Executive summary:

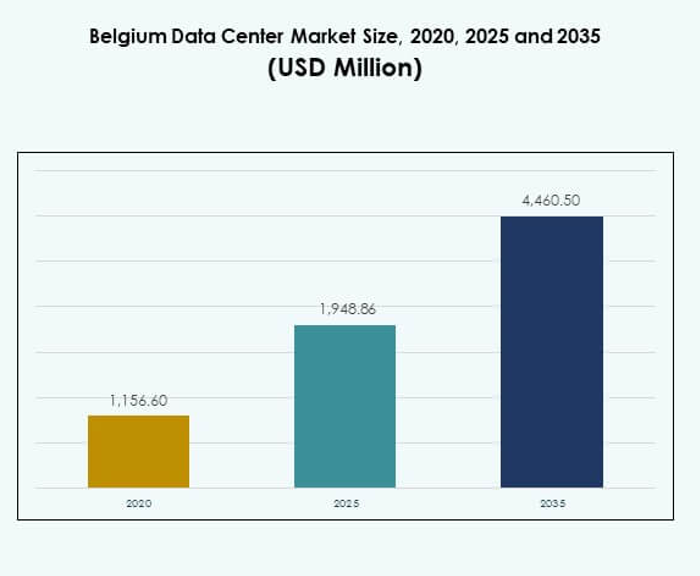

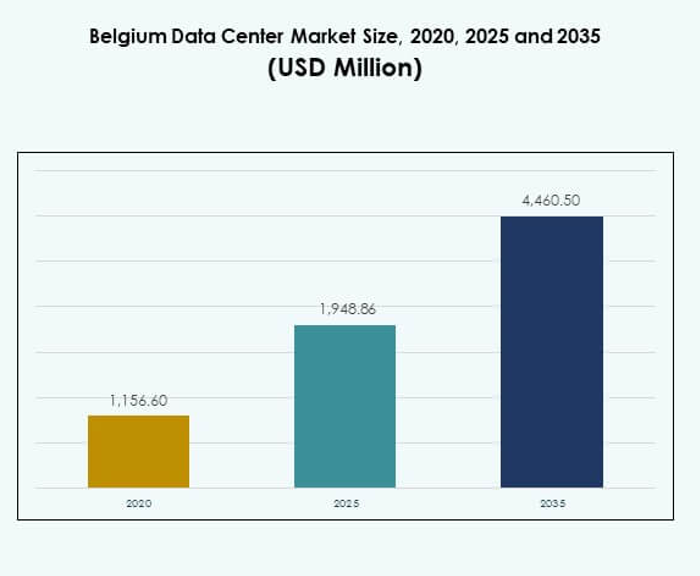

The Belgium Data Center Market size was valued at USD 1,156.60 million in 2020 to USD 1,948.86 million in 2025 and is anticipated to reach USD 4,460.50 million by 2035, at a CAGR of 8.59% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Belgium Data Center Market Size 2025 |

USD 1,948.86 Million |

| Belgium Data Center Market, CAGR |

8.59% |

| Belgium Data Center Market Size 2035 |

USD 4,460.50 Million |

Growth in the Belgium Data Center Market is driven by rising adoption of cloud computing, AI integration, and edge technologies. Enterprises are modernizing IT infrastructure to ensure scalability, security, and efficiency. Strong emphasis on sustainability and renewable energy further accelerates industry transformation. It positions Belgium as a strategic hub for businesses and investors seeking advanced digital ecosystems in Europe.

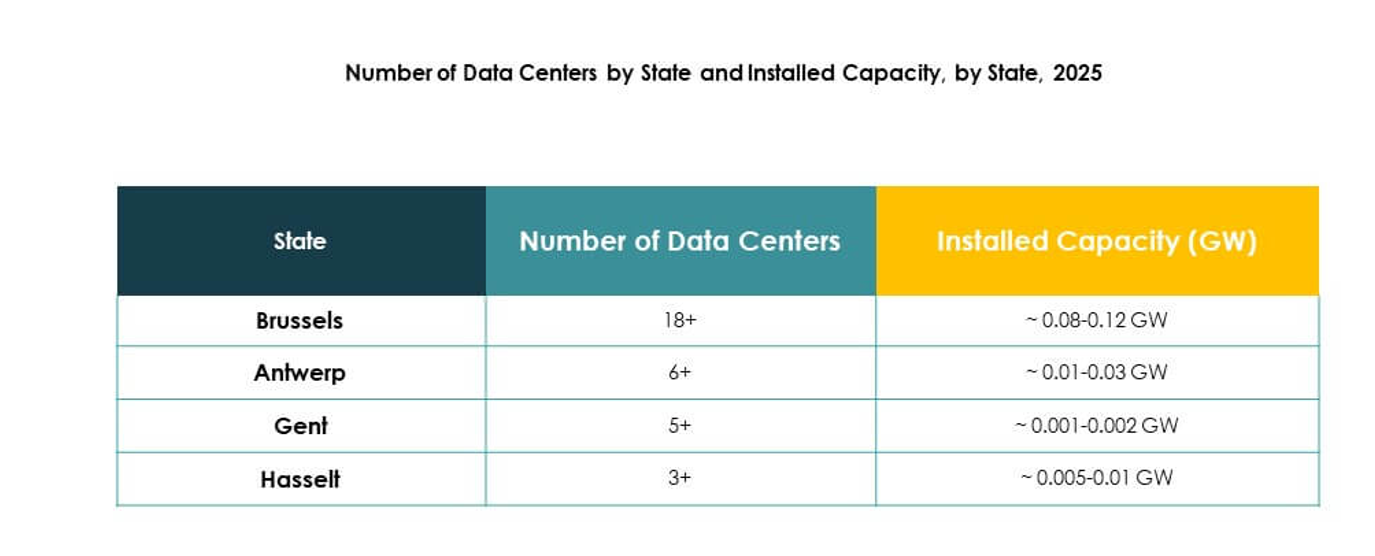

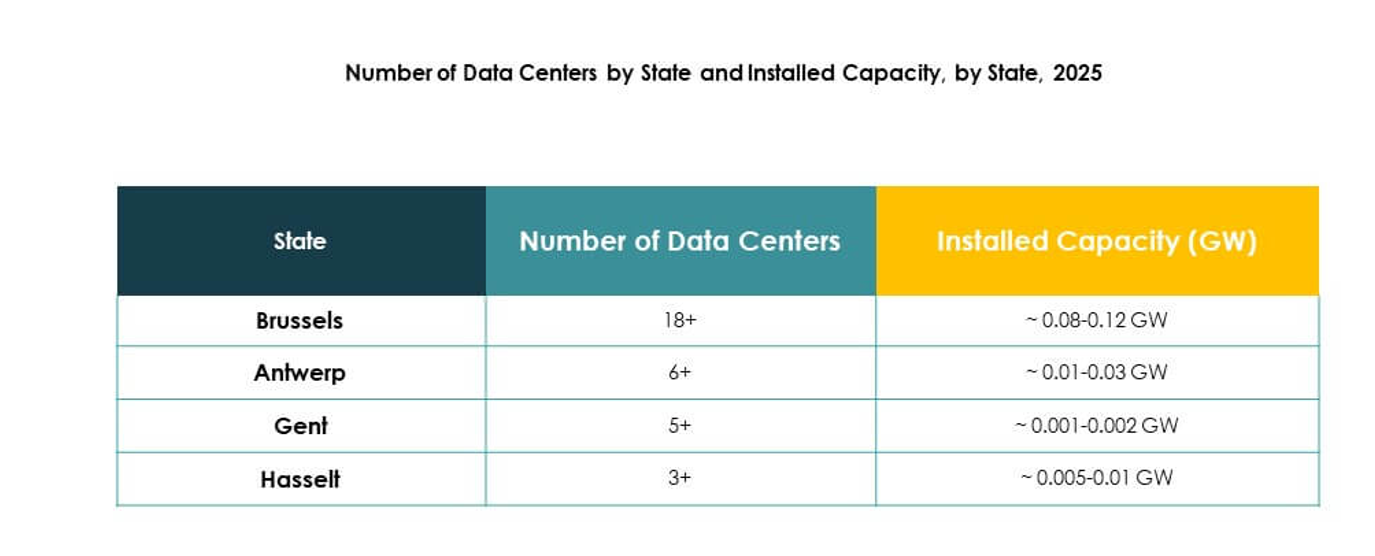

Regionally, Belgium’s central location strengthens its role as a key connectivity hub. Northern and Western Europe lead due to advanced infrastructure and strong enterprise demand, while Central and Eastern Europe emerge with new capacity investments. Belgium’s robust fiber networks, regulatory support, and proximity to major economies enhance its competitiveness within the European data center landscape.

Market Drivers

Accelerating Cloud Adoption and Digital Transformation Across Enterprises

The Belgium Data Center Market is advancing with strong adoption of cloud platforms across enterprises. Companies prioritize scalable infrastructure to support digital operations, improve efficiency, and ensure secure data storage. The surge in SaaS platforms and enterprise mobility creates sustained demand for cloud-based resources. It provides agility for firms expanding operations and managing unpredictable workloads. Businesses also use data centers to reduce costs linked with maintaining legacy systems. Growing focus on resilience and data sovereignty drives investments. Investors identify Belgium as a reliable hub for digital infrastructure. The sector positions itself as a critical enabler of economic growth.

Integration of Artificial Intelligence and Edge Technologies in Core Infrastructure

Artificial intelligence and edge computing transform how data is processed within facilities. The Belgium Data Center Market benefits from deployment of AI-driven monitoring and predictive maintenance tools. These technologies optimize energy use, reduce downtime, and enhance automation. Edge data centers enable faster data processing close to users and critical devices. Businesses leverage them for low-latency applications across healthcare, manufacturing, and telecom. It supports advanced IoT ecosystems that need real-time decision-making. Investors consider AI integration a driver of competitive advantage. Belgium’s strategic connectivity supports rapid rollout of such high-tech facilities across sectors.

- For instance, Digital Realty launched its Apollo AI platform at European data centers in early 2024, identifying 18 gigawatt-hours of energy savings, including targeted remedies such as replacing a single clogged chilled water filter, which immediately cut energy usage by 75 megawatt-hours per month during summer at one facility.

Growing Emphasis on Sustainability and Renewable Energy Integration

Sustainability is shaping investment and operational decisions across modern data centers. The Belgium Data Center Market increasingly integrates renewable power sources to align with carbon reduction targets. Operators adopt innovative cooling technologies to cut energy consumption. Demand from environmentally conscious enterprises encourages providers to emphasize green certifications. Governmental support for clean energy creates favorable conditions for green projects. It strengthens Belgium’s appeal to multinational firms with strict ESG mandates. Long-term investors prioritize regions with strong regulatory alignment and clean energy access. Sustainability acts as both a market necessity and a growth catalyst.

Strategic Importance of Belgium as a European Connectivity Hub

Belgium’s geographic position makes it a gateway to key European economies. The Belgium Data Center Market thrives due to proximity to Germany, France, and the Netherlands. Strong submarine cable connections improve latency and strengthen its role in global data flow. Enterprises use Belgian facilities to expand reach across Europe with secure connectivity. It helps investors access both mature and emerging digital markets. The region’s political stability and supportive regulation attract international providers. Belgium’s role as a cross-border hub reinforces its importance in data-driven ecosystems. This unique positioning creates sustained opportunities for enterprises and investors.

- For instance, in July 2025, EXA Infrastructure deployed a new 1,200 km high-capacity fibre route, including a 115 km North Sea subsea cable segment that connects London, Frankfurt, Amsterdam, and Brussels, providing ultra-low-loss connectivity and strengthening Brussels’ role as a European data hub.

Market Trends

Expansion of Hyper scale and Modular Data Center Infrastructure

Hyperscale and modular solutions are gaining prominence in the Belgium Data Center Market. Enterprises demand scalable architectures that allow seamless capacity adjustments. Modular setups provide flexibility in construction and deployment, reducing time to market. Hyperscale facilities serve global cloud providers managing massive workloads. It creates opportunities for rapid resource allocation and competitive pricing. Operators invest in standardized modular components to support diverse workloads. This trend aligns with fast-evolving enterprise needs. The focus is on efficiency, adaptability, and enabling next-generation digital services across sectors.

Adoption of Liquid Cooling and Advanced Thermal Management Solutions

Rising rack densities push operators toward advanced cooling techniques. The Belgium Data Center Market increasingly adopts liquid cooling systems to manage high heat loads. Traditional air cooling proves insufficient for modern servers running complex applications. Liquid cooling improves energy efficiency while supporting AI-driven workloads. Providers integrate direct-to-chip cooling to sustain operational stability. It attracts high-performance computing users requiring consistent efficiency. Thermal innovations support sustainability goals and reduce costs. This trend signals long-term adoption of advanced cooling technologies across Belgian facilities.

Rising Influence of Colocation Providers in Enterprise Expansion

Colocation models are becoming vital for enterprise IT strategies. The Belgium Data Center Market sees rising demand for shared infrastructure by small and medium firms. Colocation helps businesses reduce capital costs while ensuring high availability. It allows companies to focus on core competencies rather than infrastructure maintenance. Enterprises benefit from access to advanced connectivity and security frameworks. Providers expand services to include hybrid solutions for flexibility. It strengthens Belgium’s role in supporting both startups and established enterprises. The shift reflects broader acceptance of outsourcing IT infrastructure.

Integration of Software-Defined Data Centers and Automation Platforms

Software-defined solutions are reshaping how facilities are managed and scaled. The Belgium Data Center Market experiences steady integration of automation and orchestration platforms. Software-defined infrastructure supports dynamic allocation of storage, networking, and compute resources. Automation reduces operational errors and enhances service reliability. Enterprises value real-time monitoring for seamless workload optimization. It aligns with the need for efficient, responsive, and cost-effective operations. Providers deploy AI-based orchestration tools to maximize uptime. The trend sets the foundation for autonomous data center ecosystems.

Market Challenges

High Energy Consumption and Rising Sustainability Pressures on Operators

Energy use remains a major challenge for operators. The Belgium Data Center Market faces increasing pressure to reduce power consumption while handling high computational demands. Traditional facilities often struggle with efficiency at scale. Regulatory bodies demand compliance with carbon neutrality targets, creating financial burdens. It drives the need for investment in renewable sources and advanced cooling systems. Energy efficiency upgrades require significant upfront costs, slowing adoption for smaller players. Sustaining competitive operations while maintaining environmental commitments proves complex. Meeting sustainability benchmarks while maintaining profitability remains an ongoing issue.

Complex Regulatory Landscape and Rising Concerns About Data Sovereignty

Regulation poses operational and compliance challenges across the market. The Belgium Data Center Market operates within stringent EU-wide standards on data protection and privacy. Providers must ensure GDPR compliance while enabling cross-border data flows. It creates challenges for multinational firms managing sensitive data. Strict sovereignty requirements influence investment decisions and facility design. Companies must balance local regulations with global customer expectations. Adapting to frequent policy updates adds cost and complexity. Uncertainty over new regulations increases risks for investors and providers. This regulatory environment requires constant vigilance and strategic planning.

Market Opportunities

Growth of Edge Computing and Industry-Specific Solutions Across Sectors

Edge computing creates new opportunities for tailored services. The Belgium Data Center Market supports low-latency use cases in healthcare, manufacturing, and retail. Enterprises require localized infrastructure to process critical workloads efficiently. Edge facilities reduce delays in IoT and AI applications. It empowers industries with faster decision-making and improved customer experiences. Providers developing vertical-specific solutions gain an advantage. The trend opens revenue streams for operators serving specialized needs. Belgium’s connectivity accelerates adoption across multiple industries.

Expansion of Hybrid Models and Demand from SMEs for Affordable Solutions

Hybrid deployment is becoming a preferred approach for enterprises. The Belgium Data Center Market enables seamless integration of cloud and on-premises environments. SMEs look for affordable infrastructure with scalability and resilience. Hybrid models provide flexibility for data-sensitive applications while lowering costs. It supports broader adoption among firms with limited budgets. Providers offering managed services attract growing SME demand. Hybrid ecosystems encourage innovation by combining traditional and modern platforms. This opportunity strengthens Belgium’s market potential across business sizes.

Market Segmentation

By Component

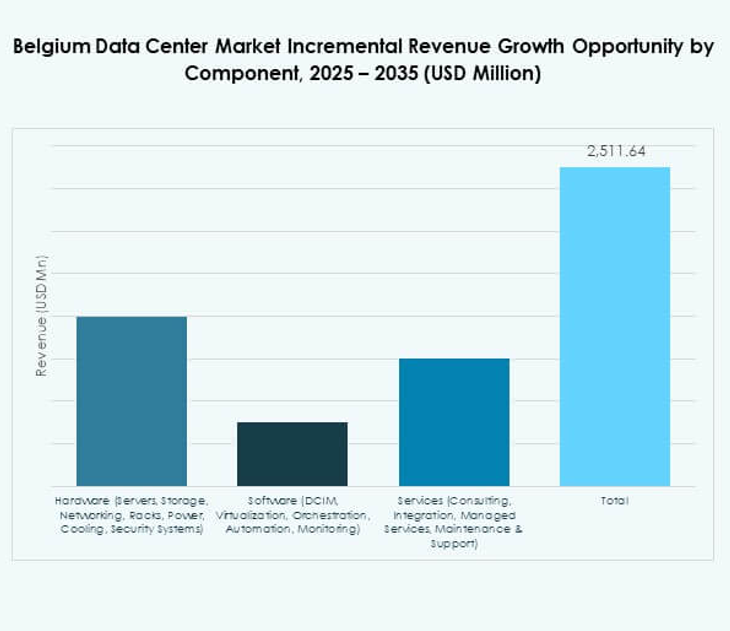

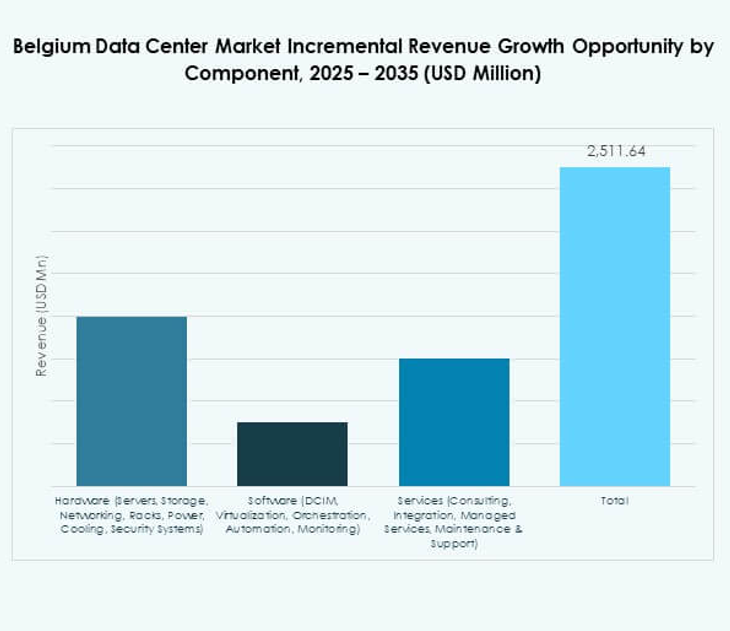

Hardware dominates the Belgium Data Center Market due to high demand for servers, storage, and networking equipment. It holds the largest share as enterprises upgrade infrastructure to support advanced workloads. Cooling and power solutions also contribute significantly to overall costs and efficiency. Software adoption grows with data center infrastructure management and virtualization tools enhancing automation. Services expand through consulting, managed services, and integration offerings. It reflects the growing need for reliable support across enterprises. Hardware remains the foundation driving continuous market growth.

By Data Center Type

Hyperscale facilities dominate the Belgium Data Center Market, driven by cloud service providers’ large-scale investments. Colocation also contributes strongly, offering shared infrastructure to enterprises reducing capital expenditure. Edge and modular setups grow in relevance for supporting IoT and 5G use cases. Enterprise facilities maintain importance for data-sensitive industries like BFSI and government. Cloud and internet data centers see rapid adoption from digital-first enterprises. Mega centers remain fewer but play a role in hosting global providers. This segmentation shows diverse adoption across industry needs.

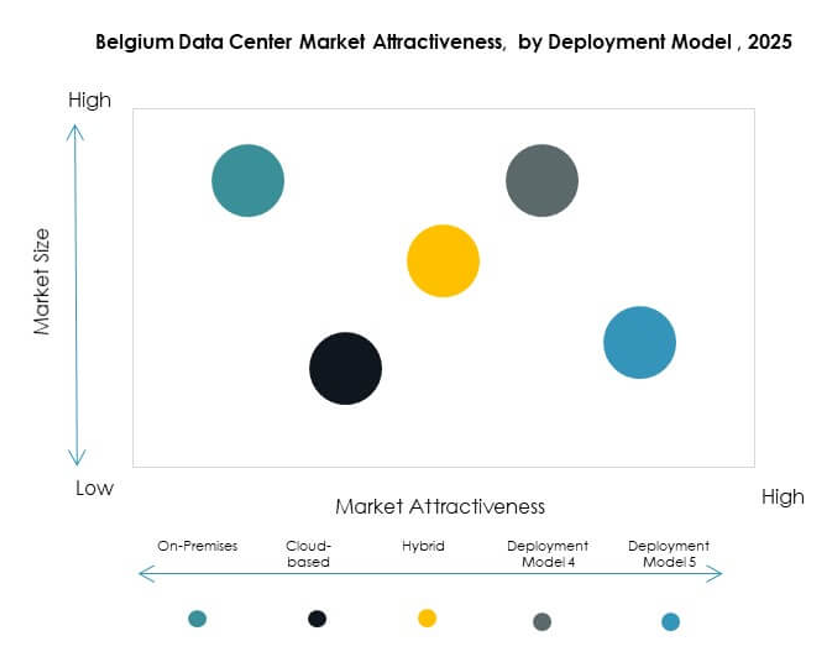

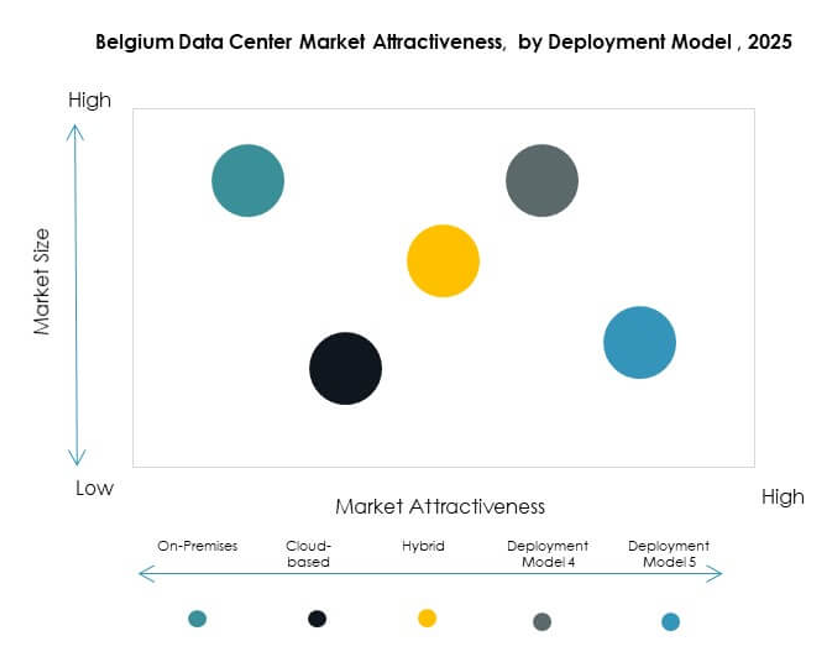

By Deployment Model

Cloud-based deployments lead the Belgium Data Center Market as enterprises prioritize scalability and flexibility. On-premises models still hold value in regulated industries where security is critical. Hybrid approaches gain traction by combining cost efficiency with control over sensitive data. Enterprises prefer hybrid to balance performance with compliance requirements. Providers increasingly tailor solutions for industries adopting hybrid strategies. It creates opportunities for innovation in service delivery models. Cloud-first strategies continue to accelerate expansion across Belgium’s digital ecosystem.

By Enterprise Size

Large enterprises dominate the Belgium Data Center Market due to greater IT budgets and demand for advanced infrastructure. These firms adopt hyperscale and hybrid models to manage vast data volumes securely. SMEs, while smaller in share, show rising adoption due to affordable colocation and cloud services. It reflects growing recognition of IT infrastructure’s importance for competitiveness. Managed service offerings tailored to SMEs drive adoption further. This segmentation highlights different priorities across business sizes. Large enterprises continue to define overall market direction.

By Application / Use Case

IT and telecom dominate the Belgium Data Center Market with strong demand for connectivity and digital services. BFSI also contributes significantly, driven by secure transaction and compliance requirements. Healthcare facilities expand demand for localized and edge infrastructure supporting digital health solutions. Retail and e-commerce rely on scalable systems for customer analytics and online platforms. Media and entertainment require high-capacity storage for digital streaming. Manufacturing benefits from IoT-driven automation needing real-time data handling. Education and utilities also adopt facilities for innovation. This diversity reflects broad applications driving growth.

By End User Industry

Cloud service providers dominate the Belgium Data Center Market with heavy investment in hyperscale infrastructure. Enterprises rely on data centers for scalability and efficiency across industries. Colocation providers gain share by supporting cost-sensitive enterprises. Government agencies invest in secure and sovereign facilities for public data. Other industries contribute to diversification with specialized use cases. It demonstrates balanced growth across private and public sector demand. Cloud providers remain central to market expansion and innovation.

Regional Insights

Northern Europe Leading With Advanced Infrastructure and Strong Investment

Northern Europe dominates the Belgium Data Center Market, holding 39% of the share in 2024. Its leadership stems from advanced digital infrastructure, heavy investments, and established hyperscale facilities. Strong adoption of cloud platforms and AI-powered solutions strengthens growth. Belgium’s proximity to the Netherlands and Germany enhances connectivity and resilience. It positions Northern Europe as a hub for global cloud providers. The region continues to attract investors seeking stability and innovation in digital ecosystems.

- For example, Google’s St. Ghislain data center in Belgium operates entirely without mechanical chillers, relying on advanced free-cooling technology. It has achieved a power usage effectiveness (PUE) of 1.09, ranking among Google’s most efficient facilities globally.

Western Europe Strengthening Position Through Regulatory Support and Cloud Expansion

Western Europe accounts for 32% of the Belgium Data Center Market, supported by favorable regulations and expanding cloud services. Strong government emphasis on data sovereignty and compliance encourages regional growth. Enterprises demand hybrid solutions balancing flexibility with regulatory needs. It attracts providers developing services aligned with evolving legal standards. Cross-border connectivity enhances Western Europe’s competitive advantage. The subregion plays a central role in shaping the regulatory and operational framework of European facilities.

- For example, in November 2023, Equinix opened its FR13 data center in Frankfurt with capacity for 1,125 cabinets and serving over 1,040 companies, designing it with optimized temperatures to improve energy efficiency.

Central and Eastern Europe Emerging With Growing Infrastructure Developments

Central and Eastern Europe hold 29% of the Belgium Data Center Market, reflecting emerging opportunities for growth. Rising investments in modular and edge infrastructure support regional expansion. Enterprises use localized facilities to meet growing connectivity needs. It helps businesses manage workloads closer to consumers in developing markets. Governments invest in digitalization initiatives to attract international players. This subregion emerges as a vital growth frontier, diversifying the European data center ecosystem.

Competitive Insights:

- LCL Data Centers

- Interxion

- Cegeka

- ENGIE Data Centers

- Equinix Belgium

- NTT Belgium

- Digital Realty Trust, Inc.

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Belgium Data Center Market features a mix of global hyperscale operators and regional providers competing on infrastructure scale, service diversity, and technological innovation. Global leaders such as AWS, Google, Microsoft, Equinix, and Digital Realty expand capacity to serve cloud-driven enterprises and ensure reliable cross-border connectivity. Regional players like LCL Data Centers, Interxion, Cegeka, and ENGIE focus on customized colocation, managed services, and sustainability commitments. It encourages competition across service delivery models, from hyperscale deployments to edge and modular solutions. Strong emphasis on renewable energy integration and advanced cooling drives differentiation among providers. Market players invest in automation, hybrid solutions, and AI-driven systems to support enterprise workloads. The ecosystem remains competitive, with collaborations and acquisitions shaping long-term strategies.

Recent Developments:

- In September 2025, the Belgium data center market witnessed a major development as Datacenter United finalized the acquisition of three data centers from Proximus for an enterprise value of €128 million. With this move, Datacenter United, supported by both existing and new shareholders, expanded its presence across Belgium especially in the Brussels region and now operates a total of 13 data centers in the country.

- In May 2025, LCL Data Centers advanced its renewable energy strategy by bringing a new 3.4MW rooftop solar portfolio online in Belgium through a partnership with Nett Energie and Elindus. The solar energy produced is being integrated into their operations and supports local farmers via small-scale PPAs, marking a significant step toward sustainability in the Belgian data center market

- In March 2025, Microsoft Corporation confirmed that its three Belgian Azure data centers, representing an investment of over €1 billion, will be operational by autumn of 2025. These facilities aim to accelerate digital transformation in the Belgian market by delivering advanced cloud and AI technologies, supporting both business and government clients with localized infrastructure solutions.