Executive summary:

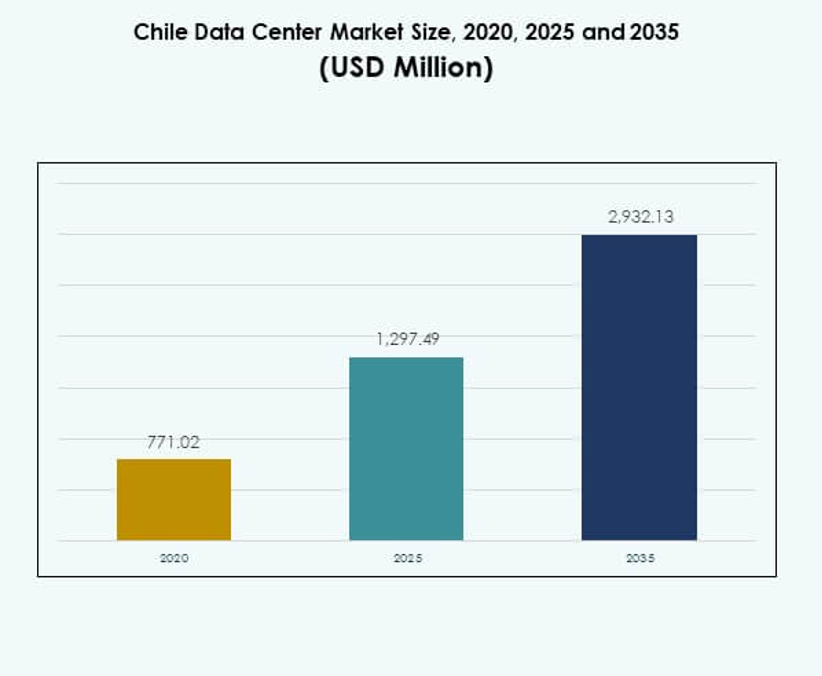

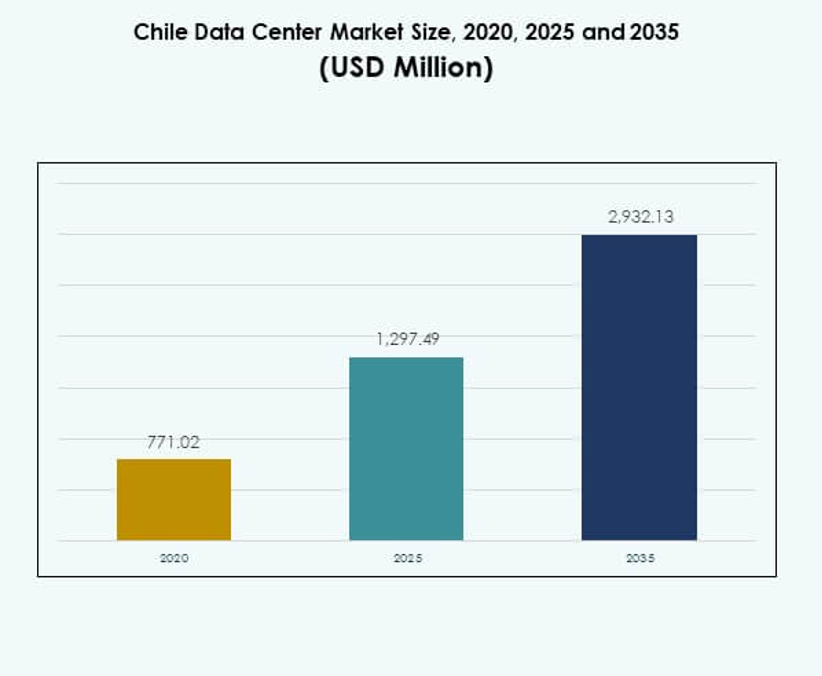

The Chile Data Center Market size was valued at USD 771.02 million in 2020 to USD 1,297.49 million in 2025 and is anticipated to reach USD 2,932.13 million by 2035, at a CAGR of 8.46% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2025 |

| Forecast Period |

2025-2035 |

| Chile Data Center Market Size 2025 |

USD 1,297.49 Million |

| Chile Data Center Market, CAGR |

8.46% |

| Chile Data Center Market Size 2035 |

USD 2,932.13 Million |

Growth in the Chile Data Center Market is driven by rapid adoption of cloud computing, increased demand for colocation services, and expansion of hyperscale facilities. Technology innovation such as modular infrastructure, AI-powered management systems, and advanced cooling designs improve efficiency. Businesses and investors consider Chile a strategic hub for digital services due to reliable energy supply, government support for renewable integration, and expanding connectivity networks that strengthen long-term competitiveness.

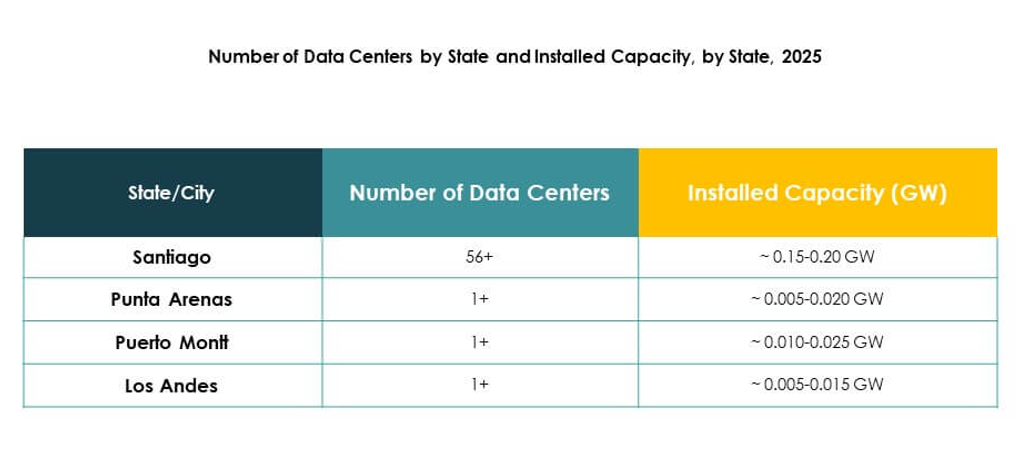

Regionally, Central Chile dominates with Santiago acting as the country’s primary data center hub. Strong connectivity, subsea cable projects, and a concentration of enterprises enhance its role as a digital gateway. Northern Chile is emerging due to industrial activity and renewable energy projects, while Southern Chile shows potential through expanding infrastructure and new investments aimed at diversifying the country’s digital ecosystem.

Market Drivers

Growing Role of Cloud Adoption and Enterprise IT Expansion in Shaping Market Demand

Cloud adoption drives steady demand for advanced data center facilities across Chile. Enterprises expand IT infrastructure to handle workloads linked to digital transformation. It pushes operators to invest in scalable and efficient designs. Hybrid and multi-cloud environments increase requirements for storage, security, and computing. The Chile Data Center Market benefits from regulatory support for digital services. Reliable infrastructure supports banking, telecom, and e-commerce sectors. Businesses seek agility through on-demand data availability. Investors view Chile as a stable hub for regional digital growth.

Advancements in Energy-Efficient Infrastructure and Green Data Center Designs

Sustainability initiatives redefine infrastructure investment in the country. Operators adopt renewable energy sources to reduce environmental impact. Advanced cooling systems enhance energy efficiency in hyperscale facilities. It encourages enterprises to adopt eco-friendly solutions. Data centers integrate AI-based monitoring for optimizing resource use. Investors favor projects committed to carbon neutrality. Renewable integration lowers operating costs while boosting resilience. Chile’s leadership in renewable energy strengthens its data center competitiveness.

Strategic Importance of Connectivity Expansion and Fiber Optic Networks

New fiber optic cables strengthen Chile’s position as a digital gateway. Connectivity expansion links the country with North America and Asia-Pacific markets. It boosts foreign investment in data center projects. The Chile Data Center Market gains from strong international bandwidth growth. Robust infrastructure supports cloud-based services, gaming, and content delivery. Enterprises depend on low-latency networks for regional competitiveness. It reinforces Chile’s importance for multinational corporations. The market’s connectivity advantages foster long-term digital innovation.

- For instance, in June 2025, Google and the Chilean government signed an agreement for the Humboldt submarine cable, a 14,800-kilometer system connecting Chile to Australia and Asia, which will reinforce Chile’s regional digital gateway role with intercontinental bandwidth scheduled to be operational by 2027.

Innovation in Modular, Hyperscale, and Edge Facilities to Address Demand Shifts

Modular designs allow faster construction and efficient scalability. Hyperscale operators deploy facilities to serve global cloud demand. Edge data centers bring computing power closer to end users. The Chile Data Center Market adapts through integration of automation and AI. Digital services require flexibility, which modular facilities provide. Healthcare and financial firms demand low-latency performance. Automation enhances operational efficiency and cost control. Investors value adaptability and technological sophistication in facility planning.

- For instance, in July 2025, Equinix announced the development of its new ST5 data center campus in Santiago, Chile, a modular and scalable facility designed to expand interconnection capacity and support hybrid multicloud demand in the region.

Market Trends

Integration of Artificial Intelligence and Predictive Analytics in Facility Management

AI-powered systems improve operational efficiency within modern facilities. Predictive analytics enhance performance monitoring and reduce downtime. It supports advanced maintenance strategies for critical equipment. AI integration ensures data security through intelligent threat detection. The Chile Data Center Market embraces automation to meet complex demands. Operators invest in AI platforms to optimize cooling and energy use. Smarter resource allocation improves long-term efficiency. AI-driven insights help enterprises manage rapidly growing workloads.

Expansion of Colocation Facilities for Enterprise and Cloud Providers

Colocation services gain traction among enterprises seeking scalability. Cloud providers partner with operators to meet rising demand. It allows businesses to reduce capital expenditure on infrastructure. The Chile Data Center Market benefits from growth in shared facilities. Colocation centers offer strong security, redundant systems, and high-speed access. Enterprises leverage these centers to streamline IT operations. Increasing digital adoption in SMEs fuels colocation demand. Market players focus on flexible pricing models to attract clients.

Growth of Edge Computing Infrastructure Across Key Urban Centers

Edge deployments rise with growing demand for real-time data processing. Healthcare, IoT, and telecom sectors drive adoption. It reduces latency by bringing computing closer to users. The Chile Data Center Market responds with localized facilities in urban hubs. Operators deploy compact, modular units to support digital services. Smart cities projects further encourage investment in edge networks. Enterprises rely on edge models for operational efficiency. It creates opportunities for vendors focusing on innovation.

Rise of Hybrid Deployment Models Among Large Enterprises and SMEs

Hybrid models gain popularity by balancing on-premises and cloud-based systems. Large enterprises pursue flexible deployment to optimize operations. It ensures greater data control while leveraging cloud scalability. SMEs adopt hybrid models for cost-efficient IT expansion. The Chile Data Center Market reflects growing hybrid adoption. Operators design solutions that integrate cloud, on-premises, and managed services. Businesses value hybrid models for compliance and data security. Demand for tailored solutions strengthens hybrid market presence.

Market Challenges

Infrastructure Constraints and Rising Energy Consumption Across Large-Scale Facilities

Data center growth increases power requirements across major cities. Energy demand raises concerns about sustainability and reliability. It creates pressure on national grids and utility providers. The Chile Data Center Market must align with energy efficiency standards. Facility expansion faces land and power availability limitations. Operators seek renewable integration to mitigate risks. Rising costs from energy consumption affect profitability. Managing growth while addressing environmental targets remains complex.

Regulatory Pressures, Talent Shortages, and High Operational Costs

Strict compliance rules impact deployment speed and flexibility. Operators adapt to evolving data protection and privacy regulations. The Chile Data Center Market also faces skilled workforce shortages. Hiring qualified professionals in cooling, AI, and cybersecurity remains difficult. Operational costs for advanced technology integration remain high. It limits access for smaller firms entering the sector. Talent and regulatory gaps create barriers to rapid scaling. Investors remain cautious about these structural challenges.

Market Opportunities

Market Opportunities

Rising Investment Potential Through Renewable Integration and Digital Economy Expansion

Chile leads in renewable power adoption, offering competitive energy costs. It strengthens the appeal for hyperscale and colocation facilities. The Chile Data Center Market attracts international investors seeking green infrastructure. Enterprises benefit from sustainable and resilient operations. Energy integration enhances cost predictability. Global providers view Chile as a gateway for digital transformation. It aligns with government support for expanding digital services. New investment channels increase long-term profitability.

Emergence of Advanced Services and Expansion Across Regional Enterprises

Demand for managed services grows across enterprises seeking efficiency. Operators expand offerings in consulting and integration support. It allows companies to focus on digital transformation goals. The Chile Data Center Market benefits from regional enterprise adoption. SMEs access cloud and colocation services at lower costs. Managed services enhance security and compliance capabilities. It creates opportunities for strategic partnerships. Regional expansion improves market diversity and resilience.

Market Segmentation

By Component

Hardware dominates the market with strong demand for servers, storage, and cooling. It holds the largest share due to reliance on physical infrastructure. The Chile Data Center Market benefits from rising hyperscale and colocation growth. Software adoption grows with DCIM and automation tools. Services expand as enterprises outsource consulting and managed support. Hardware continues leading due to mission-critical roles. Investment in efficient power and cooling increases. Security systems gain traction across all facility types.

By Data Center Type

Hyperscale data centers lead due to large-scale global cloud expansion. Colocation facilities gain momentum with flexible leasing models. Enterprise data centers hold steady demand for in-house control. The Chile Data Center Market sees edge deployments rising with IoT. Modular and mega facilities serve expanding digital ecosystems. Cloud/IDC centers support gaming, OTT, and content delivery. Hyperscale operators remain the largest revenue contributors. Colocation providers grow through enterprise partnerships.

By Deployment Model

Cloud-based deployment leads with strong adoption across industries. On-premises facilities persist for data-sensitive enterprises. The Chile Data Center Market sees hybrid models gaining importance. Hybrid deployment offers control and scalability advantages. SMEs prefer cloud due to cost benefits. Large enterprises rely on hybrid strategies for compliance. Cloud services dominate IT spending allocations. Hybrid remains critical for future demand flexibility.

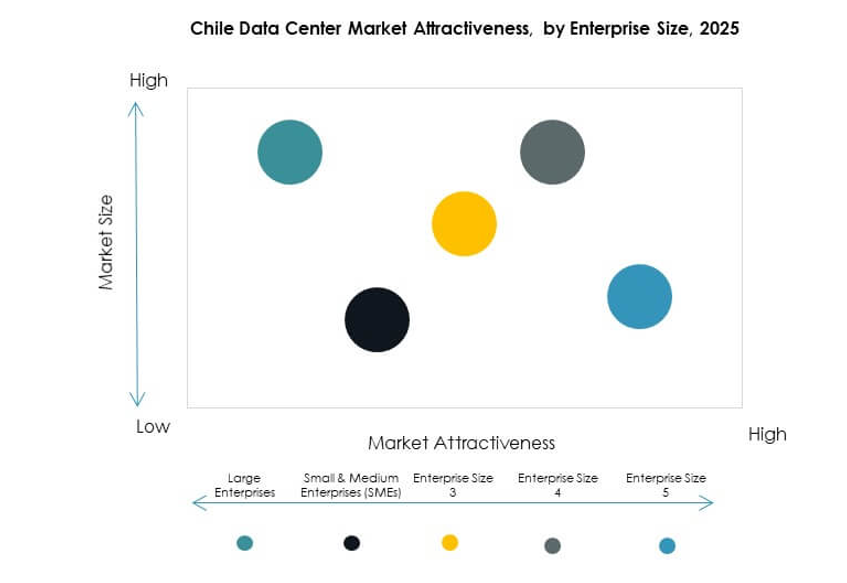

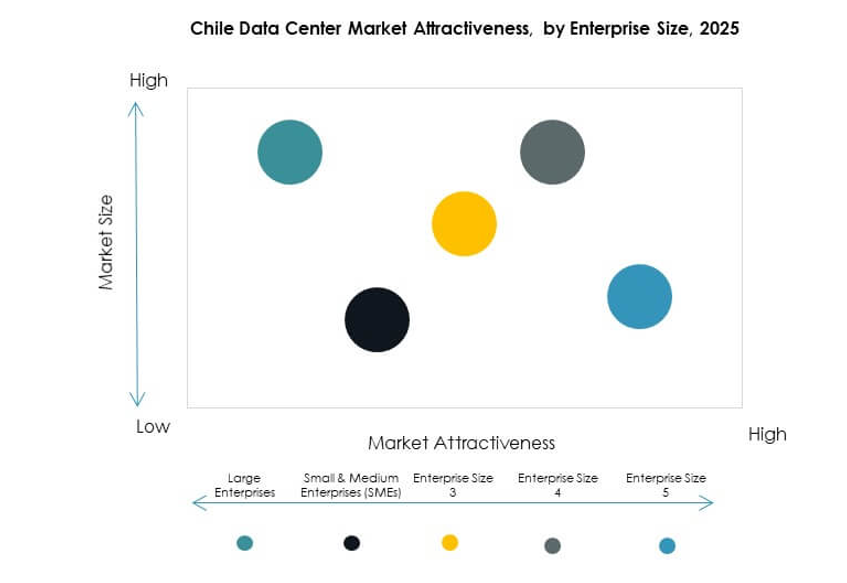

By Enterprise Size

Large enterprises dominate due to high IT budgets and global operations. They invest in hyperscale and hybrid deployments. The Chile Data Center Market benefits from SME adoption of cloud. SMEs contribute to colocation growth for cost savings. Large firms hold the largest revenue share. SMEs drive innovation through digital-first strategies. Growing start-up culture boosts SME reliance on managed services. Both segments contribute to long-term expansion.

By Application / Use Case

IT & Telecom leads demand with strong digital adoption. BFSI follows due to high reliance on secure infrastructure. The Chile Data Center Market benefits from growth in healthcare and retail. Media and entertainment expand with streaming services. Manufacturing integrates data centers for automation support. Government and defense ensure cybersecurity readiness. Education and utilities add further demand diversity. IT & Telecom continues to dominate overall share.

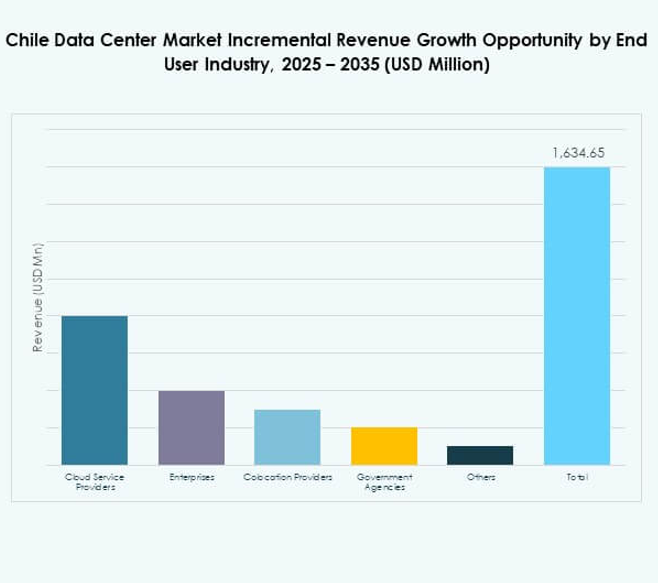

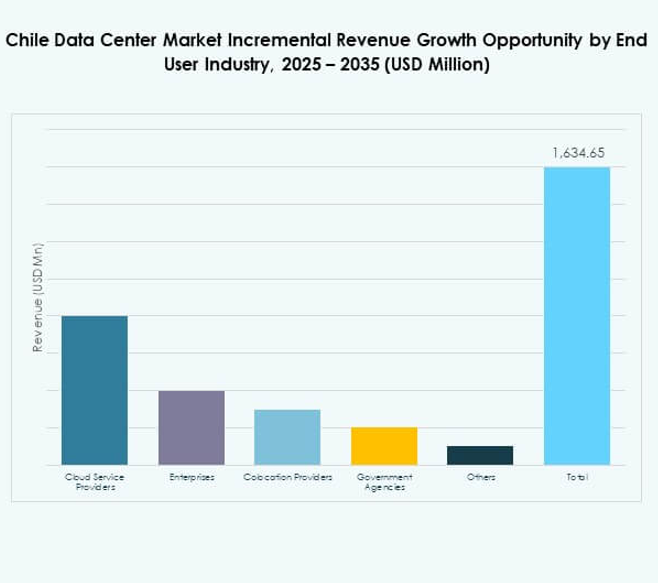

By End User Industry

Cloud service providers lead with hyperscale deployments. Enterprises contribute through hybrid and on-premises growth. The Chile Data Center Market benefits from colocation providers meeting SME needs. Government agencies invest in secure infrastructure expansion. Other industries contribute to service diversity. Cloud operators maintain the largest market share. Enterprises seek advanced managed services. Colocation remains critical for regional businesses.

Regional Insights

Regional Insights

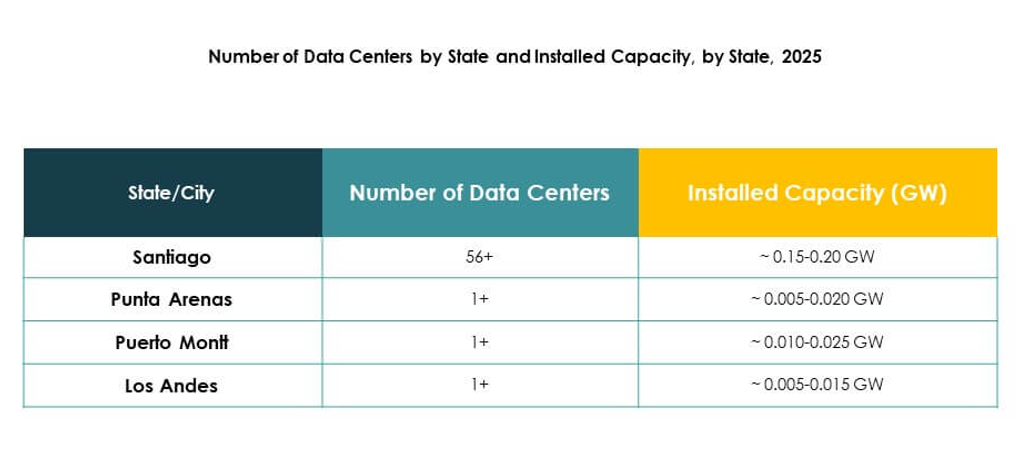

Dominance of Central Chile with Strong Market Share in Santiago Region

Central Chile leads with 62% market share, supported by Santiago’s concentration of facilities. Strong connectivity and access to renewable energy enhance its position. The Chile Data Center Market thrives with foreign investment in the capital. Enterprises in banking, retail, and healthcare benefit from local access. Santiago supports hyperscale and colocation deployments. Central Chile remains the most important subregion. It sustains leadership due to strategic economic and digital significance.

- For instance, Ascenty inaugurated its third data center in Santiago in August 2025, offering 16 MW of installed IT power capacity and room for 1,000 racks across five data halls, backed by a verified investment of US$115 million.

Steady Growth Across Northern Chile Driven by Energy and Mining Sectors

Northern Chile holds 23% share, driven by mining and industrial activity. Renewable energy projects support regional growth. The Chile Data Center Market expands through edge facilities in mining hubs. Enterprises depend on low-latency services for operations. Connectivity improvements attract new investment opportunities. Northern Chile gains relevance as demand spreads beyond Santiago. It strengthens regional digital transformation initiatives. Growth remains steady with infrastructure development.

- For instance, since July 2020, Colbún has supplied Antofagasta Minerals’ Zaldívar copper mine with 100% renewable energy, generating around 550 GWh per year and reducing annual greenhouse gas emissions by approximately 350,000 metric tons, as verified by external certification and company documentation.

Emerging Opportunities in Southern Chile With Expanding Infrastructure Projects

Southern Chile accounts for 15% share, showing emerging growth potential. Infrastructure projects boost local connectivity and digital capacity. The Chile Data Center Market benefits from undersea cable projects near the south. Enterprises in education and government create localized demand. Colocation providers expand presence in secondary cities. It helps balance the national digital ecosystem. Southern Chile emerges as a growth frontier for future expansion.

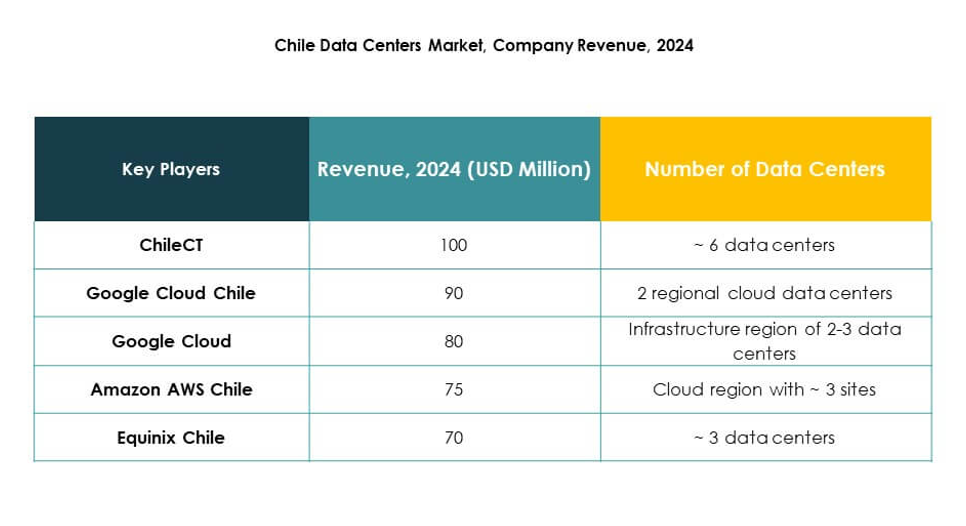

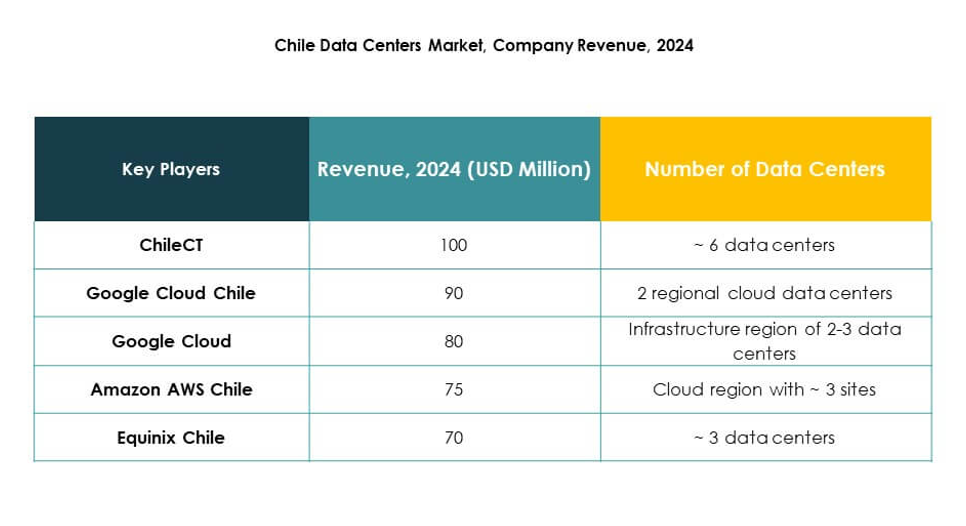

Competitive Insights:

- ChileCT

- Equinix Chile

- cl

- Entel

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Chile Data Center Market features strong competition among global hyperscale providers, regional operators, and local enterprises. Equinix Chile and Digital Realty Trust strengthen the colocation and hyperscale segments with advanced facilities and strategic investments. Local companies such as ChileCT, Hosting.cl, and Entel build regional resilience by offering tailored services and maintaining strong domestic networks. Cloud service giants including Microsoft, AWS, and Google drive innovation through large-scale deployments and advanced digital platforms. NTT Communications supports global connectivity with enterprise-grade solutions. It demonstrates a balance between international cloud leaders setting global standards and local operators ensuring adaptability to domestic market needs, creating a competitive yet collaborative environment for sustained growth.

Recent Developments:

Recent Developments:

- In January 2025, ODATA, an Aligned Data Centers company, entered a partnership agreement with Atlas Renewable Energy to power Chilean data centers with 100% renewable energy. This strategic alliance supports sustainable energy adoption and innovation across the data center sector, enhancing capacity to meet surging digital demand and advancing Chile’s position as a leader in technology and sustainability in Latin America.

Market Opportunities

Market Opportunities Regional Insights

Regional Insights Recent Developments:

Recent Developments: