Executive summary:

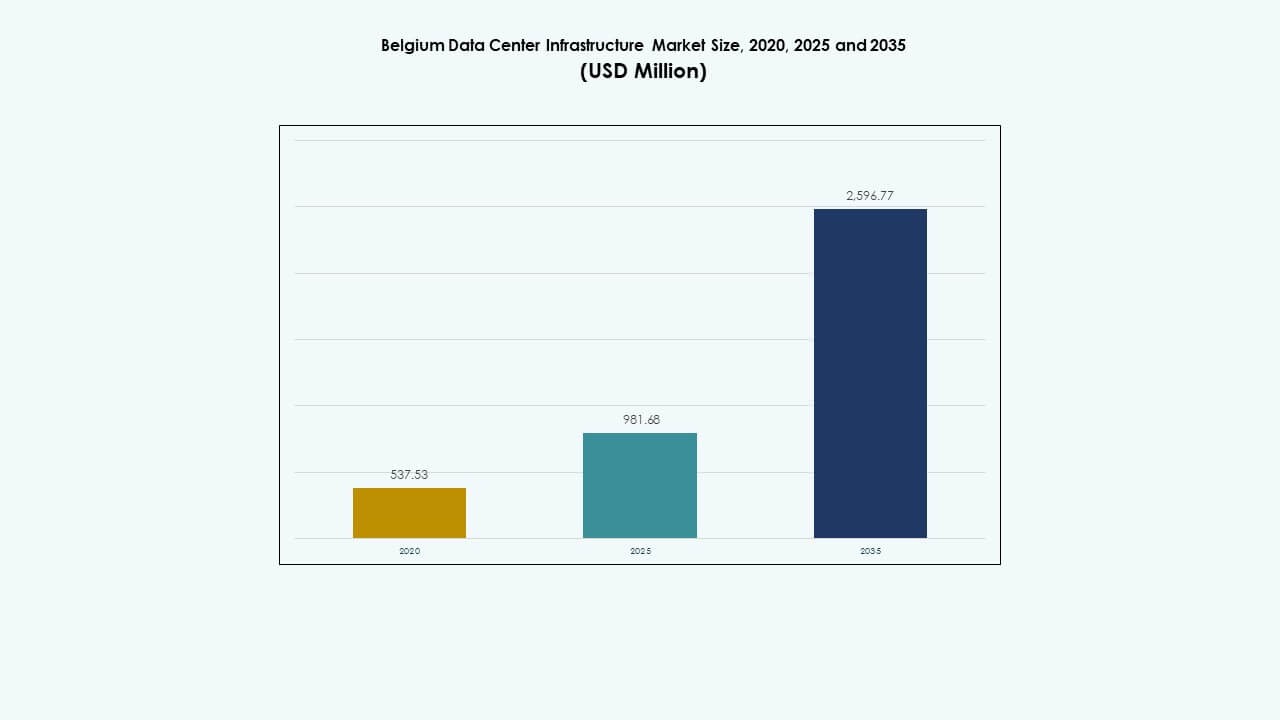

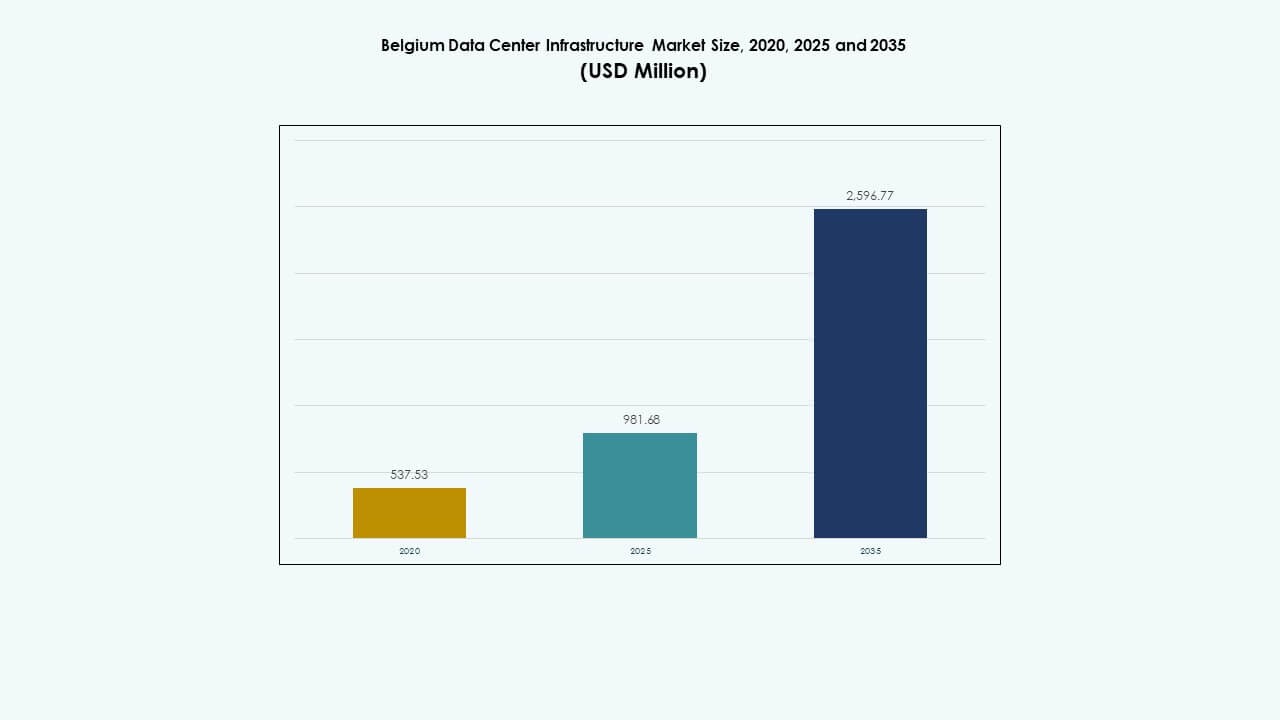

The Belgium Data Center Infrastructure Market size was valued at USD 537.53 million in 2020 and USD 981.68 million in 2025. It is anticipated to reach USD 2,596.77 million by 2035, at a CAGR of 10.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Belgium Data Center Infrastructure Market Size 2025 |

USD 981.68 Million |

| Belgium Data Center Infrastructure Market, CAGR |

10.15% |

| Belgium Data Center Infrastructure Market Size 2035 |

USD 2,596.77 Million |

Rapid technology adoption and innovation drive the Belgium Data Center Infrastructure Market as enterprises pursue digital transformation and energy-efficient operations. Businesses upgrade power and cooling systems to support AI and edge computing demands. It holds strategic importance for investors due to consistent enterprise modernization, sustainable designs, and hyperscale expansion that strengthen Belgium’s role as a key European data center hub.

Regionally, Flanders leads the Belgium Data Center Infrastructure Market with its dense industrial base and strong connectivity. Wallonia emerges through renewable energy-backed infrastructure and sustainable facility growth. The Brussels-Capital Region anchors government and enterprise demand, benefiting from advanced networking and high compliance standards. Each subregion contributes uniquely, positioning Belgium as a balanced and interconnected data infrastructure landscape within Western Europe.

Market Drivers

Rapid Expansion of Digital Transformation and Cloud Integration Across Enterprises

The Belgium Data Center Infrastructure Market experiences robust growth due to accelerating digital transformation across sectors. Enterprises embrace cloud platforms to improve data accessibility and efficiency. It supports hybrid and multi-cloud frameworks that reduce operational risks. Increasing data volumes from fintech, e-commerce, and manufacturing drive stronger compute demand. Businesses integrate advanced storage and backup solutions for compliance and data continuity. Belgium’s strong broadband network encourages fast cloud migration. The market attracts investments from colocation and hyperscale providers. This ecosystem strengthens enterprise modernization strategies. It positions Belgium as a strategic digital hub within Western Europe.

Rising Adoption of Energy-Efficient and Green Infrastructure Designs

The market gains traction from the adoption of sustainable and energy-efficient designs. Operators focus on low PUE (Power Usage Effectiveness) facilities to optimize energy performance. Renewable energy sourcing supports national carbon neutrality goals. The Belgium Data Center Infrastructure Market benefits from modular cooling systems and heat reuse projects. Companies deploy intelligent energy management platforms that balance load distribution. Such innovations reduce power costs and emissions. Governments encourage renewable-backed infrastructure through policy incentives. Investors prefer facilities aligned with ESG standards. These efforts enhance Belgium’s global appeal for sustainable colocation services.

- Operators focus on low PUE (Power Usage Effectiveness) facilities to optimize energy performance, for instance, Etix Everywhere facilities targeting PUE of 1.3 or lower through free-cooling systems and 100% renewable energy via power purchase agreements. Renewable energy sourcing supports national carbon neutrality goals.

Technological Advancements in AI, Edge Computing, and Automation

AI-driven monitoring and predictive analytics reshape infrastructure efficiency and uptime management. Edge computing expands near metropolitan zones to reduce latency for digital applications. Automation platforms improve maintenance and fault prediction across facility networks. The Belgium Data Center Infrastructure Market incorporates robotic inspection systems and smart sensor grids. This shift enables predictive cooling, real-time asset tracking, and better risk mitigation. Operators rely on DCIM (Data Center Infrastructure Management) tools for proactive resource control. Demand from AI workloads and autonomous systems boosts performance requirements. It fosters innovation in high-density computing clusters. These technological shifts drive competitiveness and reliability.

- Edge computing expands near metropolitan zones to reduce latency for digital applications, for instance, Kevlinx BRU01 data center in Brussels delivering 4 MW IT capacity in Phase 1 with support for up to 60 kW per rack for AI workloads. Automation platforms improve maintenance and fault prediction across facility networks.

Increasing Strategic Investments and Colocation Expansion Initiatives

Global data center operators increase Belgium’s market appeal through large-scale investments. Colocation providers expand rack capacities to meet growing enterprise needs. Telecom carriers collaborate with hyperscalers to strengthen connectivity and interconnection networks. The Belgium Data Center Infrastructure Market attracts investors seeking stable European growth. Government-backed data sovereignty frameworks ensure secure data hosting. Demand from financial and healthcare sectors promotes colocation adoption. Strategic positioning near Amsterdam and Frankfurt enhances cross-border connectivity. New players invest in scalable power and modular infrastructure. Belgium emerges as a secure and efficient data exchange corridor in Europe.

Market Trends

Market Trends

Growing Shift Toward Modular and Prefabricated Data Center Construction

The trend of modular construction continues to shape infrastructure deployment timelines. Prefabricated units allow faster setup and lower construction costs. These systems support flexibility in capacity expansion. The Belgium Data Center Infrastructure Market leverages factory-built modules for power and cooling units. Operators choose prefabricated frameworks to align with sustainability targets. Modular systems enhance scalability for colocation and enterprise deployments. Such flexibility aids investors seeking phased capacity additions. It promotes standardization and quality control. These benefits make modularization a preferred trend in data center engineering.

Expansion of AI-Optimized Cooling and Thermal Management Solutions

The demand for advanced cooling continues to increase due to high-density workloads. AI-based thermal optimization reduces hotspots and power losses. Operators employ liquid cooling and immersion systems for high-performance servers. The Belgium Data Center Infrastructure Market integrates real-time analytics for cooling management. Cooling innovations improve uptime consistency and lower total energy consumption. Data centers located in colder zones optimize free-air cooling systems. These systems help balance energy cost and performance metrics. The trend enhances environmental sustainability. It sets new benchmarks for operational excellence in infrastructure efficiency.

Rising Interconnection Ecosystems and Carrier-Neutral Infrastructure Growth

Carrier-neutral facilities gain traction as enterprises seek flexibility in network access. Interconnection hubs expand to support multi-cloud and hybrid environments. The Belgium Data Center Infrastructure Market supports diverse telecom integration for redundancy. Growing data exchange volumes encourage peering expansion among operators. Enterprises adopt carrier-neutral setups for improved latency management. Belgium’s proximity to major European internet exchanges drives growth. These hubs enable faster cloud integration and workload distribution. The focus on interconnectivity enhances market competitiveness. It fosters greater ecosystem collaboration across operators and clients.

Increased Focus on Cybersecurity and Data Sovereignty Compliance

The trend toward stringent data security frameworks strengthens Belgium’s market resilience. Organizations prioritize certified data centers meeting ISO 27001 and GDPR standards. It ensures controlled data handling and privacy protection. The Belgium Data Center Infrastructure Market benefits from strict national compliance policies. Operators deploy AI-based intrusion detection and zero-trust network models. Businesses prefer domestic hosting to secure sensitive digital assets. The focus on compliance encourages investments from financial institutions. Strong cybersecurity readiness builds trust across user segments. These measures reinforce Belgium’s role as a reliable digital operations center.

Market Challenges

Market Challenges

High Energy Costs and Limited Renewable Power Integration

Energy-intensive data centers face high operational expenses due to rising electricity costs. Limited renewable power capacity challenges consistent green power sourcing. The Belgium Data Center Infrastructure Market must balance expansion and sustainability goals. It faces grid congestion risks and long permitting cycles. Operators need consistent access to affordable green energy to maintain competitiveness. Upgrading power grids requires significant investment and policy support. Rising demand strains existing grid infrastructures. Limited access to local renewable supply creates dependency on external energy markets. This challenge increases long-term cost volatility for data center operators.

Complex Regulatory Environment and Skilled Workforce Shortage

Strict construction regulations and lengthy approval timelines affect new project delivery. The Belgium Data Center Infrastructure Market navigates complex compliance layers across regions. High specialization requirements limit the availability of skilled professionals. Technical staff shortages impact maintenance and service reliability. Companies face challenges in recruiting certified engineers and operators. Stringent sustainability benchmarks increase compliance costs. Continuous upskilling is needed to manage automation and AI-integrated systems. Investors require regulatory clarity to accelerate project financing. Workforce training programs remain vital to sustain the industry’s growth momentum.

Market Opportunities

Expansion of AI and HPC-Driven Infrastructure Demand

Rising AI workloads and HPC deployments create new infrastructure opportunities. Enterprises need GPU-based systems and liquid cooling facilities. The Belgium Data Center Infrastructure Market supports growth in research, finance, and telecom sectors. Edge zones near urban areas offer faster data processing. It presents high potential for modular and hybrid infrastructure models. The demand for scalable, low-latency computing will accelerate investments. Investors see this sector as a stable long-term growth engine. AI-based optimization also improves operational efficiency across sites.

Advancement in Renewable Energy and District Heat Recovery Projects

Belgium’s data centers adopt renewable energy partnerships to reduce emissions. Operators explore district heat recovery for urban utility support. The Belgium Data Center Infrastructure Market benefits from clean energy integration initiatives. Solar and wind-based sources offer cost stability for long-term operations. It aligns national energy policies with sustainability targets. New collaborations with power utilities promote grid resilience. Renewable-backed colocation hubs appeal to green-conscious clients. These opportunities enhance Belgium’s status in the European green data center network.

Market Segmentation

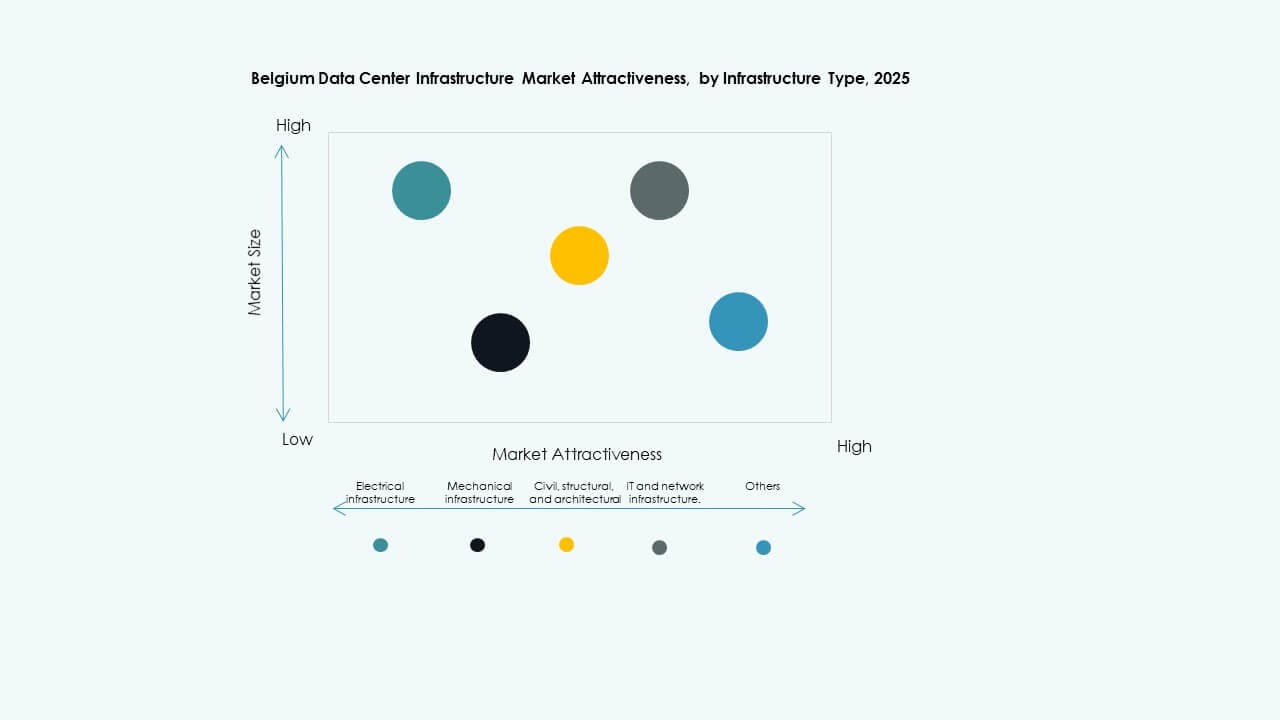

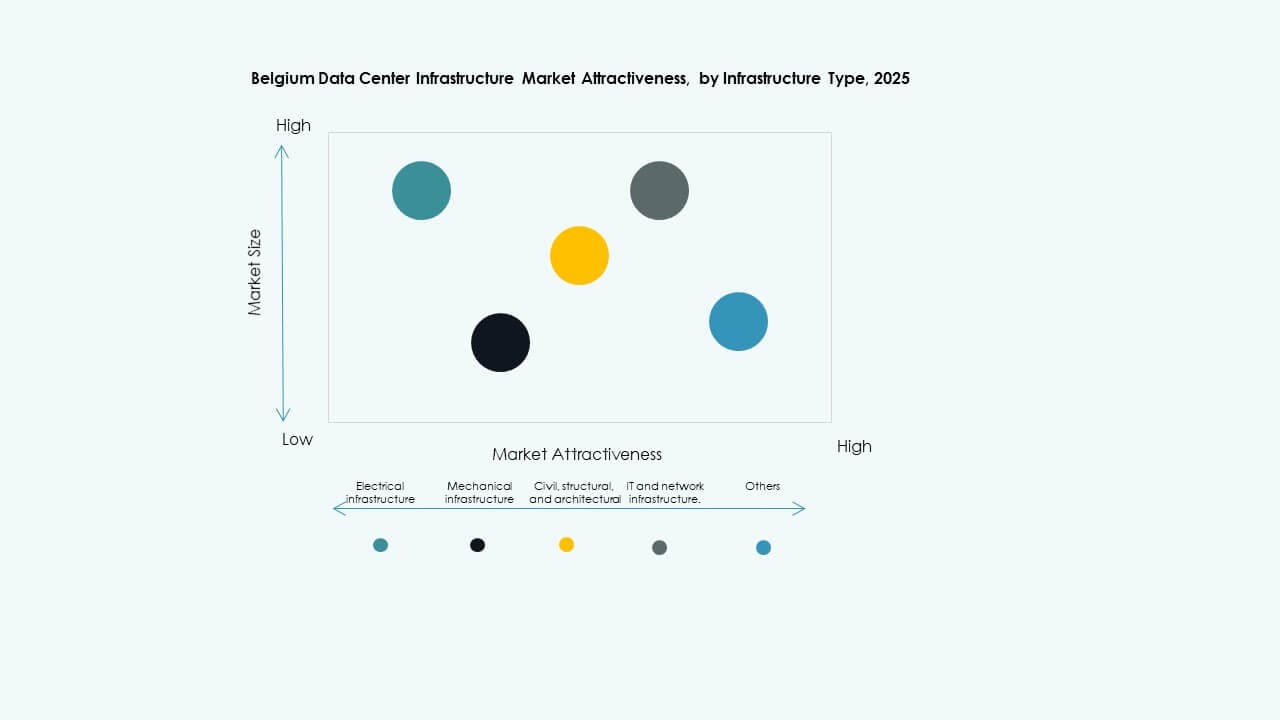

By Infrastructure Type

Electrical infrastructure holds a dominant share in the Belgium Data Center Infrastructure Market. It includes power systems, distribution units, and UPS solutions that maintain operational continuity. The segment’s growth aligns with energy efficiency goals and high reliability needs. Mechanical and IT infrastructures follow, driven by advances in cooling and networking equipment. Investments focus on redundancy and capacity expansion. Civil and architectural segments grow moderately with modular builds. Each layer strengthens Belgium’s digital infrastructure ecosystem and sustainability roadmap.

By Electrical Infrastructure

Uninterruptible Power Supply (UPS) and Power Distribution Units (PDUs) dominate this category. The Belgium Data Center Infrastructure Market relies on them to ensure uptime and stable power flow. Battery Energy Storage Systems (BESS) gain traction for grid balancing and resilience. Utility service connections enhance regional reliability. Transfer switches and switchgears support seamless energy transitions. Adoption of lithium-ion technologies strengthens this segment’s energy density. It remains crucial for supporting critical loads and hybrid power usage models.

By Mechanical Infrastructure

Cooling systems represent a leading mechanical component due to Belgium’s dense IT workloads. The Belgium Data Center Infrastructure Market integrates advanced CRAC, chillers, and containment systems. Air-cooled and liquid-based designs lower power consumption and improve efficiency. Pumps and piping networks enhance water usage optimization. Modular cooling setups simplify retrofits and expansions. The focus remains on reducing operational costs through automation. These technologies help facilities maintain performance consistency. The trend defines Belgium’s competitiveness in sustainable operations.

By Civil / Structural & Architectural

Superstructures and modular building systems dominate civil construction projects. The Belgium Data Center Infrastructure Market emphasizes prefabricated designs for scalability. Raised flooring, robust cladding, and foundation stability improve facility resilience. Operators adopt steel frameworks for faster assembly and durability. Site preparation efficiency remains a key differentiator for EPC contractors. Building envelopes integrate insulation and soundproofing for optimal temperature control. Modular frameworks enhance maintenance access and future upgrades. This segment evolves toward standardized and efficient layouts.

By IT & Network Infrastructure

Networking equipment and servers drive core IT investments in the Belgium Data Center Infrastructure Market. High-speed cabling, optical fiber, and rack systems enhance connectivity density. Enterprises deploy storage systems for real-time analytics and cloud platforms. It supports colocation and edge computing services. Growth accelerates through upgrades to high-throughput optical switches. Demand rises for AI-ready server configurations. Modernization trends align with Belgium’s expanding data-driven economy. This segment supports operational agility and workload flexibility.

By Data Center Type

Colocation data centers lead the market with scalable service models and flexible pricing. The Belgium Data Center Infrastructure Market benefits from enterprise demand for hybrid models. Hyperscale projects expand due to global cloud provider investments. Edge data centers support low-latency applications and IoT integration. Enterprise data centers maintain niche roles in critical business hosting. Growth in hyperscale and colocation continues to define Belgium’s infrastructure roadmap. The mix ensures balance between regional access and cloud scalability.

By Delivery Model

Turnkey and design-build models dominate Belgium’s market for efficiency and control. The Belgium Data Center Infrastructure Market favors turnkey projects for timeline reliability. Construction management and modular factory-built models grow with demand for flexibility. Retrofit and upgrade services target aging facilities for modernization. EPC contractors gain traction for their end-to-end project delivery expertise. Turnkey delivery ensures consistent quality and faster time-to-market. It appeals to investors seeking predictable returns. These models improve scalability and capital allocation.

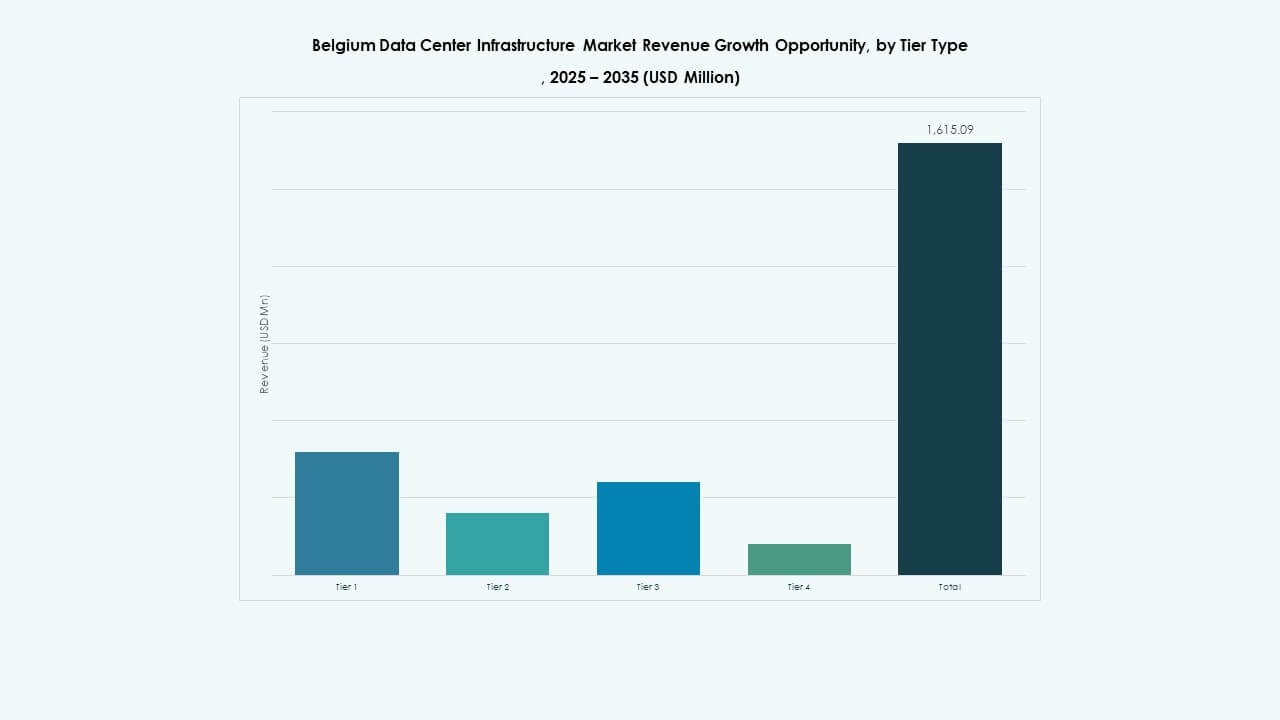

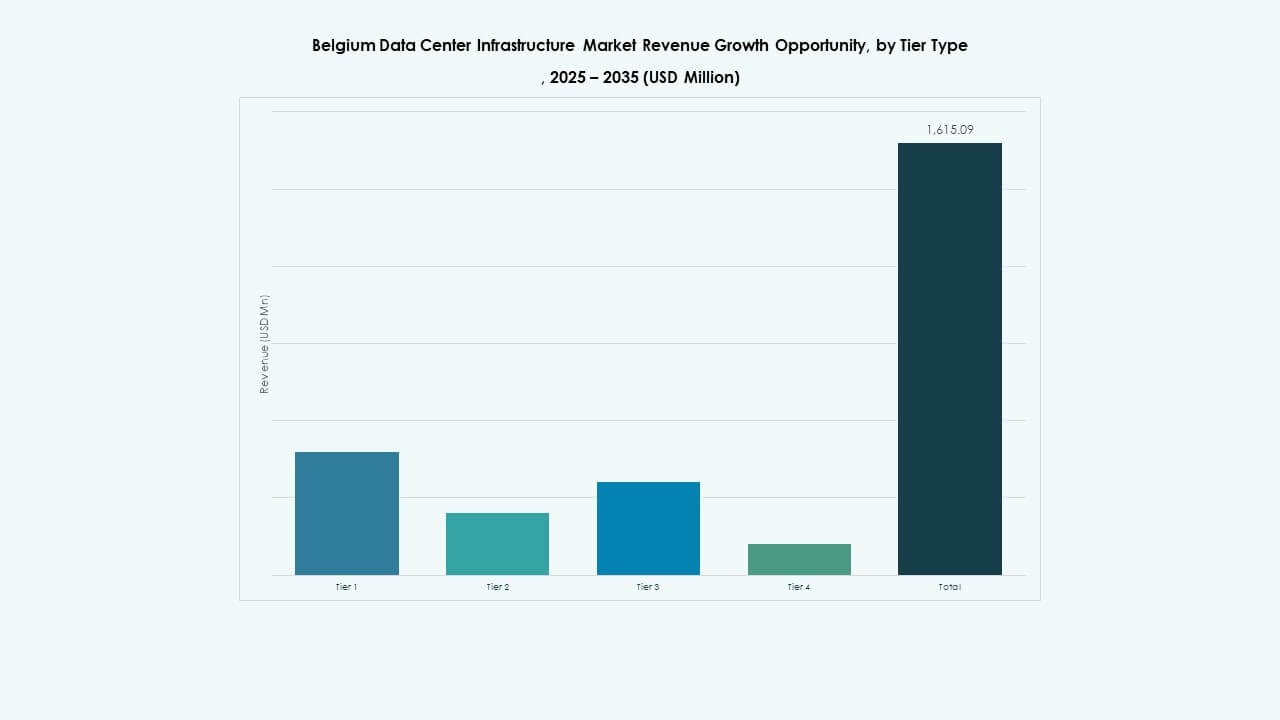

By Tier Type

Tier 3 data centers hold the majority share due to their reliability and performance. The Belgium Data Center Infrastructure Market prefers Tier 3 for redundancy and uptime balance. Tier 4 facilities emerge for mission-critical enterprises demanding zero downtime. Tier 1 and Tier 2 serve smaller or localized applications. Investment focuses on certifications to attract global clientele. Operators enhance uptime guarantees through advanced monitoring systems. These tiers ensure compliance with international standards. Belgium’s tiered landscape reflects strong service diversity.

Regional Insights

Regional Insights

Flanders Region Leading with Strong Industrial and Connectivity Base (Share ~52%)

Flanders leads the Belgium Data Center Infrastructure Market due to robust industrial infrastructure. Its proximity to European transport hubs supports data exchange and low latency. The region attracts hyperscale and colocation projects near Antwerp and Ghent. Industrial zones provide reliable grid connectivity for large-scale operations. Strong fiber networks enhance enterprise deployment rates. Flanders’ economic stability ensures continued investment momentum. The region’s dominance aligns with its balanced energy and connectivity mix.

- For example, Proximus, a major telecom operator in Belgium, is actively expanding fiber rollout in Flanders with clear deployment targets. It aims to extend fiber coverage to 95% of Belgian homes and businesses by 2032 through large-scale investments and joint ventures such as Fiberklaar focused on Flanders.

Wallonia Region Emerging as a Growing Hub for Sustainable Data Centers (Share ~30%)

Wallonia records strong growth driven by renewable energy adoption and regional incentives. The Belgium Data Center Infrastructure Market benefits from access to green power sources. Local authorities support sustainable projects through permitting and investment programs. Wallonia’s colder climate improves natural cooling efficiency. Its lower land and energy costs attract mid-size colocation and edge developers. Public-private collaborations strengthen the ecosystem for new facilities. The region’s growth reflects balanced expansion and environmental commitment.

- For example, Google’s investment in Wallonia is a fully verifiable hallmark example of the region’s growing data center prominence. In 2025, Google committed €5 billion to expand its data center campus near Saint-Ghislain, supporting about 600 employees with plans to create hundreds more jobs.

Brussels-Capital Region Anchoring Government and Enterprise Deployments (Share ~18%)

Brussels-Capital serves as the administrative and enterprise core of Belgium. The Belgium Data Center Infrastructure Market thrives on demand from government, finance, and telecom sectors. Strong international presence fuels connectivity growth. Proximity to EU institutions enhances data compliance and hosting appeal. Operators in Brussels focus on high-security and Tier 3+ certified facilities. Space limitations drive vertical or compact data center designs. It maintains strategic importance as Belgium’s centralized data and policy hub.

Competitive Insights:

- Schneider Electric SE

- ABB Ltd.

- Vertiv Group Corp.

- Dell, Inc.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Fujitsu Ltd.

- IBM Corporation

- Digital Realty

- Equinix, Inc.

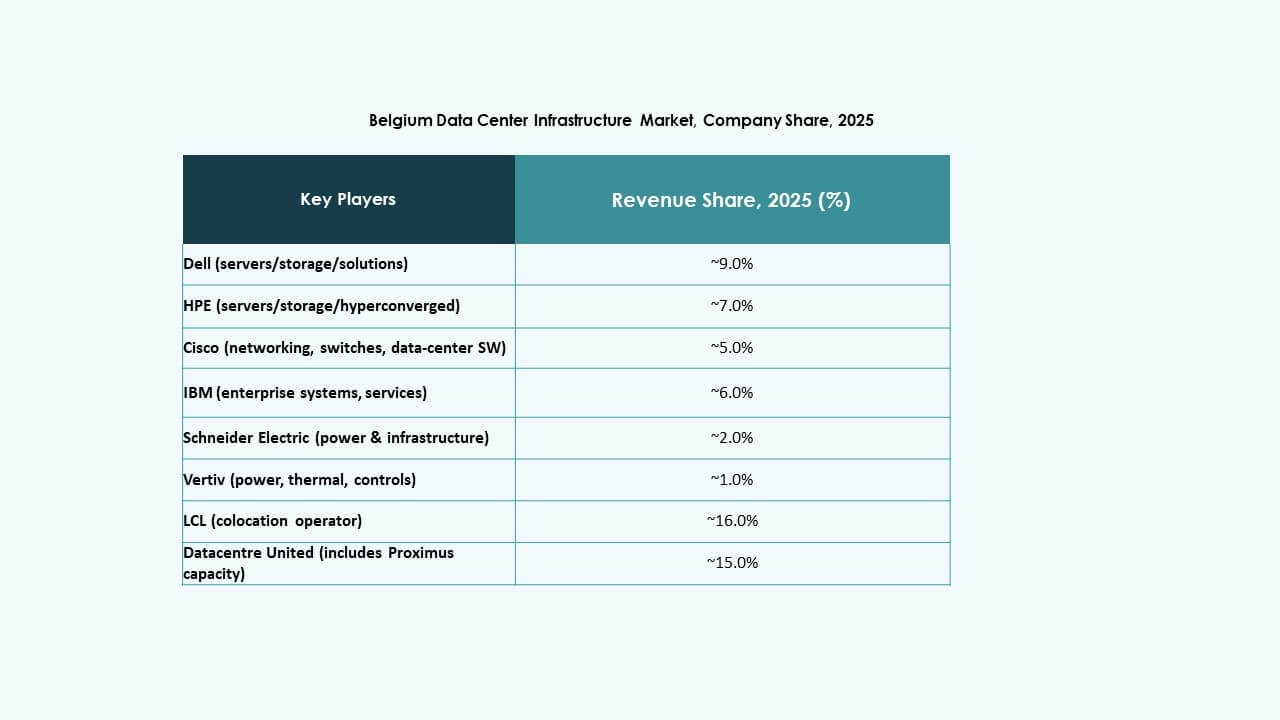

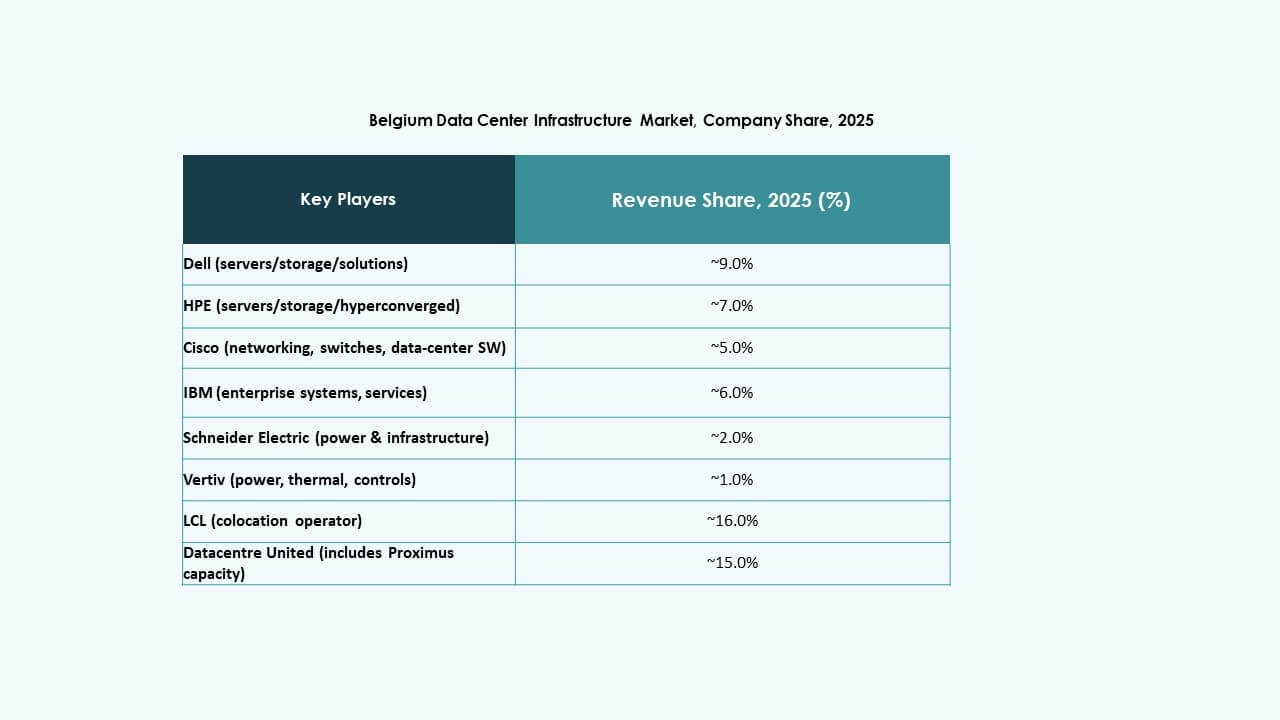

The competitive landscape in the Belgium Data Center Infrastructure Market features a mix of global infrastructure vendors, equipment providers, and colocation operators. Schneider Electric and ABB lead on power and electrical infrastructure with strong portfolios of UPS, PDUs, switchgear, and energy-management systems. Vertiv, Dell, Cisco, Huawei, Fujitsu, and IBM supply diverse mechanical, IT, and network infrastructure, supporting high-density computing and connectivity needs. On the colocation and data center services side, operators such as Digital Realty and Equinix dominate facility deployment and interconnection demand. Competition remains intense as firms push for energy efficiency, modular infrastructure, and scalable solutions. Market participants compete on reliability, sustainability credentials, and ability to support enterprise and hyperscale workloads.

Recent Developments:

- In November 2025, Vertiv announced the acquisition of HVAC services firm PurgeRite for approximately USD 1 billion. The acquisition aims to expand Vertiv’s liquid-cooling and thermal-management capabilities to meet rising demand from high-power, AI-driven data centers. This enhances Vertiv’s mechanical infrastructure offerings in cooling and HVAC services

- In October 2025, Google announced a €5 billion investment to expand its AI and cloud infrastructure in Belgium, including enhancements to its Saint-Ghislain data center through 2027, which will create 300 new full-time jobs.

- In September 2025, Schneider Electric launched its AI-ready liquid-cooled EcoStruxure solutions designed for high-density servers supporting NVIDIA GPU-based workloads, marking a significant product launch in data center infrastructure.

- In March 2025, Proximus divested its data center portfolio to Datacenter United, indicating ongoing consolidation in the Belgium data center infrastructure market.

Market Trends

Market Trends Market Challenges

Market Challenges Regional Insights

Regional Insights