Executive Summary:

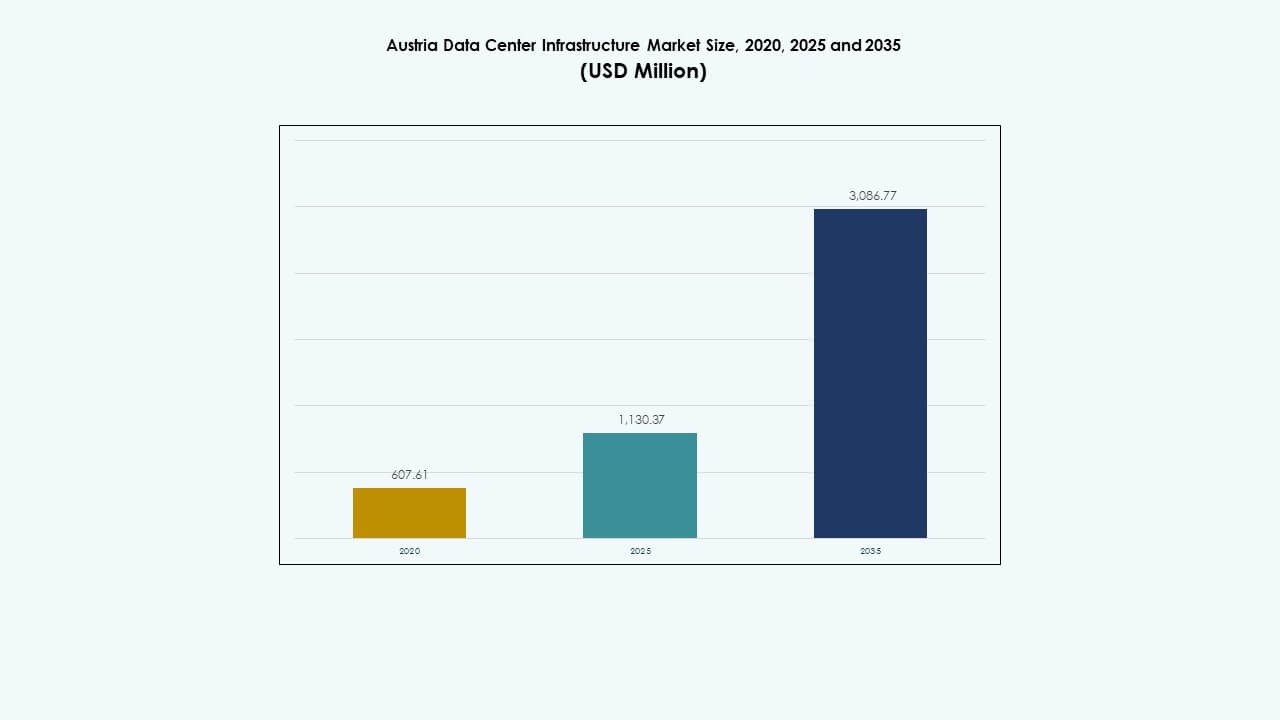

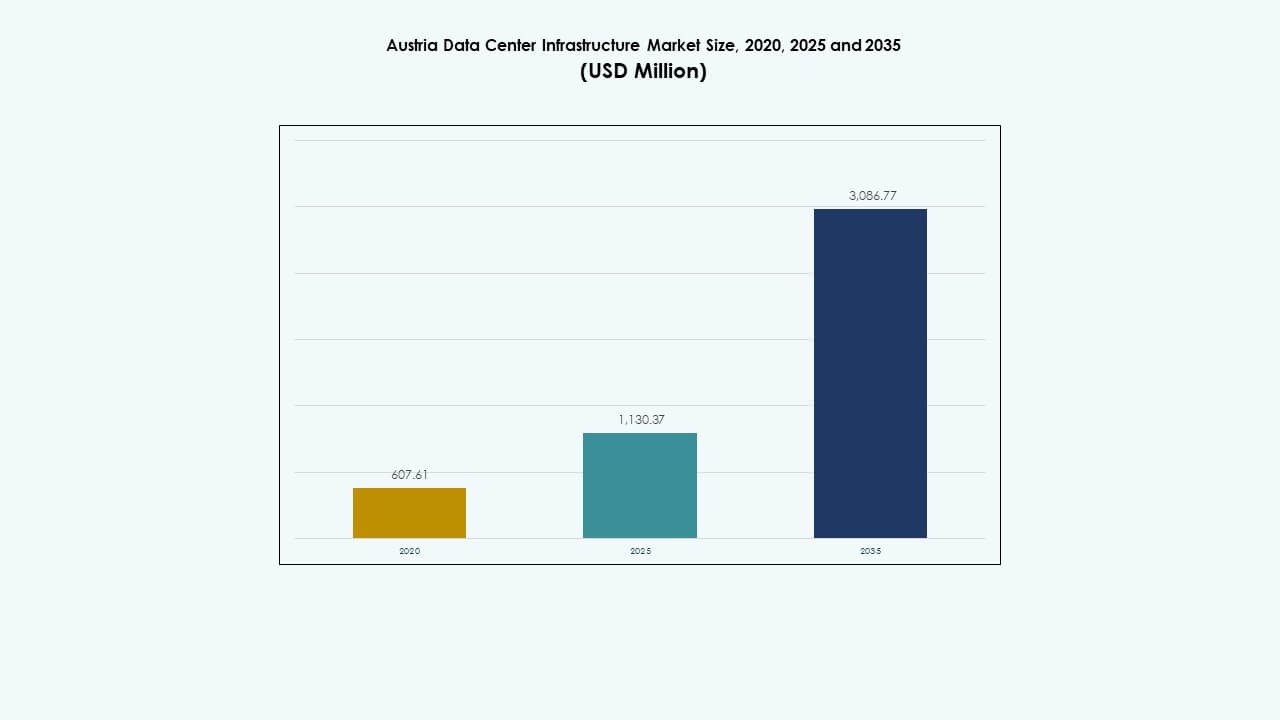

The Austria Data Center Infrastructure Market size was valued at USD 607.61 million in 2020 to USD 1,130.37 million in 2025 and is anticipated to reach USD 3,086.77 million by 2035, at a CAGR of 10.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Austria Data Center Infrastructure Market Size 2025 |

USD 1,130.37 Million |

| Austria Data Center Infrastructure Market, CAGR |

10.50% |

| Austria Data Center Infrastructure Market Size 2035 |

USD 3,086.77 Million |

Strong adoption of cloud computing, AI, and digital transformation drives the Austria Data Center Infrastructure Market forward. The market benefits from sustainable power integration, efficient cooling solutions, and edge computing expansion supporting low-latency operations. Growing demand for data localization and energy optimization attracts global and domestic investors. It establishes Austria as a vital European hub for secure, high-performance digital infrastructure and long-term technology investments.

Vienna and Lower Austria dominate the national landscape due to advanced connectivity and hyperscale presence. Upper Austria and Styria show rising potential with industrial IoT and manufacturing-led digitization. Western Austria emerges as a sustainable zone leveraging renewable power for modular facilities. This regional diversification strengthens Austria’s competitive position within Central Europe’s data infrastructure ecosystem.

Market Drivers

Market Drivers

Growing Cloud Adoption and Data Sovereignty Requirements

The Austria Data Center Infrastructure Market benefits from rising enterprise migration toward cloud and hybrid solutions. Businesses seek low-latency performance while complying with European data sovereignty laws. Enterprises in finance, healthcare, and public sectors expand in-country facilities to secure sensitive information. Hyperscalers collaborate with local providers to extend edge coverage across Vienna and Linz. The increasing demand for scalable infrastructure drives investment in Tier III and Tier IV designs. Automation enhances operational stability, lowering downtime risks. High-capacity fiber networks boost digital transformation. Investors gain confidence from steady infrastructure upgrades and transparent regulatory frameworks. It strengthens Austria’s position in the European data ecosystem.

Rapid Integration of Energy-Efficient and Green Technologies

Data centers in Austria integrate renewable energy and liquid cooling systems to reduce carbon intensity. Operators deploy solar and hydro-powered infrastructure to meet EU sustainability targets. The market adopts advanced heat reuse technologies to improve operational efficiency. Cooling systems using free-air techniques lower energy costs significantly. Equipment modernization enhances resilience while minimizing emissions. Partnerships with utility providers enable consistent green power sourcing. Businesses view sustainability compliance as a competitive advantage. It reinforces investor trust and aligns with corporate ESG priorities. Continuous energy optimization shapes long-term value creation in this sector.

- For instance, Microsoft’s Azure Austria East region sources hydropower from Verbund’s Mayrhofen/Tuxbach and Freudenau power plants, aligning with Microsoft’s commitment to cover all data centers with 100% renewable energy by the end of 2025.

Rising Edge Computing Deployments for Low-Latency Applications

Edge computing adoption increases with growth in IoT, AI, and real-time analytics. Telecom operators establish micro data centers near industrial clusters to enable latency-sensitive workloads. The Austria Data Center Infrastructure Market evolves with distributed infrastructure supporting smart manufacturing and connected mobility. Enterprises prioritize computing closer to end users to improve responsiveness. Localized hosting supports faster application delivery for healthcare, logistics, and financial services. Regional telecom backbone expansion ensures consistent connectivity across emerging hubs. It drives demand for compact, modular facilities. Integration of AI-driven monitoring further improves network performance and security. This shift establishes a foundation for next-gen service delivery models.

- For instance, Kapsch TrafficCom deployed real-time traffic management workloads on Azure Austria East starting August 2025, leveraging local three availability zones to cut latency versus Western Europe regions for IoT-connected mobility applications.

Strong Public and Private Sector Investments in Digital Infrastructure

Austria’s government promotes digitization through incentives and partnerships encouraging private investments. National broadband programs enhance connectivity for enterprise zones and industrial parks. Multinational firms invest in Vienna’s expanding technology corridors. The market gains support from financial institutions funding modernization projects. Public authorities encourage sustainable data center construction to meet EU emission norms. Infrastructure upgrades align with 5G rollout and smart city initiatives. Investors identify predictable regulatory processes and stable economic conditions. It provides long-term confidence for hyperscale and colocation developments. Continuous policy support ensures balanced growth across the nation’s digital infrastructure base.

Market Trends

Emergence of Modular and Prefabricated Data Center Construction

Operators adopt modular construction techniques to accelerate deployment timelines. Prefabricated modules reduce site-based complexity and allow flexible capacity scaling. The Austria Data Center Infrastructure Market experiences growth in factory-built components supporting faster delivery. Modular units lower capital expenditure and simplify maintenance schedules. Vendors focus on adaptable designs for urban and remote locations. Modularization improves cost efficiency for smaller enterprises. It enables phased expansion aligning with client needs. Prefabricated enclosures enhance quality control during production. The trend strengthens competitiveness through reduced construction delays and optimized scalability.

Expansion of Artificial Intelligence and Automation Capabilities

Data center operators implement AI for predictive maintenance and resource optimization. Automation enhances workload distribution across servers to prevent overheating. The Austria Data Center Infrastructure Market shifts toward intelligent management tools. AI integration improves fault detection and operational resilience. Smart systems optimize cooling, energy use, and workload balancing. Predictive analytics reduces downtime by detecting early component failure signs. Automation reduces manual errors while boosting operational uptime. It transforms traditional operations into self-regulating systems. This trend supports sustainable, efficient infrastructure that meets evolving business needs.

Growing Adoption of High-Density and Liquid Cooling Technologies

With AI and HPC workloads increasing, high-density configurations gain preference. Operators transition toward liquid cooling to manage heat more effectively. The Austria Data Center Infrastructure Market observes innovation in thermal management solutions. Advanced rack designs enable compact, energy-efficient installations. Liquid immersion systems cut cooling energy consumption significantly. Vendors collaborate with manufacturers to improve coolant performance. High-density racks support performance-intensive cloud and AI services. It improves energy use while maintaining reliable uptime. The trend underscores Austria’s push for advanced and sustainable infrastructure solutions.

Strengthening Interconnection Ecosystems Across Central Europe

Austria evolves into a regional connectivity bridge between Western and Eastern Europe. Data centers expand network access points to enhance global exchange routes. The Austria Data Center Infrastructure Market benefits from carrier-neutral ecosystems. Interconnection hubs in Vienna attract multinational enterprises. Strong fiber connectivity with Germany, Czech Republic, and Hungary fuels cross-border data flow. Enterprises leverage Austria’s location for business continuity and low-latency access. It supports international collaboration and colocation demand growth. This trend promotes Austria as a strategic node for regional data exchange.

Market Challenges

Market Challenges

High Energy Costs and Limited Renewable Capacity Availability

Rising energy prices create financial pressure on operators managing power-intensive environments. The Austria Data Center Infrastructure Market faces challenges balancing reliability with sustainability. Limited renewable capacity during peak demand periods affects operational costs. Dependence on imported energy sources increases vulnerability. Data centers must optimize efficiency through advanced cooling and automation. Energy storage adoption remains slow due to capital constraints. It compels operators to renegotiate supply agreements for cost predictability. Managing rising power expenses becomes essential for competitiveness. Ensuring affordable, green energy access will remain a key operational hurdle.

Skilled Workforce Shortage and Regulatory Compliance Complexity

The market faces shortages of professionals skilled in network design, AI integration, and cooling management. Compliance with EU data laws and energy efficiency regulations demands continuous adaptation. Smaller operators struggle to meet ISO and EN certification requirements. The Austria Data Center Infrastructure Market must align technical capabilities with legal standards. Training and workforce development programs lag behind digital expansion. It slows infrastructure commissioning timelines. Complex building codes extend approval cycles for large facilities. Addressing skills and compliance challenges is critical to sustaining long-term growth.

Market Opportunities

Rising Demand for AI-Optimized Infrastructure and Edge Deployments

AI workloads generate opportunities for specialized hardware and liquid cooling systems. The Austria Data Center Infrastructure Market positions itself to serve AI training and inferencing needs. Edge facilities near industrial clusters support automation and IoT networks. Demand for GPU-based servers and high-bandwidth connectivity continues to grow. It enables Austria to attract hyperscalers seeking mid-European coverage. Partnerships with research institutions strengthen technological innovation. Continuous AI infrastructure expansion creates new investment avenues. The opportunity supports Austria’s digital competitiveness in Central Europe.

Government-Led Sustainability and Digital Economy Initiatives

Austria’s energy transition policy favors low-emission data centers. Incentives promote adoption of renewable power and heat recovery systems. The Austria Data Center Infrastructure Market aligns with EU green data strategy. Businesses gain tax advantages for investing in eco-efficient solutions. It opens doors for modular and renewable-integrated infrastructure ventures. Strong policy backing ensures long-term investor confidence. The opportunity encourages domestic and foreign firms to expand sustainable operations. Strategic incentives continue to attract large-scale investments into the sector.

Market Segmentation

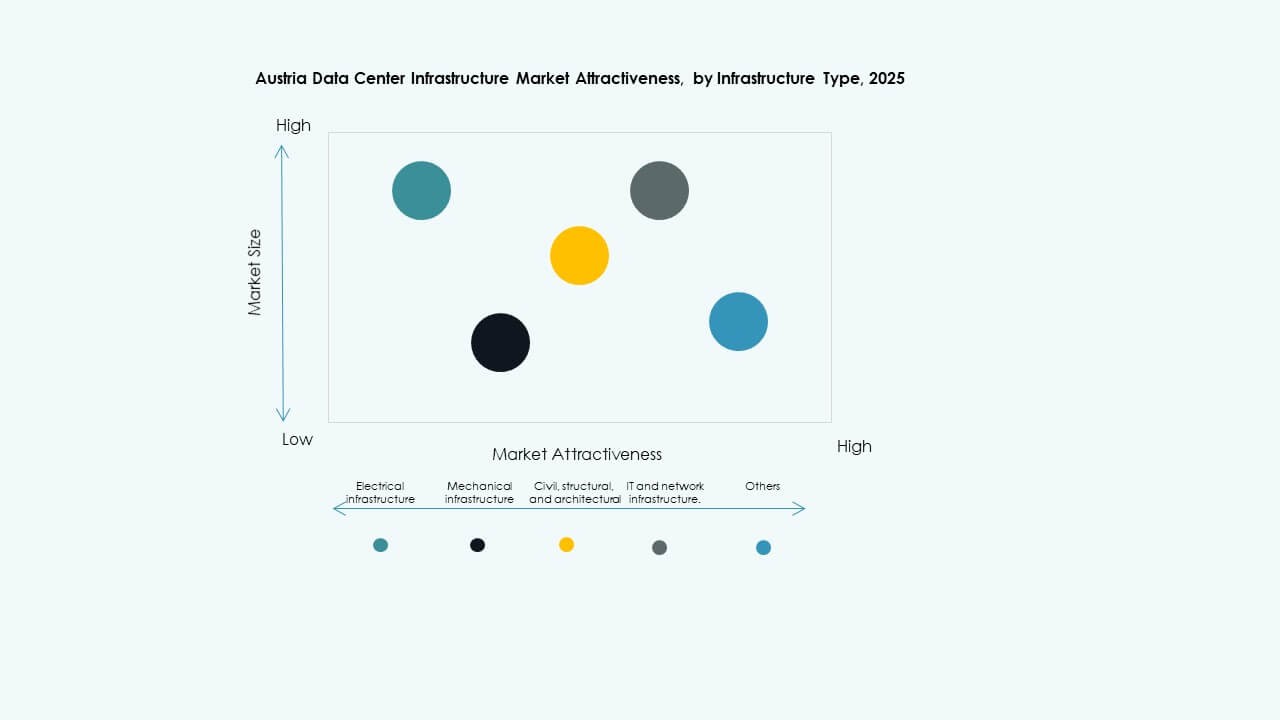

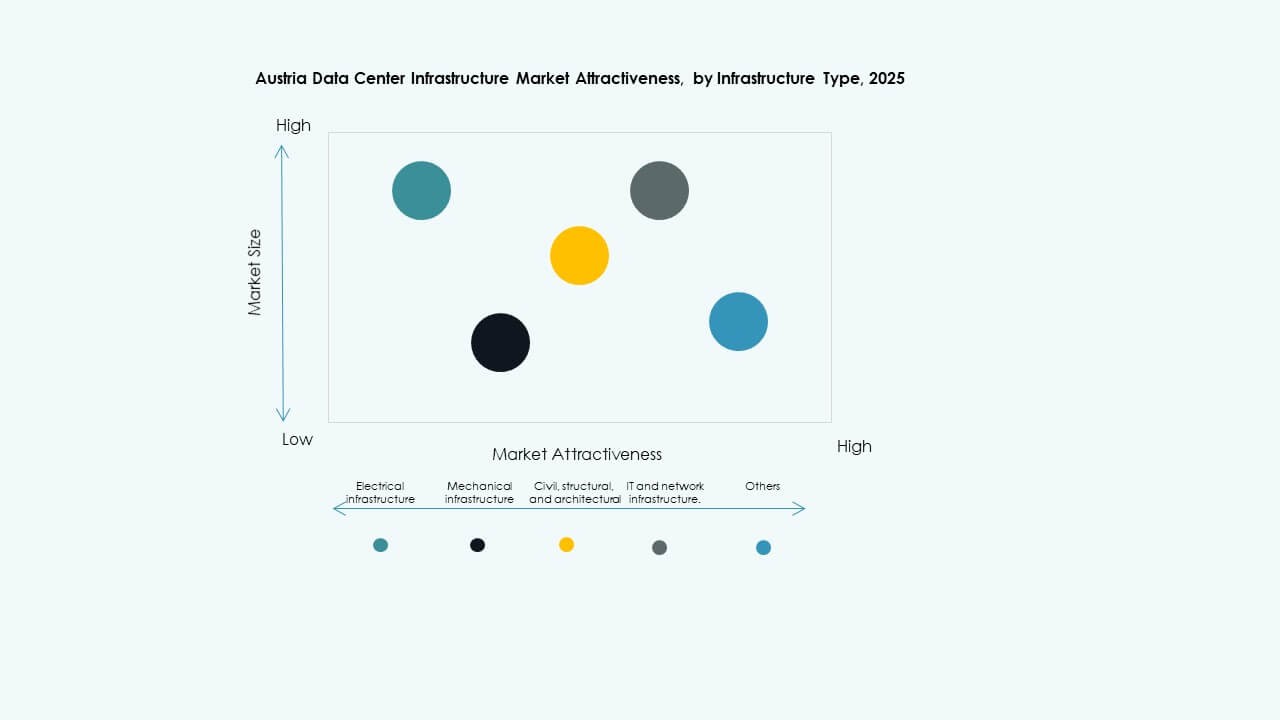

By Infrastructure Type

The Austria Data Center Infrastructure Market is dominated by electrical and mechanical infrastructure due to critical uptime requirements. Electrical systems like UPS and PDUs ensure power continuity during outages. Mechanical infrastructure supports thermal regulation through chillers and cooling systems. IT and network infrastructure gain momentum from rising data volume and cloud usage. Civil and structural segments remain vital for modular and prefabricated designs. These categories collectively ensure operational stability, scalability, and energy efficiency.

By Electrical Infrastructure

Uninterruptible Power Supply (UPS) systems lead this category, supported by expanding hyperscale deployments. Reliable backup systems and efficient PDUs sustain critical load balancing. Battery Energy Storage Systems (BESS) gain traction amid renewable integration goals. Transfer switches and switchgears provide safety and load management. Grid interconnections ensure operational reliability during energy transitions. This segment grows as Austria focuses on resilient and clean power systems for digital operations.

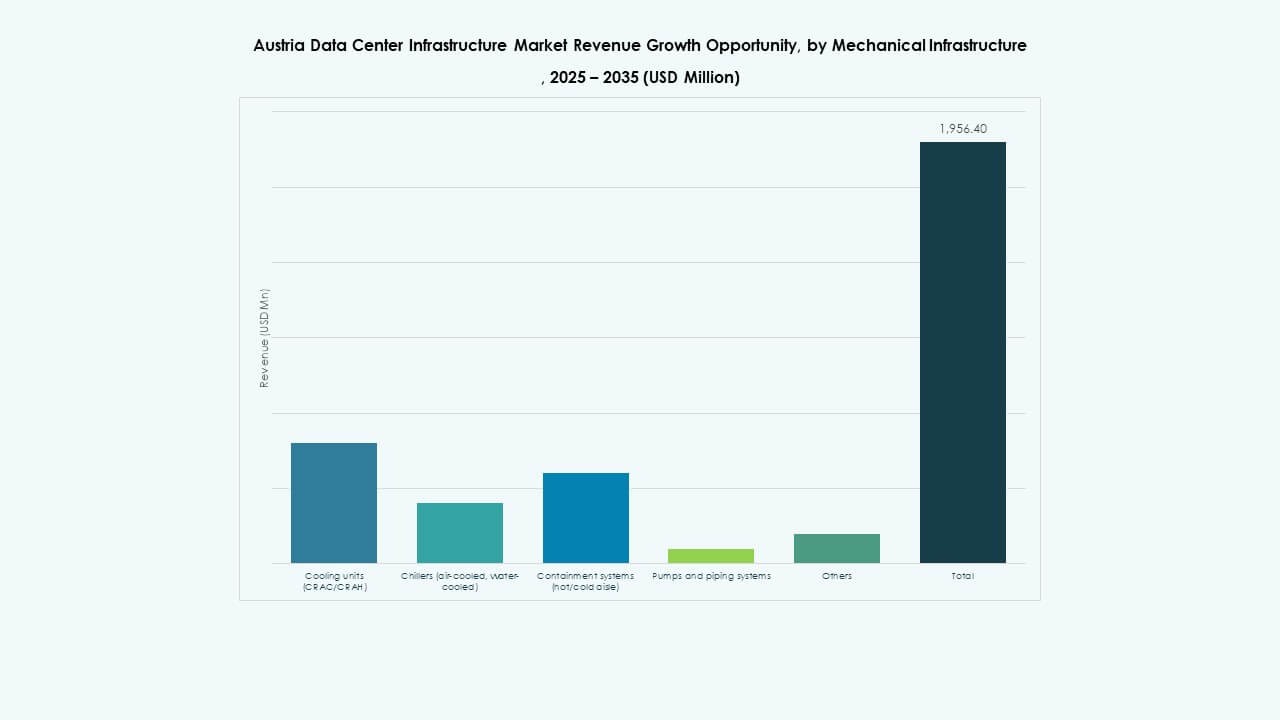

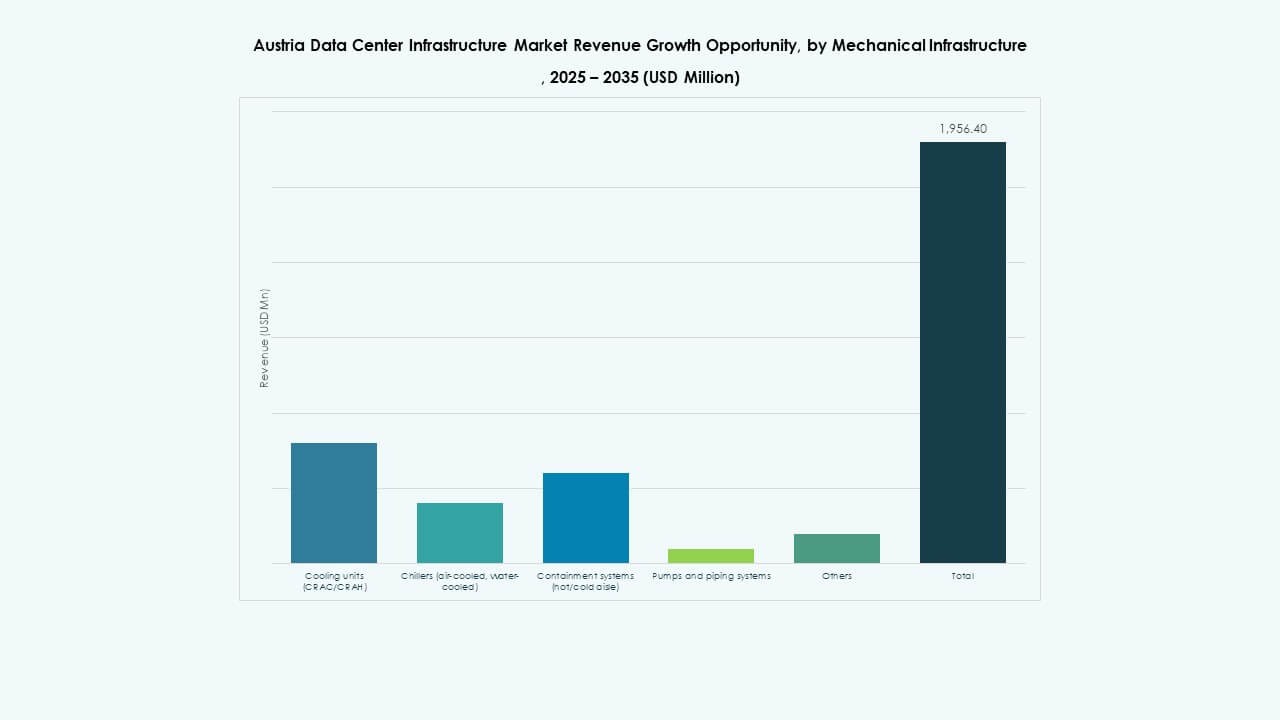

By Mechanical Infrastructure

Cooling units and chillers dominate the mechanical segment, ensuring consistent equipment performance. Operators prefer air-cooled chillers in temperate zones and water-cooled units in large facilities. Containment systems improve thermal separation for energy efficiency. Pumps and piping support advanced liquid cooling deployment. The market adopts free-air cooling to reduce carbon intensity. Continuous improvement in cooling technology enhances Austria’s sustainability goals.

By Civil / Structural & Architectural

Superstructure and building envelope design hold dominance due to stringent safety and durability norms. Site preparation and modular construction methods shorten project timelines. Raised floors and prefabricated modules improve airflow and flexibility. Austria’s construction standards prioritize energy efficiency through insulation and material quality. Modular systems reduce capital risk for investors. This segment remains essential for long-term facility reliability.

By IT & Network Infrastructure

Networking equipment and servers hold the largest share due to AI and cloud growth. Storage and cabling systems expand with data volume escalation. Racks and enclosures support space optimization for high-density systems. Optical fiber enhances connectivity between data clusters. This segment remains core to digital business transformation. Advanced computing and edge data needs drive steady investment.

By Data Center Type

Colocation and hyperscale facilities dominate due to enterprise outsourcing and cloud migration. Edge data centers grow with 5G and IoT expansion. Enterprise data centers continue serving legacy workloads. The Austria Data Center Infrastructure Market benefits from balanced growth across all types. Modular and prefabricated designs attract cost-sensitive clients.

By Delivery Model

Design-Build and EPC models dominate for large-scale developments. Construction management remains preferred for complex multi-phase projects. Retrofit models gain traction with modernization efforts. Turnkey and modular factory-built approaches enable rapid deployment. The Austria Data Center Infrastructure Market values flexibility and efficiency in execution models.

By Tier Type

Tier III facilities lead the market due to reliability and energy balance. Tier IV facilities serve mission-critical applications requiring redundancy. Tier I and II centers support small enterprises and edge nodes. The dominance of Tier III reflects Austria’s focus on high uptime and performance efficiency.

Regional Insights

Regional Insights

Vienna and Lower Austria – Core Data Center Cluster (46% Market Share)

Vienna remains Austria’s leading digital hub, hosting hyperscale and colocation centers. Its proximity to international fiber routes supports global interconnectivity. Lower Austria benefits from renewable power access and land availability. The Austria Data Center Infrastructure Market thrives here due to advanced energy management. Operators leverage stable regulations and high network reliability. Continuous infrastructure expansion sustains its leadership role across the region.

- For example, A1 Telekom Austria operates the A1 Next Generation Data Center in Vienna, spanning 13,000 m² with 2,550 m² of Tier III-compliant whitespace and a 6 MW connected load capacity. The facility was developed with IBM and adheres to advanced efficiency and reliability standards, reinforcing Vienna’s role as a major digital infrastructure hub.

Upper Austria and Styria – Industrial and Edge Expansion Zones (31% Market Share)

Upper Austria supports industrial automation and manufacturing-related digital operations. Styria experiences rapid edge data center growth driven by industrial IoT adoption. The region’s focus on logistics and energy-intensive industries creates strong digital demand. Connectivity upgrades accelerate adoption of hybrid cloud solutions. The Austria Data Center Infrastructure Market expands through regional industrial digitalization. Strong collaboration with telecom providers enhances operational efficiency.

- For example, Google has acquired land in Kronstorf, Upper Austria, for a potential hyperscale data center campus powered by nearby hydroelectric sources on the River Enns. SPIE and Austrian Power Grid (APG) are expanding the Kronstorf substation and integrating it into a new 220 kV regional power ring by 2030, supporting future large-scale infrastructure needs in the area.

Western Austria – Emerging Green and Modular Development Zone (23% Market Share)

Western Austria, including Tyrol and Vorarlberg, sees rising modular data center installations. Renewable power access from hydro resources strengthens its green credentials. The region’s smaller enterprises prefer scalable modular solutions. The Austria Data Center Infrastructure Market grows steadily due to eco-friendly incentives. Stable connectivity and climate conditions support cooling efficiency. This region represents a key area for sustainable and distributed data growth.

Competitive Insights:

- Digital Realty

- ABB

- Cisco Systems, Inc.

- Dell Inc.

- Equinix, Inc.

- Fujitsu

- Hitachi, Ltd.

- Huawei Technologies Co., Ltd.

- Schneider Electric

- Vertiv Group Corp.

The competitive landscape of the Austria Data Center Infrastructure Market features global infrastructure providers and power-management specialists competing on reliability, scalability, and sustainability. Companies such as Digital Realty and Equinix focus on large-scale colocation and interconnection services, offering broad coverage and high uptime. ABB and Schneider Electric leverage their strength in power systems and automation to deliver reliable electrical and cooling infrastructure. Dell, Fujitsu, Hitachi, and Huawei supply servers, storage, and networking gear that support enterprise and hyperscale data centers. Vertiv offers critical power, thermal management, and modular rack solutions tailored for high-density and AI workloads. Intense competition drives firms to combine energy efficiency, modular deployment, and service flexibility. Investors and operators benefit from this competition through improved infrastructure quality, competitive pricing, and accelerated deployment timelines.

Recent Developments:

- In November 2025, Vertiv announced the acquisition of HVAC services firm PurgeRite for approximately USD 1 billion. The acquisition aims to expand Vertiv’s liquid-cooling and thermal-management capabilities to meet rising demand from high-power, AI-driven data centers. This enhances Vertiv’s mechanical infrastructure offerings in cooling and HVAC services

- In October 2025, Hitachi signed a strategic partnership with OpenAI to expand global AI data-center infrastructure. Under this agreement, the companies will co-develop modular and prefabricated data-center designs, energy-efficient cooling and storage infrastructures, and plan supply-chain strategies for reliable deployment. The deal targets sustainable data-center operations and rapid global expansion of AI infrastructure

- In September 2025, Schneider Electric launched its AI-ready liquid-cooled EcoStruxure solutions designed for high-density servers supporting NVIDIA GPU-based workloads, marking a significant product launch in data center infrastructure.

- In August 2025, Microsoft launched a new cloud region in Austria consisting of three datacenters around Vienna. This allows Austrian businesses and public administration to securely and compliantly store and process their data locally, advancing the country’s digital competitiveness and offering access to advanced cloud and AI technologies.

Market Drivers

Market Drivers

Market Challenges

Market Challenges Regional Insights

Regional Insights