Executive summary:

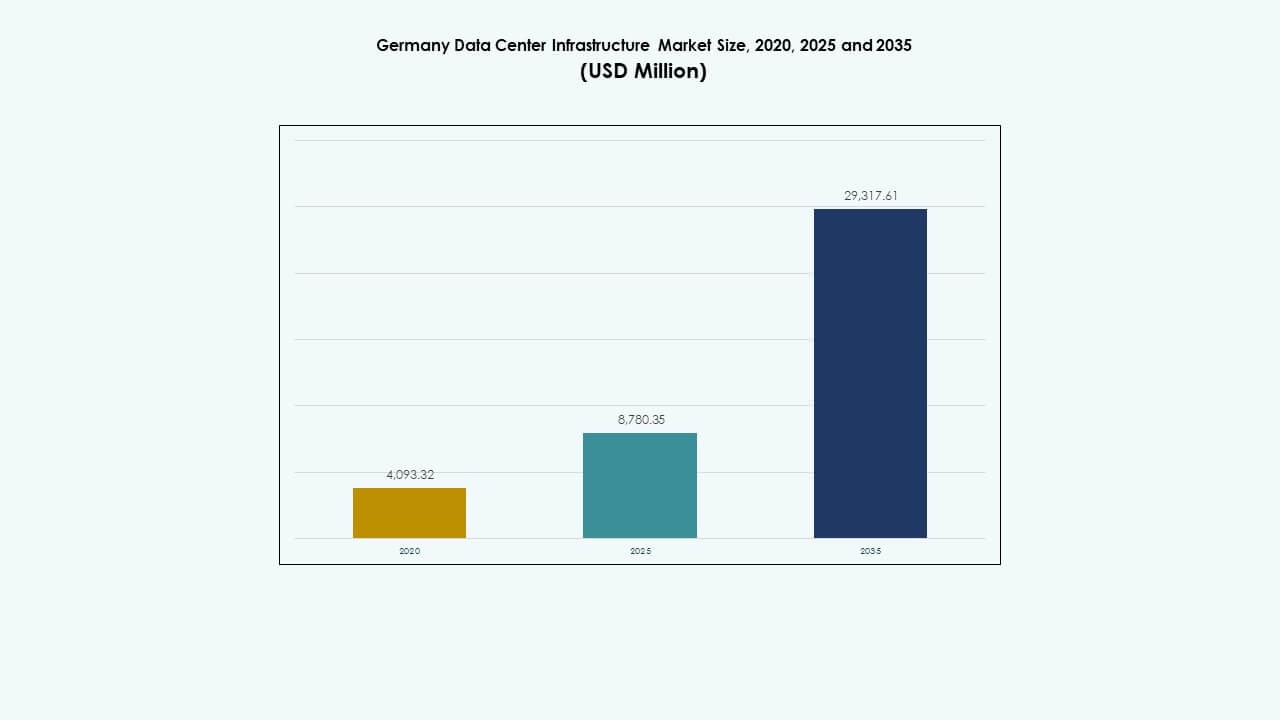

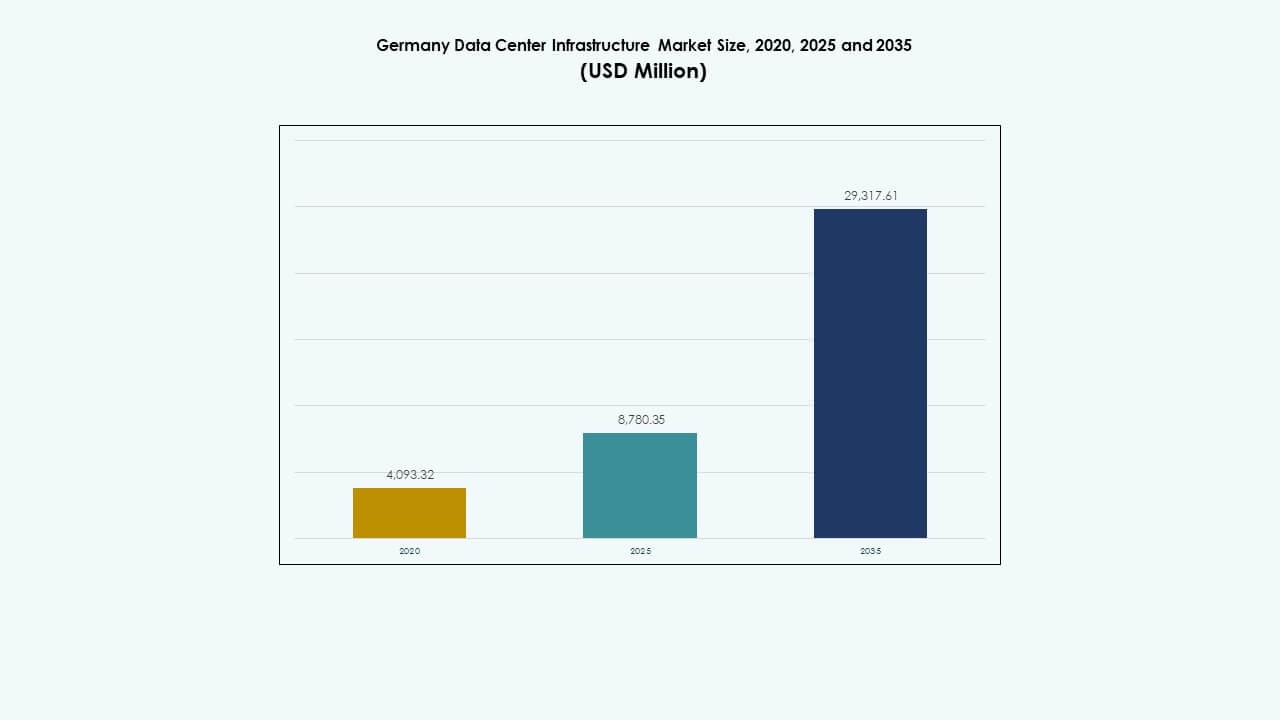

The Germany Data Center Infrastructure Market size was valued at USD 4,093.32 million in 2020 to USD 8,780.35 million in 2025 and is anticipated to reach USD 29,317.61 million by 2035, at a CAGR of 12.71% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Germany Data Center Infrastructure Market Size 2025 |

USD 8,780.35 Million |

| Germany Data Center Infrastructure Market, CAGR |

12.71% |

| Germany Data Center Infrastructure Market Size 2035 |

USD 29,317.61 Million |

Strong demand for cloud computing, AI, and digital transformation initiatives drives infrastructure expansion across Germany. Enterprises invest in advanced cooling, power, and automation systems to enhance operational efficiency. The growing focus on sustainability, renewable energy integration, and modular designs strengthens the market’s competitiveness. It attracts investors seeking long-term stability and exposure to Europe’s most advanced digital economy.

Western Germany remains the central hub for data center development, led by Frankfurt’s strong network interconnections and financial activity. Southern cities like Munich and Stuttgart expand rapidly due to industrial digitization and automotive innovation. Northern and Eastern regions emerge as edge computing hotspots supported by renewable energy sources and lower land costs.

Market Drivers

Market Drivers

Rising Demand for Cloud and Colocation Services

The Germany Data Center Infrastructure Market experiences rapid growth due to the surge in cloud computing and colocation demand. Enterprises adopt hybrid and multi-cloud models to improve agility and scalability. Hyperscale providers expand facilities to support AI, big data, and IoT workloads. Businesses rely on colocation to reduce capital expenses and ensure operational resilience. Strong internet connectivity and a strategic European location attract global cloud operators. It benefits from data sovereignty regulations that support local hosting. Investors see stable returns in expanding capacity. The market’s digitalization drive sustains high infrastructure spending.

- For example, CyrusOne is developing its Frankfurt V data center campus in Hanau, east of Frankfurt, featuring an incoming power capacity of 90 MW and around 18,000 square meters of technical space. The first construction phase of approximately 9 MW was scheduled for completion by Q3 2024, strengthening the company’s position in Germany’s hyperscale data center market.

Shift Toward Energy-Efficient and Sustainable Facilities

Operators in the Germany Data Center Infrastructure Market prioritize sustainability to meet energy efficiency goals. New data centers adopt advanced cooling and power optimization systems to cut carbon emissions. Renewable energy sourcing becomes a core focus for meeting government climate targets. Providers deploy liquid cooling, free-air systems, and heat recovery technologies. Environmental standards drive modernization of existing facilities. Green certifications enhance brand credibility and attract eco-conscious clients. It reflects a broader push toward sustainable industrial growth. Continuous innovation keeps operators competitive while reducing operating costs.

- For instance, EdgeConneX is developing a 57,000 m² campus in Heusenstamm with two data centers by 2027, operated on 100% green electricity via a new power line from Dietzenbach. Providers deploy liquid cooling, free-air systems, and heat recovery technologies.

Adoption of Advanced Computing and Automation Technologies

Digital transformation across sectors fuels integration of AI-driven automation in the Germany Data Center Infrastructure Market. Facilities deploy predictive maintenance, automated resource allocation, and DCIM tools for real-time monitoring. Machine learning enhances workload efficiency and power management. Edge computing supports low-latency applications across smart cities and industries. Operators invest in high-performance servers for AI and GPU-intensive workloads. Intelligent cooling systems ensure reliability under rising densities. It boosts operational transparency and reduces downtime. The rise of autonomous infrastructure strengthens service delivery and long-term profitability.

Strategic Investments and Industrial Digitization Initiatives

Germany’s industrial base accelerates modernization through heavy investments in IT infrastructure. Automotive, manufacturing, and finance sectors rely on secure and scalable data centers. Government digital strategies and funding programs encourage infrastructure expansion. Foreign investors find strong incentives due to stable regulations and robust connectivity. Strategic alliances between technology and energy providers enhance integration of renewable sources. It drives regional competitiveness in the European data ecosystem. Urban hubs like Frankfurt and Berlin evolve into innovation centers. Long-term policy support ensures strong investor confidence and industry growth.

Market Trends

Market Trends

Emergence of AI-Ready and High-Density Data Centers

AI workloads reshape the Germany Data Center Infrastructure Market through demand for high-density configurations. Facilities integrate liquid cooling and power-efficient architectures to handle GPU clusters. AI model training and large-scale simulations increase rack power requirements. Operators focus on scalable designs for flexible deployment. Machine learning optimization tools monitor load balancing and thermal efficiency. New data centers adopt modular expansion strategies. It strengthens the market’s competitiveness across Europe. The evolution toward AI-optimized infrastructure defines the next growth phase.

Integration of Renewable Power and Circular Energy Systems

Energy transition policies accelerate renewable adoption across the Germany Data Center Infrastructure Market. Operators partner with utilities to secure long-term green power purchase agreements. On-site solar and wind generation supplement grid supply. Waste heat recovery supports district heating networks. Facilities redesign energy flows to achieve carbon-neutral operations. Circular cooling solutions minimize water use and energy loss. It builds environmental resilience and aligns with EU sustainability mandates. Companies with strong energy management practices gain stronger client preference.

Expansion of Edge and Distributed Computing Infrastructure

Edge computing reshapes data distribution across Germany’s technology landscape. Rising IoT adoption drives small and modular data centers closer to end users. Smart factories, autonomous vehicles, and real-time analytics require low-latency processing. Regional edge hubs extend national connectivity beyond traditional metro areas. Operators use modular designs for quick deployment in industrial zones. It supports decentralized digital ecosystems essential for Industry 4.0. The shift improves performance for latency-sensitive applications. Growth of distributed networks improves national data resilience.

Growing Role of Hyperscalers and Hybrid IT Models

Global hyperscalers expand footprint across Frankfurt, Berlin, and Munich. The Germany Data Center Infrastructure Market benefits from demand for hybrid IT solutions. Enterprises seek balance between on-premise control and cloud scalability. Hyperscale operators invest in new campuses for AI, cloud storage, and SaaS platforms. Carrier-neutral interconnectivity enables multi-tenant flexibility. Data localization laws strengthen trust in domestic infrastructure. It promotes steady revenue growth across colocation and managed service segments. Integration with telecom 5G infrastructure enhances digital reach.

Market Challenges

High Energy Costs and Power Supply Constraints

The Germany Data Center Infrastructure Market faces rising electricity prices impacting operational margins. Grid dependency creates pressure during high-demand periods. Operators struggle to secure stable energy supply amid regional shortages. Transition to renewable power adds complexity to long-term contracts. Urban power limitations delay new hyperscale developments. Rising demand from AI workloads heightens pressure on existing capacity. It drives investments toward alternative energy storage solutions. Energy management remains a key barrier to sustainable expansion.

Regulatory Complexity and Construction Bottlenecks

Stringent environmental regulations slow project approval timelines. Urban planning rules add challenges for large-scale construction. Land scarcity around major hubs increases project costs. Operators encounter delays in permitting due to noise, emissions, and zoning constraints. Compliance with EU directives requires significant documentation and auditing. Local opposition to industrial expansion sometimes limits site selection. It creates a fragmented regulatory environment for developers. Balancing growth with compliance remains a persistent hurdle for investors.

Market Opportunities

Market Opportunities

Growing Investments in Green and Modular Infrastructure

The Germany Data Center Infrastructure Market offers opportunities for modular and energy-efficient designs. Businesses prioritize sustainability and scalability to meet digitalization goals. Modular data centers enable faster deployment in secondary cities. Renewable integration strengthens long-term cost efficiency. Partnerships between utilities and data operators create green ecosystems. It attracts institutional investors seeking stable, environmentally responsible portfolios. Advanced automation and DCIM software enhance operational reliability. Sustainable design adoption widens new revenue channels.

Rising Demand from AI, Cloud, and IoT Ecosystems

AI-driven industries accelerate infrastructure demand across Germany. Enterprises adopt AI-ready platforms for manufacturing, logistics, and research. The rise of IoT and connected devices boosts edge data center needs. Cloud migration among public and private sectors expands total capacity. The government’s digital initiatives amplify market opportunities. It drives collaboration between hyperscalers and regional providers. Strong network connectivity and cybersecurity support cross-industry integration. Growth in data-intensive ecosystems ensures long-term investment appeal.

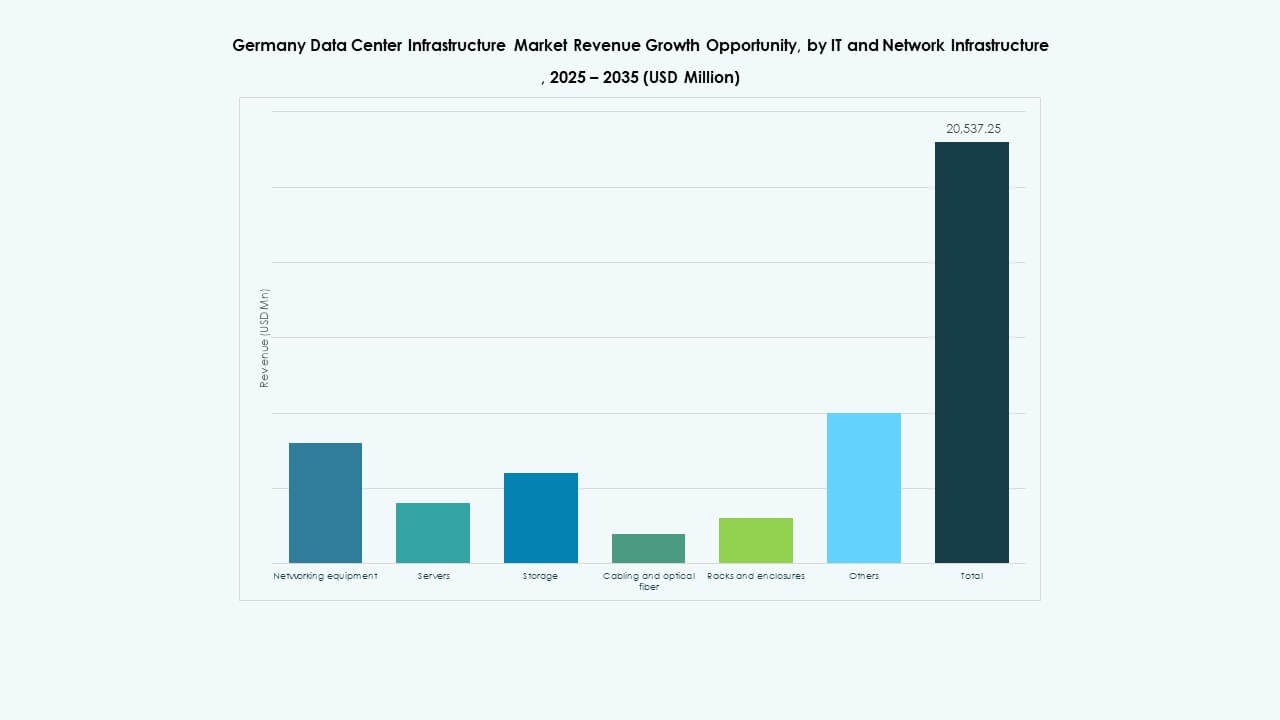

Market Segmentation

By Infrastructure Type

The Germany Data Center Infrastructure Market is dominated by IT and Network Infrastructure, followed by electrical and mechanical systems. Demand for robust servers, networking, and storage systems drives continuous investment. Electrical and cooling components ensure uptime reliability across hyperscale environments. Civil and architectural structures focus on modular construction efficiency. Growth in edge facilities supports scalable deployment. It benefits from expanding cloud service adoption. Rising automation across segments enhances performance and sustainability.

By Electrical Infrastructure

Uninterruptible Power Supply (UPS) systems hold the largest share within electrical infrastructure. Strong emphasis on power reliability drives their adoption across colocation and enterprise facilities. Battery Energy Storage Systems (BESS) gain momentum due to energy transition goals. PDUs and switchgears enhance fault tolerance and load distribution. It ensures minimal downtime during grid instability. Advanced power monitoring improves asset management. Growing renewable integration reinforces sustainable power delivery. Electrical innovation remains critical for operational continuity.

By Mechanical Infrastructure

Cooling units and chillers dominate mechanical infrastructure investments. CRAC and CRAH systems remain standard in large-scale deployments. Liquid cooling adoption rises due to dense AI and GPU workloads. Containment systems improve thermal efficiency and reduce power costs. Pumps and piping systems support flexible heat management. It ensures efficient temperature control in high-density racks. Energy-efficient mechanical designs reduce carbon footprints. Continuous innovation supports green certification compliance.

By Civil / Structural & Architectural

Superstructure and modular building systems lead civil infrastructure design. Steel and concrete frames provide durability for large campuses. Raised floors and suspended ceilings enhance airflow efficiency. Prefabricated modules reduce construction time and cost. Building envelopes integrate insulation and fire resistance for safety. It supports flexibility in phased expansion projects. Civil upgrades enhance seismic stability and operational resilience. Sustainable materials improve environmental performance across new builds.

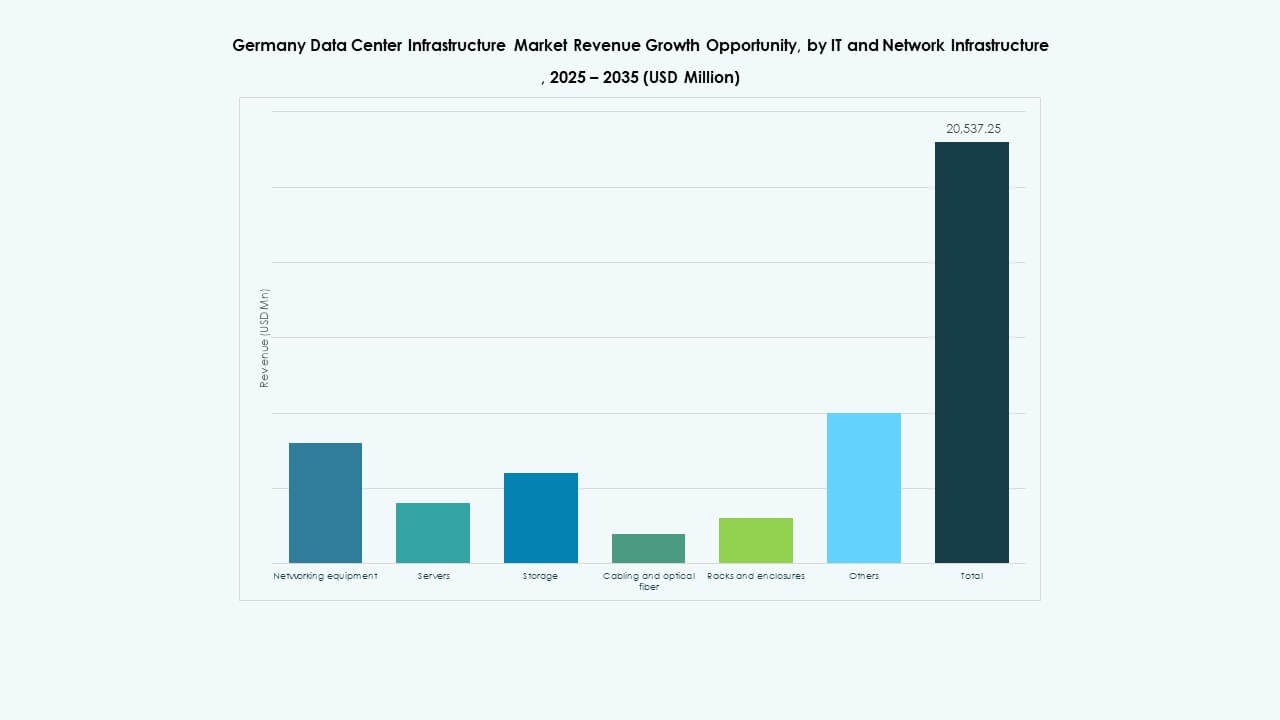

By IT & Network Infrastructure

Servers and networking equipment represent core investment areas. High-performance servers power AI and analytics workloads. Storage systems expand to handle growing unstructured data volumes. Fiber cabling and racks improve connectivity and space optimization. It enhances processing speed and inter-data center communication. Cloud and edge applications accelerate infrastructure upgrades. Scalable IT frameworks ensure future readiness. Strong vendor partnerships sustain supply stability.

By Data Center Type

Hyperscale data centers dominate due to rising AI and cloud adoption. Colocation centers follow with strong enterprise demand. Edge facilities expand rapidly for real-time applications. Enterprise and modular centers cater to customized private networks. It supports national digital strategies and industrial automation. The growing hyperscale presence in Frankfurt drives infrastructure innovation. Smaller edge setups strengthen coverage in secondary cities. Market diversification supports balanced national growth.

By Delivery Model

Design-Build and Turnkey models lead construction strategies. Integrated EPC services reduce project delivery time. Retrofit and upgrade solutions extend lifespan of existing sites. Modular factory-built units gain demand for rapid scaling. It supports agile deployment across multiple zones. Construction management ensures precision and compliance. Hybrid delivery approaches lower operational risks. Growing investor focus on efficiency strengthens delivery innovation.

By Tier Type

Tier 3 data centers hold the majority share, offering high redundancy and uptime. Tier 4 facilities rise for mission-critical industries needing fault tolerance. Tier 1 and Tier 2 centers cater to small enterprises and edge deployments. It ensures diverse service offerings across reliability levels. Demand for advanced uptime certifications drives modernization. Operators balance cost and performance to optimize investment. The tier framework enhances customer trust and infrastructure credibility.

Regional Insights

Regional Insights

Western Germany: Core Data Center Cluster

Western Germany dominates the Germany Data Center Infrastructure Market with over 45% share. Frankfurt leads as a key European interconnection hub. Strong fiber connectivity and proximity to financial institutions attract hyperscale operators. Düsseldorf and Cologne support enterprise colocation growth. The region benefits from abundant power and network redundancy. It remains the backbone of national data hosting. Industrial digitization initiatives further strengthen its infrastructure leadership.

Southern Germany: Expanding Technology and Industrial Base

Southern Germany, including Munich and Stuttgart, emerges as a growing hub for enterprise data centers. Automotive and manufacturing industries demand high-performance computing. Research institutions drive investment in AI-ready infrastructure. Energy-efficient facilities integrate renewable sources from regional grids. It leverages advanced logistics and industrial capabilities. The expansion supports balanced national coverage. Growth aligns with regional innovation and Industry 4.0 projects.

- For example, in Stuttgart, AtlasEdge opened a 20 megawatt (MW) data center powered entirely by renewable energy sources in mid-2025. The facility spans approximately 10,000 square meters and supports automotive and manufacturing high-performance computing needs, certified with energy-efficient standards such as ISO 50001 and EN 50600. This example is verified through official industry news and AtlasEdge announcements.

Northern and Eastern Germany: Emerging Edge and Green Developments

Northern and Eastern regions gain traction with edge and green data center projects. Berlin anchors startup-driven deployments with growing cloud adoption. Hamburg and Leipzig attract modular installations due to affordable land and energy availability. Renewable energy capacity strengthens the appeal of coastal hubs. It supports expansion into sustainable and decentralized networks. The rise of regional facilities enhances digital inclusion across Germany.

- For example, Berlin continues to attract startup-driven edge data center projects supporting localized digital services. In Hamburg, Penta Infra launched a 4.4 MW facility spanning around 2,500 m², designed with solar-integrated facades and natural-refrigerant cooling systems. These developments highlight Germany’s shift toward energy-efficient and modular data infrastructure across major cities.

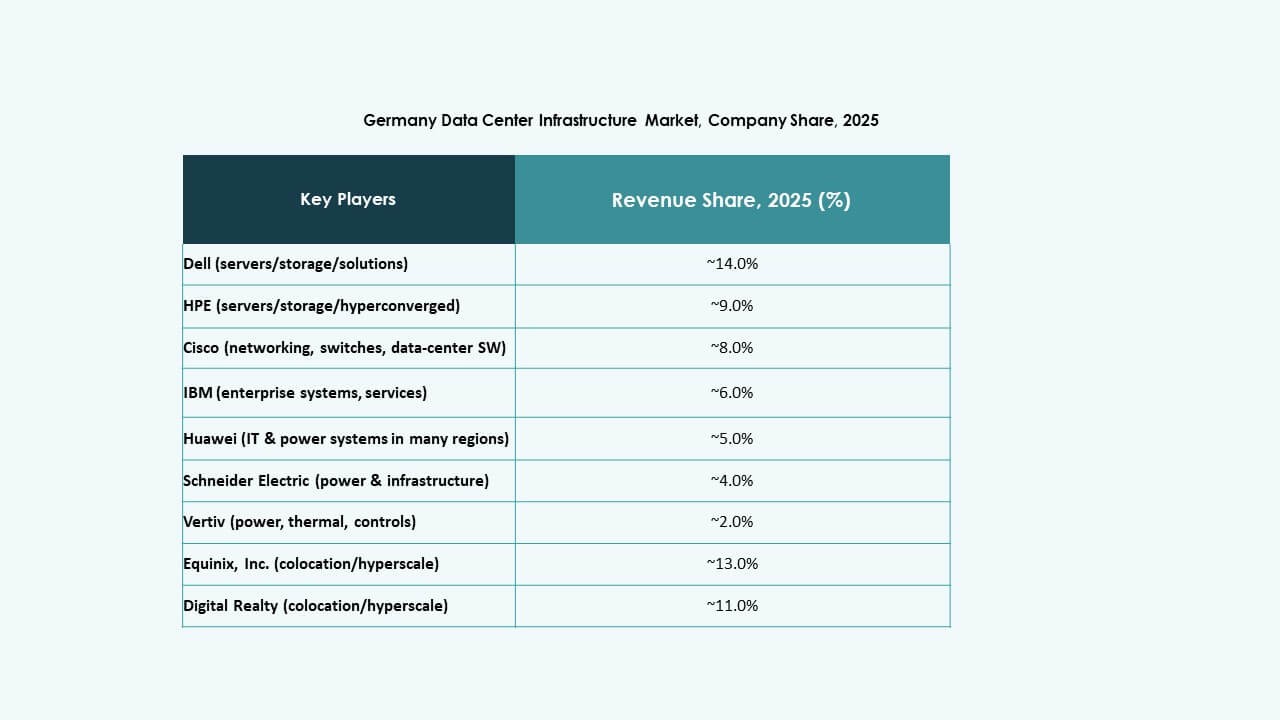

Competitive Insights:

- Schneider Electric SE

- Vertiv Group Corp.

- ABB Ltd.

- Dell, Inc.

- Hewlett Packard Enterprise (HPE)

- Cisco Systems, Inc.

- Fujitsu Ltd.

- NTT Global Data Centers (NTT)

- Digital Realty Trust, Inc.

- Equinix, Inc.

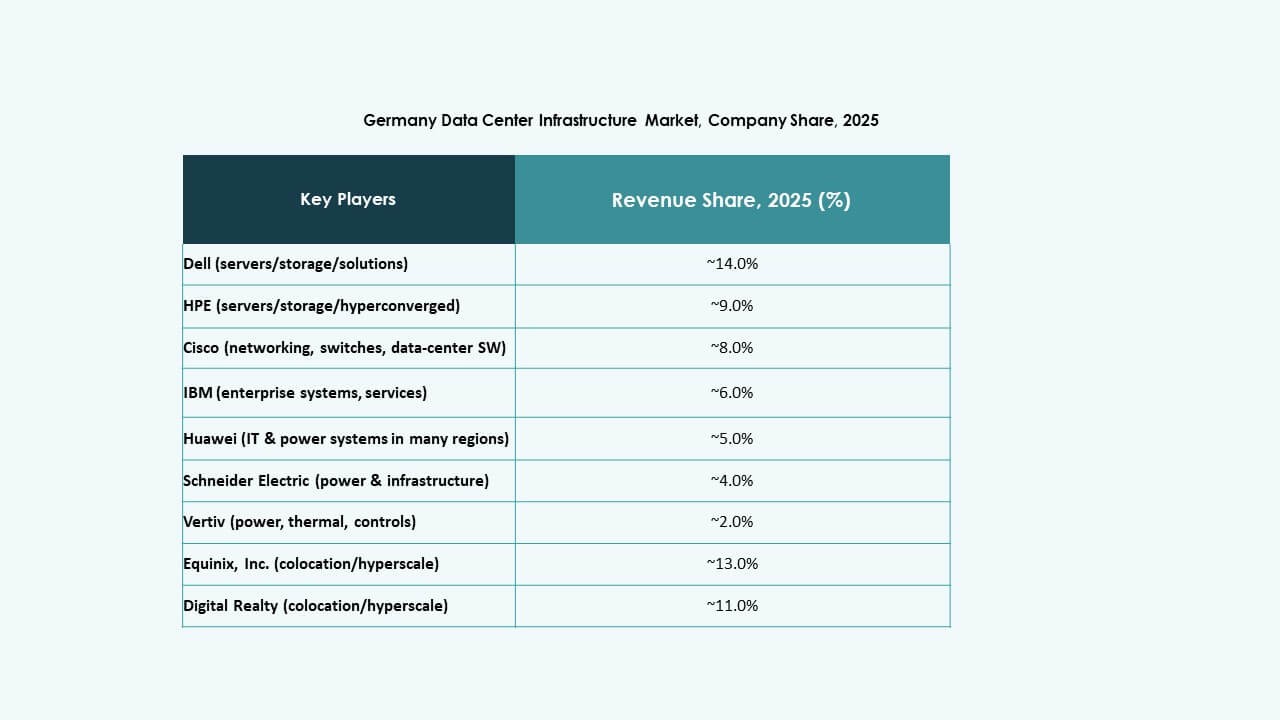

Major firms like Schneider Electric, Vertiv, ABB, Dell and Hewlett Packard Enterprise dominate core infrastructure supply, providing power, cooling, racks and servers. Networking specialists such as Cisco and Fujitsu supply critical switches and network gear supporting modern deployments. On the facility side, global operators such as NTT, Digital Realty and Equinix drive colocation and hyperscale presence in Germany. Company investments remain high in energy-efficient power systems, modular construction, and IT hardware to support AI and cloud workloads. It intensifies competition and pushes prices downward while broadening service offerings. The diverse mix of infrastructure suppliers and data-center operators creates a competitive environment that rewards efficiency, scalability and reliability. This environment attracts investors seeking stable returns and large-scale growth potential.

Recent Developments:

- In November 2025, Google revealed a major €5.5 billion investment plan for Germany that will extend into 2029. This significant capital commitment targets expanding data center infrastructure, AI capabilities, and office facilities across multiple German cities. The investment underscores Google’s commitment to strengthening digital infrastructure in Europe and advancing AI-driven technology integration.

- In May 2025, NTT DATA expanded its presence in the Germany data center infrastructure market by acquiring land in Frankfurt to develop its fifth data center site in the area. This new facility is expected to add an additional 80MW of IT capacity, reinforcing Frankfurt’s role as a key location for high-capacity, secure infrastructure supporting hyperscalers and enterprises.

- In May 2025, Portus announced the construction of a new 5.5 MW data center in Munich, Germany, as part of its growth strategy in the DACH region. This development follows Arcus Infrastructure Partners’ acquisition of Internet Port Hamburg and consolidation into Portus, aiming to meet the increasing demand for sustainable, high-performance, and low-latency IT infrastructure.

- In March 2024, NTT DATA strengthened its presence in the region further with the acquisition of a 10.8-hectare site near Berlin to support a planned 96MW capacity across two new data centers. This development marks NTT’s third data center campus in the broader EMEA region and signals ongoing investment in German Tier 1 and Tier 2 markets.

Market Drivers

Market Drivers Market Trends

Market Trends Market Opportunities

Market Opportunities Regional Insights

Regional Insights