Executive summary:

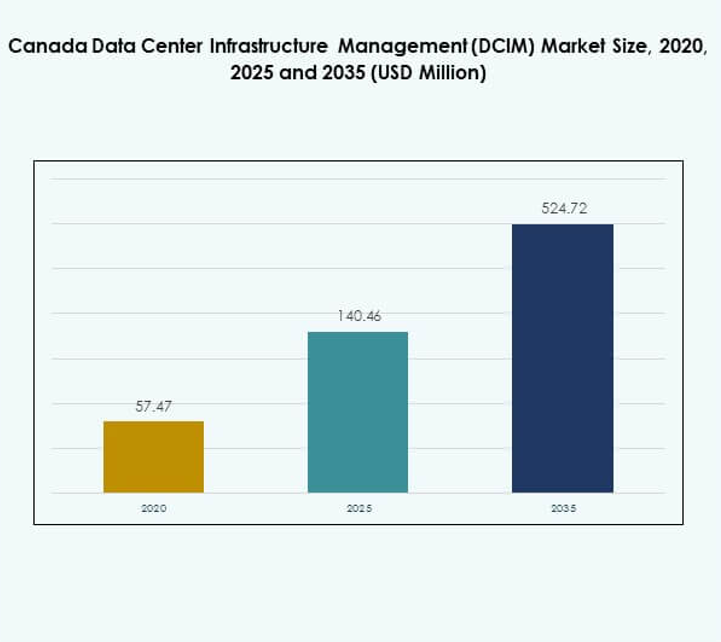

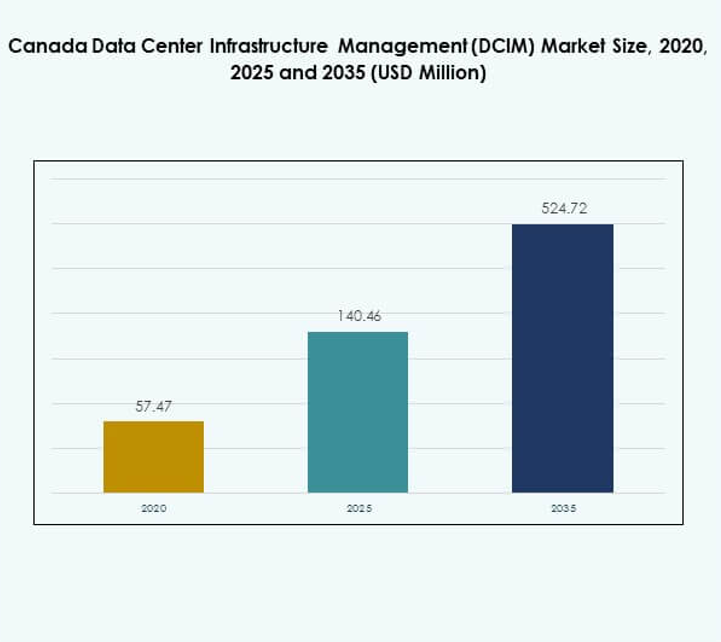

The Canada Data Center Infrastructure Management (DCIM) Market size was valued at USD 57.47 million in 2020 to USD 140.46 million in 2025 and is anticipated to reach USD 524.72 million by 2035, at a CAGR of 15.87% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Canada Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 140.46 Million |

| Canada Data Center Infrastructure Management (DCIM) Market, CAGR |

15.87% |

| Canada Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 524.72 Million |

The market is driven by the adoption of advanced technologies, cloud migration, and sustainable data center operations. Enterprises are integrating automation, AI-driven analytics, and IoT-enabled monitoring to improve efficiency and reduce downtime. It enhances energy optimization, resilience, and operational transparency, allowing businesses to align infrastructure with strategic goals. Investors see strong value in its ability to support long-term digital growth and meet compliance demands across multiple industries.

Regionally, North America leads with Canada benefiting from strong connectivity, renewable energy adoption, and proximity to U.S. hyperscale ecosystems. Western Canada holds a dominant share due to large-scale deployments, while Central Canada is emerging with significant cloud and colocation investments. Eastern Canada is gradually gaining traction, supported by telecom-driven edge expansions and sustainable infrastructure development, positioning the market for balanced regional growth.

Market Drivers

Growing Adoption of Advanced Digital Infrastructure and Cloud Technologies in Canadian Data Centers

The Canada Data Center Infrastructure Management (DCIM) Market is driven by rapid adoption of digital infrastructure upgrades and cloud technologies. Organizations are modernizing facilities to support higher workloads, digital platforms, and evolving enterprise needs. It is helping optimize operational workflows and manage energy efficiency across facilities. Businesses are deploying scalable DCIM solutions to align infrastructure with long-term digital goals. The surge in cloud adoption requires monitoring and analytics that DCIM provides. Integration with cloud ecosystems enhances reliability and resource utilization. This growing reliance strengthens the value proposition for investors and stakeholders in the market.

- For instance, Equinix’s TR2 data center in Toronto offers 106,500 square feet of raised floor colocation space and provides interconnection to over 470 companies and 60+ network service providers. The facility holds certifications including PCI DSS and ISO 27001, supporting secure and compliant operations.

Increasing Integration of Artificial Intelligence, Automation, and IoT in DCIM Solutions

Artificial intelligence, automation, and IoT integration are fueling strong adoption across data centers. AI-based monitoring tools improve cooling efficiency, reduce downtime, and forecast equipment failure. It enables predictive maintenance that extends asset lifespan and lowers operational costs. Automation reduces manual intervention, ensuring accuracy in power and capacity management. IoT sensors create real-time visibility for large enterprises seeking precision. Integration supports decision-making with actionable insights for IT teams. Businesses benefit from enhanced energy savings and resilience. These innovations position the Canada Data Center Infrastructure Management (DCIM) Market as a core driver of digital competitiveness.

Sustainability and Energy Efficiency as Core Business Imperatives in Data Center Operations

Sustainability initiatives are central drivers influencing adoption of DCIM solutions. Energy efficiency is no longer optional but mandatory for enterprises under regulatory and environmental pressures. It supports power monitoring, carbon reduction, and green certifications. Enterprises deploy DCIM to optimize cooling, reduce emissions, and meet compliance standards. Investors see strong appeal in markets aligned with sustainability mandates. Adoption is also reinforced by government policies supporting low-carbon infrastructure. Businesses value energy cost savings as a direct benefit. The Canada Data Center Infrastructure Management (DCIM) Market is strategically positioned to lead in sustainable transformation.

Strategic Importance of Data Security, Uptime, and Business Continuity for Stakeholders

Data security and uptime remain critical priorities for enterprises operating in competitive sectors. It ensures resilience through real-time monitoring of physical and environmental conditions. Secure management of power and cooling infrastructure protects against downtime risks. Rising digital dependency makes uninterrupted services essential for banking, healthcare, and telecom. Investors see resilience as a measure of long-term stability in data infrastructure. The strategic role of DCIM extends beyond efficiency to safeguarding business continuity. Enhanced operational transparency supports proactive risk management. The Canada Data Center Infrastructure Management (DCIM) Market is becoming a foundation for digital trust and growth.

- For instance, Cologix reports in its 2024 ESG summary that its Canadian data centers feature redundant power systems and uphold SLAs ensuring 99.999% uptime, verified via annual ESG audits.

Market Trends

Expansion of Colocation and Edge Facilities with Advanced DCIM Capabilities Across Canada

Colocation and edge facilities are expanding rapidly to meet demand for distributed computing. It supports faster data access, regional coverage, and localized workloads. Businesses prefer colocation for cost efficiency and scalability while demanding DCIM support. Edge centers rely on real-time monitoring to handle latency-sensitive operations. Providers integrate DCIM tools to strengthen uptime guarantees for clients. Growth is propelled by adoption in retail, healthcare, and financial industries. Enterprises value distributed infrastructure to balance cost and agility. The Canada Data Center Infrastructure Management (DCIM) Market is aligning with this distributed facility trend.

Increasing Role of Hybrid and Multi-Cloud Deployments in Shaping DCIM Adoption

Hybrid and multi-cloud strategies are reshaping demand for flexible management platforms. Enterprises are adopting DCIM tools capable of integrating across diverse deployment models. It enables seamless monitoring of on-premises and cloud-based systems together. Multi-cloud adoption drives complexity that requires centralized oversight. DCIM supports optimization of hybrid workloads and ensures better cost allocation. Firms with critical data needs benefit from this multi-layered approach. The flexibility to manage hybrid resources creates competitive advantage. The Canada Data Center Infrastructure Management (DCIM) Market is seeing growing traction from hybrid infrastructure deployments.

Emergence of AI-Driven Analytics for Predictive Maintenance and Decision Support in DCIM

AI analytics are reshaping the operational approach of modern data centers. It provides predictive insights for maintenance, helping prevent failures before they occur. Businesses gain from improved operational reliability and minimized downtime. Predictive models support capacity planning and cost forecasting. AI-powered dashboards help decision-makers with real-time performance data. Enhanced automation through AI drives cost savings and efficiency gains. Enterprises recognize the competitive advantage of analytics-driven DCIM platforms. The Canada Data Center Infrastructure Management (DCIM) Market is leveraging AI adoption to accelerate industry maturity.

Rise of Compliance-Driven DCIM Adoption with Focus on Cybersecurity and Regulatory Frameworks

Compliance requirements are pushing organizations to adopt advanced monitoring systems. It ensures adherence to energy standards, data sovereignty, and security regulations. DCIM platforms are evolving with built-in compliance tools. Cybersecurity is increasingly integrated into operational monitoring for protection. Companies in regulated sectors see compliance as a growth enabler. Meeting evolving regulations builds customer trust and investor confidence. Businesses secure reputational advantage by showcasing compliance readiness. The Canada Data Center Infrastructure Management (DCIM) Market is gaining traction as compliance becomes a non-negotiable factor.

Market Challenges

High Implementation Costs and Complexity of Managing Legacy Infrastructure with Modern DCIM Tools

The Canada Data Center Infrastructure Management (DCIM) Market faces challenges due to high costs of implementation and integration with legacy systems. Enterprises with older infrastructure struggle to align with modern monitoring tools. It raises concerns around compatibility, scalability, and operational disruptions during deployment. Small and medium enterprises view upfront investments as barriers despite long-term benefits. Complex system upgrades require skilled professionals, further adding to expenses. The high cost factor slows adoption among mid-tier organizations. Enterprises must justify ROI to investors while managing existing IT budgets. These challenges limit faster penetration across cost-sensitive business segments.

Skill Gaps, Cybersecurity Risks, and Resistance to Change within Enterprise IT Teams

Enterprises encounter skill shortages when deploying advanced DCIM platforms. It demands expertise in automation, analytics, and AI-enabled operations. Resistance to change from IT teams used to traditional systems creates adoption barriers. Cybersecurity remains a risk with interconnected systems vulnerable to attacks. It requires continuous monitoring to safeguard sensitive operational data. Organizations find it challenging to align internal teams with new technologies. Lack of trained talent slows operational integration. These human and security challenges impact the overall expansion of the Canada Data Center Infrastructure Management (DCIM) Market.

Market Opportunities

Growth Potential in Cloud-First Strategies and Expansion of Edge Data Center Deployments

The Canada Data Center Infrastructure Management (DCIM) Market holds growth potential with cloud-first and edge strategies. Enterprises are scaling distributed infrastructure to support digital transformation. It creates demand for DCIM platforms that monitor diverse environments. Cloud adoption accelerates need for efficient resource allocation. Edge expansion offers opportunities in retail, telecom, and manufacturing sectors. Businesses benefit from real-time visibility across geographically dispersed assets. Investors see value in platforms aligned with hybrid cloud and edge growth. This opens strong long-term opportunities in Canada’s digital ecosystem.

Innovation in Sustainable Data Center Operations and AI-Driven DCIM Platforms for Efficiency

Sustainable operations represent another strong opportunity for stakeholders in Canada. It encourages adoption of DCIM for energy efficiency, emissions reduction, and compliance. AI-driven tools enhance predictive maintenance and operational intelligence. Enterprises pursue green certifications to improve brand value and reduce costs. Investments in renewable energy sources support greener infrastructure. Businesses adopt these solutions to meet environmental, social, and governance (ESG) goals. The Canada Data Center Infrastructure Management (DCIM) Market benefits from this dual focus on sustainability and technology innovation. These opportunities position Canada as a strong player in the global market.

Market Segmentation

By Component

Solutions dominate the Canada Data Center Infrastructure Management (DCIM) Market, accounting for the larger share due to rising demand for real-time monitoring, asset tracking, and energy optimization. It helps enterprises manage physical infrastructure with high accuracy. Services are growing as businesses require consulting, integration, and managed support for DCIM deployment. The combination of advanced solutions and services creates a comprehensive ecosystem. Increasing complexity of data centers fuels demand for integrated platforms.

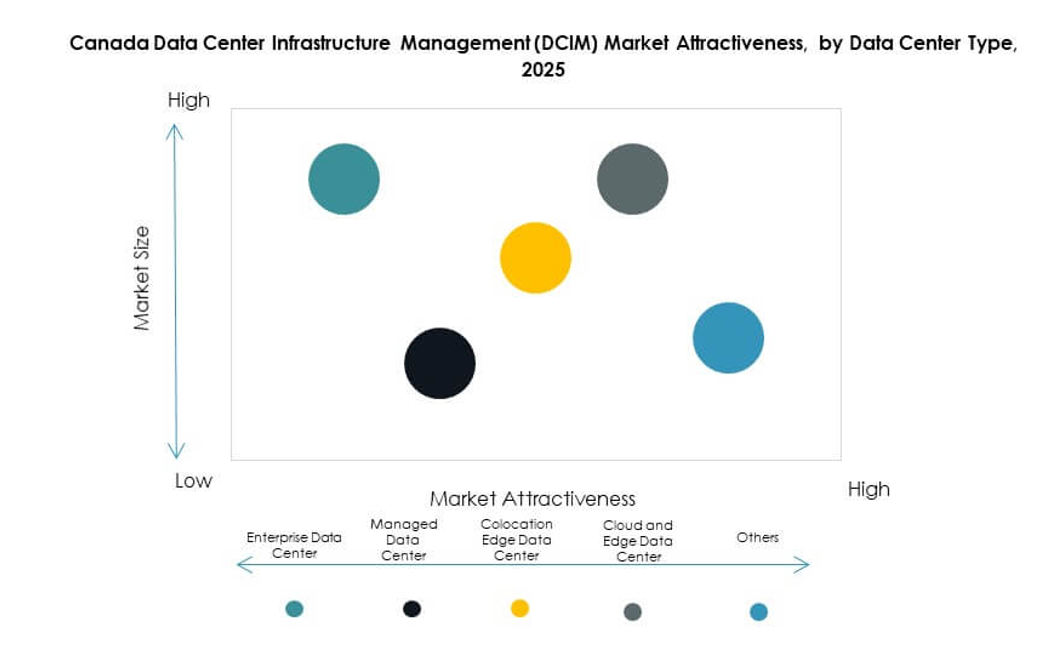

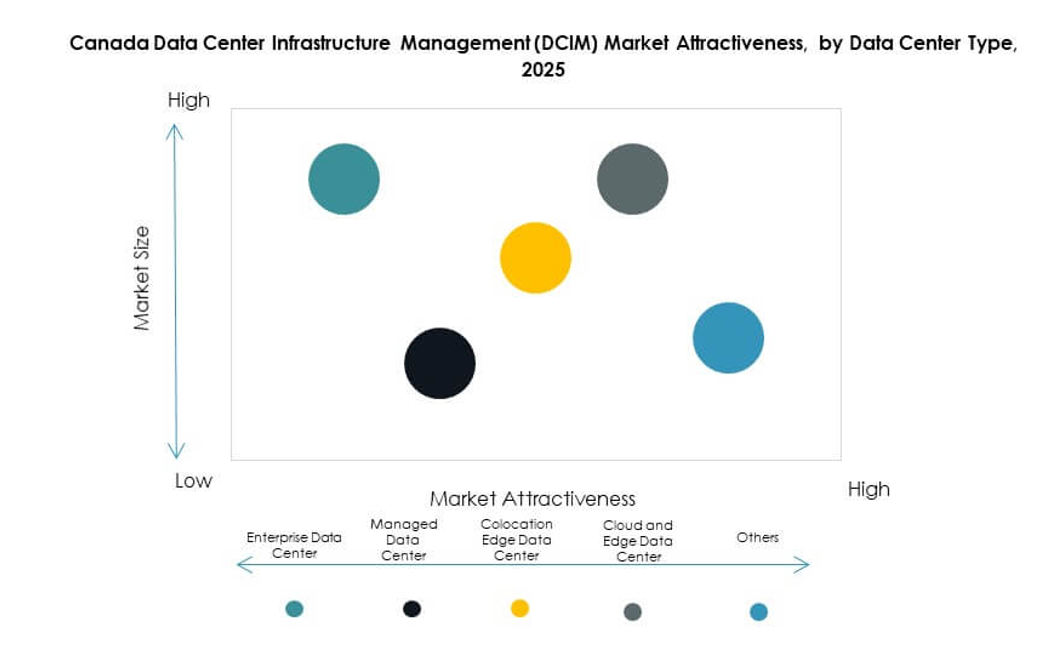

By Data Center Type

Cloud and edge data centers dominate the market with strong adoption across Canada. They offer flexibility, low latency, and scalability for digital workloads. Colocation centers also hold a significant share, driven by enterprises outsourcing infrastructure needs. Enterprise data centers maintain relevance for critical industries with sensitive data. Managed facilities expand with focus on cost optimization. This segmentation reflects Canada’s mix of traditional and modern infrastructure models supporting diverse industries.

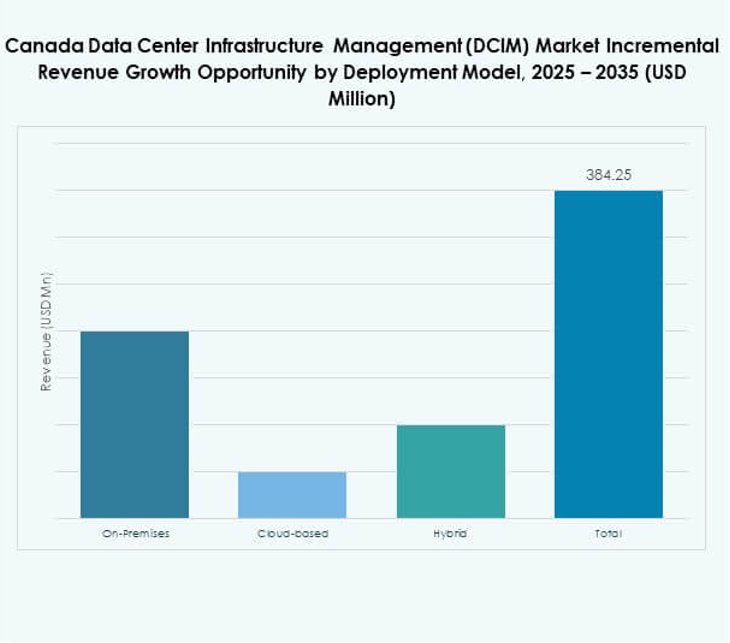

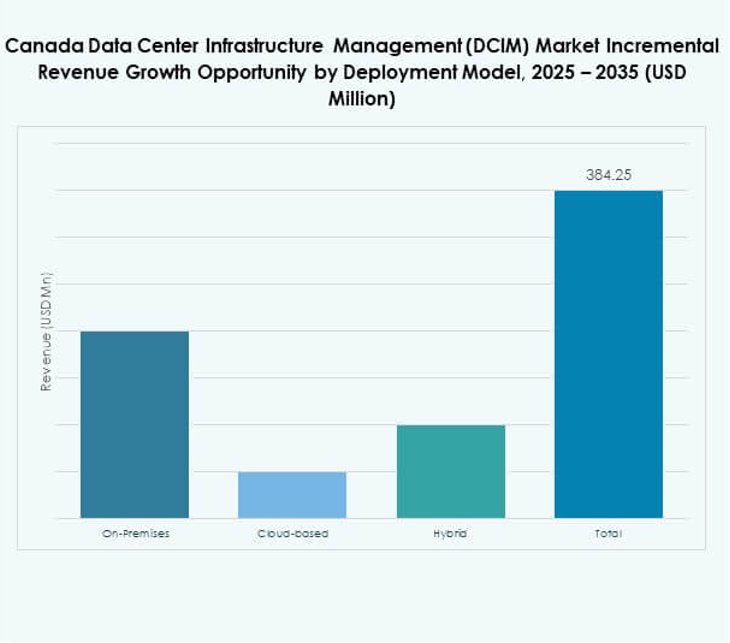

By Deployment Model

Cloud-based deployment leads the Canada Data Center Infrastructure Management (DCIM) Market as enterprises migrate workloads to flexible platforms. It supports scalability, cost efficiency, and faster adoption cycles. On-premises solutions continue to serve critical industries requiring data sovereignty and control. Hybrid models are growing, balancing both cloud flexibility and on-premises reliability. Businesses see hybrid deployments as risk-managed approaches. This combination reflects the shift toward adaptable infrastructure models.

By Enterprise Size

Large enterprises dominate adoption due to advanced digital infrastructure and strong IT budgets. They invest in automation and analytics to support complex operations. SMEs are gradually adopting cloud-based DCIM due to affordability and scalability. It allows smaller businesses to optimize resource allocation with fewer upfront investments. Growth in SMEs expands the overall adoption base. This balance ensures that both segments contribute to future expansion.

By Application / Use Case

Power monitoring dominates application usage in Canada, with enterprises prioritizing energy efficiency. Asset management and capacity management are also crucial for operational optimization. Environmental monitoring gains relevance with sustainability requirements. Business intelligence and analytics applications enhance decision-making. Each application creates specialized benefits for enterprises across industries. The Canada Data Center Infrastructure Management (DCIM) Market reflects diverse use cases in alignment with strategic priorities.

By End User Industry

IT and telecommunications lead adoption with continuous demand for data capacity and network reliability. BFSI follows with strong compliance and security requirements. Healthcare facilities adopt DCIM to ensure resilience of critical patient systems. Retail and e-commerce embrace platforms to manage scalable operations. Aerospace, defense, energy, and utilities sectors leverage DCIM for uptime and security. This diversified adoption underscores the strategic value across multiple Canadian industries.

Regional Insights

Western Canada Leading with Strongest Market Share

Western Canada leads the Canada Data Center Infrastructure Management (DCIM) Market with a 38% share, supported by large-scale deployments in Alberta and British Columbia. The region benefits from energy resources, renewable power access, and rising cloud infrastructure. It attracts global hyperscale providers building scalable facilities. Enterprises prioritize the region for sustainable operations. It plays a central role in strengthening Canada’s position in the North American digital ecosystem.

- For instance, in October 2024, eStruxture Data Centers announced the construction of a $750 million facility five kilometers north of Calgary, designed to deliver 90 megawatts of power, marking it as Alberta’s largest data center to date and the company’s third such center in the Calgary area.

Central Canada Emerging as a High-Growth Region for Colocation and Cloud Deployments

Central Canada, with a 34% share, is a growing hub for colocation and cloud data centers. Ontario and Quebec drive demand with strong enterprise presence and digital adoption. It supports industries such as banking, retail, and healthcare with robust infrastructure. Proximity to major urban hubs and skilled workforce strengthens its advantage. Central Canada benefits from government initiatives to expand broadband and connectivity. It is becoming a strategic region for global investors seeking growth opportunities.

- For instance, in July 2025, QScale confirmed a minimum C$2.5–C$4 billion investment to build a hyperscale data center campus in Toronto, backed by up to $320 million in government support, reinforcing the region’s colocation and cloud demand with new high-density compute capacity.

Eastern Canada Gaining Momentum with Edge Deployments and Telecom Growth

Eastern Canada accounts for 28% share of the Canada Data Center Infrastructure Management (DCIM) Market, fueled by telecom growth and edge deployments. Nova Scotia and New Brunswick attract data center projects with renewable energy capacity. The region supports industries seeking low-latency services. It is seeing rising investments from telecom operators to expand digital coverage. Eastern Canada plays an important role in providing redundancy and supporting national connectivity goals. The subregion strengthens the overall balance in Canada’s digital infrastructure landscape.

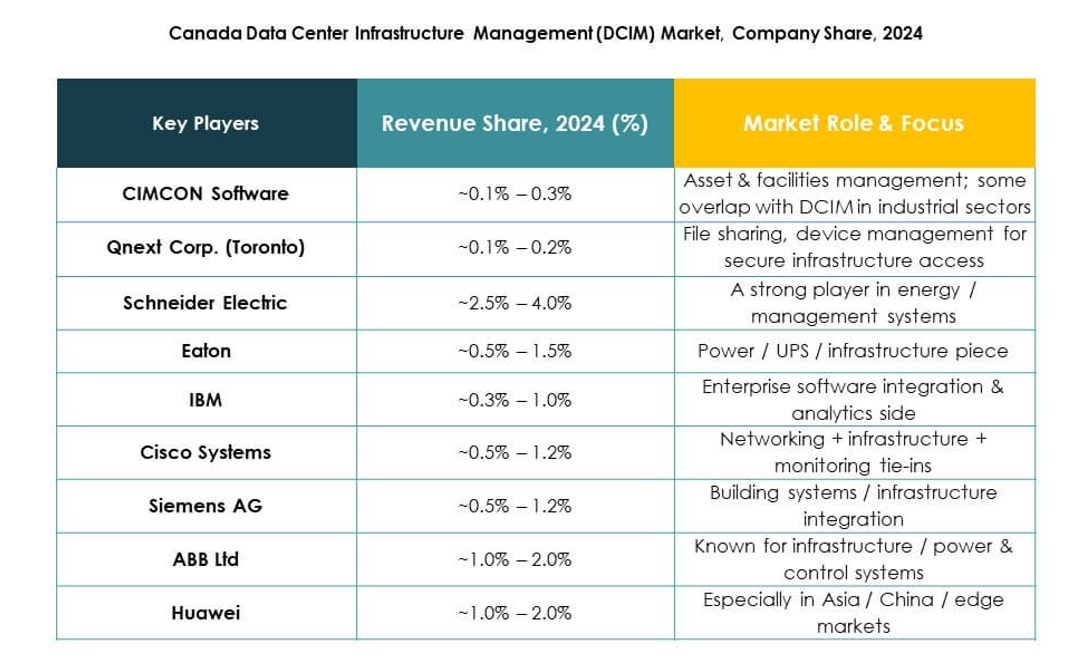

Competitive Insights:

- CIMCON Software

- Qnext Corp.

- Beanfield Metroconnect

- Adaptiv Networks (Quebec)

- ABB Ltd.

- Cisco Systems, Inc.

- Device42, Inc.

- Eaton Corporation

- FNT GmbH

- Huawei Technologies Co., Ltd

- IBM

- Schneider Electric SE

- Siemens AG

- HPE (Hewlett Packard Enterprise)

- Sunbird Inc.

- Vertiv Holdings

- Delta Electronics

- Nlyte Software

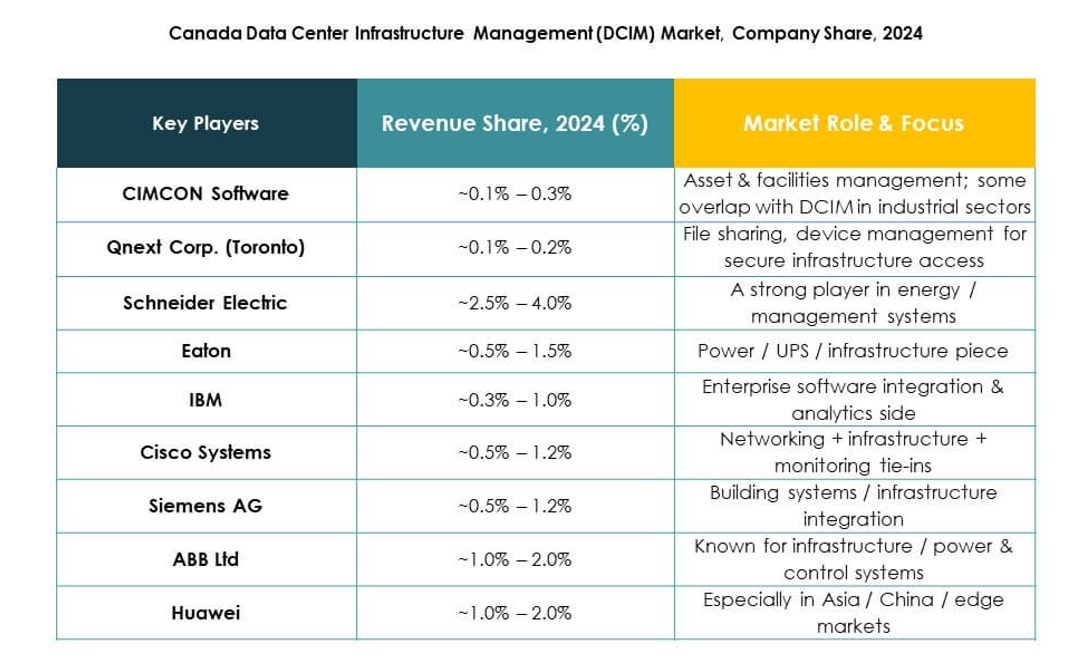

The Canada Data Center Infrastructure Management (DCIM) Market is highly competitive, with global leaders and domestic players shaping its evolution. It is characterized by innovation in AI-driven monitoring, energy-efficient solutions, and integration of hybrid and cloud-based models. Multinational firms like Schneider Electric, ABB, and Huawei dominate through extensive portfolios and global reach, while Canadian firms such as Qnext Corp. and Beanfield Metroconnect strengthen the local ecosystem with tailored solutions. Cisco, IBM, and HPE leverage strong R&D to support enterprise adoption. Vertiv and Eaton focus on power and cooling optimization, enhancing operational resilience. Sunbird, Nlyte, and Device42 differentiate through specialized software platforms for asset and capacity management. Competition is intensifying as vendors prioritize sustainability, compliance, and cybersecurity features to capture market share across large enterprises and SMEs.

Recent Developments:

- In July 2024, Vertiv introduced its new liquid-cooled modular data center solution called MegaMod CoolChip, specifically designed for AI computing workloads in the Canada Data Center Infrastructure Management market. This product aims to help Canadian data centers manage increasing energy consumption and support efficient, high-density operations needed for AI applications, signaling a shift toward greater innovation and sustainability in infrastructure management.

- In August 2025, National Wireless partnered with Adaptiv Networks to integrate Adaptiv’s cloud-managed SD-WAN and SASE security solutions within its network services, broadening access to secure, high-performance connectivity options for Canadian businesses operating data center environments.