Executive summary:

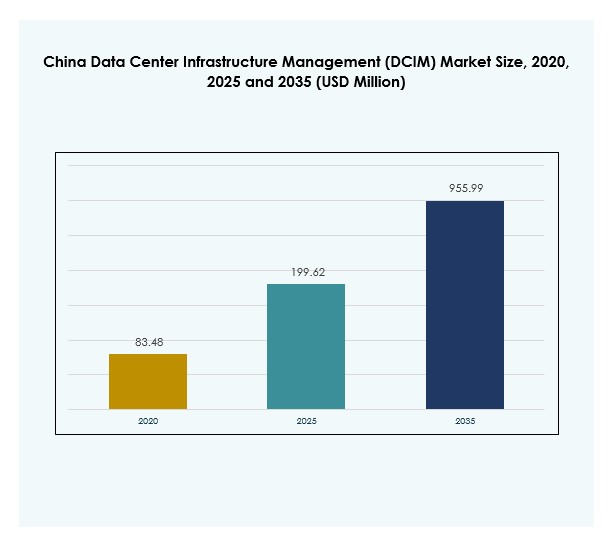

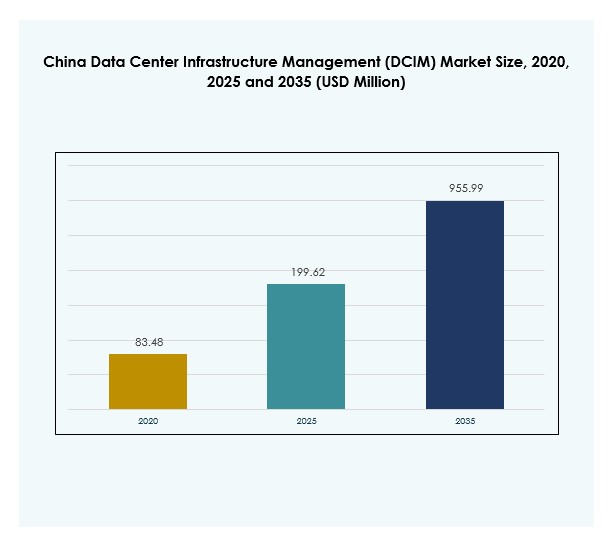

The China Data Center Infrastructure Management (DCIM) Market size was valued at USD 83.48 million in 2020 to USD 199.62 million in 2025 and is anticipated to reach USD 955.99 million by 2035, at a CAGR of 18.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2025 |

| Forecast Period |

2025-2035 |

| China Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 199.62 Million |

| China Data Center Infrastructure Management (DCIM) Market, CAGR |

18.67% |

| China Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 955.99 Million |

The market is advancing rapidly as enterprises adopt AI-driven automation, IoT-enabled monitoring, and predictive analytics to optimize data center operations. Growing demand for energy efficiency and regulatory compliance is strengthening the adoption of intelligent DCIM platforms. Innovation in cloud-native solutions, hybrid deployments, and sustainability dashboards is reshaping operational strategies. For businesses and investors, the market holds strategic importance as it underpins China’s digital transformation and positions the country at the forefront of global data infrastructure modernization.

Regional growth in China is highly concentrated in Eastern hubs such as Beijing, Shanghai, and Shenzhen, where hyperscale projects and strong cloud service demand dominate. Northern regions are expanding steadily, driven by government digitalization projects and industrial adoption. Western and Central China are emerging as growth frontiers due to favorable policies, lower operating costs, and rising investment in new facilities. This balanced regional expansion reflects China’s goal of building a nationwide, resilient digital infrastructure.

Market Drivers

Rising Adoption of AI and Automation in Data Center Infrastructure

The China Data Center Infrastructure Management (DCIM) Market is driven by the rapid adoption of AI and automation for data center optimization. Enterprises use predictive analytics to improve resource efficiency and minimize downtime. Automated tools support dynamic capacity planning and streamline workload allocation across hybrid infrastructures. The push for smarter energy use strengthens demand for intelligent DCIM platforms. Integration with IoT devices enhances visibility and operational control. Businesses view these advancements as a way to reduce costs while boosting resilience. Investors also see scalable automation solutions as reliable growth drivers in this digital era.

- For instance, Huawei’s iCooling@AI solution, deployed in Chinese data centers, has reduced power usage effectiveness (PUE) by 8% to 15% through AI-driven cooling optimization, as documented in official Huawei case studies and technical releases from 2023 and 2024.

Expansion of Cloud and Edge Deployments Driving Strategic Integration

Growth in cloud and edge ecosystems is creating demand for advanced infrastructure management tools. Organizations deploy DCIM platforms to address increasing complexity in distributed data networks. The China Data Center Infrastructure Management (DCIM) Market is witnessing strong integration of cloud-native solutions to ensure seamless monitoring. Enterprises seek hybrid models that balance flexibility and security. Industry players recognize the role of edge computing in supporting 5G applications and digital services. This shift positions DCIM as a critical enabler of long-term infrastructure sustainability. Businesses invest in these solutions to remain competitive in fast-evolving digital economies.

Focus on Energy Efficiency and Sustainability in Data Centers

Sustainability is central to the development of modern data centers in China. Companies adopt DCIM systems to track energy use and manage carbon emissions effectively. The China Data Center Infrastructure Management (DCIM) Market emphasizes eco-friendly operations through advanced cooling and monitoring technologies. Government sustainability targets push enterprises toward greener data management practices. Investors see value in companies prioritizing environmentally conscious infrastructure. Energy efficiency tools not only reduce costs but also extend operational lifespans. This creates opportunities for scalable growth while aligning with national digital and environmental goals. Adoption rates rise steadily with increased regulatory enforcement.

Digital Transformation and Regulatory Frameworks Accelerating Growth

Digital transformation initiatives by enterprises and government are propelling DCIM adoption across multiple industries. Strong regulations on cybersecurity and data localization increase the need for infrastructure monitoring. The China Data Center Infrastructure Management (DCIM) Market benefits from policies supporting digital expansion. IT and telecom firms lead investments to modernize legacy infrastructure. Healthcare, BFSI, and retail sectors accelerate adoption to ensure compliance and performance. Businesses seek DCIM platforms to handle growing volumes of data with transparency. This growing reliance highlights DCIM as a strategic enabler of secure and efficient data ecosystems in China’s evolving economy.

- For instance, China Unicom’s Guangzhou Eco-Friendly Data Center, enabled by Huawei’s DCIM and intelligent power solutions, recorded an annual electricity saving of 13.2 million kWh and a corresponding reduction of 7,695 tons of carbon emissions starting in early 2024

Market Trends

Emergence of AI-Driven Predictive Maintenance and Monitoring

The rise of AI-driven predictive maintenance is a defining trend for the China Data Center Infrastructure Management (DCIM) Market. Predictive models enable proactive detection of equipment failures and enhance operational uptime. Data-driven insights allow real-time adjustments for energy and resource management. Businesses integrate machine learning models into DCIM platforms for scalable decision-making. This adoption reduces human error and improves resource optimization. It becomes a critical feature for enterprises managing large-scale hybrid networks. The market strengthens its technological foundation with AI becoming central to digital transformation.

Growing Importance of Cybersecurity Integration with DCIM Platforms

Security remains a top priority for enterprises managing critical infrastructure. DCIM providers integrate cybersecurity features to protect sensitive assets and networks. The China Data Center Infrastructure Management (DCIM) Market observes rising demand for platforms with embedded threat detection. Enterprises look for tools that balance performance and protection. Compliance with stricter national data laws fuels integration of advanced safeguards. Businesses seek to reduce risks by adopting holistic monitoring solutions. It highlights the trend of merging infrastructure and security management under one framework. This shift positions DCIM as both operational and protective technology.

Shift Toward Modular and Scalable DCIM Deployments

Organizations prefer modular DCIM solutions that scale with business needs. The China Data Center Infrastructure Management (DCIM) Market sees demand for flexible architectures adaptable to both small and large enterprises. Modular deployments allow enterprises to adopt features gradually and control costs. Businesses choose scalable solutions for edge expansion and hybrid environments. Vendors highlight the ability to expand capacity without disrupting operations. This trend strengthens vendor-client relationships through long-term flexibility. Enterprises view modularity as an essential feature in competitive digital markets. It aligns closely with evolving technology demands and sustainability priorities.

Integration of Sustainability Dashboards and Green Monitoring Tools

Sustainability dashboards gain prominence in DCIM offerings across China. Companies adopt these platforms to measure and report environmental performance transparently. The China Data Center Infrastructure Management (DCIM) Market increasingly features advanced cooling management and renewable integration options. Green dashboards help businesses align with environmental goals and investor expectations. Enterprises monitor carbon footprints with higher precision using these tools. The market reflects growing emphasis on balancing digital growth with environmental responsibility. Adoption supports corporate reputation and compliance with national sustainability frameworks. It becomes a critical trend shaping long-term industry evolution.

Market Challenges

Complexity of Integration Across Hybrid and Legacy Infrastructures

The China Data Center Infrastructure Management (DCIM) Market faces difficulty in integrating new systems with existing hybrid and legacy frameworks. Many enterprises struggle with compatibility issues between modern platforms and older equipment. This limits the speed of deployment and increases operational risk. Vendors must address these integration gaps to ensure reliability. Businesses often delay adoption due to high transition costs and technical uncertainty. It creates pressure on providers to deliver seamless migration strategies. The challenge becomes more pressing as hybrid and multi-cloud models gain dominance.

High Capital Expenditure and Limited Skilled Workforce

Another challenge lies in the high cost of deploying advanced DCIM platforms. The China Data Center Infrastructure Management (DCIM) Market demands significant investment in software, training, and infrastructure upgrades. Smaller enterprises hesitate due to financial constraints. Limited availability of skilled workforce further hampers adoption. Companies require professionals with expertise in AI-driven monitoring and cyber-secure operations. Lack of adequate training slows implementation timelines. It adds operational risk for organizations transitioning to advanced digital infrastructure. Cost barriers and workforce shortages together remain key hurdles for market expansion.

Market Opportunities

Rising Investments in Edge and Hyperscale Infrastructure Expansion

The China Data Center Infrastructure Management (DCIM) Market benefits from rising investments in edge and hyperscale projects. Enterprises invest heavily in infrastructure to meet growing cloud service demands. Expanding 5G applications further accelerate adoption of DCIM platforms. Vendors offering edge-ready solutions secure competitive advantage in this dynamic landscape. It creates opportunities for cross-industry collaborations with telecom and cloud leaders. Businesses recognize the importance of advanced monitoring for scaling digital ecosystems efficiently. This shift presents opportunities for both established players and new entrants.

Adoption of Cloud-Based DCIM Models Among SMEs

SMEs are embracing cloud-based DCIM solutions to gain affordable and scalable monitoring capabilities. The China Data Center Infrastructure Management (DCIM) Market shows strong potential in this segment. Cloud-based platforms allow smaller enterprises to bypass high upfront investments. Vendors design flexible subscription models tailored for SME adoption. It broadens the market scope and increases penetration in mid-tier enterprises. Affordable cloud solutions also support compliance for emerging businesses. Growth in this segment opens significant opportunities for expanding digital inclusion across China.

Market Segmentation

By Component

Solutions hold the largest share in the China Data Center Infrastructure Management (DCIM) Market due to their ability to centralize monitoring and analytics. Services follow closely, driven by demand for integration, consulting, and maintenance. Vendors enhance solution portfolios with AI-driven analytics and sustainability dashboards. Service offerings expand as enterprises require training and support to manage complex deployments. Both segments complement each other, ensuring operational efficiency and reliability across varied data center types.

By Data Center Type

Cloud and edge data centers dominate the China Data Center Infrastructure Management (DCIM) Market owing to rapid cloud adoption and nationwide 5G rollouts. Colocation and managed data centers follow, attracting enterprises seeking cost-efficient and secure environments. Enterprise data centers maintain relevance for legacy operations but decline in share compared to cloud-centric models. Edge data centers expand faster due to demand for localized, low-latency applications. These trends strengthen the strategic role of DCIM in diverse architectures.

By Deployment Model

Cloud-based models lead adoption in the China Data Center Infrastructure Management (DCIM) Market due to flexibility and scalability. On-premises solutions remain strong in regulated sectors requiring greater control over sensitive data. Hybrid deployments gain traction as enterprises combine benefits of both approaches. This balance provides operational efficiency, compliance, and adaptability. Hybrid models particularly support industries with fluctuating capacity demands. Vendors continue enhancing hybrid features to attract businesses with complex infrastructures.

By Enterprise Size

Large enterprises hold a dominant share in the China Data Center Infrastructure Management (DCIM) Market due to extensive infrastructure investments. They adopt DCIM platforms to manage distributed operations at scale. SMEs show rapid adoption growth, driven by affordable cloud-based solutions. Vendors increasingly focus on SME needs through subscription models. This dual dynamic ensures market coverage across enterprise scales. Large enterprises sustain market leadership while SMEs emerge as high-potential growth drivers.

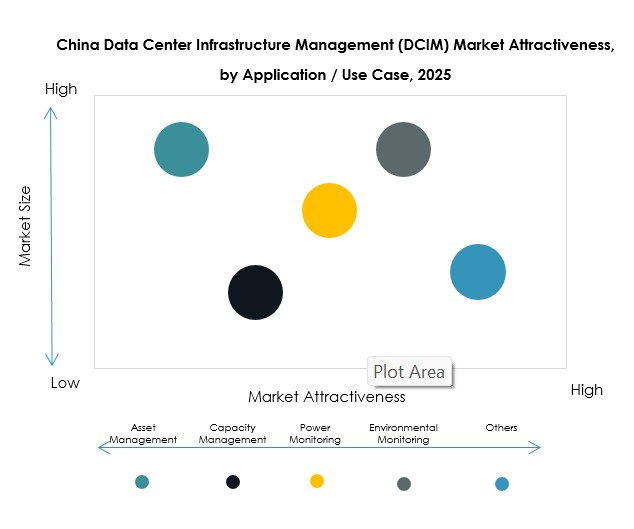

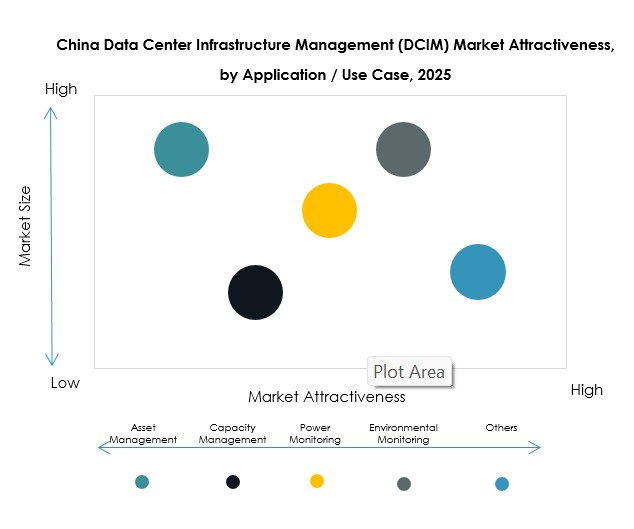

By Application / Use Case

Asset management and capacity management are the leading applications in the China Data Center Infrastructure Management (DCIM) Market. Businesses prioritize asset visibility, performance monitoring, and capacity planning to reduce costs. Power monitoring and environmental monitoring are also critical, aligning with energy efficiency targets. Business intelligence and analytics expand rapidly as enterprises seek deeper operational insights. The diversity of use cases demonstrates DCIM’s value in enabling holistic infrastructure control.

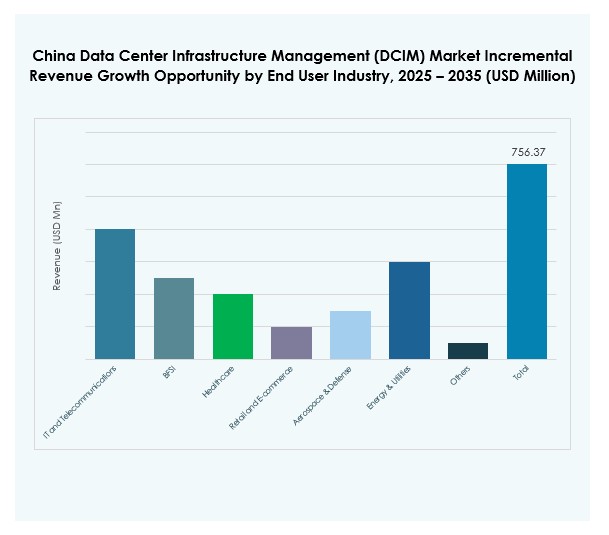

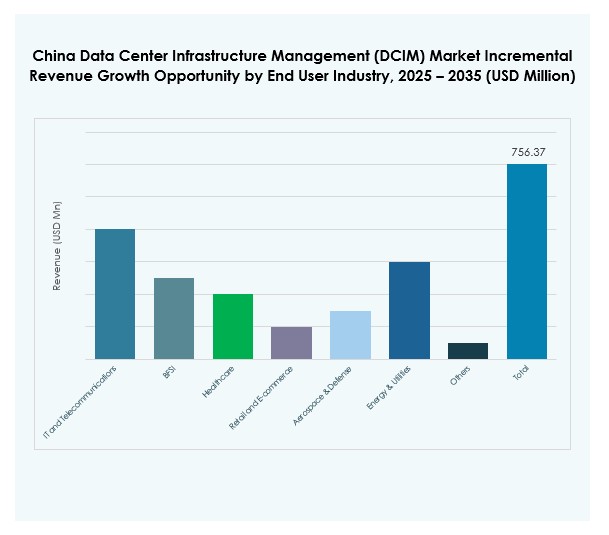

By End User Industry

The IT and telecommunications sector leads the China Data Center Infrastructure Management (DCIM) Market, supported by continuous cloud expansion. BFSI and healthcare industries accelerate adoption to meet compliance and data security requirements. Retail and e-commerce expand usage to handle increasing digital transactions and customer data. Energy, utilities, aerospace, and defense also strengthen adoption due to critical infrastructure demands. Diverse end-user applications demonstrate DCIM’s broad relevance across industries.

Regional Insights

Regional Insights

Eastern China Leading with Strong Hyperscale and Cloud Deployments

Eastern China dominates the China Data Center Infrastructure Management (DCIM) Market with 46% share. Cities like Shanghai and Beijing anchor hyperscale growth supported by strong cloud service providers. Enterprises deploy advanced DCIM platforms to manage large-scale infrastructure efficiently. Strong regulatory focus in these regions further strengthens adoption. Investors prioritize Eastern hubs due to their technological leadership and high demand concentration. This region sets the pace for nationwide digital transformation initiatives.

- For instance, at HUAWEI CONNECT 2025 held in Shanghai in September 2025, Huawei unveiled new AI data center infrastructure innovations and released an “AIDC Facility Reference Design White Paper,” with business leaders and technical experts convening to advance green and low-carbon data center solutions.

Northern China Expanding Through Industrial and Government Digitalization

Northern China accounts for 31% share of the China Data Center Infrastructure Management (DCIM) Market. Strong government investment in smart city projects drives regional growth. Industries adopt DCIM tools for compliance, performance, and environmental monitoring. The presence of state-owned enterprises strengthens the pace of adoption. Vendors target these regions for long-term contracts and infrastructure upgrades. It highlights the importance of public-private collaboration in scaling DCIM penetration.

Western and Central China Emerging as High-Growth Regions

Western and Central China represent 23% share of the China Data Center Infrastructure Management (DCIM) Market. Data localization laws and lower operational costs make these regions attractive for new facilities. Enterprises expand infrastructure outside Tier 1 hubs to ensure balanced national coverage. Vendors highlight opportunities in localized services and modular deployments. It positions these areas as high-potential zones for future DCIM expansion. Market activity reflects China’s broader effort to distribute digital growth evenly.

- For instance, Sugon (Dawning Information Industry Co., Ltd.), a CAS-linked supercomputer and data center equipment manufacturer, announced in May 2025 a merger with Hygon Information Technology to expand capacity and technological capabilities in Western and Central China, supporting large-scale infrastructure with secure, local platforms.

Competitive Insights:

- Kingsoft Cloud

- Inspur

- Fibertel

- FNT GmbH

- Device42

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd

- IBM

- Schneider Electric SE

- Siemens AG

- Hewlett Packard Enterprise (HPE)

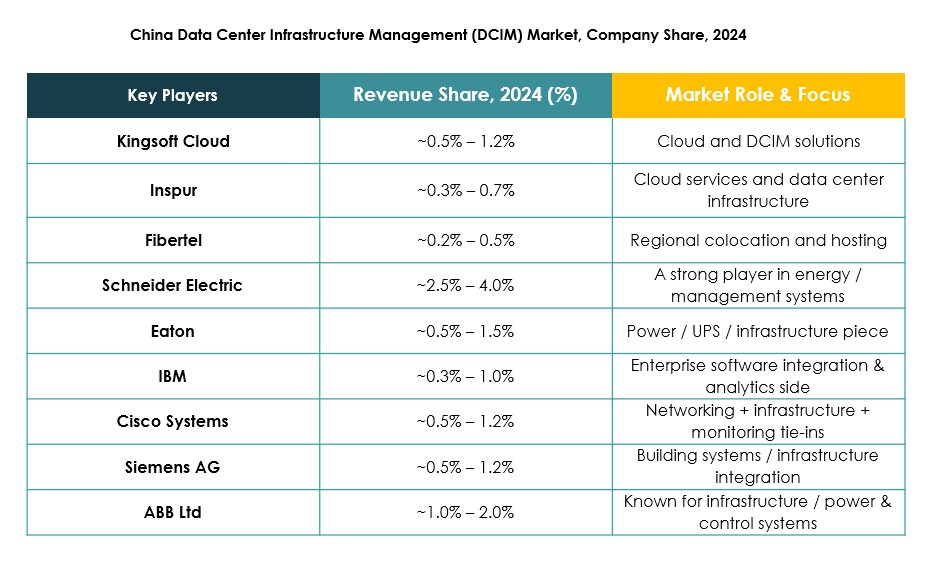

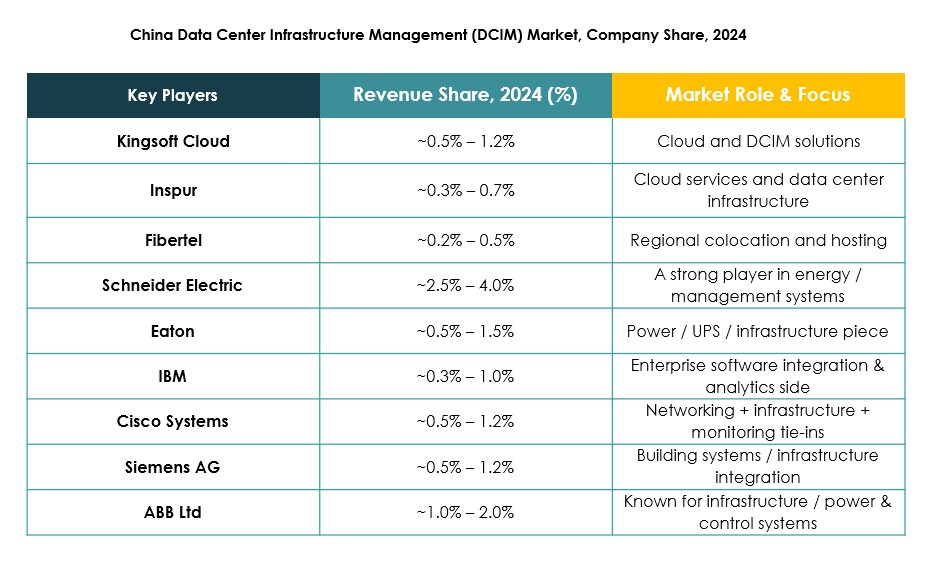

- Delta Electronics

The China Data Center Infrastructure Management (DCIM) Market features a strong mix of global technology leaders and domestic innovators. Companies such as Huawei, Inspur, and Kingsoft Cloud lead with localized expertise and large-scale deployments, while multinational firms like Schneider Electric, IBM, and Cisco strengthen the market with global portfolios and advanced software ecosystems. It remains highly competitive due to continuous innovation in AI-driven monitoring, sustainability dashboards, and hybrid cloud support. Domestic firms often focus on compliance with Chinese regulatory frameworks, which enhances their market positioning. Global players expand through partnerships with local enterprises to secure long-term presence. This combination of domestic dominance and international collaboration shapes a dynamic and fast-evolving competitive landscape.

Recent Developments:

- In September 2025, Bain Capital agreed to sell its China data centre operator WinTriX DC Group to a local consortium led by Guangdong Hec Technology for $3.93 billion, marking a significant acquisition in the China Data Center Infrastructure Management (DCIM) market and highlighting ongoing consolidation within the sector.

- In September 2025, Kingsoft Cloud announced a proposed offering of 282 million new ordinary shares through an offshore placement, with 80% of the proceeds aimed at strengthening its AI infrastructure and cloud service capabilities to support the company’s growth in China’s competitive cloud services market. The allocation intends to address the swift expansion of artificial intelligence as a central growth driver in the data center infrastructure management market.

- In June 2025, Eaton Corporation and Siemens Energy entered a partnership to accelerate integrated data center infrastructure. The collaboration enables the simultaneous construction of data centers and on-site power generation solutions, supporting grid-independent energy supply with modular plant concepts to improve agility, reliability, and regulatory compliance in China’s rapidly growing market

Regional Insights

Regional Insights