Executive summary:

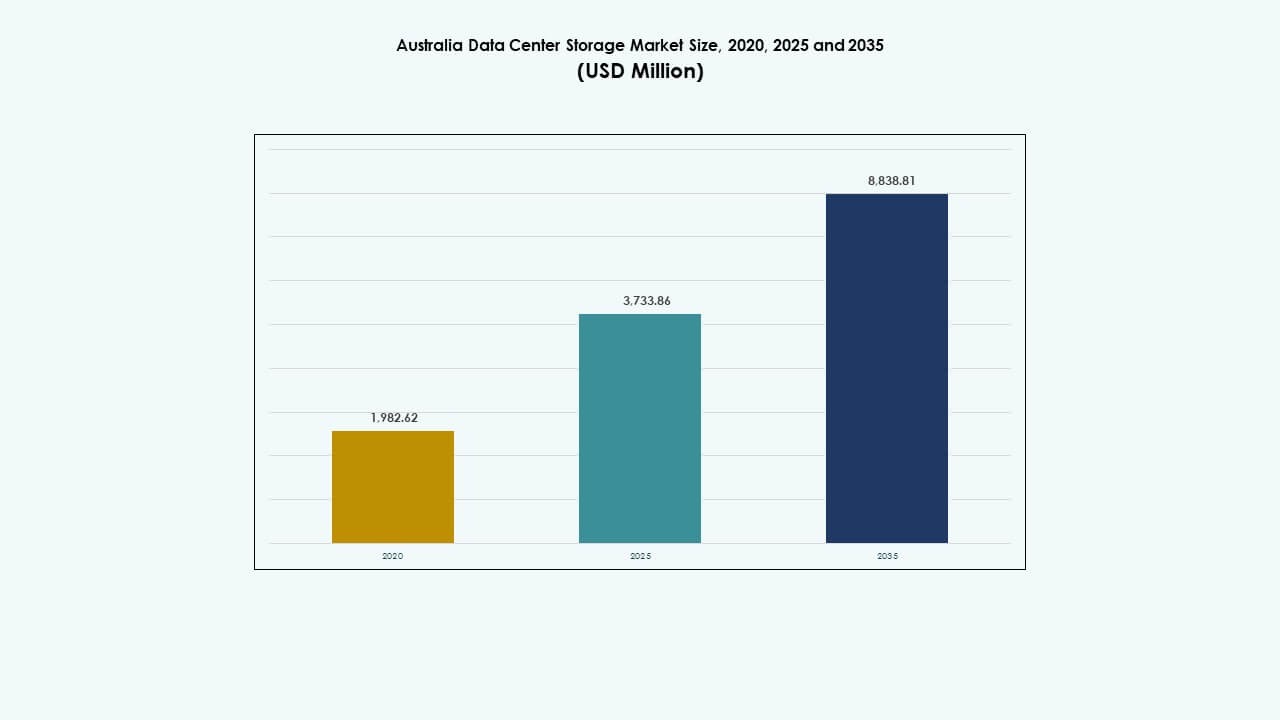

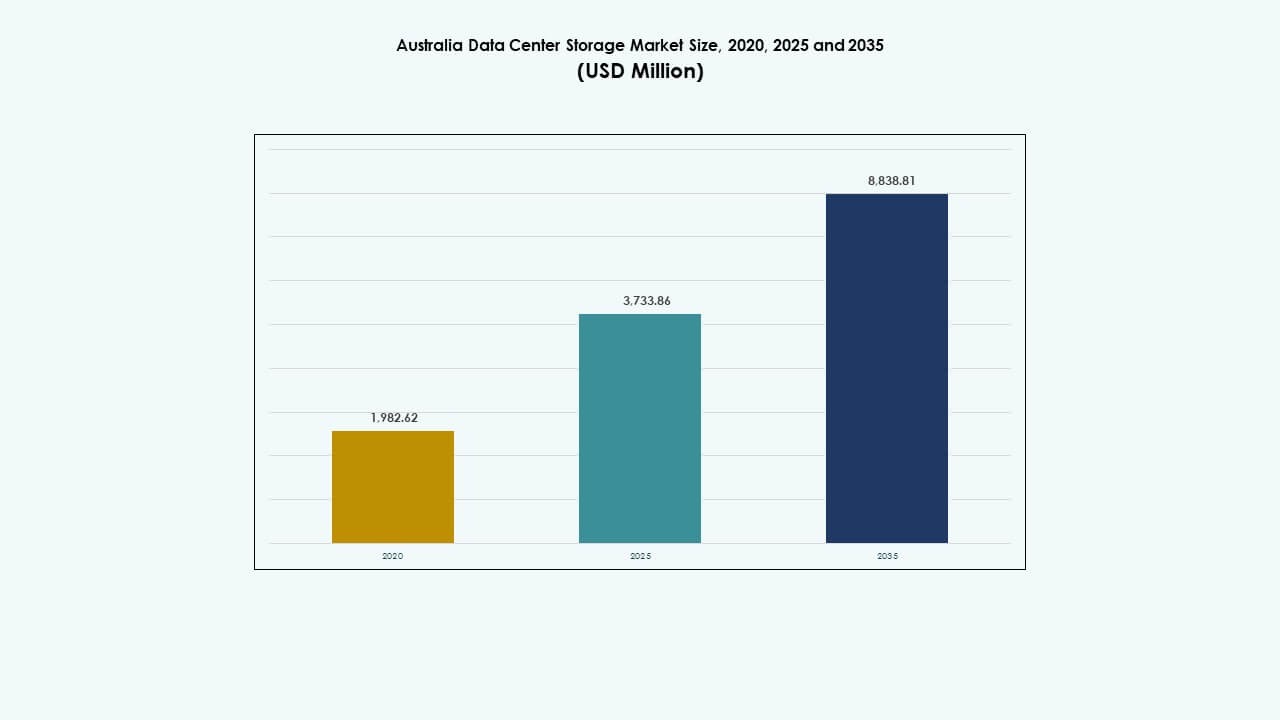

The Australia Data Center Storage Market size was valued at USD 1,982.62 million in 2020 to USD 3,733.86 million in 2025 and is anticipated to reach USD 8,838.81 million by 2035, at a CAGR of 8.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Australia Data Center Storage Market Size 2025 |

USD 3,733.86 Million |

| Australia Data Center Storage Market, CAGR |

8.91% |

| Australia Data Center Storage Market Size 2035 |

USD 8,838.81 Million |

The market is experiencing rapid growth due to increasing demand for cloud storage, AI workloads, and digital transformation across enterprises. Businesses are shifting to software-defined and flash-based storage for better performance and lower latency. Regulatory compliance, data sovereignty, and sustainability are pushing the adoption of localized and energy-efficient systems. Innovations like NVMe, hyperconverged infrastructure, and AIOps are reshaping storage strategies. Investors see strong potential in this market due to resilient demand, infrastructure expansion, and government-backed tech initiatives.

New South Wales leads the market, driven by Sydney’s concentration of hyperscale facilities and global cloud zones. Victoria is emerging, supported by renewable energy availability and strategic fiber networks. Queensland and Western Australia are growing due to edge deployments, submarine cable projects, and regional cloud needs. These states are expanding data infrastructure to support decentralized enterprise demand and improve latency for remote services.

Market Dynamics:

Market Drivers

Accelerated Shift Toward Cloud and Digital Infrastructure Across All Business Scales

Enterprises across Australia are adopting cloud-first strategies to improve flexibility, uptime, and security. This shift boosts demand for scalable, high-performance storage. The rise in multi-cloud environments and data virtualization tools fuels storage refresh cycles. Enterprises are replacing legacy systems with faster, redundant, and modular platforms. The Australia Data Center Storage Market reflects this digital push by enabling efficient data lifecycle management. Small and mid-sized firms are also modernizing their storage, supporting wider adoption. Cloud providers scale up local zones to meet growing user needs. It aligns with federal digital transformation programs aimed at enhancing service delivery. Data-driven strategies by banks, logistics, and healthcare drive sustained storage demand.

Proliferation of AI, Big Data, and IoT Demands High-Throughput, Low-Latency Storage Systems

Real-time analytics and edge computing create constant streams of structured and unstructured data. To process this data, businesses require low-latency, high-IOPS storage systems. The deployment of AI-enabled services boosts the use of NVMe-based architectures. Data center operators prioritize flash storage for its speed, density, and energy savings. The Australia Data Center Storage Market caters to these performance demands through agile and modular systems. Industries deploying AI models need efficient caching and data tiering tools. This dynamic drives innovation across infrastructure layers. Storage vendors integrate AI into management software for predictive insights. Faster data processing directly impacts operational agility and decision-making speed.

- For instance, Microsoft’s Azure Australia East region provides Premium SSD v2 and Ultra Disk Storage with up to 80,000 IOPS and 1,200 MB/s throughput per disk. These storage options support high-performance workloads such as AI training and large-scale analytics.

Rapid Growth of Edge and Colocation Facilities in Tier-II and Tier-III Cities

Decentralization trends are accelerating infrastructure build-outs beyond Sydney and Melbourne. Edge data centers closer to end-users support latency-sensitive applications and regional compliance. These facilities need localized storage, driving demand for compact and rugged solutions. Telcos and CDN providers partner with colocation firms to expand regional footprints. The Australia Data Center Storage Market reflects this with rising storage procurement for edge setups. Regional governments invest in connectivity and tech zones to support digital inclusion. The trend creates opportunities for storage vendors offering scalable, containerized units. Local enterprises gain faster access to data and services. Edge-focused strategies reduce network congestion and increase availability.

- For instance, NEXTDC’s B2 facility in Brisbane offers around 6,000 m² of technical space with about 12 MW of IT capacity, and it provides direct low‑latency connectivity to major cloud providers such as AWS, Microsoft Azure, and Google Cloud to support hybrid and cloud storage architectures in Southeast Queensland.

Policy Support, Renewable Energy Goals, and Data Sovereignty Concerns Shape Investments

Australia’s National Data Security Action Plan and carbon-neutral mandates influence storage procurement. Operators seek energy-efficient systems with power management and thermal control. Sovereign cloud initiatives push organizations to store data locally within regulated frameworks. The Australia Data Center Storage Market aligns with these policies through green-certified, compliant storage solutions. Regulatory clarity encourages long-term investments from both domestic and foreign firms. Data localization rules in finance and healthcare boost secure storage setups. Vendors respond with software-defined platforms offering encryption and policy controls. ESG-focused investment flows into clean infrastructure and low-emission data center tech. Public-private collaborations support secure and sustainable storage ecosystems.

Market Trends

Rising Adoption of Software-Defined Storage (SDS) for Scalability and Cost Efficiency

SDS separates storage software from hardware, enabling flexible deployment across multiple locations. It reduces dependence on proprietary systems while enhancing performance and agility. The Australia Data Center Storage Market is witnessing widespread SDS adoption for cost optimization. Enterprises choose SDS to handle structured, semi-structured, and unstructured data. It simplifies backup, disaster recovery, and replication processes. Vendors bundle SDS with automation and container orchestration support. Organizations reduce capital costs and gain faster provisioning times. SDS enables centralized control of hybrid storage environments. Increased demand from BFSI, healthcare, and e-commerce sectors accelerates this transition.

Integration of AI-Powered Storage Management and Predictive Analytics

Storage solutions now include AI capabilities for workload forecasting, anomaly detection, and auto-tiering. These features optimize performance, reduce downtime, and support self-healing infrastructure. The Australia Data Center Storage Market reflects this shift toward intelligent automation. AI helps balance storage loads, reduce waste, and improve energy efficiency. Vendors deploy machine learning in SSD health monitoring and failure prediction. Predictive analytics cut operational costs and enable proactive scaling. Storage becomes smarter, more reliable, and easier to maintain. It also supports autonomous data centers in the long run. Enterprises benefit from lower TCO and improved SLAs.

Increased Use of NVMe-Based Architectures and All-Flash Arrays for Performance Boost

NVMe storage delivers superior read-write speeds and reduced latency, ideal for high-demand applications. Adoption is growing in workloads such as VDI, analytics, and virtualization. The Australia Data Center Storage Market integrates NVMe to meet performance SLAs. All-flash arrays gain traction due to falling SSD prices and space efficiency. These systems also reduce cooling and power requirements, aligning with green goals. Enterprises prioritize flash storage for mission-critical environments. Vendors offer hybrid options to balance cost and performance. NVMe-over-Fabric (NoF) adoption supports scalable, high-speed access across distributed sites. Flash remains vital for cloud-native workloads and AI deployments.

Growing Focus on Cyber Resilience, Immutable Storage, and Ransomware Protection

With rising data breaches, storage solutions include built-in security and compliance layers. Immutable snapshots and air-gapped storage protect against ransomware and insider threats. The Australia Data Center Storage Market responds with solutions supporting zero-trust architecture. Businesses implement WORM (Write Once Read Many) systems in regulatory-heavy sectors. Backup systems now use encryption-at-rest and in-transit. Regulatory compliance (such as APRA CPS 234) influences storage choices. Cyber insurance requirements drive multi-site backup and instant recovery. Vendors promote storage hardening tools and forensic data recovery capabilities. Data resilience becomes a boardroom priority in storage procurement.

Market Challenges

High Energy Consumption, Operational Costs, and Pressure on Power Infrastructure

Data center storage systems demand continuous power and cooling, especially flash-based and performance-intensive setups. Rising energy prices and environmental regulations increase operational costs. The Australia Data Center Storage Market must address this with energy-efficient and thermally optimized designs. Power constraints limit expansion in urban zones like Sydney, slowing hyperscale deployments. Infrastructure aging in suburban areas adds risk for consistent uptime. Government grid modernization programs take time to deliver capacity improvements. Operators need to balance performance with sustainability. Edge deployments mitigate load but increase redundancy requirements. Storage system efficiency directly impacts carbon footprint targets.

Limited Skilled Workforce and Complexity of Hybrid Infrastructure Management

Managing hybrid environments across on-prem, cloud, and edge requires advanced skills and continuous training. Talent shortages in IT infrastructure and cloud-native operations delay deployment cycles. The Australia Data Center Storage Market struggles to scale fast in regional zones due to workforce gaps. SMEs face difficulties hiring or retaining certified data engineers and cloud architects. Complexities grow with multi-vendor, multi-platform systems requiring centralized orchestration. Security, compliance, and automation increase the learning curve. Rural and Tier-II city projects experience longer setup times and reduced resilience. Companies invest in training and managed service partnerships to address capability issues.

Market Opportunities

Rising Hyperscaler Investments and Submarine Cable Projects Fuel Storage Demand

Hyperscalers like AWS, Microsoft, and Google are expanding cloud availability zones in Australia. These expansions require large-scale storage infrastructure with high-speed interconnects. The Australia Data Center Storage Market benefits from submarine cable projects that enhance global connectivity. Cities like Darwin and Hobart gain relevance as new landing points. This growth brings opportunities for storage vendors offering low-latency, scalable platforms. Local players partner with global firms to meet rising cloud storage needs. Regional tech hubs become focal points for future data infrastructure.

Edge and AI-Driven Applications Create Demand for Decentralized, Intelligent Storage

Use cases such as smart cities, autonomous transport, and telehealth generate data outside core zones. These applications need decentralized storage with real-time analytics and fast recovery. The Australia Data Center Storage Market supports this shift through modular, AI-ready systems. Vendors offer micro data centers with inbuilt GPU acceleration and SSD arrays. It opens avenues for service providers and OEMs targeting defense, mining, and agriculture verticals. Demand grows for ruggedized, scalable, and software-defined storage solutions in field operations.

Market Segmentation

By Storage Type

Traditional storage remains relevant but is gradually declining in favor of all-flash and hybrid solutions. All-flash storage leads the segment due to high speed, energy efficiency, and lower maintenance. Hybrid storage offers balance and flexibility for mixed workloads. In the Australia Data Center Storage Market, hybrid solutions gain traction in mid-size enterprises transitioning from legacy systems. Vendors promote integrated storage tiers to support variable data loads. Others, such as object-based storage, are emerging for archival use cases.

By Storage Deployment

Storage Area Network (SAN) systems dominate due to their high performance and availability in critical workloads. Network-Attached Storage (NAS) systems serve file-based data in content-heavy sectors. Direct-Attached Storage (DAS) is preferred in small setups or edge environments. The Australia Data Center Storage Market sees rising deployment of SAN for database and virtualization. NAS is growing in media and education sectors due to scalability. Emerging trends like NVMe-over-Fabrics impact SAN evolution and adoption.

By Component

Hardware continues to drive the bulk of market value, with SSDs and high-performance servers in demand. Software growth accelerates through SDS and data management platforms. The Australia Data Center Storage Market reflects a shift where hardware forms the base, but software delivers differentiation. Software adds intelligence, automation, and orchestration in hybrid deployments. Vendors bundle monitoring and predictive analytics into offerings. Demand grows for data protection and snapshot management tools.

By Medium

Solid-State Drives (SSD) dominate the market due to performance, reliability, and decreasing costs. Hard Disk Drives (HDD) serve cold and backup storage where cost-per-TB remains key. Tape storage continues in archival use for government and research sectors. The Australia Data Center Storage Market heavily favors SSDs for latency-sensitive operations. HDDs find niche demand in archival and Tier-III applications. Vendors innovate around SSD endurance, caching, and energy use.

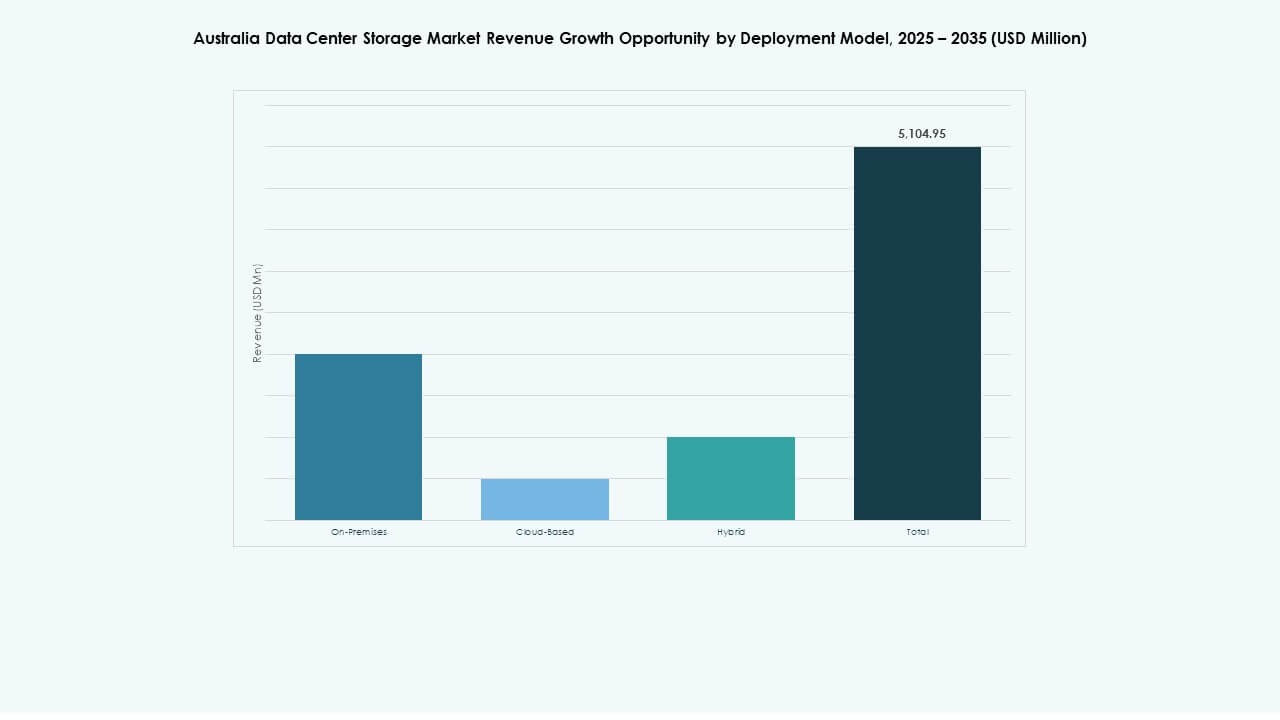

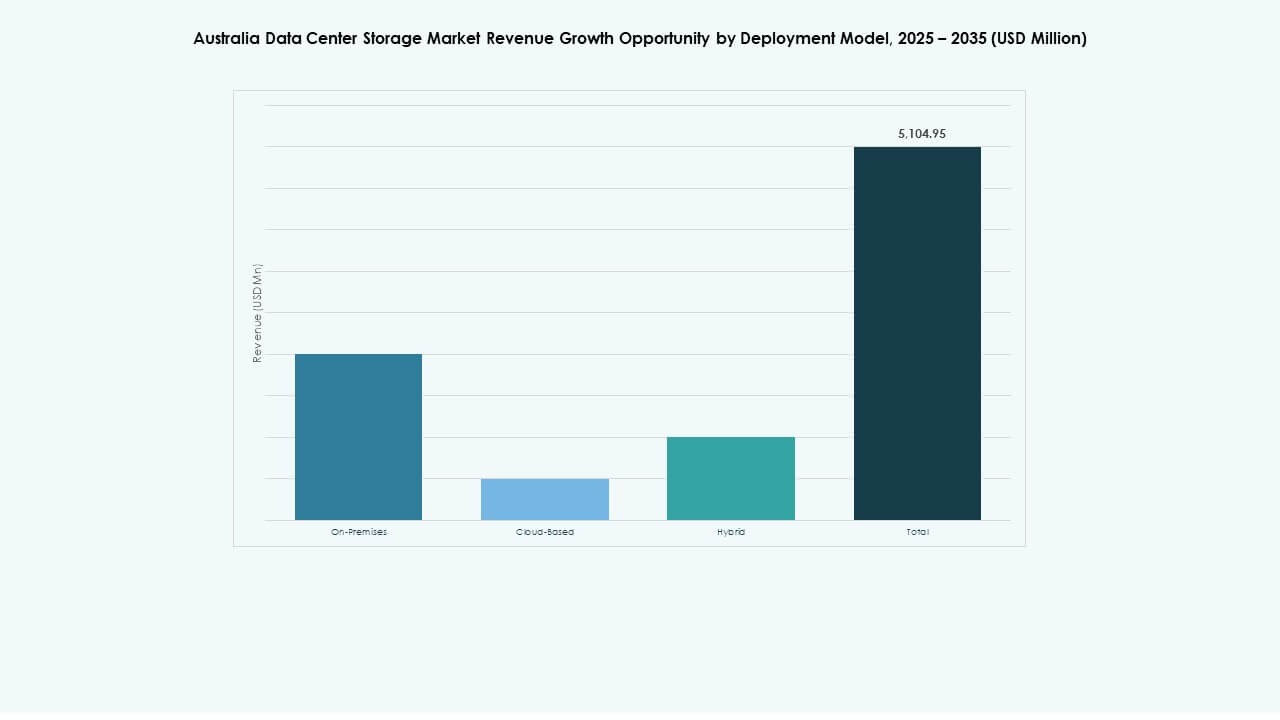

By Deployment Model

Cloud-based deployment sees fastest growth due to flexibility, scalability, and reduced CAPEX. On-premises remains critical for security-sensitive workloads. Hybrid deployment balances control and scalability for multi-site enterprises. The Australia Data Center Storage Market embraces hybrid models across BFSI, telecom, and healthcare. Regulatory requirements drive on-prem setups. Cloud-native businesses push storage demand into managed service models. Hybrid storage becomes a default for enterprises needing agility and compliance.

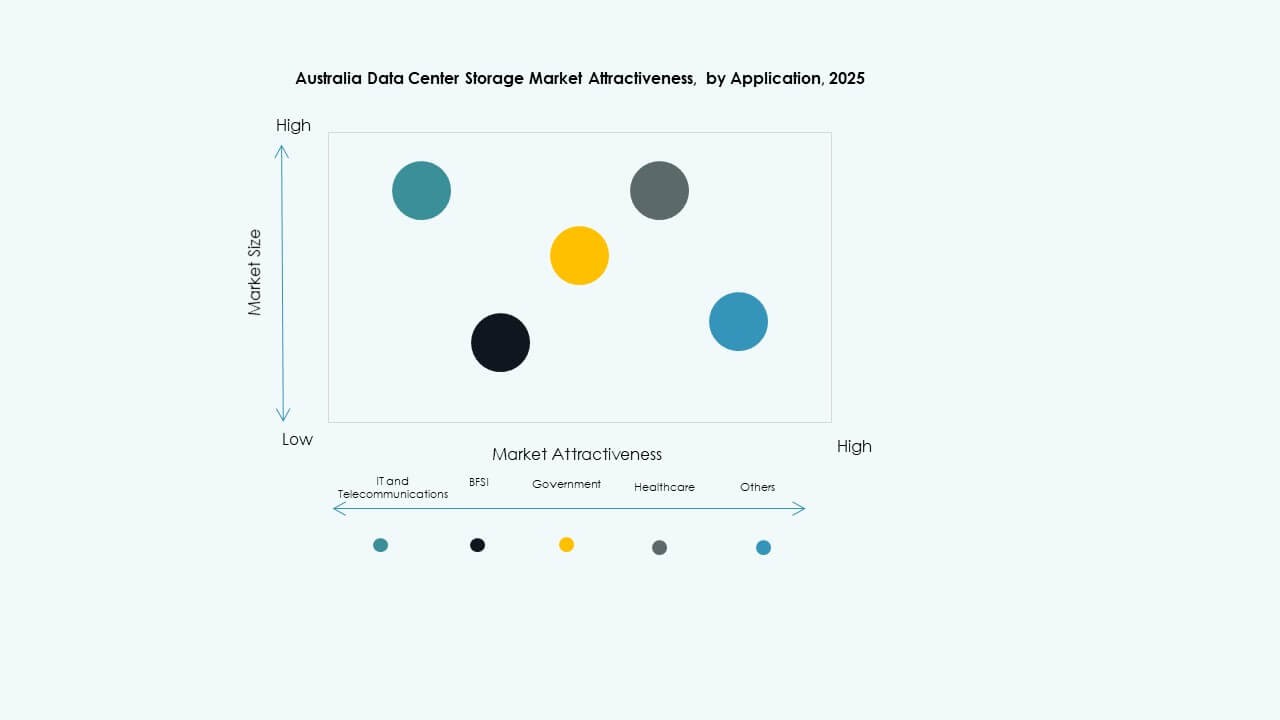

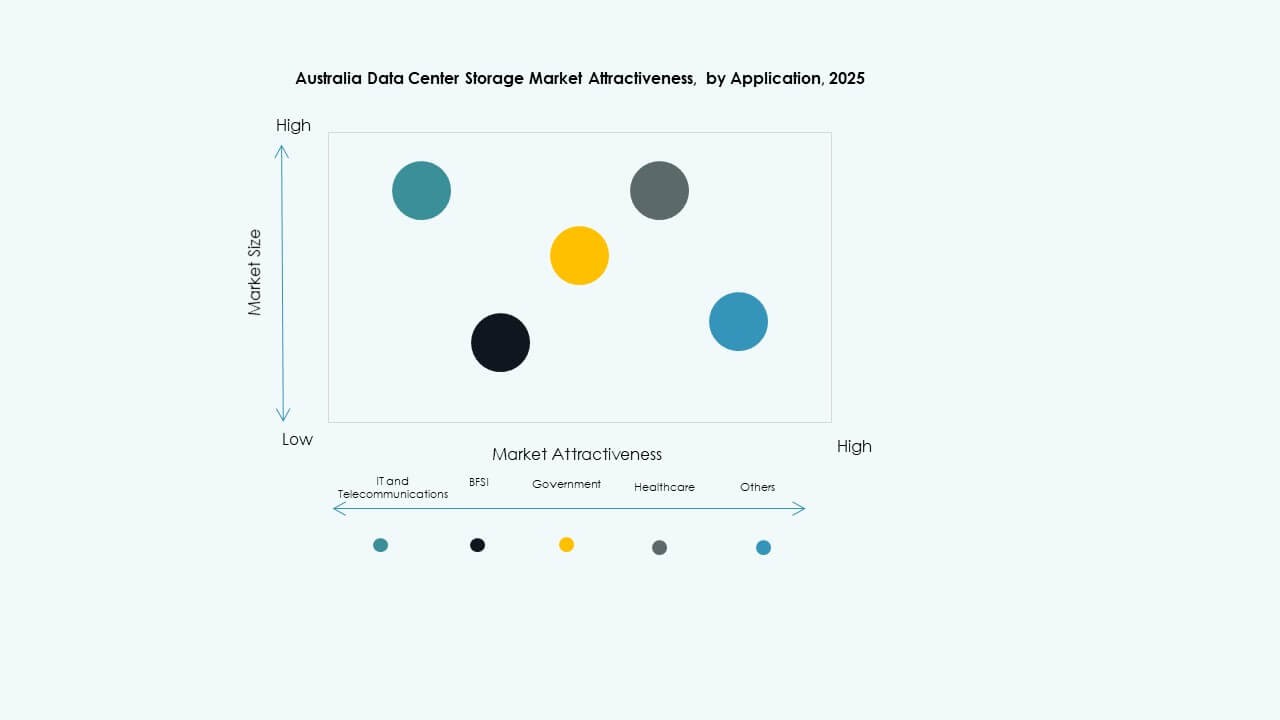

By Application

IT and Telecommunications lead the market, driven by digital transformation and data growth. BFSI needs secure, compliant, and high-availability storage for critical applications. Government and healthcare sectors demand localized, regulated, and encrypted systems. The Australia Data Center Storage Market sees IT, telecom, and BFSI as dominant end-users. Healthcare gains traction due to telemedicine and EMR adoption. Retail and logistics create new demand with e-commerce and last-mile tracking.

Regional Insights

New South Wales Leads with Over 42% Market Share Driven by Sydney’s Hyperscale Ecosystem

Sydney hosts Australia’s largest concentration of data centers, attracting hyperscalers and global cloud platforms. The region benefits from robust connectivity, skilled talent, and policy support. The Australia Data Center Storage Market sees New South Wales as the central hub for Tier-IV facilities and storage clusters. New submarine cable landings further strengthen global access. Local colocation providers scale facilities to meet growing cloud storage demands. The region leads due to enterprise density and government contracts.

- For instance, AirTrunk operates SYD1 and SYD2 data centers in Sydney with capacities exceeding 130 MW and 110 MW respectively. The planned SYD3 campus is designed to deliver over 320 MW, reinforcing Sydney’s status as a major hyperscale hub in Australia.

Victoria Emerges with 26% Market Share Backed by Renewable Power and Fiber Infrastructure

Melbourne supports expanding colocation and edge deployments across suburban areas. Victoria benefits from a strong renewable energy mix, helping meet ESG targets. The Australia Data Center Storage Market sees storage deployments rising near industrial and research zones. Local policies promote data center growth through tax and land incentives. Storage vendors target education, biotech, and finance clusters. Infrastructure-ready zones around Dandenong and Geelong become focal points.

- For instance, Equinix’s ME1 and ME2 data centers in Melbourne host over 220 companies and connect with more than 50 network and cloud providers. These facilities support key sectors including financial services, cloud, and content delivery across the metro region.

Queensland and Western Australia Capture a Combined 18% Share Due to Decentralization

Brisbane, Perth, and regional zones see rising edge and telco-driven investments. The Australia Data Center Storage Market expands in these states due to regional cloud zones, industrial activity, and defense installations. Connectivity upgrades link remote regions to national fiber networks. Mining, logistics, and agriculture verticals create decentralized data needs. Darwin and Hobart gain interest due to cable landings and sovereignty-focused projects. Growth in these states remains steady but highly targeted.

Competitive Insights:

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- IBM Corporation

- NetApp

- Cisco Systems, Inc.

- NEXTDC

- Macquarie Data Centres

- Cohesity, Inc.

- Huawei Technologies Co., Ltd.

- Hitachi Vantara

The Australia Data Center Storage Market features a strong mix of global storage OEMs and domestic infrastructure providers. Dell Technologies, HPE, and IBM lead with broad portfolios covering SAN, NAS, and SDS solutions. NetApp and Cisco add strength in high-performance networking and hybrid storage platforms. Local operators like NEXTDC and Macquarie Data Centres bring facility-level integration and sovereign cloud capabilities. Cohesity and Nutanix compete through software-defined and hyperconverged models. Huawei and Hitachi Vantara offer enterprise-class systems with built-in AI and automation. Market competition is driven by latency reduction, data compliance, and energy efficiency. Vendors differentiate through NVMe adoption, AIOps integration, and modular deployments. Strategic alliances and managed services further shape vendor positions.

Recent Developments:

- In December 2025, NEXTDC signed a Memorandum of Understanding with OpenAI to co‑develop sovereign AI infrastructure in Sydney. This partnership focuses on building a hyperscale AI campus and GPU supercluster at NEXTDC’s S7 site.

- In November 2025, NEXTDC joined the newly established peak body Data Centres Australia to advance digital infrastructure and AI readiness nationwide. This partnership brings hyperscale operators, technology providers, and policy makers together to strengthen sovereign capability and investment coordination.

- In August 2025, Macquarie Data Centres announced a strategic alliance to host the Dell AI Factory with NVIDIA within its IC3 Super West data centre in Sydney. This initiative integrates cutting‑edge AI and storage capabilities with Dell and NVIDIA technologies, enabling secure, sovereign AI and data workloads across Australia.

- In March 2025, Partners Group revealed plans to acquire GreenSquare Data Centres for up to AUD 1.2 billion. This acquisition aims to build next‑generation, sustainable data centres in Sydney, Melbourne, and Perth that support scalable and high‑performance storage infrastructure for global cloud and enterprise customers.