Executive summary:

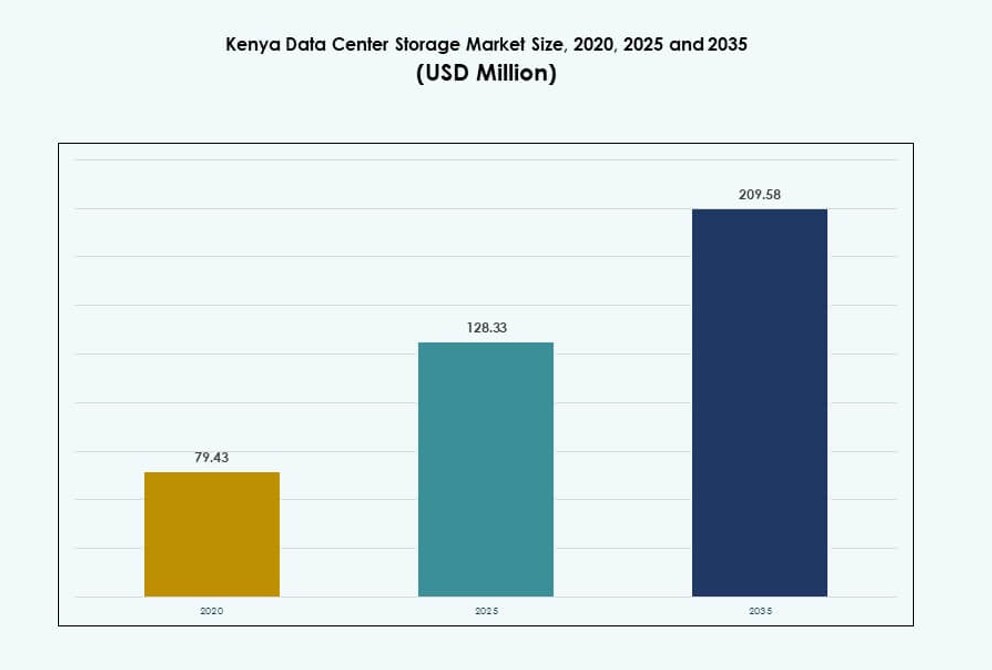

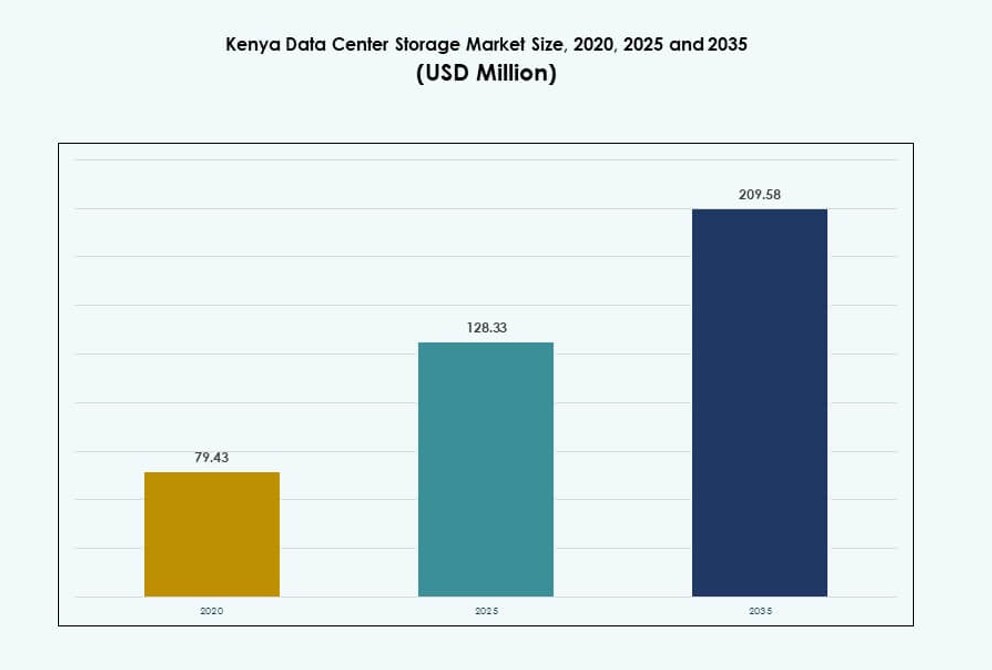

The Kenya Data Center Storage Market size was valued at USD 79.43 million in 2020 to USD 128.33 million in 2025 and is anticipated to reach USD 209.58 million by 2035, at a CAGR of 4.97% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Kenya Data Center Storage Market Size 2025 |

USD 128.33 Million |

| Kenya Data Center Storage Market, CAGR |

4.97% |

| Kenya Data Center Storage Market Size 2035 |

USD 209.58 Million |

Kenya’s data center storage market is expanding due to rising adoption of cloud-based services, AI-driven workloads, and real-time analytics. Enterprises in BFSI, government, healthcare, and telecom are modernizing storage systems to support latency-sensitive applications. Hybrid and all-flash solutions are replacing legacy infrastructure to improve resilience and speed. Digital transformation and regulatory policies continue to fuel demand for localized storage. Investors find this market appealing due to predictable growth, increasing digital traffic, and Kenya’s role as a regional tech gateway.

Nairobi dominates the market with a strong concentration of data centers, supported by fiber connectivity and enterprise demand. Mombasa is emerging as a key coastal hub due to subsea cable landings and hosting facilities. Cities like Kisumu and Eldoret are gaining attention for edge deployments and localized service delivery. These regions shape the structure and expansion of the Kenya Data Center Storage Market through differentiated use cases and demand patterns.

Market Dynamics:

Market Drivers

Rapid Digital Transformation Across Government, Banking, and Telecom Sectors Is Creating Persistent Storage Demand

Government-led e-services, digital ID systems, and revenue collection platforms require high-volume data storage. The financial sector is expanding mobile money platforms and digital banking operations that rely on secure storage frameworks. Telecom providers are scaling 4G and 5G rollouts, demanding fast, low-latency storage solutions. Major operators are building infrastructure to support video streaming and real-time data analytics. Smart city initiatives in Nairobi and Mombasa generate structured and unstructured data at scale. The Kenya Data Center Storage Market supports this surge with demand for scalable, efficient solutions. Businesses need reliable infrastructure to meet performance, redundancy, and security needs. It is strategically important for investors targeting East Africa’s expanding digital ecosystem. The rising volume of enterprise and citizen data continues to reinforce demand for robust storage deployment.

- For instance, Safaricom’s M-Pesa processed 37.15 billion transactions totaling KES 38.29 trillion in FY 2024/25, driving demand for encrypted, high-availability storage arrays.

Cloud Integration and Edge Computing Drive the Shift from Legacy to Modular Storage Systems

Organizations are retiring legacy tape and disk-based storage systems to adopt agile, modular systems that support hybrid cloud integration. Edge computing is gaining traction, reducing latency and improving performance across decentralized operations. Local cloud providers and global players are deploying containerized micro data centers at branch locations. These setups require compact, high-performance storage units. The Kenya Data Center Storage Market reflects this shift through increased uptake of all-flash and hybrid systems. Energy-efficient storage is prioritized in response to rising power costs and ESG mandates. Investors benefit from asset-light, high-ROI deployments that align with hybrid workloads. The market aligns with enterprise focus on flexibility, performance, and compliance. Strong demand exists for storage designed to handle edge AI, IoT data, and distributed cloud environments.

High Uptake of AI and Big Data Analytics in Healthcare, Retail, and Education Demands Low-Latency Storage Infrastructure

Healthcare providers use diagnostic AI systems and electronic health records that generate continuous data loads. Retailers are deploying real-time analytics and behavior tracking tools across online and offline channels. Academic institutions leverage video-based learning, online examinations, and cloud-native research repositories. These activities require storage systems capable of sustained input/output operations and seamless scalability. The Kenya Data Center Storage Market is expanding to meet these real-time requirements across sectors. Many firms are turning to NVMe storage arrays to meet latency-sensitive workloads. Secure storage also ensures data protection compliance under evolving national ICT policies. It continues to enable AI training, deep learning, and massive unstructured data analysis. Businesses that adopt modern storage benefit from operational efficiency and actionable insight generation.

Private-Public Collaborations and Regulatory Frameworks Boost Confidence in Long-Term Data Infrastructure Investments

The Kenyan government has initiated policies to attract hyperscalers and local investors in data infrastructure. Tax incentives and data sovereignty laws are encouraging cloud service providers to set up localized storage nodes. Partnerships between private tech firms and public agencies are leading to Tier III certified facility development. The Kenya Data Center Storage Market gains strategic advantage through this institutional support. Investors are assured of long-term regulatory clarity and political backing. Nairobi’s Konza Technopolis and Mombasa’s SEZs (Special Economic Zones) offer ideal locations for storage hubs. It benefits from regional integration plans, such as the East African Community ICT framework. The ecosystem is structured to support long-term digital trade, compliance, and resilience. Stable policy direction supports investor confidence and structured infrastructure growth.

- For instance, Konza Technopolis’ Phase 1 development includes a Tier III National Data Centre designed with multi‑petabyte storage capacity to support cloud and enterprise services.

Market Trends

Rising Demand for High-Density Storage Systems to Support Urban Data Growth and Capacity Optimization

Urban centers are witnessing a steep rise in user-generated data and enterprise storage needs. Facilities in Nairobi, Kisumu, and Mombasa are investing in high-density rack storage to optimize space. This trend supports compact footprint deployment while boosting storage capacity per square foot. It is encouraging vendors to offer modular systems with tiered performance options. The Kenya Data Center Storage Market reflects this urban push toward consolidation and scale. Cooling systems are evolving to support denser setups with better airflow management. Operators are adopting rack-scale architecture to ensure fault tolerance and minimal downtime. Enterprises prefer centralized control with higher throughput per node. This trend is reinforced by real estate constraints in top cities and regulatory zoning limits.

Adoption of Open Standards and Interoperable Storage Solutions Across Mid-Sized Enterprises

Many mid-sized firms are transitioning to open-source and vendor-neutral storage systems to reduce lock-in risk. Open standards allow seamless integration across hybrid infrastructure and cloud-native workloads. The Kenya Data Center Storage Market is increasingly shaped by this shift toward flexibility and interoperability. Storage providers now prioritize compatibility with Kubernetes, Docker, and other container ecosystems. This trend supports DevOps teams managing continuous delivery pipelines and CI/CD workloads. It also lowers total cost of ownership for businesses operating under tight IT budgets. Open architectures improve transparency, ease of customization, and vendor-switching flexibility. More firms are joining industry alliances to ensure consistent data management practices. Kenya’s storage ecosystem is evolving into a developer-friendly, open innovation hub.

Decentralization of Data Workloads Through Regional Hubs and Edge Deployment Models

Enterprise workloads are moving closer to the source of data generation, particularly in retail, logistics, and smart infrastructure. Regional Tier II cities are emerging as storage demand centers due to edge-ready architecture and last-mile connectivity. The Kenya Data Center Storage Market shows increased demand for local caching and distributed storage nodes. Applications with real-time processing needs benefit from edge-optimized systems. Organizations are using lightweight storage appliances that ensure consistent performance outside primary data centers. Low-latency computing is critical for traffic management, industrial automation, and media streaming. This decentralization is enabling better geographic distribution of digital services. Enterprises see improved redundancy, lower bandwidth usage, and better compliance under local data policies.

Strong Focus on Data Security-Driven Storage Modernization in BFSI and Public Sector

Cybersecurity and regulatory compliance are driving the adoption of storage systems with built-in encryption and role-based access control. Financial institutions demand systems with immutability and high redundancy to prevent data breaches. The Kenya Data Center Storage Market is aligning with international standards such as ISO/IEC 27001. Government agencies are implementing secure storage for national ID, election, and public health databases. Providers offer zero-trust architecture, multi-factor authentication, and hardened storage nodes. BFSI institutions are deploying AI-driven threat detection embedded within storage systems. Enterprises now prioritize systems that log access, monitor anomalies, and enable data recovery. Vendors that offer secure-by-design infrastructure are gaining a competitive edge in the market.

Market Challenges

Insufficient Power Infrastructure and High Operational Costs Constrain Long-Term Storage Expansion Potential

Power supply in Kenya remains unstable, especially in remote or Tier II zones. Frequent outages disrupt operations and increase reliance on diesel generators, adding to operating costs. Data centers must invest in UPS systems and backup power, making total deployment expensive. The Kenya Data Center Storage Market faces cost pressures due to high electricity tariffs and cooling energy demands. These costs impact pricing and profit margins for storage service providers. Small operators struggle to achieve economies of scale and compete with global brands. Energy constraints also slow down storage-intensive workloads like AI training and backup recovery. The sector needs stronger energy reforms and incentives for green power usage.

Limited Domestic Hardware Manufacturing and Dependency on Imports Increases Deployment Delays

Kenya lacks local manufacturing for advanced storage components like SSDs, controllers, and enclosures. Most systems rely on imports, making them vulnerable to global supply chain disruptions. Fluctuating forex rates and customs delays slow project timelines and inflate costs. The Kenya Data Center Storage Market depends on timely delivery of imported storage systems for new setups. Procurement cycles for large-scale deployments often stretch over multiple months. Delays hinder service-level agreements and disrupt enterprise scaling plans. Logistics infrastructure must improve to support efficient inland transport of imported components. Local integration centers and repair facilities are limited, adding to downtime during maintenance cycles.

Market Opportunities

Expanding Hyperscaler Presence and Regional Integration Offers Strong Potential for Storage Infrastructure Localization

Global cloud service providers are eyeing Nairobi as a strategic hub for East Africa. Localizing storage to meet regional data residency needs will create demand for scalable systems. The Kenya Data Center Storage Market offers opportunities for vendors offering modular, quick-deploy solutions. Government support for data localization laws makes it favorable for hybrid cloud deployments. Investors can tap into untapped regions and industries underserved by legacy infrastructure.

Accelerated Growth in E-commerce and Fintech Platforms Requires Agile Storage That Supports Real-Time Analytics

Kenya’s fintech boom is creating demand for fast-access, fault-tolerant storage systems. E-commerce firms need scalable storage that supports large catalogs, media files, and customer data. This opens a market for vendors offering elastic and API-integrated storage. The Kenya Data Center Storage Market benefits from these evolving digital economies. New players can address niche needs such as object storage for real-time customer behavior analysis.

Market Segmentation

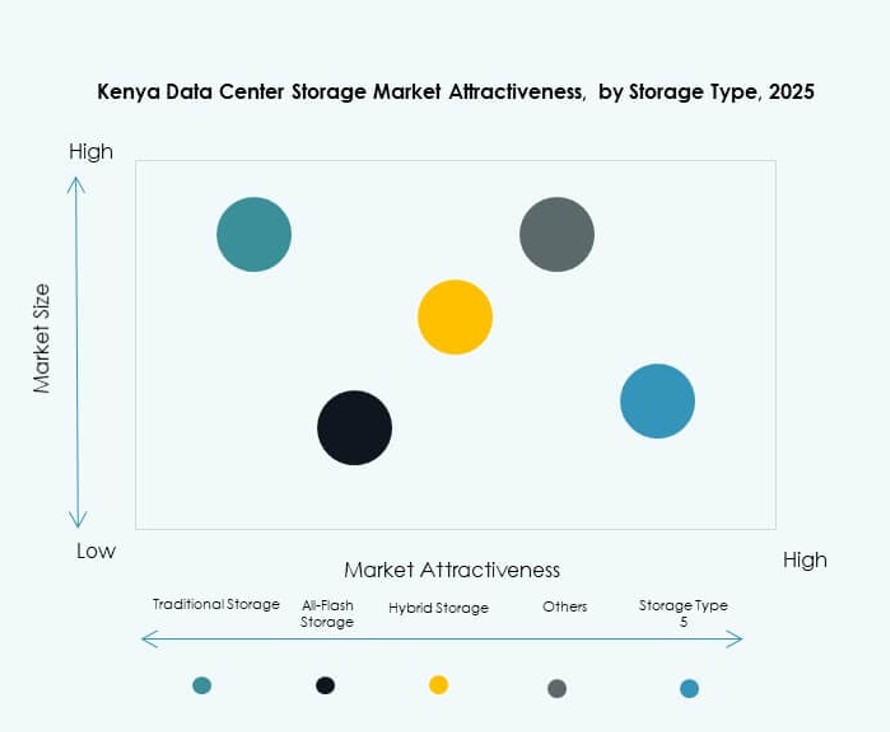

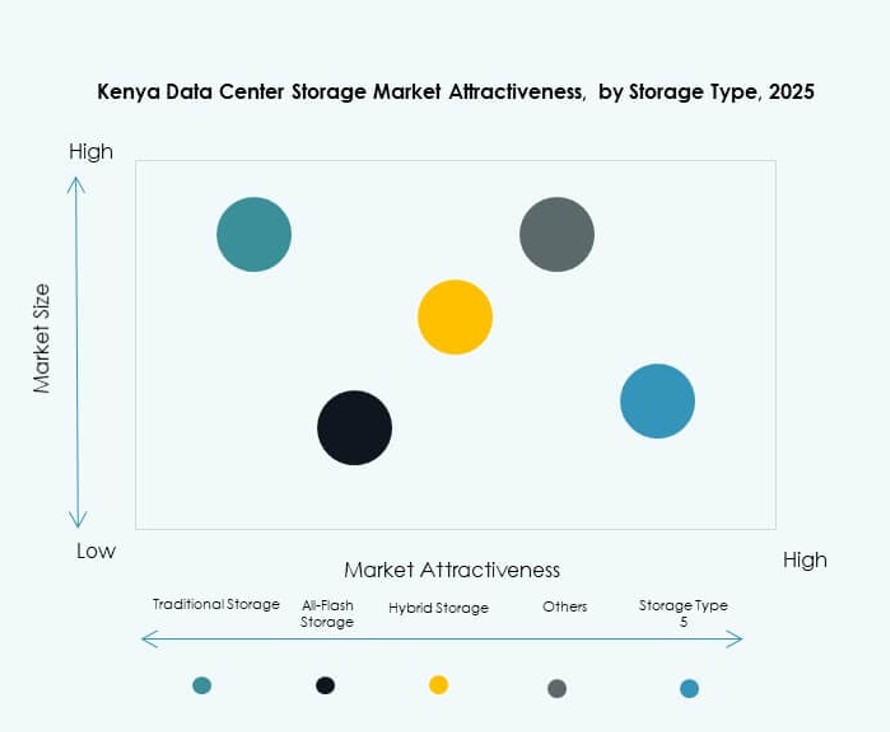

By Storage Type

Traditional storage systems still hold a notable share, especially in government and legacy banking operations. However, hybrid storage is becoming dominant due to its balance of speed, flexibility, and cost-efficiency. The Kenya Data Center Storage Market sees growing preference for all-flash arrays in AI and real-time use cases. Hybrid setups offer scalability while managing diverse workloads, making them attractive for enterprises expanding regionally. Others, like object storage, are gaining traction for unstructured data.

By Storage Deployment

Storage Area Network (SAN) systems dominate large enterprise and telecom deployments due to high throughput and centralized control. Network-attached Storage (NAS) is growing across SMEs and mid-sized institutions for shared access and ease of setup. The Kenya Data Center Storage Market is also witnessing adoption of Direct-attached Storage (DAS) in micro data centers and edge sites. Other deployment models include hyperconverged storage, which combines compute and storage in single systems.

By Component

Hardware dominates the market share due to continuous investments in high-performance racks, drives, and backup systems. Software components are gaining momentum with the shift toward AI-powered analytics and storage virtualization. The Kenya Data Center Storage Market benefits from solutions combining both hardware resilience and software automation. Data orchestration, deduplication, and encryption modules are becoming critical in ensuring storage efficiency.

By Medium

Hard Disk Drives (HDD) continue to serve archival and backup storage needs due to cost advantages. Solid-State Drives (SSD) are rapidly gaining market share, driven by high-speed access and reduced power use. The Kenya Data Center Storage Market sees niche use of tape storage in compliance-heavy sectors, though it’s declining. SSDs are preferred in BFSI, healthcare, and real-time analytics due to superior performance and longevity.

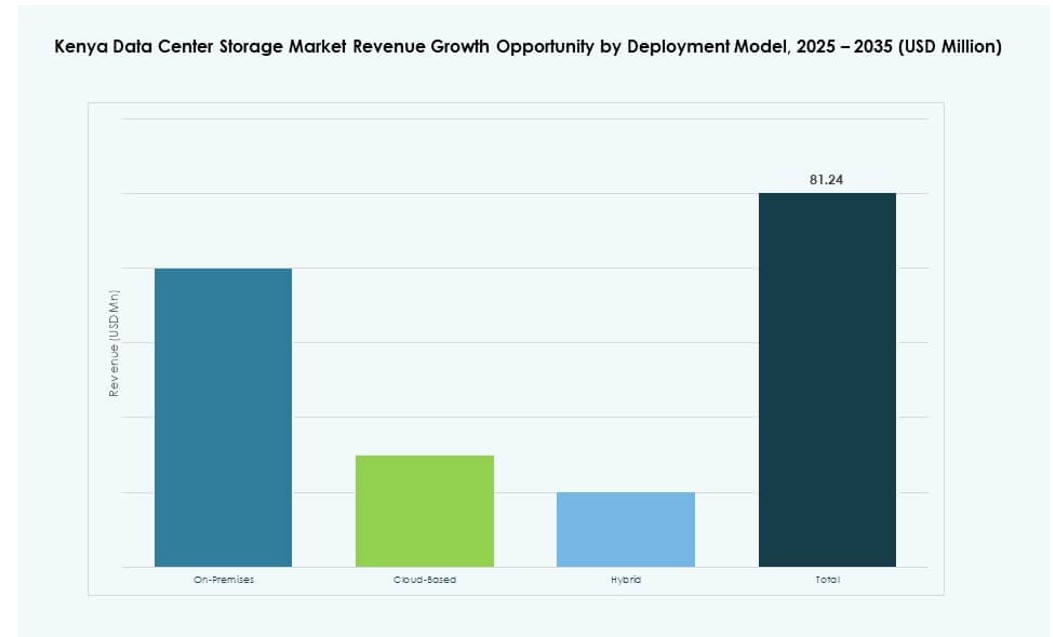

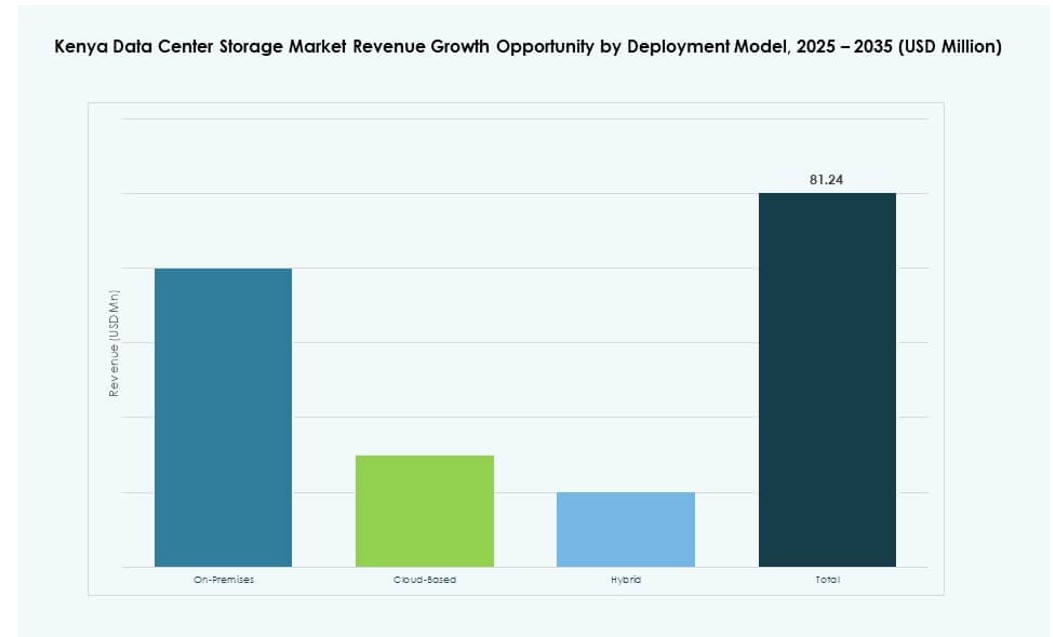

By Deployment Model

On-premises deployments remain dominant among financial institutions and government bodies for data control. Cloud-based storage is expanding across startups and mid-sized businesses for flexibility and lower CapEx. The Kenya Data Center Storage Market also shows rising interest in hybrid models, enabling organizations to scale while retaining sensitive data in-house. Hybrid models allow disaster recovery, seamless scaling, and regulatory compliance.

By Application

IT and telecommunications lead market demand due to large-scale infrastructure and data transmission loads. BFSI follows closely, driven by digital banking and secure transaction storage needs. The Kenya Data Center Storage Market also sees strong demand from government applications, especially for e-citizen platforms and national ID programs. Healthcare and education sectors are investing in scalable storage for patient data and cloud-based learning platforms. Others include retail and logistics.

Regional Insights

Nairobi Leads with 68% Market Share Due to Dense Urban Digital Activity and Infrastructure Readiness

Nairobi remains the core hub for data center development in Kenya, backed by strong enterprise presence and reliable power infrastructure. The Kenya Data Center Storage Market sees consistent growth from Nairobi’s financial sector, government services, and ICT businesses. The city hosts multiple Tier III and hyperscale facilities, creating demand for dense, scalable storage. Nairobi’s strategic position, policy support, and fiber connectivity solidify its leadership. Its large user base and centralized data access needs sustain ongoing infrastructure upgrades.

- For instance, Africa Data Centres’ NBO1 facility provides 7.5 MW available site capacity across four Uptime Institute Tier III certified data halls.

Mombasa Holds 18% Market Share as a Key Subsea Landing Point and Gateway for Coastal Enterprise Activity

Mombasa benefits from undersea cable landings and a growing logistics ecosystem. It is emerging as a backup and secondary hub, supporting content delivery networks and marine sector data. The Kenya Data Center Storage Market sees storage demand for caching, video streaming, and port automation in this zone. Mombasa also supports redundancy needs for Nairobi-based deployments. Growing local enterprise activity fuels demand for scalable, cost-effective storage solutions.

- For instance, iColo.io’s MBA2 data center delivers 1.7 MW capacity across 1,200 square meters, supporting approximately 580 racks adjacent to subsea cable landings.

Other Regions Contribute 14% Market Share as Edge and Regional Digital Hubs Gain Momentum

Cities like Kisumu, Eldoret, and Nakuru are becoming emerging centers due to expanding mobile internet and enterprise digitization. These locations support government services, education hubs, and growing healthcare infrastructure. The Kenya Data Center Storage Market benefits from localized deployments in these regions to reduce latency and improve service coverage. Edge-ready storage systems are increasingly deployed to meet real-time data processing needs. These areas hold potential for future capacity expansion as digital access spreads.

Competitive Insights:

- iColo Data Centers

- Safaricom Data Center

- Liquid Intelligent Technologies

- Dell Technologies

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- NetApp

- Huawei Technologies

- Cisco Systems

- Nutanix, Inc.

The Kenya Data Center Storage Market is moderately consolidated, with a mix of telecom-led local operators and global storage technology providers. iColo, Safaricom, and Liquid Intelligent Technologies lead infrastructure ownership and service delivery in major regions like Nairobi and Mombasa. Global players such as Dell, HPE, and IBM provide enterprise-grade storage systems, often partnering with regional integrators. It is defined by growing collaboration between hyperscalers and local data center firms to meet rising storage needs. Demand for hybrid, all-flash, and cloud-based storage allows companies like NetApp and Nutanix to grow rapidly in enterprise segments. The market shows rising M&A activity and vendor partnerships focused on sustainability, latency optimization, and compliance-driven solutions.

Recent Developments:

- In September 2025, iXAfrica Data Centres secured up to US$200 million in debt financing from Rand Merchant Bank to expand its Nairobi campus by an additional 20 MW of IT power, enhancing storage capacity for hyperscale and AI applications.

- In September 2025, Digital Parks Africa and iXAfrica Data Centres announced a strategic partnership to provide seamless data center services across Kenya and South Africa, allowing customers reciprocal access to storage and connectivity ecosystems in both regions.

- In August 2025, iColo Data Centers expanded its Mombasa peering capabilities through a key partnership with the Kenya Internet Exchange Point (KIXP), which launched a new point of presence in the MBA2 data center.