Executive summary:

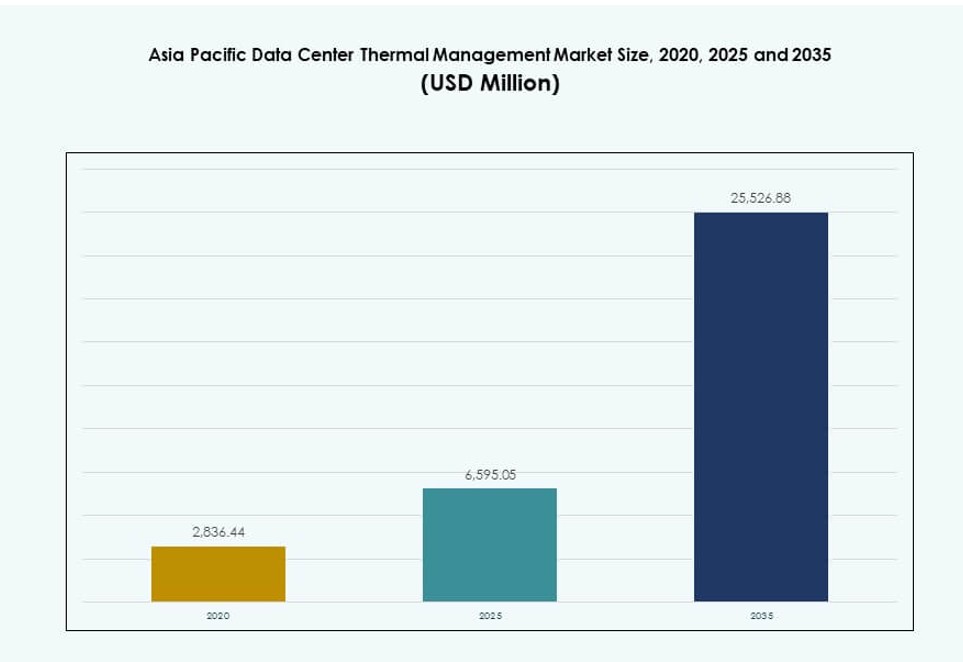

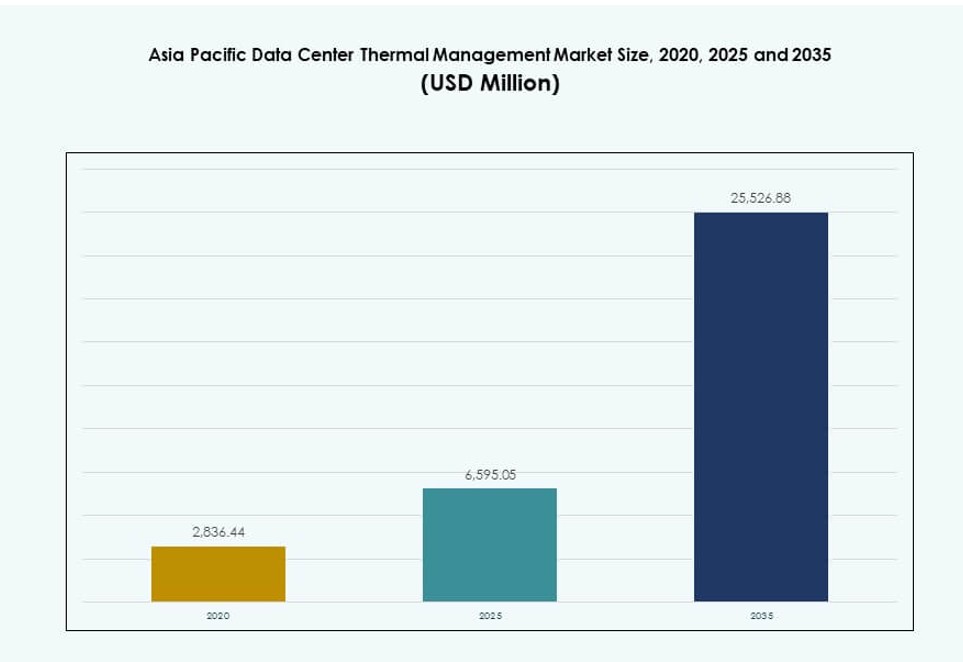

The Asia Pacific Data Center Thermal Management Market size was valued at USD 2,836.44 million in 2020, grew to USD 6,595.05 million in 2025, and is anticipated to reach USD 25,526.88 million by 2035, registering a CAGR of 14.39% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Asia Pacific Data Center Thermal Management Market Size 2025 |

USD 6,595.05 Million |

| Asia Pacific Data Center Thermal Management Market, CAGR |

14.39% |

| Asia Pacific Data Center Thermal Management Market Size 2035 |

USD 25,526.88 Million |

Rising demand for AI workloads, cloud services, and edge computing is driving innovation in thermal solutions. Operators adopt liquid-based, immersion, and hybrid cooling to manage high-density server heat. Intelligent control systems and predictive thermal analytics are transforming efficiency benchmarks. Businesses see thermal design as central to operational reliability and energy optimization. Sustainability goals and stricter efficiency mandates push investments in green cooling. The market holds strategic value for investors focused on hyperscale expansion and digital infrastructure resilience.

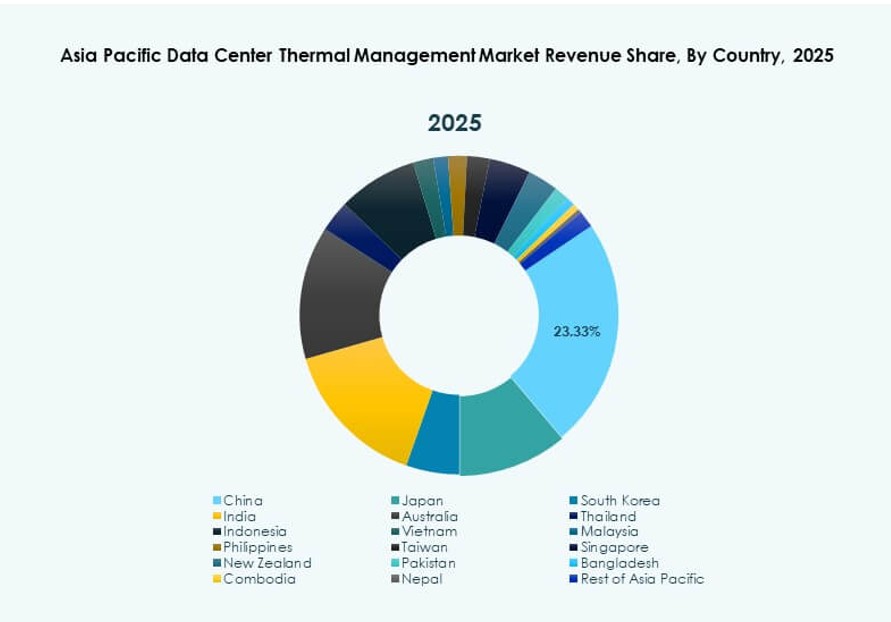

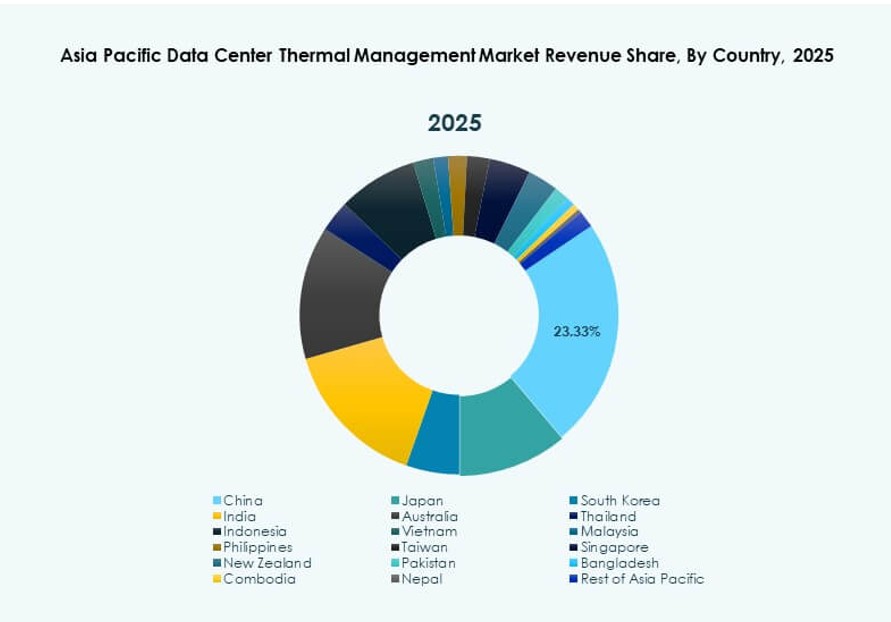

China, Japan, and India lead in market share due to rapid data center construction and digital growth. Southeast Asia including Indonesia, Vietnam, and the Philippines is emerging quickly with strong cloud adoption and local policy support. Mature infrastructure and innovation hubs in South Korea and Australia drive smart cooling adoption. This regional diversity shapes tailored thermal strategies and accelerates demand across different climate zones and digital maturity levels.

Market Dynamics:

Market Drivers

Surging Hyperscale and Colocation Data Center Development in Leading Economies Across the Region

The Asia Pacific Data Center Thermal Management Market is expanding due to hyperscale and colocation project growth across China, India, Japan, and Southeast Asia. Cloud majors like AWS, Google, Microsoft, and Alibaba continue to build hyperscale campuses, driving demand for efficient thermal infrastructure. Rising digital workloads require precise cooling in high-density server environments. Operators need thermal solutions that reduce power use while maintaining uptime. Colocation providers scale faster with modular, integrated cooling systems. Public and private investments flow into Tier III and IV facilities, pushing thermal innovation. It supports resilient service delivery in the region’s high-growth cloud environment. Market players view thermal management as a mission-critical investment, ensuring consistent performance in tropical and temperate climates.

- For instance, AWS introduced advanced hybrid cooling components in its next‑generation data centers, combining air and liquid cooling to cut mechanical energy consumption by up to 46% during peak cooling conditions compared to earlier designs.

Accelerating AI and High-Performance Workload Adoption Driving Shift Toward Advanced Cooling Systems

The rapid deployment of artificial intelligence and GPU-based computing has transformed thermal needs across regional data centers. Dense server racks with AI chips generate higher heat loads, requiring new-generation cooling methods. Liquid cooling and immersion cooling gain traction for performance and efficiency. Enterprises and cloud firms adopt direct-to-chip systems to manage temperature at the processor level. Traditional air-based systems no longer meet the demands of AI models running 24/7. Thermal management vendors introduce AI-integrated systems that adjust cooling in real-time. The Asia Pacific Data Center Thermal Management Market responds with scalable, high-efficiency technologies. Infrastructure planners prioritize cooling as a core metric in greenfield and brownfield builds. Strategic adoption secures long-term sustainability and performance.

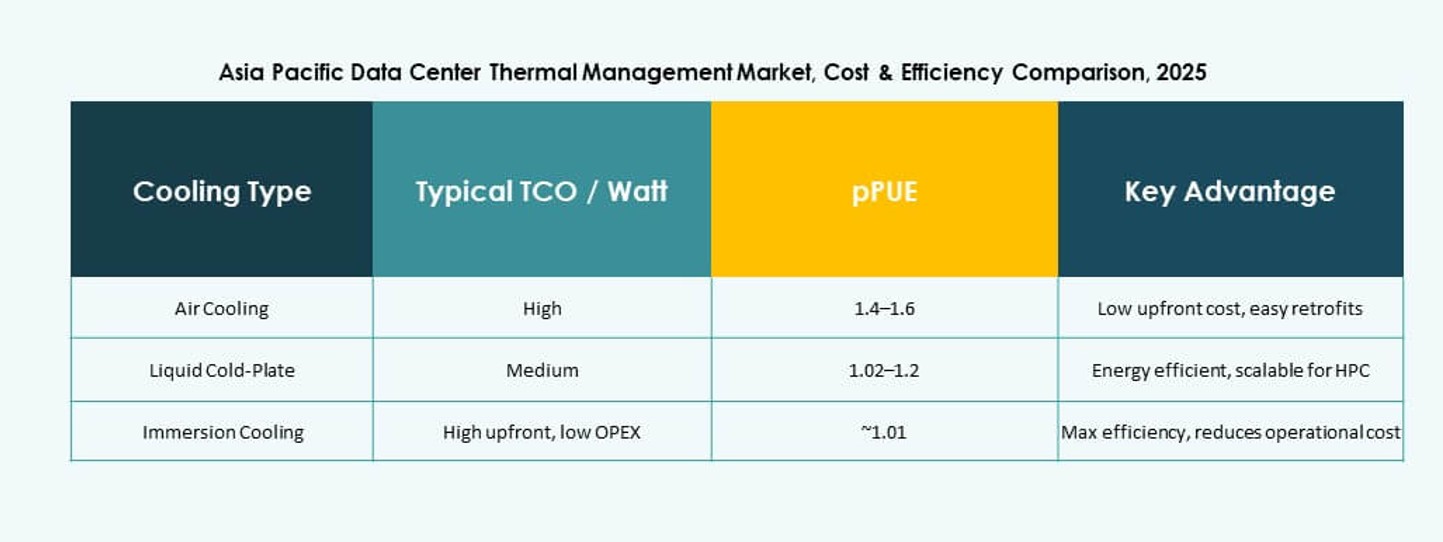

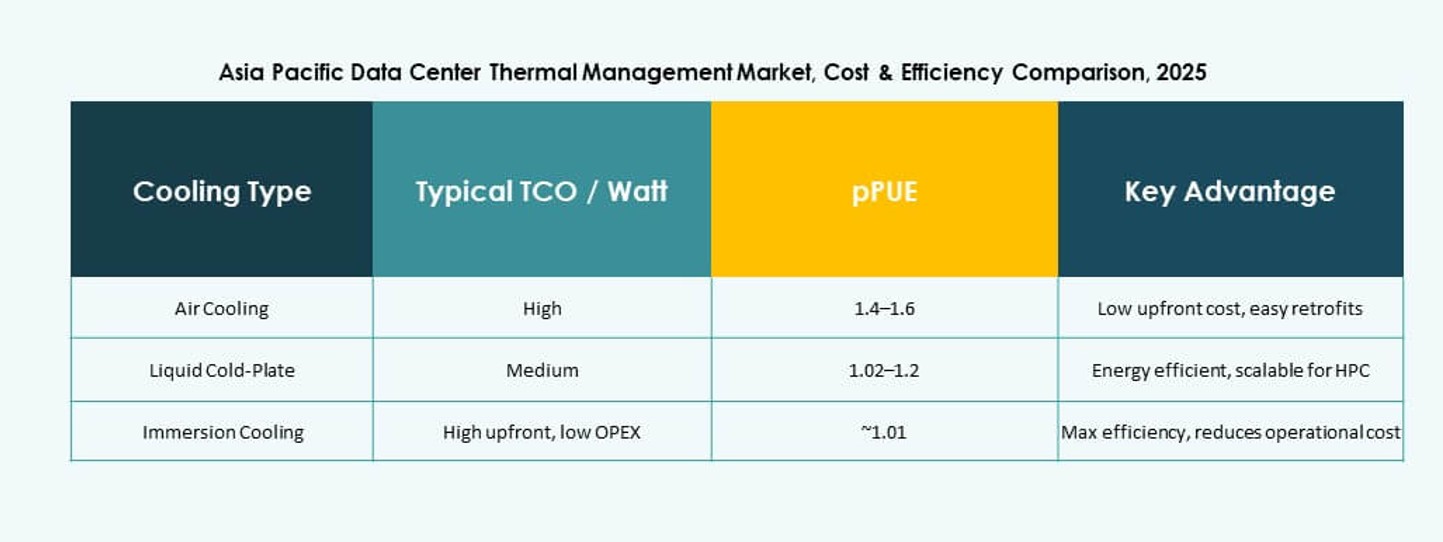

Energy Efficiency Mandates and Carbon Reduction Targets Boost Green Thermal Innovation and Retrofits

Countries across Asia Pacific enforce stricter energy efficiency codes and carbon reduction goals. Operators invest in low-PUE (Power Usage Effectiveness) solutions to align with sustainability metrics. National roadmaps in Singapore, South Korea, and Australia promote renewable-linked cooling systems. Existing data centers deploy retrofits like economizers, free-air cooling, and thermal storage to reduce emissions. Government subsidies and carbon credits support upgrades in critical IT hubs. Startups introduce eco-friendly cooling fluids and passive heat rejection systems. Large players adopt DCIM tools to track energy waste and optimize airflow. The Asia Pacific Data Center Thermal Management Market adapts through localized, eco-sensitive system design. Businesses meet compliance while improving operating margins through reduced energy costs.

- For instance, AWS reported that its global data centers achieved an average Power Usage Effectiveness (PUE) of 1.15 in 2023, and new infrastructure components are expected to lower future PUE scores toward 1.08. This reflects strong efficiency gains through advanced cooling and design improvements across its global footprint.

Private Equity and Infrastructure Funds View Thermal Efficiency as a Strategic Differentiator in Investment Decisions

Thermal efficiency plays a central role in asset evaluation for investors backing digital infrastructure. Funds increasingly demand low-PUE benchmarks and scalable cooling technologies in project proposals. Operators highlight advanced thermal systems to attract financing in green bonds and ESG-linked loans. Efficient cooling reduces OpEx and increases asset lifetime value. Cooling systems influence return on investment for colocation and hyperscale builds. Strategic partnerships with technology firms strengthen design-to-build integration. The Asia Pacific Data Center Thermal Management Market is viewed as a core value lever in investor portfolios. Efficient thermal strategies improve exit valuations and attract global capital. Data centers with smart cooling command premium leasing rates in competitive colocation markets.

Market Trends

AI-Integrated Cooling Control Systems Transform Thermal Management With Real-Time Predictive Automation

Thermal management systems now integrate artificial intelligence to predict and control temperature changes in real time. AI-driven solutions use data from sensors to optimize airflow, reduce overcooling, and prevent hotspots. These systems help operators respond instantly to workload fluctuations. The Asia Pacific Data Center Thermal Management Market supports this shift with software platforms that automate fan speed, coolant flow, and vent positioning. AI models learn thermal patterns, lowering energy costs and extending component life. Predictive controls enable dynamic response instead of static thresholds. Data centers increase energy savings and improve uptime using machine learning. Operators rely on thermal intelligence to handle diverse hardware loads and climate conditions.

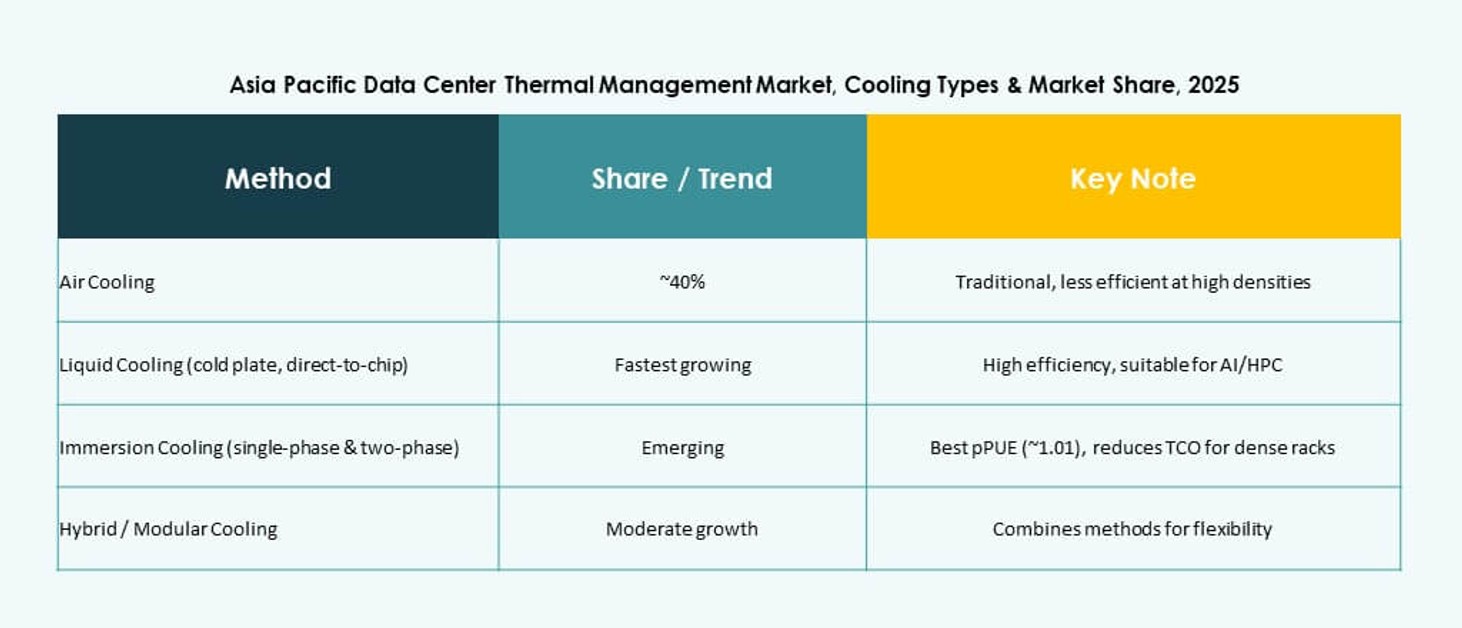

Growing Shift Toward Liquid Cooling Technologies for High-Density Server Environments

Liquid cooling adoption continues to rise, particularly for AI and high-performance computing workloads. Direct-to-chip, rear door liquid, and immersion systems replace inefficient air-based cooling in dense racks. Operators prefer liquid systems for greater thermal transfer and compact footprint. The Asia Pacific Data Center Thermal Management Market supports this trend through localized manufacturing of cooling plates and distribution units. Suppliers introduce modular systems that simplify retrofitting. Enterprises test immersion cooling to manage heat from training large language models. Liquid systems improve energy efficiency while enabling space savings. Vendors also integrate environmental monitoring for coolant flow and leak detection, improving reliability.

Thermal Management Becoming Core Component of Edge and Micro Data Center Design in Emerging Areas

Edge computing expands thermal management needs to remote and smaller-scale installations. Operators deploy micro data centers at telecom towers, factories, and smart city sites. Thermal systems for edge environments must be compact, modular, and self-regulating. The Asia Pacific Data Center Thermal Management Market shifts focus toward edge-ready cooling units with remote monitoring. Solutions include fanless heat exchangers, phase-change systems, and hybrid air-liquid setups. Edge operators require silent, maintenance-free systems for space-constrained environments. Resilience under fluctuating outdoor temperatures is critical. Suppliers package thermal systems with prefabricated edge modules, enabling faster deployments in underserved markets.

Focus on Smart Data Center Infrastructure with Integrated Thermal and Power Monitoring Platforms

Operators now demand integrated management systems that track thermal, power, and environmental performance. DCIM tools merge temperature, airflow, energy use, and asset status into a single dashboard. Smart platforms help teams visualize hotspots, airflow blockages, and energy drift. The Asia Pacific Data Center Thermal Management Market sees growing uptake of AI-enabled DCIM software. Vendors offer predictive tools that forecast system stress and cooling needs. Centralized dashboards support faster decisions and remote troubleshooting. These tools increase operational efficiency and reduce risks of thermal failure. Facilities integrate BMS, DCIM, and CFD simulation to plan capacity and performance.

Market Challenges

High Capital Costs and Complexity of Deploying Advanced Cooling Solutions in Brownfield Environments

Advanced cooling systems such as liquid and immersion cooling carry high upfront costs. Retrofitting these into legacy facilities is complex and labor-intensive. Operators face structural constraints, space limitations, and compatibility issues with old hardware. Transitioning from air-cooled systems to hybrid models often disrupts operations. Liquid-based systems also require specialized piping, sensors, and leak detection infrastructure. These add cost and technical risk to projects. The Asia Pacific Data Center Thermal Management Market must balance innovation with affordability. Many operators hesitate to invest without clear ROI or technical skills in-house. Financial limitations slow adoption, especially in mid-tier and emerging markets.

Lack of Skilled Workforce and Regional Disparity in Thermal Technology Readiness Slows Adoption

Thermal system design and maintenance need specialized training in fluid dynamics, controls, and data center operations. Across Asia Pacific, access to such skilled professionals is uneven. Advanced cooling adoption remains low in countries without strong technical ecosystems. Smaller operators rely on imported systems with limited support infrastructure. Language and regulatory barriers delay deployment across multiple countries. The Asia Pacific Data Center Thermal Management Market must address skill gaps through vendor-led training and certification programs. Without local knowledge, cooling systems often run suboptimally, wasting energy. This limits the benefits of thermal innovation across the region.

Market Opportunities

Southeast Asia’s Rise in Cloud Adoption and Green Data Centers Creates Demand for Sustainable Cooling

Indonesia, Vietnam, Thailand, and the Philippines are emerging as key growth zones for data infrastructure. Governments push digital services, cloud adoption, and data localization. These trends create demand for sustainable and efficient thermal systems. The Asia Pacific Data Center Thermal Management Market can capture growth by localizing low-PUE solutions. Vendors offering modular, scalable, and eco-friendly cooling units will find strong demand. Green building certifications and energy mandates support market expansion in these nations.

Partnerships With Utilities and Municipal Networks Unlock New Thermal Recovery and Free Cooling Models

Several cities across Asia Pacific explore using waste heat from data centers in district heating networks. Cooling systems that enable heat reuse can access government incentives and reduce carbon footprint. The Asia Pacific Data Center Thermal Management Market benefits from public-private partnerships that support water-free, grid-integrated cooling. Vendors offering systems compatible with these networks gain a strategic edge. Urban data centers with thermal integration features will become preferred investment targets.

Market Segmentation

By Data Center Size

Large data centers dominate the Asia Pacific Data Center Thermal Management Market due to the scale of hyperscale and colocation investments. These facilities demand multi-MW cooling capacity and deploy a mix of hybrid cooling technologies. Medium-sized centers see steady adoption, especially from regional enterprises and public cloud zones. Small data centers cater to on-premise needs but face space and budget limitations. Growth in the large-size segment is driven by hyperscale demand and regional government-supported cloud programs.

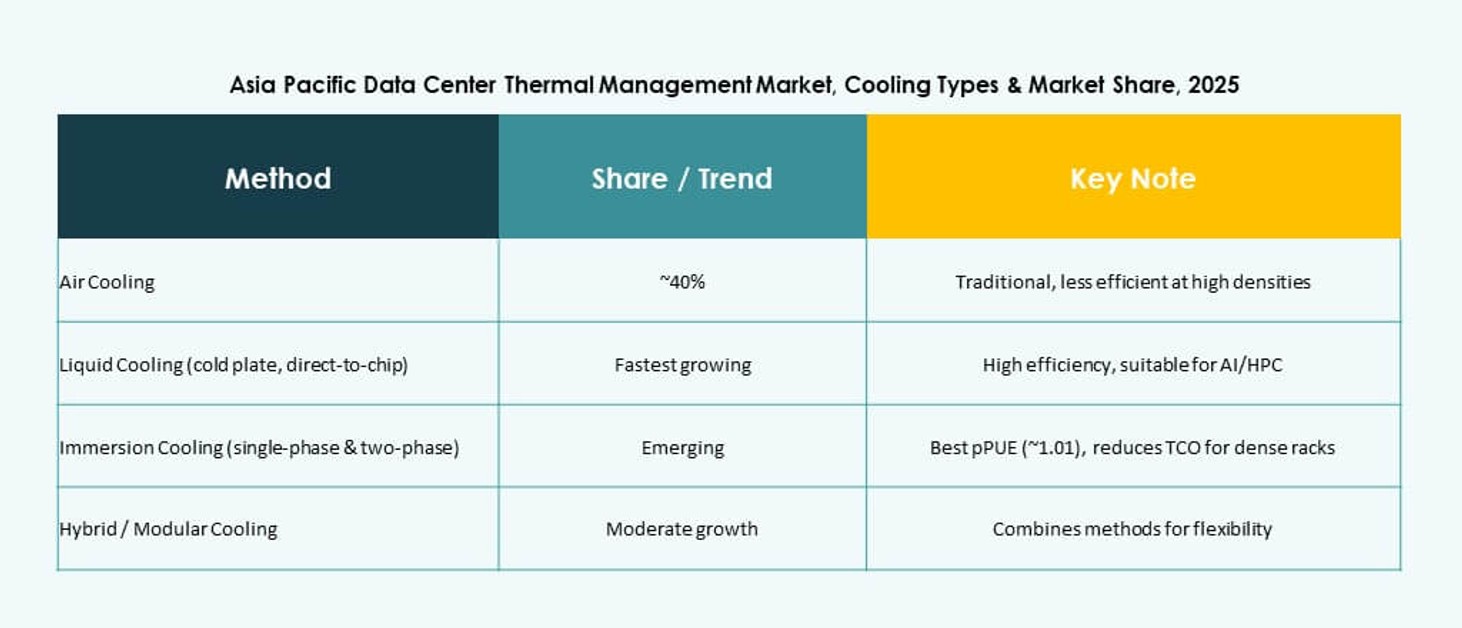

By Cooling Technology

Air-based cooling remains the most common, with hot/cold aisle and rear door exchangers widely adopted. However, liquid-based cooling gains market share due to efficiency in AI-intensive workloads. Direct-to-chip and immersion methods are preferred for high-density racks. Hybrid systems combining both air and liquid are emerging in multi-tier deployments. Phase-change and thermoelectric options remain niche but show promise for compact environments. The Asia Pacific Data Center Thermal Management Market is shifting toward a liquid-dominant future.

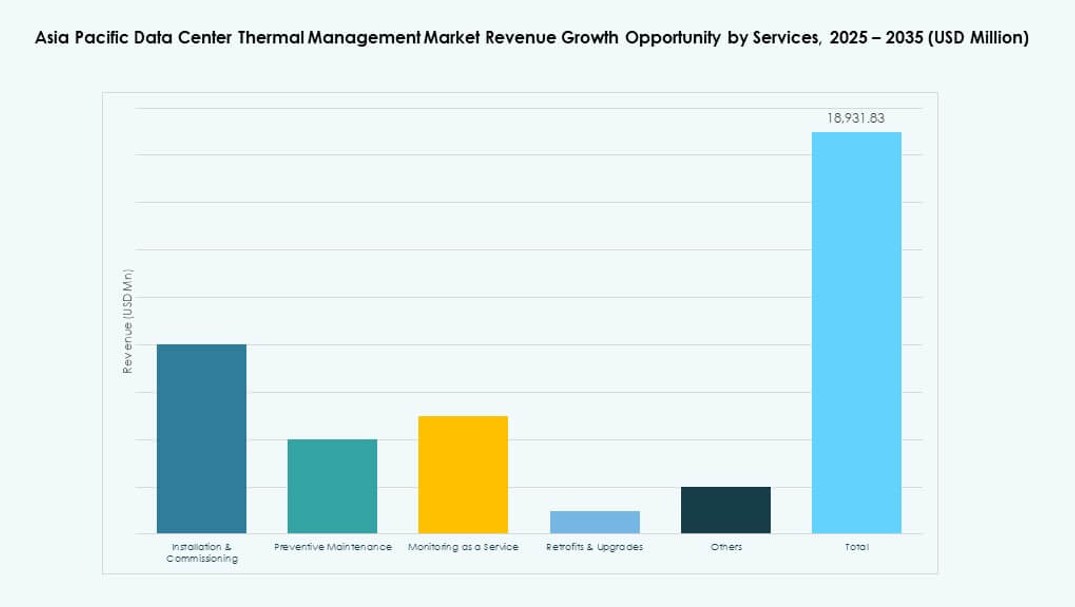

By Component

Hardware holds the largest market share, led by cooling units, fans, and piping systems. Software is growing faster as AI and DCIM tools automate cooling controls. Services like retrofits, monitoring, and preventive maintenance also expand with increased facility aging. Operators invest in service contracts to ensure uptime. The market balances between traditional hardware spending and rising digital services around thermal performance.

By Hardware

Cooling units and chillers account for the largest revenue share. Piping and distribution systems support liquid cooling deployment. Fans and airflow devices remain key for air-cooled setups. Heat exchangers are essential in both air and liquid systems. Modular and energy-efficient hardware remains in high demand. Other components like sensors and thermal plates gain attention with direct-to-chip systems.

By Software

DCIM dashboards and AI optimization tools dominate the software segment. CFD simulation software supports advanced planning and performance modeling. BMS modules link HVAC, power, and cooling into a unified system. Vendors focus on predictive analytics and automation features. Software helps reduce energy costs and supports sustainability metrics.

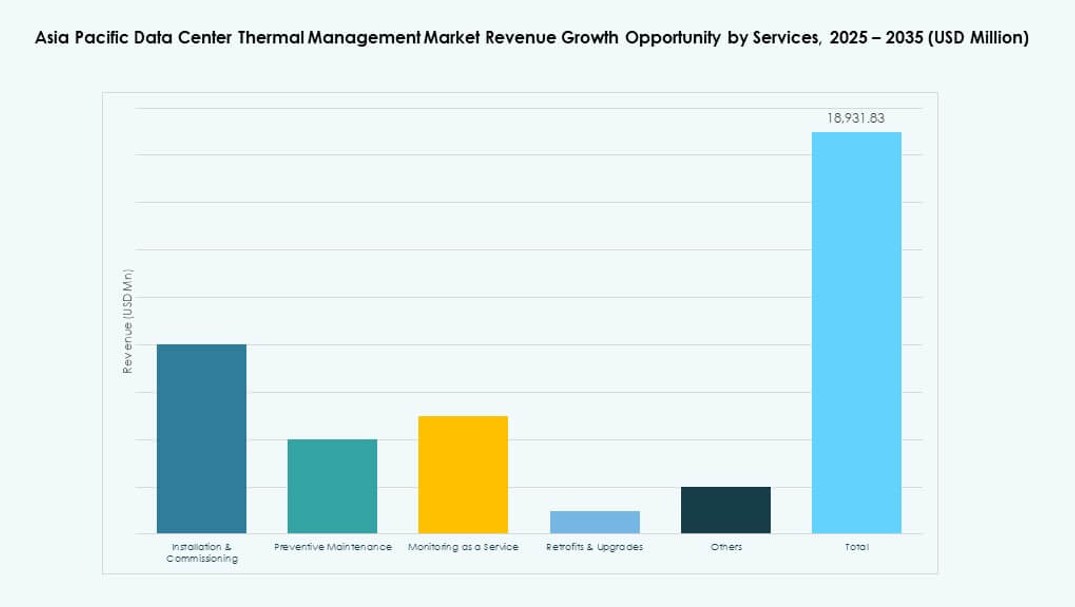

By Services

Installation and commissioning lead the services segment, followed by preventive maintenance. Monitoring as a service gains popularity due to remote site operations. Retrofit services help older facilities adopt new cooling methods. Upgrades ensure PUE compliance and regulatory standards. Data center operators rely on service vendors to optimize long-term thermal efficiency.

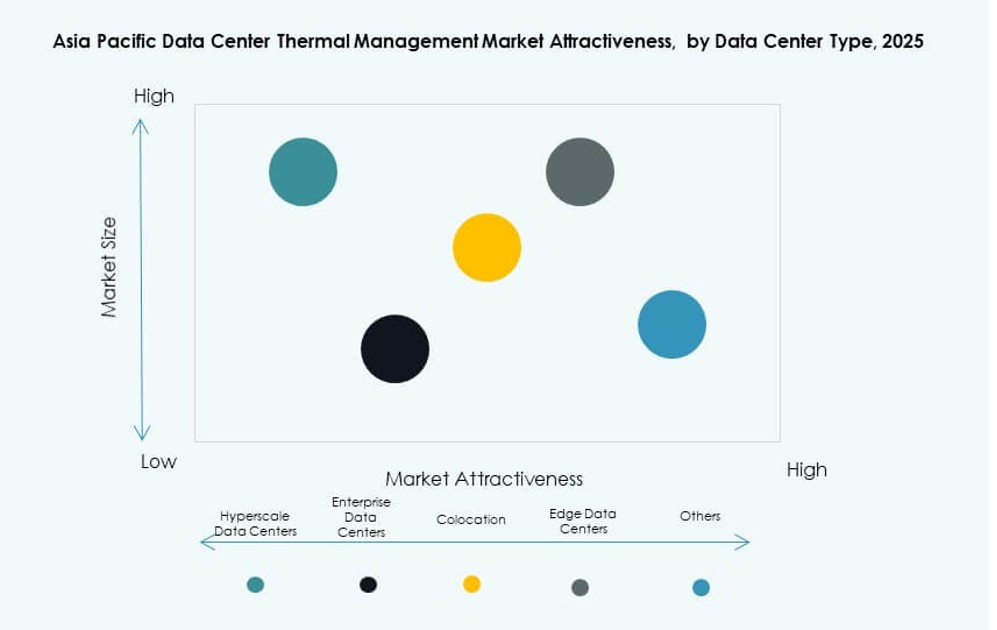

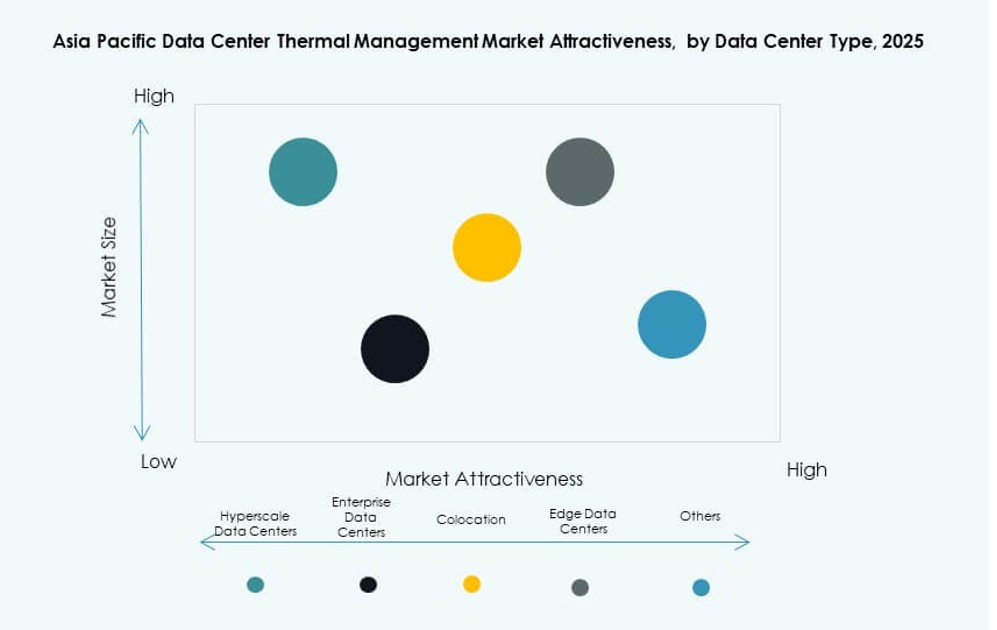

By Data Center Type

Hyperscale data centers dominate the market due to high-capacity and performance demands. Colocation/cloud providers follow, requiring flexible and multi-tenant cooling systems. Enterprise data centers maintain their presence in regulated industries. Edge/micro data centers see growing adoption in telecom and industrial settings. Each type requires tailored thermal solutions based on scale and location.

By Structure

Room-based cooling remains the most common but gives way to row- and rack-based systems in new builds. Rack-based systems provide precision cooling for dense racks. Row-based units optimize airflow in modular pods. The shift toward distributed, high-density setups supports structure-specific cooling growth. The Asia Pacific Data Center Thermal Management Market aligns with this structural evolution.

Regional Insights

East Asia Leads with China, Japan, and South Korea Accounting for Over 47% of the Regional Share

East Asia dominates the Asia Pacific Data Center Thermal Management Market, driven by digital transformation, industrial AI, and strong cloud infrastructure. China leads with hyperscale builds and state-backed green data zones. Japan maintains leadership in modular and energy-efficient systems. South Korea advances smart thermal automation across telecom-backed data centers. Vendors focus on high-efficiency and hybrid cooling systems in these tech-driven countries. Mature regulations and energy mandates further boost market depth.

- For instance, China’s national green data center action plan requires the average power usage effectiveness of data centers to fall below 1.5 by 2025. This mandate drives large-scale adoption of energy‑efficient cooling systems and advanced thermal management technologies across hyperscale and enterprise facilities.

South Asia Sees Rapid Growth with India Emerging as a Key Market with 23% Regional Share

India leads South Asia due to national data sovereignty laws, digital inclusion policies, and hyperscale expansion. Its tropical climate makes thermal efficiency critical, pushing adoption of high-efficiency systems. Government initiatives support new cooling tech under Make-in-India and PLI schemes. Demand from cloud, fintech, and retail drives multi-city deployments. The market also attracts foreign investment into edge and AI-focused infrastructure. It presents long-term potential for sustainable and scalable thermal solutions.

- For instance, AdaniConneX’s Chennai 1 data center is designed to achieve a power usage effectiveness below 1.45. This facility reflects India’s shift toward energy-efficient infrastructure to support hyperscale and enterprise workloads.

Southeast Asia Gains Momentum with 18% Share Driven by Cloud, Edge, and Green Infrastructure Push

Southeast Asia, including Indonesia, Singapore, Vietnam, and the Philippines, is the fastest-growing regional cluster. Rising cloud adoption and smart city initiatives push demand for compact, energy-efficient thermal systems. Singapore enforces energy use limits, creating demand for ultra-efficient cooling. Indonesia and Vietnam attract hyperscale investments tied to rising digital user bases. Market players focus on region-specific cooling tailored to humid, tropical conditions. Emerging data centers integrate free cooling, liquid systems, and renewable energy coupling.

Competitive Insights:

- Schneider Electric

- Vertiv Group Corp.

- Daikin Industries Ltd.

- Delta Electronics, Inc.

- Johnson Controls International plc

- Airedale International Air Conditioning Ltd.

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- Mitsubishi Electric Corporation

- Eaton Corporation

The competitive landscape in the Asia Pacific Data Center Thermal Management Market shows strong global and regional players. Companies compete on product performance, energy efficiency, and integration with digital controls. Schneider Electric leads with broad portfolios and strong service networks. Vertiv focuses on modular cooling and AI-driven controls to meet varied workloads. Daikin and Delta push efficient hardware with local support across key markets. Johnson Controls and Airedale supply large enterprise and industrial cooling systems with robust reliability. Fujitsu, Huawei, and Mitsubishi leverage strong local presence and data center partnerships. Eaton supports integrated power and cooling orchestration. Firms invest in R&D to lower power use and reduce total cost of ownership. This competition drives faster adoption of advanced thermal solutions across hyperscale and enterprise facilities.

Recent Developments:

- In November 2025, LG Electronics partnered with Flex to develop advanced thermal management solutions for gigawatt-scale AI data centers in the Asia Pacific region. In this collaboration, LG combines its high-performance air and liquid cooling modules including CRAC, CRAH, chillers, and coolant distribution units with Flex’s liquid cooling and IT infrastructure to create modular, prefabricated data center solutions addressing escalating heat challenges.

- In November 2025, Eaton Corporation signed a definitive agreement to acquire Boyd Thermal for $9.5 billion, expanding liquid cooling solutions for high-density data centers in the Asia Pacific region.

- In August 2025, Daikin Industries Ltd. acquired Dynamic Data Centers Solutions, Inc. (DDC Solutions) to strengthen AI data center cooling offerings with server rack-level air conditioning for the Asia Pacific thermal management market.