Executive summary:

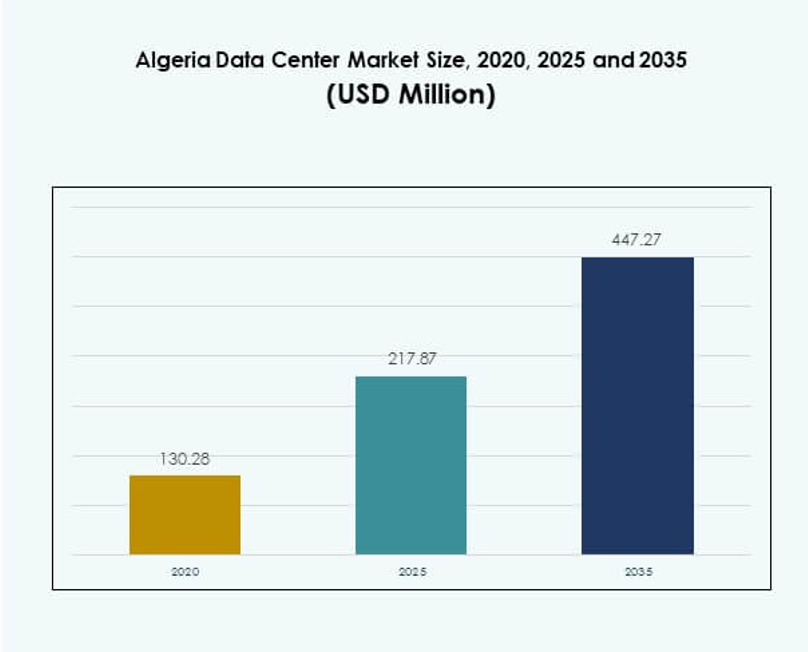

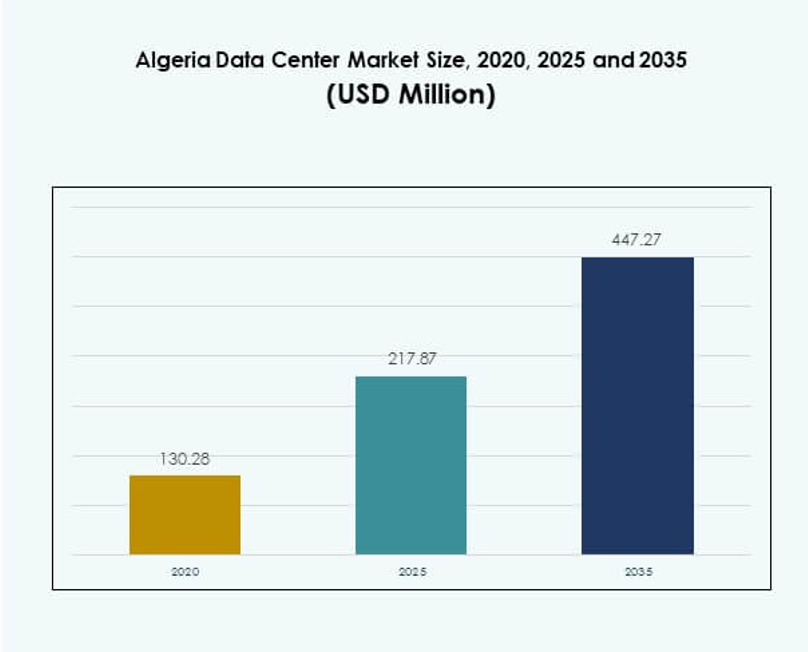

The Algeria Data Center Market size was valued at USD 130.28 million in 2020 to USD 217.87 million in 2025 and is anticipated to reach USD 447.27 million by 2035, at a CAGR of 7.39% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Algeria Data Center Market Size 2025 |

USD 217.87 Million |

| Algeria Data Center Market, CAGR |

7.39% |

| Algeria Data Center Market Size 2035 |

USD 447.27 Million |

The market is driven by rising cloud adoption, digital transformation across enterprises, and growing demand for secure and scalable IT infrastructure. Advancements in hardware and software integration, including automation and AI-driven monitoring, improve performance and reliability. Government initiatives encourage modernization, while industries such as BFSI, telecom, and healthcare expand digital operations. The Algeria Data Center Market holds strategic importance for investors due to its role in connecting Africa with Europe and the Middle East.

North Algeria leads with strong enterprise activity, telecom hubs, and government-backed projects, making it the country’s primary data center hub. Central Algeria shows growing momentum due to manufacturing and SME adoption of cloud and hybrid models. Southern Algeria remains an emerging subregion, with potential supported by renewable energy projects and rising interest in edge deployments. Together, these regions make the Algeria Data Center Market a competitive and evolving digital infrastructure landscape.

Market Drivers

Growing Adoption of Cloud Infrastructure and Hybrid Deployment Models

The Algeria Data Center Market benefits from enterprises shifting to cloud and hybrid models for scalability and cost efficiency. It supports workloads requiring flexibility and lower latency, improving business continuity and disaster recovery capabilities. Enterprises adopt hybrid strategies to manage sensitive workloads while leveraging cloud agility. Telecom operators expand connectivity, creating a reliable foundation for these deployments. The growing adoption improves access for SMEs with limited infrastructure budgets. It strengthens the competitive positioning of domestic businesses. Investors identify it as a foundation for broader digital transformation. The government promotes regulatory frameworks that encourage wider adoption.

Advancements in Hardware and Software Integration for Enhanced Performance

Hardware and software integration improves operational efficiency across Algerian facilities, strengthening the Algeria Data Center Market. Advanced servers, storage solutions, and high-performance networks ensure faster data throughput and reduced downtime. Software tools like DCIM and orchestration platforms enhance automation, optimizing resource allocation. Enterprises implement monitoring solutions to prevent system failures and maintain uptime. Integration supports higher-density workloads, improving the overall capacity of colocation and hyperscale setups. Service providers highlight security systems and advanced cooling to improve reliability. This strategic combination appeals to enterprises seeking advanced digital infrastructure. It positions Algeria as a rising technology hub in North Africa.

- For instance, Dell Technologies’ PowerEdge XE9680 rack servers are detailed in official 2024–2025 technical documentation for deployment in advanced AI and machine learning workloads, featuring robust air cooling and centralized iDRAC management widely used in modernized global data centers.

Government Support for Digital Transformation and Industry Modernization

Government initiatives play a central role in driving the Algeria Data Center Market by aligning policies with digital modernization. Public sector investments in IT modernization encourage private sector participation and foreign investments. National strategies emphasize secure, energy-efficient facilities to meet regional demand. Government agencies invest in e-government platforms that require scalable data management. Regulatory clarity strengthens investor confidence and reduces operational risks. Enterprises respond positively to consistent policy support and long-term planning. The presence of reliable frameworks attracts global hyperscale operators to the market. It transforms Algeria into a preferred destination for advanced IT deployments.

- For instance, in March 2025, the Algerian government commenced construction of an AI data center in Oran, aimed at supporting nationwide digital transformation programs for researchers, startups, and academia, representing a concrete infrastructure investment by public authorities.

Strategic Importance of Market for Regional and Global Businesses

The Algeria Data Center Market holds strategic significance due to its location bridging Europe, Africa, and the Middle East. Proximity to international submarine cables enhances cross-border connectivity. Enterprises value the reduced latency and improved redundancy offered by facilities within the country. International businesses target Algeria as a gateway for regional expansion. Investors view it as a scalable market for long-term growth. Strong enterprise adoption across BFSI, telecom, and government sectors accelerates development. Emerging edge deployments improve support for content delivery and IoT applications. It strengthens the regional digital economy and fosters international partnerships.

Market Trends

Expansion of Edge and Modular Data Centers for Localized Demand

Edge and modular facilities are shaping the Algeria Data Center Market by addressing demand for localized services. Edge deployments improve latency for applications in gaming, streaming, and real-time analytics. Modular centers enable rapid construction with flexible capacity scaling. Enterprises adopt them to serve distributed business operations efficiently. Cloud service providers expand footprints with smaller but strategically located hubs. It supports industries such as retail and healthcare that depend on fast data processing. Enterprises view modular deployment as cost-efficient compared to traditional large facilities. The trend is reshaping future infrastructure planning and investment priorities.

Integration of AI and Machine Learning for Operational Optimization

AI and machine learning tools gain traction within the Algeria Data Center Market to optimize resource utilization. Operators employ AI-driven monitoring to predict energy loads and reduce downtime risks. Machine learning enhances cybersecurity through intelligent threat detection systems. Smart automation reduces operational costs while ensuring high availability. Enterprises adopt AI-enabled solutions for capacity forecasting and traffic management. It improves efficiency for hyperscale and colocation models supporting demanding workloads. AI-based cooling management reduces energy waste and improves sustainability. This trend increases adoption of next-generation facilities equipped with advanced intelligence.

Focus on Green Energy Adoption and Sustainable Infrastructure Models

The Algeria Data Center Market experiences strong momentum toward green energy integration. Operators deploy renewable energy sources such as solar power to reduce carbon emissions. Energy-efficient cooling systems lower power usage effectiveness (PUE). Enterprises prioritize facilities with environmental certifications to align with sustainability goals. Global investors demand eco-friendly infrastructure for long-term partnerships. Government policies encourage low-carbon technology adoption in IT operations. It creates opportunities for providers offering sustainable colocation services. The trend strengthens Algeria’s positioning in the environmentally conscious global digital ecosystem.

Increased Partnerships Between Telecom Operators and Cloud Providers

Collaboration between telecom operators and hyperscale providers is expanding the Algeria Data Center Market. Telecom firms enhance connectivity through fiber upgrades and submarine cable integration. Cloud providers partner to establish colocation and hybrid models within the country. Strategic alliances improve service quality and accelerate digital adoption for enterprises. Enterprises benefit from improved redundancy and service-level agreements. Partnerships extend service offerings in sectors like banking, government, and e-commerce. It creates a competitive environment that attracts global and regional players. The trend accelerates digital transformation and market maturity.

Market Challenges

Infrastructure Gaps and Limited Availability of Skilled Workforce

The Algeria Data Center Market faces challenges from underdeveloped infrastructure and limited expertise in advanced IT. Power reliability and connectivity gaps slow large-scale deployments. Shortages of skilled engineers affect operational efficiency and system maintenance. Enterprises struggle with maintaining uptime when technical staff availability is low. Lack of standardized infrastructure design reduces compatibility with international systems. It restricts the ability of local firms to scale effectively. These issues delay foreign investments despite growing demand. Addressing them requires training initiatives and stronger infrastructure planning.

Regulatory Uncertainty and High Capital Expenditure Requirements

The Algeria Data Center Market must overcome regulatory complexities and financial barriers for growth. Inconsistent licensing processes delay new project execution. High capital investment requirements deter smaller players from entering the market. Limited financial incentives reduce the appeal of large-scale infrastructure projects. Compliance requirements create longer timelines for deployment and integration. Enterprises delay investment decisions due to regulatory risks. It hampers Algeria’s ability to attract international hyperscale providers. Addressing these issues is essential to unlock full digital infrastructure potential.

Market Opportunities

Expansion Potential through Hyperscale Investments and Regional Connectivity

The Algeria Data Center Market presents growth opportunities through hyperscale developments and stronger connectivity infrastructure. Proximity to Europe and North Africa supports cross-border data exchange. Enterprises leverage hyperscale models to handle AI and cloud workloads. Strategic alliances enhance international service delivery. It provides opportunities for new players seeking regional entry. Demand for scalable cloud solutions boosts interest in large facilities. Energy-efficient systems make Algeria attractive for sustainable hyperscale investments. Stronger regional links enhance competitiveness across industries.

Rising Demand for Digital Services and Emerging Industry Verticals

The Algeria Data Center Market offers opportunities in sectors adopting digital-first strategies. BFSI firms deploy secure platforms requiring advanced colocation support. Healthcare systems invest in digital records and telemedicine applications. Retail and e-commerce rely on scalable platforms for online growth. Manufacturing adopts automation tools needing high-capacity data management. It unlocks opportunities for providers offering tailored infrastructure. Digital adoption across SMEs creates demand for flexible colocation models. These opportunities ensure sustained growth for investors and enterprises.

Market Segmentation

By Component

Hardware leads the Algeria Data Center Market with strong demand for servers, storage, and networking. High-density server racks and advanced cooling dominate investments. Power and security systems support reliable uptime. Software adoption grows with DCIM, orchestration, and automation tools. Enterprises prioritize services like consulting and managed operations. Service providers integrate maintenance support to improve efficiency. Hardware maintains dominance due to high infrastructure demand. It shapes future facility development across Algeria.

By Data Center Type

Colocation centers dominate the Algeria Data Center Market as enterprises seek scalable solutions. Hyperscale projects gain traction with international cloud providers. Edge and modular facilities expand to support local demand. Enterprise data centers remain critical for secure workloads. Mega facilities attract attention for AI and analytics applications. Cloud and internet data centers support global service delivery. Each type fulfills unique business requirements. It strengthens the industry’s ability to serve diverse verticals.

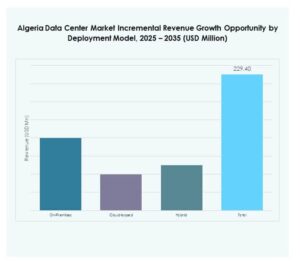

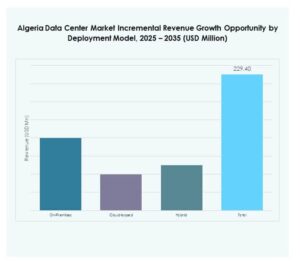

By Deployment Model

Hybrid deployment dominates the Algeria Data Center Market as firms balance security and scalability. On-premises systems continue serving industries with sensitive data. Cloud-based platforms grow rapidly due to cost advantages. Hybrid models support critical workloads while reducing capital burden. Enterprises choose deployment models aligning with compliance needs. It reflects rising trust in shared infrastructure. Providers expand offerings to support flexible options. The shift enhances resilience and adoption.

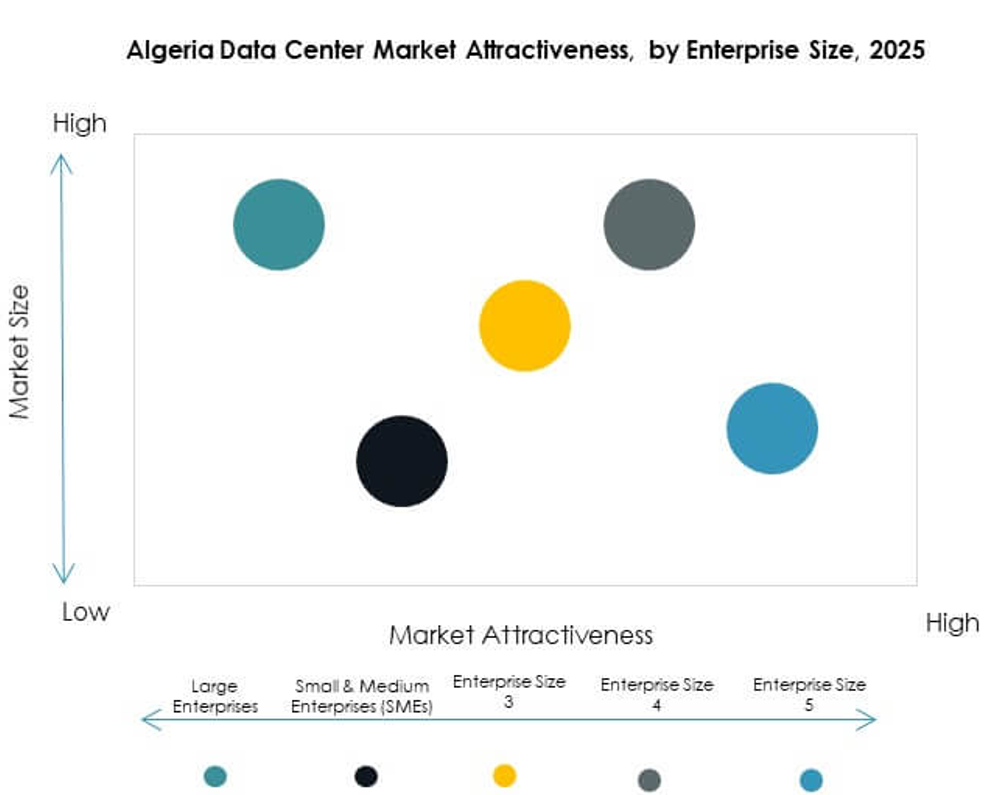

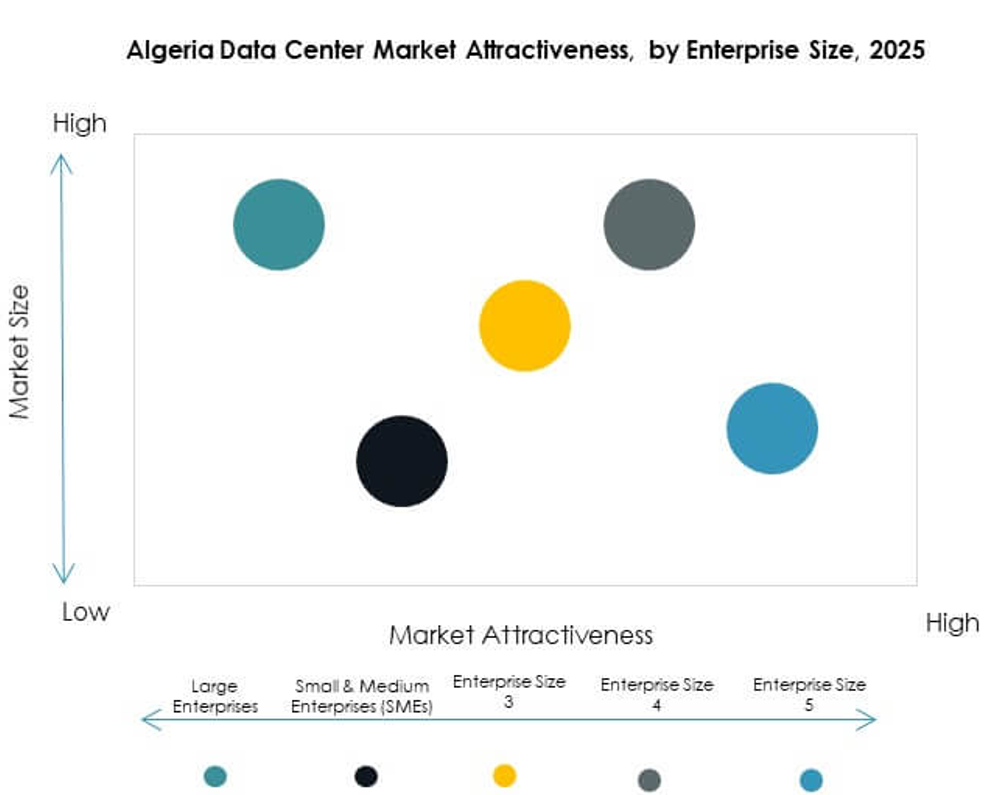

By Enterprise Size

Large enterprises dominate the Algeria Data Center Market with major investments in advanced facilities. SMEs gain traction through affordable colocation and cloud-based solutions. Larger firms drive adoption of high-density servers and automation. SMEs embrace hybrid deployments to reduce costs. Enterprises of all sizes contribute to demand growth. It ensures balanced expansion across different tiers. The presence of both segments enhances market diversity. The dual structure supports long-term digital adoption.

By Application / Use Case

BFSI dominates the Algeria Data Center Market due to reliance on secure platforms. IT and telecom adopt large-scale infrastructure for service delivery. Government invests in digital transformation and secure data handling. Healthcare expands data-driven patient services. Retail and e-commerce accelerate digital adoption. Media and entertainment require content delivery infrastructure. Manufacturing demands automation support. It reflects strong adoption across industries.

By End User Industry

Cloud service providers lead the Algeria Data Center Market with significant infrastructure investment. Enterprises expand reliance on colocation services. Government agencies strengthen national platforms with secure facilities. Colocation providers play a vital role in serving SMEs. Other industries adopt infrastructure for niche requirements. It highlights diverse demand across end users. The growing mix of players shapes market evolution. This segmentation supports resilient development.

Regional Insights

North Algeria Leading with Strong Market Share

North Algeria holds 42% share of the Algeria Data Center Market due to concentrated enterprise activity in Algiers and surrounding areas. Strong connectivity infrastructure and government-backed initiatives attract hyperscale operators. The presence of telecom hubs supports colocation and hybrid adoption. BFSI and public sector clients rely heavily on facilities in this region. It strengthens demand for scalable services. Investors identify the north as the primary hub for digital growth. Strategic projects make this subregion highly competitive.

- For instance, in October 2024, the People’s National Assembly (APN) of Algeria inaugurated its own modern data center on the fifth floor of the APN building in Algiers, designed to host data processing, storage, archiving, and security devices, directly serving government and public sector digitalization needs.

Central Algeria Emerging with Growing Enterprise and SME Adoption

Central Algeria accounts for 33% share of the Algeria Data Center Market with increasing enterprise and SME activity. Manufacturing and retail businesses require advanced IT infrastructure. Demand for hybrid deployment expands with regional economic activity. Growing cloud adoption strengthens demand for colocation services. It supports local enterprises seeking to improve service delivery. Strategic positioning within the country makes it a target for new facilities. The subregion’s growth enhances national digital transformation.

- For instance, Ayrade operates its AYRADE DC1 facility in Rahmania, Algiers, while ICOSNET runs a dedicated data center in Algiers, both offering hosting and cloud services to regional enterprises, according to Datacenter Map and Datacenter Catalog listings.

South Algeria Developing with Rising Potential

South Algeria holds 25% share of the Algeria Data Center Market with early-stage developments. Limited infrastructure availability slows expansion. Renewable energy projects create opportunities for future growth. Enterprises explore edge deployments to support remote operations. It reflects untapped potential that investors monitor closely. Growth prospects improve with government-backed energy and connectivity projects. The subregion is emerging as a long-term opportunity zone.

Competitive Insights:

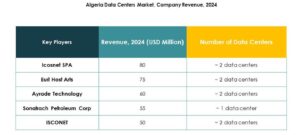

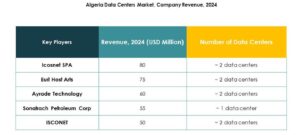

- Icosnet SPA

- Eurl Host Arts

- Ayrade Technology

- Sonatrach Petroleum Corp

- ISCONET

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Algeria Data Center Market features a mix of local providers and global hyperscale firms, each shaping competition through unique strengths. Local players such as Icosnet SPA, Eurl Host Arts, Ayrade Technology, and ISCONET focus on colocation, managed services, and regional enterprise support. Sonatrach Petroleum Corp leverages its industrial footprint to integrate energy-driven infrastructure solutions. Global giants including Microsoft, AWS, and Google expand cloud-based services, targeting enterprise digital transformation with scalable platforms. Competition emphasizes energy efficiency, security, and reliable connectivity. It fosters an ecosystem where local expertise and global capabilities complement each other, positioning Algeria as a strategic hub for regional data hosting and cross-border digital services.

Recent Developments:

- In March 2025, the Algerian government officially launched construction of a new artificial intelligence data center in Oran, aiming to provide cutting-edge access for researchers, startups, and academic institutions while positioning Algeria as a regional technology leader; local players, such as Eurl Host Arts and Ayrade Technology, continue operating hosting services in this evolving market.

- In February 2025, Alphabet Inc. (Google LLC) reaffirmed a colossal $75 billion commitment for expanding its AI-ready data center network worldwide, focusing on technical infrastructure and server growth; while Algerian market-specific initiatives have yet to be detailed, this investment translates into broader access to Google Cloud and AI resources for emerging markets needing data scalability.