Executive summary:

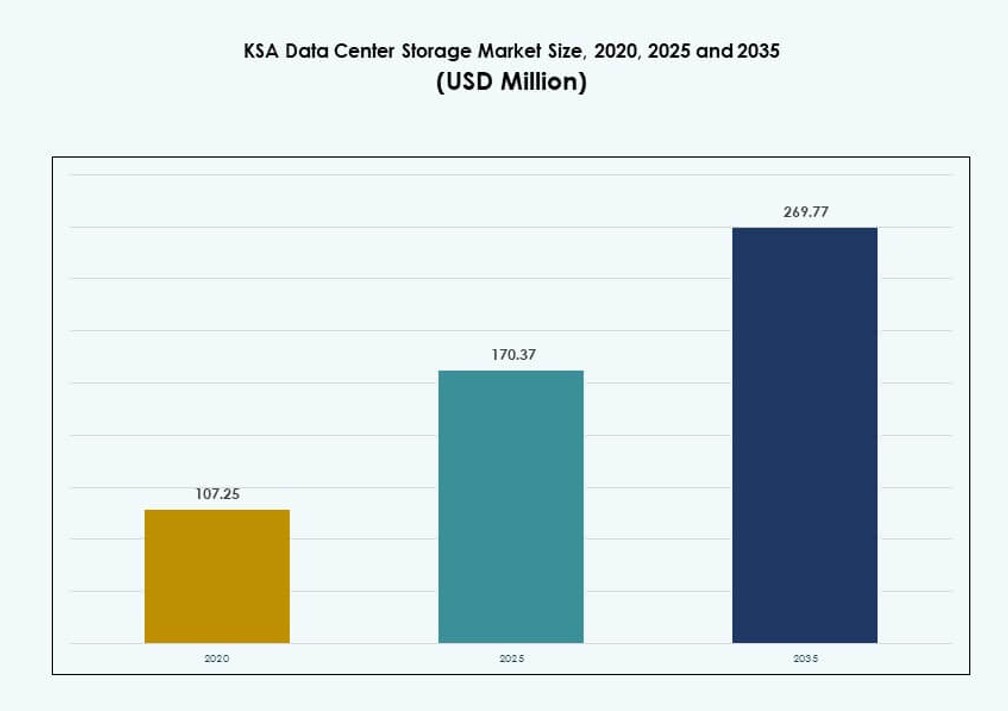

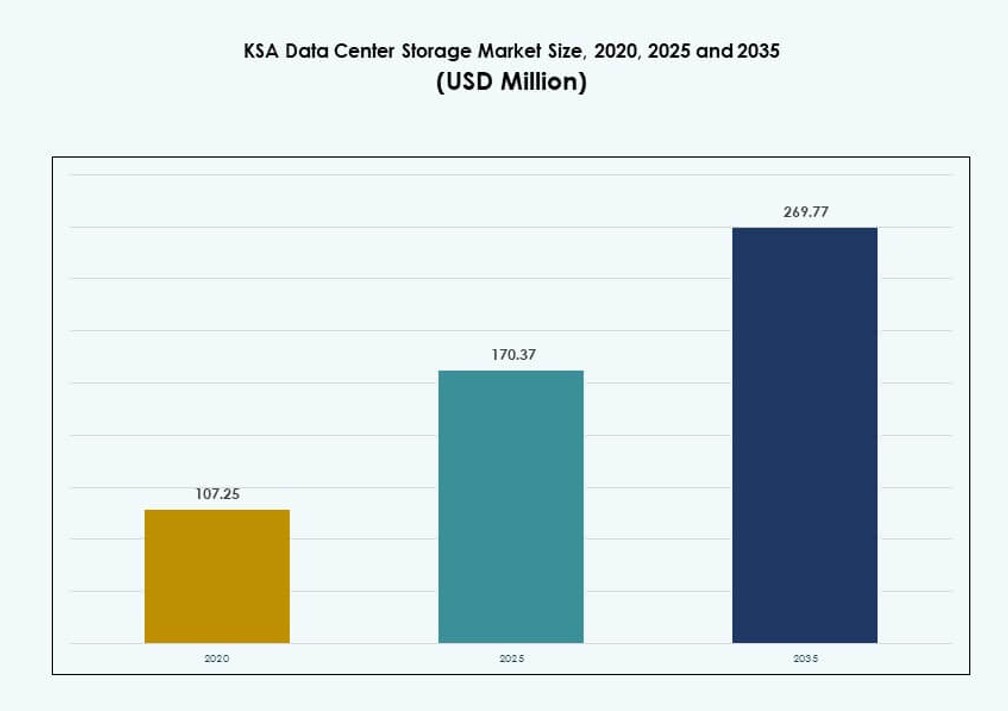

The KSA Data Center Storage Market size was valued at USD 107.25 million in 2020 to USD 170.37 million in 2025 and is anticipated to reach USD 269.77 million by 2035, at a CAGR of 4.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| KSA Data Center Storage Market Size 2025 |

USD 170.37 Million |

| KSA Data Center Storage Market, CAGR |

4.56% |

| KSA Data Center Storage Market Size 2035 |

USD 269.77 Million |

The market is growing steadily due to rising demand for secure, scalable, and locally hosted data storage solutions. Government initiatives under Vision 2030 are pushing digital transformation, cloud adoption, and AI workloads, all of which require robust infrastructure. Enterprises are transitioning from legacy systems to modern, hybrid environments with all-flash and software-defined storage. This shift enhances performance, compliance, and operational resilience. The market plays a vital role in enabling digital services, enterprise growth, and data governance frameworks for both public and private sectors.

Riyadh leads the market due to high enterprise density, government-led digital projects, and availability of hyperscale infrastructure. Jeddah and Dammam are emerging as secondary hubs, driven by industrial activity, subsea cable connectivity, and edge deployments. These cities are investing in data center upgrades to support regional services and AI computing needs. The geographical distribution reflects a national push for balanced infrastructure development, ensuring lower latency and broader access across key economic zones.

Market Dynamics:

Market Drivers

Vision 2030 and Digital Economy Goals Driving Infrastructure Investment

Saudi Arabia’s Vision 2030 agenda plays a major role in accelerating data center development. The government prioritizes digital transformation across sectors, pushing large enterprises to modernize IT infrastructure. This shift is driving adoption of scalable, secure, and compliant storage systems. The demand for localized storage is growing due to national data sovereignty goals. Public and private sectors both invest in hybrid cloud and edge computing environments. Banks, telecom providers, and healthcare institutions are updating legacy systems. The KSA Data Center Storage Market benefits from the country’s push for smart governance and e-services. It positions the sector as a strategic enabler for long-term growth. The market is drawing strong interest from global technology vendors and local system integrators.

Growth in Artificial Intelligence and Machine Learning Applications Requiring High-Performance Storage

Rising AI and machine learning deployment in Saudi Arabia increases demand for high-throughput storage. AI workloads require low-latency systems that can manage structured and unstructured data. Real-time processing for language models, analytics, and video surveillance is accelerating infrastructure upgrades. Enterprises seek NVMe-based flash arrays to support demanding AI environments. Local startups and public institutions adopt AI in healthcare, energy, and logistics. The KSA Data Center Storage Market benefits from increased investment in AI-focused compute and storage clusters. Storage systems must handle high input/output operations and offer horizontal scalability. This demand supports long-term adoption of modern storage types. The need for robust and intelligent infrastructure makes the market vital for tech-driven transformation.

- For instance, Humain, Saudi Arabia’s state‑backed AI company, has begun developing its first 50 MW data center that will host 18,000 NVIDIA GPUs to support sovereign AI compute workloads. The facility represents the initial phase of a broader AI infrastructure rollout aimed at building large‑scale AI data center capacity within the Kingdom.

Cloud and Edge Storage Adoption Accelerating Due to Regulatory Compliance and Application Growth

Cloud-first strategies and expanding mobile applications are boosting storage demand across Saudi Arabia. Government-mandated cloud adoption policies for public entities are pushing investments into both on-premise and cloud storage. Enterprises operating multi-region setups rely on edge nodes and local cloud zones for performance and compliance. The KSA Data Center Storage Market is shaped by this dual need for low-latency access and centralized analytics. Storage providers must ensure integration across hybrid and multi-cloud environments. Workloads such as content delivery, IoT analytics, and smart city systems push the boundaries of traditional infrastructure. Growing application diversity adds pressure on storage scalability. Regulatory frameworks also guide data residency and encryption features across storage platforms.

Large Enterprise and Government Sector Demand for Tiered and Encrypted Storage Solutions

Government agencies and top-tier enterprises lead demand for secure, tiered storage solutions. Strategic sectors like energy, defense, and banking require audit-ready, encrypted data systems. Tiered storage helps optimize costs across hot, warm, and cold data categories. Vendors offer secure data lifecycle management to meet stringent policies. The KSA Data Center Storage Market reflects this demand with rising investments in modular and compliant systems. Backup, disaster recovery, and ransomware protection are also becoming core features. Enterprises need seamless storage orchestration for compliance and operational resilience. Decision-makers consider both cost and performance when choosing platforms. This drives adoption of solutions with strong access control and audit mechanisms.

- For instance, DataVolt and HUMAIN unveiled projects targeting over 1 GW combined capacity with focus on secure, scalable storage.

Market Trends

Shift Toward Software-Defined Storage to Improve Scalability and Cost Efficiency

Software-defined storage (SDS) is gaining adoption across Saudi enterprises aiming to decouple hardware from management layers. It allows organizations to manage mixed storage environments with centralized tools. SDS improves cost visibility, automation, and scalability in complex environments. It helps integrate cloud-native workloads with legacy storage systems. Enterprises seeking flexibility in vendor selection favor this trend. The KSA Data Center Storage Market sees more deployments of SDS in colocation and private cloud facilities. This model supports infrastructure modernization without major physical upgrades. Open-source and commercial SDS platforms both find growing adoption. SDS is also a foundation for future-ready storage infrastructure across sectors.

Rise in NVMe Storage Deployment for Latency-Sensitive and High-Performance Applications

Non-Volatile Memory Express (NVMe) drives significant changes in storage performance across hyperscale and enterprise environments. It enables faster data transfer and lower latency compared to traditional protocols. Organizations running AI inference, fraud detection, and analytics adopt NVMe-based storage. In the KSA Data Center Storage Market, NVMe helps accelerate application workloads. Telecom operators and financial institutions use NVMe to handle transaction-heavy environments. Edge computing nodes also integrate NVMe for rapid data access. Adoption of NVMe over Fabrics (NVMe-oF) extends its benefits over distributed infrastructure. NVMe support is becoming standard in Tier III and IV facilities. It improves energy efficiency while boosting throughput.

Convergence of Backup, Archival, and Cyber Recovery into Unified Storage Architecture

Enterprises are consolidating backup, archival, and recovery workloads into unified storage frameworks. This shift reduces operational complexity and improves security posture. Modern storage systems integrate cyber resilience features like immutability and ransomware protection. The KSA Data Center Storage Market supports this trend through growing demand for enterprise continuity. Multi-tier backup, long-term retention, and air-gapped copies are gaining traction. Vendors are embedding AI to detect anomalies in data access patterns. Regulatory pressures also influence how archival and audit data is stored. Unified platforms simplify compliance reporting and incident response. Organizations value storage that supports recovery objectives across use cases.

Deployment of Storage-as-a-Service Models to Enhance Flexibility and Reduce Capex

Storage-as-a-Service (STaaS) offerings are gaining relevance for enterprises shifting from CapEx to OpEx models. STaaS provides scalability and on-demand provisioning of capacity, reducing upfront investment. Organizations prefer pay-per-use models to optimize budget. The KSA Data Center Storage Market sees uptake in STaaS by SMEs and digital-first companies. Cloud providers and MSPs are expanding STaaS portfolios in metro cities. It helps reduce hardware lifecycle costs and maintenance overhead. Data migration and integration services often accompany STaaS contracts. Enterprises rely on SLAs for guaranteed uptime and security. This trend fosters broader storage access across mid-sized organizations.

Market Challenges

Fragmented Data Management Across Hybrid Environments Creating Integration and Visibility Gaps

Organizations managing hybrid and multi-cloud environments face challenges in maintaining visibility and control. Fragmented data across on-premise, cloud, and edge locations limits centralized governance. Tools that support unified storage orchestration remain under-deployed in many setups. The KSA Data Center Storage Market faces complexity from diverse application demands and data silos. IT teams struggle to enforce consistent security policies across platforms. This leads to inefficiencies in backup, compliance, and lifecycle management. Integrating legacy systems with modern APIs requires custom development. Inconsistent vendor standards add another layer of friction. These issues slow digital transformation efforts across enterprises.

Skilled Workforce Shortage and Vendor Dependency Limiting Operational Agility

The market faces a skilled labor gap in storage system deployment and orchestration. Enterprises depend heavily on vendors for configuration, monitoring, and maintenance. This dependency increases cost and reduces agility in scaling or troubleshooting environments. The KSA Data Center Storage Market requires certified professionals to support SDS, NVMe, and hybrid platforms. Talent shortage limits internal capacity to innovate or customize deployments. Cybersecurity risks grow without in-house oversight on sensitive storage layers. Vendor lock-in also restricts flexibility in switching platforms. Public-private partnerships for upskilling can help reduce this gap. Until then, adoption may lag in smaller or resource-constrained organizations.

Market Opportunities

Localization and Sovereign Cloud Policies Opening Opportunities for Regional Storage Providers

National data localization laws are reshaping how enterprises procure and manage storage. Organizations prioritize providers with in-country facilities and compliance certifications. This trend creates space for local players offering sovereign cloud platforms. The KSA Data Center Storage Market supports these shifts with new investments in Tier III+ infrastructure. Edge deployments for government and defense workloads are gaining visibility. Local partnerships provide an edge in public tenders and regulatory contracts.

IoT, Smart City, and Surveillance Projects Requiring Real-Time Storage Capabilities

Large-scale smart city initiatives require real-time storage systems that support video analytics, traffic data, and public safety applications. These use cases push demand for low-latency storage with high IOPS and durability. The KSA Data Center Storage Market benefits from government funding in mobility, utilities, and public infrastructure digitization. Opportunities exist for edge-native and ruggedized storage deployments across urban and remote zones.

Market Segmentation

By Storage Type

Traditional storage holds a major share due to its wide usage in legacy systems and stable workloads. However, all-flash storage is rapidly gaining traction, driven by low latency and high throughput needs. Hybrid storage solutions attract enterprises needing both performance and cost-efficiency. In the KSA Data Center Storage Market, demand for hybrid setups grows among government and BFSI sectors. Vendors offer tiered systems to balance performance with archival needs.

By Storage Deployment

Storage Area Network (SAN) systems dominate due to their scalability and high-speed connectivity in enterprise-grade applications. Network-Attached Storage (NAS) sees adoption in media, content, and shared file environments. Direct-Attached Storage (DAS) is preferred for small deployments and edge nodes. In the KSA Data Center Storage Market, SAN remains the backbone for mission-critical workloads. Organizations focus on combining performance with manageability in centralized infrastructures.

By Component

Hardware contributes the largest share, driven by capital investment in racks, drives, and controllers. However, software components are rising steadily due to SDS platforms and storage orchestration tools. In the KSA Data Center Storage Market, hardware remains dominant for on-premise builds. Yet software’s role expands with hybrid deployments requiring intelligent management, deduplication, and automation capabilities.

By Medium

Solid-State Drives (SSD) lead adoption in performance-critical workloads across banking, AI, and telecom sectors. Hard Disk Drives (HDD) remain vital for archival and bulk data storage. Tape storage has niche use in ultra-long-term backup scenarios. In the KSA Data Center Storage Market, SSDs dominate due to energy efficiency and NVMe compatibility. Enterprises balance SSD and HDD to optimize storage costs.

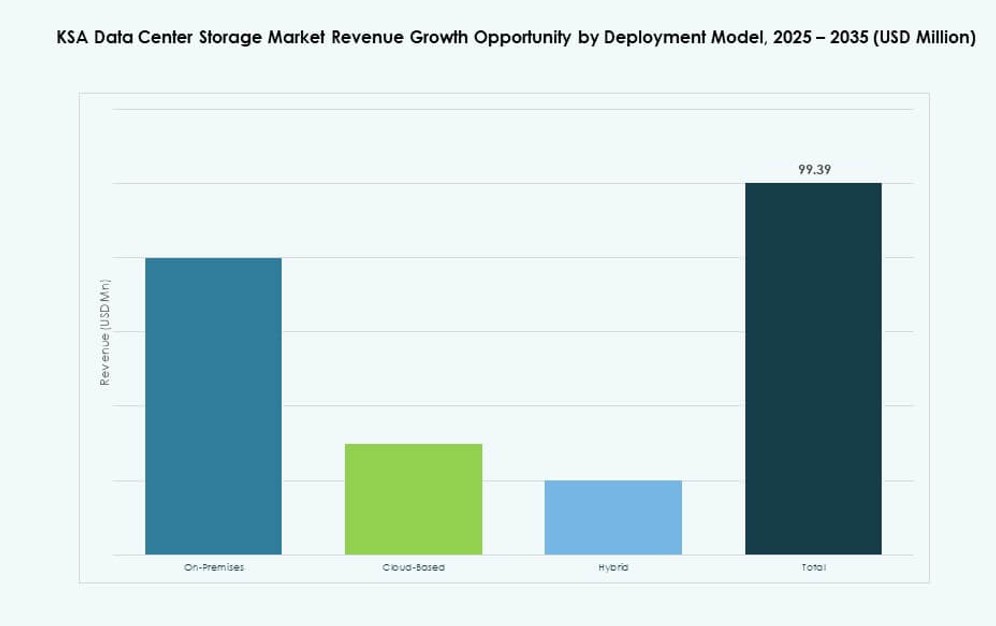

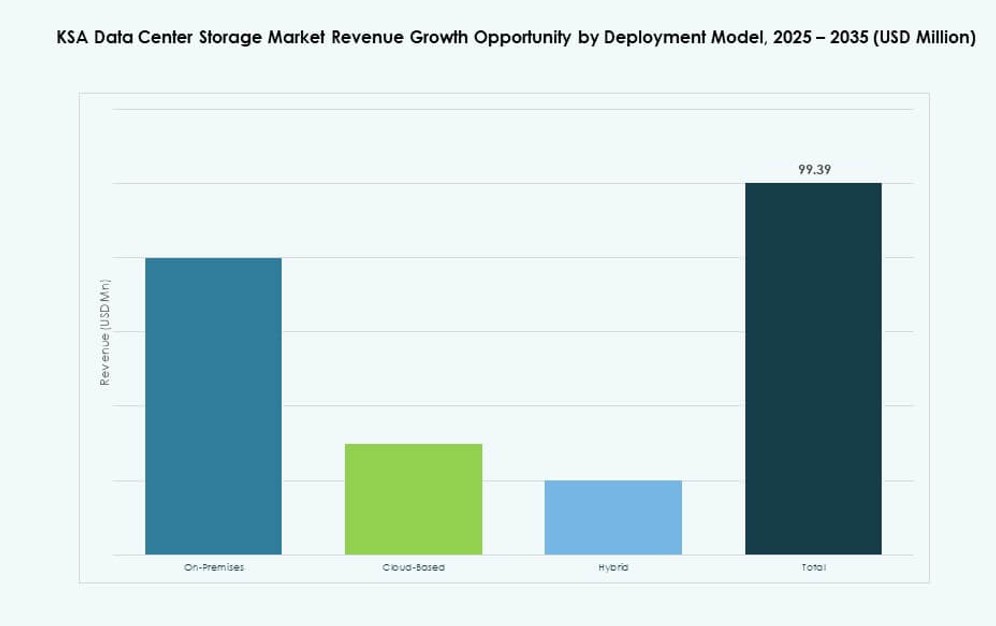

By Deployment Model

On-premises deployments dominate due to compliance mandates in government and finance sectors. However, cloud-based models see rapid growth, particularly among startups and mid-sized firms. Hybrid models gain traction where performance and flexibility are equally important. The KSA Data Center Storage Market reflects this mix, with growing hybrid infrastructure in hyperscale and regional facilities. Demand rises for dynamic provisioning and cross-platform data control.

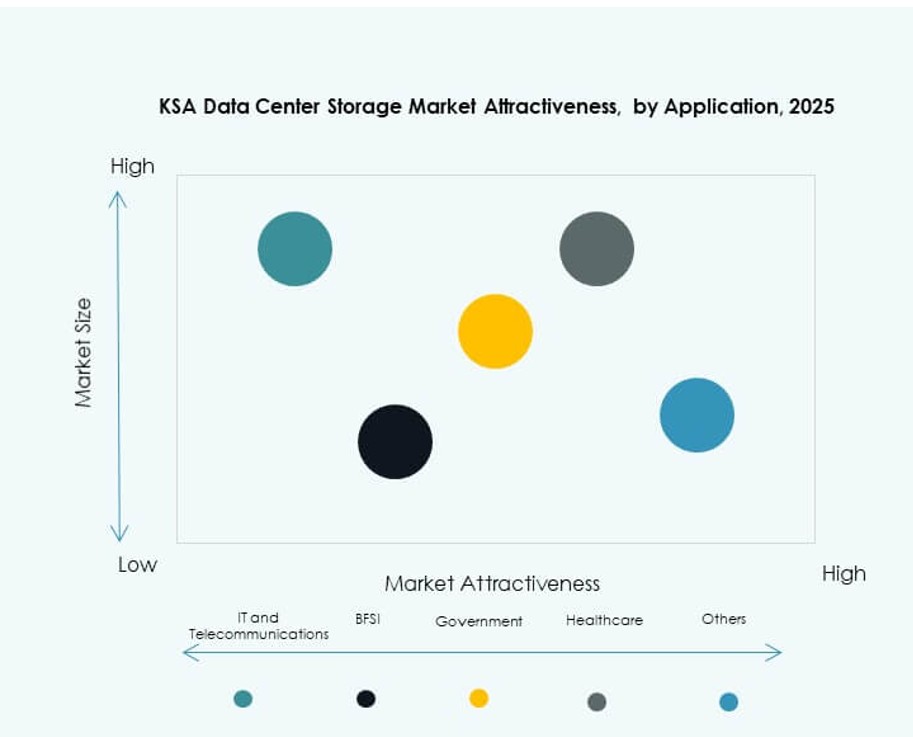

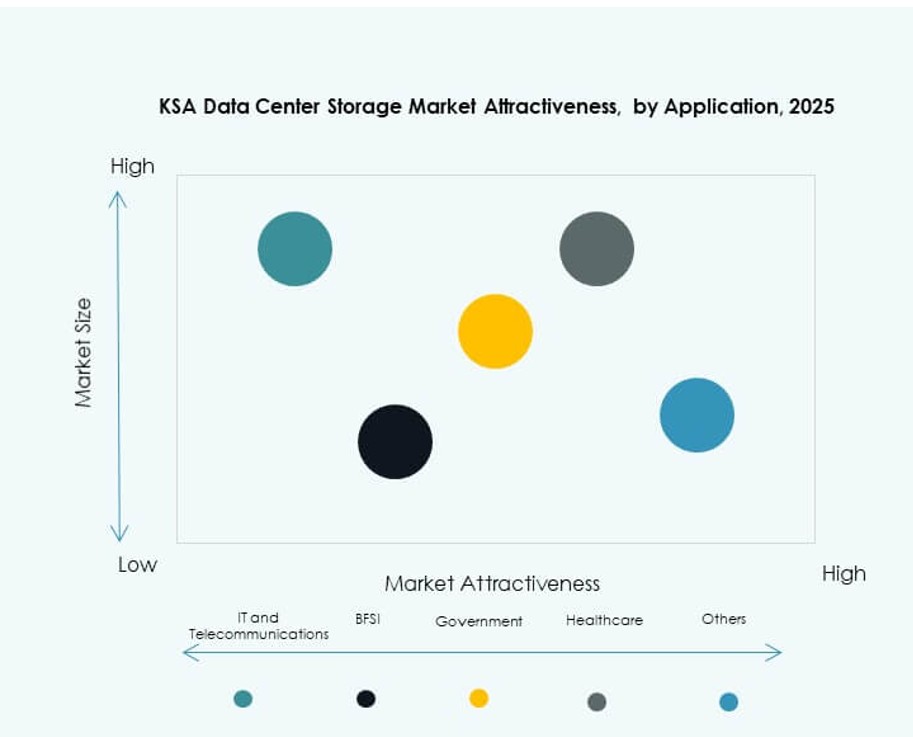

By Application

IT and telecommunications lead the market due to continuous demand for high-performance, scalable storage. BFSI follows, driven by data-intensive applications like fraud detection and customer analytics. Government sector demand remains strong due to digital governance and data localization. Healthcare adopts secure storage to support imaging, patient records, and compliance. In the KSA Data Center Storage Market, each sector drives unique needs, pushing vendors to tailor offerings accordingly.

Regional Insights

Riyadh Region Dominates Due to Government Projects and Enterprise Density (42% Market Share)

Riyadh leads the KSA Data Center Storage Market, driven by strong enterprise activity and public sector digitalization. The region hosts the largest number of government-backed smart initiatives and tech parks. Major cloud zones and hyperscale providers operate here to meet central demand. Strategic partnerships support the deployment of Tier III and IV facilities. Riyadh benefits from high network density and skilled workforce availability. Its regulatory environment is also more mature than other regions.

- For instance, AWS confirmed the launch of its Saudi Arabia (Riyadh) cloud region in 2026, featuring three Availability Zones designed to meet high availability and data sovereignty requirements. The region will support storage and compute workloads for entities such as stc Group, Mobily, Seera Holding Group, and Red Sea Global, as part of AWS’s $5.3 billion long-term investment.

Western Region (Jeddah and Makkah) Emerges as Secondary Hub with 28% Market Share

Jeddah and Makkah are gaining traction due to proximity to Red Sea trade routes and subsea cable landings. These regions attract investments in colocation and cloud services. Data centers in this corridor support port logistics, fintech, and industrial customers. The KSA Data Center Storage Market sees rising edge deployments in this region. Operators benefit from access to both international connectivity and local enterprise demand. Urban expansion and tourism growth also increase digital service needs.

- For instance, center3, a subsidiary of STC Group, operates carrier‑neutral data centers and cable landing stations in Jeddah, connecting Saudi Arabia to multiple international subsea cable systems along the Red Sea corridor. These facilities support low‑latency connectivity and regional data traffic exchange, strengthening Jeddah’s role as a key digital gateway for western Saudi Arabia.

Eastern Province (Dammam, Dhahran) Strengthening Due to Energy Sector and Industrial Base (21% Market Share)

The Eastern Province supports storage demand from oil, gas, and heavy industrial sectors. Major enterprises in Dhahran and Dammam rely on high-availability storage for analytics and operational continuity. The KSA Data Center Storage Market benefits from partnerships between energy firms and technology providers here. Growth in smart manufacturing and environmental monitoring adds use cases for data-intensive applications. Proximity to Aramco and other industrial giants sustains regional infrastructure growth.

Competitive Insights:

- STC Solutions

- Mobily Cloud

- Sahara Net

- Gulf Data Hub

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Cisco Systems, Inc.

- IBM Corporation

- Huawei Technologies Co., Ltd.

- NetApp

The KSA Data Center Storage Market features a strong mix of regional service providers and global storage vendors. Local players like STC Solutions and Mobily Cloud dominate enterprise and public sector deployments with tailored, in-country solutions. Gulf Data Hub and Sahara Net support hyperscale and colocation services. Global firms such as Dell, HPE, and Cisco offer advanced infrastructure like all-flash arrays, SAN/NAS systems, and NVMe integration. IBM, Huawei, and NetApp deliver AI-ready storage, SDS, and cyber-resilient platforms. The market rewards partnerships that align with national cloud policies and data localization mandates. It remains competitive, with vendors focusing on hybrid models, smart storage, and energy-efficient systems to meet evolving enterprise needs.

Recent Developments:

- In December 2025, STC signed a memorandum of understanding with HUMAIN to form a joint venture for developing and operating advanced data centers in Saudi Arabia. HUMAIN holds 51% of the venture while STC holds 49%, aiming to support storage‑intensive AI workloads and boost national data infrastructure in line with digital transformation strategies.

- In October 2025, HUMAIN partnered with AirTrunk and Blackstone in a $3 billion strategic deal to finance, develop, and operate next‑generation data centers across Saudi Arabia. This partnership aims to expand regional data center capacity, support AI applications, and enhance the Kingdom’s storage and compute infrastructure, making it a key milestone for large‑scale digital investments in the region.

- In August 2025, Hewlett Packard Enterprise expanded its ‘Saudi Made’ server portfolio with the launch of new HPE ProLiant DL365 and DL385 Gen11 servers built in partnership with AMD at the alfanar facility in Riyadh.

- In May 2025, Cisco announced an expanded partnership with HUMAIN to build scalable, secure AI infrastructure across Saudi Arabia. The collaboration focuses on cloud-based solutions and data center-ready networking technologies to support growing storage and AI workload demands, reinforcing Cisco’s role in the data ecosystem and helping accelerate local digital and AI initiatives aligned with national priorities.