1. Introduction

1.1. Market Definition & Scope

1.2. Research Methodology

1.2.1. Primary Research

1.2.2. Secondary Research

1.2.3. Data Validation & Assumptions

1.3. Market Segmentation Framework

2. Executive Summary

2.1. Market Snapshot

2.2. Key Findings

2.3. Analyst Recommendations

2.4. Market Outlook (2025–2035)

3. Market Dynamics

3.1. Market Drivers

3.2. Market Restraints

3.3. Market Opportunities

3.4. Challenges & Risks

3.5. Value Chain Analysis

3.6. Porter’s Five Forces Analysis

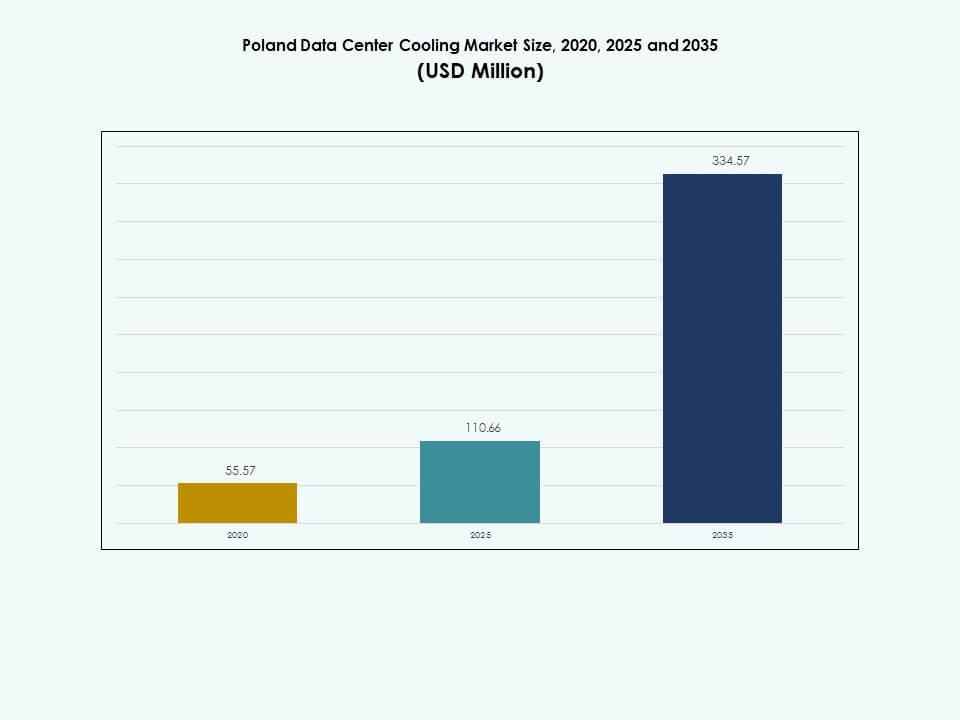

4. Poland Data Center Cooling Market – Market Sizing & Forecast

4.1. Historical Market Size (2020–2025)

4.2. Forecast Market Size (2026–2035)

4.3. Market Growth Rate Analysis

4.4. Market Outlook by Country

5. Capital Expenditure (CapEx) Analysis

5.1. CapEx Trends by Cooling Solution

5.1.1. Investment patterns across air-based, liquid-based, hybrid, and immersion cooling

5.1.2. CapEx share by cooling equipment type (CRAC/CRAH, chillers, cooling towers, economizers, etc.)

5.1.3. Country-wise CapEx trends

5.1.4. OEM vs. retrofit investment analysis

5.2. Return on Investment (ROI) & Payback Period Analysis

5.2.1. ROI by cooling technology type

5.2.2. Cost-benefit comparison: air cooling vs. liquid cooling vs. immersion cooling

5.2.3. Payback period across Tier I–IV data centers

5.2.4. Case examples of cost savings through energy-efficient cooling adoption

6. Data Center Cooling Capacity & Utilization

6.1. Installed Capacity (MW & Sq. Ft.) by Cooling Solution

6.1.1. Installed cooling capacity by solution type and Country

6.1.2. Cooling system density (kW/rack and per sq. ft.)

6.1.3. Capacity expansion trends by hyperscale vs. colocation vs. enterprise

6.2. Utilization Rates & Efficiency Metrics

6.2.1. Cooling system utilization vs. design capacity

6.2.2. Average and peak load management practices

6.2.3. Equipment lifecycle and performance benchmarks

6.3. Power Usage Effectiveness (PUE) & Energy Efficiency

6.3.1. Average PUE by data center size and cooling technology

6.3.2. Comparison of traditional vs. green cooling systems

6.3.3. Cooling system contribution to total facility energy consumption

6.4. Rack Density & Cooling Efficiency

6.4.1. Average rack density (kW/rack) trends

6.4.2. Cooling adequacy vs. rack load

6.4.3. Relationship between high-density workloads (AI, HPC) and cooling requirements

7. Data Center Cooling Market, Energy & Resource Consumption Analysis

7.1. Energy Consumption Analysis

7.1.1. Total energy consumption by cooling solution type (air-based, liquid, hybrid, immersion)

7.1.2. Energy intensity per MW of IT load

7.1.3. Energy share of cooling in total facility power (cooling load ratio)

7.1.4. Annualized Energy Efficiency Ratio (EER / SEER) by cooling system type

7.1.5. Trend in energy consumption reduction through automation, AI, and free cooling technologies

7.2. Water Consumption Analysis

7.2.1. Water Usage Effectiveness (WUE) – liters per kWh of IT load

7.2.2. Water consumption by cooling technology (evaporative cooling, adiabatic cooling, etc.)

7.2.3. Water recycling and reuse systems in data centers

7.2.4. Impact of Country-wise water scarcity regulations on cooling system choice

7.2.5. Shift from water-intensive to air-based or hybrid systems

7.3. Combined Energy–Water Efficiency Metrics

7.3.1. Energy-Water Nexus in cooling optimization

7.3.2. Correlation between PUE, WUE, and total operational cost (OpEx)

7.3.3. Case studies of zero-water or waterless cooling deployments

7.4. Benchmarking & Comparative Analysis

7.4.1. Benchmarking against ASHRAE, Uptime Institute, and DOE standards

7.4.2. Comparison of Poland WUE/PUE averages by Country

7.4.3. Best practices adopted by hyperscalers (AWS, Google, Microsoft, Meta, etc.)

8. Poland Data Center Cooling Market – By Component

8.1. Solution

8.2. Services

9. Poland Data Center Cooling Market – By Data Center Cooling Solution

9.1. Air Conditioners

9.2. Precision Air Conditioners

9.3. Chillers

9.4. Air Handling Units

9.5. Liquid Cooling

9.6. Others

10. Poland Data Center Cooling Market – By Service

10.1. Installation & Deployment

10.2. Support & Consulting

10.3. Maintenance Services

11. Poland Data Center Cooling Market – By Enterprise Size

11.1. Large Enterprises

11.2. Small & Medium Enterprises (SMEs)

12. Poland Data Center Cooling Market – By Floor Type

12.1. Raised Floors

12.2. Non-Raised Floors

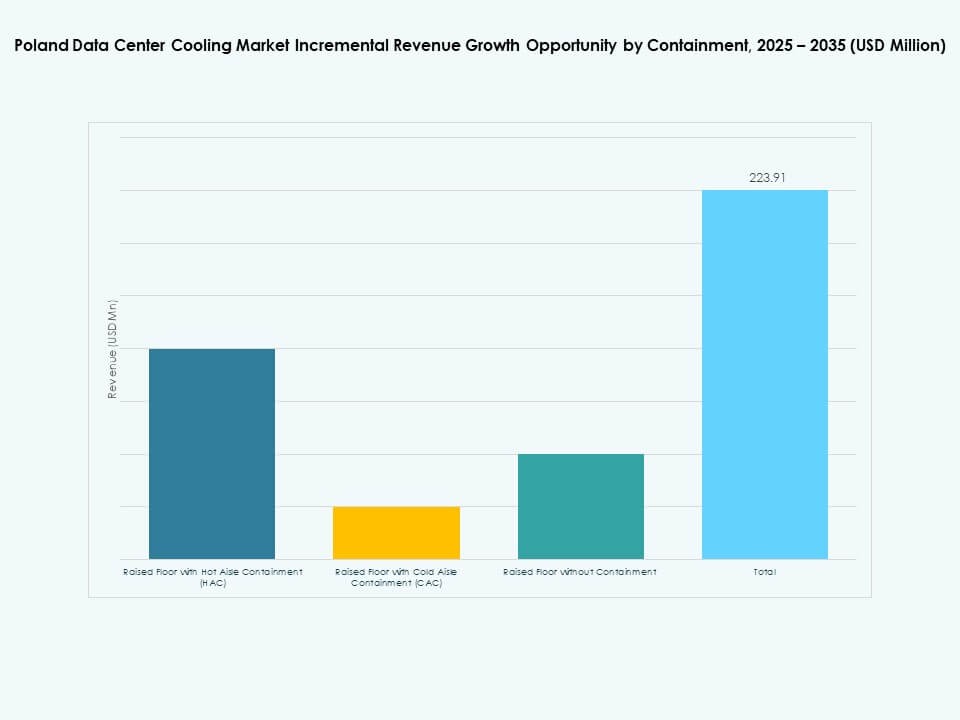

13. Poland Data Center Cooling Market – By Containment

13.1. Raised Floor with Hot Aisle Containment (HAC)

13.2. Raised Floor with Cold Aisle Containment (CAC)

13.3. Raised Floor without Containment

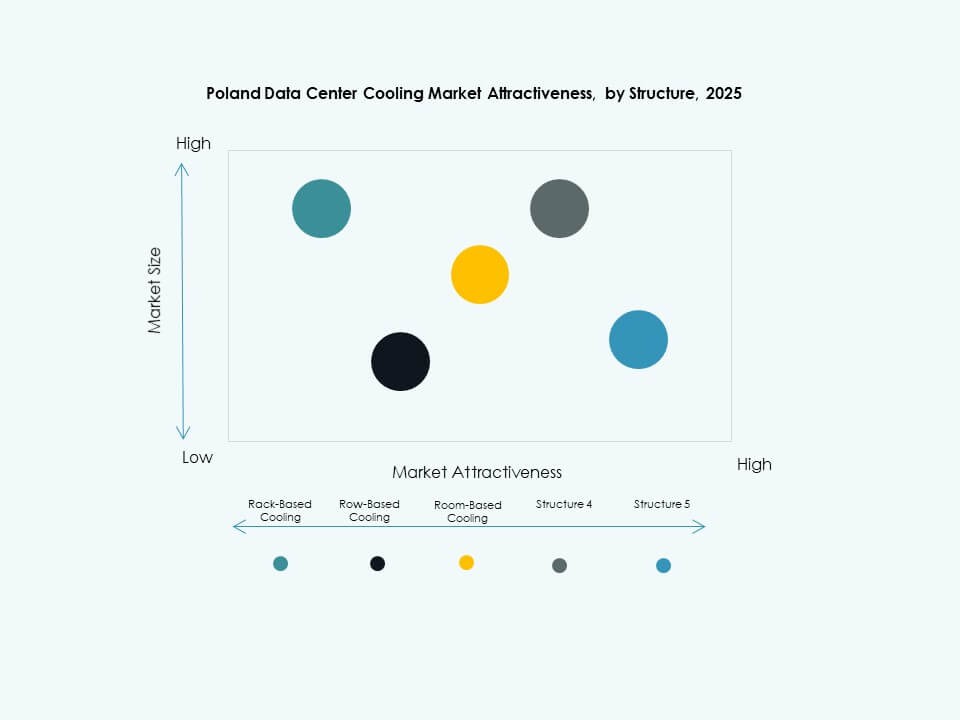

14. Poland Data Center Cooling Market – By Structure

14.1. Rack-Based Cooling

14.2. Row-Based Cooling

14.3. Room-Based Cooling

15. Poland Data Center Cooling Market – By Application

15.1. Hyperscale Data Center

15.2. Colocation Data Center

15.3. Enterprise Data Center

15.4. Edge Data Center

15.5. Other Data Centers

16. Poland Data Center Cooling Market – By End-user

16.1. Telecom

16.2. IT

16.3. Retail

16.4. Healthcare

16.5. BFSI

16.6. Energy

16.7. Others

17. Sustainability & Green Data Center Cooling

17.1. Energy Efficiency Initiatives

17.1.1. Deployment of free cooling, adiabatic cooling, and economizers

17.1.2. Smart control systems for temperature and airflow optimization

17.1.3. Case studies of efficiency improvement programs

17.2. Renewable Energy Integration

17.2.1. Integration of solar, wind, or geothermal sources in cooling operations

17.2.2. Hybrid systems combining renewable energy with mechanical cooling

17.3. Carbon Footprint & Emission Analysis

17.4. GHG reduction initiatives

17.5. LEED & Green Certifications

17.5.1. Share of cooling systems installed in LEED, BREEAM, or Energy Star certified facilities

17.5.2. Compliance with ASHRAE and ISO energy efficiency standards

18. Emerging Technologies & Innovations

18.1.1. Emerging Technologies & Innovations

18.1.2. Liquid Cooling & Immersion Cooling

18.1.3. Adoption rate and technology maturity

18.1.4. Key vendors and installations by Country

18.1.5. Comparative analysis: performance, cost, and energy savings

18.2. AI & HPC Infrastructure Integration

18.2.1. Cooling demand driven by AI training clusters and HPC systems

18.2.2. Adaptation of cooling design to high heat density workloads

18.3. Quantum Computing Readiness

18.3.1. Cooling requirements for quantum processors

18.3.2. Potential cooling technologies suitable for quantum environments

18.4. Modular & Edge Data Center Cooling

18.4.1. Cooling strategies for prefabricated and modular facilities

18.4.2. Compact and adaptive cooling for edge sites

18.5. Automation, Orchestration & AIOps

18.5.1. Integration of AI-driven thermal management

18.5.2. Predictive maintenance and automated cooling optimization

19. Competitive Landscape

19.1. Market Share Analysis

19.2. Key Player Strategies

19.3. Mergers, Acquisitions & Partnerships

19.4. Product & Service Launches

20. Company Profiles

20.1. DCX Liquid Cooling Systems

20.2. Schneider Electric

20.3. Vertiv Group Corp.

20.4. Danfoss

20.5. Carrier

20.6. Mitsubishi Electric Corporation

20.7. STULZ GmbH

20.8. Rittal GmbH & Co. KG

20.9. CoolIT Systems

20.10. Modine Manufacturing Company

Market Drivers:

Market Drivers: Market Trends:

Market Trends: Regional Insights:

Regional Insights: