Executive summary:

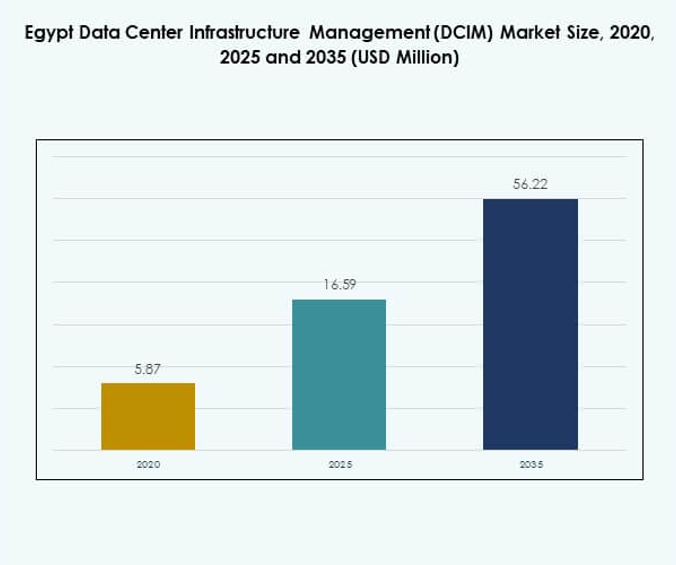

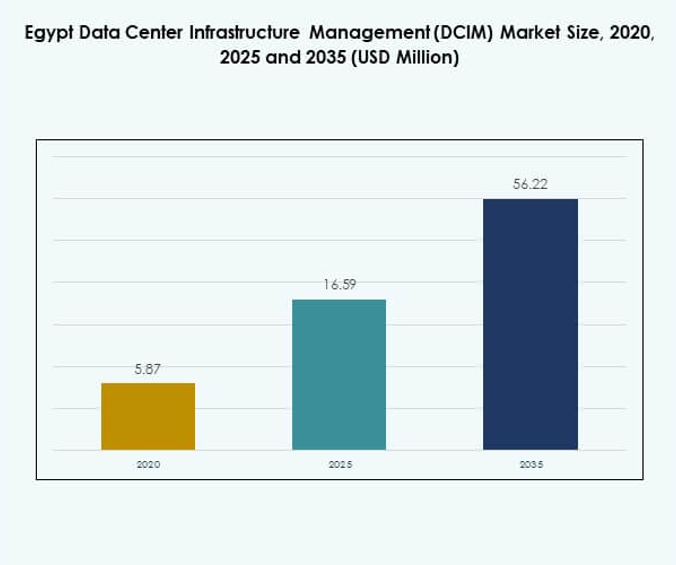

The Egypt Data Center Infrastructure Management (DCIM) Market size was valued at USD 5.87 million in 2020, increased to USD 16.59 million in 2025, and is anticipated to reach USD 56.22 million by 2035, at a CAGR of 14.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2025 |

| Forecast Period |

2025-2035 |

| Egypt Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 16.59 Million |

| Egypt Data Center Infrastructure Management (DCIM) Market, CAGR |

14.72% |

| Egypt Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 56.22 Million |

The market growth is driven by rising demand for smart and efficient data center operations, accelerated cloud adoption, and increasing AI integration in monitoring and management systems. Businesses are investing in DCIM solutions to optimize power, cooling, and capacity planning. The shift toward automation and sustainability enhances reliability, minimizes downtime, and supports Egypt’s digital transformation goals, making the market a key focus area for investors and technology providers.

Cairo dominates the market with its strong IT infrastructure, skilled workforce, and high concentration of enterprise and hyperscale facilities. Emerging regions such as Alexandria and Suez are attracting investments for edge and colocation centers, supported by strategic geographic positioning and renewable energy initiatives. These regional developments strengthen Egypt’s position as a growing data management and connectivity hub in North Africa.

Market Drivers

Rising Demand for Intelligent Infrastructure and Real-Time Monitoring

The Egypt Data Center Infrastructure Management (DCIM) Market is driven by a growing need for intelligent infrastructure to ensure efficient resource utilization. Enterprises across sectors are deploying AI-driven monitoring tools and IoT-based control systems to manage power, cooling, and asset performance in real time. It supports predictive maintenance and minimizes downtime across large-scale operations. The integration of advanced analytics enhances decision-making accuracy and operational transparency. Businesses increasingly view DCIM as a strategic asset for sustainability and performance optimization. The market benefits from rising government digital transformation programs promoting smart technology. Rapid IT modernization across public and private sectors strengthens the need for scalable and automated infrastructure solutions. These developments collectively boost the demand for advanced DCIM software and integrated platforms in Egypt.

- For instance, Schneider Electric Egypt provides the EcoStruxure IT Expert platform, the country’s first cloud-based DCIM solution, allowing continuous remote monitoring and device management across distributed data centers. EcoStruxure IT Expert is available in Egypt as a vendor-agnostic SaaS monitoring and incident management platform, proven through installation case studies and technical documentation from Schneider Electric Egypt.

Growing Adoption of AI and Automation in Data Center Operations

Automation and artificial intelligence adoption are transforming how data centers in Egypt operate. DCIM systems now integrate machine learning for anomaly detection, predictive analytics, and dynamic resource allocation. It improves operational efficiency while cutting energy costs and manual intervention. AI-enabled solutions enhance resilience, scalability, and sustainability, making them crucial in managing expanding digital ecosystems. Companies are investing in intelligent DCIM platforms to handle increasing data traffic and AI workloads. Vendors emphasize automation to address rising demands for remote management and real-time performance tracking. These innovations align with Egypt’s broader digital transformation goals. Continuous technological evolution positions DCIM as a backbone of Egypt’s next-generation data infrastructure.

Government Digitalization Initiatives and Cloud Infrastructure Growth

Egypt’s Vision 2030 and ICT strategy have accelerated national digitalization efforts, promoting investments in data center modernization. The government supports cloud infrastructure expansion and local hosting services to improve data sovereignty. It fosters partnerships with global technology firms to develop advanced and secure facilities. Public sector demand for digital services drives wider adoption of DCIM for compliance and energy management. Enterprises seek cloud-based DCIM models for cost efficiency and scalability. The country’s emphasis on e-governance and digital finance further strengthens the ecosystem. Investments from telecom and IT players enhance infrastructure reliability and resilience. The market is gaining strategic importance for enabling Egypt’s smart economy goals.

Increasing Focus on Energy Efficiency and Sustainable Infrastructure

Data center operators are prioritizing sustainable operations to meet global environmental standards. DCIM platforms play a critical role in monitoring energy consumption, optimizing cooling, and reducing carbon emissions. It ensures compliance with efficiency benchmarks while cutting operational costs. Egypt’s energy transition policies encourage the use of renewable energy in data center facilities. Vendors integrate DCIM tools with smart power distribution units and precision cooling systems. Businesses seek sustainability-linked certifications, reinforcing their commitment to green infrastructure. The focus on ESG performance has made DCIM adoption a strategic move for investors. This shift toward energy-conscious infrastructure enhances long-term growth prospects for the Egyptian data center ecosystem.

- For instance, in August 2024, Eaton Corporation opened a new office in Cairo to expand its regional operations and strengthen support for data center clients. The facility includes a Customer Experience Centre showcasing Eaton’s advanced power management and energy-efficient technologies tailored for Egypt’s growing infrastructure sector.

Market Trends

Integration of Edge Computing and Distributed DCIM Architectures

The Egypt Data Center Infrastructure Management (DCIM) Market is witnessing a shift toward distributed and edge-based architectures. Companies deploy modular DCIM systems to manage geographically dispersed micro data centers. It allows for unified control, low-latency operations, and improved reliability. The integration of edge computing supports real-time data processing near end users. Telecom and cloud service providers are expanding regional edge nodes across Egypt. Vendors design DCIM platforms that enable seamless integration with multi-location assets. The trend strengthens operational agility for enterprises managing hybrid workloads. This decentralization of data operations aligns with Egypt’s growing focus on 5G and IoT connectivity.

Adoption of Hybrid Cloud Models Enhancing Infrastructure Flexibility

Hybrid cloud adoption is reshaping Egypt’s data center landscape. Businesses seek to balance security and scalability through integrated DCIM solutions supporting both on-premises and cloud environments. It provides centralized visibility and control over hybrid assets. Demand is rising for DCIM platforms offering unified dashboards and automated configuration management. Vendors are enhancing interoperability between private and public clouds to meet enterprise needs. This hybrid approach increases flexibility and disaster recovery efficiency. It also enables organizations to comply with national data residency requirements. As digital workloads grow, hybrid DCIM adoption continues to gain strategic importance for large-scale enterprises.

Rise of AI-Enabled Predictive Analytics and Automation Frameworks

AI-enabled analytics tools are redefining data center efficiency in Egypt. DCIM platforms now feature automated fault detection, adaptive resource allocation, and intelligent capacity planning. It helps operators predict and prevent performance degradation. The rise of AI integration promotes smarter cooling and energy optimization. Vendors emphasize automation frameworks to ensure continuous uptime in high-demand facilities. Predictive algorithms enhance visibility across equipment and improve operational resilience. Egypt’s expanding data center ecosystem benefits from AI-driven insights for strategic decision-making. These innovations represent a key competitive advantage for data center operators.

Shift Toward Cloud-Native and API-Driven DCIM Platforms

Enterprises in Egypt are moving toward cloud-native DCIM platforms for enhanced scalability and integration. It enables seamless data sharing and compatibility with third-party software and IoT devices. API-driven architectures improve workflow automation and remote management. Vendors are developing customizable dashboards and modular interfaces for better user control. The approach accelerates data-driven decision-making and process efficiency. Organizations prefer subscription-based DCIM models for cost flexibility and quick deployment. This transition reflects Egypt’s push toward cloud innovation and service agility. The growing demand for interoperability continues to drive modernization across the DCIM landscape.

Market Challenges

High Capital Investment and Complex Integration Requirements

The Egypt Data Center Infrastructure Management (DCIM) Market faces significant cost barriers in deploying advanced platforms. Many organizations struggle to allocate budgets for large-scale installations and technology integration. It requires substantial investment in software, sensors, and automation infrastructure. Legacy systems complicate interoperability with modern DCIM tools, leading to longer deployment cycles. Smaller enterprises often delay adoption due to unclear return on investment. The need for specialized expertise adds further complexity. Limited local manufacturing capacity for DCIM components raises dependency on imports. These challenges slow market penetration among mid-sized enterprises aiming to modernize operations.

Cybersecurity Risks and Limited Technical Expertise in DCIM Implementation

Cybersecurity concerns present a major challenge for Egypt’s growing digital infrastructure. DCIM platforms manage sensitive operational data, making them prime targets for cyber threats. It demands robust security protocols and constant monitoring to prevent breaches. Many organizations lack in-house technical expertise to handle DCIM deployment and updates. The shortage of skilled professionals leads to inefficient use of the technology’s capabilities. Data privacy regulations further increase compliance burdens for operators. Interoperability between multi-vendor solutions introduces additional security vulnerabilities. Continuous training and cybersecurity readiness have become essential to sustain long-term reliability.

Market Opportunities

Expansion of Smart Cities and Renewable Energy-Linked Data Centers

The Egypt Data Center Infrastructure Management (DCIM) Market benefits from the national focus on smart cities and sustainability. Projects like the New Administrative Capital drive investments in advanced IT and green infrastructure. It opens opportunities for DCIM platforms to manage smart energy grids and efficient cooling systems. Renewable-powered data centers are gaining traction for compliance with sustainability targets. Vendors providing AI-driven environmental monitoring solutions will see growing demand. These developments align with Egypt’s green growth vision and attract global investors. The focus on sustainability creates high-value opportunities for next-generation DCIM providers.

Growing Demand for Colocation and Edge Facilities in Emerging Regions

Colocation and edge data centers are emerging as critical growth drivers. Businesses seek cost-effective solutions for scalability without building large standalone facilities. It encourages the deployment of modular DCIM solutions to manage distributed assets. Emerging cities such as Alexandria and Suez are developing digital infrastructure hubs. Telecom operators are investing in new edge locations to support 5G rollouts. Localized DCIM solutions enhance connectivity, energy use, and operational control. The growing need for decentralized computing continues to expand the market’s scope across Egypt.

Market Segmentation

By Component

In the Egypt Data Center Infrastructure Management (DCIM) Market, the solution segment holds a dominant share due to growing adoption of advanced software platforms offering predictive analytics, energy optimization, and capacity management. The service segment is expanding steadily with increasing demand for consulting, integration, and maintenance support. Businesses rely on end-to-end managed services to streamline data center operations and enhance reliability across hybrid infrastructures.

By Data Center Type

The enterprise data center segment leads the market, driven by high data storage requirements and security needs among large corporations. Managed and cloud data centers are witnessing rapid growth with rising demand for scalable hosting services. It supports hybrid workloads across critical sectors such as telecom, BFSI, and government operations. The edge data center segment is also gaining momentum due to low-latency needs for IoT and AI applications.

By Deployment Model

Cloud-based DCIM dominates the Egypt Data Center Infrastructure Management (DCIM) Market, driven by growing preference for flexible and remotely managed systems. Enterprises adopt hybrid models to balance scalability and data security. On-premises deployment continues to serve critical infrastructure where compliance and data sovereignty remain key. Increasing investment in cloud migration supports market growth among SMEs and public organizations.

By Enterprise Size

Large enterprises account for the largest market share due to strong investment capacity and advanced IT integration. SMEs are emerging as a fast-growing segment supported by affordable cloud-based DCIM solutions. It enables small firms to access enterprise-grade monitoring and automation without high capital costs. The trend is improving infrastructure efficiency and energy optimization across diverse business sizes.

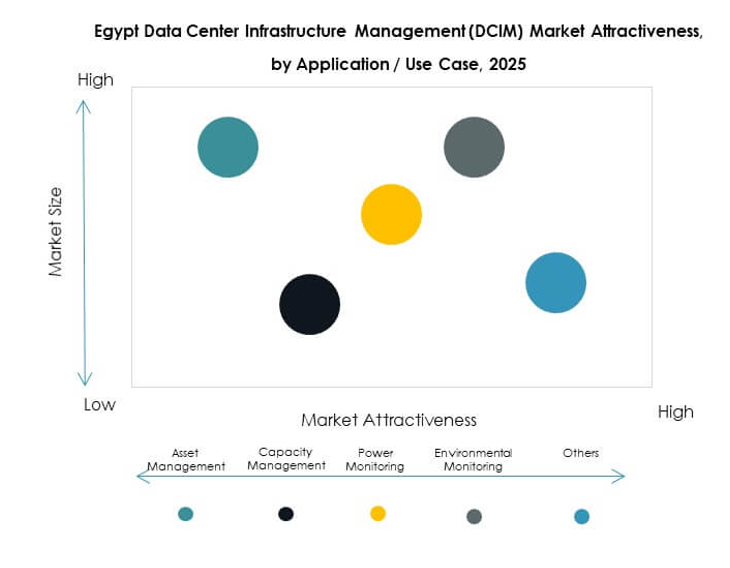

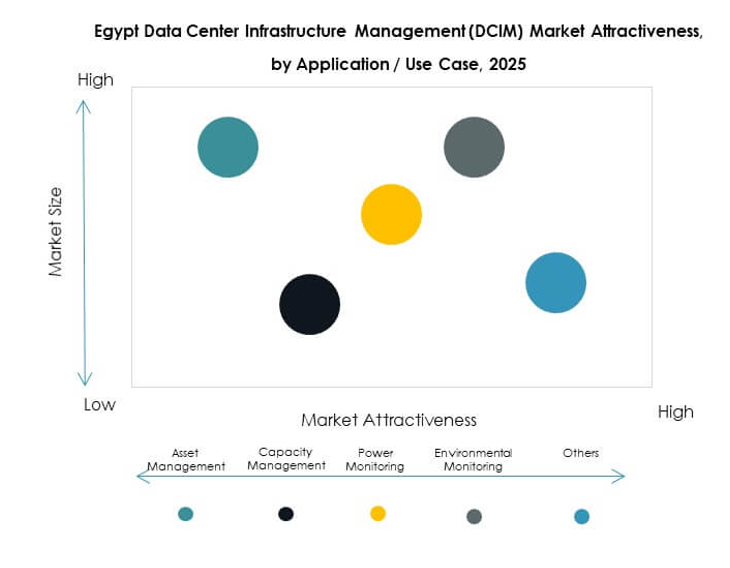

By Application / Use Case

Power monitoring and asset management are the most widely used applications within the Egypt Data Center Infrastructure Management (DCIM) Market. These segments ensure efficient energy use and reduce downtime through predictive insights. Capacity management and environmental monitoring follow closely, addressing sustainability and performance targets. Business intelligence and analytics applications are expanding as firms seek data-driven operational improvements.

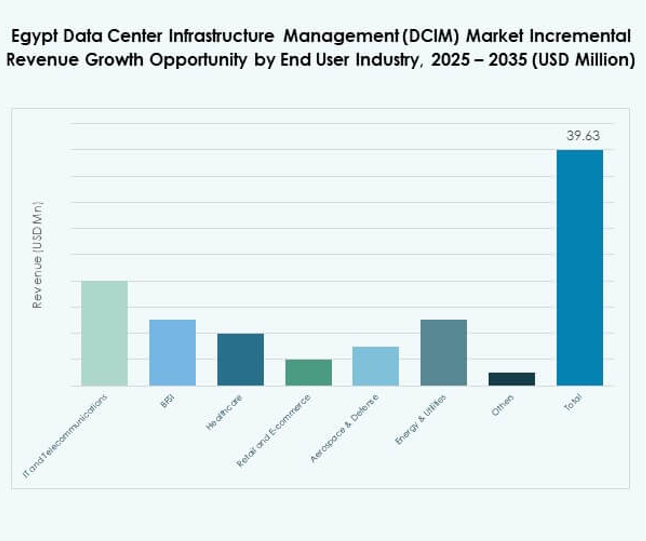

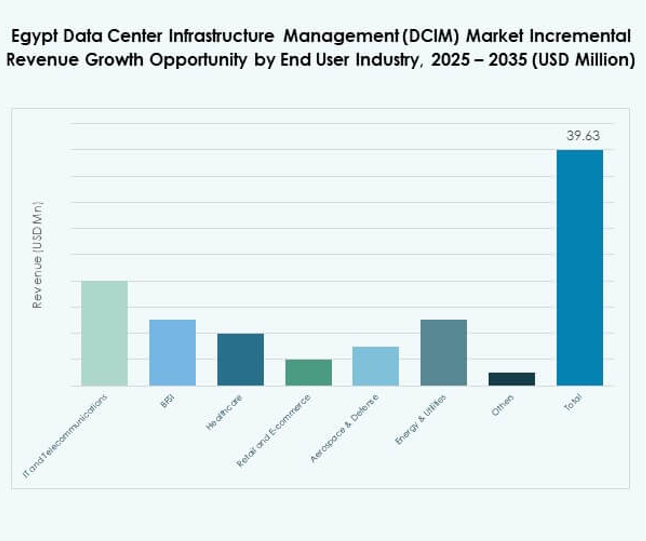

By End User Industry

The IT and telecommunications sector leads due to rapid digital transformation and rising network traffic. BFSI, healthcare, and retail industries adopt DCIM solutions for uptime reliability and regulatory compliance. It ensures operational transparency and optimized energy performance. The energy and utilities sector also presents strong growth opportunities as Egypt moves toward smart grids and renewable integration.

Regional Insights

Cairo – Dominant Data Center Hub with 54% Market Share

Cairo remains the central hub of the Egypt Data Center Infrastructure Management (DCIM) Market, accounting for 54% of total share. It hosts the majority of hyperscale and enterprise data centers due to superior connectivity and government-backed digital projects. It benefits from high investment inflows and infrastructure modernization programs. Telecom operators and global service providers establish major DCIM deployments in this region. The presence of financial and government institutions sustains long-term infrastructure demand. Cairo’s continued growth reinforces its position as Egypt’s primary digital core.

- For instance, in June 2024, Telecom Egypt partnered with SubCom and IEX partners to complete landings of the India-Europe-Xpress (IEX) subsea cable system at Zafarana2 (Red Sea) and Sidi Kerir (Mediterranean), connecting Cairo’s region to an international network stretching from Mumbai to Milan, thus enabling high-capacity data traffic for the nation’s digital hubs.

Alexandria and Suez Region – Emerging Secondary Data Center Clusters with 31% Market Share

The Alexandria and Suez region is gaining importance as an alternative data center cluster with 31% market share. Strategic coastal positioning supports strong connectivity through submarine cables and renewable energy potential. It attracts both local and foreign investments focused on green data center development. The government’s industrial zone programs near Suez further promote IT infrastructure expansion. It creates a favorable environment for colocation and edge data center setups. This region’s growing ecosystem complements Cairo’s infrastructure and drives balanced national digital development.

Other Regions – Developing Markets with 15% Market Share

Other Egyptian cities including New Administrative Capital and Upper Egypt contribute 15% market share to the DCIM sector. It benefits from ongoing smart city projects and public-private partnerships. Local authorities focus on digital inclusion and improved data access for regional businesses. It helps extend DCIM adoption beyond major metropolitan areas. Continued investment in renewable power and 5G connectivity supports regional capacity expansion. These developing regions represent strong long-term potential for Egypt’s national data infrastructure growth.

- For instance, in January 2020, Etisalat Misr and Honeywell announced a partnership to implement a state-of-the-art City Operations Center using Internet of Things (IoT) platforms in Egypt’s New Administrative Capital, underpinning smart city operations and integrated DCIM services for the new urban district.

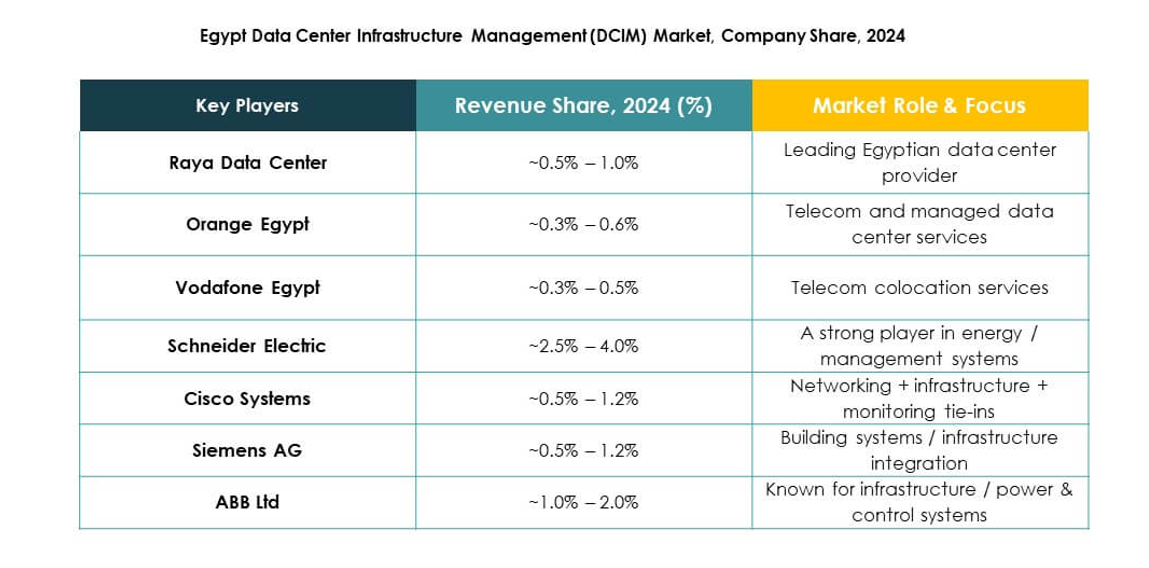

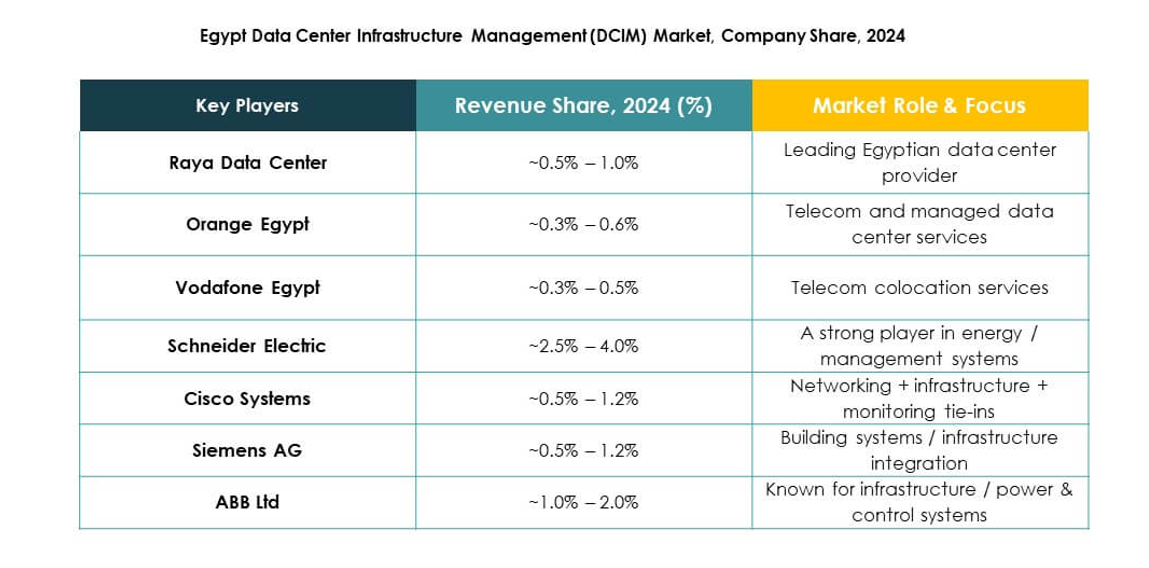

Competitive Insights:

- Raya Data Center

- Orange Egypt

- Vodafone Egypt

- Cisco Systems, Inc.

- Equinix

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- Schneider Electric SE

- Siemens AG

The Egypt Data Center Infrastructure Management (DCIM) Market features a mix of global technology leaders and domestic service providers competing for modernization projects. It focuses on delivering integrated DCIM solutions combining automation, power optimization, and predictive analytics. Schneider Electric and Huawei dominate with comprehensive digital platforms supporting AI-driven data centers. Siemens and Eaton emphasize energy-efficient systems and modular designs. Cisco and Equinix expand through partnerships and scalable hybrid infrastructure offerings. Local firms like Raya Data Center, Orange Egypt, and Vodafone Egypt strengthen market presence through cloud hosting, colocation, and managed IT services. Continuous investment in innovation and green infrastructure defines the competition, promoting long-term growth and operational efficiency across Egypt’s evolving data ecosystem.