Executive summary:

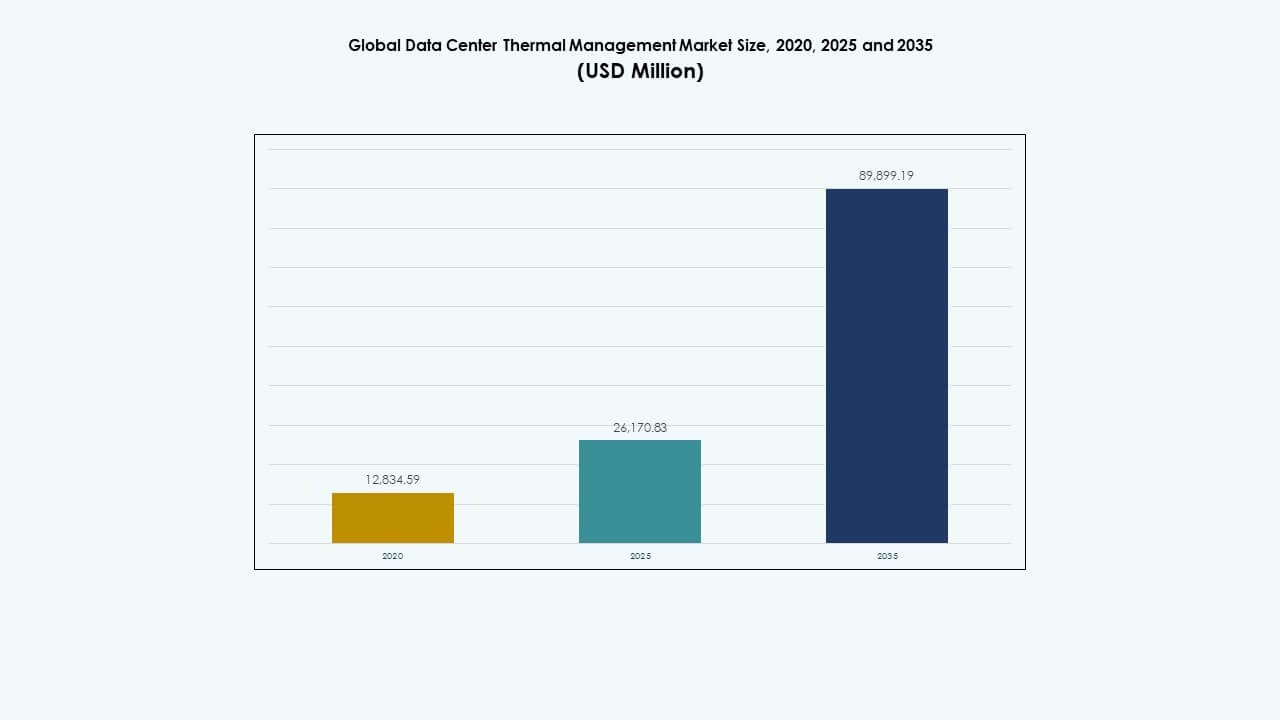

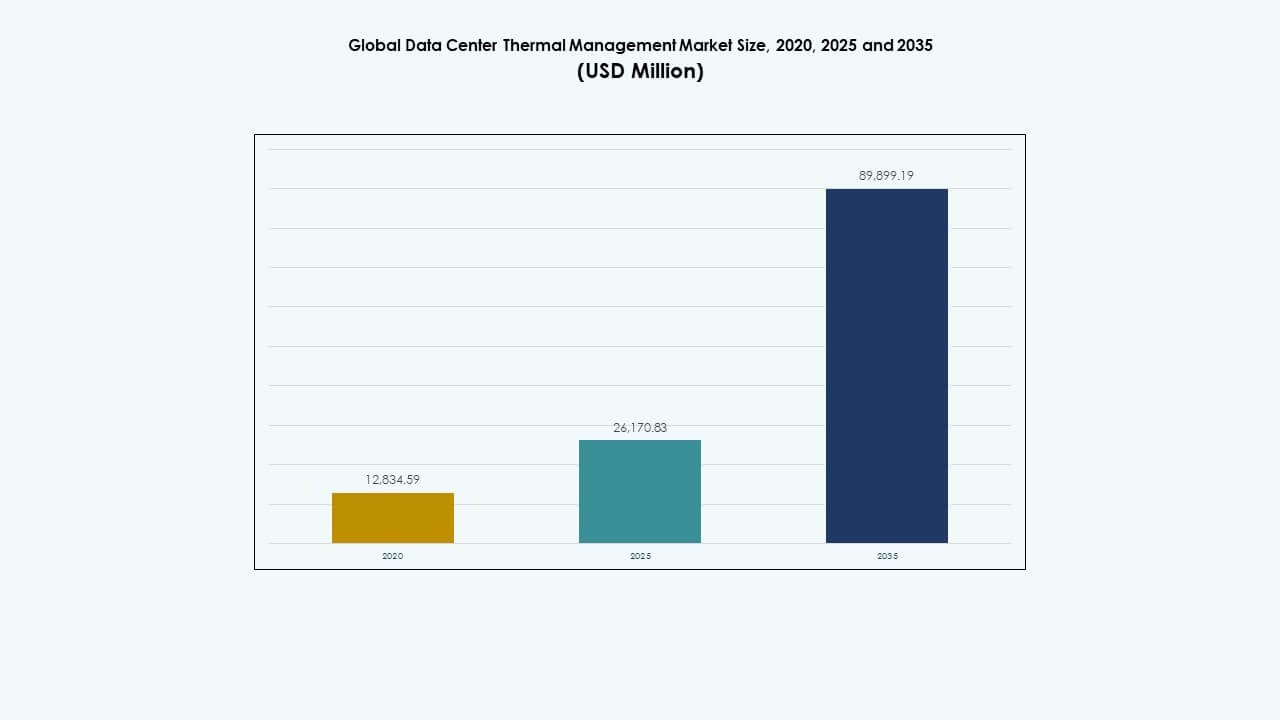

The Global Data Center Storage Market size was valued at USD 12,834.59 million in 2020 to USD 26,170.83 million in 2025 and is anticipated to reach USD 89,899.19 million by 2035, at a CAGR of 13.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Data Center Storage Market Size 2025 |

USD 26,170.83 Million |

| Data Center Storage Market, CAGR |

13.06% |

| Data Center Storage Market Size 2035 |

USD 89,899.19 Million |

Rising deployment of SSDs, NVMe, and hybrid cloud storage solutions accelerates performance efficiency and data accessibility. Organizations prioritize low-latency architecture to support digital transformation and analytics. The Global Data Center Storage Market supports business resilience, operational agility, and data-driven decision-making. Investors see strong long-term value in this sector due to expanding hyperscale and edge data center projects, increasing demand for energy-efficient, intelligent storage solutions.

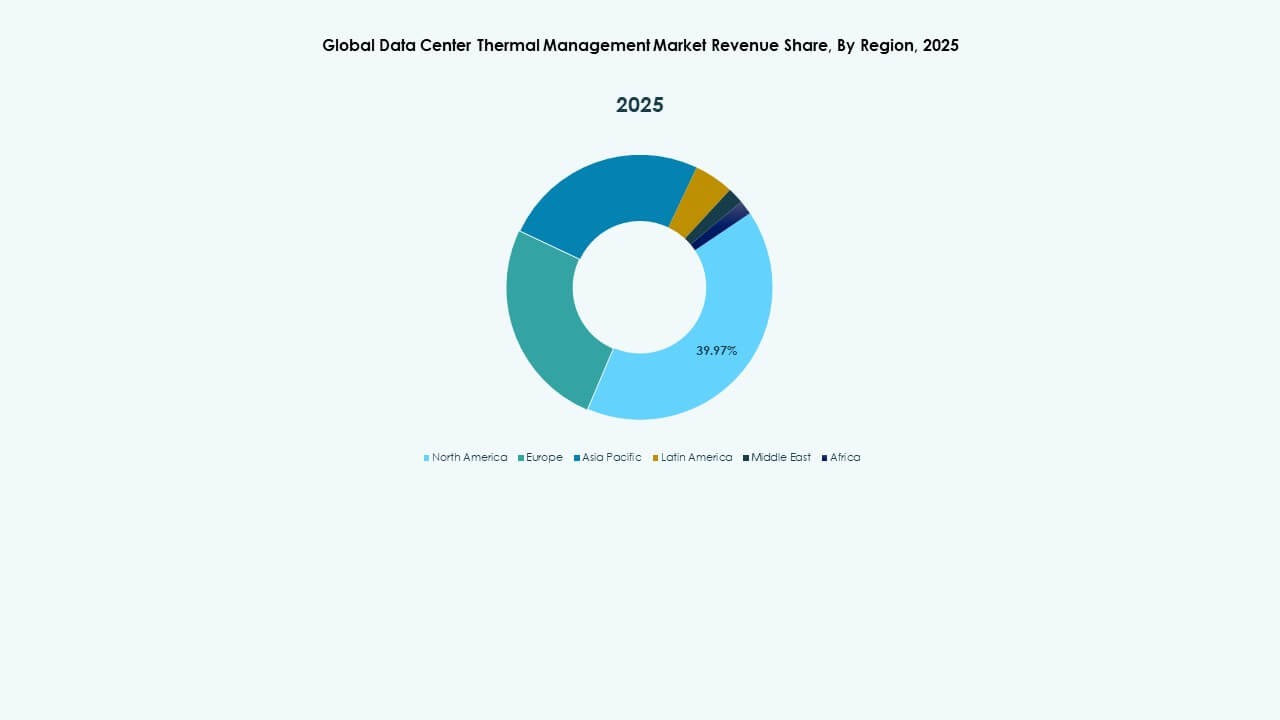

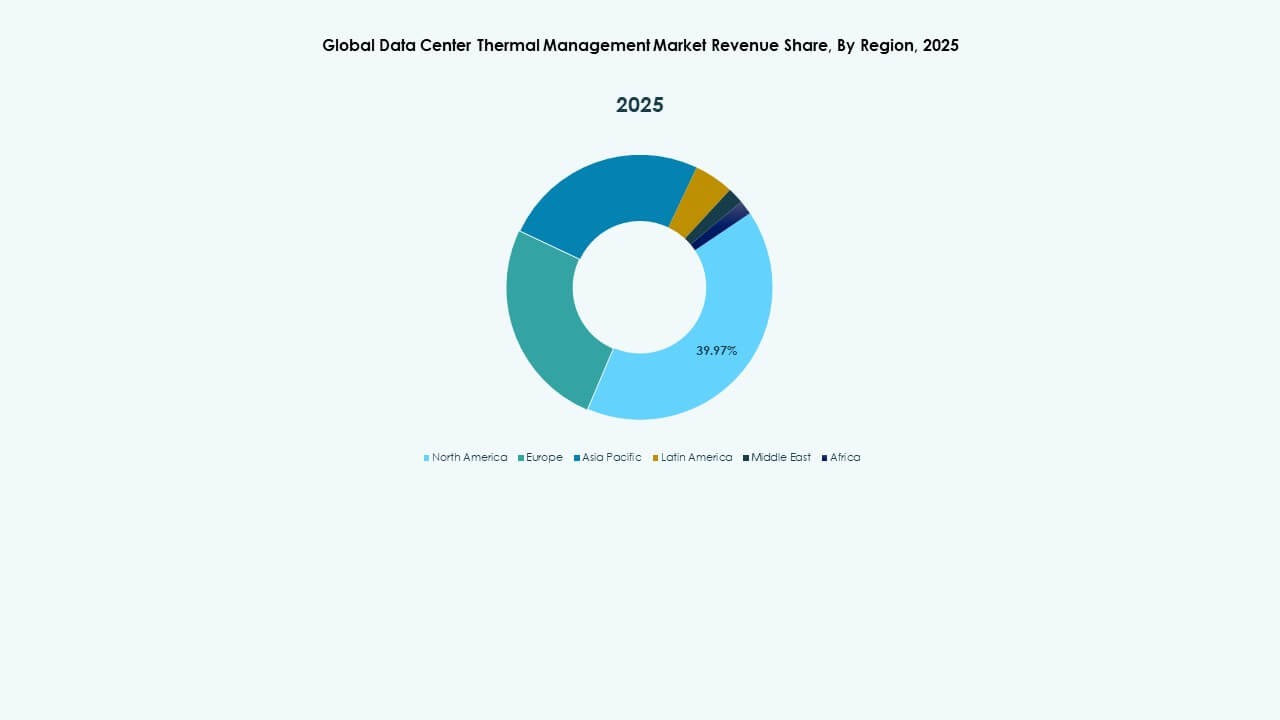

North America dominates the market due to established hyperscale facilities and strong cloud infrastructure. Europe maintains steady growth supported by sustainable storage solutions and strict data compliance standards. Asia-Pacific emerges as the fastest-growing region, driven by rapid digitalization, rising cloud adoption, and government-led data localization efforts. Latin America and the Middle East show steady expansion through increased enterprise IT investments and growing colocation activity across regional markets.

Market Drivers

Market Drivers

Rising Data Volume and Cloud Adoption Boost Storage Demand

The Global Data Center Storage Market grows due to the surge in digital transformation and enterprise data generation. Businesses migrate workloads to cloud and hybrid models, demanding scalable and high-speed storage systems. It supports the shift toward software-defined and virtualized environments. Enterprises invest in resilient architecture to handle expanding datasets from IoT, AI, and analytics platforms. This transition strengthens operational agility and data security. Cloud service providers accelerate the replacement of legacy storage with high-density, low-latency infrastructure. Tiered storage models gain importance for balancing cost and performance. Investors focus on infrastructure expansion that supports modern application ecosystems.

- For instance, Pure Storage’s FlashArray delivers an average data reduction ratio of around 5:1 in real customer environments, achieved through advanced variable block deduplication and compression technologies that optimize storage efficiency across workloads without manual tuning.

Advancements in Storage Technologies Enhance Performance and Efficiency

Next-generation storage technologies drive greater performance and energy efficiency. NVMe, SSD arrays, and all-flash systems redefine data processing speed and reliability. It supports latency-sensitive workloads, improving overall system throughput. Data deduplication, compression, and tiering reduce storage footprint while maintaining cost efficiency. Integration of AI in data management automates capacity planning and failure prediction. Hardware and software convergence increases resource utilization in large-scale facilities. Vendors focus on edge-aligned and composable storage systems. These innovations strengthen competitiveness across enterprise and hyperscale segments.

- For example, NetApp’s latest all-flash storage platforms demonstrate performance improvements with sub-millisecond latency (as low as 250µs) and sustained throughput gains, enabling support for latency-sensitive, high-throughput workloads typical in hyperscale and enterprise data centers.

Strategic Role of Storage in Business Continuity and Resilience

Enterprises prioritize storage for business continuity and disaster recovery. The Global Data Center Storage Market benefits from this shift toward high-availability architecture. It enables replication, redundancy, and secure backup against system failures or cyberattacks. Adoption of multi-zone and multi-region data strategies ensures uptime. Storage networks become central to maintaining compliance and governance requirements. Businesses align data storage with sustainability goals through low-power drives and intelligent cooling systems. Increased awareness of data sovereignty promotes investment in local data facilities. These strategies reinforce operational trust and investor confidence.

Growing Investments in Edge and AI-Driven Infrastructure

Edge computing and AI workloads transform the storage landscape. Data generated at the edge requires local, high-performance storage to reduce latency. It supports autonomous systems, IoT devices, and content delivery applications. AI and machine learning demand massive real-time processing power, driving specialized hardware adoption. Organizations build AI-ready storage infrastructure with optimized throughput. Integration of GPU clusters and memory-centric storage enhances inference speed. Government and enterprise investments in AI infrastructure create sustained market momentum. This trend ensures a continuous cycle of capacity and innovation expansion.

Market Trends

Market Trends

Shift Toward Software-Defined and Hyperconverged Storage

The Global Data Center Storage Market sees strong migration toward software-defined storage (SDS) and hyperconverged solutions. These architectures enable flexible scaling and simplify management across hybrid environments. It reduces dependency on proprietary hardware and improves cost efficiency. Vendors design modular platforms that integrate compute, storage, and networking functions. Automation tools streamline provisioning and workload balancing. Organizations adopt cloud-native storage to align with containerized application deployments. Multi-cloud management becomes critical for performance optimization. This transformation supports dynamic business continuity and workload agility.

Emergence of Green and Energy-Efficient Storage Infrastructure

Sustainability drives innovation across storage design and operations. Data centers adopt low-power SSDs, energy-efficient drives, and liquid-cooled systems. The Global Data Center Storage Market aligns with net-zero carbon goals through intelligent energy management. It focuses on renewable energy sourcing and reduced hardware waste. Technologies like heat reuse and advanced cooling enhance eco-performance. Vendors develop recyclable materials and long-life components to minimize carbon impact. Energy dashboards and AI-powered monitoring help optimize power usage. These initiatives attract eco-conscious investors and enterprise buyers.

Integration of AI and Predictive Analytics in Storage Management

AI integration reshapes how storage is managed and optimized. Predictive analytics tools forecast capacity needs and detect anomalies early. It allows proactive maintenance and improves uptime across data centers. Automated workload distribution enhances efficiency for high-traffic applications. AI models also support security through anomaly detection and threat prediction. Vendors incorporate machine learning to refine storage allocation dynamically. This evolution ensures higher data integrity and service continuity. Enterprises achieve cost savings while improving operational visibility and control.

Expansion of Data Sovereignty and Security Regulations

Tighter data governance and privacy laws shape market operations. The Global Data Center Storage Market adapts to regional compliance mandates, including GDPR and local hosting laws. It drives investment in sovereign cloud and in-country data centers. Security-by-design principles influence storage architecture from inception. Encryption, key management, and zero-trust frameworks become standard practices. Businesses strengthen perimeter defense against breaches and ransomware. Vendors enhance data erasure and audit trails to ensure compliance. These practices build trust among regulated industries such as finance and healthcare.

Market Challenges

Market Challenges

Rising Complexity and Cost of Infrastructure Management

The Global Data Center Storage Market faces rising management complexity with hybrid and multi-cloud ecosystems. Enterprises struggle with data silos and uneven workload distribution. It increases demand for orchestration tools and skilled professionals. Integration across diverse hardware and software layers becomes difficult. Maintenance and energy costs climb with capacity expansion. Vendors confront margin pressure due to rapid technological cycles. Regulatory compliance adds operational overheads for global operators. Limited standardization slows cross-platform interoperability and innovation speed.

Cybersecurity Threats and Data Privacy Risks

Growing cyber threats challenge storage integrity and trust. Ransomware attacks and data breaches target valuable enterprise information. The Global Data Center Storage Market must adapt with layered defense systems. It emphasizes encryption-at-rest, intrusion detection, and continuous monitoring. Increasing attack sophistication demands AI-driven protection and real-time recovery mechanisms. Organizations struggle to balance accessibility with stringent security measures. Cloud storage vulnerabilities expose multi-tenant environments to higher risks. Compliance violations from misconfigurations cause reputational and financial damage.

Market Opportunities

Expanding Edge Data Centers and AI Integration

Edge data centers open new opportunities for scalable, low-latency storage. The Global Data Center Storage Market benefits from AI-enabled automation that processes massive distributed datasets. It allows enterprises to manage workloads closer to users for faster performance. IoT and 5G growth accelerate this demand across manufacturing, telecom, and healthcare. Smart infrastructure deployment supports continuous data capture. Investments in compact modular storage units enhance market penetration. These advances position vendors to serve high-demand, real-time applications effectively.

Growth Potential in Emerging Economies and Green Technology Adoption

Developing regions present strong prospects for next-generation storage deployment. It aligns with rapid cloud adoption and digital transformation in Asia-Pacific, Africa, and Latin America. Governments promote local data hosting and renewable-powered facilities. Vendors expand with cost-effective and energy-efficient systems suited for regional needs. Partnerships with telecom and cloud operators strengthen market reach. Adoption of sustainable hardware and AI-based monitoring attracts global investors. These developments ensure a steady long-term growth outlook for the market.

Market Segmentation:

By Data Center Size

The Global Data Center Storage Market is led by large data centers, accounting for nearly 58% of total revenue in 2024. These facilities store massive datasets from hyperscale cloud providers and large enterprises operating AI, IoT, and analytics workloads. Their demand for scalable and high-speed storage drives investments in SSD arrays, NVMe architecture, and modular racks. Medium data centers follow closely due to hybrid cloud adoption among mid-sized enterprises, while small data centers expand gradually, supported by edge computing and localized data storage initiatives.

By Cooling Technology

Air-based cooling dominates the Global Data Center Storage Market with over 52% share, supported by its cost efficiency and easy integration into existing infrastructure. Direct air and aisle containment methods remain common in traditional data centers. Liquid-based cooling, however, grows fastest due to high-density server racks used in AI and HPC applications. Hybrid cooling approaches combine both systems for optimized performance and energy efficiency. Advanced thermoelectric and phase-change methods emerge for niche, high-heat workloads requiring precise thermal management and sustainability-focused operations.

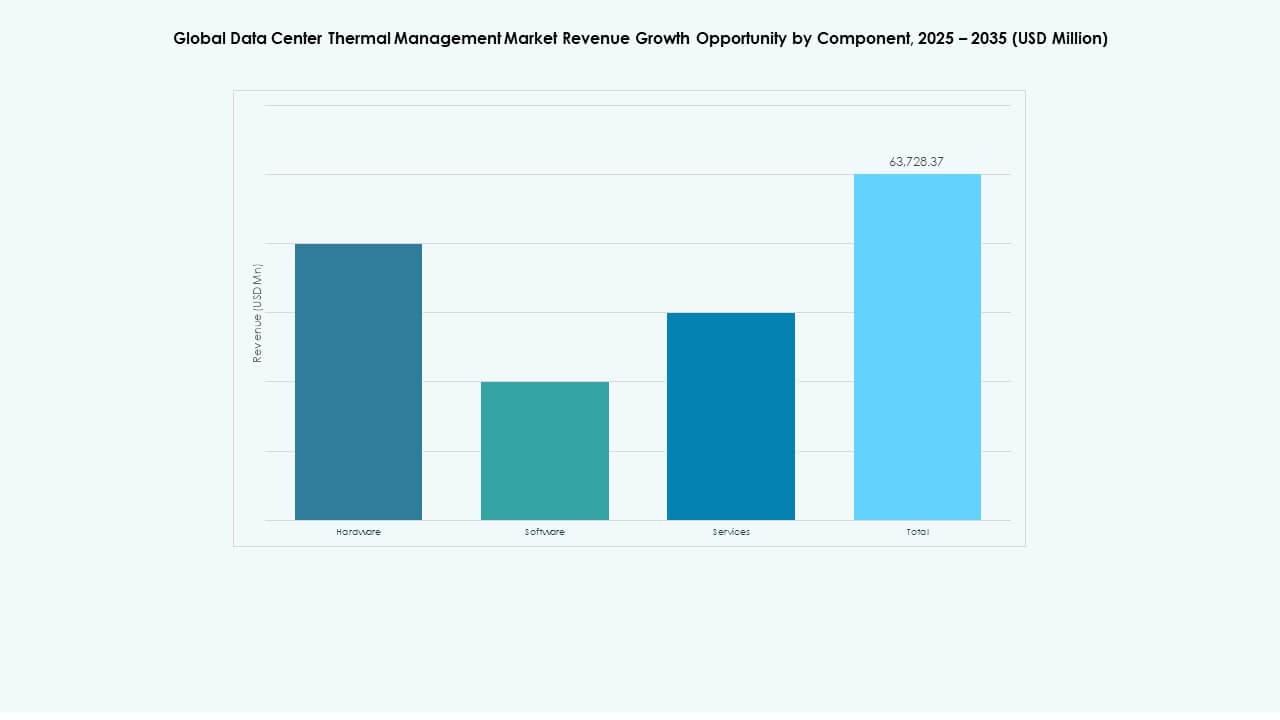

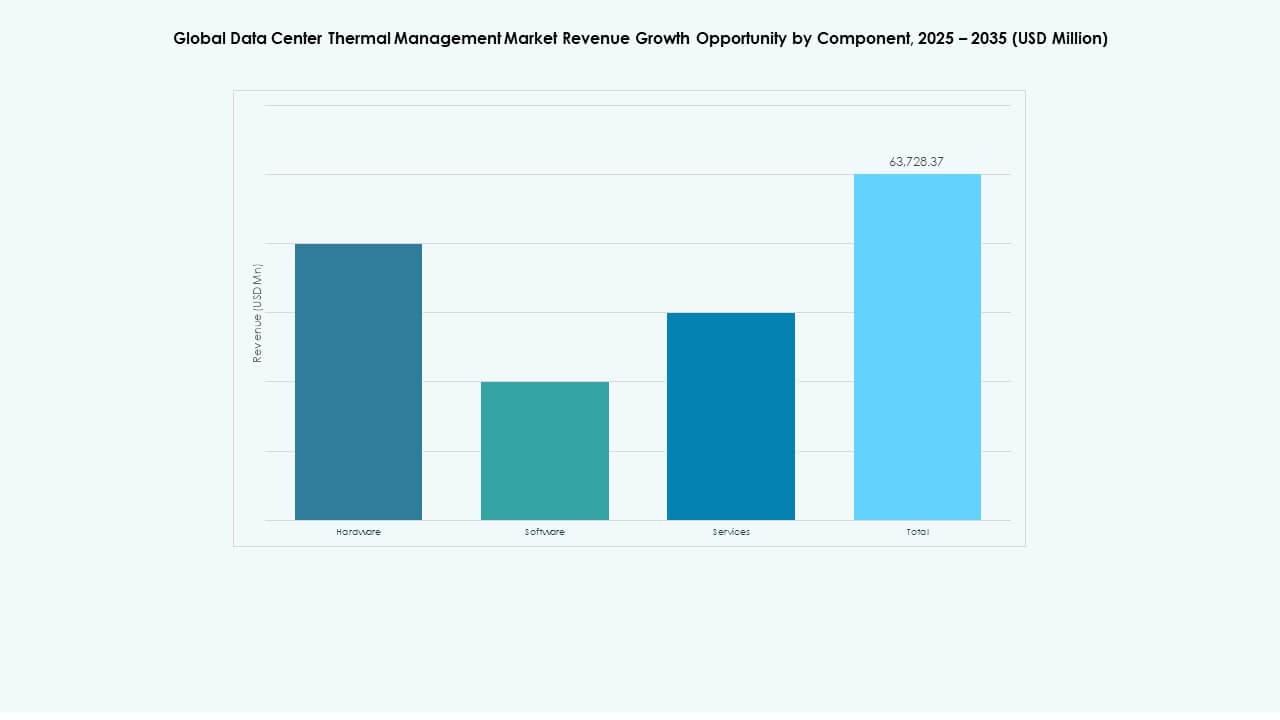

By Component

Hardware represents the largest component share in the Global Data Center Storage Market, exceeding 60% in 2024. Rising deployment of SSDs, HDDs, and modular storage enclosures drives this dominance. Software solutions, including automation and analytics-based storage management, witness significant traction for optimizing capacity and security. Service segments—installation, maintenance, and upgrades—show growing demand as enterprises seek lifecycle support and continuous uptime assurance. The combined synergy of hardware reliability, smart software orchestration, and proactive services defines market competitiveness and operational resilience.

By Hardware

Cooling units and chillers lead the hardware category within the Global Data Center Storage Market, holding around 35% share. These systems maintain optimal temperature for high-capacity drives and processors. Heat exchangers and airflow management devices follow, supporting effective thermal distribution and energy savings. Infrastructure components such as piping and distribution channels ensure efficient coolant circulation in liquid-based systems. Vendors integrate sensor-driven heat sinks to enhance reliability under intensive workloads, ensuring stable data processing and system longevity in storage-heavy environments.

By Software

AI thermal optimization software leads adoption within the Global Data Center Storage Market, driving predictive cooling and load balancing for high-performance environments. DCIM dashboards provide real-time visibility into temperature, humidity, and storage utilization trends. CFD simulation tools enable modeling of airflow and thermal dynamics before hardware deployment, minimizing inefficiencies. BMS thermal modules integrate facility management for seamless control of power and cooling operations. The software segment ensures automation, efficiency, and compliance, turning thermal management into a data-driven operation.

By Services

Preventive maintenance holds the leading share within the Global Data Center Storage Market services segment. Organizations prioritize reliability through predictive diagnostics and equipment longevity programs. Installation and commissioning services remain critical for greenfield data center setups. Monitoring as a Service gains traction with cloud-based diagnostics and AI-powered performance tracking. Retrofits and upgrades help existing facilities transition to advanced cooling and storage technologies. Service diversification improves operational efficiency, scalability, and environmental sustainability, fostering strong growth potential for specialized service providers.

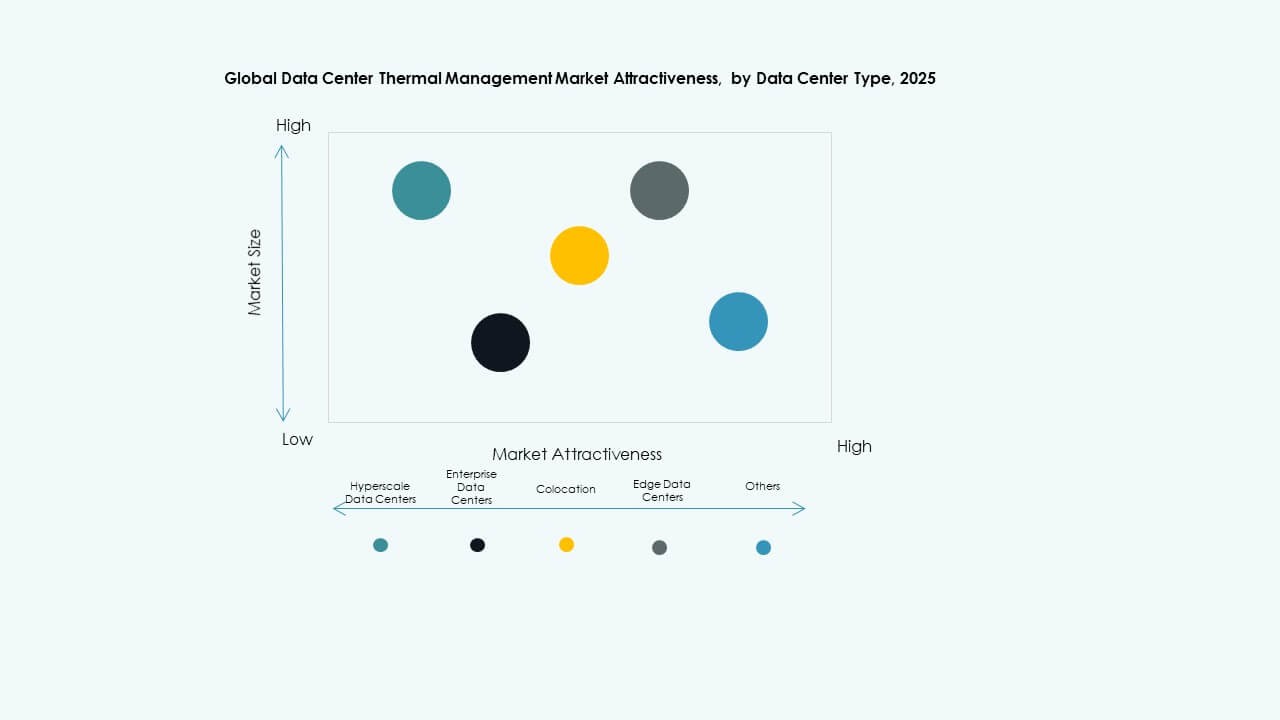

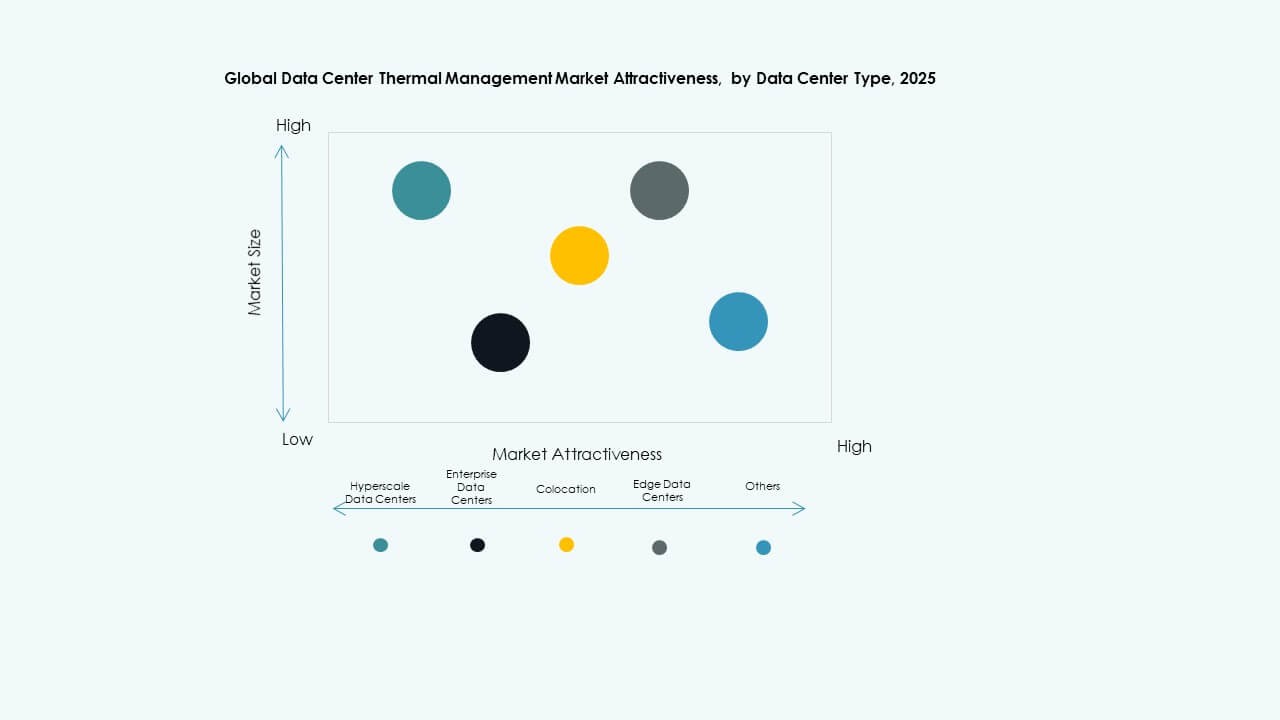

By Data Center Type

Hyperscale data centers dominate the Global Data Center Storage Market, contributing over 60% of total revenue. These centers require vast, high-speed storage to support cloud computing, AI, and streaming platforms. Enterprise data centers maintain stable demand through hybrid and private cloud models. Colocation providers expand rapidly to meet outsourced storage needs from SMBs and global corporations. Edge and micro data centers show the highest growth rate, driven by IoT, latency reduction, and real-time analytics at localized nodes.

By Structure

Room-based cooling leads the Global Data Center Storage Market structure segmentation with over 45% share due to its scalability and established infrastructure. Row-based cooling follows, driven by modularity and efficiency in mid-size facilities. Rack-based cooling gains momentum in high-density environments, especially for AI and HPC storage systems. The shift toward micro-modular and adaptive cooling designs supports flexible capacity expansion. Structural optimization across these layers ensures consistent temperature control, extended equipment life, and reduced total cost of ownership.

Regional Insights:

North America

The North America Global Data Center Storage Market size was valued at USD 5,264.75 million in 2020 to USD 10,460.48 million in 2025 and is anticipated to reach USD 35,730.43 million by 2035, at a CAGR of 13.00% during the forecast period. North America holds the largest market share of around 38% in 2024. It benefits from a mature digital ecosystem and strong adoption of cloud computing, AI, and enterprise data services. Major hyperscale operators, including AWS, Microsoft, and Google, continue to expand storage capacity. The region shows strong investment in NVMe, flash arrays, and hybrid storage technologies. Government initiatives on data security and sustainability support infrastructure growth. It remains the global benchmark for energy-efficient, high-performance data centers. The U.S. drives innovation, while Canada strengthens green data facility deployment.

- For example, AWS announced detailed real-time performance statistics for EC2 Nitro-based instance store NVMe volumes, providing 11 comprehensive metrics at one-second granularity including queue length, IOPS, throughput, and detailed latency histograms. These metrics enable precise optimization of workloads and application I/O patterns on NVMe storage.

Europe

The Europe Global Data Center Storage Market size was valued at USD 3,566.73 million in 2020 to USD 6,807.03 million in 2025 and is anticipated to reach USD 21,926.41 million by 2035, at a CAGR of 12.34% during the forecast period. Europe accounts for about 27% of global market share in 2024. It grows steadily due to data sovereignty policies and expansion of edge and colocation facilities. Enterprises in Germany, the UK, and France lead adoption of cloud storage and virtualization. EU initiatives promoting sustainable infrastructure accelerate green storage investments. Increasing demand for AI-enabled data management and analytics also strengthens regional growth. Companies adopt SSDs and intelligent cooling for efficiency gains. Regional cooperation on renewable energy sourcing supports low-carbon data storage strategies. It remains a key hub for compliance-driven, energy-efficient storage development.

Asia Pacific

The Asia Pacific Global Data Center Storage Market size was valued at USD 2,836.44 million in 2020 to USD 6,595.05 million in 2025 and is anticipated to reach USD 25,526.88 million by 2035, at a CAGR of 14.39% during the forecast period. Asia Pacific holds approximately 25% of the global market in 2024 and represents the fastest-growing region. Rapid digitalization in China, India, Japan, and South Korea drives expansion of hyperscale and colocation data centers. Cloud migration, 5G rollout, and rising AI workloads fuel large-scale storage demand. Domestic and international firms invest in new facilities to support regional data growth. Governments promote data localization and green energy initiatives. It benefits from competitive construction costs and a young digital economy. Growth in manufacturing and fintech sectors further enhances demand for resilient storage infrastructure.

- For instance, Samsung’s PM9A3 NVMe SSDs widely used in large Asian hyperscale data centers deliver sequential read speeds up to 7,000 MB/s and write speeds up to 5,000 MB/s, accelerating AI workload processing and cloud migration in the region.

Latin America

The Latin America Global Data Center Storage Market size was valued at USD 639.16 million in 2020 to USD 1,282.37 million in 2025 and is anticipated to reach USD 4,000.51 million by 2035, at a CAGR of 11.98% during the forecast period. Latin America contributes roughly 6% of the global market share in 2024. Brazil, Mexico, and Chile lead with growing cloud and colocation adoption. The expansion of 5G networks and local data centers supports digital transformation. It experiences steady migration toward SSD and hybrid storage platforms. Regional enterprises invest in backup and disaster recovery solutions. Energy efficiency and renewable sourcing gain importance in new projects. Increasing government support for data localization strengthens growth potential. It attracts global hyperscale providers establishing regional cloud availability zones.

Middle East

The Middle East Global Data Center Storage Market size was valued at USD 345.25 million in 2020 to USD 672.59 million in 2025 and is anticipated to reach USD 1,856.42 million by 2035, at a CAGR of 10.56% during the forecast period. The region holds close to 3% of global market share in 2024. Strong data infrastructure investments in the UAE and Saudi Arabia lead market growth. Expansion of smart city projects and national digital transformation programs drives demand. Enterprises in energy, banking, and logistics sectors boost private cloud deployment. It sees growing preference for modular, energy-efficient storage systems. Government-backed initiatives to host regional cloud zones enhance resilience. Data localization regulations encourage the development of new facilities. Regional partnerships with global IT firms strengthen market competitiveness.

Africa

The Africa Global Data Center Storage Market size was valued at USD 182.25 million in 2020 to USD 353.31 million in 2025 and is anticipated to reach USD 858.54 million by 2035, at a CAGR of 9.30% during the forecast period. Africa accounts for nearly 1% of global market share in 2024. Growing digital inclusion and enterprise modernization drive early-stage investments. South Africa, Nigeria, and Egypt lead with hyperscale and colocation data center projects. Cloud adoption expands rapidly among telecom and public sector entities. It faces challenges related to power availability and connectivity costs. Investments in renewable-powered facilities improve operational sustainability. Global technology firms increase presence through partnerships with local operators. Rising smartphone and fintech adoption accelerates storage infrastructure growth across major economies.

Competitive Insights:

Competitive Insights:

- Airedale International Air Conditioning Ltd.

- Asetek, Inc.

- Black Box Corporation

- Canovate Group

- Coolcentric

- Daikin Industries Ltd.

- Delta Electronics, Inc.

- Eaton Corporation

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- Johnson Controls International plc

- Liebherr-International AG

- Mitsubishi Electric Corporation

- Munters Group AB

- Nortek Air Solutions, LLC

- Rittal GmbH & Co. KG

- Schneider Electric

- Stulz GmbH

- Trane Technologies plc

- Vertiv Group Corp.

- Others

The competitive field in the Global Data Center Storage Market features a mix of established infrastructure vendors, thermal-management specialists, and integrated solution providers. Companies like Schneider Electric, Eaton, and Vertiv dominate thanks to broad portfolios covering power, cooling, and storage infrastructure — delivering turnkey solutions for hyperscale and enterprise data centers. Firms such as Fujitsu and Huawei remain strong through hardware depth and global reach. Smaller and niche players bring specialized cooling or modular rack innovations that target edge or high-density workloads. Market competition centers on delivering high reliability, energy efficiency, and scalability under expanding data demand. It rewards firms that combine storage performance with efficient thermal and power systems, giving investors clarity on long-term infrastructure value.

Recent Developments:

- In December 2025, Wasabi Technologies released a new feature called Covert Copy intended to protect critical backup data against external and internal threats, emphasizing increased data security for backup solutions within data center storage environments.

- In September 2025, HiTHIUM, a global provider of integrated energy storage solutions, launched its AI data center energy storage system (ESS) portfolio at RE+ 2025. The products include the ∞Power 6.25MWh 8-hour long-duration BESS, ∞Power N2.28MWh 1-hour BESS, and a lifespan assessment model specifically designed for AI data center ESS.

Market Drivers

Market Drivers Market Trends

Market Trends Market Challenges

Market Challenges

Competitive Insights:

Competitive Insights: