Executive summary:

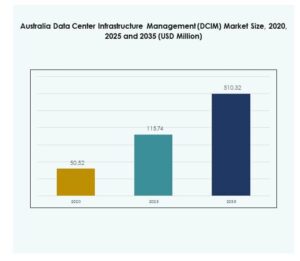

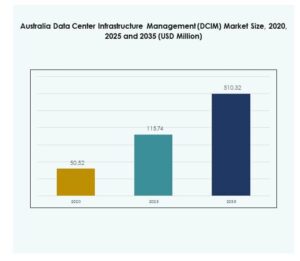

The Australia Data Center Infrastructure Management (DCIM) Market size was valued at USD 50.52 million in 2020, increased to USD 115.74 million in 2025, and is anticipated to reach USD 510.32 million by 2035, at a CAGR of 17.77% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Australia Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 115.74 Million |

| Australia Data Center Infrastructure Management (DCIM) Market, CAGR |

17.77% |

| Australia Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 510.32 Million |

The market is expanding due to rising cloud adoption, edge computing, and integration of AI-powered monitoring systems. Businesses are adopting DCIM tools to improve operational efficiency, sustainability, and data-driven decision-making. The shift toward automation and modular infrastructure supports smarter energy use and reduced downtime. It has become strategically important for investors and enterprises focusing on digital transformation, infrastructure scalability, and long-term operational reliability.

New South Wales and Victoria dominate the market due to high data center density and advanced digital infrastructure. Sydney and Melbourne serve as key hubs for hyperscale and colocation investments. Queensland and Western Australia are emerging regions benefiting from growing cloud deployments, renewable integration, and smart city initiatives. These developments strengthen nationwide connectivity and enhance Australia’s position in the Asia-Pacific digital ecosystem.

Market Drivers

Rapid Digital Transformation Driving Data Center Efficiency and Automation

The Australia Data Center Infrastructure Management (DCIM) Market is growing due to widespread digital transformation and cloud adoption. Organizations are investing in advanced monitoring tools to manage distributed data centers and reduce operational costs. Automated systems enhance energy efficiency and reduce downtime. Businesses use real-time analytics to manage IT assets and improve service reliability. The demand for smart monitoring aligns with sustainability goals. Integration of AI and IoT improves predictive maintenance. Enterprises are modernizing legacy infrastructure to support new workloads. It is becoming a critical enabler of digital business resilience and scalability.

Integration of AI and IoT Technologies Enhancing Predictive and Adaptive Management

AI and IoT adoption in DCIM platforms is transforming how facilities operate. Smart sensors and analytics tools provide insights into temperature, energy, and capacity usage. Predictive models allow operators to prevent system failures before they occur. AI-driven automation reduces manual intervention and enhances operational precision. Cloud-based dashboards improve decision-making by consolidating performance data. Energy optimization through machine learning improves sustainability. Companies use these innovations to align with global energy standards. It strengthens long-term competitiveness in the digital infrastructure landscape.

- For instance, in June 2024, Equinix Australia announced a AUD 240 million investment to expand AI-ready infrastructure at its Sydney and Melbourne data centers, enhancing high-performance hybrid environments and enabling Australian enterprises to deploy private AI models with improved data control, privacy, and security.

Growing Sustainability Initiatives and Green Data Center Developments

Australia’s focus on renewable energy and carbon neutrality drives sustainable data center operations. Organizations are adopting DCIM to monitor energy usage and reduce environmental impact. Real-time power monitoring supports compliance with ESG standards. DCIM tools help optimize cooling and improve PUE metrics. Green energy integration enhances system reliability and cost efficiency. Renewable-powered facilities attract both public and private investment. Sustainability strategies improve corporate reputation and market confidence. It positions DCIM solutions as vital for low-carbon digital infrastructure management.

- For instance, Numen’s real-time electrical monitoring platform helped an Australian data center achieve a 56% improvement in Power Usage Effectiveness (PUE), saving AU$150,000 in annual energy costs and reducing carbon emissions by 980 tonnes, as documented in Numen’s published case study on sustainable data center performance.

Rising Edge Infrastructure and Cloud Expansion Across the Country

The expansion of edge and cloud data centers is accelerating market adoption. Businesses require low-latency environments for critical applications. DCIM provides centralized visibility across hybrid architectures. Remote management tools ensure consistent performance across distributed networks. Growth in smart city and 5G projects fuels infrastructure investment. Companies use DCIM to maintain uptime in fast-scaling facilities. Multi-site coordination strengthens disaster recovery planning. It ensures operational agility for businesses targeting nationwide digital service delivery.

Market Trends

Shift Toward AI-Driven and Automated Infrastructure Optimization

AI-driven DCIM systems are revolutionizing data center management in Australia. Intelligent algorithms optimize cooling, power, and space utilization. Automation enables proactive fault detection and resource allocation. Self-learning systems analyze usage patterns to reduce energy consumption. Operators benefit from reduced downtime and enhanced equipment lifespan. AI integration lowers human dependency and boosts scalability. Predictive insights allow better asset planning and forecasting. It signals a long-term transition toward self-regulating digital infrastructure ecosystems.

Increased Cloud-Based DCIM Adoption Enabling Scalability and Flexibility

Cloud-based DCIM platforms are gaining traction for their cost efficiency and accessibility. Enterprises prefer cloud deployment for real-time updates and seamless scalability. These platforms support multi-location monitoring through centralized interfaces. Cloud-based tools integrate easily with hybrid IT environments. Businesses use them to manage fast-growing workloads and remote assets. Flexibility in deployment supports data-driven decision-making. Service providers leverage cloud DCIM for faster implementation cycles. It reflects a growing trend toward adaptive and unified infrastructure oversight.

Focus on Modular and Scalable DCIM Solutions Across Data Centers

The demand for modular DCIM architecture is increasing to support evolving data loads. Scalable systems enable quick expansion without disrupting operations. Modular solutions enhance compatibility with diverse hardware ecosystems. Businesses adopt these to future-proof infrastructure investments. Scalable models facilitate seamless integration with AI and IoT technologies. This trend improves performance management and capital efficiency. Enterprises choose modular DCIM to align with hybrid deployment models. It highlights the importance of adaptability in modern data center operations.

Growing Emphasis on Cybersecurity and Data Governance in Infrastructure Management

Cybersecurity is becoming central to DCIM adoption strategies. Companies integrate advanced encryption and access control into management systems. Secure platforms protect sensitive infrastructure data from breaches. Compliance with national cybersecurity standards strengthens investor trust. Businesses rely on encrypted telemetry for safe operations. Continuous audits ensure policy alignment and threat mitigation. Data governance frameworks guide secure handling of performance data. It enhances confidence in digital transformation across critical infrastructure sectors.

Market Challenges

High Implementation Costs and Integration Complexity in Hybrid Environments

The Australia Data Center Infrastructure Management (DCIM) Market faces challenges from high deployment costs and integration barriers. Implementation requires alignment across legacy and modern systems, which increases complexity. Smaller enterprises struggle to justify capital expenditure on DCIM tools. Vendor interoperability remains limited, creating compatibility gaps between hardware and software. Training requirements add additional operational burden. Customizing platforms for varied infrastructure types raises expenses. Businesses face delays in return on investment due to fragmented deployments. It slows adoption in cost-sensitive segments despite long-term efficiency gains.

Shortage of Skilled Workforce and Limited Standardization Across Data Centers

A lack of skilled DCIM professionals hampers the sector’s growth. Operators often lack the expertise to manage advanced monitoring tools. Absence of uniform operational standards leads to inconsistent performance outcomes. Fragmented regulatory frameworks add complexity for multinational operators. Workforce training programs are limited in scale and scope. Businesses depend on external service providers to fill technical gaps. Skill shortages increase maintenance costs and operational risks. It constrains scalability for organizations aiming for rapid digital expansion.

Market Opportunities

Expansion of Edge Data Centers and Rising Investment in Digital Infrastructure

Rapid edge data center growth creates new opportunities for DCIM providers. Enterprises require tools that ensure operational consistency across distributed networks. Investments in 5G, IoT, and AI infrastructure drive demand for advanced monitoring systems. Government-backed digital initiatives attract global technology investors. Scalability in hybrid environments positions DCIM as a preferred solution. Local providers benefit from regional diversification strategies. It enhances Australia’s standing as a key digital hub in the Asia-Pacific region.

Innovation in Sustainable and AI-Powered DCIM Solutions for Green Data Centers

Rising demand for energy-efficient operations fosters AI-powered and eco-friendly DCIM innovation. Companies develop systems that optimize resource use and reduce emissions. Green data centers integrate renewable energy with smart automation. AI enables real-time adjustments for optimal energy performance. Vendors focus on transparent sustainability reporting and compliance tools. Sustainable practices attract investors seeking ESG-aligned portfolios. It strengthens the nation’s leadership in low-carbon digital infrastructure innovation.

Market Segmentation

By Component

Solutions dominate the Australia Data Center Infrastructure Management (DCIM) Market with the largest share. These include monitoring, analytics, and visualization platforms that support operational optimization. Services segment is growing due to increased demand for integration and maintenance. Businesses prioritize scalable solutions for hybrid data environments. Cloud compatibility enhances adoption across industries. Advanced tools provide comprehensive visibility into power and asset management. Continuous upgrades improve interoperability. It reinforces long-term efficiency and sustainability goals for end users.

By Data Center Type

Enterprise data centers hold the largest market share due to their extensive infrastructure needs. These facilities prioritize automation and centralized monitoring to improve performance. Managed and colocation edge data centers are witnessing rapid growth. The shift toward hybrid environments drives demand for flexible DCIM solutions. Cloud and edge centers support AI and IoT applications requiring low latency. Vendors focus on modular and scalable solutions. It ensures operational reliability across expanding infrastructure networks.

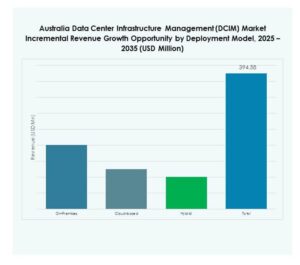

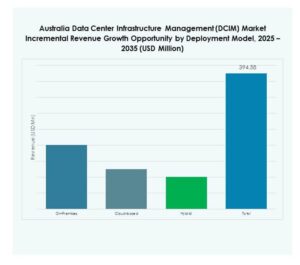

By Deployment Model

Cloud-based deployment leads the market due to easy scalability and lower upfront costs. Businesses prefer flexible solutions that allow remote monitoring and quick integration. On-premises models remain vital for sectors prioritizing data security. Hybrid models gain traction for balancing control and scalability. Enterprises implement DCIM to enhance visibility across diverse environments. Service providers deliver continuous updates through cloud interfaces. It supports efficient asset utilization and operational resilience for dynamic workloads.

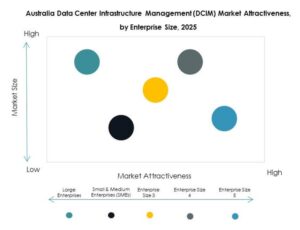

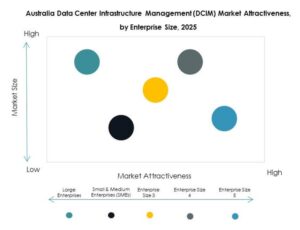

By Enterprise Size

Large enterprises dominate the segment due to their complex infrastructure ecosystems. These organizations require advanced analytics and real-time performance tracking. SMEs are rapidly adopting lightweight DCIM platforms to reduce costs. Cloud integration allows small businesses to compete effectively. Enterprises invest in training and skilled workforce for optimized use. Enhanced asset visibility supports better capacity planning. It strengthens competitiveness and operational sustainability across varied business sizes.

By Application / Use Case

Power monitoring holds a dominant position, driven by the need for energy optimization. Asset and capacity management applications follow closely with wide deployment across sectors. Environmental monitoring ensures compliance with energy standards. BI and analytics tools aid predictive maintenance and efficiency tracking. Businesses deploy DCIM for real-time decision support. Integration across applications enhances productivity and uptime. It promotes data-driven operational governance and sustainability alignment.

By End User Industry

The IT and telecommunications sector leads the Australia DCIM Market due to strong infrastructure investment. BFSI and healthcare follow, requiring secure and compliant operations. Retail and e-commerce adopt DCIM to improve logistics efficiency. Aerospace, defense, and energy sectors use it for operational reliability. Utilities implement monitoring for grid-connected data operations. Vendors tailor industry-specific solutions for compliance and automation. It expands DCIM penetration across critical sectors of national importance.

Regional Insights

New South Wales Leading the Market with High Concentration of Hyperscale Facilities (41%)

New South Wales leads the Australia Data Center Infrastructure Management (DCIM) Market with a 41% share. Sydney hosts several hyperscale and colocation centers powered by renewable energy. Strategic proximity to submarine cables enhances connectivity. Global cloud providers prefer the region for its network resilience. Government incentives support data modernization initiatives. Businesses in the region use DCIM to optimize energy and operations. It remains the country’s largest digital and economic hub.

- For instance, in August 2025, NEXTDC announced plans to develop 850 MW of new data center capacity in Sydney as part of a AU$15 billion investment strategy over the next decade, positioning Sydney as a global hyperscale and cloud hub with multiple sites strategically connected to major submarine cable networks for enhanced international connectivity.

Victoria Emerging as a Secondary Growth Hub with Expanding Cloud Infrastructure (28%)

Victoria holds a 28% market share supported by Melbourne’s expanding cloud ecosystem. The region focuses on sustainability-driven construction and renewable energy integration. Data center operators invest in AI-enabled DCIM systems to enhance uptime. High enterprise density drives managed service adoption. Government-backed digital initiatives foster investment confidence. The growing tech ecosystem strengthens its regional importance. It positions Victoria as a key hub for future digital infrastructure growth.

- For instance, in September 2022, Equinix completed a AU$23 million expansion of its ME2 data center in Melbourne, increasing total colocation space to 4,070 square meters and cabinet capacity to 1,500, with direct connectivity to major cloud providers such as Microsoft, Oracle, and Google, and plans to expand the facility further to 3,000 cabinets.

Queensland and Western Australia Gaining Momentum through Edge and Regional Deployments (19%)

Queensland and Western Australia jointly account for 19% of the market share. Both regions experience rising demand for edge data centers supporting remote industries. Mining and energy sectors invest in DCIM to ensure secure and efficient operations. Cloud service providers expand into these areas for reduced latency. Infrastructure projects align with smart city development goals. Local partnerships enable faster implementation cycles. It enhances regional resilience and infrastructure decentralization across Australia.

Competitive Insights:

- NEXTDC Ltd.

- Macquarie Telecom Group

- Vocus Group Ltd.

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- Schneider Electric SE

- Siemens AG

The Australia Data Center Infrastructure Management (DCIM) Market features strong competition among global and domestic players offering scalable, energy-efficient, and AI-enabled management platforms. It is driven by vendors expanding cloud-based and hybrid DCIM portfolios to meet the growing demand for automation and sustainability. Companies such as Schneider Electric, Siemens, and ABB focus on integrated power and cooling optimization systems. Local providers like NEXTDC and Macquarie Telecom emphasize high-density, renewable-powered facilities with advanced monitoring tools. Cisco and Eaton deliver network-centric and intelligent power solutions that enhance infrastructure visibility. Huawei invests in AI-driven analytics and modular data center innovation. It reflects a market advancing toward intelligent, automated, and sustainability-oriented infrastructure ecosystems.

Recent Developments:

- In September 2025, UCS Group entered a partnership with Schneider Electric to deploy intelligent microgrid systems across Australia, integrating solar, battery storage, and AI-based optimization to support grid-independent energy management.

- In June 2025, Schneider Electric launched new high-density data centre solutions, including a prefabricated modular EcoStruxure Pod and upgraded EcoStruxure rack systems built for AI and HPC architectures, boosting infrastructure flexibility and cooling performance.