Executive summary:

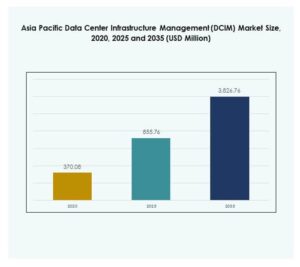

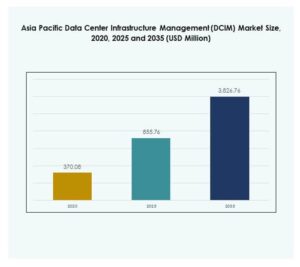

The Asia Pacific Data Center Infrastructure Management (DCIM) Market size was valued at USD 370.08 million in 2020 to USD 855.76 million in 2025 and is anticipated to reach USD 3,826.76 million by 2035, at a CAGR of 17.94% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Asia Pacific Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 855.76 Million |

| Asia Pacific Data Center Infrastructure Management (DCIM) Market, CAGR |

17.94% |

| Asia Pacific Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 3,826.76 Million |

Growth in the Asia Pacific Data Center Infrastructure Management (DCIM) Market is fueled by rapid digital transformation, cloud expansion, and demand for efficient energy management. Enterprises are adopting AI-driven and IoT-enabled tools to optimize operations and improve sustainability. Innovation in predictive analytics and hybrid infrastructure management enhances resilience, making DCIM platforms essential for minimizing downtime. Businesses and investors view it as strategically vital to support scalability, competitiveness, and operational excellence across industries.

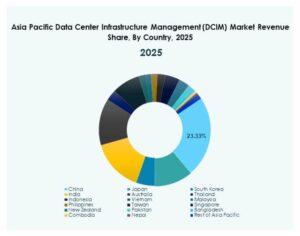

The Asia Pacific Data Center Infrastructure Management (DCIM) Market shows strong regional diversity, with China, Japan, and South Korea leading due to advanced IT ecosystems and hyperscale data center projects. India is rapidly emerging with government-backed digital initiatives and cloud adoption. Southeast Asian countries such as Singapore, Indonesia, and Vietnam are gaining importance as regional hubs, driven by connectivity growth, rising internet penetration, and favorable investment climates.

Market Drivers

Rising Need for Advanced Data Center Operations Through Smart Technology Integration

The Asia Pacific Data Center Infrastructure Management (DCIM) Market is driven by the rising demand for advanced tools that ensure efficiency and reliability in large-scale facilities. Businesses are increasingly focusing on monitoring assets, power, and capacity with real-time visibility. The adoption of AI and IoT enables predictive analysis, improving energy use and reducing downtime risks. Companies view DCIM platforms as critical for sustainability goals, ensuring compliance with regulatory frameworks. Investors recognize its potential to cut operational costs while enhancing infrastructure lifespan. This driver emphasizes technology’s role in reshaping operational strategies for enterprises.

- For example, Digital Realty launched a cooling tower initiative at its SIN10 data center in Singapore in 2024 to improve water efficiency by 15%. The project aligns with IMDA’s new standards permitting operating temperatures up to 26 °C, which can deliver 2–5% cooling energy savings per degree increase.

Expanding Cloud Adoption and the Growing Strategic Value of Digital Transformation

The adoption of cloud and hybrid models is accelerating investments in DCIM solutions. Enterprises depend on scalable tools to manage dispersed infrastructure and ensure resource optimization. The Asia Pacific Data Center Infrastructure Management (DCIM) Market benefits from cloud-native architectures that support automated decision-making. The trend highlights the strategic importance of DCIM for maintaining competitive positioning in the digital economy. Investors see value in its ability to improve resilience against service disruptions. Cloud-driven growth strengthens demand for platforms offering agility and secure integration. This creates significant opportunities for both technology providers and enterprises.

Innovation in Energy Efficiency and Growing Focus on Sustainability Goals

Data center operators are under pressure to reduce energy consumption and meet sustainability targets. Advanced DCIM solutions with intelligent power monitoring and cooling systems enable lower carbon footprints. The Asia Pacific Data Center Infrastructure Management (DCIM) Market reflects strong alignment with green data center initiatives. Governments and enterprises prioritize technology investments that ensure compliance with sustainability regulations. Businesses see innovation in this space as essential for long-term competitiveness. Investors are attracted to energy-focused advancements, given rising electricity costs across the region. DCIM platforms enhance both cost savings and corporate responsibility commitments.

Shifts in Industry Models and Strategic Positioning for Scalability and Resilience

Enterprises are restructuring IT infrastructure models, prioritizing scalability and resilience in uncertain environments. The Asia Pacific Data Center Infrastructure Management (DCIM) Market supports this shift with tools that improve operational flexibility. Hybrid and edge data center expansion is accelerating demand for dynamic monitoring platforms. Businesses value DCIM in minimizing risks linked to downtime and security vulnerabilities. Investors identify strong opportunities due to the link between infrastructure performance and digital business continuity. It provides the foundation for supporting e-commerce, BFSI, and telecom operations. Industry shifts strengthen DCIM’s role as a cornerstone of IT strategy.

- For example, Cushman & Wakefield’s H1 2025 APAC Data Centre Update reported that the Asia Pacific region added nearly 2,300 MW to its development pipeline in the first half of 2025. The report also highlighted that new data centers are being designed to support AI workloads.

Market Trends

Adoption of AI-Powered Predictive Capabilities Across Infrastructure Monitoring Platforms

The Asia Pacific Data Center Infrastructure Management (DCIM) Market is witnessing strong uptake of AI-powered predictive tools. Operators use machine learning models to detect early risks in cooling or power systems. Predictive maintenance helps extend asset lifecycles while minimizing unexpected failures. Busin

esses adopt these tools to improve capacity planning accuracy. Investors see the shift as evidence of advanced automation supporting critical operations. AI adoption raises standards in data center performance and security. It signals a move toward more autonomous, self-managing infrastructure models. This trend strengthens DCIM’s importance in technology evolution.

Emergence of Edge Computing Integration for Distributed Infrastructure Optimization

Edge computing adoption is expanding across Asia Pacific, requiring advanced DCIM tools for monitoring. The Asia Pacific Data Center Infrastructure Management (DCIM) Market supports distributed assets, especially in IoT-heavy industries. Enterprises demand real-time insights to ensure operational reliability at remote sites. It drives adoption of cloud-integrated DCIM platforms with scalable functionality. Investors consider edge integration a high-value opportunity in telecom, retail, and industrial automation. Businesses deploy DCIM to streamline management across hybrid infrastructures. This trend reflects a shift from centralized models to distributed, agile ecosystems. The rise of edge computing strengthens market demand.

Increased Focus on Cybersecurity and Resilient Data Management in Complex Environments

Rising cyber threats force enterprises to secure infrastructure visibility and management platforms. The Asia Pacific Data Center Infrastructure Management (DCIM) Market integrates cybersecurity features within monitoring systems. Companies demand stronger tools to safeguard data flows and critical assets. It supports business continuity strategies in industries like BFSI and healthcare. Investors view enhanced security integration as a driver of customer trust and compliance readiness. Enterprises value DCIM platforms capable of mitigating risk in multi-tenant facilities. The emphasis on cybersecurity highlights the convergence of IT and operational technology priorities. This trend reshapes long-term adoption strategies.

Integration of Business Intelligence and Analytics for Smarter Decision-Making

DCIM platforms now incorporate advanced analytics for decision-making support. The Asia Pacific Data Center Infrastructure Management (DCIM) Market highlights BI integration as a major trend. Businesses rely on visual dashboards for insights into power, capacity, and asset performance. It provides actionable intelligence for both operations and strategy teams. Investors identify analytics-driven innovation as essential for improving ROI on IT infrastructure. Enterprises deploy BI-enabled platforms to reduce inefficiencies and support forecasting. The convergence of DCIM with data analytics strengthens its business relevance. This trend underscores the growing demand for intelligent digital ecosystems.

Market Challenges

Complex Integration Across Hybrid Infrastructure Models and Operational Silos

The Asia Pacific Data Center Infrastructure Management (DCIM) Market faces challenges in integrating solutions across hybrid ecosystems. Enterprises often operate legacy systems alongside modern cloud-native platforms, creating compatibility concerns. It complicates monitoring consistency, leading to inefficiencies in visibility and performance analysis. Businesses struggle with aligning DCIM tools across different vendors and geographies. Investors view integration costs as a barrier for SMEs entering the market. The lack of standardized protocols also slows adoption in critical industries. Addressing these silos is necessary for ensuring scalability in digital infrastructure strategies.

High Initial Investment Costs and Limited Skilled Workforce Availability

Cost-intensive deployments present a major obstacle to broader market penetration. The Asia Pacific Data Center Infrastructure Management (DCIM) Market demands significant capital for licensing, hardware, and training. It creates hesitation among mid-sized enterprises with budget constraints. The shortage of skilled IT professionals further limits effective system implementation. Businesses often face difficulties in maximizing the benefits of advanced features. Investors recognize financial risks associated with long deployment cycles. The challenge of aligning investment with measurable ROI slows adoption momentum. Workforce upskilling remains essential to overcome this limitation.

Market Opportunities

Expansion of Cloud-Integrated Platforms and Rising SME Adoption Potential

The Asia Pacific Data Center Infrastructure Management (DCIM) Market presents growth opportunities with cloud-based platforms targeting SMEs. It offers scalable solutions that lower entry barriers compared to traditional deployments. Businesses can access monitoring features without large upfront investments. Investors see potential in SaaS-based DCIM models expanding across emerging economies. The growing need for agile infrastructure among smaller enterprises drives long-term demand. Technology vendors can capture significant revenue by offering modular subscription packages. Cloud-integrated DCIM opens doors for rapid scalability and geographic expansion.

Sustainability-Driven Innovation and Increasing Green Data Center Investments

Investments in sustainable operations create strong growth potential for DCIM vendors. The Asia Pacific Data Center Infrastructure Management (DCIM) Market aligns with regional green energy initiatives. It supports operators in tracking carbon footprints and optimizing cooling efficiency. Enterprises adopt energy-focused DCIM platforms to ensure compliance with sustainability goals. Investors prioritize funding solutions that directly reduce power costs and environmental impact. Governments reinforce this opportunity with policies supporting renewable integration. The trend ensures DCIM providers gain competitive advantage through eco-centric innovation.

Market Segmentation

By Component

Solutions dominate the Asia Pacific Data Center Infrastructure Management (DCIM) Market with the largest share, driven by demand for asset and power monitoring platforms. Businesses rely on software tools to manage real-time operations effectively. Services complement solutions but remain secondary, mainly focused on training, consulting, and integration. Growth in services is supported by enterprises needing expert guidance to deploy complex systems. The expansion of hybrid models fuels rising solution adoption. Vendors emphasize scalable and customizable solutions for diverse enterprise needs.

By Data Center Type

Cloud and edge data centers lead the Asia Pacific Data Center Infrastructure Management (DCIM) Market due to their expanding role in supporting digital transformation. Enterprises demand agility in managing distributed infrastructure across geographies. Colocation facilities also show strong adoption, fueled by rising multi-tenant operations. Enterprise-owned centers maintain relevance but face scalability limitations. Managed centers grow steadily with outsourced IT operations. Vendors target hybrid models that integrate both cloud and colocation for maximum efficiency.

By Deployment Model

Cloud-based DCIM models dominate the Asia Pacific Data Center Infrastructure Management (DCIM) Market with growing adoption across industries. Enterprises prefer subscription-based models to reduce upfront investment costs. Hybrid deployments also gain traction, supporting flexibility across centralized and distributed infrastructure. On-premises platforms continue to serve critical sectors with strict security regulations. The trend highlights enterprise preference for scalable, cost-efficient systems. Investors view cloud-based models as vital for future growth.

By Enterprise Size

Large enterprises dominate the Asia Pacific Data Center Infrastructure Management (DCIM) Market due to their high infrastructure complexity. These organizations adopt DCIM platforms to ensure optimal efficiency and compliance. Small and medium enterprises show increasing adoption driven by cloud-based DCIM models. Vendors target SMEs with modular and affordable subscription solutions. Rising digital adoption in mid-sized businesses ensures a stronger future growth trajectory.

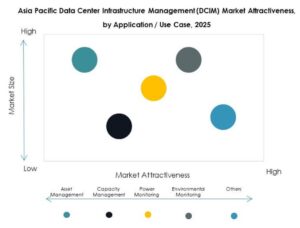

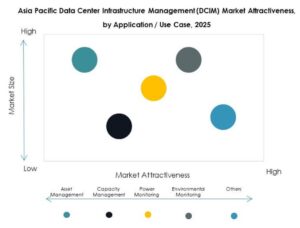

By Application / Use Case

Capacity management leads the Asia Pacific Data Center Infrastructure Management (DCIM) Market due to its role in ensuring efficiency under growing workloads. Enterprises deploy tools for real-time monitoring and accurate forecasting. Asset management and power monitoring also contribute strongly to adoption. Environmental monitoring gains importance with sustainability requirements. Business intelligence integration is emerging as a strategic use case for better decision-making.

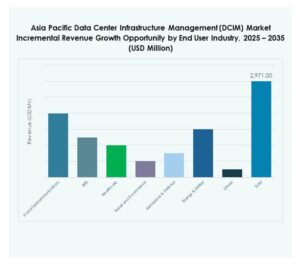

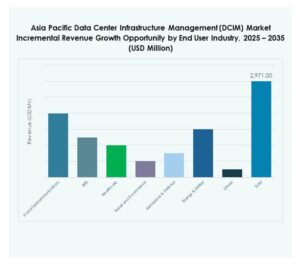

By End User Industry

IT and telecommunications dominate the Asia Pacific Data Center Infrastructure Management (DCIM) Market with the highest share. Telecom operators adopt platforms to support 5G rollout and data-driven services. BFSI ranks second with demand for compliance and resilience features. Healthcare and retail show rising adoption fueled by digitalization initiatives. Aerospace and defense sectors require advanced monitoring for secure and critical operations. Energy and utilities are expanding adoption to support smart grid initiatives.

Regional Insights

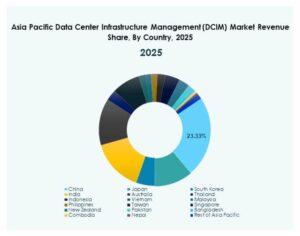

East Asia Leading Market Growth with China, Japan, and South Korea Holding Strong Position

East Asia holds the largest share of the Asia Pacific Data Center Infrastructure Management (DCIM) Market at 42%. China leads with extensive hyperscale data center investments, supported by strong government initiatives. Japan follows with mature IT infrastructure and enterprise demand for DCIM. South Korea expands adoption due to rapid 5G and cloud integration. It demonstrates advanced capacity for high-density workloads. Investors view East Asia as the most attractive region due to scalability and innovation.

South Asia and Southeast Asia Emerging with Strong Growth Opportunities

South Asia and Southeast Asia collectively account for 33% of the Asia Pacific Data Center Infrastructure Management (DCIM) Market. India dominates with rapid cloud adoption and government-backed digital programs. Singapore leads in Southeast Asia due to its role as a regional data hub. Indonesia, Vietnam, and Malaysia show strong growth in colocation and edge deployments. It reflects rising demand from SMEs and multinational corporations. This region is emerging as a key driver of future investments.

- For example, India had 153 data centers with a total installed capacity of 1,263 MW in 2025, supported by US$6.5 billion in investments. The industry is advancing sustainability through renewable energy integration and the adoption of liquid cooling technologies.

Oceania and Rest of Asia Pacific Showing Consistent Adoption with Growing Focus on Hybrid Models

Oceania and other Asia Pacific nations account for 25% of the Asia Pacific Data Center Infrastructure Management (DCIM) Market. Australia drives growth with strong demand for hybrid infrastructure solutions. New Zealand supports steady adoption with rising digital transformation initiatives. Other Pacific countries expand gradually with growing e-commerce and cloud services penetration. It highlights opportunities for vendors to address mid-scale enterprise requirements. Investors note Oceania’s focus on hybrid cloud as a critical differentiator.

- For instance, hybrid cloud setups enabled by Australian enterprises in 2025 have reduced data transfer times by up to 50% and increased operational uptime, with widespread use in financial institutions for secure transaction processing and compliance.

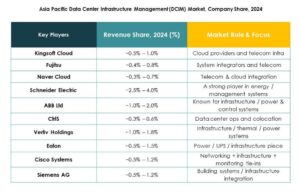

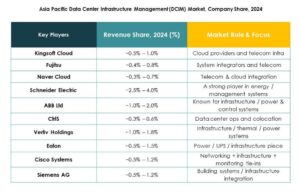

Competitive Insights:

- Kingsoft Cloud

- Fujitsu

- Naver Cloud

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- IBM

- Schneider Electric SE

- Siemens AG

- Hewlett Packard Enterprise (HPE)

- Vertiv Holdings

The Asia Pacific Data Center Infrastructure Management (DCIM) Market is defined by strong competition among global leaders and regional specialists. Companies such as Huawei, Schneider Electric, and Vertiv focus on advanced infrastructure solutions with energy efficiency and automation features. IBM, Cisco, and HPE drive adoption of hybrid and cloud-integrated platforms, while Fujitsu and Kingsoft Cloud strengthen regional presence with tailored offerings. ABB and Siemens expand their influence with power and monitoring expertise. It demonstrates rapid innovation cycles, mergers, and strategic alliances that enhance service portfolios and strengthen market reach. Vendors compete on sustainability, scalability, and digital transformation alignment, making the landscape highly dynamic and investment-driven.

Recent Developments:

- In September 2025, Kingsoft Cloud signed a cooperation framework agreement with Xiaomi, under which Xiaomi will provide data center (IDC) related services and network hardware equipment to Kingsoft Cloud for periods of three years and one year, respectively. This partnership is aimed at deepening product innovation and improving the operating efficiency of Kingsoft Cloud’s infrastructure for AI and cloud growth in the Asia Pacific market.

- In June 2025, Cisco Systems announced its entry as a technology partner in the AI Infrastructure Partnership (AIP), collaborating with BlackRock, Microsoft, NVIDIA, and others to accelerate innovation and scaling for AI-driven data centers in the Asia Pacific region. Cisco also introduced new AI-optimized products and partnerships, such as integrating the NVIDIA Spectrum-X Ethernet networking into its infrastructure offering, underscoring its commitment to secure and scalable data center technology for hyperscale growth.

- In July 2025, Data Center Asia (DCA) debuted at AsiaWorld-Expo in Hong Kong, marking the introduction of a major new entity in the APAC data center infrastructure sector. The event emphasized collaboration and innovation among leading DCIM solution providers and hosted various partnership announcements to boost the digital ecosystem of the region.