Executive summary:

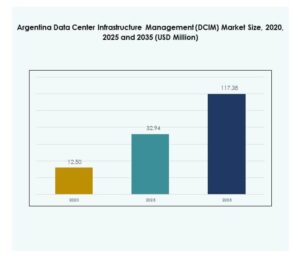

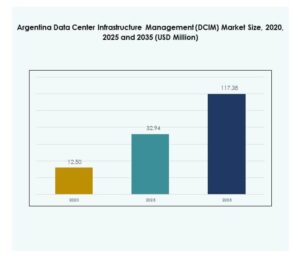

The Argentina Data Center Infrastructure Management (DCIM) Market size was valued at USD 12.50 million in 2020, reaching USD 32.94 million in 2025, and is anticipated to reach USD 117.38 million by 2035, at a CAGR of 15.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Argentina Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 32.94 Million |

| Argentina Data Center Infrastructure Management (DCIM) Market, CAGR |

15.33% |

| Argentina Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 117.38 Million |

The market growth is driven by expanding digital transformation initiatives, AI integration, and cloud adoption across industries. Businesses are prioritizing automation and energy-efficient systems to enhance operational visibility and reduce downtime. The Argentina Data Center Infrastructure Management (DCIM) Market plays a strategic role in optimizing resource utilization, improving sustainability, and strengthening data-driven decision-making for enterprises and investors seeking long-term infrastructure resilience.

Regionally, Buenos Aires leads the market due to its strong digital infrastructure and concentration of enterprise facilities. Córdoba is emerging as a secondary hub, supported by improved connectivity and government-backed innovation projects. Rosario and other developing regions are gaining traction with expanding data center investments and renewable energy integration, reinforcing Argentina’s position in Latin America’s evolving data infrastructure network.

Market Drivers

Rising Adoption of Cloud Computing and Digital Transformation Initiatives

Cloud adoption and digital transformation across Argentina’s enterprises are propelling strong demand for data center infrastructure management platforms. Businesses are implementing hybrid environments to handle growing workloads with efficiency and transparency. The Argentina Data Center Infrastructure Management (DCIM) Market benefits from the government’s digital economy programs, encouraging companies to optimize operations through automation. Organizations are embracing smart infrastructure solutions to improve uptime and reduce energy costs. The trend drives adoption among telecom and BFSI sectors. It reflects Argentina’s commitment to developing a digitally integrated economy. Investments in hybrid cloud and virtualization continue to increase operational flexibility.

Technological Innovation in AI, IoT, and Predictive Analytics Integration

AI, IoT, and predictive analytics are revolutionizing monitoring and control within data centers. Operators rely on AI-powered algorithms to predict system failures and optimize power efficiency. The Argentina Data Center Infrastructure Management (DCIM) Market shows growing integration of sensors and intelligent dashboards that provide real-time visibility. It enhances the decision-making process for enterprises managing large workloads. Predictive analytics supports proactive maintenance strategies, reducing downtime risks. IoT connectivity offers better tracking of temperature, humidity, and energy parameters. The demand for intelligent management tools strengthens competitiveness among service providers. Continuous innovation ensures long-term system resilience and sustainability.

- For instance, IBM Cloud Pak for AIOps uses AI-driven predictive analytics to automate incident management and reduce downtime across global enterprise data centers. The platform’s capabilities in proactive monitoring and anomaly detection align with infrastructure optimization goals.

Growing Emphasis on Energy Efficiency and Sustainability Standards

Sustainability and energy optimization are key growth drivers shaping the local data center ecosystem. Enterprises prioritize low-PUE facilities that meet global energy standards. The Argentina Data Center Infrastructure Management (DCIM) Market supports this shift through integrated energy monitoring and optimization software. It enables operators to align infrastructure with carbon reduction targets. Green building initiatives and renewable power sourcing drive adoption of smart energy frameworks. Firms invest in advanced cooling systems and automation to minimize waste. Local policies promote environmentally responsible practices. Sustainability-focused solutions strengthen operational transparency and investor appeal.

Strategic Importance for Regional Connectivity and Investment Growth

Argentina’s expanding role as a digital hub in Latin America enhances its strategic market relevance. Businesses view DCIM deployment as vital for supporting scalable, secure, and interconnected networks. The Argentina Data Center Infrastructure Management (DCIM) Market serves as a foundation for cross-border data exchange and cloud expansion. It provides opportunities for global investors entering the region’s ICT infrastructure landscape. The country’s evolving regulatory framework fosters innovation and technology transfer. International firms establish partnerships to expand regional capacity. The growing digital ecosystem strengthens Argentina’s regional competitiveness. Investors view infrastructure resilience and scalability as major advantages.

- For instance, Ascenty, a Digital Realty and Brookfield Infrastructure company, operates 34 data centers across Latin America interconnected by a proprietary 5,000-kilometer fiber-optic network. This infrastructure enhances cloud connectivity, hybrid integration, and regional data exchange, supporting enterprise operations throughout the region.

Market Trends

Shift Toward Hybrid and Edge Data Center Architectures

Hybrid and edge infrastructures are transforming how enterprises manage and scale operations. Companies deploy modular solutions that combine on-premises and cloud models for agility. The Argentina Data Center Infrastructure Management (DCIM) Market aligns with this shift by enabling seamless hybrid management through integrated dashboards. It supports flexible computing environments suited for diverse workloads. Edge facilities ensure low latency for applications like IoT and AI. This trend strengthens connectivity across industries. The transition from legacy data centers to distributed systems improves response speed. Argentina’s edge readiness attracts investments from regional cloud providers.

Integration of Automation and Machine Learning in DCIM Platforms

Automation and ML-driven systems are reshaping operational efficiency. Advanced DCIM platforms automate capacity planning and incident detection, reducing manual oversight. The Argentina Data Center Infrastructure Management (DCIM) Market increasingly incorporates automation to maintain reliability under heavy workloads. It ensures predictive control of assets and energy flows. AI integration enables faster root-cause identification, lowering unplanned downtime. The adoption trend enhances competitiveness among hyperscale operators. Automation fosters proactive management, improving customer satisfaction and operational cost control. It represents a key differentiator in Latin America’s evolving data center ecosystem.

Growing Demand for Cybersecure Infrastructure and Regulatory Compliance

Rising cybersecurity risks are driving demand for integrated security within management platforms. Enterprises require end-to-end visibility across digital assets to meet compliance standards. The Argentina Data Center Infrastructure Management (DCIM) Market is witnessing greater focus on security analytics, encryption, and audit-ready data governance. It helps companies comply with national and international cybersecurity frameworks. Increased regulations drive implementation of certified security modules. Businesses seek secure network configurations that align with new data protection laws. The trend reflects Argentina’s effort to build trust in its digital infrastructure. Security integration enhances long-term market credibility and resilience.

Expansion of Renewable-Powered Data Centers and Sustainable Operations

Sustainability has become a defining trend across regional data center ecosystems. Companies commit to powering facilities through renewable energy and optimized cooling systems. The Argentina Data Center Infrastructure Management (DCIM) Market encourages sustainable practices through real-time energy consumption tracking. It enables operators to benchmark performance against carbon-neutral goals. Green innovation improves reputation among eco-conscious enterprises. Renewable-powered facilities attract long-term contracts from multinational clients. It strengthens environmental accountability across sectors. The trend aligns Argentina’s technology market with global sustainability objectives and responsible growth.

Market Challenges

High Capital Investment and Limited Infrastructure Modernization Pace

Building and upgrading large-scale data centers require significant capital, impacting adoption across mid-sized enterprises. Limited access to advanced hardware and slower modernization delay full integration of DCIM systems. The Argentina Data Center Infrastructure Management (DCIM) Market faces constraints in scalability due to budget and resource gaps. It slows digital transformation among smaller operators. Currency fluctuations further hinder import of specialized equipment. Many local firms still rely on legacy systems with minimal automation. The cost-intensive transition toward intelligent infrastructure limits rapid expansion. Bridging this gap needs coordinated efforts between private and public sectors.

Shortage of Skilled Workforce and Operational Complexity in Deployment

Argentina experiences a growing demand for skilled professionals capable of managing advanced DCIM platforms. The shortage increases dependency on foreign expertise and extends deployment timelines. The Argentina Data Center Infrastructure Management (DCIM) Market contends with high operational complexity during implementation phases. It challenges operators in configuration, integration, and performance optimization. Limited local training programs slow technology adoption. Complex interoperability between software and hardware requires continuous learning. The talent gap also affects cybersecurity readiness. Developing a strong domestic skill base is critical for ensuring sustainable and independent market growth.

Market Opportunities

Growing Hyperscale Investments and AI-Driven Infrastructure Expansion

Argentina’s increasing hyperscale investments create new opportunities for DCIM deployment. Global and regional players seek AI-integrated management solutions to handle complex operations. The Argentina Data Center Infrastructure Management (DCIM) Market benefits from this transition, creating openings for advanced analytics and automation vendors. It enables businesses to improve scalability and transparency. Emerging demand for high-density facilities supports AI-ready designs. Partnerships with tech providers stimulate software innovation. Investment incentives from government initiatives boost foreign participation. These dynamics open pathways for long-term infrastructure modernization.

Emerging Renewable Energy Integration and Smart Sustainability Platforms

Sustainable operations offer significant opportunity for innovation and differentiation. Data centers in Argentina are exploring renewable-powered infrastructure aligned with ESG commitments. The Argentina Data Center Infrastructure Management (DCIM) Market promotes green solutions through real-time energy optimization and smart tracking systems. It supports long-term carbon neutrality goals among enterprises. Demand for eco-certified facilities drives new collaborations with energy providers. Smart sustainability tools enable measurable performance improvement. Green adoption strengthens Argentina’s reputation for responsible digital infrastructure. Companies gain both regulatory and competitive advantages through these initiatives.

Market Segmentation

By Component

The solution segment dominates due to strong demand for integrated monitoring and analytics tools. DCIM solutions enable automation, predictive maintenance, and real-time power tracking. The Argentina Data Center Infrastructure Management (DCIM) Market sees growth in service integration, but solutions remain the leading component with higher adoption rates among large enterprises. It supports system efficiency and asset control. Services complement deployments through consulting, training, and maintenance. Solution-driven architecture enhances accuracy and scalability. Operators prefer comprehensive platforms over standalone products to meet diverse needs.

By Data Center Type

The enterprise data center segment leads with the largest share due to private investments from banking, telecom, and government entities. The Argentina Data Center Infrastructure Management (DCIM) Market shows steady rise in cloud and edge facilities supporting AI and IoT applications. It enables decentralized computing and latency reduction. Managed and colocation centers expand capacity for growing workloads. Edge facilities appeal to local businesses seeking cost efficiency. Hybrid data center types combine reliability with flexibility. Continuous modernization ensures performance and scalability across verticals.

By Deployment Model

The cloud-based model dominates due to lower upfront costs and ease of scalability. Organizations adopt cloud-hosted DCIM platforms for centralized management and remote accessibility. The Argentina Data Center Infrastructure Management (DCIM) Market experiences rising hybrid model adoption for balanced control and flexibility. It improves data governance and infrastructure resilience. On-premises systems remain relevant among enterprises handling sensitive information. The hybrid trend reflects Argentina’s balanced approach toward performance and compliance. Cloud-driven frameworks support agility across industries and attract SMEs seeking efficient deployment.

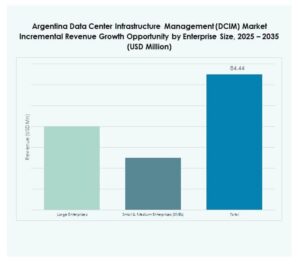

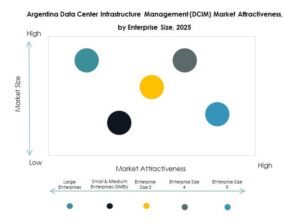

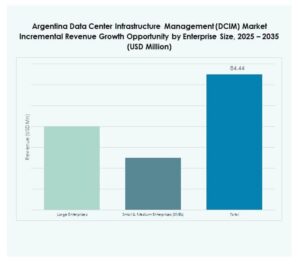

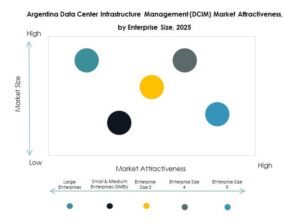

By Enterprise Size

Large enterprises hold a leading share due to stronger investment capacity and established IT infrastructure. These firms adopt DCIM tools to optimize operations and energy consumption. The Argentina Data Center Infrastructure Management (DCIM) Market also gains traction among SMEs integrating affordable SaaS-based platforms. It enables smaller firms to achieve efficiency through digital management. Large enterprises continue upgrading legacy systems to improve monitoring precision. SMEs drive volume growth through flexible cloud adoption. The combined demand strengthens Argentina’s evolving digital ecosystem and innovation momentum.

By Application / Use Case

Asset management remains the dominant use case, ensuring full control over IT equipment and performance. Companies employ DCIM for capacity and power monitoring to maximize uptime. The Argentina Data Center Infrastructure Management (DCIM) Market also observes rapid growth in BI and analysis modules that support data-driven decision-making. It fosters improved planning and resource allocation. Environmental monitoring gains attention for sustainable operations. Businesses integrate analytics for cost and energy optimization. Real-time visibility across functions enhances overall infrastructure performance.

By End User Industry

The IT and telecommunications sector dominates due to continuous network expansion and service digitalization. It uses DCIM to ensure operational reliability and scalability. The Argentina Data Center Infrastructure Management (DCIM) Market sees BFSI, healthcare, and retail as fast-growing end users adopting automation tools. It empowers organizations to handle critical workloads and maintain compliance. Energy and utilities sectors enhance resilience through power analytics. Defense and aerospace industries employ DCIM for mission-critical security. The technology’s flexibility supports diverse verticals, driving nationwide adoption.

Regional Insights

Buenos Aires – Core Digital and Connectivity Hub (Market Share: 52%)

Buenos Aires dominates due to its strong telecom infrastructure and concentration of large enterprises. The region supports major colocation and cloud facilities equipped with AI-enabled management systems. The Argentina Data Center Infrastructure Management (DCIM) Market benefits from international partnerships expanding capacity and network reliability. It attracts investments in hybrid cloud and hyperscale developments. Strong connectivity with fiber networks enhances operational uptime. Regulatory stability and skilled workforce availability make Buenos Aires the preferred hub for digital infrastructure.

- For instance, in August 2025, Cirion Technologies completed the expansion of its BUE1 Data Center in Buenos Aires, adding over 2 MW of IT capacity and around 160 new racks to support AI workloads and strengthen regional interconnection across Argentina.

Córdoba – Growing Secondary Data Center Cluster (Market Share: 31%)

Córdoba is rapidly emerging as Argentina’s secondary data center cluster with rising regional investments. Local enterprises and universities collaborate on smart technology adoption. The Argentina Data Center Infrastructure Management (DCIM) Market grows here through hybrid deployments and public-private initiatives. It benefits from lower operational costs and improved regional connectivity. The city’s technological education base fosters skilled labor supply. Renewable energy projects further enhance sustainability appeal. Córdoba strengthens the country’s infrastructure diversity and decentralization.

Rosario and Other Regions – Emerging Digital Frontiers (Market Share: 17%)

Rosario and nearby regions are witnessing increasing digital infrastructure development. New colocation and managed service providers establish localized data hubs. The Argentina Data Center Infrastructure Management (DCIM) Market leverages regional expansion supported by national broadband programs. It creates access for SMEs to adopt cloud and monitoring tools. These cities offer cost-effective locations for secondary operations. Regional diversification helps balance network loads and reduces latency. Infrastructure growth outside the capital enhances Argentina’s overall digital competitiveness.

- For instance, Telecom Argentina officially launched 5G services in Buenos Aires and Rosario, expanding high-speed connectivity across major urban centers. The rollout supports edge data center development and enterprise digitalization, strengthening Argentina’s national telecom and IT infrastructure.

Competitive Insights:

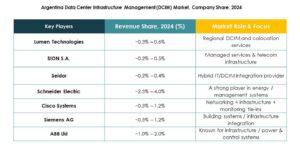

- Lumen Technologies

• SION S.A.

• Seidor

• DataWise

• ABB Ltd.

• Cisco Systems, Inc.

• Eaton Corporation

• Huawei Technologies Co., Ltd.

• Schneider Electric SE

• Siemens AG

• Others

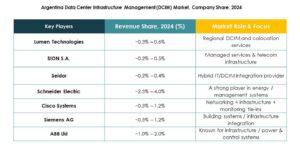

The Argentina Data Center Infrastructure Management (DCIM) Market features strong competition among global and regional players focusing on intelligent automation, energy efficiency, and cloud integration. It shows rising collaboration between technology firms and local service providers to expand infrastructure reliability and hybrid cloud connectivity. Schneider Electric, Huawei, and Siemens lead through innovation in modular DCIM platforms, while Cisco and Eaton emphasize network and power management solutions. Local firms such as SION S.A., Seidor, and DataWise strengthen market accessibility through customized software and managed services. It reflects an ecosystem balancing global expertise with domestic adaptability, fostering sustainable and scalable infrastructure growth.

Recent Developments:

- In August 2025, Cirion Technologies announced the expansion of its Buenos Aires Data Center (BUE1), highlighting new infrastructure aimed at supporting advanced digital transformation and regional connectivity in Argentina’s data center market. This expansion includes enhanced high-availability, energy-efficient solutions, and scalability features designed to accommodate the growing demands brought by artificial intelligence (AI) applications and bolster their position as the leading carrier-neutral facility in the region.

- In August 2025, ARSAT, a major Argentine telecommunications corporation, revealed a multi-million-dollar expansion plan for its Buenos Aires data center. The new expansion is designed to meet stringent energy efficiency standards and support the region’s increasing needs for robust, digitally enabled infrastructure.