Executive summary:

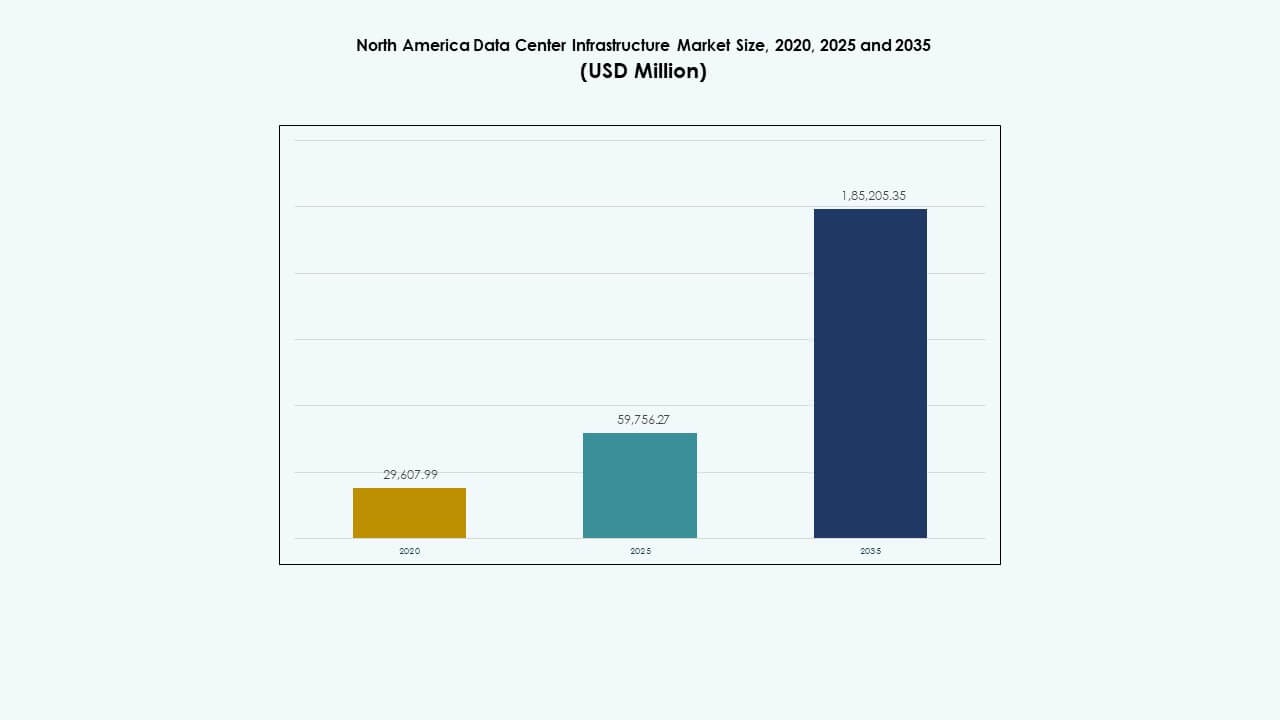

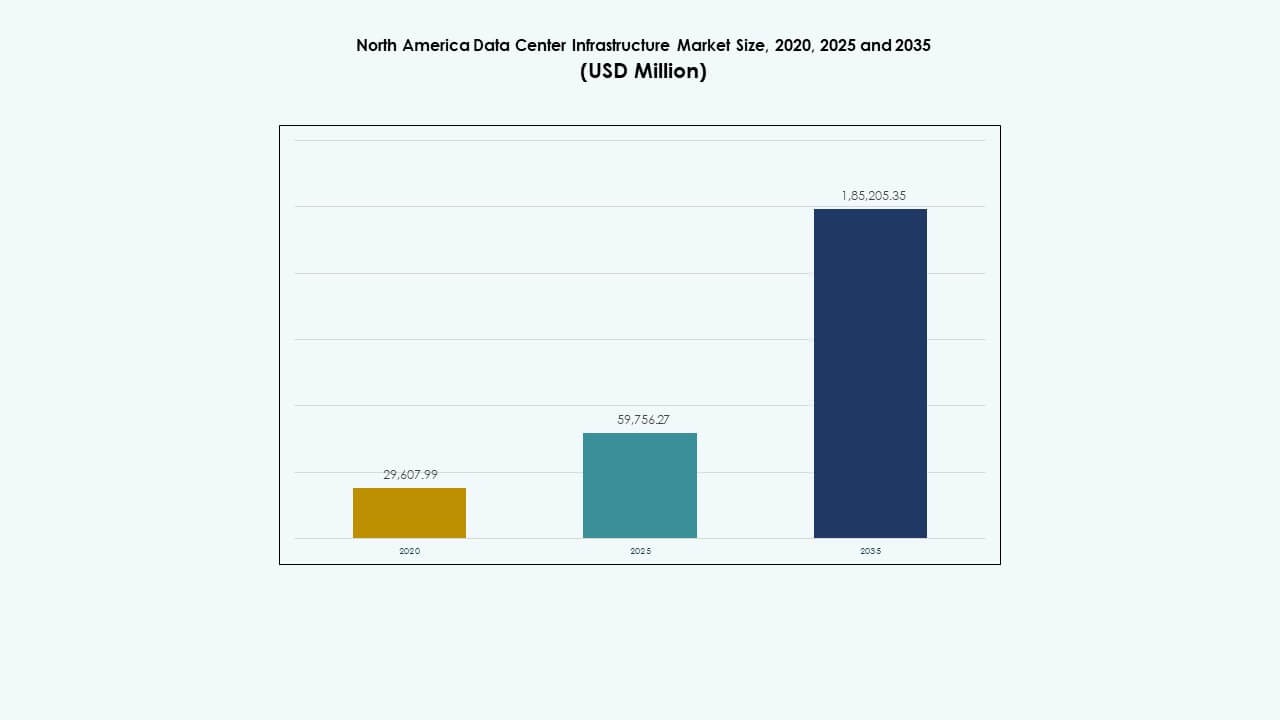

The North America Data Center Infrastructure Market size was valued at USD 29,607.99 million in 2020 to USD 59,756.27 million in 2025 and is anticipated to reach USD 185,205.35 million by 2035, at a CAGR of 11.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| North America Data Center Infrastructure Market Size 2025 |

USD 59,756.27 Million |

| North America Data Center Infrastructure Market, CAGR |

11.89% |

| North America Data Center Infrastructure Market Size 2035 |

USD 185,205.35 Million |

Rising digital transformation, cloud computing adoption, and AI integration are fueling infrastructure upgrades. Enterprises invest in energy-efficient systems and modular data centers to improve performance and reduce costs. The shift toward automation, renewable power integration, and smart monitoring systems enhances operational resilience. This market remains strategically important for businesses seeking scalability, while investors target its consistent returns through expanding hyperscale and colocation developments.

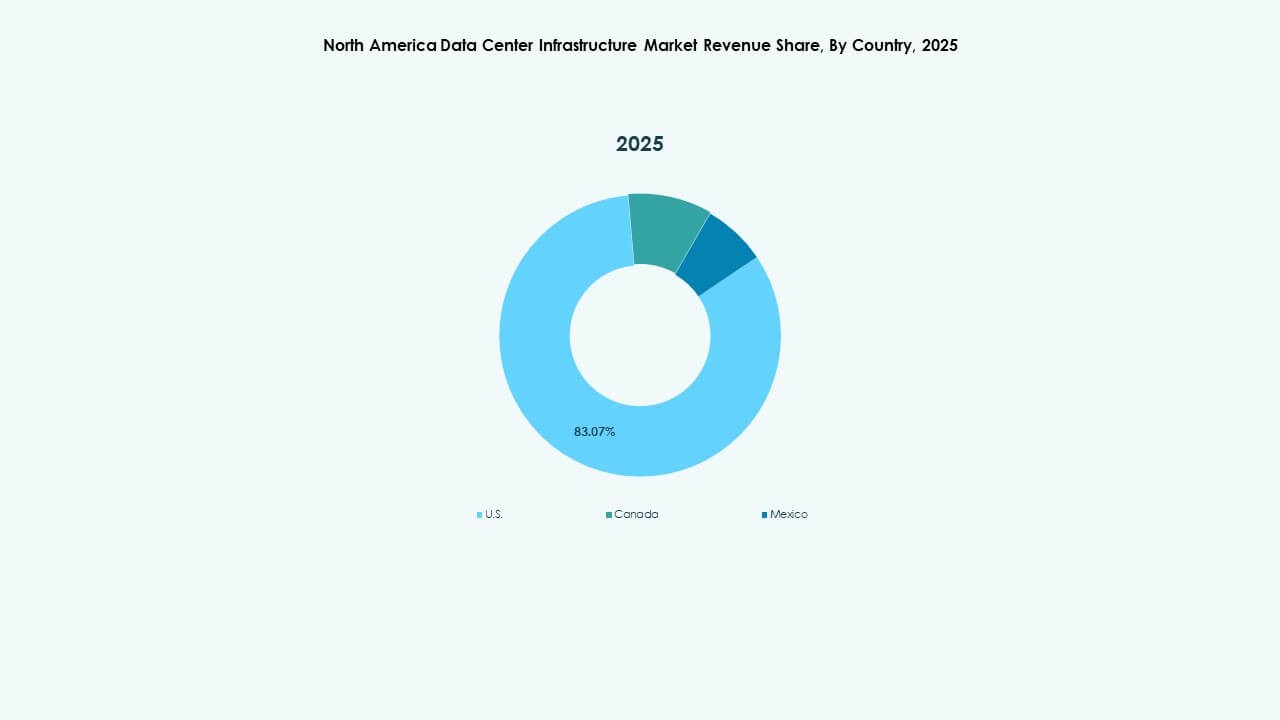

The United States leads in capacity deployment with extensive hyperscale and colocation facilities. Canada shows rapid growth supported by sustainability initiatives and renewable energy availability. Mexico emerges as an upcoming market driven by near-shoring demand and improved connectivity. Together, these regions create a balanced infrastructure ecosystem supporting enterprise growth, regional data sovereignty, and AI infrastructure development across North America.

Market Drivers

Rising Cloud Expansion and AI Integration Reshaping Infrastructure Demand

The North America Data Center Infrastructure Market experiences major growth through cloud adoption and AI-driven workloads. Businesses migrate critical operations to hybrid environments to optimize scalability and resilience. Growing reliance on edge nodes and distributed computing creates the need for efficient hardware and power systems. Innovation in high-density server architecture supports greater performance output. Investments in cooling systems lower operational costs while improving energy efficiency. AI analytics drive predictive maintenance for uptime assurance. Large enterprises pursue data center modernization to sustain digital competitiveness. Strategic infrastructure upgrades enhance long-term enterprise agility and operational reliability.

Shift Toward Sustainable and Energy-Efficient Infrastructure Models

Sustainability goals influence every major infrastructure decision across the region. Companies invest in renewable power sources and low-carbon design principles to align with ESG targets. Modern data centers deploy energy-efficient UPS and BESS solutions to reduce grid dependency. The integration of AI-enabled monitoring tools ensures real-time optimization of cooling and power distribution. It improves carbon transparency and operational compliance with environmental standards. Green building certifications strengthen investor confidence in sustainable projects. Operators prioritize resource efficiency to meet stricter state-level emissions regulations. This strategic transition positions the market for long-term energy stability and competitive advantage.

- For instance, Google data centers achieved an average annual Power Usage Effectiveness (PUE) of 1.10 in 2023 through AI-optimized cooling systems that dynamically adjust airflow based on real-time server loads.

Technological Innovations Driving Modular and Scalable Deployment Models

Innovation in modular construction accelerates facility deployment and cost control. Prefabricated modules enable faster build times while maintaining reliability. The market benefits from standardization in design-build and EPC delivery frameworks. Scalable IT and network infrastructure reduces downtime during expansions. It supports diverse workloads across hyperscale, colocation, and enterprise facilities. Rapid advances in liquid cooling improve thermal performance under high computing loads. Automation and robotics streamline maintenance cycles, cutting human error risks. Modularization enhances project ROI by improving flexibility and resource utilization.

- For instance, Microsoft deployed modular data centers using prefabricated components that cut deployment time from 18-24 months to under 90 days for certain facilities. Scalable IT and network infrastructure reduces downtime during expansions.

Growing Strategic Importance for Enterprises and Investors

The region’s infrastructure backbone underpins digital transformation across all industries. Enterprises invest in high-performance computing environments to support analytics, cybersecurity, and automation. Investors target the market for consistent long-term returns due to recurring service demand. The market’s maturity enables strong regulatory stability and infrastructure financing support. It remains vital to the growth of cloud, AI, and digital commerce ecosystems. Data sovereignty rules and local hosting needs further increase capacity demand. Enterprises prioritize security and resilience through tiered and redundant system designs. Strategic partnerships between developers and utilities strengthen regional competitiveness.

Market Trends

Market Trends

Rising Edge Data Center Development to Support Low-Latency Applications

The North America Data Center Infrastructure Market witnesses an accelerating shift toward edge computing. 5G rollout and IoT expansion create demand for smaller, high-efficiency nodes closer to users. These deployments reduce latency for streaming, gaming, and real-time analytics. It leads to distributed infrastructure strategies among hyperscalers and telecom providers. Edge facilities integrate compact power and cooling systems for sustainability. Many firms leverage AI-driven automation for remote site management. The focus on localized processing enables faster content delivery and improved data sovereignty. This evolution reshapes network topologies across urban and rural markets alike.

Integration of Artificial Intelligence for Data Center Operations Optimization

AI adoption transforms operational management across large facilities. Predictive algorithms now forecast equipment wear and energy consumption patterns. It enhances proactive maintenance and reduces costly downtime. Smart energy management systems balance load distribution during peak demand. Machine learning assists in improving power utilization and cooling efficiency metrics. Operators deploy AI for security monitoring, identifying anomalies in real time. These tools support safer, leaner, and more sustainable facility operations. Intelligent automation improves asset performance and scalability for complex IT environments.

Adoption of Liquid Cooling and Advanced Thermal Management Solutions

Growing compute density drives adoption of innovative cooling designs. Operators move away from traditional air-cooling toward direct liquid-based systems. These systems improve energy efficiency and allow denser rack configurations. It helps maintain performance for GPUs and AI accelerators under heavy workloads. Integration of immersion and rear-door heat exchangers expands across hyperscale centers. Vendors invest in sustainable coolants that align with green standards. Advanced heat reuse models convert waste energy into building heating applications. These innovations reduce operational costs and environmental impact across the region.

Rising Demand for Modular and Prefabricated Data Center Solutions

Enterprises and service providers prefer modular setups for scalability and speed. Prefabricated units enable phased construction aligned with funding cycles. The North America Data Center Infrastructure Market benefits from reduced on-site labor and predictable project delivery. It supports remote locations with standard configurations that simplify deployment. Modularization ensures design uniformity, enabling faster permitting and compliance. These facilities integrate power and mechanical components in pre-tested modules. It enables flexible expansion while minimizing downtime risks. Growing preference for turnkey modular data centers boosts vendor competition and innovation.

Market Challenges

Market Challenges

Escalating Energy Demand and Grid Dependency Issues

The North America Data Center Infrastructure Market faces significant pressure from rising energy consumption. High power density designs strain regional grids and challenge sustainability goals. Many facilities depend on aging grid infrastructure that lacks redundancy. Limited renewable integration complicates zero-emission commitments for hyperscale operators. It increases operating costs and risks during power interruptions. Utility delays slow expansion timelines, impacting ROI for investors. Regional climate variations add complexity to cooling efficiency and energy forecasting. Operators must secure long-term energy contracts to ensure operational stability.

Supply Chain Disruptions and Skilled Workforce Shortages

Ongoing global supply constraints delay critical component deliveries for construction. Shortages in semiconductors and power equipment extend project lead times. The North America Data Center Infrastructure Market contends with rising material and logistics costs. Workforce shortages in engineering and maintenance slow infrastructure rollouts. It limits deployment capacity during peak demand cycles. Vendor consolidation reduces equipment diversity and competitive pricing. Certification and compliance hurdles further extend commissioning phases. These structural challenges create persistent operational inefficiencies for developers and operators.

Market Opportunities

Expansion of Renewable Energy Integration and Sustainable Infrastructure Projects

The North America Data Center Infrastructure Market gains opportunities from renewable energy adoption. Operators invest in solar and wind power procurement through long-term PPAs. It reduces carbon footprints and aligns with corporate sustainability mandates. The growing focus on green infrastructure attracts ESG-driven investment funds. Innovations in microgrid and battery storage systems improve power reliability. Sustainability partnerships between data centers and utilities unlock mutual growth potential.

Growth in Edge and AI Infrastructure Across Secondary Cities

Emerging cities across the U.S. and Canada attract investments in smaller data facilities. Telecom operators expand edge capacity to support connected devices and autonomous technologies. It allows faster data processing near users and reduces network congestion. AI-driven edge analytics encourage infrastructure standardization for scale efficiency. This decentralization creates new investment zones and balances regional infrastructure distribution.

Market Segmentation

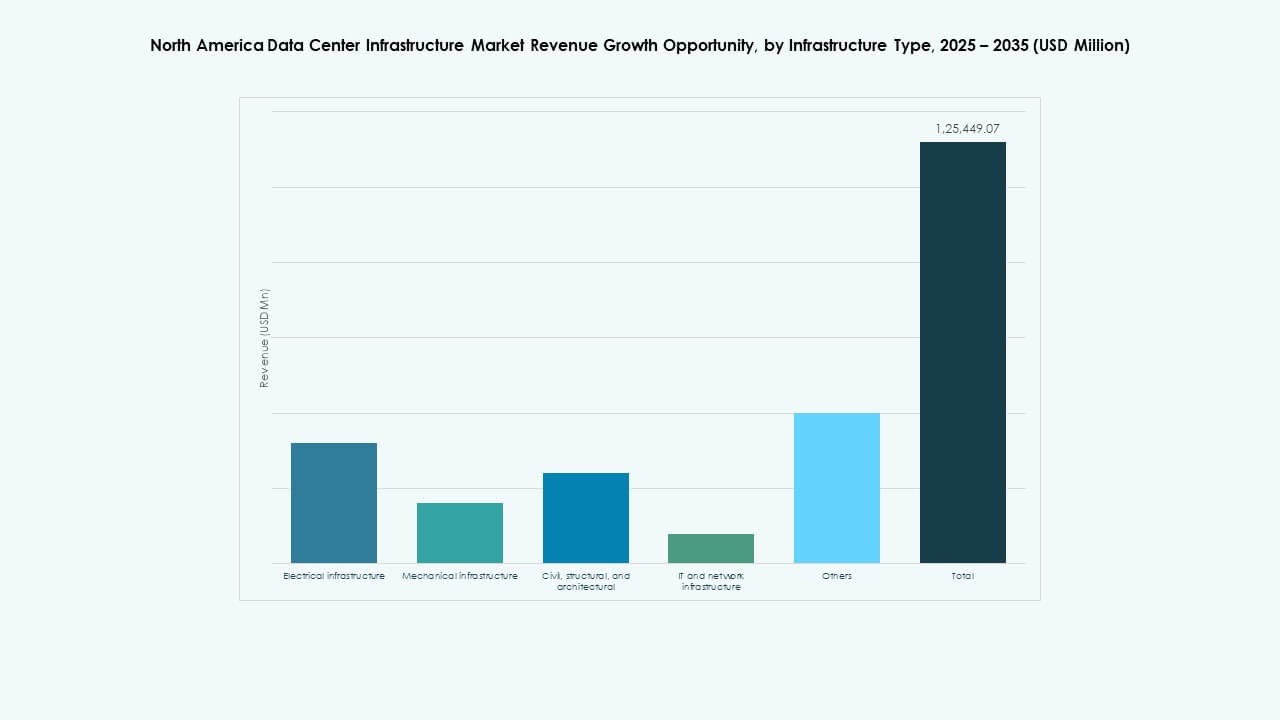

By Infrastructure Type

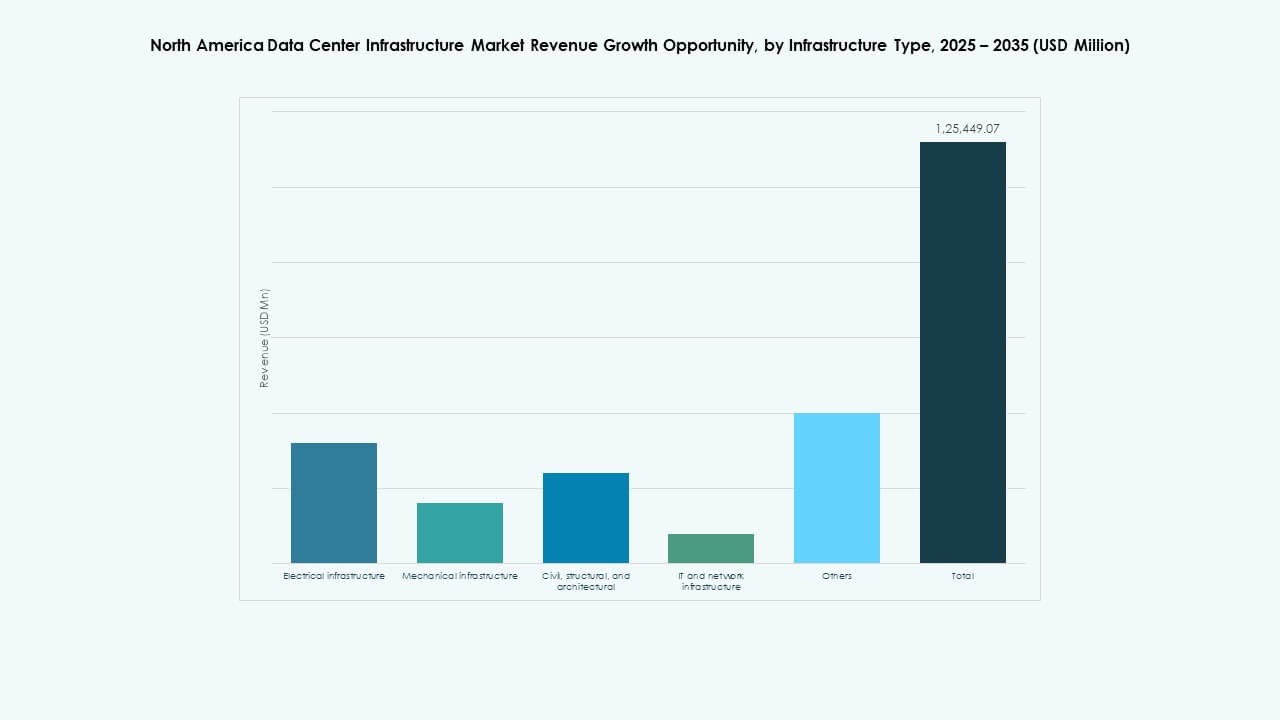

Electrical infrastructure dominates the North America Data Center Infrastructure Market due to power-intensive workloads and high uptime requirements. Mechanical infrastructure follows, driven by advanced cooling technologies for high-density computing. IT and network infrastructure remain crucial for data throughput optimization. Civil and architectural components expand with new modular and prefabricated designs. Growing reliance on digital platforms sustains strong investment across all infrastructure layers.

By Electrical Infrastructure

Uninterruptible Power Supply (UPS) systems lead the electrical segment with high adoption for reliability assurance. Battery Energy Storage Systems (BESS) gain traction as backup and peak-shaving solutions. Power Distribution Units (PDUs) and transfer switchgear enhance operational safety. Utility service integration supports grid stability across expanding campuses. The focus on efficiency and energy management strengthens this segment’s growth trajectory.

By Mechanical Infrastructure

Cooling units such as CRAC and CRAH systems dominate due to their reliability and scalability. Chillers, both air and water-cooled, improve temperature regulation across hyperscale centers. Containment systems enhance airflow and minimize power waste. Pumps and piping systems integrate with intelligent controllers for precise cooling distribution. The adoption of advanced cooling strategies keeps energy consumption under control.

By Civil / Structural & Architectural

Superstructure and modular building systems hold the largest share, driven by prefabrication and cost control. Raised floors and suspended ceilings optimize airflow management and cabling. Building envelopes improve thermal efficiency and noise isolation. Site preparation and foundation work require advanced materials for seismic resilience. Architectural flexibility supports both hyperscale and colocation project models.

By IT & Network Infrastructure

Servers and storage solutions dominate this segment due to AI and analytics workloads. Networking equipment and optical fiber enable faster data transfer and reduced latency. Racks and enclosures provide efficient space management. The integration of next-generation cabling supports scalability for future expansions. Continuous hardware innovation ensures seamless connectivity across large-scale environments.

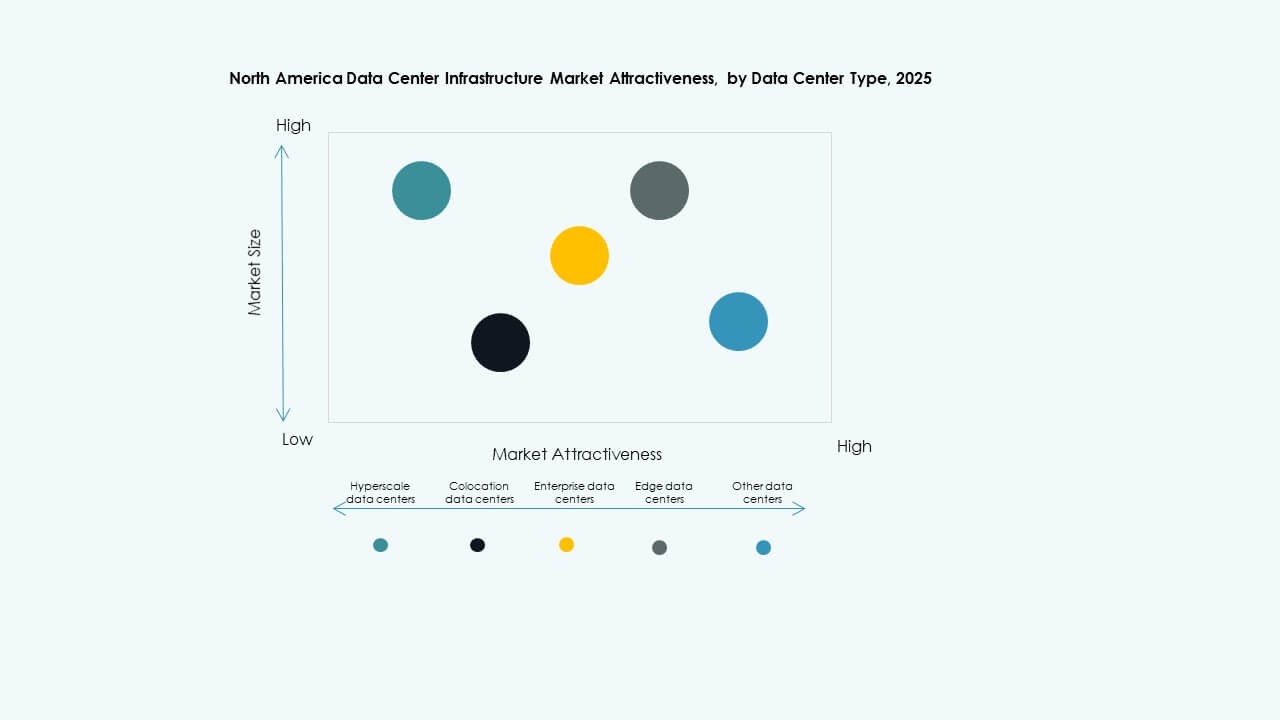

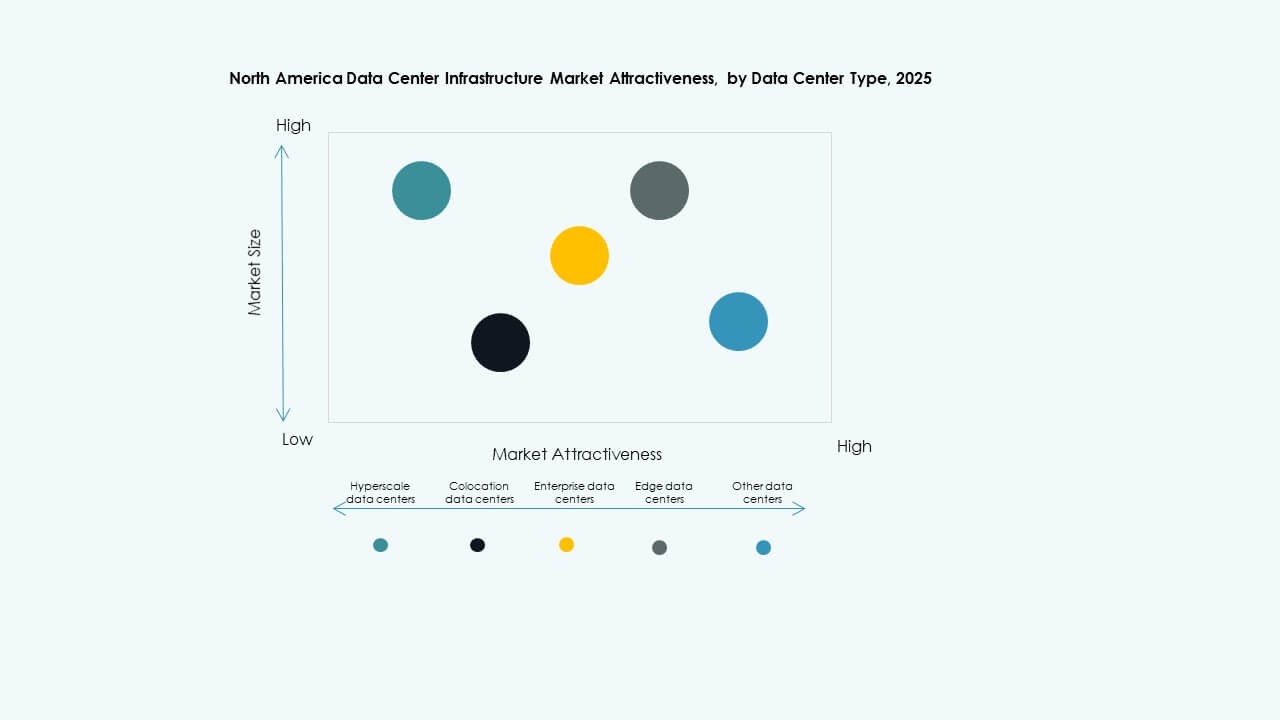

By Data Center Type

Hyperscale data centers lead the market with extensive capacity and automation. Colocation centers follow, offering cost-efficient solutions for enterprises seeking shared resources. Edge facilities expand rapidly to meet latency-sensitive application needs. Enterprise data centers maintain relevance for private infrastructure control. Each type addresses unique user and performance requirements across industries.

By Delivery Model

Design-Build and EPC models dominate due to integrated project management benefits. Turnkey and modular factory-built approaches accelerate deployment schedules. Construction management gains traction among large developers for budget control. Retrofit and upgrade projects increase as older facilities adopt new efficiency standards. Flexible delivery options meet evolving customer needs across project scales.

By Tier Type

Tier 3 facilities lead due to balanced reliability and cost performance. Tier 4 data centers grow with demand for maximum redundancy in hyperscale deployments. Tier 1 and 2 facilities serve smaller enterprises with limited uptime requirements. Standardization of tier certifications ensures trust and operational transparency. Demand for higher-tier data centers rises with stricter uptime SLAs.

Regional Insights

Regional Insights

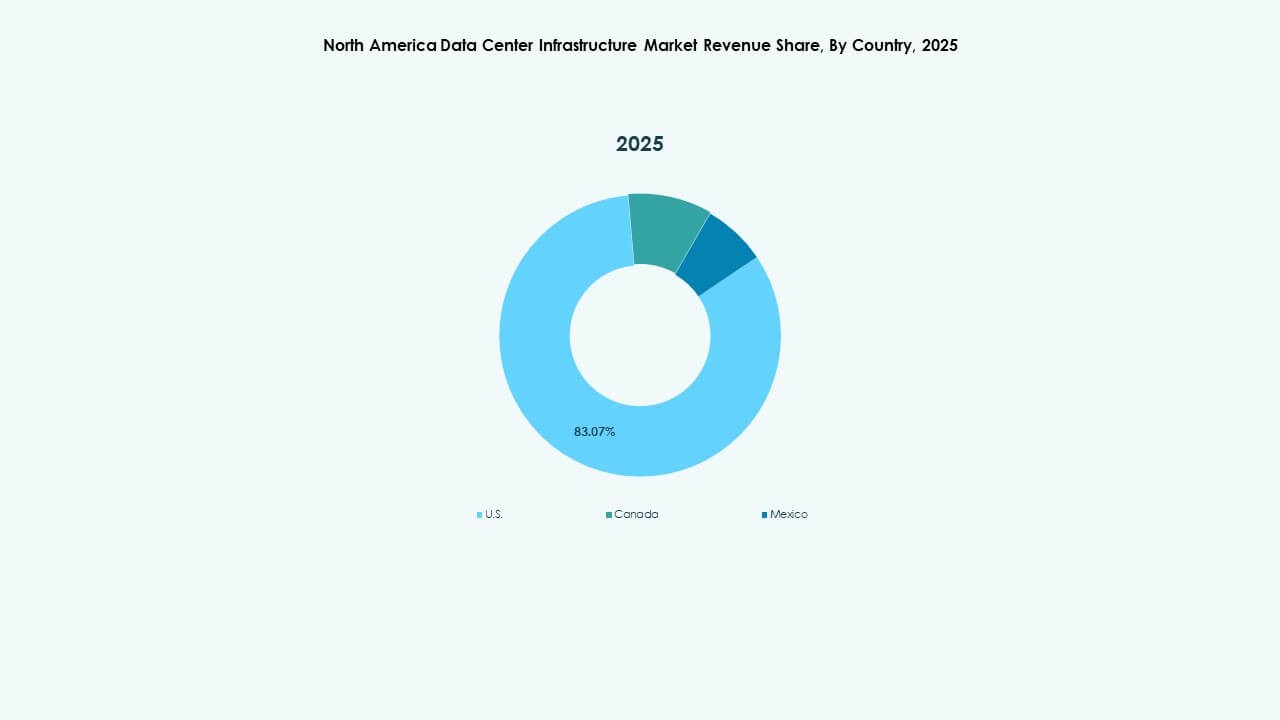

United States: Market Leader with 75% Regional Share

The United States dominates the North America Data Center Infrastructure Market, accounting for around 75% share. The country hosts hyperscale developments from AWS, Google, and Microsoft. Strong regulatory frameworks and renewable investments reinforce infrastructure reliability. Silicon Valley, Northern Virginia, and Texas remain prime deployment zones. High network density and enterprise demand sustain continuous upgrades. It serves as a global benchmark for efficiency and operational standards.

- For example, Northern Virginia, the leading data center hub in the U.S., had a total data center power capacity exceeding 4,900 MW by the first quarter of 2025 with an 80% increase in under-construction capacity reaching 2,078.2 MW and 538.6 MW of net absorption in the first half of 2025.

Canada: Rapid Growth Driven by Sustainability and Cooler Climate

Canada holds approximately 18% of the regional share with expanding hyperscale and colocation facilities. The country benefits from abundant renewable energy and government support for sustainable projects. Toronto, Montreal, and Calgary emerge as key investment hubs. The cooler climate aids in natural cooling efficiency, reducing power costs. Canada’s growing digital economy supports continuous capacity addition and innovation. It attracts investors focusing on clean and cost-effective infrastructure.

Mexico: Emerging Hub with Strategic Expansion Potential

Mexico accounts for nearly 7% of the regional market, with strong near-shoring opportunities. Querétaro and Monterrey lead infrastructure expansion through government-backed data policies. The market gains momentum from industrial growth and cloud adoption. Proximity to the U.S. strengthens cross-border connectivity and business continuity. It attracts colocation providers targeting enterprise clients in Latin America. Mexico’s infrastructure evolution enhances regional data resilience and investment appeal.

- For instance, the government of Querétaro has promoted data center-friendly policies that supported an increase of over 50 MW of colocation capacity additions in 2024 alone. This expansion is driven by rising industrial demand and cloud adoption, with enhanced cross-border connectivity infrastructure facilitating seamless business continuity with the U.S. market.

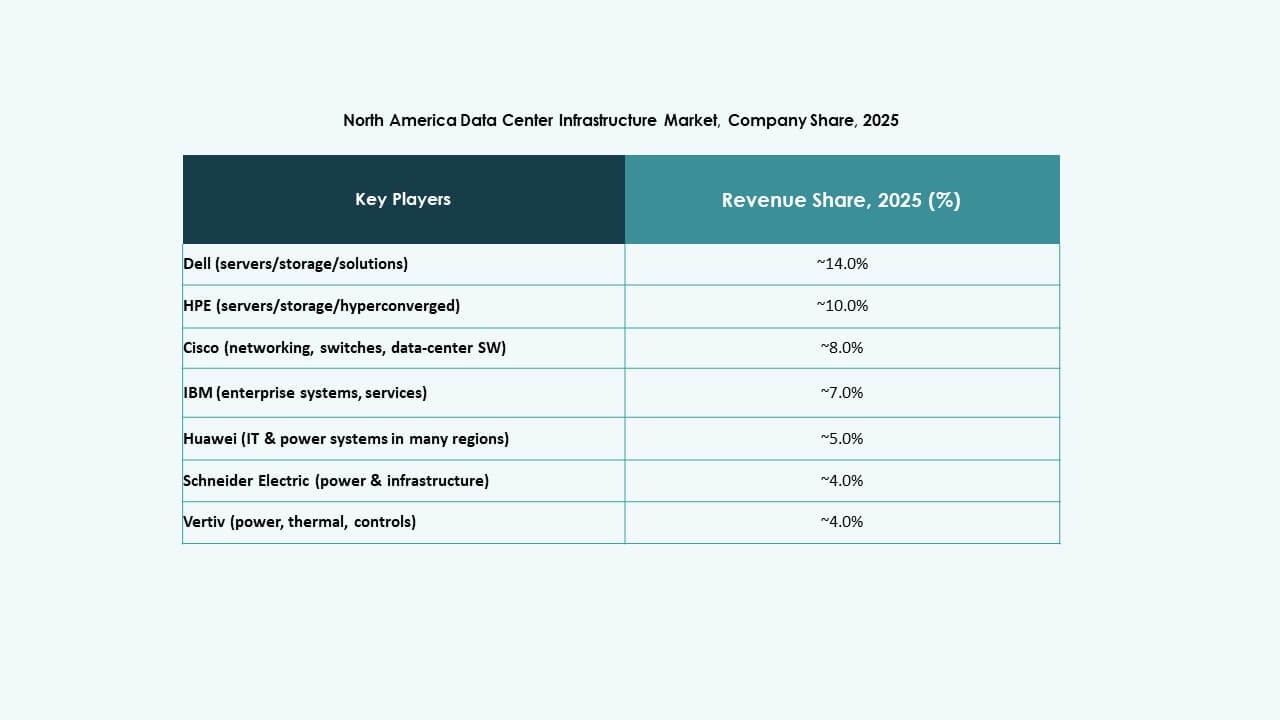

Competitive Insights:

- ABB

- Cisco Systems, Inc.

- Dell Inc.

- Equinix, Inc.

- Hewlett Packard Enterprise Development LP (HPE)

- Schneider Electric SE

- Vertiv Group Corp.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Lenovo Group Ltd.

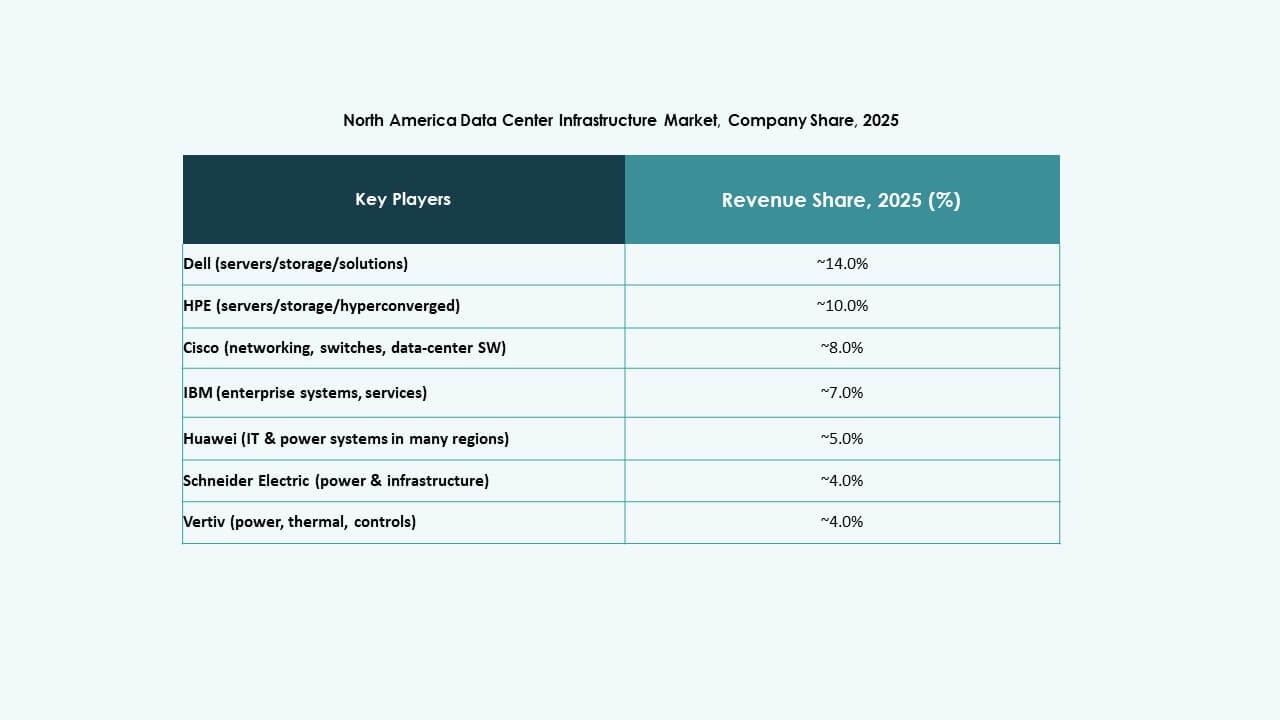

The North America Data Center Infrastructure Market features a competitive environment shaped by strong global and regional players. It emphasizes energy-efficient designs, modular scalability, and integration of AI-based management systems. Major firms expand portfolios through digital twins, smart power systems, and prefabricated solutions. Partnerships between technology vendors and hyperscale operators strengthen end-to-end delivery capabilities. Companies compete through innovation in cooling efficiency, automation, and edge-ready architecture. The market favors players with strong service networks and proven sustainability credentials. Continuous mergers and strategic collaborations drive product diversification and regional footprint expansion across the U.S., Canada, and Mexico.

Recent Developments:

Recent Developments:

- In October 2025, a consortium including BlackRock, Microsoft, Nvidia, and others agreed to acquire Aligned Data Centers for $40 billion. This consortium, known as the Artificial Intelligence Infrastructure Partnership (AIP), is set to deploy $30 billion in equity with plans to expand, targeting AI infrastructure growth across the U.S. and Latin America.

- In October 2025, ABB announced the development of next-generation AI data centers in collaboration with NVIDIA. ABB introduced innovative products including HiPerGuard, the world’s first solid-state medium voltage UPS, designed to increase power density and energy efficiency in AI data centers, and the SACE Infinitus, the world’s first IEC-certified solid-state circuit breaker for direct current distribution viability in data centers.

- In June 2025, Amazon announced a $10 billion investment for a high-tech cloud computing and AI innovation campus in Richmond County, North Carolina. This new data center will support cloud computing and generative AI technologies.

- In May 2025, Cisco Systems, Inc. joined the AI Infrastructure Partnership (AIP), collaborating with key investors and technology leaders such as BlackRock, Microsoft, NVIDIA, and others to drive investments into AI data centers and related infrastructure. This partnership aims to mobilize significant investment capital to support secure and scalable AI workloads across data centers in North America.

Market Trends

Market Trends Market Challenges

Market Challenges Regional Insights

Regional Insights Recent Developments:

Recent Developments: