Executive summary:

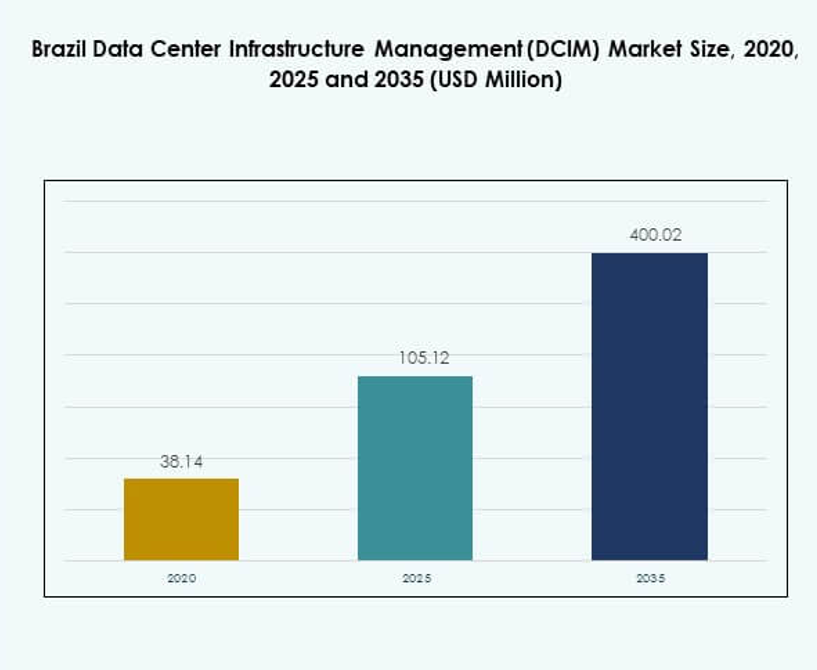

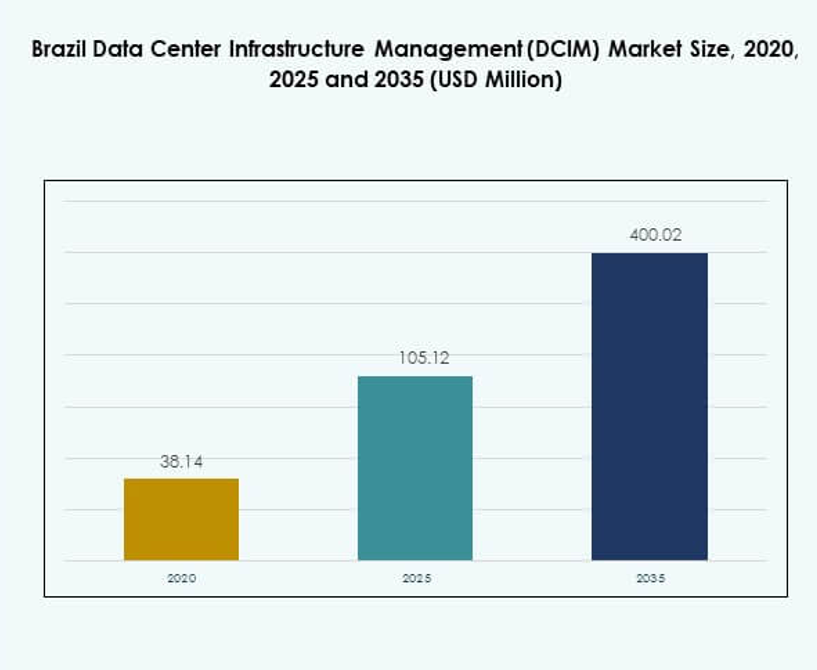

The Brazil Data Center Infrastructure Management (DCIM) Market size was valued at USD 38.14 million in 2020, reached USD 105.12 million in 2025, and is anticipated to attain USD 400.02 million by 2035, growing at a CAGR of 16.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Brazil Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 105.12 Million |

| Brazil Data Center Infrastructure Management (DCIM) Market, CAGR |

16.08% |

| Brazil Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 400.02 Million |

Rapid digital transformation, increasing cloud adoption, and the expansion of hyperscale and colocation facilities are driving the Brazil Data Center Infrastructure Management (DCIM) Market. Businesses are integrating AI-based analytics, automation, and real-time monitoring to optimize power and cooling efficiency. The rising focus on sustainability and operational transparency makes DCIM platforms strategically vital for enterprises and investors aiming to improve energy efficiency and regulatory compliance.

Geographically, São Paulo leads the Brazil Data Center Infrastructure Management (DCIM) Market, supported by advanced infrastructure, reliable power supply, and dense connectivity. Rio de Janeiro follows with strong cloud service growth, while Fortaleza and Curitiba are emerging due to renewable energy integration and submarine cable expansion. These regions collectively strengthen Brazil’s position as Latin America’s primary data infrastructure hub.

Market Drivers

Rising Integration of AI and Automation to Optimize Data Center Operations

The Brazil Data Center Infrastructure Management (DCIM) Market is witnessing strong adoption of AI-driven platforms that automate energy use, thermal control, and predictive maintenance. Automation tools enhance real-time visibility into asset performance, reducing operational costs and unplanned downtime. AI analytics help identify performance inefficiencies across IT and power systems. Integration with digital twins enables continuous modeling of data center conditions. The shift toward intelligent DCIM enhances decision-making for operators and investors. Enterprises rely on these systems to meet uptime commitments. Automation strengthens competitiveness and supports Brazil’s growing digital economy.

- For instance, Schneider Electric’s EcoStruxure IT DCIM platform has been deployed in nearly 500,000 sites globally, providing real-time monitoring, predictive analytics, and asset management, as confirmed in Schneider Electric’s official press documentation. While country-level metrics exclusive to Brazil are not disclosed, the platform’s global deployment underlines enterprise-grade adoption and the impact of AI- and IoT-enabled automation tools in practical, real-world operations.

Expansion of Cloud and Edge Infrastructure Driving DCIM Adoption

The rapid expansion of cloud and edge computing infrastructure is creating sustained demand for DCIM tools. These platforms enable efficient monitoring of distributed environments with unified dashboards. Cloud providers and colocation operators invest in DCIM to manage hybrid workloads across multiple sites. It allows remote supervision and energy balancing for both hyperscale and edge facilities. Growth in IoT devices increases complexity, reinforcing the need for centralized control systems. Businesses view DCIM as critical for infrastructure scalability. Strategic investments in these solutions reduce latency and improve service reliability.

- For instance, Equinix, a major cloud and colocation operator in Brazil, opened its RJ3 data center in Rio de Janeiro in early 2025 with the facility supplied 100% by renewable energy and housing up to 560 racks. This expansion supports scalable, managed cloud, and edge solutions and reinforces the trend of unified, hybrid-infrastructure management; the launch was officially reported by Datacenter Dynamics and Equinix Brazil itself.

Growing Emphasis on Energy Efficiency and Sustainability Standards

The market is experiencing rising pressure to meet sustainability goals and carbon reduction mandates. DCIM platforms track power usage effectiveness (PUE) and optimize energy distribution to align with ESG commitments. Operators deploy renewable-powered cooling systems and intelligent sensors for precise monitoring. It enables compliance with regulatory frameworks and supports transparent sustainability reporting. Energy optimization reduces total cost of ownership while improving facility performance. Sustainable practices attract green investments in data infrastructure. Companies view DCIM as a strategic tool to balance performance and environmental responsibility.

Increasing Demand from Colocation and Hyperscale Facilities

The surge in colocation and hyperscale projects across Brazil fuels the need for advanced DCIM solutions. Large facilities require scalable platforms that integrate across diverse IT and electrical systems. It enhances equipment utilization, capacity planning, and security compliance. Colocation providers use DCIM to deliver customized monitoring dashboards for tenants. Hyperscale operators leverage it to sustain high-density computing environments. The growing reliance on hybrid IT architectures strengthens adoption. This trend positions DCIM as a vital enabler for Brazil’s expanding digital infrastructure ecosystem.

Market Trends

Adoption of Cloud-Native DCIM Platforms for Real-Time Data Management

The Brazil Data Center Infrastructure Management (DCIM) Market is shifting toward cloud-native platforms that offer real-time scalability and data synchronization. These solutions enable remote monitoring and control without extensive hardware dependencies. Cloud-native frameworks support faster deployment and continuous upgrades. It ensures seamless integration across geographically dispersed facilities. This shift aligns with enterprises adopting hybrid cloud models. Operators prioritize interoperability and automation efficiency. The trend accelerates digital transformation across mission-critical infrastructure environments.

Integration of Digital Twins and Predictive Maintenance Capabilities

Digital twin integration is emerging as a transformative trend for data center performance optimization. Predictive modeling allows operators to simulate energy flows and thermal behavior. It supports proactive decision-making before faults occur. This integration enhances resilience and service continuity. Predictive DCIM systems minimize downtime through intelligent maintenance alerts. The technology bridges design and operations, ensuring consistent performance. Companies leveraging digital twins achieve measurable improvements in uptime and energy efficiency.

Focus on Cybersecurity and Compliance in DCIM Deployments

Cybersecurity has become a priority within DCIM frameworks due to rising data privacy regulations. DCIM providers integrate multi-layer authentication, encryption, and compliance management modules. It protects critical data center assets from external threats. Enhanced visibility across network layers reduces security vulnerabilities. Regulatory compliance with frameworks like ISO 27001 and LGPD strengthens trust. This trend expands DCIM’s role beyond monitoring into risk governance. Businesses adopting secure DCIM systems gain operational and reputational advantages.

Emergence of Modular and Edge-Specific DCIM Architectures

The growing number of edge deployments encourages adoption of modular DCIM systems. Modular architectures allow fast scalability in distributed environments. It helps small and medium data centers achieve enterprise-grade visibility. Edge-specific DCIM tools manage localized assets efficiently while synchronizing with central systems. The design supports faster setup and adaptability for evolving workloads. This trend enables regional data management efficiency and improved operational control. It reinforces Brazil’s leadership in decentralized digital infrastructure innovation.

Market Challenges

High Implementation Costs and Complex Integration Processes

The Brazil Data Center Infrastructure Management (DCIM) Market faces cost-related barriers due to complex deployment requirements. Integration with legacy systems increases time and capital expenditure. Smaller enterprises hesitate to invest due to uncertain ROI and skilled workforce shortages. It demands specialized expertise to align DCIM with existing IT infrastructure. Licensing and customization costs add to financial constraints. Limited interoperability among vendors complicates scalability. These factors slow adoption across smaller operators. Companies must address cost-efficiency to unlock full market potential.

Lack of Skilled Workforce and Limited Standardization in Data Infrastructure

A shortage of skilled technicians and engineers poses a significant operational challenge. The fast evolution of DCIM technologies creates a gap in workforce readiness. It affects implementation quality and system optimization. Lack of consistent industry standards limits cross-platform compatibility. Inconsistent data protocols make integration difficult between multiple vendors. Training and certification programs remain limited across the region. The absence of a unified standard delays innovation cycles. Addressing this challenge is crucial for sustained market growth.

Market Opportunities

Rising Investments in Green Data Centers and Renewable Integration

The Brazil Data Center Infrastructure Management (DCIM) Market is positioned to benefit from the rise of green data centers. Operators focus on integrating solar and wind energy within their facilities. It enables energy-efficient power distribution and compliance with carbon reduction goals. The demand for eco-friendly infrastructure attracts international investments. Partnerships with renewable suppliers enhance sustainability performance and brand credibility. Green innovation presents major opportunities for long-term competitiveness.

Growing Potential for AI-Powered and Cloud-Based DCIM Platforms

AI-based analytics and cloud-driven management platforms are unlocking new revenue streams. It enables predictive maintenance, intelligent asset tracking, and adaptive load balancing. Businesses benefit from centralized visibility and reduced operational risk. The demand for SaaS-based DCIM tools expands across managed and hybrid facilities. Strategic collaborations between cloud providers and integrators strengthen this opportunity. The trend encourages innovation and reinforces Brazil’s leadership in digital infrastructure modernization.

Market Segmentation

Market Segmentation

By Component

The solution segment dominates the Brazil Data Center Infrastructure Management (DCIM) Market, supported by the demand for integrated monitoring and control systems. It accounts for the majority share, driven by automation in power, cooling, and asset tracking. The service segment grows steadily due to consulting, integration, and maintenance demand. Managed service providers enhance adoption among enterprises aiming for cost-effective deployment and system optimization.

By Data Center Type

The colocation edge data center segment leads the market, capturing a significant share due to rapid enterprise cloud adoption. It provides scalable and energy-efficient infrastructure for growing data demands. Cloud and edge data centers show strong growth as businesses expand latency-sensitive operations. Enterprise and managed centers sustain demand for private and hybrid workloads. The segment’s growth is reinforced by rising data localization policies and connectivity expansion.

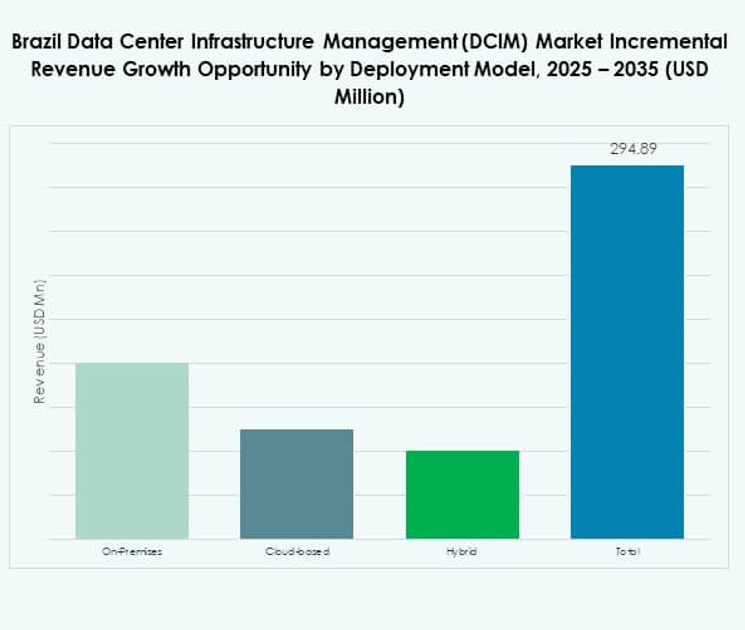

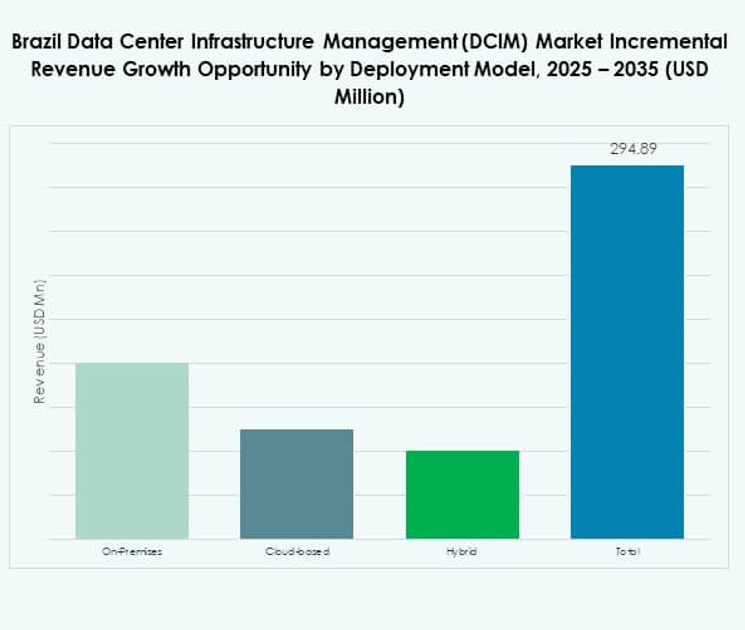

By Deployment Model

The cloud-based segment holds the leading share, supported by flexibility, scalability, and real-time visibility. It eliminates physical infrastructure costs and allows remote control. Hybrid models are gaining traction for balancing security and flexibility. On-premises solutions remain relevant among highly regulated industries prioritizing control and data sovereignty. It supports mission-critical applications demanding continuous uptime and data protection.

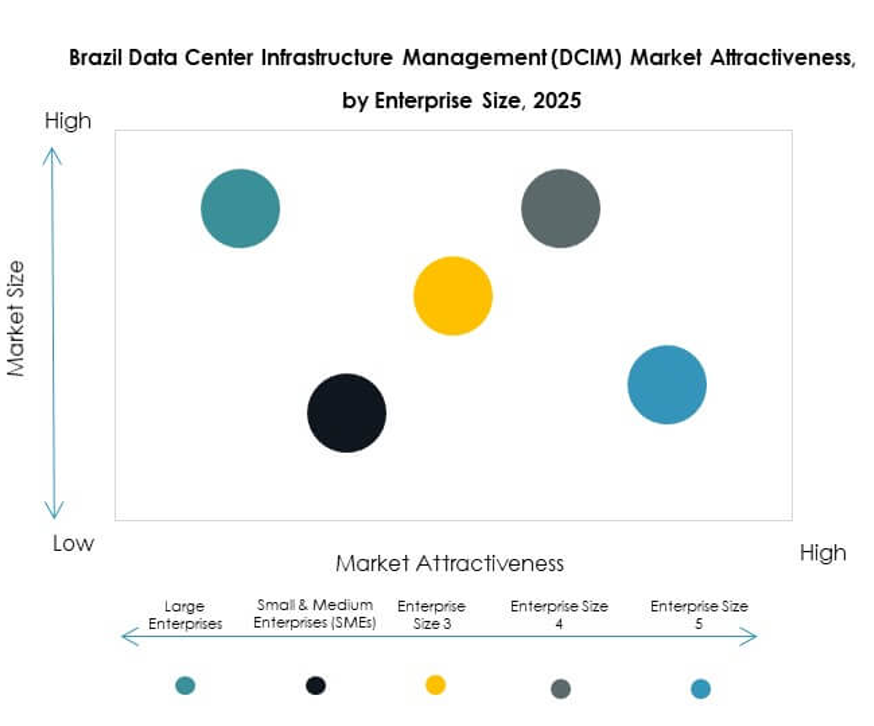

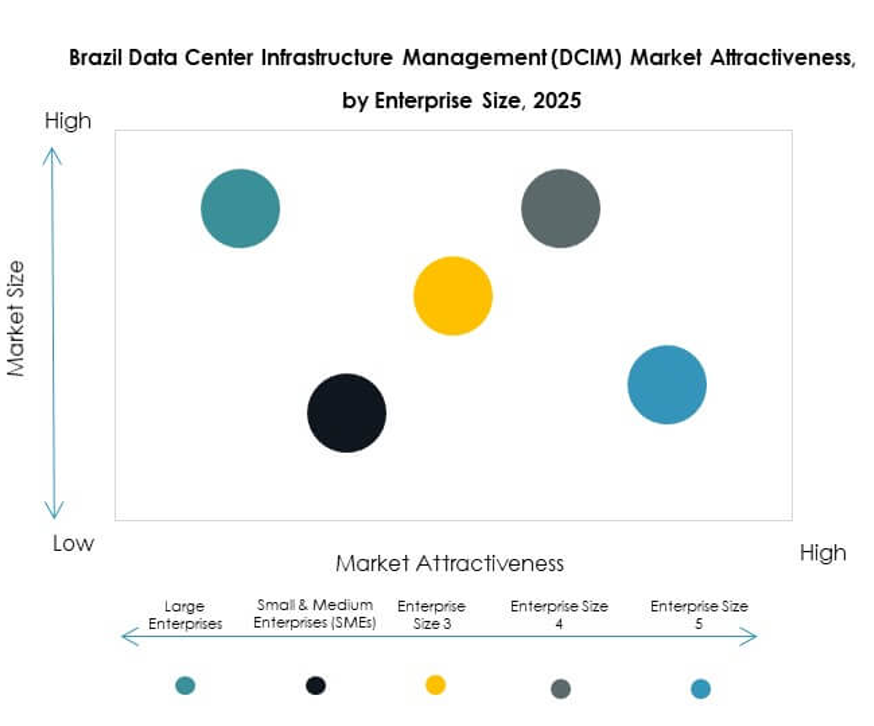

By Enterprise Size

Large enterprises dominate the market due to higher digital infrastructure investments and complex operations. It drives advanced DCIM adoption for predictive insights and performance optimization. SMEs show steady growth with increasing awareness of automation benefits. Affordable cloud-based DCIM platforms support adoption among small businesses. This segment benefits from simplified deployment and scalability features that lower operational barriers.

By Application / Use Case

Power monitoring leads the segment due to its vital role in energy optimization and load balancing. Asset management and capacity planning follow with strong adoption in hyperscale environments. Environmental monitoring grows with rising sustainability requirements. Business intelligence and analytics functions enhance decision-making and performance tracking. The segment’s expansion aligns with digital transformation initiatives in enterprises.

By End User Industry

IT and telecommunications hold the largest share in the market, driven by high data traffic and cloud expansion. BFSI follows with strong adoption for compliance and uptime management. Healthcare and retail sectors deploy DCIM for data integrity and real-time asset control. Energy, defense, and manufacturing sectors adopt it to enhance safety, operational visibility, and process automation.

Regional Insights

Southeast Brazil – Leading Hub for Hyperscale and Colocation Expansion (38.7% Share)

The Southeast region dominates the Brazil Data Center Infrastructure Management (DCIM) Market with 38.7% share. São Paulo hosts major hyperscale data centers, offering dense fiber networks and power availability. It attracts global cloud and colocation operators expanding capacity. Regional policies favor infrastructure investment and renewable adoption. It strengthens Brazil’s position as South America’s primary digital hub.

- For instance, ODATA signed a long-term agreement with Casa dos Ventos in October 2024 to supply its Brazilian data centers including those in Porto Alegre entirely with wind energy from the 360 MW Babilônia Sul wind complex, marking ODATA as the first operator to power their facilities using solely renewable energy generated from partner-owned plants.

South Brazil – Rapid Growth Driven by Renewable Integration (26.5% Share)

South Brazil demonstrates steady growth supported by renewable integration and strong industrialization. Major cities like Curitiba and Porto Alegre are investing in green data centers. The region benefits from lower energy costs and local technology innovation. It fosters partnerships between utilities and IT firms for sustainable infrastructure management. Increasing enterprise digitalization supports long-term demand for DCIM platforms.

Northeast and Central-West Regions – Emerging Data Infrastructure Markets (22.1% and 12.7% Share)

The Northeast region shows rising investments in submarine cable landing stations and network connectivity. Fortaleza has become a key interconnection point linking Latin America with the U.S. and Europe. Central-West Brazil is emerging through government-led digitization projects. It offers untapped opportunities for colocation and hybrid cloud expansion. Together, these regions diversify Brazil’s digital ecosystem and strengthen national connectivity resilience.

- For instance, Angola Cables committed up to 400 million reais ($80 million) in early 2024 to construct a second data center in Fortaleza, adjacent to its existing facility, and its cable landing station in Fortaleza is Tier III certified, serving as hub for international cable systems including Monet and SACS.

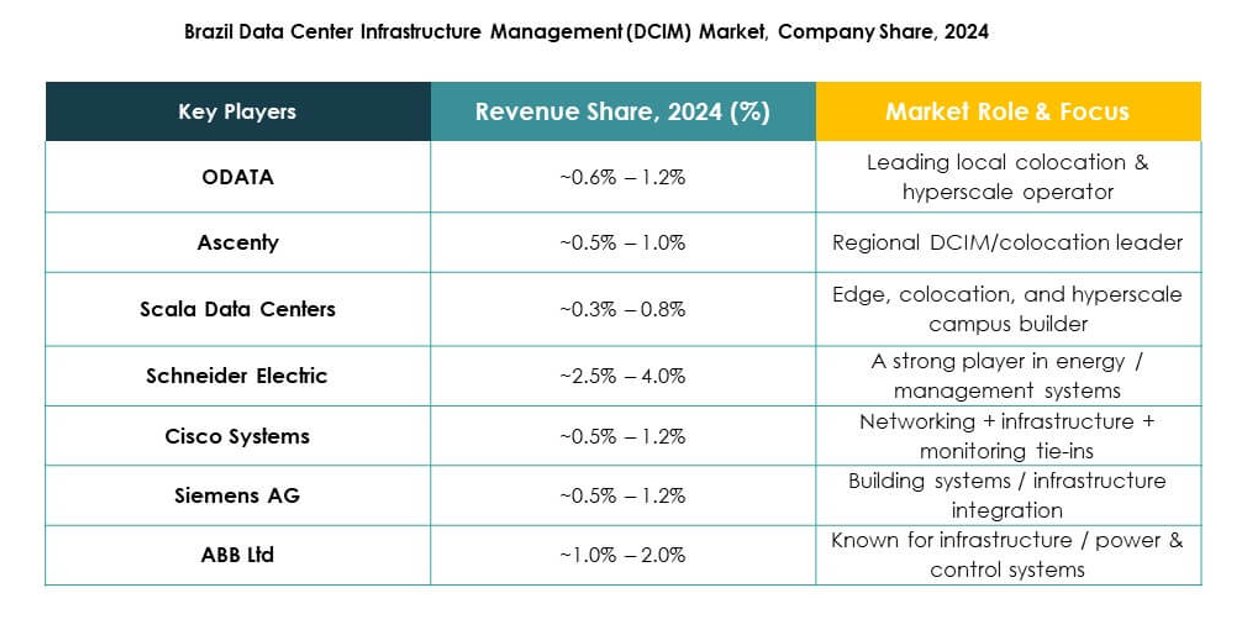

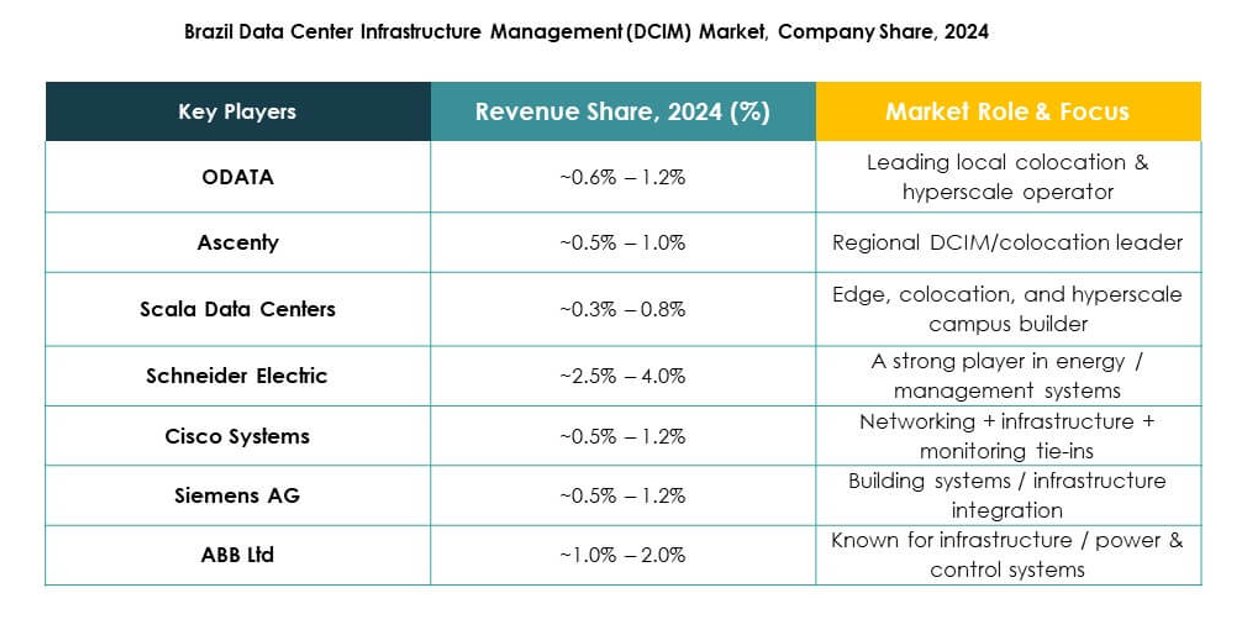

Competitive Insights:

- ODATA

- Ascenty

- Scala Data Centers

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd

- Schneider Electric SE

- Siemens AG

- Others

The Brazil Data Center Infrastructure Management (DCIM) Market features a highly competitive landscape driven by digital transformation, sustainability goals, and infrastructure expansion. Local operators like ODATA, Ascenty, and Scala Data Centers dominate with large-scale colocation facilities and renewable energy integration. Global technology leaders such as Schneider Electric, ABB, and Siemens focus on advanced DCIM software, energy efficiency, and automation. Cisco and Huawei strengthen competitiveness through intelligent network and cloud management platforms. Eaton Corporation expands presence with power monitoring and predictive maintenance solutions. It reflects a market evolving toward AI-driven, cloud-based, and energy-optimized DCIM systems, creating opportunities for both global and regional players to enhance operational reliability and sustainability performance.

Recent Developments:

- In October 2025, Elea Data Centers secured a significant contract to build a 30 MVA data center for Petrobras in São Paulo, Brazil. This project, valued at approximately $500 million, represents the largest IT infrastructure deal in Latin America and incorporates advanced liquid cooling technology to enhance energy efficiency and sustainability.

- In September 2025, ServiceNow announced investments to expand the capacity of its data centers located in Rio de Janeiro and São Paulo, Brazil. This initiative aligns with the surging demand for cloud-based IT services in the region, aiming to strengthen Brazil’s digital infrastructure.

- In August 2024, Orca Security launched a new data center in Brazil in partnership with AWS. This expansion supports Orca’s rapid growth in the LATAM region and enhances cloud security solutions for Brazilian customers, offering low latency, compliance with local data regulations, and improved protection of sensitive data.

Market Segmentation

Market Segmentation