Executive summary:

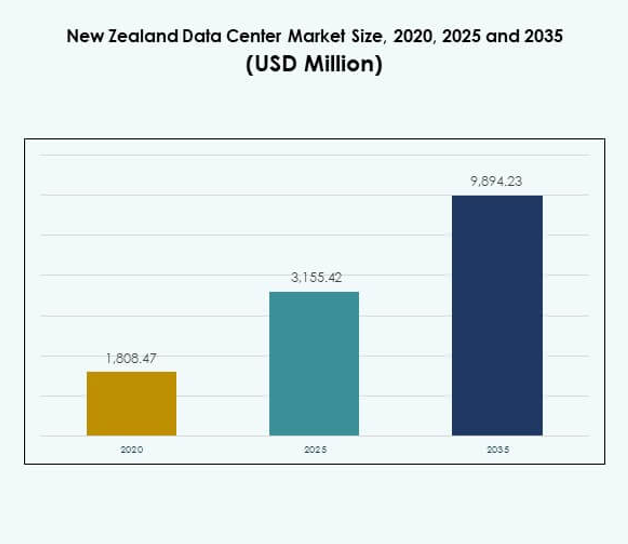

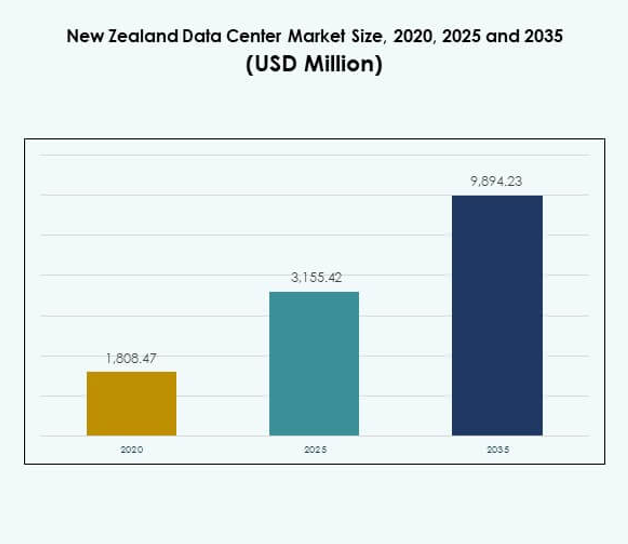

The New Zealand Data Center Market size was valued at USD 1,808.47 million in 2020 to USD 3,155.42 million in 2025 and is anticipated to reach USD 9,894.23 million by 2035, at a CAGR of 12.02% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| New Zealand Data Center Market Size 2025 |

USD 3,155.42 Million |

| New Zealand Data Center Market, CAGR |

12.02% |

| New Zealand Data Center Market Size 2035 |

USD 9,894.23 Million |

Growth in the market is driven by cloud adoption, rapid digital transformation, and rising demand for scalable infrastructure. Enterprises invest heavily in advanced technologies such as AI, edge computing, and green energy integration to strengthen efficiency and security. The market holds strategic importance for businesses and investors by enabling digital resilience, improving cost efficiency, and providing reliable infrastructure to support evolving industries.

Regionally, the North Island dominates due to its strong connectivity, enterprise concentration, and government presence. The South Island is emerging with growth in modular and disaster recovery facilities, attracting enterprises seeking resilience and cost advantages. Other regions show smaller but steady adoption, with localized deployments supporting healthcare, education, and energy sectors.

Market Drivers

Growing Digital Transformation and Cloud Adoption in Enterprise Operations

The New Zealand Data Center Market is expanding due to enterprises accelerating digital transformation and adopting cloud infrastructure. Companies across industries are shifting workloads to hybrid and cloud-based platforms to improve agility and scalability. This driver is reinforced by rising demand for secure storage, high-speed networking, and uninterrupted service delivery. Businesses prioritize data centers to support enterprise resource planning, advanced analytics, and customer engagement platforms. It is clear that cloud adoption enables cost efficiency and operational reliability. Investors find the sector appealing because of consistent returns. Enterprise clients prefer providers that integrate sustainability with performance. The market is strategically positioned to support evolving enterprise technology needs.

Rising Demand for Advanced Computing and High-Capacity Infrastructure

The demand for advanced computing power drives large investments in high-capacity servers, storage, and network systems. The New Zealand Data Center Market benefits from the rising use of artificial intelligence, machine learning, and big data platforms across sectors. Organizations require scalable infrastructure to manage resource-heavy workloads and data-intensive applications. The growth of e-commerce, online services, and media streaming further accelerates infrastructure investments. It is evident that enterprises are focused on reducing latency while enhancing security. The push for low-power and energy-efficient hardware strengthens this driver. Businesses increasingly partner with hyperscale and colocation providers. Investors recognize the profitability of infrastructure-backed growth.

- For instance, in September 2025, Amazon Web Services (AWS) officially began operations for its Asia Pacific (New Zealand) Region, launching three availability zones designed to improve local redundancy and resilience, and bringing AWS’s full suite of cloud, storage, database, and machine learning tools directly to New Zealand businesses.

Innovation in Edge Computing and Emerging Micro Data Centers

Edge computing adoption plays a key role in transforming the market landscape by supporting real-time data processing closer to users. The New Zealand Data Center Market gains momentum from emerging micro and modular data centers. These facilities are designed to address connectivity demands across industries such as telecom, retail, and healthcare. Edge adoption improves response times for critical applications while reducing bandwidth strain. It is becoming a necessity for businesses aiming to provide faster customer experiences. Providers are investing in modular solutions to improve deployment speed. Growing IoT adoption strengthens the relevance of edge-based strategies. Investors see scalability and cost efficiency as strong attractions.

Strategic Importance of Green Data Center Innovations for Business Growth

Green innovation is shaping investment patterns, with enterprises prioritizing sustainable and energy-efficient solutions. The New Zealand Data Center Market is strategically important for businesses and investors due to its focus on renewable energy integration and carbon footprint reduction. Operators are developing eco-friendly cooling and power management systems to comply with regulatory and environmental goals. It is creating strong alignment with national climate policies. Enterprises prefer data center providers that demonstrate measurable sustainability performance. Large-scale renewable adoption lowers operational risks for investors. Businesses also gain reputational benefits from using environmentally responsible providers. The shift to green infrastructure ensures long-term growth.

- For instance, at the December 2024 opening of Microsoft’s New Zealand cloud region, the company confirmed it will run entirely on carbon-free energy sourced through a 51.4 MW, 10-year geothermal agreement with Contact Energy, setting a new national precedent for sustainable digital infrastructure.

Market Trends

Integration of Artificial Intelligence to Enhance Efficiency and Resource Utilization

Artificial intelligence adoption is reshaping facility management by automating cooling, power use, and security systems. The New Zealand Data Center Market is witnessing AI integration to optimize real-time operations and predict maintenance requirements. AI enables data centers to balance workloads across servers efficiently. It is reducing downtime risks while improving reliability. Operators focus on predictive modeling to ensure energy savings. Businesses value AI-led solutions that improve operational continuity. Investors recognize its potential to reduce long-term costs. The trend is expected to intensify across both hyperscale and colocation centers.

Expansion of Data Sovereignty and Compliance-Driven Investments

Data sovereignty regulations influence where enterprises host and process sensitive information. The New Zealand Data Center Market aligns with national and regional compliance frameworks to build trust. Governments emphasize secure hosting within domestic borders to safeguard data privacy. It is driving enterprises to partner with local providers. This trend improves demand for colocation and enterprise-specific facilities. Investors benefit from stable and regulation-backed opportunities. Businesses in finance, healthcare, and defense prioritize providers with compliance certifications. Operators are expanding facilities with stronger auditing and monitoring frameworks.

Growing Interconnection Ecosystems Supporting Cross-Industry Collaboration

The interconnection trend is strengthening data exchange across sectors by linking enterprises, service providers, and networks within integrated facilities. The New Zealand Data Center Market benefits from demand for secure and high-capacity interconnect services. Operators build ecosystems that support cloud, telecom, and enterprise collaboration. It is enabling businesses to scale without latency concerns. Service providers promote bundled solutions including managed hosting and interconnection services. Retail, media, and BFSI industries adopt these ecosystems rapidly. Investors recognize ecosystem-centric providers as more competitive. This trend underlines the shift toward integrated value chains.

Adoption of Automation Platforms for Streamlined Operations and Monitoring

Automation platforms are being deployed to manage complex workloads and reduce manual dependency. The New Zealand Data Center Market leverages orchestration and virtualization tools to improve efficiency. Enterprises rely on automation to streamline capacity scaling and improve monitoring. It is reducing operational errors and lowering maintenance expenses. Providers invest in AI-enabled orchestration platforms for greater precision. Automated systems support rapid deployment of services in cloud and hybrid environments. Businesses view automation as vital for speed-to-market strategies. Investors see strong potential in efficiency-driven models. The trend is expected to gain further traction with rising complexity.

Market Challenges

High Energy Consumption and Rising Sustainability Concerns in Operations

Energy demand is a pressing challenge for operators due to the power-intensive nature of facilities. The New Zealand Data Center Market faces mounting scrutiny over energy use, cooling systems, and greenhouse gas emissions. Operators must balance cost efficiency with growing sustainability expectations. It is difficult for small players to match the investments of larger hyperscale providers. Government regulations on energy efficiency put pressure on existing infrastructures. Rising demand for green energy integration increases upfront costs. Businesses demand providers that can guarantee sustainable practices. Investors evaluate the financial risks tied to energy-intensive operations.

Shortage of Skilled Workforce and Increasing Cybersecurity Threats

The shortage of skilled professionals in networking, cybersecurity, and data center operations creates barriers to expansion. The New Zealand Data Center Market contends with rising cyber threats targeting critical infrastructure. It is challenging to maintain resilience against evolving ransomware and data breaches. Enterprises expect high standards of security and compliance, increasing operational costs. Limited availability of specialized workforce delays project timelines. Cyber risks demand continuous investment in monitoring and protection systems. Investors remain cautious about providers lacking robust security frameworks. Businesses prefer providers with advanced threat detection capabilities.

Market Opportunities

Rising Investments in Hyperscale and Colocation Facilities to Meet Demand

Hyperscale and colocation expansion is an opportunity for operators aiming to support increasing enterprise needs. The New Zealand Data Center Market benefits from multinational cloud providers investing in scalable infrastructure. It is creating strong demand for partnerships and localized service models. Enterprises seek providers capable of offering flexible, low-latency solutions. Colocation operators attract SMEs by providing cost-efficient hosting. Investors find hyperscale projects appealing due to their scale and stability. The opportunity is strengthened by growing cloud-native businesses.

Integration of Renewable Energy to Enhance Market Competitiveness

Sustainability-driven investment strategies open new opportunities for providers seeking competitive advantages. The New Zealand Data Center Market is advancing in renewable energy adoption for powering critical facilities. It is aligning with national environmental goals and business sustainability priorities. Enterprises prioritize eco-friendly service providers to meet their corporate commitments. Operators gain a strategic edge by investing in clean energy. Green certifications increase investor trust and market visibility. This opportunity will continue to attract funding from global infrastructure investors.

Market Segmentation

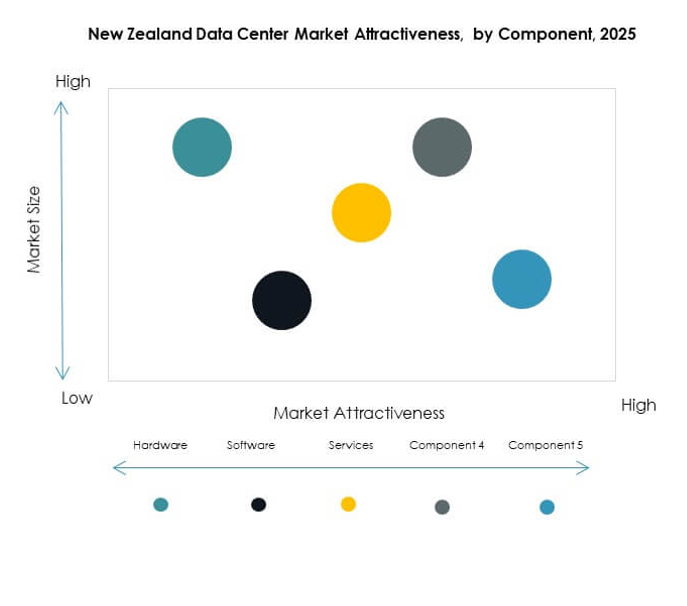

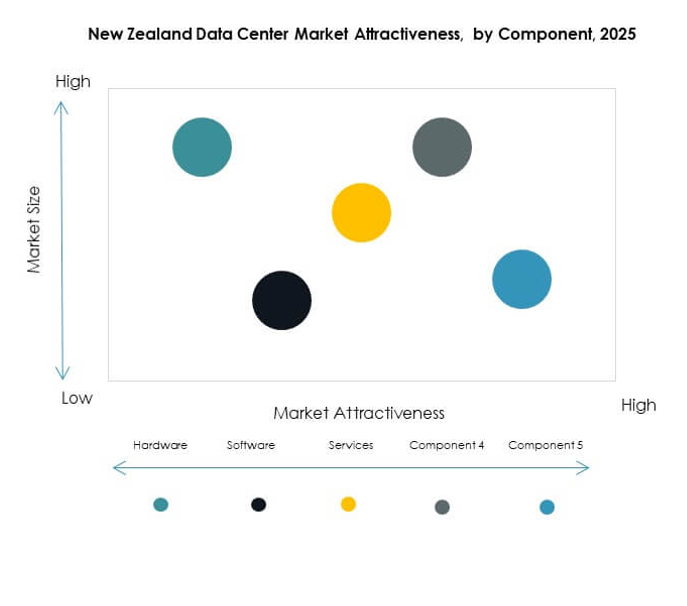

By Component

Hardware dominates the New Zealand Data Center Market with servers, storage, and networking driving core infrastructure. Strong demand for power and cooling systems further supports this dominance. Enterprises rely on hardware to deliver speed, capacity, and reliability. Software platforms including DCIM and virtualization are growing as businesses prioritize automation. Services such as consulting and managed services complement infrastructure, providing recurring revenue. Hardware holds over 45% share, supported by continuous upgrades and expansion.

By Data Center Type

Hyperscale centers lead the New Zealand Data Center Market due to rising global cloud adoption and enterprise workloads. Colocation facilities remain vital for SMEs seeking cost-effective hosting solutions. Enterprise data centers support organizations with custom-built environments. Edge and micro data centers are growing to improve response times. Cloud and IDC facilities are rapidly expanding as digital-first strategies grow. Mega centers, though fewer, offer long-term scalability. Hyperscale maintains above 40% market share.

By Deployment Model

Cloud-based deployment holds the largest share in the New Zealand Data Center Market due to scalability and cost efficiency. On-premises models are still relevant for industries requiring data control and compliance. Hybrid models are gaining traction as enterprises balance flexibility with security. Large corporations prefer hybrid to optimize legacy infrastructure. SMEs are driving adoption of public cloud services. It is clear that hybrid deployment will grow steadily. Cloud-based models represent more than 45% share.

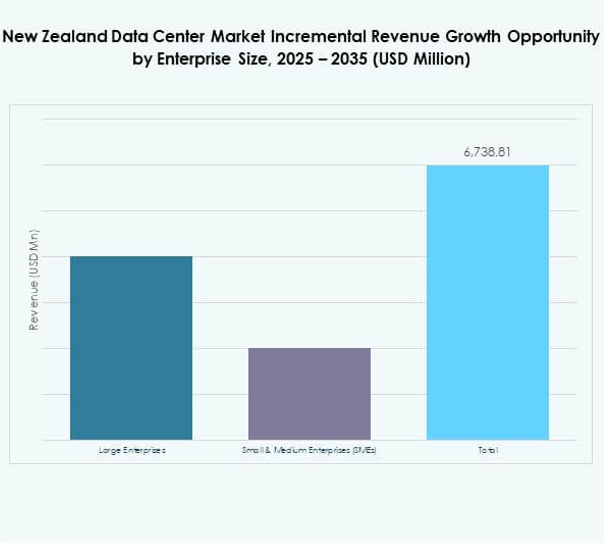

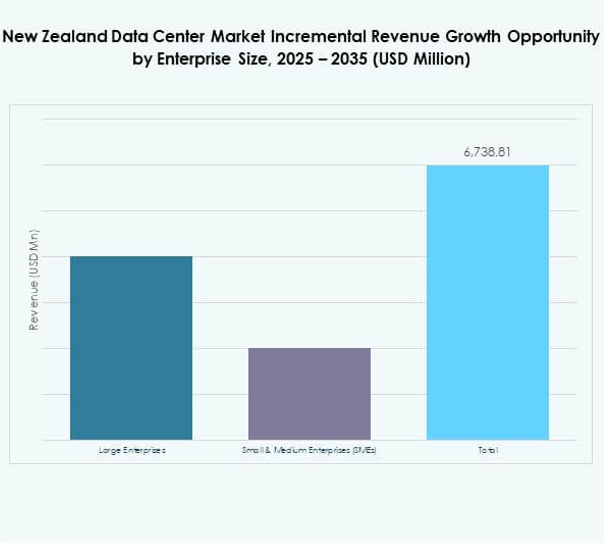

By Enterprise Size

Large enterprises dominate the New Zealand Data Center Market due to significant IT budgets and data storage requirements. They demand secure, scalable, and efficient infrastructure. SMEs contribute through adoption of colocation and cloud services. It is evident that SMEs prefer cost-efficient and flexible solutions. Providers target SMEs with modular services to expand penetration. Large enterprises maintain more than 60% market share. Their long-term contracts strengthen market stability and investment confidence.

By Application / Use Case

IT and Telecom dominates the New Zealand Data Center Market with strong demand for bandwidth and connectivity. BFSI remains a key sector due to data-intensive services and compliance requirements. Government and defense prioritize security and sovereignty. Healthcare invests in digital records and telemedicine. Retail and e-commerce drive demand for scalable solutions. Media and entertainment need high-capacity infrastructure for streaming. Manufacturing and education sectors are emerging contributors. IT and Telecom secures above 30% market share.

By End User Industry

Cloud service providers dominate the New Zealand Data Center Market due to rising demand for hosted services. Enterprises contribute significantly with hybrid and colocation adoption. Government agencies remain important for compliance-driven infrastructure. Colocation providers serve SMEs with cost-efficient hosting models. It is evident that cloud providers hold above 35% share. Their dominance is fueled by global partnerships and rapid expansion of hyperscale facilities.

Regional Insights

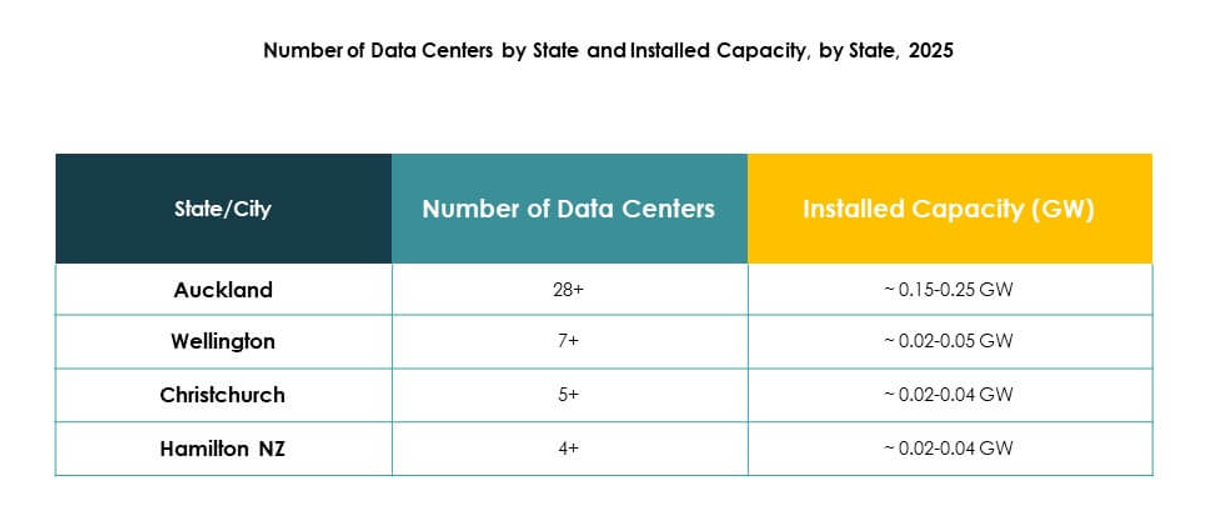

North Island Leading with Strong Market Share

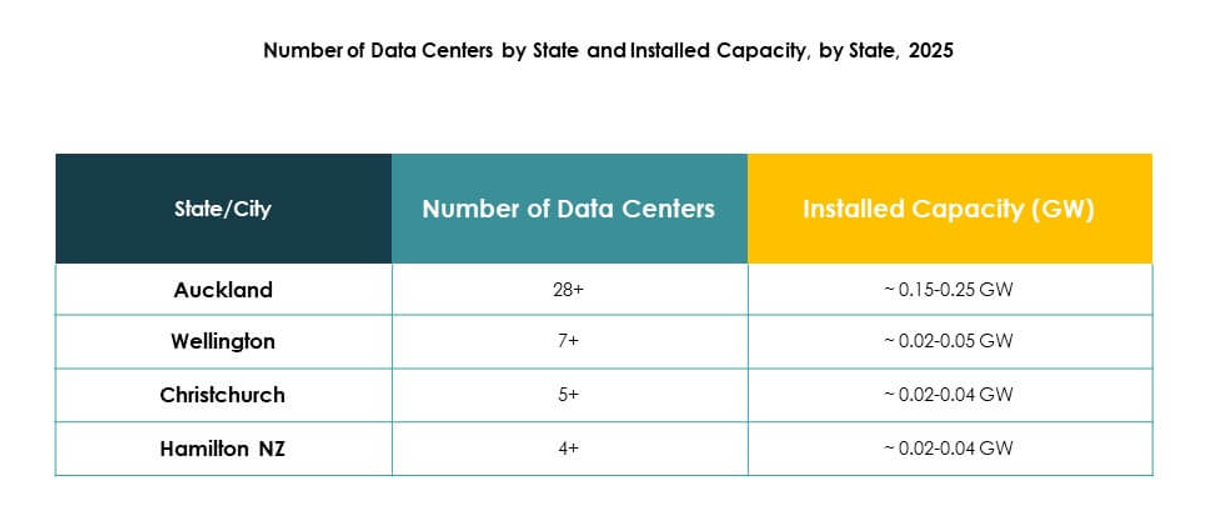

The North Island accounts for 62% share of the New Zealand Data Center Market, driven by Auckland and Wellington as primary hubs. Strong connectivity infrastructure and concentration of enterprises strengthen dominance. It is the preferred location for hyperscale and colocation investments. Government and financial institutions further support demand. Local availability of skilled workforce enhances operational growth. Providers focus on expanding capacity across major cities.

South Island Expanding with Emerging Opportunities

The South Island holds 28% share of the New Zealand Data Center Market, with Christchurch as a growing hub. It is gaining attention due to stable energy resources and lower land costs. Enterprises explore this region for edge and modular deployments. Providers emphasize resilience and disaster recovery capabilities. Manufacturing and logistics industries support demand. Investors recognize the potential for regional diversification.

- For example, Spark New Zealand operates a national network of data centers with a combined capacity of around 22 MW as of 2025, with over 100 MW in the development pipeline to meet growing demand.

Other Regions Growing with Niche Deployments

Other regions account for 10% share of the New Zealand Data Center Market, reflecting niche and localized developments. It is characterized by smaller modular and edge facilities. Education and healthcare sectors drive adoption in regional areas. Providers target low-latency requirements of local businesses. The regions support balanced growth beyond major cities. Investors view these as secondary opportunities with long-term relevance.

- For instance, New Zealand’s data center rollout includes seven upcoming facilities, with one located in Palmerston North among the announced sites. This move supports edge computing and industry-specific deployments closer to regional users.

Competitive Insights:

- Datacom

- Spark New Zealand

- Revera

- Northpower

- GlobalNet

- NTT Communications Corporation

- Microsoft Azure New Zealand

- AWS New Zealand

- Google Cloud New Zealand

Competitive Insights

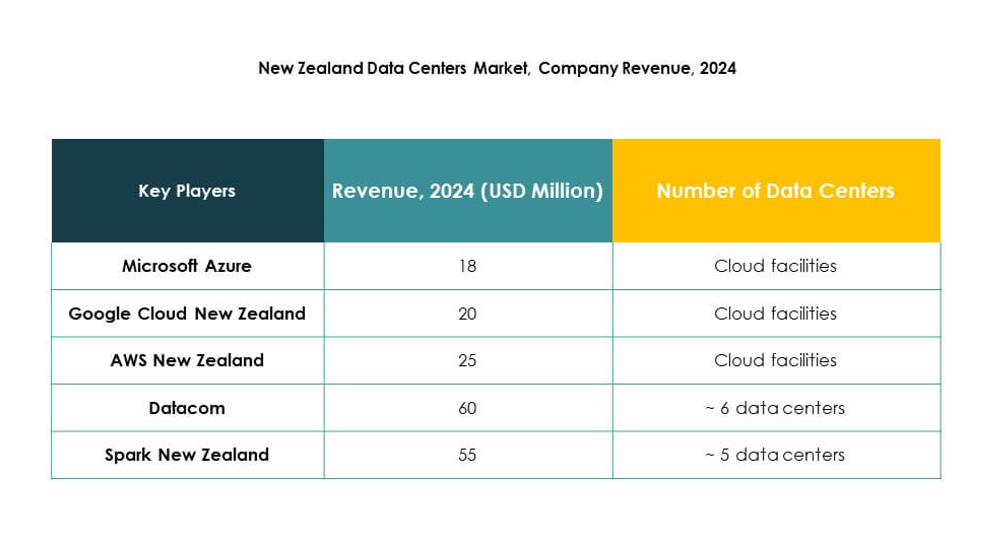

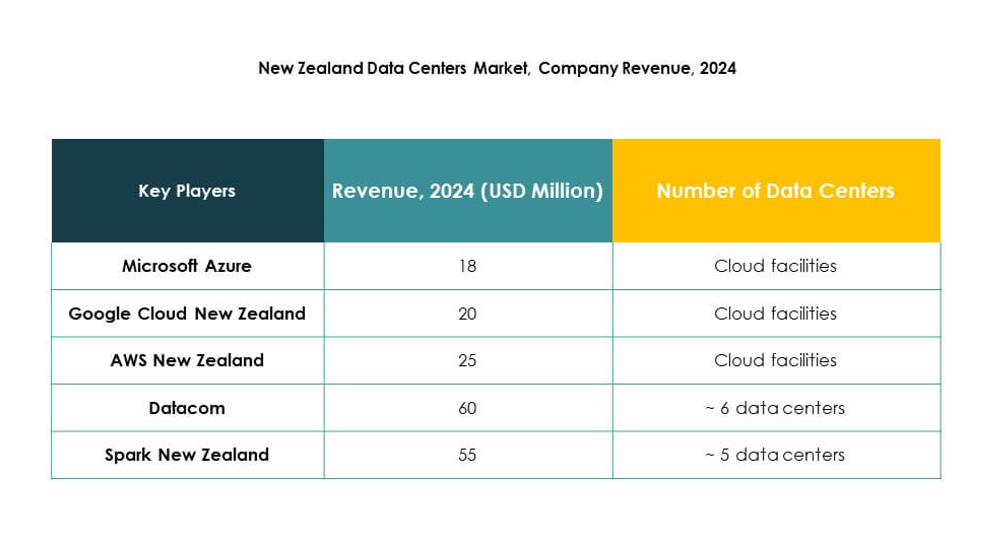

The New Zealand Data Center Market features strong competition between local providers and global cloud giants. Datacom, Spark New Zealand, and Revera lead domestic operations with deep regional networks and enterprise-focused services. Northpower and GlobalNet strengthen the ecosystem through localized infrastructure and connectivity. NTT Communications Corporation enhances global integration with advanced colocation and managed services. Microsoft Azure, AWS, and Google Cloud expand through hyperscale investments and partnerships with local operators. It is marked by consolidation of cloud services, rising demand for colocation, and a push toward sustainability-driven facilities. Providers differentiate through service depth, energy efficiency, and compliance with data sovereignty regulations. The market continues to evolve as enterprises prioritize hybrid deployment and scalable cloud solutions.

Recent Developments:

- In September 2025, Amazon Web Services (AWS) officially launched the AWS Asia Pacific (New Zealand) Region, marking a major milestone in the New Zealand data center market. This new region enables organizations to securely store and run their applications locally, providing lower latency and enhanced data residency for New Zealand businesses and public sector entities. AWS announced plans to invest over NZ$7.5 billion ($4.4 billion) into the development and operation of these data centers, with the infrastructure running entirely on renewable energy from day one.