Executive summary:

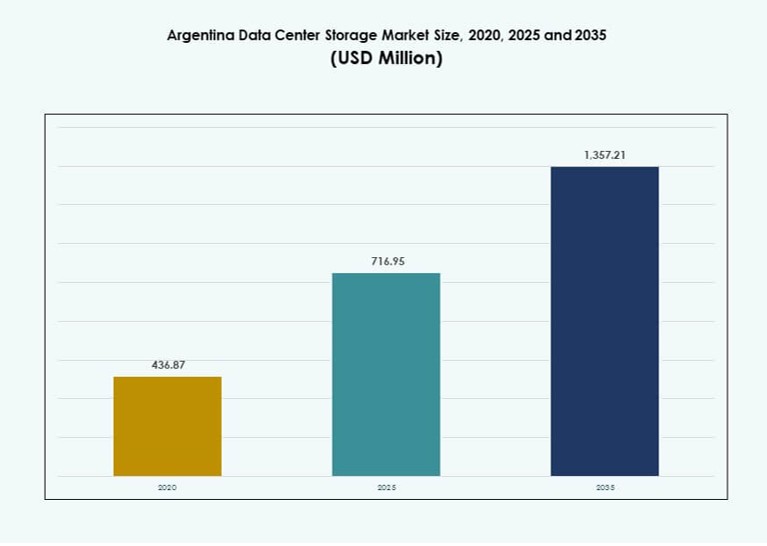

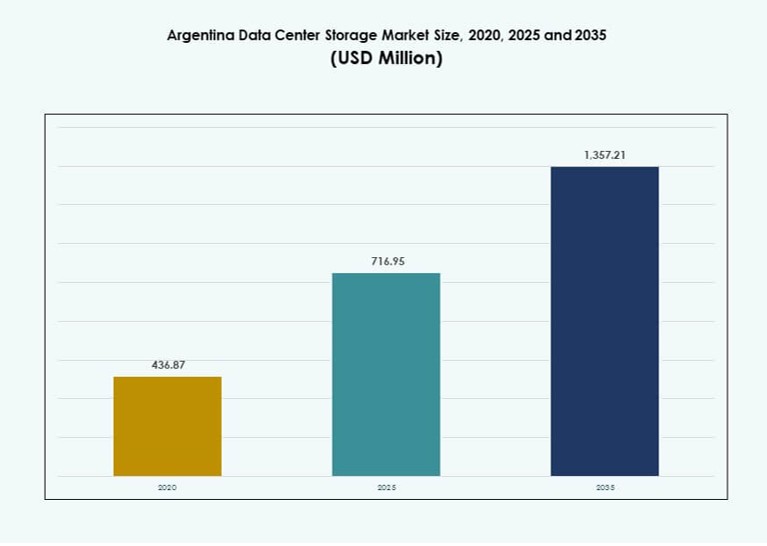

The Argentina Data Center Storage Market size was valued at USD 436.87 million in 2020 to USD 716.95 million in 2025 and is anticipated to reach USD 1,357.21 million by 2035, at a CAGR of 6.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Africa Data Center Storage Market Size 2025 |

USD 716.95 Million |

| Africa Data Center Storage Market, CAGR |

6.53% |

| Africa Data Center Storage Market Size 2035 |

USD 1,357.21 Million |

The market is expanding due to increased demand for hybrid cloud storage, software-defined infrastructure, and data localization policies. Enterprises are investing in secure and scalable platforms to support digital transformation across finance, telecom, and public sectors. The shift toward virtualization and edge computing also contributes to new storage deployments. Vendors offering AI-integrated and high-availability storage solutions are gaining traction. This makes the market strategically important for supporting business continuity, regulatory compliance, and operational agility in Argentina’s evolving digital ecosystem.

Buenos Aires leads the market with the highest concentration of data centers and enterprise infrastructure. The city benefits from robust connectivity, enterprise demand, and access to technical expertise. Cordoba and Mendoza are emerging regions, driven by tech startups, university-led innovation, and growing cloud adoption. These locations are expanding their role as secondary hubs. This regional growth supports national resilience, digital inclusion, and infrastructure decentralization.

Market Dynamics:

Market Drivers

Rising Digital Transformation Demands Driving Infrastructure Modernization in Argentina

Argentina’s digital economy is expanding due to rising cloud adoption, e-commerce, and financial technology. Enterprises and public sector bodies are upgrading legacy systems to meet regulatory and efficiency goals. This shift drives the demand for scalable and secure data storage solutions. Cloud-native applications and mobile-first platforms generate high volumes of data, requiring robust storage backbones. The Argentina Data Center Storage Market plays a central role in enabling fast access, regulatory compliance, and uptime reliability. Data center investments are increasing to accommodate growing user bases. Local firms are also shifting toward virtualized and software-defined infrastructure. Investors see value in high-availability storage services. The ecosystem is evolving to support next-gen platforms.

- For instance, ARSAT operates the Red Federal de Fibra Óptica (REFEFO), a nationwide fiber backbone that supports public and private connectivity services across Argentina. The network enhances cloud and data center interconnection, particularly in key urban hubs like Buenos Aires.

Enterprise Preference for Hybrid Storage Architectures is Accelerating Local Market Expansion

Hybrid storage solutions are gaining traction among Argentine businesses seeking performance and cost optimization. Combining all-flash arrays with traditional HDDs allows balanced latency and capacity benefits. Organizations with sensitive workloads rely on on-premises components, while analytics workloads shift to cloud. This mix drives demand for flexible deployment models and cross-platform compatibility. The Argentina Data Center Storage Market benefits from this trend, as vendors tailor offerings to hybrid environments. Compliance and workload portability further reinforce hybrid storage’s appeal. Edge use cases are increasing across retail and telecom sectors. Companies are redesigning their architecture to achieve agility. The hybrid approach supports expansion while mitigating risk.

Government-Led Digital Strategies Encouraging Data Localization and Storage Investment

Argentina’s federal and provincial digital strategies promote data localization and cybersecurity. Government mandates for local storage of citizen and financial data are expanding. Public sector investments are focusing on sovereign cloud and national data center initiatives. This drives demand for enterprise-grade storage systems with security and backup features. The Argentina Data Center Storage Market is strategically positioned to support this transition. Vendors offering high availability, disaster recovery, and encryption solutions are in demand. Public-private partnerships are shaping national infrastructure. Investments in healthtech and education tech add pressure for data expansion. Regulatory frameworks are tightening, reinforcing local storage adoption.

Growing Startup and SME Ecosystem Requiring Agile and Scalable Storage Infrastructure

Argentina’s growing startup ecosystem and SME segment require fast, scalable, and affordable data storage platforms. Businesses in fintech, healthtech, and logistics generate data continuously and require responsive infrastructure. Cloud-native solutions and API-driven platforms help startups integrate quickly without large upfront costs. The Argentina Data Center Storage Market supports this evolution through flexible pricing and modular infrastructure. Innovation in storage-as-a-service (STaaS) models is key to market accessibility. Local data centers are providing low-latency services to regional businesses. Interconnect hubs in Buenos Aires improve performance. Startups prefer local vendors for cost and compliance alignment. SMEs continue to shape long-tail demand patterns.

- For instance, Cirion Technologies operates Tier III certified data center facilities in Buenos Aires that support secure, compliance‑ready storage and processing services for enterprise and SME customers across Argentina’s digital ecosystem.

Market Trends

Shift Toward Edge Data Storage Solutions in Support of Decentralized Digital Workflows

Decentralized workloads in IoT, remote education, and smart utilities are accelerating edge deployments. Argentina’s rural regions and tier-two cities are adopting edge storage to support latency-sensitive applications. Edge infrastructure reduces reliance on central hubs and increases redundancy. The Argentina Data Center Storage Market is responding with compact, modular edge systems. These systems enable real-time analytics at the source. Energy-efficient configurations reduce operational burdens. The trend supports applications like smart metering and mobile healthcare. Edge storage fosters regional development. It diversifies infrastructure distribution across provinces.

Adoption of NVMe-Based Flash Storage for High-Speed Data Workloads

High-performance applications such as AI, video analytics, and real-time transactions are growing. Organizations are replacing SATA and SAS storage with NVMe for faster throughput and lower latency. NVMe-based storage supports scalable compute environments and parallel workloads. The Argentina Data Center Storage Market integrates NVMe arrays to address hyperscale needs. Fintech, digital banking, and media sectors are early adopters. Vendors are offering hybrid NVMe+HDD arrays to balance speed and capacity. NVMe’s performance advantages align with next-gen application demands. Integration with cloud-native platforms is seamless. Local providers are expanding NVMe support in new deployments.

Rise of Green Storage Infrastructure Amid Energy Efficiency Pressures

Energy consumption and carbon emissions from storage infrastructure are under scrutiny. Argentina’s operators are adopting green storage practices including liquid cooling, storage tiering, and renewable energy integration. The Argentina Data Center Storage Market is adapting with energy-efficient SSDs and intelligent power management. Regulatory incentives encourage the use of low-power components. Storage providers focus on sustainability metrics to appeal to ESG-focused investors. Optimized cooling and smart capacity allocation reduce power use. Hybrid cloud also enables resource consolidation. Efficiency remains key for long-term competitiveness. Vendors align offerings with national green ICT goals.

Integration of AI-Powered Storage Management for Predictive Optimization

AI and machine learning are transforming storage management through predictive analytics. Tools now monitor workload behavior to preemptively allocate capacity or flag potential failures. The Argentina Data Center Storage Market is seeing increased adoption of AI-powered orchestration platforms. These systems reduce downtime, optimize performance, and lower admin overhead. Financial and telecom enterprises are using AI to manage rapid scaling. Automation enhances compliance and security checks. AI helps forecast resource demands and provision accordingly. Intelligent tiering optimizes cost and performance. Vendors are embedding AI into enterprise storage solutions. This trend supports operational agility and business continuity.

Market Challenges

Macroeconomic Instability and Currency Volatility Impacting Capital Investments in Infrastructure

Argentina’s inflationary pressures and currency fluctuations affect capital planning for large-scale IT deployments. International vendors face pricing challenges due to import taxes and inconsistent exchange rates. These factors increase the total cost of ownership for high-performance storage platforms. The Argentina Data Center Storage Market experiences delays in project execution due to funding uncertainties. Businesses remain cautious, focusing on operational efficiency over aggressive expansion. Financing constraints limit the speed of technology upgrades. Long ROI cycles make certain high-end systems less attractive. Volatile conditions also complicate procurement and vendor negotiations. This makes strategic investment planning more complex.

Skill Gaps and Technical Resource Shortages Hindering Advanced Storage Adoption

The deployment and management of complex storage solutions require skilled personnel. Argentina faces shortages in certified professionals for cloud, cybersecurity, and enterprise storage systems. This limits the ability of organizations to maintain or scale infrastructure efficiently. The Argentina Data Center Storage Market needs workforce development programs to close this gap. Smaller enterprises often lack in-house IT expertise, relying heavily on vendor support. Training costs and time impact adoption timelines. It creates bottlenecks in implementation, especially for hybrid and AI-integrated solutions. Education partnerships and technical bootcamps can help. Without talent, advanced platforms remain underutilized.

Market Opportunities

Expansion of Localized Cloud Services Offering Tailored Storage for Regulated Sectors

Cloud providers that offer localized, sovereign storage solutions are positioned to grow. Healthcare, banking, and government sectors require compliance with local data laws. The Argentina Data Center Storage Market supports this opportunity through secure, scalable platforms. Vendors providing sector-specific features like encryption and audit trails can win long-term contracts. Tiered cloud storage models improve affordability. Sovereign storage reduces exposure to geopolitical risks. Local availability zones also improve latency and performance.

Growing Demand for Disaster Recovery and Backup-as-a-Service in Remote Regions

Argentina’s provinces are investing in resilience against outages and cyberattacks. Backup-as-a-Service (BaaS) and DRaaS solutions are in demand outside core cities. The Argentina Data Center Storage Market enables this through low-cost, scalable deployment models. SMEs and public agencies seek redundancy with minimal capital investment. Partners providing regional service nodes are gaining traction. Cloud-integrated platforms are preferred. This creates growth avenues in underpenetrated segments.

Market Segmentation

By Storage Type

Traditional storage holds a notable presence due to legacy deployments in government and telecom. However, hybrid storage leads in adoption, combining HDD and SSD for cost-effective performance. All-flash storage is growing rapidly in financial services, where speed and reliability are critical. Hybrid models dominate the Argentina Data Center Storage Market, offering adaptability for mixed workloads. Others include object-based and software-defined storage, mainly in emerging enterprise use cases.

By Storage Deployment

Storage Area Network (SAN) systems dominate due to high performance and centralized control. SAN systems serve enterprise databases and critical applications. NAS systems gain traction for unstructured data in content-heavy sectors. DAS systems support low-cost, direct application workloads. The Argentina Data Center Storage Market continues shifting toward SAN for mission-critical workloads, while NAS sees adoption in media and healthcare.

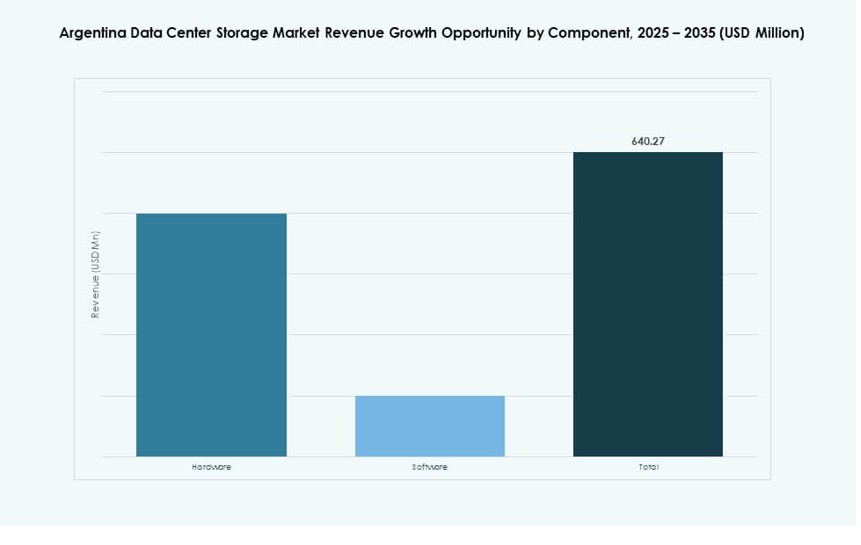

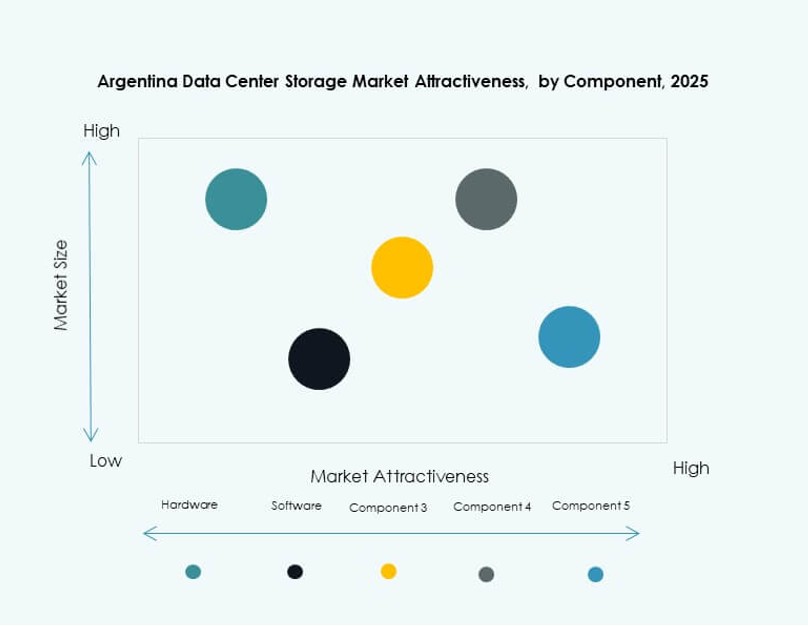

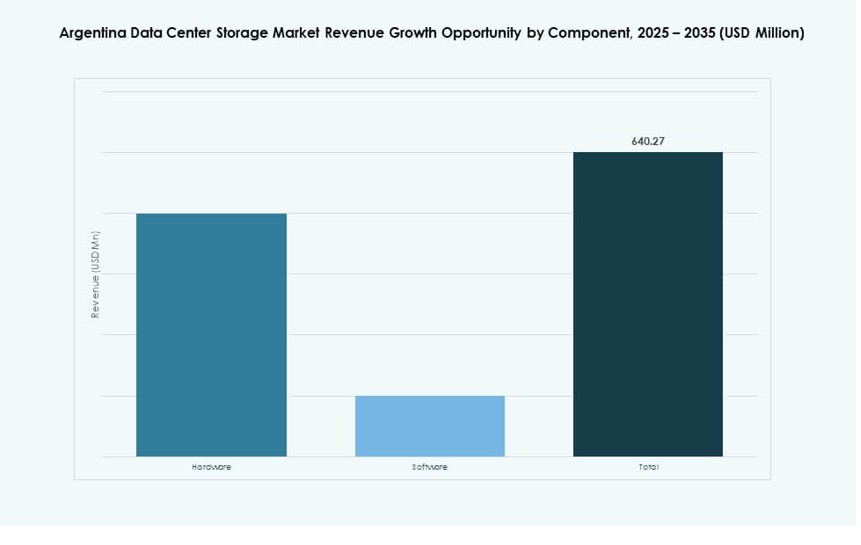

By Component

Hardware holds the major share in the Argentina Data Center Storage Market, driven by servers, racks, and flash systems. However, software is gaining ground with the rise of storage virtualization, SDS, and AI-based orchestration. Enterprises seek control, scalability, and performance via intelligent storage management. Software enables flexible provisioning and faster scaling, especially in hybrid environments.

By Medium

Hard Disk Drives (HDDs) still account for a large portion of deployments due to affordability and capacity. Solid-State Drives (SSDs) are rapidly gaining share in performance-sensitive applications such as fintech and e-commerce. Tape storage remains in limited use for archival purposes in government and education. The Argentina Data Center Storage Market is shifting toward SSD as prices decline and workloads grow complex.

By Deployment Model

On-premises remains strong among public institutions and financial services for security and compliance. Cloud-based storage is expanding across tech startups and media firms seeking scalability. Hybrid deployment is the fastest-growing model in the Argentina Data Center Storage Market. It allows organizations to manage sensitive data internally while leveraging cloud agility. Hybrid models reduce cost and improve business continuity.

By Application

IT and Telecommunications lead in adoption due to large-scale data operations and 24/7 uptime needs. BFSI follows closely, demanding secure, fast, and compliant storage solutions. Government agencies invest in data localization and digital governance. Healthcare is an emerging segment, requiring real-time access to medical data. Others include retail, logistics, and education with growing digital transformation needs. The Argentina Data Center Storage Market supports these with tailored storage frameworks.

Regional Insights

Buenos Aires Metropolitan Region Leading with Over 60% Share Due to Data Center Density

The Buenos Aires metro area dominates the Argentina Data Center Storage Market with over 60% share. It hosts the largest concentration of Tier III and Tier IV facilities. High connectivity, power reliability, and enterprise demand fuel continued expansion. The presence of global and domestic cloud providers supports hyperscale deployments. Regulatory and financial institutions in the capital require resilient infrastructure. It remains the national hub for storage and interconnection. Growth in AI and fintech also strengthens demand here.

- For instance, NextStream Barracas (formerly Nabiax) data center operates as Tier III standard with 1.1 MW IT power supply, scalable to 2.2 MW, across 2,162 sqm of IT surface in 5 rooms.

Central and Western Regions Including Cordoba and Mendoza Emerging with 25% Share

Cordoba and Mendoza together contribute nearly 25% to the Argentina Data Center Storage Market. These cities attract investments due to their skilled workforce, university networks, and tech startup culture. Fiber rollout and edge data center development increase infrastructure access. Government incentives and lower operating costs support facility expansion. Regional cloud and DRaaS services see higher uptake. These regions form strategic hubs for decentralization of compute workloads. Expansion supports national resilience goals.

- For instance, in August 2025, ARSAT announced the expansion of its Tier III-certified data center in Benavídez, Buenos Aires, with a new Room IV designed to support 620 kW of IT load and improved energy efficiency. The upgrade includes turnkey design, procurement, and commissioning services.

Northern and Southern Provinces Including Salta and Neuquén Holding 15% Share with Growth Potential

Northern and southern provinces such as Salta and Neuquén contribute 15% of the market. Industrial activity, government digitalization, and rural connectivity drive gradual growth. New deployments focus on modular data centers and container-based storage. It is enabling localized storage support for remote education and healthcare. Economic diversification supports digital services adoption. These regions show potential for edge-focused storage strategies. Market activity is expected to accelerate with regional policy support.

Competitive Insights:

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- IBM Corporation

- NetApp

- Cirion Technologies

- Cohesity, Inc.

- Cisco Systems, Inc.

- IPLAN

- Grupo Datco

- Huawei Technologies Co., Ltd.

The Argentina Data Center Storage Market features a mix of global OEMs and regional service providers competing across hardware, software, and hybrid solutions. Dell, HPE, and IBM lead with broad product portfolios and partnerships in enterprise and public sectors. NetApp and Cohesity capture demand for backup, flash storage, and software-defined infrastructure. Local firms like IPLAN and Grupo Datco provide sovereign storage, connectivity, and customized solutions for compliance-sensitive clients. Cirion Technologies strengthens its role through integrated regional infrastructure and managed services. Competition focuses on hybrid models, NVMe adoption, and performance optimization. It pushes vendors to differentiate through AI integration, cost efficiency, and flexible service models. Players invest in local facilities and edge coverage to support urban and mid-tier city expansion.

Recent Developments:

- In October 2025, OpenAI and Sur Energy signed a letter of intent to explore a significant data center project in Argentina that could attract up to USD 25 billion in investment. This initiative plans a 500‑megawatt facility to support advanced artificial intelligence computing and digital infrastructure growth.

- In October 2025, Vertiv announced a strategic distribution partnership with Grupo Datco to expand access to critical data center infrastructure solutions in Argentina and Chile. The collaboration aims to strengthen local support for high‑density facilities that underpin compute and storage services for enterprise and AI workloads.