelerates adoption. It positions Malaysia as a key regional hub for digital transformation.

- For example, Amazon Web Services (AWS) officially launched its Asia Pacific (Malaysia) Region in August 2024, introducing three Availability Zones and planning to invest $6.2 billion (MYR 29.2 billion) through 2038.

Integration of Artificial Intelligence and Advanced Automation Solutions

Artificial intelligence integration is transforming infrastructure design and operations. AI-powered systems optimize cooling, reduce downtime, and improve energy efficiency. Automation enables predictive maintenance and real-time monitoring across facilities. Enterprises use AI to enhance service delivery for critical workloads. This integration reduces costs and boosts system reliability. The Malaysia Data Center Market reflects this change with advanced deployment models. Smart systems ensure operational resilience and scalability. It strengthens the attractiveness of facilities for global enterprises and investors.

Shift Toward Green Infrastructure and Energy Efficiency Innovations

Sustainability remains central for global and local operators. Facilities adopt renewable energy sources and green building practices. Cooling technologies with lower energy consumption are becoming mainstream. Regulatory policies favor low-carbon operations to meet climate targets. The Malaysia Data Center Market incorporates waste heat recovery and smart power systems. Enterprises prefer providers with strong environmental compliance. Investment in clean technologies reduces long-term operational expenses. It enhances Malaysia’s competitive edge in the regional infrastructure market.

- For example, Time Energy, partnered with AIMS Group in June 2025 to launch Malaysia’s first community solar project for data centers. The agreement allows landed households within 5 km of AIMS Group’s data center campus to lease rooftop space, aggregating solar power for the data center, directly contributing clean energy to its operations through the Community Renewable Energy Aggregation Mechanism (CREAM).

Growing Strategic Importance for Investors and Technology Providers

Malaysia attracts increasing investments from domestic and foreign players. Investors view the sector as a gateway to Southeast Asia. Colocation facilities and hyperscale campuses receive significant funding. Global technology firms collaborate with local operators for market entry. The Malaysia Data Center Market plays a vital role in supporting this flow. Government-backed incentives further stimulate large-scale investments. Strategic partnerships boost ecosystem expansion and resilience. It highlights Malaysia’s rising role in the regional digital economy.

Market Trends

Emergence of Edge and Micro Data Centers to Support IoT Expansion

Edge facilities are becoming critical for decentralized computing. Enterprises deploy micro centers near urban and industrial clusters. This ensures faster processing for IoT and real-time applications. The Malaysia Data Center Market reflects growing adoption of such models. Telecom providers lead initiatives by enabling 5G-driven services. Edge facilities reduce latency for smart city projects and autonomous solutions. Their modular design supports scalable and cost-efficient deployment. It strengthens Malaysia’s readiness for next-generation digital services.

Increased Demand for High-Density and AI-Optimized Infrastructure

High-performance computing reshapes infrastructure requirements. Operators design facilities to host GPU-intensive and AI workloads. Advanced cooling and power systems support these environments. Enterprises demand higher rack densities for evolving workloads. The Malaysia Data Center Market adapts with AI-ready campuses. Cloud and AI service providers drive significant demand. Facilities integrate liquid cooling and adaptive power distribution. It positions Malaysia as a preferred hub for advanced workloads in the region.

Strengthening Role of Colocation Facilities in Enterprise Strategy

Colocation models gain traction as enterprises seek flexibility. They reduce capital expenditure by leveraging shared infrastructure. Security, scalability, and connectivity drive this demand. The Malaysia Data Center Market records rising adoption of colocation services. International firms prefer colocation to accelerate regional expansion. These facilities provide robust interconnection with global cloud ecosystems. Operators expand capacity to meet enterprise requirements. It enables businesses to achieve agility while maintaining compliance.

Focus on Cybersecurity and Compliance in Digital Infrastructure

Rising data volumes demand stronger cybersecurity frameworks. Enterprises prioritize infrastructure aligned with compliance standards. Operators deploy advanced security systems including biometrics and monitoring. The Malaysia Data Center Market incorporates resilient policies to safeguard assets. Cloud providers adhere to financial and government security guidelines. Demand grows for sovereign and regulated hosting environments. Robust compliance ensures trust among enterprises and regulators. It strengthens Malaysia’s role as a secure digital hub.

Market Challenges

High Energy Consumption and Rising Sustainability Pressures

The Malaysia Data Center Market faces challenges from growing energy demands. Facilities consume large amounts of power, straining national grids. Rising electricity costs pressure operators to maintain profitability. Transitioning to renewable energy requires significant capital. Government policies add compliance burdens for carbon reduction. Operators must invest in sustainable cooling and power solutions. Smaller enterprises struggle to meet sustainability standards. It highlights the difficulty of balancing efficiency with cost-effectiveness.

Talent Shortages and Increasing Infrastructure Complexity

A skilled workforce is essential for managing advanced facilities. Malaysia experiences shortages of professionals in cloud, cybersecurity, and AI operations. Complex systems require specialized expertise for maintenance and scaling. The Malaysia Data Center Market highlights the gap between demand and talent availability. Operators invest in training and global partnerships to close this gap. Rising infrastructure complexity also increases operational risks. Enterprises face higher costs for recruitment and retention. It limits growth for smaller data center operators.

Market Opportunities

Expanding Regional Connectivity and Cloud Ecosystem Integration

Malaysia’s geographic position makes it a natural connectivity hub. Growing submarine cable investments strengthen its interconnection with Asia-Pacific. Global cloud providers increase their presence in the market. The Malaysia Data Center Market benefits from this expansion. Enterprises leverage local infrastructure to access regional markets. Strong connectivity enhances competitiveness across sectors. It boosts opportunities for hosting global-scale services. It positions Malaysia as a key digital economy player.

Rising Demand from Emerging Sectors and Industry Vertical Growth

Healthcare, retail, and manufacturing increase reliance on digital solutions. Their demand for secure hosting and analytics drives infrastructure growth. The Malaysia Data Center Market supports these industry shifts. AI-driven healthcare services require scalable computing resources. Retail and e-commerce leverage infrastructure for omnichannel strategies. Manufacturing adopts Industry 4.0 platforms, supported by resilient facilities. Demand from new industries creates long-term growth opportunities. It enables diversification across multiple verticals.

Market Segmentation

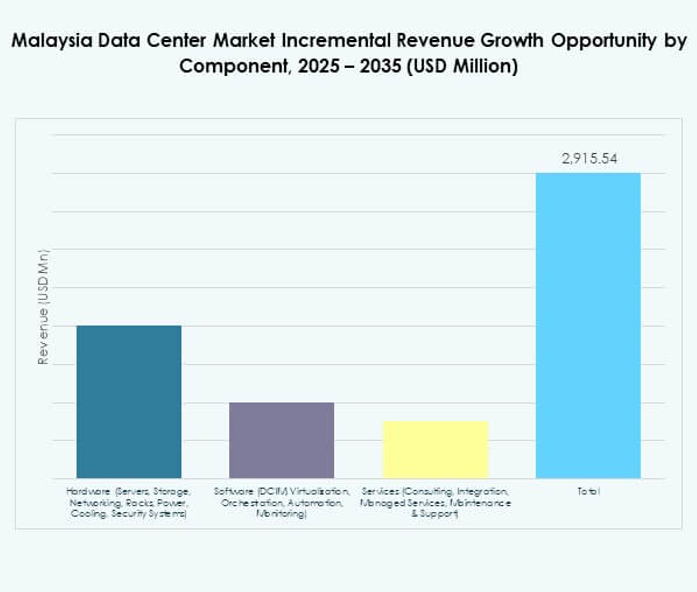

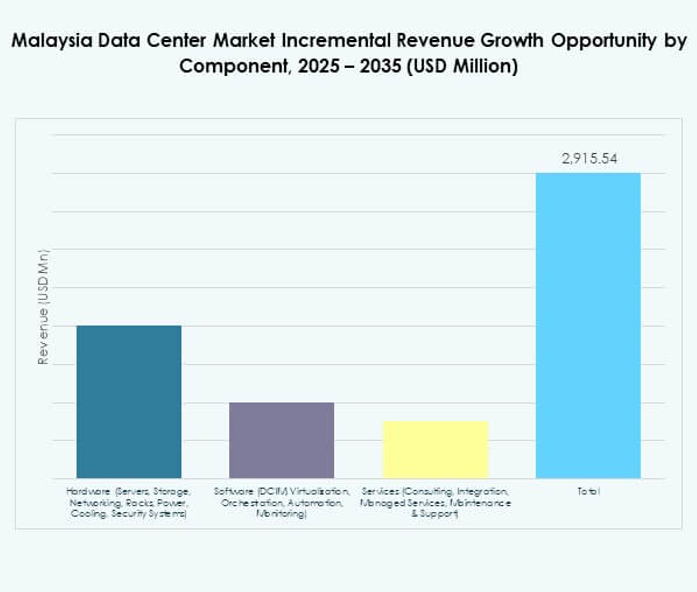

By Component

Hardware dominates due to essential roles of servers, networking, racks, and cooling systems. Demand for scalable power systems and advanced storage drives investment. Software solutions such as DCIM and automation are gaining adoption. Services including consulting and managed operations expand as enterprises outsource management. The Malaysia Data Center Market shows hardware maintaining the largest share. It reflects strong reliance on physical infrastructure while software and services accelerate future growth.

By Data Center Type

Hyperscale centers dominate with growing investment from global providers. Colocation models also expand as enterprises seek flexibility. Edge and modular designs grow with IoT and 5G rollout. Enterprise facilities remain relevant for private infrastructure. The Malaysia Data Center Market highlights hyperscale and colocation as the leading segments. Mega centers support regional workloads, while internet data centers rise with cloud growth. Each type plays a role in shaping Malaysia’s infrastructure landscape.

By Deployment Model

Cloud-based deployments lead the market with rising digital transformation. Hybrid models grow rapidly due to demand for flexibility. On-premises facilities continue in regulated industries like finance and defense. The Malaysia Data Center Market reflects dominance of cloud and hybrid models. These options support scalability while maintaining control over sensitive workloads. Enterprises prioritize hybrid adoption to balance cost efficiency with compliance. It reinforces Malaysia’s role in digital infrastructure adoption.

By Enterprise Size

Large enterprises dominate due to their heavy investments in infrastructure. SMEs increasingly adopt cloud-based services for agility and cost savings. Hybrid solutions help SMEs scale while managing expenses. The Malaysia Data Center Market emphasizes large enterprises as key revenue drivers. However, SMEs provide strong growth momentum in the coming years. Expanding access to managed services enables wider SME participation. It strengthens the overall ecosystem across enterprise segments.

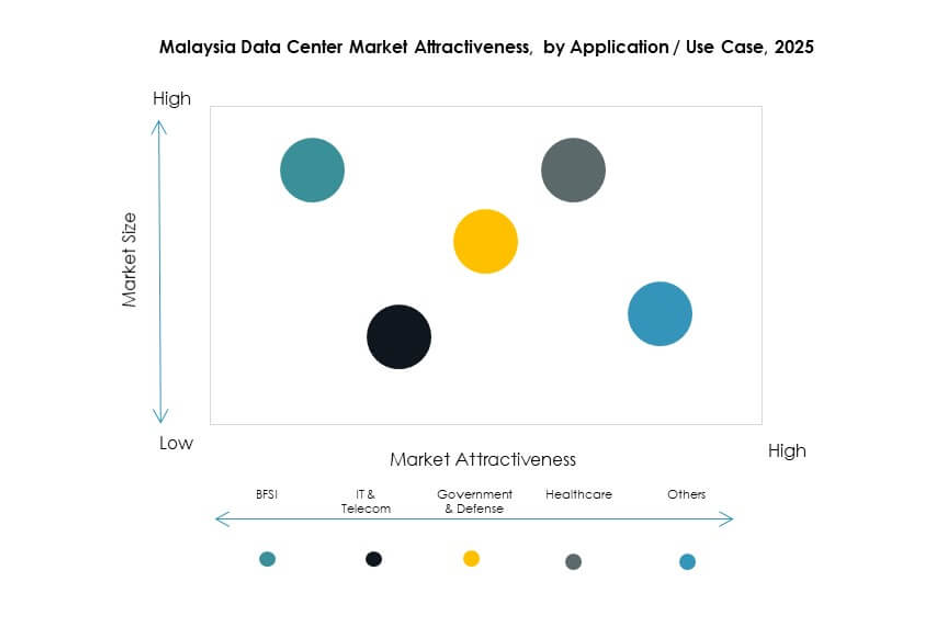

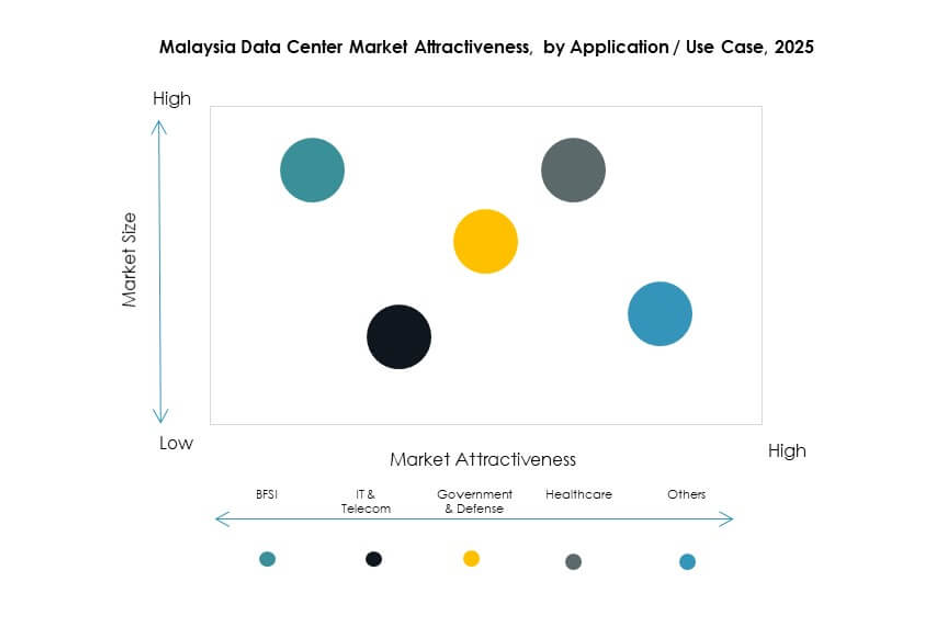

By Application / Use Case

IT and telecom lead the market, followed by BFSI and e-commerce. Healthcare and manufacturing demonstrate fast growth with digital integration. Government and defense rely on sovereign hosting and secure facilities. The Malaysia Data Center Market shows IT and telecom holding the largest share. Retail and entertainment expand with rising online demand. Manufacturing embraces Industry 4.0 platforms, driving computing needs. Broader adoption across verticals ensures long-term demand growth.

By End User Industry

Cloud service providers dominate with extensive investments in hyperscale facilities. Enterprises and government agencies also contribute significantly. Colocation providers gain traction as global firms expand. The Malaysia Data Center Market shows cloud providers leading in overall share. Enterprises demand compliance and scalability, while government focuses on sovereignty. Colocation providers bridge gaps for smaller firms. It ensures balanced participation across end-user segments.

Regional Insights

Central and Urban Malaysia as the Leading Subregion with Largest Market Share

Central Malaysia, including Kuala Lumpur and Selangor, holds 52% share. This region hosts most hyperscale and colocation facilities. Strong connectivity and high enterprise concentration drive demand. Global operators choose central hubs for proximity to customers. The Malaysia Data Center Market is reinforced by government and enterprise projects here. Central hubs ensure scalability for finance, telecom, and retail sectors. It establishes the region as the national digital core.

- For instance, Equinix completed the second phase expansion of its KL1 data center in Kuala Lumpur in May 2025, adding 450 new cabinets to the facility in response to growing digital infrastructure demand from global and local cloud and enterprise clients.

Northern Malaysia as an Emerging Subregion with Strong Investment Potential

Northern Malaysia accounts for 28% share and shows rising significance. Penang leads with electronics and manufacturing-driven demand. Growing SME clusters create additional infrastructure requirements. The Malaysia Data Center Market records increased colocation adoption here. Submarine cable projects improve international connectivity. Expansion of industrial parks accelerates regional demand growth. It positions the north as an important emerging hub.

- For instance, Open DC launched the PE2 data center in Penang’s Bayan Lepas Technology Park in August 2025, with a total planned capacity of 30 MW. The facility is positioned as Penang’s largest and most advanced data center, designed to support AI and high-performance workloads.

Southern Malaysia as a Growing Hub with Cross-Border Connectivity

Southern Malaysia contributes 20% share, strengthened by Johor’s proximity to Singapore. The region benefits from spillover demand from Singapore’s saturated market. Data centers expand rapidly to meet regional workloads. The Malaysia Data Center Market highlights Johor’s growth due to cloud adoption. Cross-border connectivity projects enhance infrastructure resilience. Southern hubs attract investors seeking cost-effective alternatives. It underscores the region’s importance in Malaysia’s digital growth map.

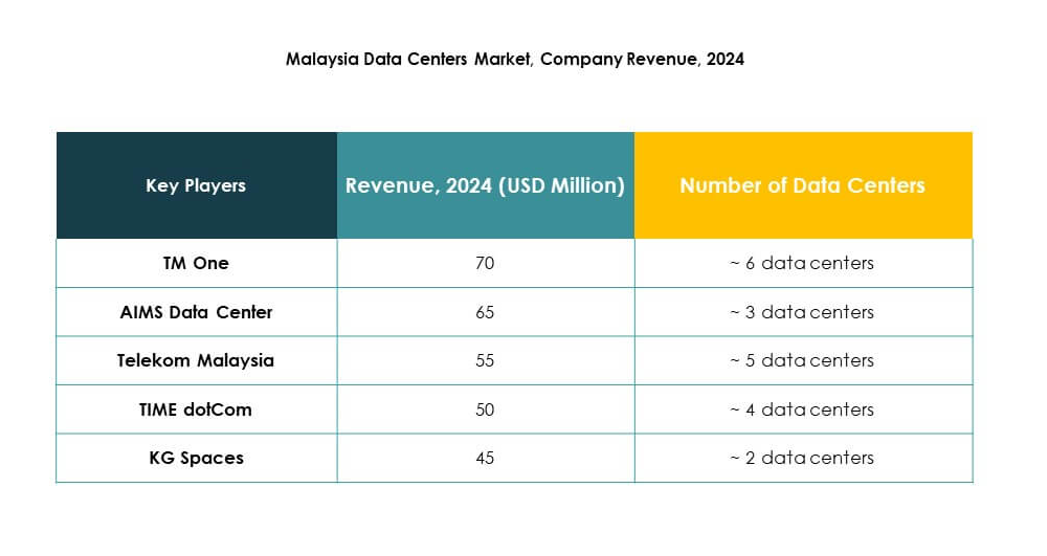

Competitive Insights:

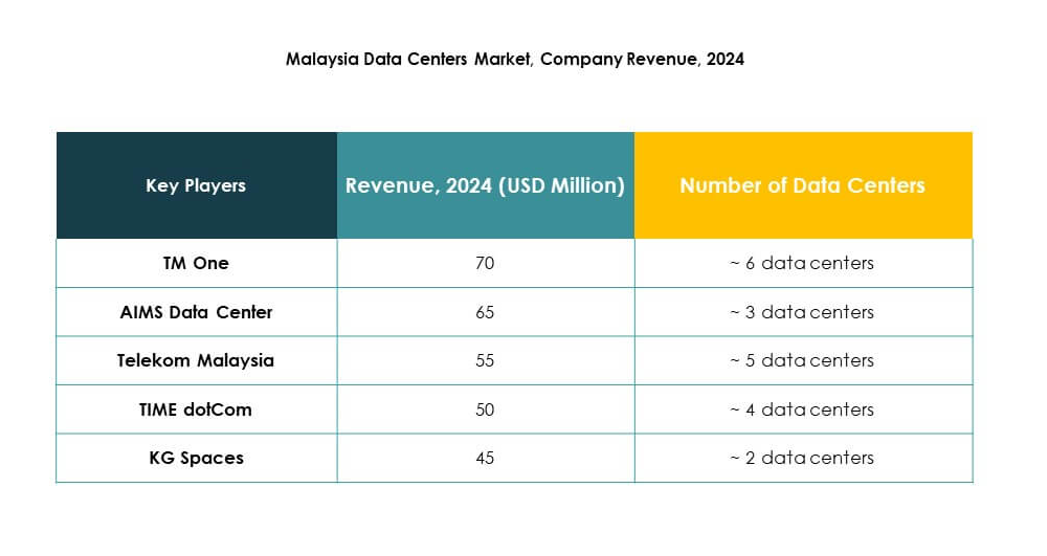

- TM One

- AIMS Data Center

- Telekom Malaysia

- TIME dotCom

- KG Spaces

- NTT Communications Corporation

- Digital Realty Trust, Inc.

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Malaysia Data Center Market features strong competition between domestic leaders and global players. TM One, AIMS Data Center, and Telekom Malaysia drive local dominance through extensive infrastructure and enterprise-focused services. TIME dotCom and KG Spaces strengthen regional connectivity and colocation capabilities. Global operators such as NTT Communications and Digital Realty expand through partnerships and large-scale investments. Hyperscale providers like Microsoft, AWS, and Google leverage cloud demand to establish AI-ready and scalable campuses. It reflects a market where local expertise combines with international capital, ensuring Malaysia’s position as a regional hub for digital infrastructure and enterprise growth.

Recent Developments:

- In September 2025, Vantage Data Centers revealed its agreement to acquire Southeast Asia’s largest data center campus in Johor Bahru, Malaysia, from Yondr Group for $1.6 billion; this deal follows Oracle’s leasing of the first 98 megawatts of the site for fifteen years, signifying Malaysia’s emergence as a central regional digital hub.

- In September 2025, Nokia partnered with Extreme Broadband to enhance security and future-proof data centers in Malaysia, targeting improvements to infrastructure resiliency and supporting digital transformation for Malaysian enterprises.

- In May 2025, Microsoft disclosed the development of three new hyperscale data centers set to open by Q2 2025 across Greater Kuala Lumpur and Johor, supported by a $2.2 billion investment that aims to bolster Malaysia’s digital infrastructure and job creation.