Executive summary:

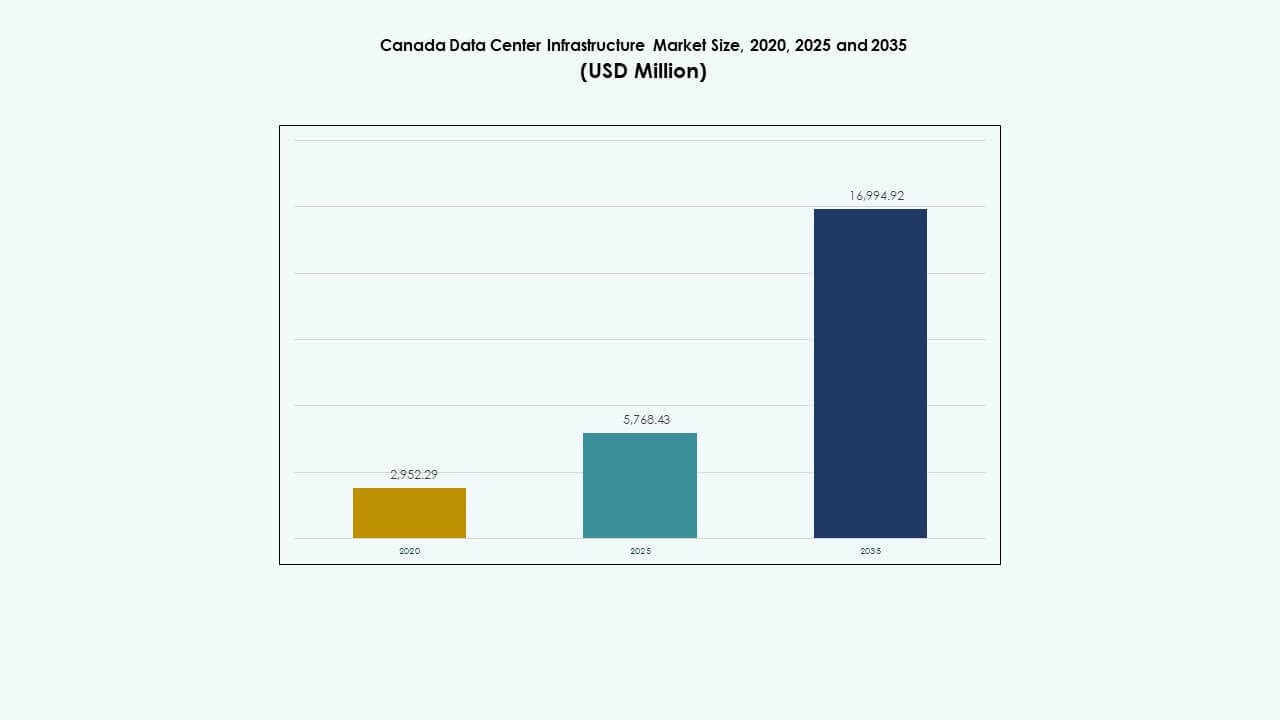

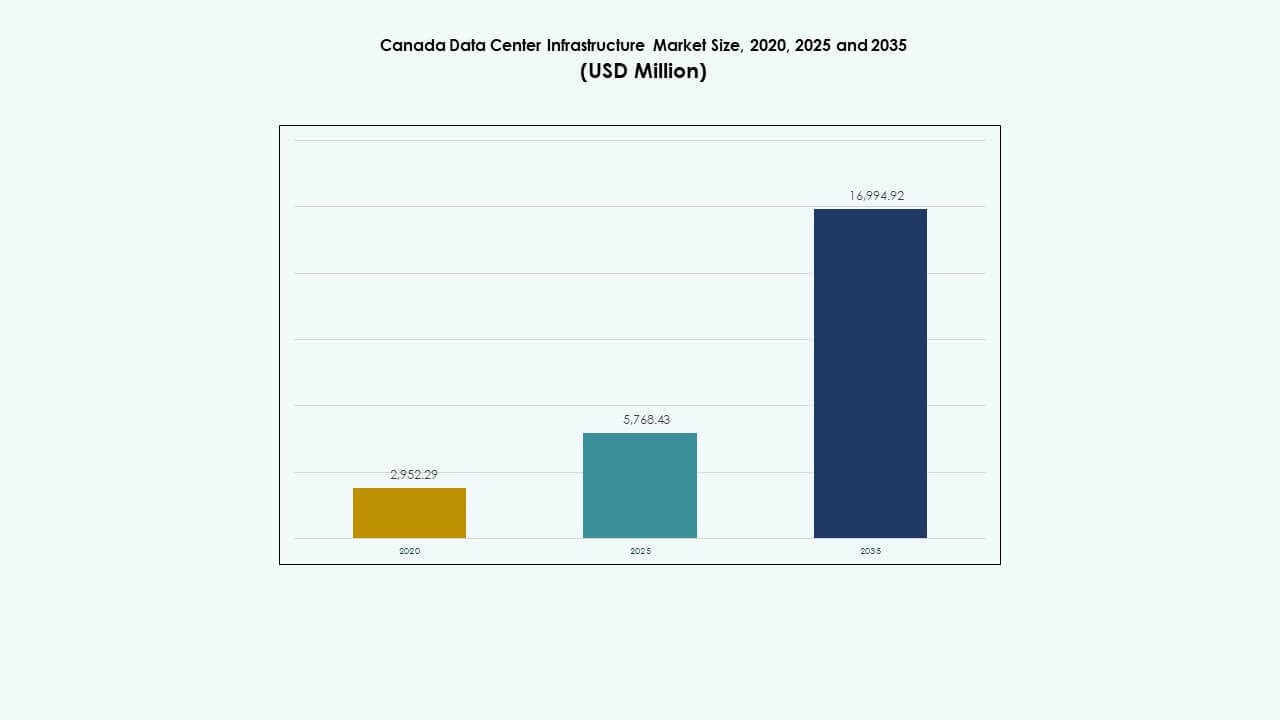

The Canada Data Center Infrastructure Market size was valued at USD 2,952.29 million in 2020, reached USD 5,768.43 million in 2025, and is anticipated to reach USD 16,994.92 million by 2035, at a CAGR of 11.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Canada Data Center Infrastructure Market Size 2025 |

USD 5,768.43 Million |

| Canada Data Center Infrastructure Market, CAGR |

11.33% |

| Canada Data Center Infrastructure Market Size 2035 |

USD 16,994.92 Million |

Rising demand for AI, cloud computing, and edge technologies continues to fuel infrastructure upgrades. The market benefits from heavy investments in energy-efficient cooling, automation, and smart grid integration. Strong government incentives, favorable climate conditions, and digital transformation initiatives attract hyperscale and enterprise operators. The Canada Data Center Infrastructure Market has become a strategic asset for investors seeking long-term digital infrastructure returns.

Ontario and Quebec dominate the national landscape due to strong power stability, connectivity, and renewable availability. Toronto and Montreal lead hyperscale and colocation growth, supported by extensive fiber and hydroelectric power. Emerging regions such as Alberta and British Columbia gain traction through low-cost energy and strategic land availability. Canada’s balanced energy resources and policy framework foster sustainable expansion across multiple provinces, enabling long-term capacity growth nationwide.

Market Drivers

Market Drivers

Rising Cloud Adoption and Expansion of Hyperscale Facilities

Cloud migration and the rise of hyperscale facilities are major forces driving growth in the Canada Data Center Infrastructure Market. Companies expand hybrid and multi-cloud strategies to support digital operations. Hyperscale operators establish new campuses across Toronto, Montreal, and Calgary to meet rising compute demand. It attracts long-term investments from both domestic and global players. Energy-efficient designs and smart power systems strengthen infrastructure scalability. Businesses invest heavily to meet storage and processing needs for AI and IoT workloads. Investors see reliable returns due to stable policies and renewable power incentives. These trends position Canada as a data resilience hub for North America.

- For example, by mid-2025, the Greater Toronto Area reached approximately 312 MW of operational data-center capacity, with an additional 112 MW under construction in Markham, Ontario, reflecting Canada’s strong hyperscale growth driven by rising AI and cloud computing demand.

Advancement in Energy-Efficient Technologies and Sustainability Commitments

Sustainability initiatives lead to major upgrades in infrastructure efficiency. Operators focus on liquid cooling, high-density racks, and AI-enabled monitoring to lower energy use. The Canada Data Center Infrastructure Market benefits from the nation’s green energy mix, primarily hydro and wind power. Data center developers use modular designs to improve deployment flexibility. It ensures operational reliability under strict energy regulations. Carbon-neutral initiatives drive innovation in renewable integration. Many firms aim to achieve zero-emission data facilities by 2030. The national push for sustainability supports steady market expansion.

- For example, Equinix operates multiple data centers in Montreal, providing colocation and interconnection services for enterprise and cloud clients. The company actively invests in energy-efficient cooling and renewable-powered operations, reflecting its global commitment to sustainable data center infrastructure.

Government Incentives and Supportive Digital Infrastructure Policies

Government-led incentives for technology and green infrastructure strengthen investor confidence. Tax credits, land grants, and policy backing accelerate data center buildouts. The Canada Data Center Infrastructure Market expands through improved fiber connectivity and national broadband projects. Provincial governments promote smart city and edge computing initiatives. It aligns with national goals for secure digital transformation. The presence of skilled labor and transparent governance attracts international data players. Long-term digital frameworks ensure predictable operating environments. The country’s digital policy foundation strengthens infrastructure innovation across industries.

Rising Integration of AI, Edge Computing, and Automation Platforms

AI-driven operations and automation redefine how facilities operate. Intelligent analytics improve asset utilization and predictive maintenance. Edge computing enables faster data processing closer to end-users. The Canada Data Center Infrastructure Market integrates these technologies for scalable performance. It supports 5G deployment, low-latency applications, and next-gen workloads. Automation enhances capacity planning and uptime reliability. Companies invest in robotic management systems to optimize energy and space use. Such digital transformation makes Canada’s data ecosystem future-ready.

Market Trends

Market Trends

Expansion of Colocation and Modular Data Centers Across Provinces

Colocation centers expand rapidly to serve enterprise and cloud clients. The Canada Data Center Infrastructure Market sees strong modular deployments for fast installation and scalable growth. Modular systems reduce construction time by up to 40%. It enables customized layouts for various workloads. Rising demand from SMEs and startups fuels colocation adoption. Data center operators adopt pre-engineered building models for flexibility. Increased demand for digital sovereignty strengthens local facility development. Such modular trends help balance capacity with energy efficiency targets.

Growing Preference for Renewable Energy-Powered Data Centers

The shift toward renewable-powered data centers gains momentum. Operators leverage Canada’s vast hydropower and wind resources. The Canada Data Center Infrastructure Market aligns sustainability goals with lower operational costs. Renewable integration improves PUE metrics and carbon accountability. Companies form power purchase agreements to secure clean energy supply. It helps enhance brand reputation and meet ESG commitments. Green design certifications like LEED and ISO 50001 become standard. The industry’s alignment with sustainability policies attracts responsible investors.

Emergence of AI-Driven Operations and Predictive Analytics

AI integration transforms facility management and service delivery. Real-time analytics monitor equipment health and power efficiency. The Canada Data Center Infrastructure Market benefits from automation that cuts downtime risks. Predictive tools detect anomalies before failures occur. Intelligent cooling systems reduce energy use and optimize workloads. Firms deploy AI to manage dynamic resource allocation. It enables smarter planning for growing data demands. Predictive intelligence ensures reliable performance and higher uptime in mission-critical environments.

Expansion of Edge and Regional Connectivity Networks

Edge data centers gain traction across suburban and industrial zones. Localized processing reduces latency and enhances service continuity. The Canada Data Center Infrastructure Market benefits from telecom investment in edge infrastructure. 5G rollout supports real-time analytics and low-latency computing. Distributed networks improve resilience and data localization compliance. It helps cloud and enterprise clients expand regional footprints. The emergence of micro data centers addresses rural connectivity gaps. This trend builds an inclusive, nationwide digital infrastructure framework.

Market Challenges

Market Challenges

High Energy Consumption and Limited Grid Flexibility

Energy consumption remains a major constraint in sustaining large data facilities. The Canada Data Center Infrastructure Market faces high grid dependency across dense provinces. Many operators confront rising utility tariffs and grid capacity issues. Renewable integration remains limited by transmission infrastructure. It challenges the pace of sustainable transition for hyperscale operators. Delays in power upgrades create risk for upcoming expansions. Operators explore on-site generation and battery systems to mitigate dependence. Balancing energy efficiency with uptime remains a persistent issue.

Supply Chain Bottlenecks and Construction Delays

Supply chain disruptions cause long lead times for key electrical and mechanical components. The Canada Data Center Infrastructure Market experiences delays in equipment delivery and site completion. Dependence on global suppliers limits flexibility during demand spikes. Rising material costs add financial strain for builders. It reduces the speed of capacity scaling in major hubs. Labor shortages in specialized construction trades add pressure. Regulatory approvals in urban zones slow down site deployment. These constraints limit the industry’s ability to meet accelerated demand.

Market Opportunities

Rising Investment in Green and AI-Enabled Data Center Designs

Canada’s renewable portfolio offers clear investment potential for sustainable data centers. The Canada Data Center Infrastructure Market attracts global interest in AI-enabled, low-carbon campuses. Green data infrastructure aligns with corporate ESG goals. It supports high-efficiency cooling and next-gen automation for operational savings. AI-based maintenance tools improve resource use and extend hardware life. Sustainable builds appeal to both hyperscale and colocation investors. The opportunity for renewable-linked PPA contracts enhances project viability.

Expansion into Edge and Secondary City Infrastructure

Edge development and regional city expansion present significant growth potential. The Canada Data Center Infrastructure Market benefits from new sites in Alberta, Manitoba, and Saskatchewan. Local facilities enhance network reach for enterprises and cloud services. It enables low-latency connections for industrial and retail sectors. Emerging smart-city projects need edge support for IoT devices. Decentralized facilities reduce network congestion in metro zones. Investors identify high ROI opportunities in regional expansion.

Market Segmentation

By Infrastructure Type

Electrical infrastructure dominates the Canada Data Center Infrastructure Market with the largest share. Power systems ensure uninterrupted service and meet growing AI workload needs. Mechanical infrastructure follows, driven by high-efficiency cooling and containment systems. Civil and IT infrastructure segments show robust growth from new campus construction. The sector’s diversity supports scalable capacity for varied clients.

By Electrical Infrastructure

Uninterruptible power supply (UPS) systems lead the electrical segment, ensuring operational continuity. The Canada Data Center Infrastructure Market invests heavily in advanced lithium-ion battery systems. PDUs and BESS gain popularity for redundancy and grid stability. Switchgear and transfer systems enhance fault tolerance and reliability. Growing power loads from hyperscale expansions boost system integration demand.

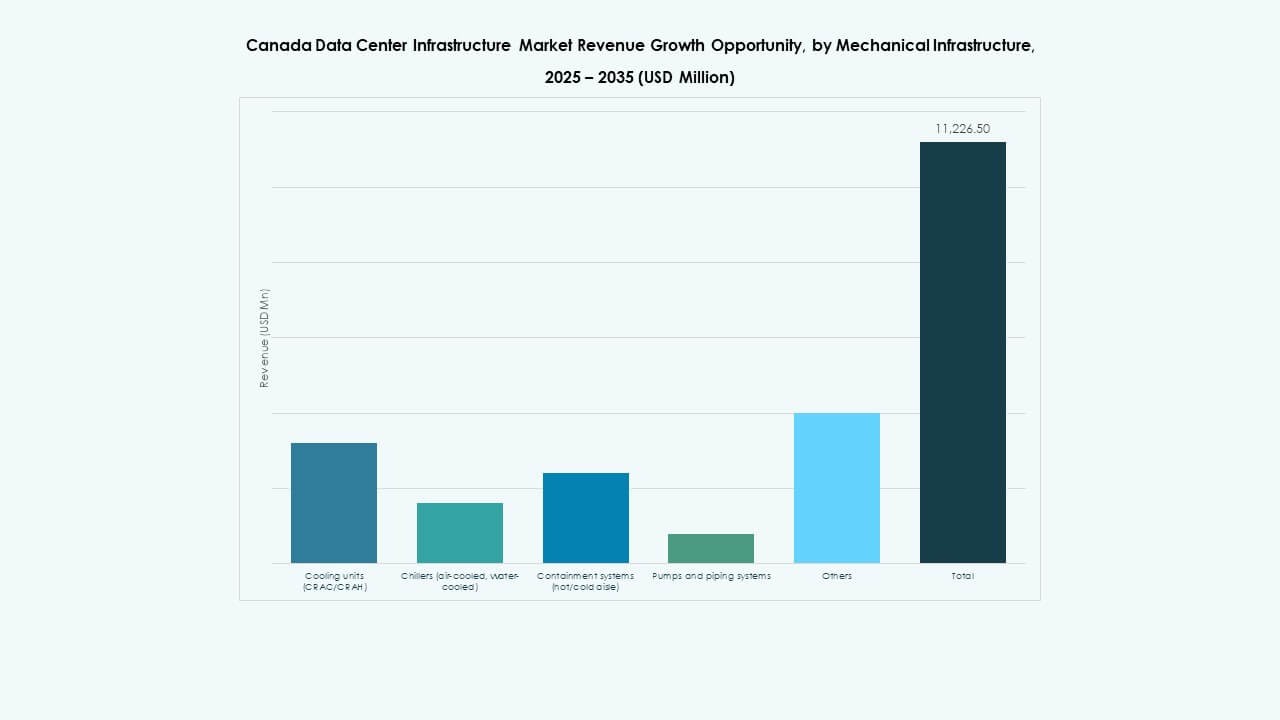

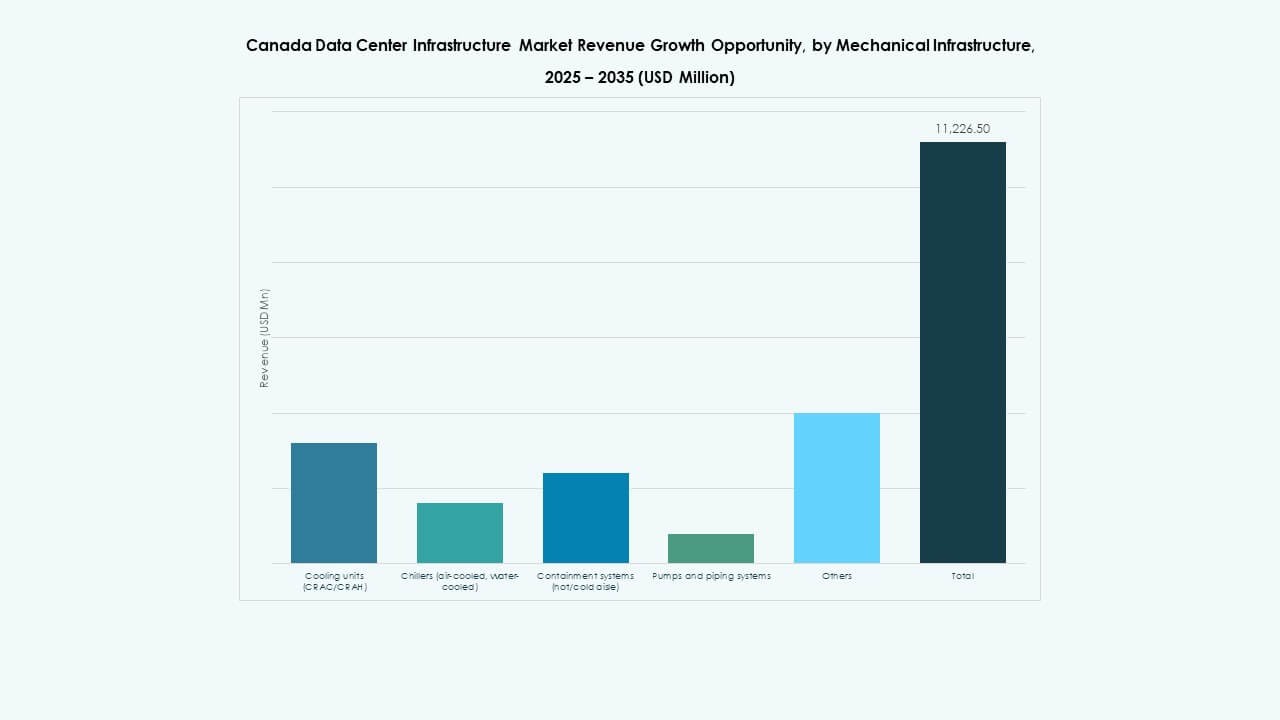

By Mechanical Infrastructure

Cooling units, particularly CRAC/CRAH systems, dominate the mechanical segment. The Canada Data Center Infrastructure Market adopts water-cooled chillers to reduce energy intensity. Containment and liquid cooling improve thermal control efficiency. Pumps and piping systems gain relevance in modular facilities. Rising rack densities drive continuous innovation in cooling designs.

By Civil / Structural & Architectural

Superstructure and modular building systems hold the largest share in this segment. The Canada Data Center Infrastructure Market emphasizes prefabricated steel frameworks for faster delivery. Raised flooring and envelope insulation improve efficiency. Site preparation and foundation work support resilient construction. Urban zoning standards drive architectural modernization in large campuses.

By IT & Network Infrastructure

Server and storage systems form the backbone of IT infrastructure. The Canada Data Center Infrastructure Market witnesses strong networking and optical fiber adoption. High-speed cabling ensures stable connectivity for large data volumes. Racks and enclosures improve modular scalability. Cloud-driven demand accelerates continuous upgrades in IT systems.

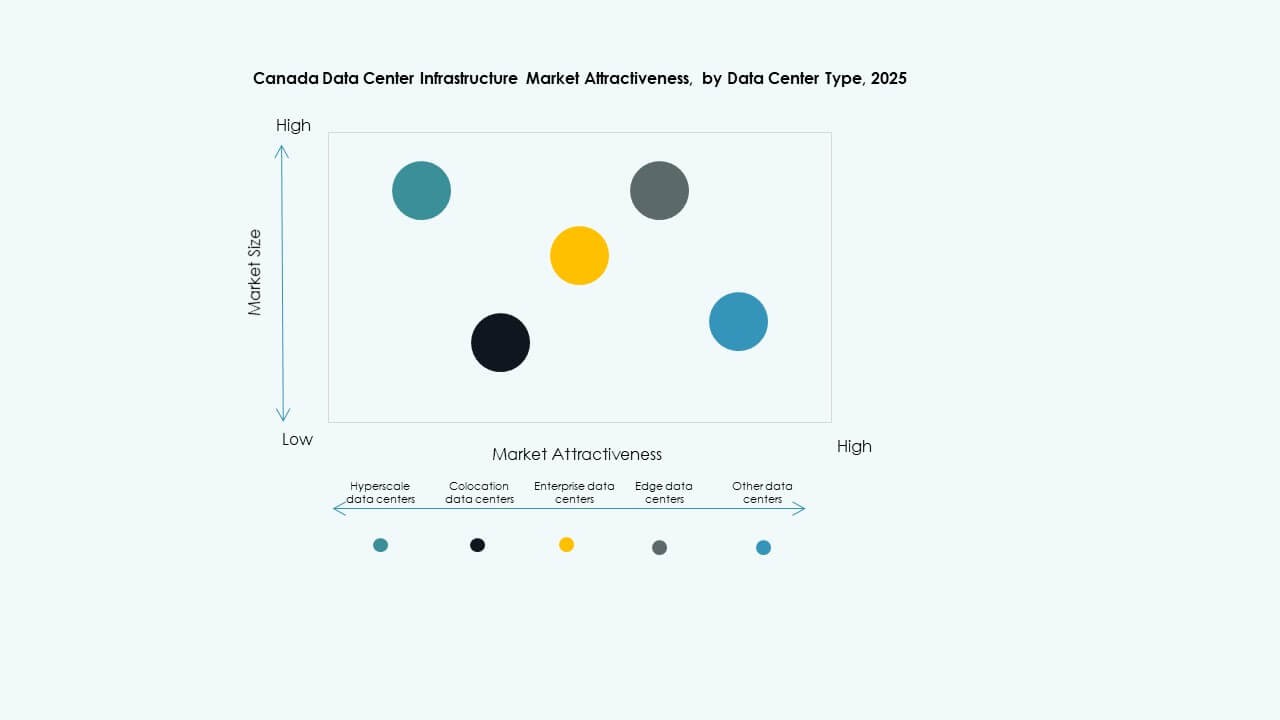

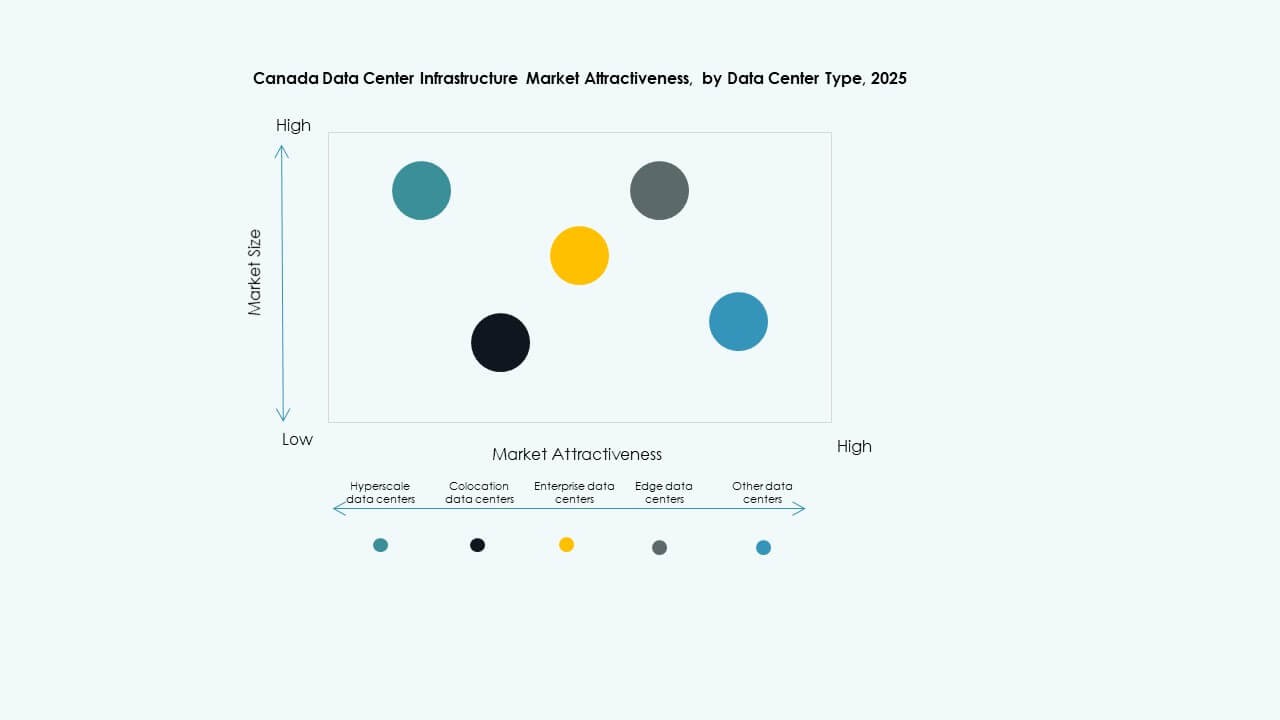

By Data Center Type

Hyperscale data centers dominate due to rising cloud storage demand. The Canada Data Center Infrastructure Market also sees strong colocation growth for hybrid deployments. Enterprise and edge centers show expansion in secondary regions. High uptime and flexible service models fuel diverse customer demand.

By Delivery Model

Design-build/EPC models dominate project delivery. The Canada Data Center Infrastructure Market prefers turnkey and modular factory-built models for speed and control. Retrofit projects rise as operators upgrade legacy systems. Modular factories reduce build costs while improving standardization.

By Tier Type

Tier 3 data centers lead with widespread enterprise and hyperscale adoption. The Canada Data Center Infrastructure Market sees growing Tier 4 developments for mission-critical reliability. Tier 1 and Tier 2 facilities serve smaller clients and edge nodes. Tier upgrades align with global uptime and compliance standards.

Regional Insights

Eastern Canada Dominates with Over 55% Market Share

Eastern Canada, led by Ontario and Quebec, holds about 55% of the total market. The Canada Data Center Infrastructure Market benefits from stable power, cold climate, and strong connectivity. Toronto and Montreal remain prime sites for hyperscale and colocation providers. Hydro-based energy supports carbon-neutral operations. Abundant talent and regulatory clarity encourage foreign investment. Eastern Canada remains the heart of national infrastructure development.

- For example, Vantage Data Centers’ Montreal II (QC4) campus is a proven example in Eastern Canada. It spans a 10-acre site near downtown Montreal with three facilities totaling 50 MW of critical IT load and 320,000 square feet of space when fully developed.

Western Canada Gains Momentum with 25% Market Share

Western Canada, including British Columbia and Alberta, represents nearly 25% of the market. The Canada Data Center Infrastructure Market sees growing attention from cloud and enterprise operators. Vancouver offers strong connectivity with the U.S. West Coast. Alberta provides low-cost power and emerging renewable assets. Strategic proximity to Pacific routes enhances export potential for data services. The region’s evolving grid reliability strengthens its role in future growth.

Northern and Atlantic Regions Emerging with 20% Combined Share

Northern and Atlantic provinces together contribute around 20% of market activity. The Canada Data Center Infrastructure Market in these areas develops through smaller colocation and edge hubs. Provinces like Nova Scotia and Newfoundland attract sustainable projects powered by wind energy. Government-backed rural connectivity programs expand regional capacity. Cold ambient temperatures offer natural cooling advantages. These emerging zones are expected to gain greater prominence by 2035.

- For example, Cologix’s MTL8 data center near Montreal demonstrates the scalability of colocation facilities powered by nearly 100% renewable energy. It offers more than 21 MW of capacity and serves as an example of how smaller hubs in emerging regions utilize sustainable energy sources.

Competitive Insights:

- Equinix, Inc.

- Schneider Electric

- Vertiv Group Corp.

- Dell Inc.

- Cisco Systems, Inc.

- Fujitsu

- Huawei Technologies Co., Ltd.

- IBM

- Cologix

- Vantage Data Centers

The competitive landscape reflects a mixture of global infrastructure providers and specialized equipment vendors strengthening data-center capabilities across Canada. Major firms supply everything from colocation and interconnection services to power, cooling and support systems. The presence of strong vendors boosts the maturity of local markets. It ensures reliable infrastructure delivery, rapid deployment, and scalable capacity for enterprise and hyperscale clients. The Canada Data Center Infrastructure Market benefits from this robust vendor base because developers and operators find trustworthy partners for electrical, mechanical, and IT components. Competition remains intense around service quality, energy efficiency, modular design, and total cost of ownership. Firms that combine infrastructure depth with flexible solutions attract most customers and investors.

Recent Developments:

- In September 2025, HIVE Digital Technologies completed the acquisition of a 7.2 MW data center located in Toronto for CAD 17.25 million, which included payment and issuance of shares as part of the deal. This acquisition is expected to strengthen HIVE’s infrastructure capabilities in the Canadian data center market.

- In September 2025, Schneider Electric launched its AI-ready liquid-cooled EcoStruxure solutions designed for high-density servers supporting NVIDIA GPU-based workloads, marking a significant product launch in data center infrastructure.

- In January 2025, Yondr Group initiated the construction of a new 27 MW data center in Toronto, Ontario, on a 4.5-acre site. This facility aims to feature a closed-loop cooling system, significantly reducing water usage once operational, and is scheduled to be ready for service by mid-2026.

Market Drivers

Market Drivers Market Trends

Market Trends Market Challenges

Market Challenges