Executive summary:

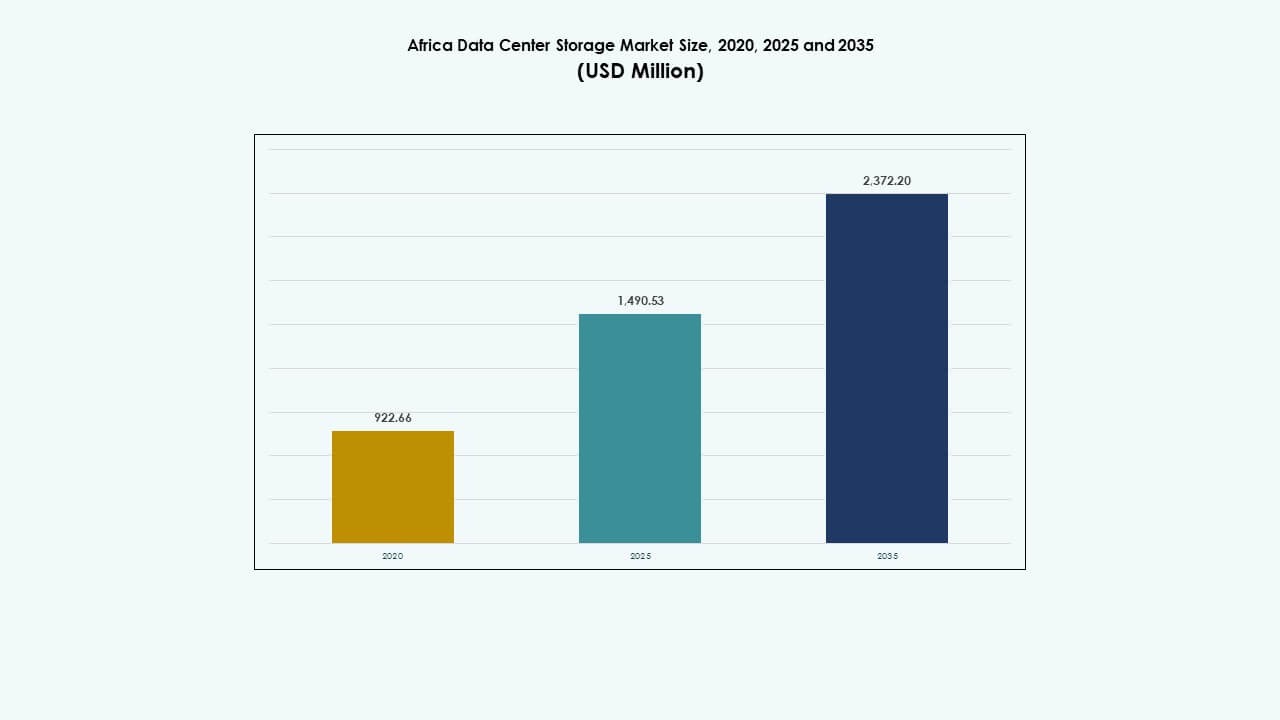

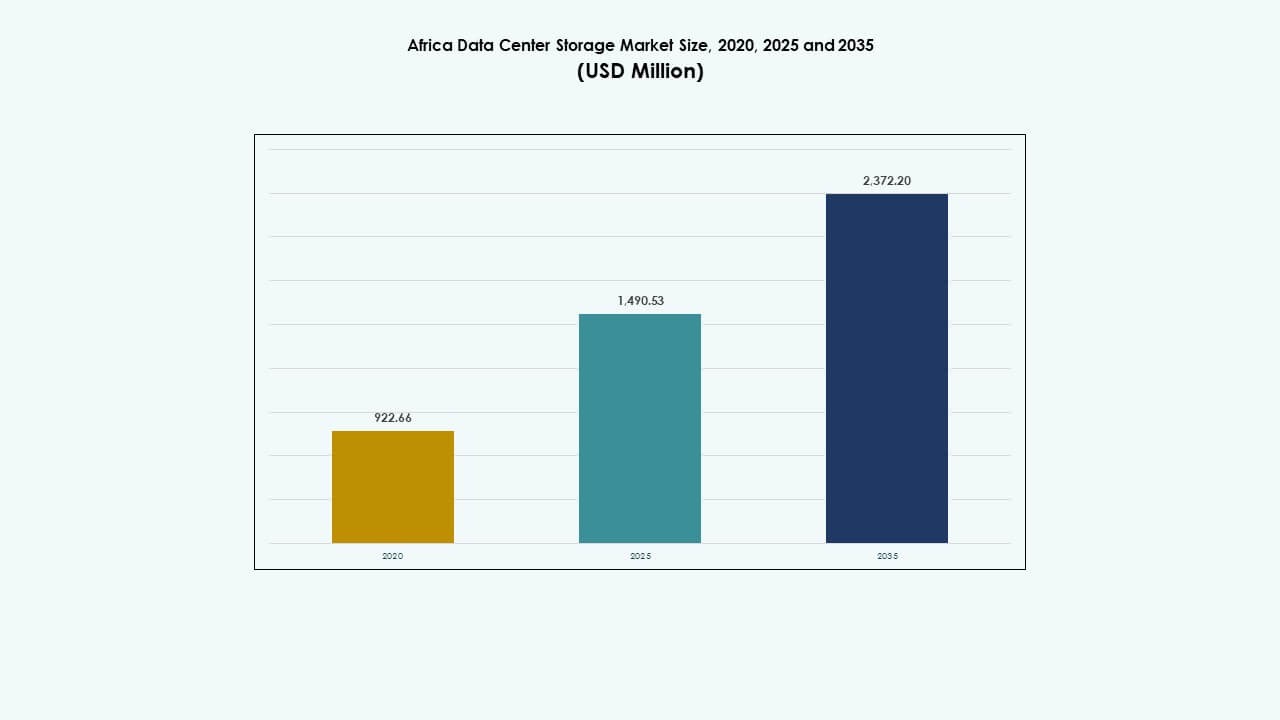

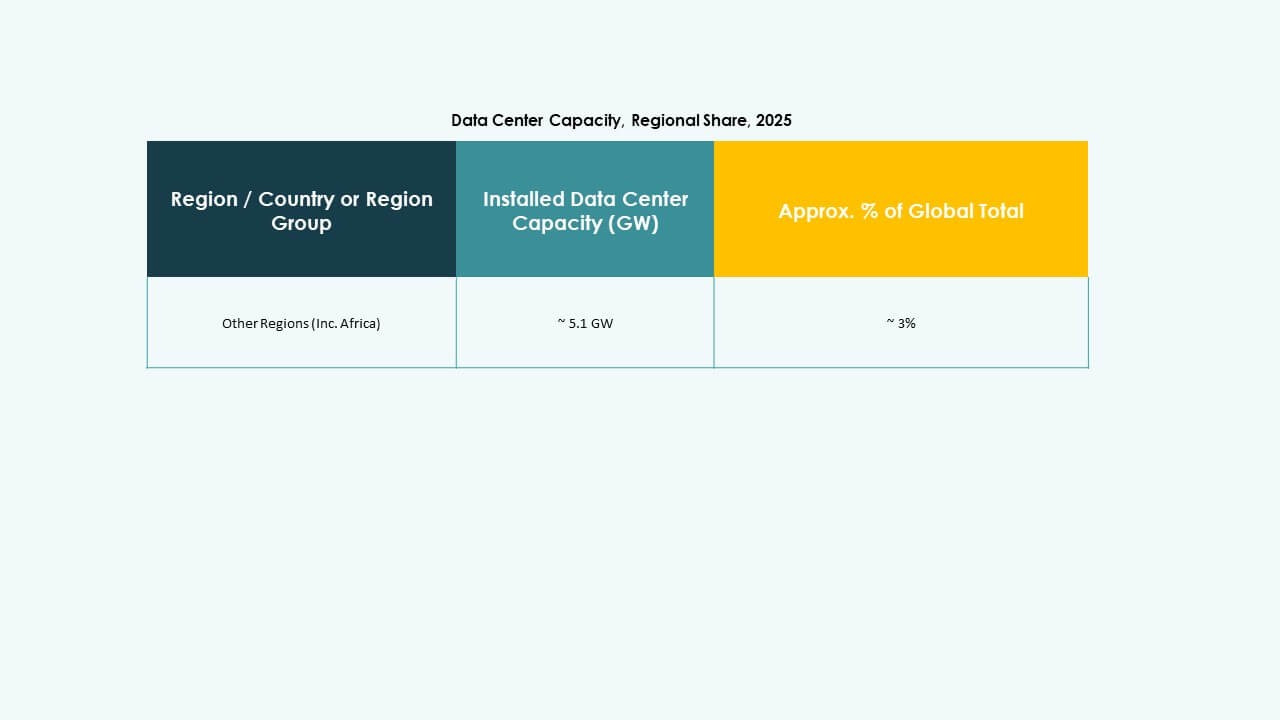

The Africa Data Center Storage Market size was valued at USD 922.66 million in 2020 to USD 1,490.53 million in 2025 and is anticipated to reach USD 2,372.20 million by 2035, at a CAGR of 4.77% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Africa Data Center Storage Market Size 2025 |

USD 1,490.53 Million |

| Africa Data Center Storage Market, CAGR |

4.77% |

| Africa Data Center Storage Market Size 2035 |

USD 2,372.20 Million |

The market is growing due to expanding cloud services, rising data localization policies, and demand for scalable infrastructure. Enterprises are adopting hybrid storage systems to manage both structured and unstructured data more efficiently. Governments are pushing digital transformation, prompting upgrades in secure and compliant storage platforms. Telecom and BFSI sectors are key drivers, as they rely on high-speed, low-latency access. AI and analytics applications further boost demand for high-performance flash-based storage. For investors, it offers long-term returns supported by infrastructure modernization across sectors.

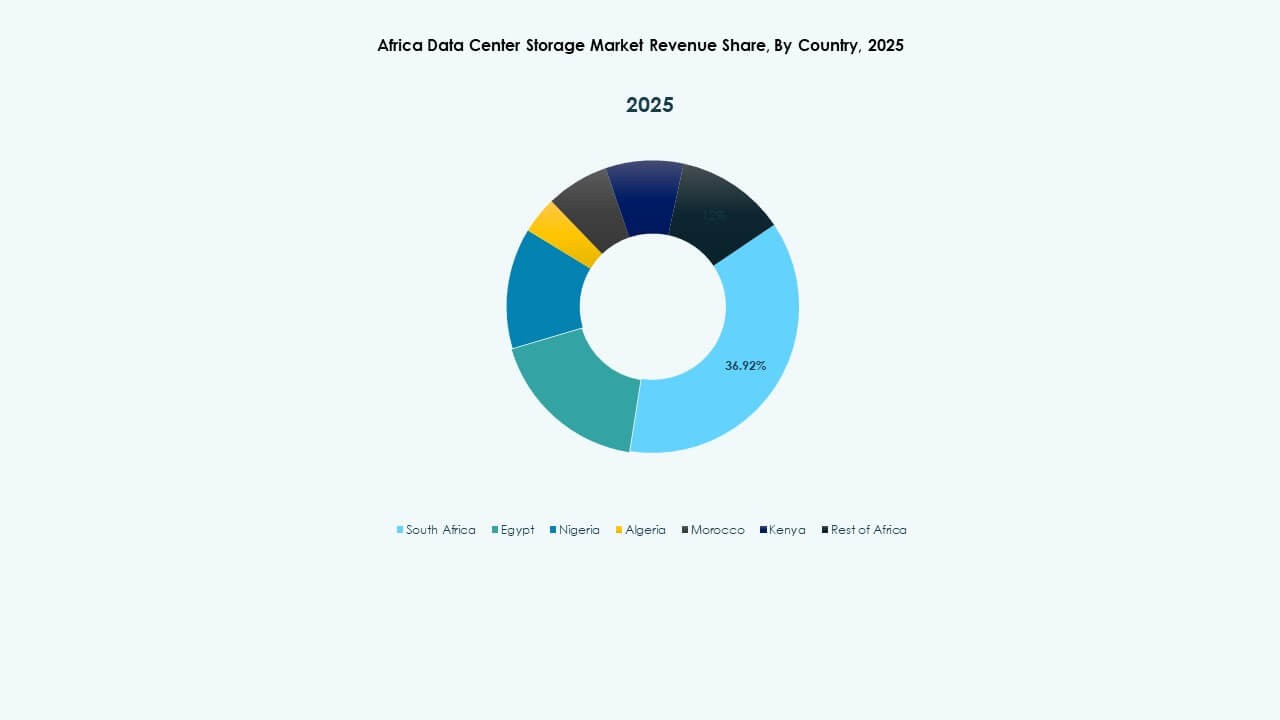

South Africa leads the market with dense hyperscale deployments and strong regulatory support. Nigeria and Kenya are emerging hubs due to fintech growth, connectivity improvements, and favorable government initiatives. Egypt is expanding storage capabilities through state-backed digitization and colocation investments. Other regions like Ghana and Morocco are also gaining traction as submarine cable landings and enterprise digitization continue to improve access and reliability.

Market Dynamics:

Market Drivers

Rapid Growth of Digital Services and Cloud Adoption in Enterprise and Public Sectors

The growth of digital platforms, mobile applications, and cloud services is fueling demand for scalable data storage. Enterprises are shifting workloads to cloud-native platforms to reduce latency and enhance accessibility. Public sector agencies in Africa are adopting digital government models, pushing storage infrastructure to expand. Cloud providers are deploying regional storage nodes to support sovereignty and regulatory compliance. The Africa Data Center Storage Market benefits from this shift, supporting both structured and unstructured data. Real-time access, AI-driven analytics, and content delivery require advanced storage setups. Enterprises view data as a core asset and are investing accordingly. IT strategies now prioritize high-performance storage for continuity, disaster recovery, and low-latency access. This trend aligns data center storage with core national infrastructure goals.

- For instance, Microsoft’s Azure South Africa North (Johannesburg) and South Africa West (Cape Town) regions launched in 2019 support Blob Storage and Files services with data residency compliance, handling workloads across 70+ global Azure regions and 400+ data centers worldwide.

Deployment of Submarine Cables and Terrestrial Fiber Enabling High-Speed Interconnection

High-capacity submarine cables such as 2Africa, Equiano, and PEACE are reshaping Africa’s digital backbone. These projects enhance bandwidth availability and reduce latency across the continent. Terrestrial fiber expansion connects inland regions to international gateways, supporting local data center growth. The Africa Data Center Storage Market is leveraging this infrastructure to expand beyond coastal metros. Increased fiber connectivity allows distributed data centers to synchronize storage and maintain replication targets. ISPs and carriers are investing in regional edge storage nodes to reduce long-haul traffic. Enterprises can now deploy hybrid cloud strategies in more cities. Interconnected nodes require high-performance storage to handle redundancy and synchronization. These infrastructure upgrades are positioning African cities as viable regional data hubs.

- For instance, Google’s Equiano submarine cable delivers 144 Tbps design capacity with landings in Nigeria (Lagos), Namibia (Swakopmund), and South Africa (Cape Town), enabling SEACOM to activate services for low-latency continental connectivity.

Regulatory Push for Data Localization Across Key Markets and Industries

Data sovereignty regulations in countries like Nigeria, Kenya, and South Africa are reshaping storage priorities. Governments mandate local storage of sensitive data across banking, telecom, and public sectors. This is creating demand for Tier III and Tier IV data centers with compliant storage infrastructure. The Africa Data Center Storage Market is aligning with national digital policies to offer secure, local alternatives. Financial institutions are among the first to upgrade legacy infrastructure with encrypted storage. Telecom operators are migrating subscriber data to localized NVMe-based systems. Healthcare and education sectors are also shifting to in-country hosting models. Investors see this shift as a long-term driver of infrastructure-backed services. Storage architecture now plays a central role in digital trust frameworks.

Accelerated Adoption of AI, Edge Computing, and IoT Increasing Storage Complexity

AI and machine learning applications require fast, high-throughput storage platforms to process training and inference workloads. Video surveillance, automated inspection, and real-time analytics generate massive volumes of unstructured data. The Africa Data Center Storage Market is seeing rising demand for GPU-optimized, all-flash arrays to support AI-centric use cases. Edge computing is gaining traction in mining, agriculture, and transportation, where localized storage supports real-time decision-making. IoT networks generate continuous sensor data, pushing storage infrastructure toward low-latency, scalable designs. Many organizations are deploying hybrid storage setups to manage core-to-edge data flows. Multitenancy, security, and deduplication features are becoming critical for infrastructure design. These trends are making advanced storage architecture a key enabler of innovation in Africa.

Market Trends

Rise of Hyperscale and Colocation Investments by Global Cloud Providers in Strategic Hubs

Africa is witnessing increased interest from hyperscale players like Microsoft, Google, and AWS. These companies are setting up or partnering with local providers to build large-scale infrastructure. Key markets like South Africa, Kenya, and Nigeria are becoming hotspots for these deployments. The Africa Data Center Storage Market is being reshaped by this influx of hyperscale demand. Storage requirements include high availability, fault tolerance, and modular scalability. Colocation facilities are also evolving, offering dedicated storage zones with customizable configurations. Global standards in storage performance and compliance are being implemented. Enterprises prefer these colocation hubs due to proximity to end users and robust SLAs. The storage segment is becoming more diversified across performance tiers and redundancy levels.

Adoption of Software-Defined Storage and Virtualization for Flexible Resource Management

The shift toward software-defined infrastructure is transforming how data center storage is deployed and managed. Operators are using software-defined storage (SDS) to decouple hardware and control layers. This approach allows better utilization of storage pools and real-time reallocation of resources. The Africa Data Center Storage Market is increasingly reliant on SDS for flexibility, scalability, and automation. Hypervisors and orchestration platforms like Kubernetes are integrating storage orchestration features. Operators can now scale storage independently of compute, optimizing costs and energy use. SDS also enhances redundancy and snapshot capabilities. Businesses are adopting SDS to support containerized applications and agile development cycles. This shift aligns with the broader move toward software-defined everything across Africa’s data ecosystem.

Integration of Renewable Energy Sources to Power Storage-Intensive Workloads

Data center operators are actively integrating solar and wind energy into their infrastructure plans. Energy-intensive workloads, especially in storage-heavy deployments, require long-term power cost reduction. In the Africa Data Center Storage Market, energy cost is a defining metric for expansion planning. Operators are deploying energy-efficient SSD arrays to complement clean energy use. Many facilities now use on-site battery storage and advanced power management systems. Power usage effectiveness (PUE) optimization is influencing storage hardware choices. Liquid-cooled storage systems are being tested to lower thermal footprint. Renewable power aligns with national green energy goals and attracts ESG-conscious investors. Clean-powered storage setups are becoming a competitive advantage in Africa’s maturing data infrastructure landscape.

Expansion of Edge Storage Nodes to Support Regional Content Delivery and Smart Applications

Edge storage is gaining traction across secondary cities to support content caching, smart city applications, and real-time analytics. Telecom operators and CDNs are placing small-scale storage appliances near end users. The Africa Data Center Storage Market is responding with modular edge nodes equipped for local caching and fast delivery. Video streaming, mobile banking, and e-learning platforms benefit from reduced backhaul needs. Some nodes integrate AI acceleration for local inference, creating demand for compact all-flash systems. These installations reduce pressure on central data hubs and enhance service uptime. Emerging markets in East and West Africa are witnessing faster deployment cycles. The trend supports inclusive digital growth beyond capital cities, anchoring storage at the network edge.

Market Challenges

Power Reliability, Infrastructure Gaps, and High Operating Costs in Emerging Data Center Markets

Many African countries face recurring power outages and unstable electricity infrastructure. Data centers require constant power for critical storage systems, creating high reliance on diesel generators and UPS systems. This raises operational costs and limits scalability in many secondary cities. The Africa Data Center Storage Market struggles with uneven infrastructure readiness across regions. Limited access to high-speed fiber and low redundancy networks hampers deployment of low-latency storage. Developers must factor in power provisioning, cooling, and land availability, slowing project timelines. Grid instability also shortens equipment lifespan and increases maintenance needs. These structural issues make long-term planning and ROI prediction difficult for investors. The result is slower penetration of high-density storage infrastructure beyond primary metros.

Talent Shortage and Vendor Fragmentation Hindering Large-Scale Storage System Implementation

A lack of specialized IT talent and storage engineers limits the deployment of complex, high-performance storage systems. Many regions depend on foreign expertise, raising implementation costs and causing project delays. The Africa Data Center Storage Market also faces fragmentation across vendors, with limited local representation of global storage OEMs. Integration between software and hardware platforms often requires external consultants. Public and private sector clients lack awareness of advanced storage technologies. Training programs and certifications are still nascent in several countries. Complexities around procurement, regulatory approvals, and compliance also affect vendor relationships. Without a skilled local ecosystem, scaling intelligent storage systems remains a challenge.

Market Opportunities

Untapped Demand from Digital SMEs, Fintechs, and E-Governance Programs in Emerging Cities

Digital transformation across Africa is fueling demand for localized storage infrastructure. SMEs in fintech, agritech, and edtech sectors require secure, low-latency platforms for growth. Governments are expanding e-services and digital ID programs, creating long-term storage needs. The Africa Data Center Storage Market has strong opportunity in developing urban centers where capacity is still limited. Investments in small-scale, modular data centers offer a path to fast deployment. Localized cloud providers can serve niche, compliance-driven markets. This demand aligns with rising mobile data usage and local application ecosystems.

Government Incentives and PPP Models Driving Infrastructure Growth Beyond Primary Cities

Several African governments offer tax incentives, land grants, and energy subsidies to attract data center investment. Public-private partnerships (PPPs) are helping deploy storage infrastructure in underserved regions. National broadband and digital economy plans prioritize equitable access to digital infrastructure. The Africa Data Center Storage Market can benefit from coordinated regional strategies. Strategic location planning near power and fiber corridors enables scalable deployment. These incentives lower the entry barrier for domestic and international investors.

Market Segmentation

By Storage Type

Traditional storage systems currently lead due to existing legacy infrastructure in public and enterprise sectors. However, all-flash storage is gaining momentum, driven by its high speed and performance in cloud and AI workloads. Hybrid storage solutions are being adopted to balance cost and scalability. The Africa Data Center Storage Market reflects a gradual shift toward flash-based systems for core applications, especially in government and telecom sectors seeking low-latency operations.

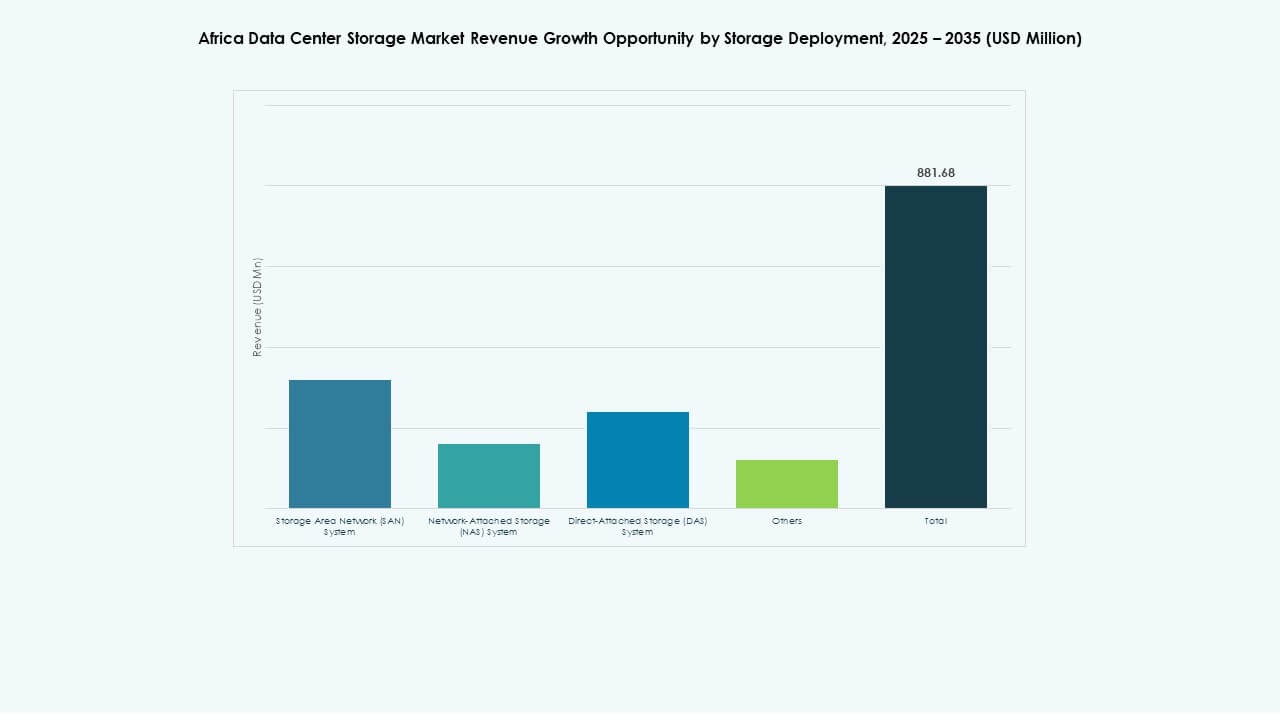

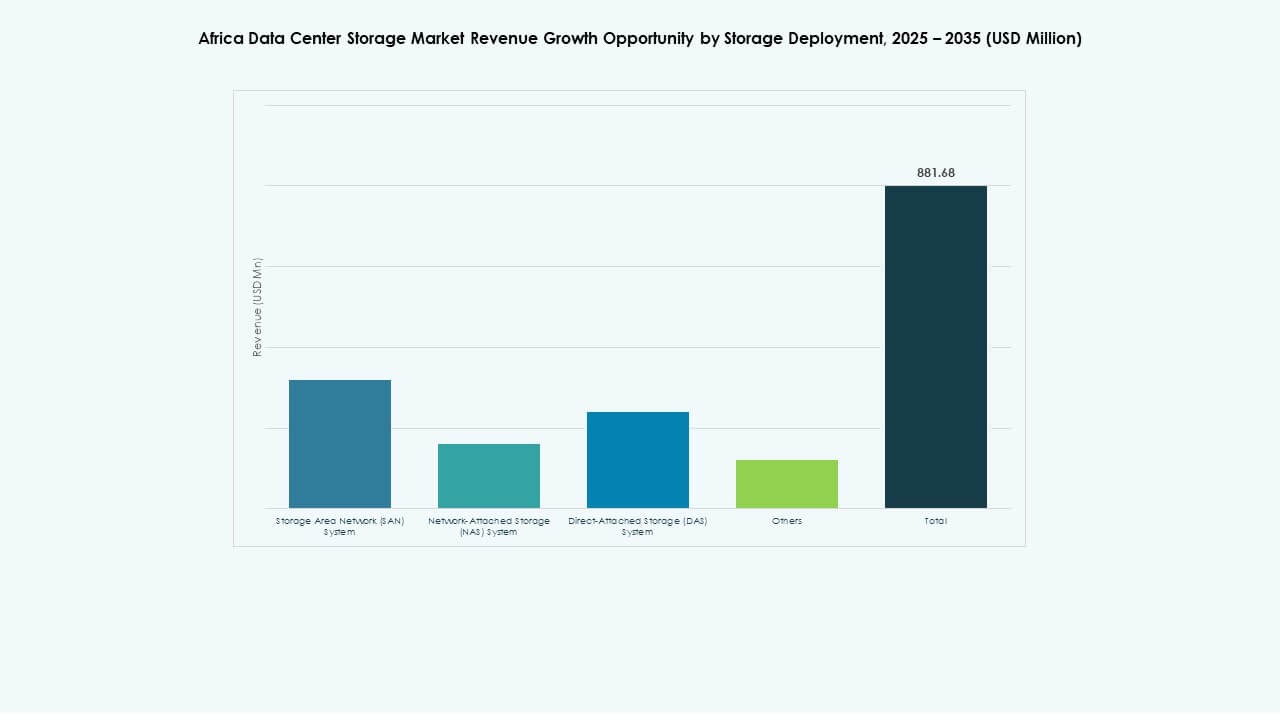

By Storage Deployment

Storage Area Network (SAN) systems dominate due to their reliability, scalability, and ability to support large enterprise environments. SAN is heavily used by telecom, BFSI, and public service providers. Network-attached Storage (NAS) systems are growing rapidly in SMEs and education segments due to ease of integration. Direct-attached Storage (DAS) remains relevant in edge deployments and smaller setups. The Africa Data Center Storage Market is seeing a transition toward mixed deployment models to support diverse workload types.

By Component

Hardware holds the largest share due to demand for high-density servers, racks, and storage arrays. Software solutions are growing in significance, especially in cloud-native environments using SDS and orchestration tools. The rise of AI workloads is increasing demand for advanced storage software features such as deduplication and snapshotting. The Africa Data Center Storage Market reflects a growing balance between hardware and software investments as operators aim for optimized performance and flexibility.

By Medium

Hard Disk Drives (HDD) are still widely used for archival and bulk storage due to cost advantages. Solid-State Drives (SSD) are seeing faster growth, especially in mission-critical, real-time, and AI-related storage needs. Tape storage, while declining, remains relevant in government and research sectors for cold storage. The Africa Data Center Storage Market is witnessing growing interest in NVMe-based SSDs to meet performance benchmarks in cloud and analytics environments.

By Deployment Model

Cloud-based storage is expanding rapidly due to its flexibility and cost efficiency. On-premises deployments remain critical in regulated sectors like finance and healthcare. Hybrid models are becoming common among enterprises looking to balance control, scalability, and cost. The Africa Data Center Storage Market supports a mixed deployment landscape, with cloud adoption accelerating faster in urban centers and hybrid models dominating the transition phase in emerging regions.

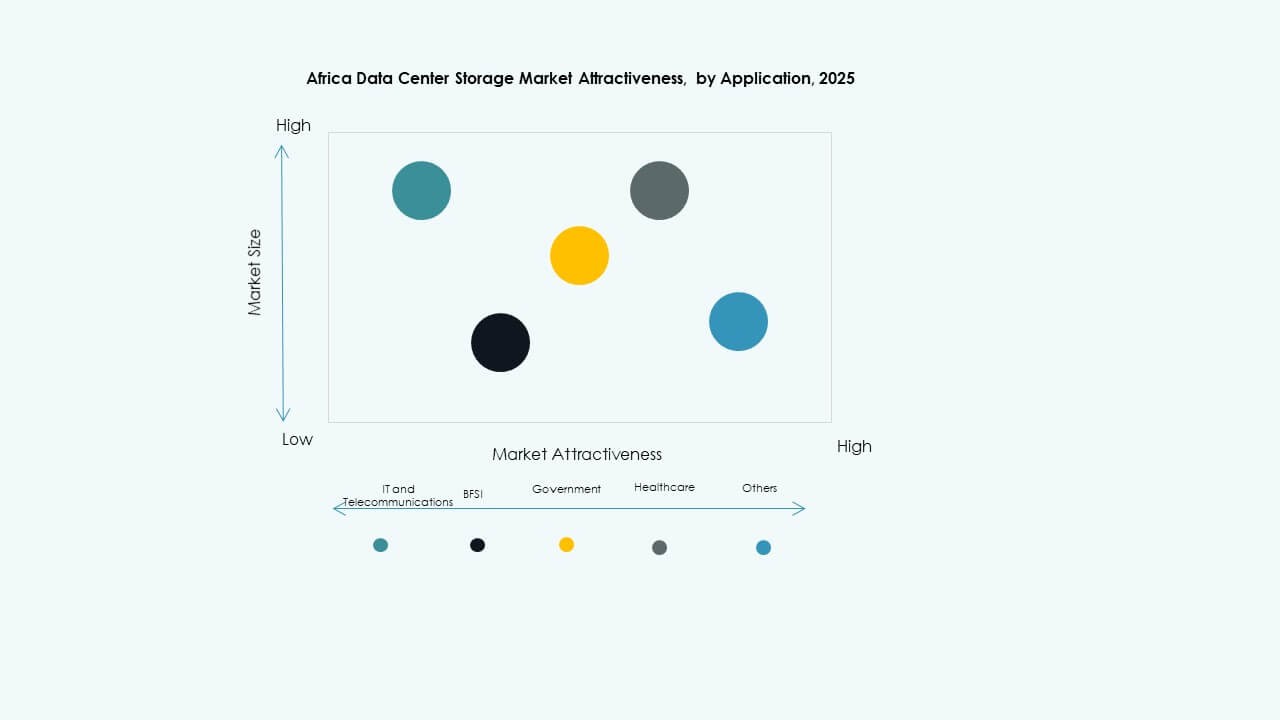

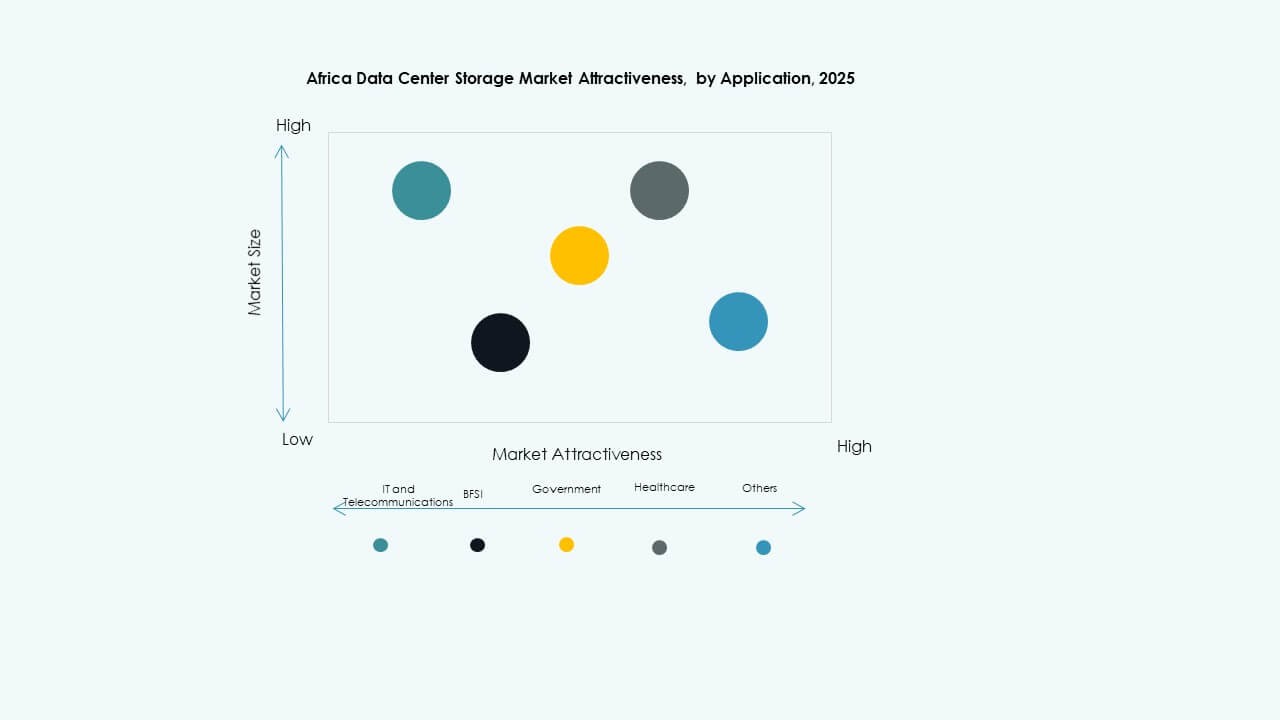

By Application

IT and Telecommunications hold the largest share due to continuous data traffic growth and subscriber data management. BFSI is another dominant segment with strong compliance requirements and rapid digitization. Government applications are increasing as national ID, e-governance, and public data repositories scale. Healthcare is growing due to digitization of records and telemedicine services. The Africa Data Center Storage Market is diversifying across applications, with startups and educational institutions also driving localized demand.

Regional Insights

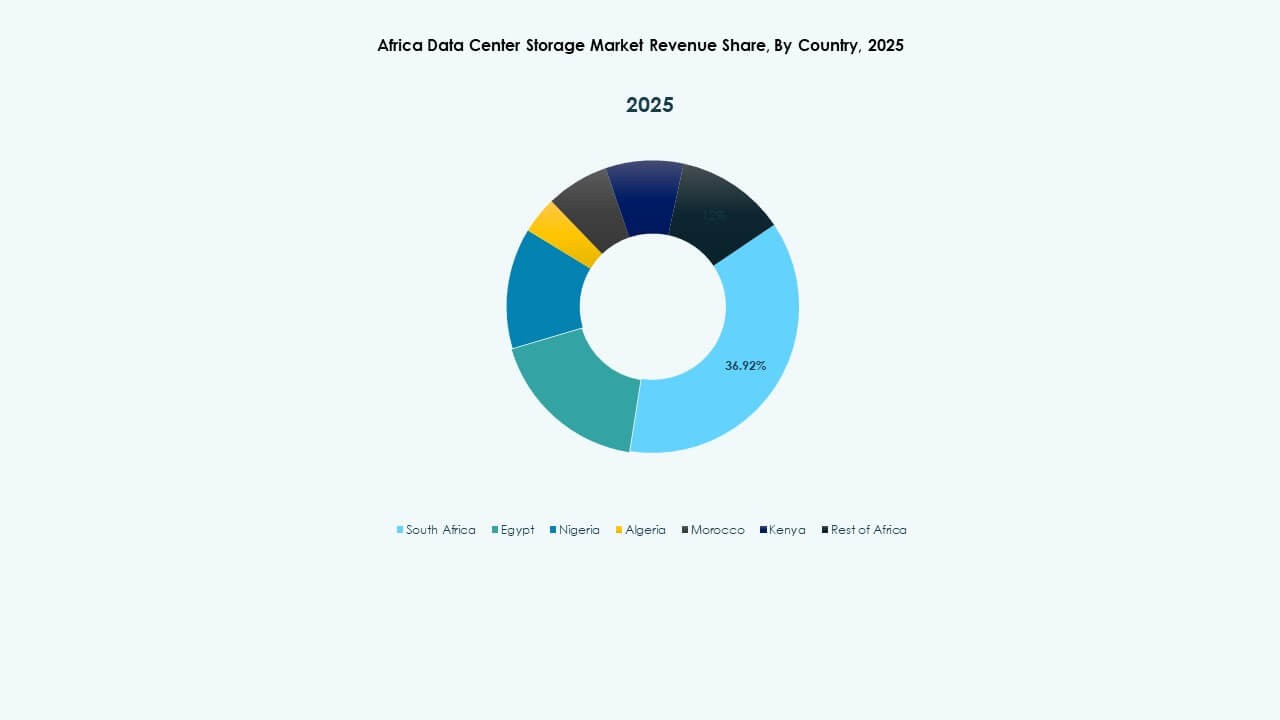

Southern Africa Leads with Strong Hyperscale Activity and 42% Market Share

Southern Africa, particularly South Africa, dominates the Africa Data Center Storage Market with 42% share. Johannesburg and Cape Town host major hyperscale data centers backed by global players like Microsoft and Amazon. The region benefits from strong power grids, undersea cable landing stations, and skilled workforce. Enterprise and public sector cloud adoption is mature, creating consistent demand for storage. The ecosystem also includes leading colocation providers and infrastructure partners. These strengths make Southern Africa the anchor region for advanced storage infrastructure.

Western Africa Emerging as a Secondary Hub with 27% Market Share and Rising Investment

Western Africa holds around 27% of the Africa Data Center Storage Market, led by Nigeria and Ghana. Lagos is becoming a digital infrastructure hub due to increasing enterprise digitization and subsea cable connections. Government mandates on data localization support demand for local storage. Ghana is investing in data center parks and renewable energy integration. The fintech boom across the subregion fuels storage needs from payment platforms, e-commerce, and mobile apps. Western Africa is fast becoming a regional growth engine for data storage deployments.

- For instance, Rack Centre commissioned its LGS2 facility in April 2025 with 12 MW IT load across six halls and 3,240 sqm white space, enabling hyperscale storage connectivity for local fintech platforms.

Eastern and Northern Africa Share the Remaining 31%, Driven by E-Government and Enterprise Digitalization

Eastern Africa and Northern Africa contribute a combined 31% to the market. Kenya, Egypt, and Morocco are key players in this segment. Nairobi leads in East Africa, benefiting from regulatory clarity and regional cloud activity. Egypt is a digital government leader with strong public-sector IT investment. Morocco focuses on colocation and smart city infrastructure. Storage growth is supported by education, logistics, and manufacturing digitization. These regions are catching up quickly, with data center clusters forming around national broadband corridors.

- For instance, Airtel broke ground on a 44 MW data center campus in Nairobi in September 2025, featuring multiple halls with over 3,000 racks designed for high-density storage in East Africa’s cloud ecosystem.

Competitive Insights:

- Africa Data Centres

- PAIX Data Centres

- Raxio Group

- Huawei Technologies Co., Ltd.

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- IBM Corporation

- Cisco Systems, Inc.

- Lenovo Group

- Nutanix, Inc.

The Africa Data Center Storage Market is shaped by a mix of global tech giants and regional colocation operators. Global players like Dell, HPE, and Huawei dominate the hardware and enterprise storage solutions segment. These firms supply SAN, NAS, and hybrid systems with advanced features like NVMe and SDS integration. Regional data center providers such as Africa Data Centres, PAIX, and Raxio lead colocation and edge storage deployments, targeting local compliance and latency needs. Cloud enablement, data localization mandates, and government digitization programs are encouraging more partnerships and infrastructure alliances. Companies compete on energy efficiency, modular scalability, and AI-ready storage designs. The market remains fragmented, with strong vendor activity in South Africa and growing footprints in Kenya, Nigeria, and Egypt. It supports diverse use cases from BFSI to telecom and public sector storage.

Recent Developments:

- In December 2025, Africa Data Centres (a Cassava Technologies business) announced a strategic partnership with CSSi South Africa focused on expanding high‑performance data storage capabilities within its South African facilities. This partnership specifically targets improved data storage and colocation solutions for enterprises.

- In April 2025, Raxio Group secured USD 100 million in financing from the International Finance Corporation (IFC) to expand its data centre platform across Sub‑Saharan Africa, including Ethiopia, Mozambique, and the Democratic Republic of the Congo. This financing is confirmed by official Raxio Group announcements and press releases.