Executive summary:

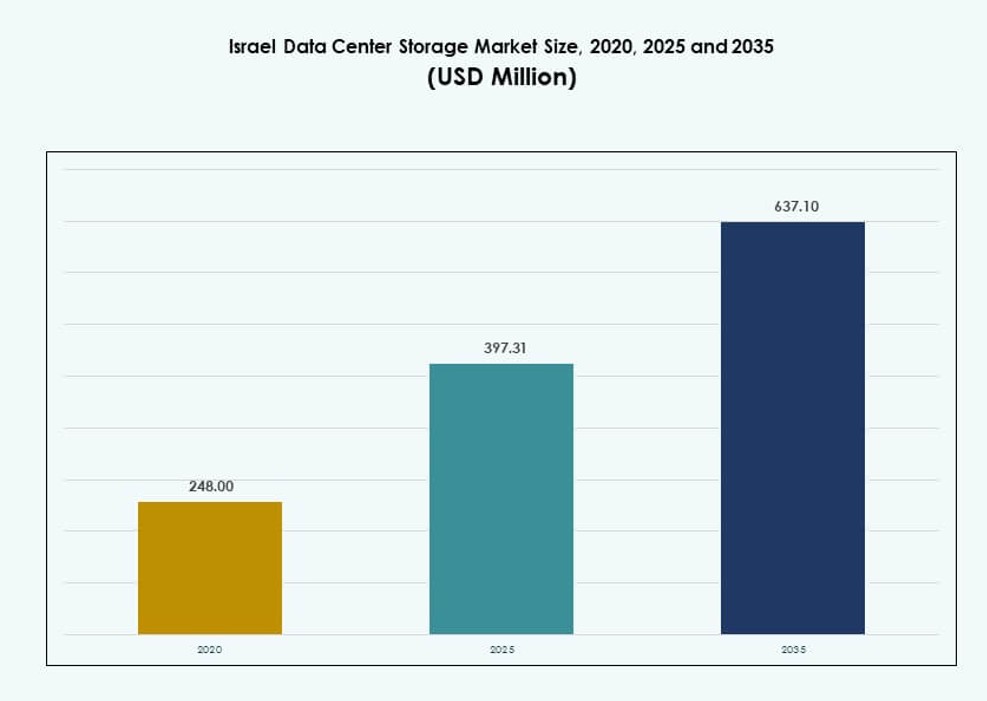

The Israel Data Center Storage Market size was valued at USD 248.00 million in 2020 to USD 397.31 million in 2025 and is anticipated to reach USD 637.10 million by 2035, at a CAGR of 4.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Israel Data Center Storage Market Size 2025 |

USD 397.31 Million |

| Israel Data Center Storage Market, CAGR |

4.69% |

| Israel Data Center Storage Market Size 2035 |

USD 637.10 Million |

Strong demand for secure and scalable data infrastructure drives growth across sectors like government, defense, telecom, and fintech. Technology adoption spans flash storage, hybrid cloud models, and software-defined platforms. AI workloads, smart cities, and cybersecurity requirements reshape procurement strategies. Investors see value in sovereign storage infrastructure and compliant cloud platforms. Innovation from domestic startups pushes early use of NVMe and container-integrated storage. The Israel Data Center Storage Market enables organizations to control data, ensure uptime, and support long-term digital strategies.

Tel Aviv leads with over 50% share due to high data density, cloud zones, and hyperscale hubs. Haifa and nearby areas emerge with advanced R&D and public-sector demand. Be’er Sheva gains traction with cybersecurity clusters and smart infrastructure mandates. These zones anchor regional expansion and enable sovereign data services. The Israel Data Center Storage Market continues evolving with rising needs for latency-sensitive, distributed storage environments across urban and innovation-focused regions.

Market Dynamics:

Market Drivers

Strong Push for National Data Sovereignty and Security-Driven Storage Infrastructure

Israel prioritizes national data protection and cyber resilience, driving investments in local data storage. The government enforces strict regulations for sensitive sectors like defense, finance, and healthcare. Enterprises must meet compliance for data residency, supporting demand for sovereign infrastructure. This fuels deployment of on-premises and hybrid storage platforms with advanced encryption. Growing concerns about external threats accelerate the need for isolated, secure environments. The Israel Data Center Storage Market benefits from military-grade storage solutions backed by local vendors. Sovereign cloud frameworks push enterprises toward local data centers. It continues to evolve as a critical pillar of digital independence.

- For instance, in 2024, Elbit Systems was awarded multi-million-dollar contracts by the Israeli Ministry of Defense to deliver tactical communication and battlefield network systems, strengthening secure data exchange across dynamic military operations.

Acceleration in AI, Edge Computing, and Digital Government Programs

The rapid expansion of AI workloads increases demand for low-latency and high-speed storage infrastructure. National AI strategies and smart governance efforts rely on structured and unstructured data handling. Storage technologies need to support massive inferencing and training models. Edge computing in transportation and utilities adds to storage volumes and distribution complexity. Smart city initiatives generate real-time data needing instant retrieval and processing. The Israel Data Center Storage Market grows alongside these applications. It provides foundational infrastructure for next-gen digital services. Investors benefit from scalable platforms aligned with long-term national digitalization goals.

Surge in Enterprise Cloud Adoption and Multi-Tier Storage Demands

Local enterprises migrate workloads to cloud environments, needing scalable and elastic storage options. Multi-tier storage models help optimize performance and cost for varied workloads. AI-driven analytics, ERP systems, and collaborative platforms require storage with strong IOPS and backup capacity. Cloud service providers localize infrastructure, leading to demand for network-attached and object storage systems. Tiered systems offer cold, warm, and hot storage capabilities tailored for data lifecycle management. The Israel Data Center Storage Market reflects this transition in architecture. It drives revenue from diverse configurations for mid to large enterprises. Storage flexibility is now essential to meet operational agility.

Vibrant Startup Ecosystem Supporting Advanced Storage Innovation

Israel’s vibrant startup scene boosts demand for agile, high-performance storage infrastructure. Tech firms working on AI, fintech, and cybersecurity adopt NVMe-based storage early. Rapid product iterations and data-intensive operations create demand for flash-heavy configurations. The availability of venture funding supports early integration of cutting-edge storage models. Startups often deploy hybrid or cloud-native storage that balances performance and cost. It helps the Israel Data Center Storage Market evolve with innovation-focused deployments. Service providers offer tailored packages for tech SMEs. The segment becomes a growth driver by scaling innovation without sacrificing data control.

- For instance, StorOne demonstrated high-performance benchmarks for its Prime Storage OS in 2024, showcasing multi-million IOPS on compact 2U systems optimized for AI and analytics workloads strengthening Israel’s software-defined innovation footprint in the data center storage market.

Market Trends

Shift Toward Liquid-Cooled Storage Racks for High-Density Environments

Thermal challenges in data-dense environments have led operators to adopt liquid-cooled storage racks. These solutions support high IOPS with energy efficiency and less downtime. Hyperscalers running AI and ML models require consistent performance under intense workloads. Liquid cooling improves storage density per rack, optimizing space in Tier III and Tier IV centers. Vendors in Israel design compact, liquid-ready units tailored to domestic standards. The Israel Data Center Storage Market embraces these trends across cloud and telecom verticals. It supports growth in data-hungry workloads like video analytics and genomics. Adoption of direct-to-chip and rear-door cooling accelerates across new builds.

Rising Preference for Software-Defined Storage (SDS) Across Enterprises

Enterprise buyers in Israel adopt software-defined storage to reduce vendor lock-in and optimize costs. SDS platforms separate storage hardware from management layers, offering flexibility. Businesses with dynamic workloads use SDS for better resource pooling. These solutions support virtualization, analytics, and container-based applications. SDS integration with orchestration tools like Kubernetes enhances performance in hybrid setups. The Israel Data Center Storage Market sees strong uptake among mid-sized firms and government agencies. It supports modernization without large upfront capital. Open-source SDS platforms also gain traction among cost-sensitive deployments.

Increased Adoption of Data Lifecycle Management and Intelligent Tiering

Organizations invest in tools that automate data classification and optimize tier usage. Intelligent tiering reduces costs by automatically moving infrequently accessed data to cold storage. Active archives support quick retrieval for regulatory compliance. Businesses manage huge datasets from IoT, surveillance, and CRM platforms. AI-powered tools analyze usage and automate tier selection. The Israel Data Center Storage Market aligns with this shift to operational efficiency. Storage vendors bundle lifecycle features with backup and replication tools. It reduces storage overhead while meeting speed and access requirements.

Growth in Object-Based Storage to Handle Unstructured Data Volumes

The rise of video, logs, social data, and backups accelerates object storage adoption. Enterprises require scalable and durable solutions for archiving and active use. Object storage handles metadata better and supports distributed access. Cloud-native applications benefit from easy integration via APIs. Media, research, and telecom verticals drive most of the demand. The Israel Data Center Storage Market gains traction through adoption of S3-compatible platforms. It also supports long-term AI and analytics workloads. Hybrid object storage models become standard for backup and cold tier use.

Market Challenges

Limited Availability of Energy-Efficient Infrastructure Across Older Facilities

Many data centers in Israel still operate using legacy infrastructure not optimized for energy efficiency. Cooling and power management systems limit the scalability of modern storage platforms. Operators face high operational costs when integrating NVMe or GPU-intensive workloads. Retrofitting is slow due to physical space and regulatory constraints. Energy cost spikes increase TCO for enterprises. The Israel Data Center Storage Market must address this legacy issue to unlock full performance potential. Storage density improvements remain constrained in several Tier II facilities. It also restricts full deployment of AI-ready infrastructure.

Regulatory Compliance Complexity and Shortage of Skilled Storage Professionals

Evolving compliance rules for data protection, localization, and cybersecurity increase complexity for storage design. Enterprises must meet both domestic and international standards. This leads to demand for compliant architectures with audit trails and RBAC features. A shortage of skilled professionals limits the pace of implementation. The Israel Data Center Storage Market struggles to meet demand for architects and storage security experts. Training efforts remain uneven across regions. Managed services partly offset this skill gap, but dependence remains high. Complex workloads require specialized tuning, delaying rollout.

Market Opportunities

Expansion of Hyperscale and Modular Data Centers in Tech Corridors

Rapid growth in digital services drives hyperscale construction in Tel Aviv, Haifa, and surrounding corridors. These data centers need large-scale, redundant, and flexible storage systems. The Israel Data Center Storage Market can scale with modular deployments. It enables just-in-time expansion for new cloud tenants. Vendors offering scalable storage-as-a-service gain traction in this environment.

Government-Backed Digital Transformation Creating Long-Term Storage Demand

Digital-first policies across public agencies, healthcare, and education sectors create lasting demand for compliant, on-premises storage. Institutions require backup, archiving, and rapid access layers. The Israel Data Center Storage Market benefits from steady contracts and long lifecycle support. Public-private storage partnerships drive ecosystem expansion and national capacity building.

Market Segmentation

By Storage Type

Traditional storage holds a strong presence due to its familiarity and ease of maintenance. However, all-flash storage is gaining share due to its speed, reliability, and falling costs. Hybrid storage remains dominant in the Israel Data Center Storage Market as it blends cost efficiency with performance. Organizations prefer flexibility to balance hot and cold data tiers. All-flash leads deployments in AI and fintech segments.

By Storage Deployment

Network-attached storage (NAS) systems are dominant in enterprise and mid-sized environments. SAN systems follow in mission-critical sectors like BFSI and government. Direct-attached storage (DAS) still supports small-scale setups and temporary backups. The Israel Data Center Storage Market benefits from multi-model integration. Hybrid deployments using NAS for general use and SAN for performance-sensitive workloads gain momentum.

By Component

Hardware holds the majority share due to the physical footprint of storage appliances. Storage servers, racks, and power modules contribute to this. However, software is growing faster with SDS, data management, and replication tools. In the Israel Data Center Storage Market, demand for storage software supporting multi-cloud and AI is rising. Value shifts toward intelligent orchestration over pure capacity.

By Medium

Solid-State Drives (SSD) dominate performance-focused workloads in banking, defense, and AI. Hard Disk Drives (HDD) still account for bulk storage and archiving. Tape storage supports long-term backup for compliance-heavy sectors. SSD adoption continues rising in Israel Data Center Storage Market due to speed and energy efficiency. HDD remains relevant in cost-sensitive deployments.

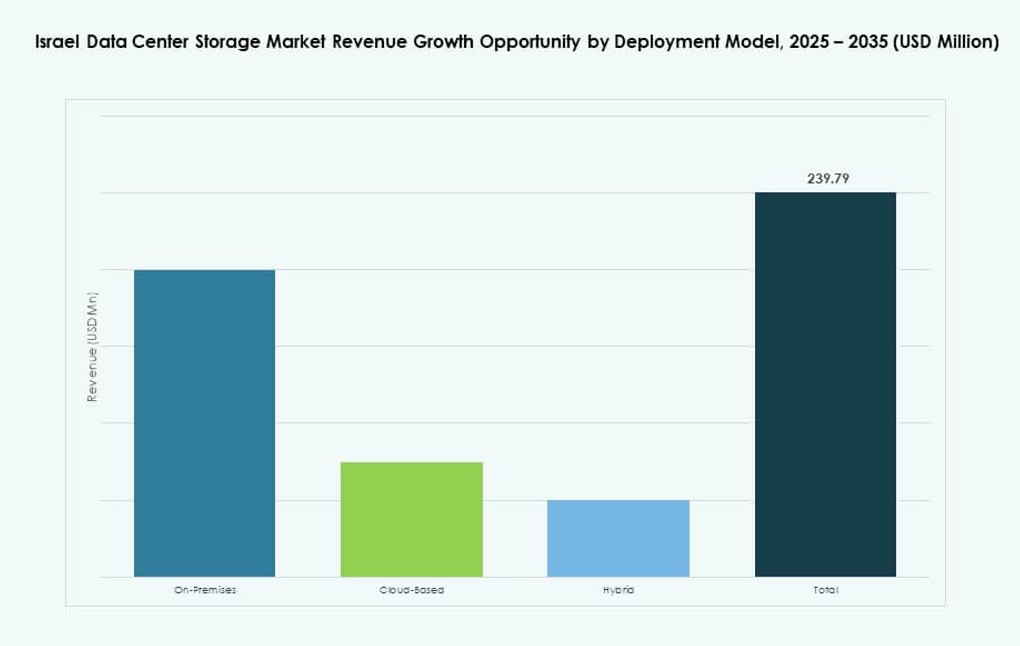

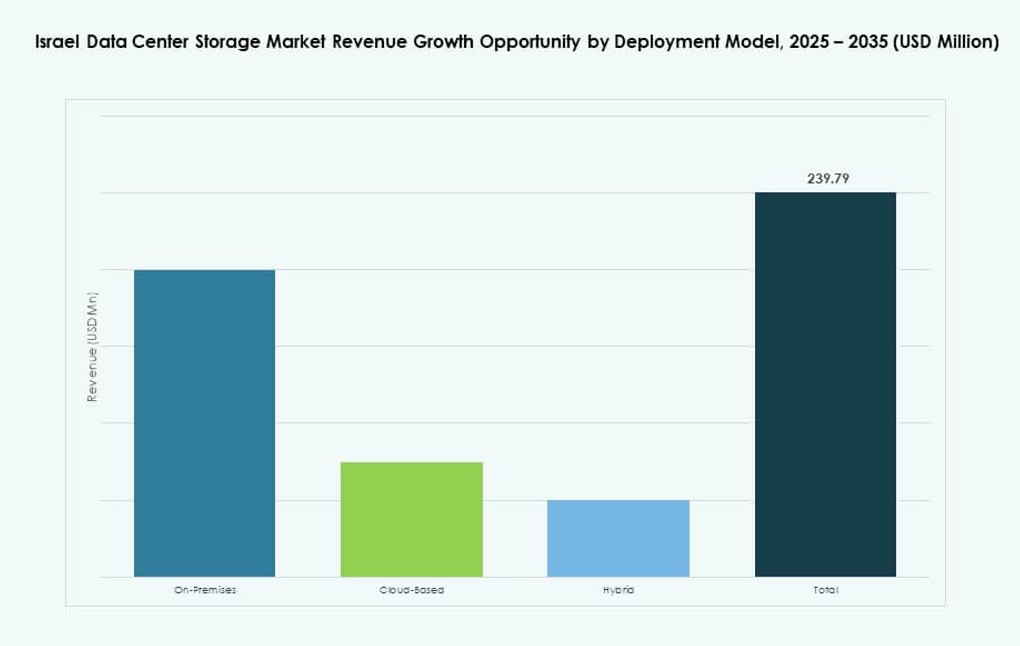

By Deployment Model

Cloud-based storage is growing with SaaS, PaaS, and data analytics. Hybrid remains dominant, offering flexibility and data control. On-premises deployment is common in defense and finance sectors due to data privacy. The Israel Data Center Storage Market sees hybrid as the preferred model. It combines scalability with regulatory compliance and network control.

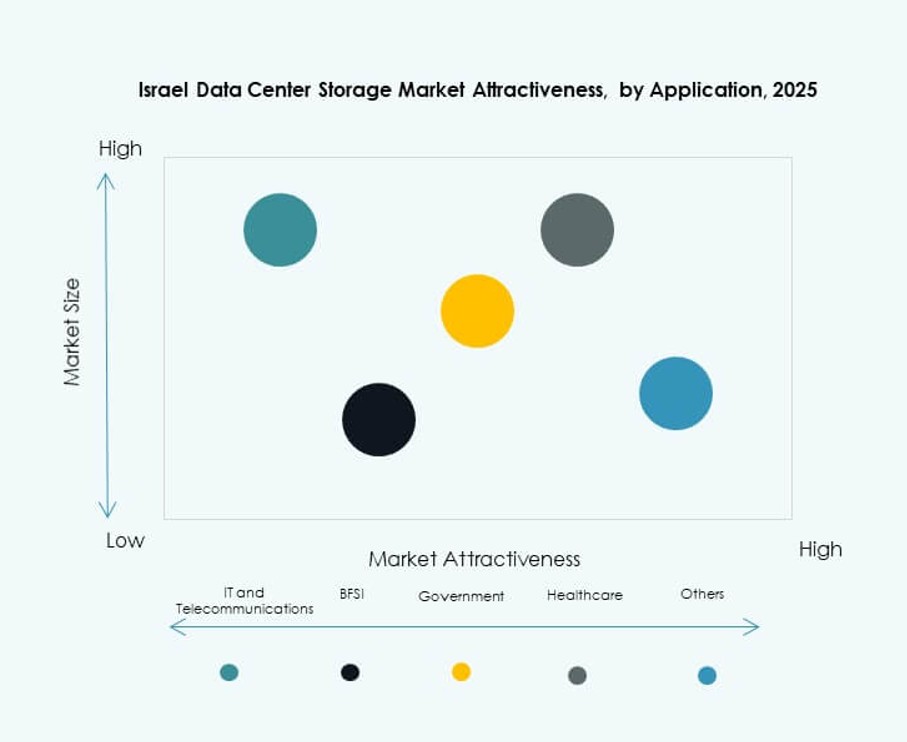

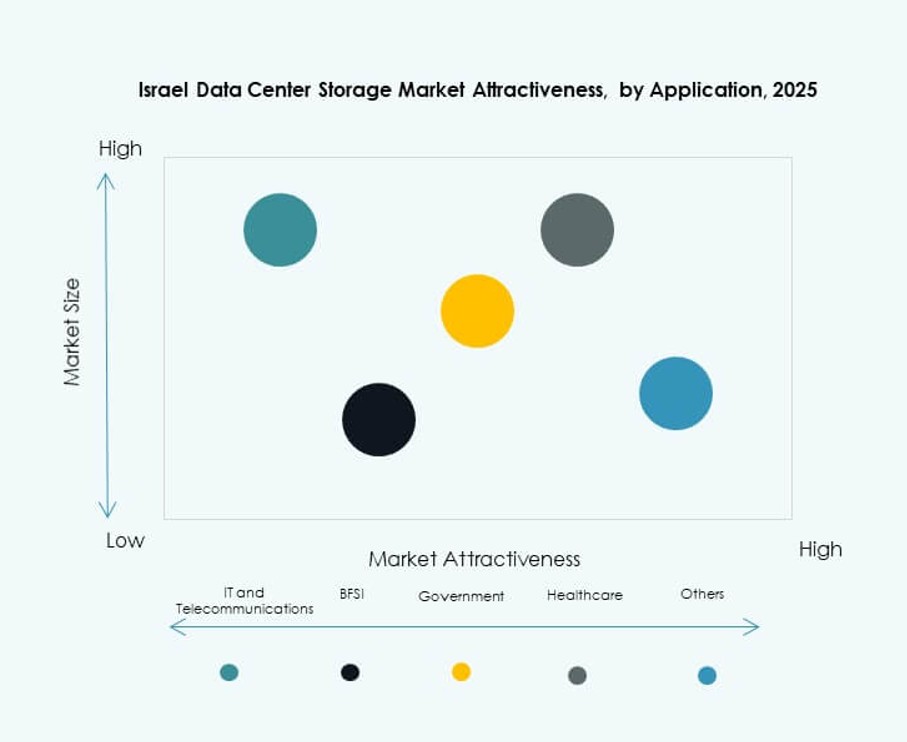

By Application

IT and telecommunications lead storage demand, driven by digital transformation and content delivery. BFSI follows, requiring encrypted and high-speed storage for transactions and compliance. Government agencies demand secure, sovereign platforms. Healthcare requires PACS archiving and real-time access. The Israel Data Center Storage Market serves diverse use cases with modular offerings across sectors.

Regional Insights

Tel Aviv Metropolitan Area – Leading Region with Over 50% Market Share

Tel Aviv dominates the Israel Data Center Storage Market with over 50% share. The region houses the highest concentration of data centers, cloud zones, and hyperscale providers. Enterprises, startups, and public agencies operate from this zone, generating large data volumes. Connectivity, talent pool, and regulatory support add to its leadership. Tel Aviv continues to attract investments for AI, cloud-native, and cybersecurity-focused storage.

Haifa and Northern Districts – Emerging with Around 25% Share and R&D Storage Demand

Haifa and nearby districts hold about 25% of the market, driven by university research, government labs, and healthcare centers. Academic institutions and innovation parks use high-capacity storage for analytics and simulations. AI research and national defense labs need secure, fast, and localized infrastructure. The Israel Data Center Storage Market sees growth here through R&D and secure government contracts. Demand for private cloud and on-premises storage continues to grow.

- For instance, in 2024, the Technion – Israel Institute of Technology expanded its Zeus and Athena clusters in Haifa, integrating NetApp-based centralized storage to support AI and scientific simulations across approximately 200 HPC nodes and GPU-accelerated research workloads.

Southern District and Be’er Sheva – Developing Zone with Nearly 15% Market Share

Be’er Sheva and surrounding regions contribute around 15% share. Cybersecurity clusters and government-backed IT projects push storage demand. The National Cyber Directorate supports secure data infrastructure in this zone. Storage requirements emerge from public-private partnerships and education institutions. The Israel Data Center Storage Market expands here with modular and edge deployments. Demand rises for regional backup, DRaaS, and government digital services.

- For instance, Ben-Gurion University in Be’er Sheva, as part of Israel’s national CyberSpark hub, expanded its data infrastructure in 2025 to support large-scale cybersecurity research and AI-driven threat modeling, aligning with national initiatives like the Cyber Dome and the IDF tech relocation to the Negev.

Competitive Insights:

- NVIDIA Mellanox

- Energix Data Centers

- Bezeq International

- MedOne

- Dell Technologies

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- NetApp

- Cisco Systems, Inc.

- Nutanix, Inc.

The Israel Data Center Storage Market is shaped by a mix of global technology providers and regional infrastructure specialists. Companies like NVIDIA Mellanox and Dell Technologies lead in high-performance hardware and NVMe-based storage integration. Local firms such as MedOne and Bezeq International strengthen domestic capacity through sovereign data hosting and hybrid cloud services. HPE, IBM, and NetApp compete with scalable all-flash and software-defined storage solutions, targeting BFSI, telecom, and government clients. Cisco and Nutanix offer hyperconverged platforms tailored to Israel’s growing mid-market enterprise base. It remains competitive due to innovation in AI-ready storage, software-defined stacks, and edge deployment models. Vendor differentiation focuses on latency performance, compliance, and orchestration capabilities.

Recent Developments:

- In August 2025, NVIDIA (via Mellanox) launched Spectrum-XGS, a new Ethernet networking solution for connecting remote data centers. This Israel-developed technology enables distributed data centers to operate as unified AI computing fabrics, expanding beyond traditional intra-site networking.

- In March 2025, NVIDIA featured Israeli innovations from Mellanox and Deci in a major product launch. CEO Jensen Huang emphasized their role in advancing AI and chip technologies for data center applications.

- In January 2025, NVIDIA announced plans to invest over $500 million in a new Israeli AI research data lab. The initiative highlights ongoing commitment to Israel’s tech ecosystem post-Mellanox acquisition, focusing on AI infrastructure advancements.