Executive summary:

The Japan Data Center Colocation Market size was valued at USD 917.23 million in 2020 to USD 2,225.83 million in 2025 and is anticipated to reach USD 9,667.93 million by 2035, at a CAGR of 15.73% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Japan Data Center Colocation Market Size 2025 |

USD 2,225.83 Million |

| Japan Data Center Colocation Market, CAGR |

15.73% |

| Japan Data Center Colocation Market Size 2035 |

USD 9,667.93 Million |

Rapid cloud adoption, AI integration, and advanced digital infrastructure are driving strong demand from enterprises and hyperscale providers. The market is expanding with investments in energy-efficient technologies, hybrid cloud models, and secure connectivity solutions. Businesses view the Japan Data Center Colocation Market as a strategic backbone to support operational agility, data security, and competitive growth in a digitally transforming economy.

Tokyo and Osaka are the leading hubs due to strong connectivity, enterprise density, and mature infrastructure. Emerging regions are gaining attention as operators expand capacity to secondary markets to reduce costs and improve redundancy. This geographic diversification strengthens national resilience and accelerates market development.

Market Drivers

Accelerating Digital Transformation Across Critical Industries

The rapid expansion of cloud adoption, AI applications, and Industry 4.0 initiatives drives strong demand for high-capacity colocation infrastructure. Enterprises in banking, healthcare, manufacturing, and telecommunications are shifting to scalable data center environments to support automation, edge computing, and real-time data processing. The Japan Data Center Colocation Market benefits from this shift, enabling faster digital execution. It offers enterprises flexibility, security, and operational resilience. High-speed fiber networks and low-latency interconnections strengthen business continuity strategies. Investors view this transformation as a long-term growth engine for modern digital infrastructure.

Rising Hyperscale Deployments and Hybrid Cloud Integration

Hyperscale cloud providers are scaling operations in key urban hubs to address growing enterprise workload demands. Colocation facilities are becoming critical for integrating public and private cloud environments. The Japan Data Center Colocation Market supports secure hybrid models that enhance performance and reduce total infrastructure costs. It allows operators to optimize resources while maintaining compliance. Global cloud firms are partnering with domestic operators to extend service coverage. These collaborations increase availability zones and strengthen ecosystem maturity. Businesses gain operational agility and faster service delivery across verticals.

- For instance, in December 2024, AWS announced a new Direct Connect location at Telehouse Osaka 2, supporting 1 G, 10 G, and 100 G MACsec-enabled ports. AT TOKYO’s CC1 Chuo Data Center also hosts an AWS Direct Connect location, enhancing secure connectivity options in Japan.

Growing Data Localization and Cybersecurity Requirements

Japan’s regulatory framework is driving demand for secure, localized infrastructure. Data localization mandates require critical information to remain within national borders, increasing reliance on domestic colocation centers. The Japan Data Center Colocation Market supports compliance while ensuring robust cybersecurity and physical security measures. It addresses enterprise concerns over data sovereignty and risk mitigation. Industries such as BFSI, healthcare, and government demand advanced security solutions. Operators invest in next-generation encryption, zero-trust models, and resilient network architecture. Strong compliance frameworks attract both local and international investors.

Strategic Infrastructure Investment and Renewable Energy Adoption

Investments in renewable energy integration and power efficiency are reshaping long-term infrastructure strategies. Operators are deploying efficient cooling systems, renewable sourcing, and high-density racks to meet enterprise sustainability targets. The Japan Data Center Colocation Market reflects this shift, aligning infrastructure expansion with environmental goals. It creates opportunities for sustainable growth and competitive differentiation. Green certifications and low PUE targets attract ESG-focused investors. Energy security and grid modernization enhance reliability and operational continuity. Strategic infrastructure financing supports capacity expansion in key cities and emerging regions.

- For instance, in March 2024, MC Digital Realty opened the NRT12 facility in Inzai, Chiba, with 34 MW of IT capacity. The site supports up to 70 kW per rack and uses advanced air-assisted liquid cooling technology, enhancing infrastructure efficiency for hyperscale deployments.

Market Trends

Surge in Edge Deployments and Latency Optimization Initiatives

Edge computing is reshaping the data center landscape by bringing compute resources closer to users and devices. Enterprises demand ultra-low latency to support applications like autonomous vehicles, telemedicine, and immersive media. The Japan Data Center Colocation Market is evolving toward distributed edge architectures. It enables operators to host localized workloads while maintaining connectivity to core hyperscale nodes. Telecom operators and cloud providers are collaborating on edge deployment projects. This shift accelerates service delivery speed. Edge nodes are becoming vital for digital economy expansion and real-time processing demands.

Focus on Modular Construction and Rapid Deployment Models

Data center operators are moving toward modular and prefabricated designs to reduce build times and increase flexibility. These models allow faster capacity deployment in urban and regional locations. The Japan Data Center Colocation Market is adapting to this shift by implementing scalable, modular designs. It helps operators align with dynamic enterprise needs and technological shifts. Modular builds support standardization, improve cost efficiency, and ease upgrades. Operators can quickly expand into secondary markets. This agility strengthens network resilience and ensures competitive positioning.

Expansion of Carrier-Neutral Interconnection Ecosystems

Carrier-neutral facilities are becoming strategic assets for enterprises seeking flexible and cost-effective connectivity. Businesses prefer interconnection-rich campuses that host multiple cloud and network service providers. The Japan Data Center Colocation Market is seeing strong development in these ecosystems. It enhances cross-connectivity and multi-cloud interoperability. Data-intensive industries benefit from reduced latency and better redundancy. Interconnection hubs are attracting global and domestic service providers. This ecosystem growth supports regional digital transformation and strengthens Japan’s global connectivity profile.

Integration of AI and Automation for Infrastructure Efficiency

AI-driven operations and predictive maintenance tools are transforming colocation management. Automated monitoring systems optimize energy use and improve equipment uptime. The Japan Data Center Colocation Market is embracing AI adoption to enhance operational performance. It allows real-time load balancing and resource optimization. Operators reduce operational costs while improving customer service levels. Automation supports resilient and agile infrastructure strategies. These shifts enhance capacity utilization, reduce carbon footprints, and future-proof large-scale facilities.

Market Challenges

High Power Consumption and Energy Sustainability Constraints

The growing scale of colocation infrastructure creates rising energy demand and grid pressure. High-density computing and hyperscale expansion increase power usage, raising operational costs. The Japan Data Center Colocation Market faces strong pressure to align growth with sustainable energy sourcing. It requires grid modernization and investment in renewable capacity. Operators face challenges in balancing expansion with power efficiency goals. Strict environmental regulations increase compliance requirements. Limited land availability in key hubs adds to cost pressure. Energy sourcing complexity remains a key operational constraint for investors and operators.

Rising Real Estate and Infrastructure Development Costs

Japan’s limited urban land supply and high construction costs increase barriers to large-scale data center development. Securing prime real estate in strategic hubs like Tokyo and Osaka involves high capital expenditure. The Japan Data Center Colocation Market experiences cost constraints that slow new builds and expansion timelines. It requires strong financial strategies to balance investment returns. Regulatory approvals and land-use limitations add delays. Operators must adopt innovative space optimization and modular solutions. These economic pressures challenge scalability and reduce investment flexibility.

Market Opportunities

Expansion Into Secondary Markets and Regional Edge Clusters

Demand for distributed IT infrastructure is rising outside Tokyo and Osaka. Operators are identifying secondary cities for cost-effective capacity deployment and strategic network diversification. The Japan Data Center Colocation Market is positioned to benefit from this regional expansion. It supports reduced latency and better resilience across national networks. Enterprises prefer diversified deployment models to enhance disaster recovery. This creates new investment opportunities for operators targeting untapped clusters. Expanding edge footprints accelerates market maturity.

Strategic Alliances for Green and High-Density Infrastructure

Sustainability is driving strategic alliances between operators, utilities, and technology firms. Partnerships enable development of energy-efficient, high-density facilities powered by renewable energy. The Japan Data Center Colocation Market aligns with ESG goals, making it attractive for institutional investors. It supports innovative cooling systems, low PUE designs, and carbon reduction targets. Green alliances strengthen operational reliability and brand reputation. Operators use these collaborations to secure long-term energy contracts and improve infrastructure economics.

Market Segmentation

By Type

Retail colocation dominates the Japan Data Center Colocation Market with a large share, driven by high demand from SMEs and enterprises seeking flexible capacity solutions. Wholesale colocation is expanding as hyperscale providers increase their presence in Tokyo and Osaka. Hybrid cloud colocation is gaining traction due to integration needs across public and private clouds. Retail facilities enable faster deployment, while wholesale ensures cost efficiency at scale. This type-based structure supports diverse enterprise workload demands.

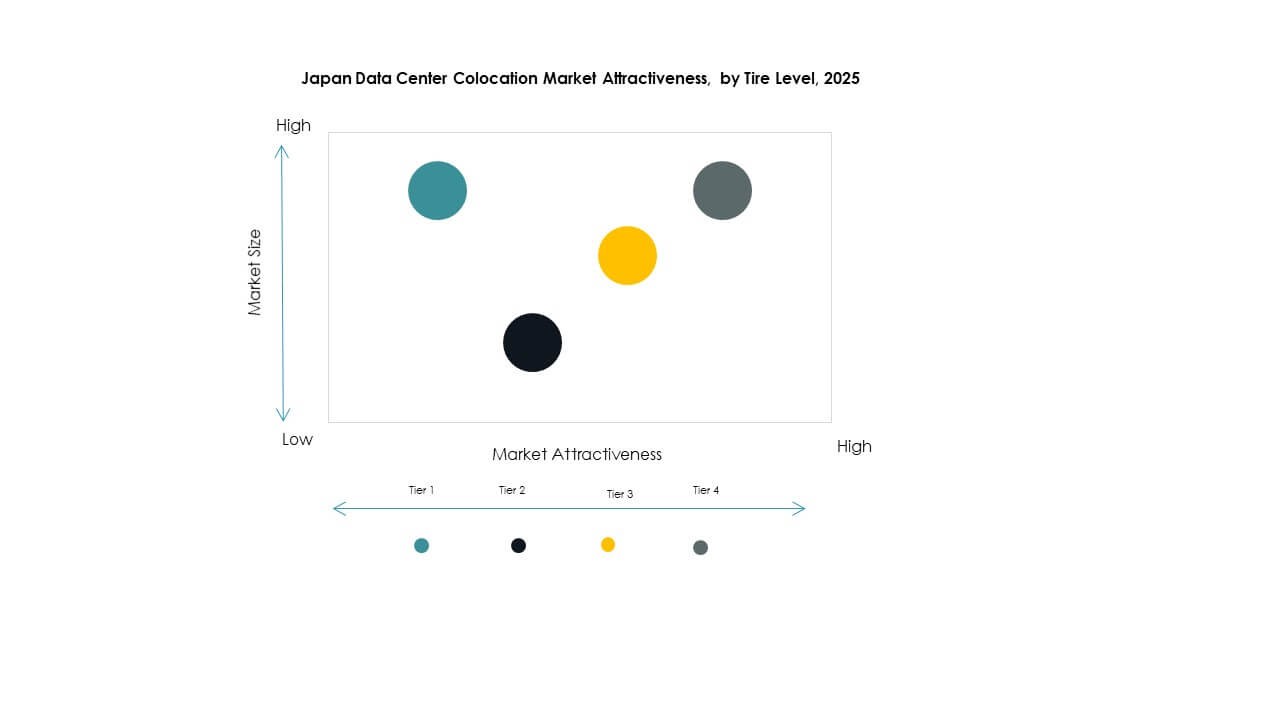

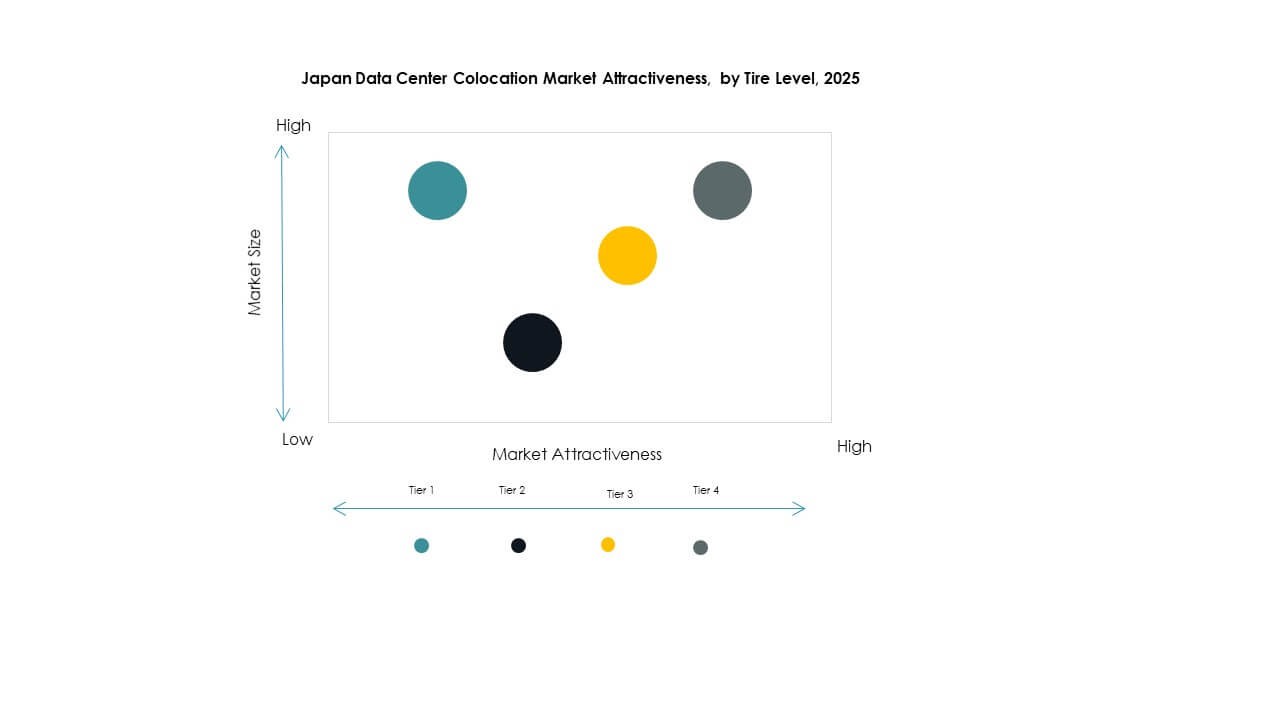

By Tier Level

Tier 3 facilities hold the largest share in the Japan Data Center Colocation Market due to their strong uptime assurance and reliability. Tier 4 is growing fast as critical industries demand high availability and fault tolerance. Tier 1 and Tier 2 remain relevant for smaller deployments with lower resilience needs. Tier 3 aligns well with enterprise demand for balanced cost and performance. Strong SLA commitments and redundancy drive adoption in financial and telecom sectors.

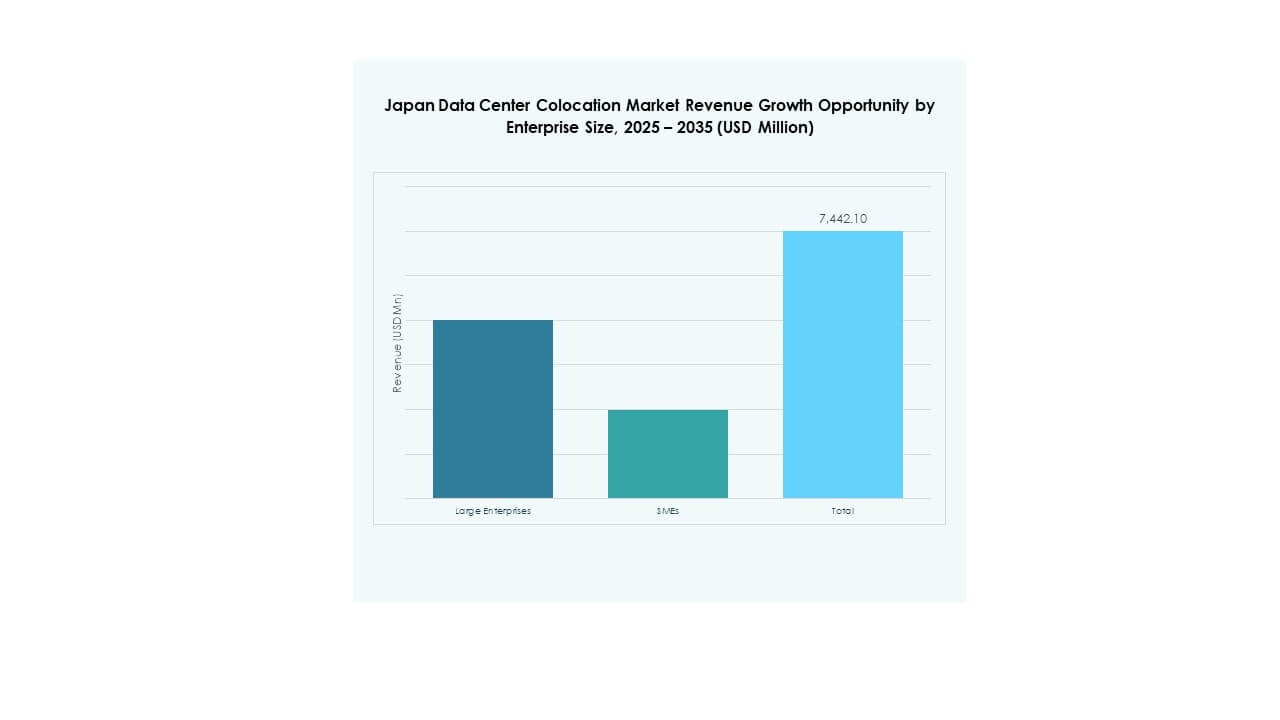

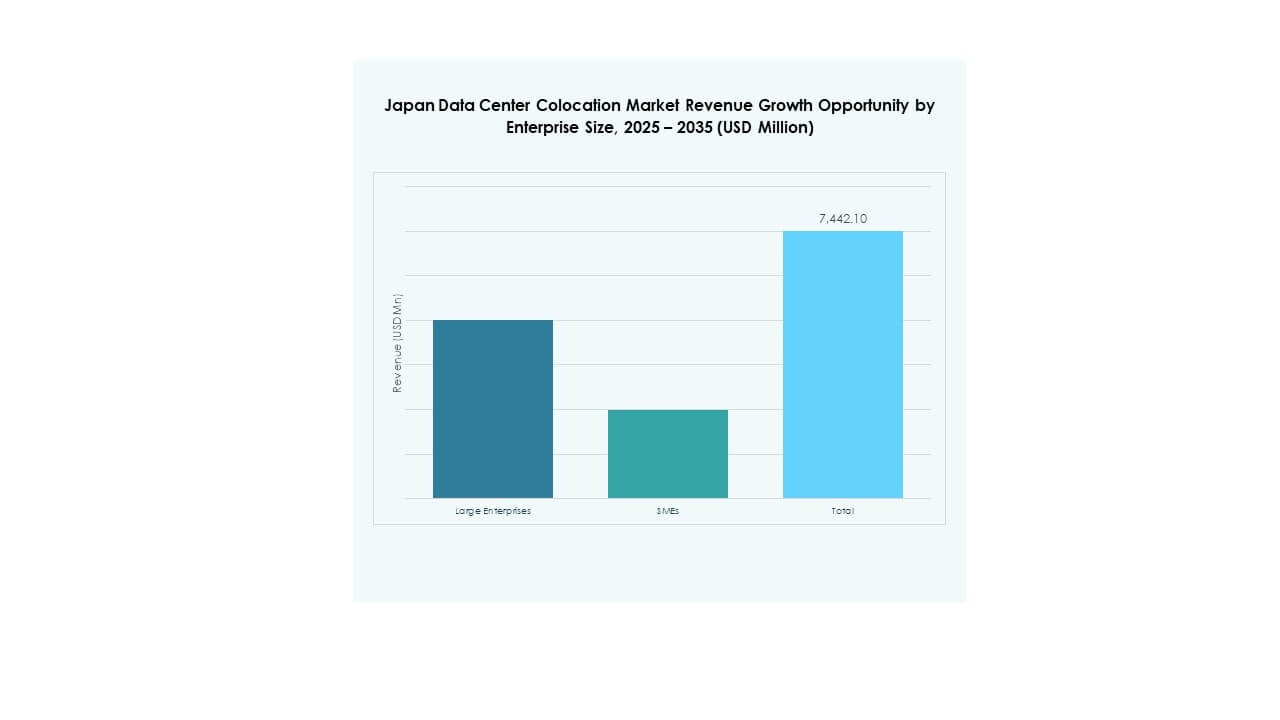

By Enterprise Size

Large enterprises lead the Japan Data Center Colocation Market, contributing a dominant share due to their strong digital transformation programs. SMEs are increasing adoption driven by cost savings, security, and scalability. Enterprises prefer colocation to avoid high CAPEX and focus on core operations. Large corporations drive demand for hybrid and hyperscale-ready facilities. SMEs create steady demand for retail colocation spaces and managed services. This size-based structure supports both stable and high-growth customer segments.

By End User Industry

The IT & Telecom segment dominates the Japan Data Center Colocation Market, supported by strong cloud adoption, data traffic growth, and advanced network infrastructure. BFSI follows closely, driven by secure infrastructure needs and regulatory compliance. Healthcare and media sectors are expanding their presence through low-latency and data-driven services. Retail leverages colocation to improve omnichannel strategies. Other industries such as education and logistics contribute to steady growth, strengthening diversification across verticals.

Regional Insights

Tokyo Metropolitan Area – Core Hyperscale and Connectivity Hub

Tokyo accounts for 58% of the Japan Data Center Colocation Market, making it the largest subregion. It serves as the primary hub for hyperscale operators, financial institutions, and global cloud providers. Tokyo’s advanced connectivity infrastructure, reliable power grid, and high enterprise density drive demand. It benefits from strong fiber backbones and carrier-neutral interconnections. Large technology firms prioritize Tokyo for low-latency deployments. Real estate constraints remain, but strategic vertical builds and modular construction support continued expansion.

- For instance, Equinix opened its TY13x data center in Tokyo (Inzai, Chiba) in 2023 and announced TY15 for late 2024 to expand its colocation and interconnection footprint. These facilities strengthen Tokyo’s position as a strategic hub for global cloud and hyperscale operators.

Osaka Region – Strategic Redundancy and Secondary Hub

Osaka holds 31% share of the Japan Data Center Colocation Market, serving as a strategic backup and secondary deployment location. It supports disaster recovery strategies and capacity balancing for large enterprises. Osaka’s growing connectivity, lower land costs, and regulatory stability make it attractive for expansion. Operators use Osaka to reduce latency for western Japan workloads. Regional partnerships with telecom providers enhance interconnection density. The city’s steady infrastructure investments strengthen its role as a complementary hub to Tokyo.

- For instance, in May 2024, Digital Realty, through its MC Digital Realty joint venture, broke ground on the 31 MW NRT14 data center in Inzai, Chiba. The facility is scheduled to open in December 2025, bringing the campus capacity to 104 MW and strengthening Japan’s hyperscale infrastructure expansion.

Emerging Secondary Regions – Expanding Edge Footprints

Emerging cities hold 11% share of the Japan Data Center Colocation Market, showing growing importance in edge network expansion. Locations such as Fukuoka, Nagoya, and Sapporo are becoming preferred sites for distributed deployments. These areas offer cost advantages, land availability, and expanding network infrastructure. Operators are investing in modular and energy-efficient facilities to meet regional enterprise needs. Edge deployments in these areas reduce latency and increase resilience. This geographic diversification supports national digital infrastructure growth.

Competitive Insights:

- NTT Communications

- MC Digital Realty

- SoftBank

- Mitsubishi

- Amazon Web Services (AWS)

- Google Cloud

- Japan Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The Japan Data Center Colocation Market features strong competition between domestic operators and global hyperscale providers. It is shaped by NTT Communications and MC Digital Realty, which dominate through extensive infrastructure and advanced connectivity. Global players such as AWS, Google Cloud, and Equinix expand their local footprint through strategic alliances and hybrid models. Operators focus on green energy sourcing, low-latency networks, and modular builds to secure enterprise contracts. Partnerships with telecom companies strengthen interconnection density. Competitors aim to differentiate through sustainability, scalability, and service depth. Continuous investment in edge deployments and carrier-neutral ecosystems enhances market reach and customer retention.

Recent Developments:

- In October 2025, NTT DOCOMO BUSINESS (formerly NTT Communications Corporation) entered into a partnership with OMRON Corporation to deliver secure data collaboration solutions leveraging Catena-X standards. The partnership aims to merge Operational Technology (OT) and Information Technology (IT) data across manufacturing sites, boosting supply chain transparency and cybersecurity in Japan’s industrial ecosystem.

- In October 2025, SoftBank Corp. formed a partnership with Oracle Corporation to deliver sovereign cloud and AI services in Japan. Under this collaboration, SoftBank launched Cloud PF Type A, supported by Oracle Alloy, to strengthen data sovereignty and cybersecurity in the Japanese market. The initiative aims to empower local industries with over 200 Oracle Cloud Infrastructure (OCI) services through secure data centers, reinforcing Japan’s cloud independence strategy.

- In May 2024, Digital Realty, through its joint venture with Mitsubishi called MC Digital Realty, commenced construction on a 31MW data center (NRT14) in Inzai, Chiba Prefecture. Expected to be operational by December 2025, the facility is tailored for AI workloads using air-assisted liquid cooling. This expansion takes the Inzai campus capacity to 104MW, reinforcing the joint venture’s role in Japan’s growing AI and hyperscale infrastructure market.

- In February 2025, Colt Data Centre Services launched another large-scale data center, Inzai 4, in Tokyo. The facility’s first phase, with a 4.8MW IT load, is operational, and once complete, will deliver 20MW total capacity. Developed under the Fidelity-Mitsui joint venture, Inzai 4 further consolidates Colt’s footprint in Japan’s hyperscale colocation market.