Executive summary:

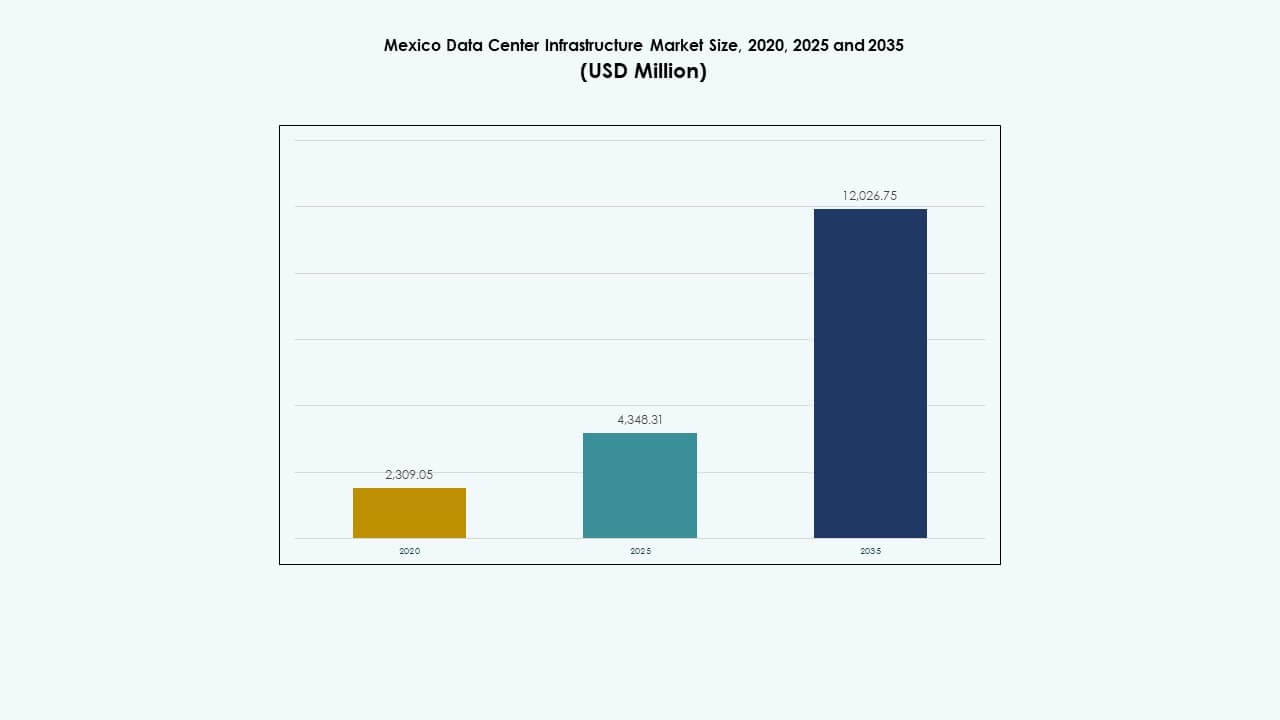

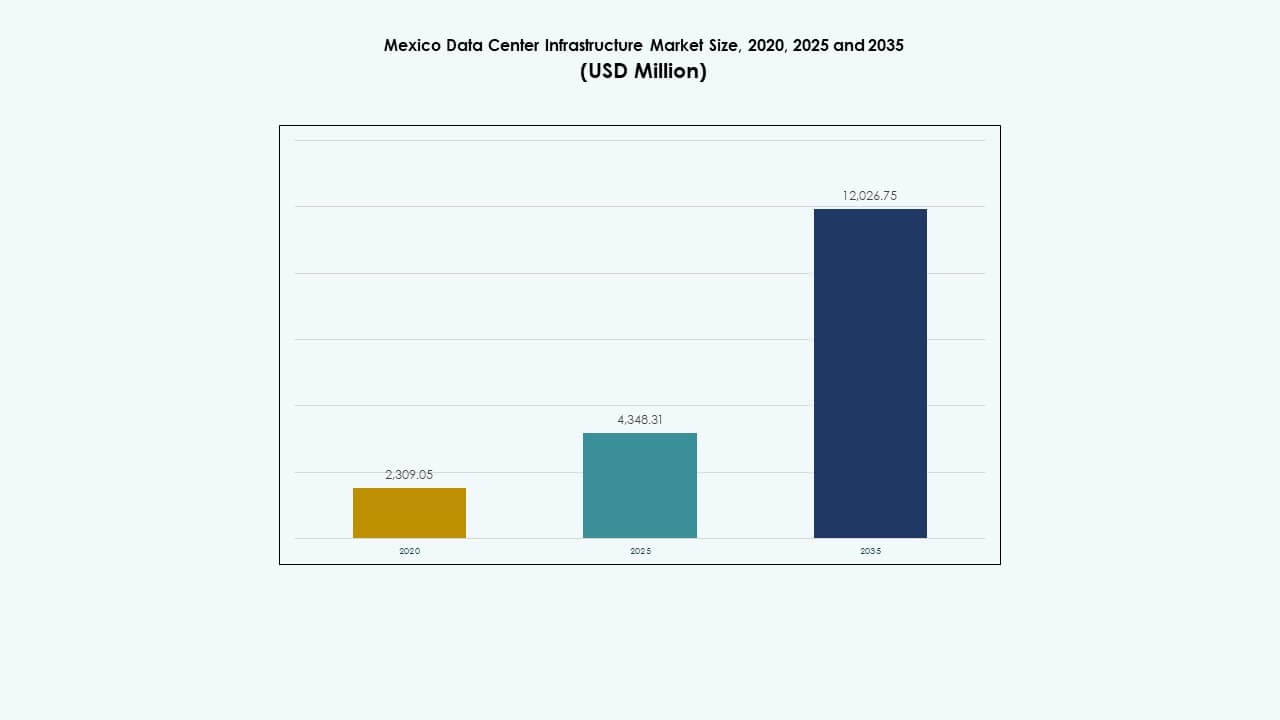

The Mexico Data Center Infrastructure Market size was valued at USD 2,309.05 million in 2020, reached USD 4,348.31 million in 2025, and is anticipated to reach USD 12,026.75 million by 2035, at a CAGR of 10.63% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Mexico Data Center Infrastructure Market Size 2025 |

USD 4,348.31 Million |

| Mexico Data Center Infrastructure Market, CAGR |

10.63% |

| Mexico Data Center Infrastructure Market Size 2035 |

USD 12,026.75 Million |

Strong demand for digital transformation, cloud computing, and AI integration drives infrastructure expansion across Mexico. Enterprises adopt scalable, energy-efficient systems to improve operational continuity and data processing capacity. Investment in hyperscale and colocation facilities accelerates modernization, while green technologies reduce energy intensity. It holds strategic importance for investors seeking stable digital infrastructure growth and sustained enterprise demand across industries like telecom, banking, and e-commerce.

Central Mexico, particularly the Mexico City region, leads the market due to strong connectivity and enterprise concentration. Northern states such as Querétaro and Monterrey emerge as high-growth zones, driven by cross-border trade and industrial expansion. Southern regions gain traction through renewable-powered data centers and growing network penetration. The country’s balanced mix of connectivity, energy access, and enterprise clusters reinforces its position as a regional digital hub.

Market Drivers

Market Drivers

Rapid Digital Transformation and Enterprise Cloud Migration Fuel Infrastructure Expansion

The Mexico Data Center Infrastructure Market grows due to rapid enterprise digitalization and large-scale cloud migration. Businesses seek localized infrastructure for lower latency and regulatory compliance. Rising adoption of SaaS and hybrid platforms drives higher compute demand across financial, telecom, and e-commerce sectors. Multinationals deploy hyperscale facilities to meet AI and IoT workloads. Edge computing adoption further strengthens distributed network investments. It benefits from government efforts promoting digital resilience and broadband coverage. Investors recognize steady returns from expanding service needs. This environment fosters robust infrastructure growth and modernization.

- For example, in January 2025, Amazon Web Services (AWS) announced a $5 billion investment to launch its New Mexico (Central) Region in Querétaro. The hyperscale region includes three Availability Zones to provide local data storage, lower latency, and advanced cloud services supporting Mexico’s digital transformation.

Rising AI, Big Data, and Analytics Demand Driving High-Performance Infrastructure Investments

AI workloads and analytics drive stronger infrastructure investments to support scalable and resilient operations. Enterprises implement GPU-based servers and high-density racks to manage complex computing processes. Telecom operators modernize core systems to deliver faster data throughput. The Mexico Data Center Infrastructure Market benefits from AI-driven demand shaping network and storage capabilities. IT service providers prioritize liquid cooling and energy-efficient power systems. Financial and retail sectors adopt advanced data processing for predictive operations. It positions the market as a core hub for AI innovation in Latin America. Investors view it as a long-term growth enabler.

- For example, in September 2024, Microsoft confirmed a $1.3 billion investment to strengthen its cloud and AI infrastructure in Mexico, centered on launching the Azure Mexico Central region in Querétaro. The initiative supports national digital transformation and expands access to AI, cloud, and cybersecurity services for local enterprises and public institutions.

Energy Efficiency and Sustainability Goals Strengthen Investment Momentum

Sustainability goals accelerate adoption of energy-efficient systems across new builds and retrofits. Operators replace legacy UPS and cooling systems with low-emission alternatives. Smart energy management platforms integrate renewable sources for grid stability. The Mexico Data Center Infrastructure Market aligns with global carbon reduction targets, boosting green investments. Developers adopt modular designs to cut operational energy intensity. It attracts sustainability-focused investors and enterprise clients seeking ESG-compliant data operations. Clean power policies encourage long-term investment confidence. This shift positions the country as a responsible data hub within the region.

Strengthening Connectivity and Strategic Location Support Cross-Border Expansion

Mexico’s proximity to the United States enhances its role as a nearshore data hub. Cross-border fiber routes and submarine cable systems raise network reliability and speed. The Mexico Data Center Infrastructure Market gains value through improved redundancy and direct cloud interconnections. Global hyperscalers deploy edge nodes to serve both North and Latin America. It benefits from competitive energy pricing and industrial park availability. Strategic positioning draws multinational cloud and telecom players. Strengthened 5G deployment supports higher data volumes. This infrastructure foundation secures Mexico’s status as a key regional technology bridge.

Market Trends

Market Trends

Growing Adoption of Modular and Prefabricated Data Center Designs

Modular construction emerges as a key trend supporting rapid scalability and lower capital expenditure. Developers deploy prefabricated modules for faster deployment and flexible site planning. The Mexico Data Center Infrastructure Market integrates factory-built systems to meet time-sensitive client demands. It ensures consistent quality and reduced on-site construction risk. Operators use modularity to support tier upgrades and power expansions. This trend aligns with sustainability goals through reduced material waste. Scalable prefabrication supports smaller edge and enterprise data centers. The model promotes faster rollout of regional capacity across emerging cities.

Integration of AI and Automation for Predictive Data Center Management

AI-driven automation transforms operational efficiency through predictive monitoring and maintenance. Machine learning tools optimize cooling, energy consumption, and load balancing. The Mexico Data Center Infrastructure Market leverages AI to minimize downtime and improve power utilization. It supports real-time fault detection and automated resource allocation. Data centers deploy digital twins for scenario testing and infrastructure modeling. Intelligent control systems help reduce human error and enhance reliability. The shift to smart automation strengthens uptime performance. Businesses adopt AI-managed operations to meet growing data and energy demands effectively.

Shift Toward Edge Data Centers to Support 5G and IoT Ecosystems

Edge data centers gain prominence to deliver ultra-low latency for connected devices and 5G networks. Telecom providers build smaller, distributed nodes near population centers. The Mexico Data Center Infrastructure Market evolves with rising edge deployments supporting industrial IoT and autonomous systems. It enables local processing to reduce bandwidth strain. Manufacturing and logistics sectors rely on localized analytics to improve response speed. Edge expansion diversifies investment beyond large metros. It strengthens nationwide digital infrastructure coverage. This movement supports real-time applications across transportation, healthcare, and retail networks.

Expansion of Renewable-Powered and Carbon-Neutral Data Centers

Developers integrate renewable energy sources into operational frameworks to meet sustainability commitments. Solar and wind-based power purchase agreements support clean operations. The Mexico Data Center Infrastructure Market adopts low-PUE designs aligned with global energy standards. It accelerates green certifications for facilities targeting zero-carbon goals. Operators invest in heat-reuse technologies and water-efficient cooling systems. Renewable integration also attracts ESG-driven investors. Power grid modernization improves reliability and availability for green data parks. These practices redefine long-term operational efficiency and market competitiveness.

Market Challenges

Power Supply Constraints and Grid Reliability Affecting Large-Scale Deployments

Energy supply reliability remains a primary challenge for expanding capacity. Certain industrial zones face intermittent power shortages or aging grid infrastructure. The Mexico Data Center Infrastructure Market faces hurdles due to uneven energy distribution. It prompts operators to install on-site generators and backup energy storage systems. Grid modernization programs progress slowly in remote areas. Permitting delays for high-capacity connections create project bottlenecks. Investors face higher costs linked to redundant systems and fuel-based backup plans. Reliable energy integration remains essential for consistent service delivery and expansion planning.

Complex Regulatory Procedures and Limited Skilled Workforce Slowing Development Pace

Developers often face complex permitting, environmental, and land-use regulations. The Mexico Data Center Infrastructure Market must navigate multi-agency approvals that delay construction timelines. It also experiences shortages of skilled professionals in data center design and critical systems maintenance. Talent gaps in electrical engineering and network optimization slow adoption of advanced technologies. Companies invest in workforce training to mitigate risks. Land acquisition and zoning conflicts create additional legal complexities. Infrastructure delays discourage foreign direct investment. Streamlined regulatory frameworks remain essential for sustainable industry growth.

Market Opportunities

Market Opportunities

Rising Hyperscale and Cloud Expansion Creating Long-Term Investment Potential

The expansion of hyperscale infrastructure creates major investment prospects for developers and operators. Cloud providers establish new campuses to serve enterprise and public workloads. The Mexico Data Center Infrastructure Market gains traction as firms localize storage for compliance and latency reduction. It attracts institutional investors focused on stable digital asset returns. Opportunities arise in renewable integration and modular expansion. Telecom partnerships further enhance connectivity ecosystems. This growth outlook reinforces Mexico’s emergence as a digital powerhouse in Latin America.

Expansion of AI, IoT, and Smart Infrastructure Strengthening Innovation Ecosystem

Integration of AI, IoT, and smart city initiatives generates demand for robust digital foundations. The Mexico Data Center Infrastructure Market benefits from smart infrastructure rollouts across logistics, manufacturing, and public services. It supports analytics-driven decision-making and real-time control systems. Edge computing and automation foster innovation-led growth. Investment incentives support localized production and technology adoption. The ecosystem attracts startups and multinationals investing in smart networks. This evolution unlocks new avenues for digital transformation and infrastructure innovation.

Market Segmentation

By Infrastructure Type

Electrical infrastructure dominates the Mexico Data Center Infrastructure Market due to heavy reliance on continuous power supply. It ensures stable operations and optimal uptime across hyperscale and enterprise facilities. Mechanical and IT infrastructure segments also witness strong growth from AI and high-density computing needs. Civil and structural systems evolve with modular construction trends. Integrated power and cooling networks sustain long-term efficiency.

By Electrical Infrastructure

Uninterruptible Power Supply (UPS) and Power Distribution Units (PDUs) hold the largest share due to their critical role in uptime assurance. The Mexico Data Center Infrastructure Market prioritizes high-efficiency UPS and battery systems to stabilize energy output. Transfer switches and switchgears gain adoption for redundancy management. Utility grid integration and renewable-based storage gain traction. Advanced battery energy systems emerge as vital backup resources.

By Mechanical Infrastructure

Cooling units such as CRAC and CRAH systems dominate mechanical investments. The Mexico Data Center Infrastructure Market emphasizes precision cooling to control high-density rack heat. Air- and water-cooled chillers gain traction for energy optimization. Containment systems and pumps improve airflow management. Efficient cooling solutions directly enhance operational reliability. Energy-conscious designs reduce lifecycle costs and carbon impact.

By Civil / Structural & Architectural

Superstructures and modular building systems lead this segment, enabling faster deployments. The Mexico Data Center Infrastructure Market uses prefabricated frames and raised flooring systems for design flexibility. Site preparation and foundations remain vital for seismic resilience. Sustainable materials lower carbon impact. Modern cladding and envelope designs improve insulation and airflow. These trends create durable, scalable, and efficient data campuses.

By IT & Network Infrastructure

Servers and storage units represent the largest subsegment driven by AI and analytics workloads. The Mexico Data Center Infrastructure Market focuses on faster interconnects through optical fiber cabling. Networking equipment upgrades strengthen low-latency performance. Rack and enclosure systems evolve to support dense architectures. IT modernization ensures higher reliability for mission-critical applications. This segment remains the backbone of data processing efficiency.

By Data Center Type

Hyperscale facilities dominate Mexico’s data center landscape due to global cloud expansion. The Mexico Data Center Infrastructure Market benefits from hyperscaler investment supporting regional traffic growth. Colocation centers attract enterprise clients demanding secure and scalable environments. Edge data centers rise in relevance for real-time applications. Enterprise and modular data centers maintain steady expansion across industrial zones.

By Delivery Model

Design-Build and Turnkey models dominate due to time-sensitive deployment needs. The Mexico Data Center Infrastructure Market values EPC expertise for large-scale projects. Construction management remains vital for complex, multi-phase developments. Retrofit projects modernize older facilities to current efficiency standards. Modular factory-built designs provide fast, cost-effective deployment.

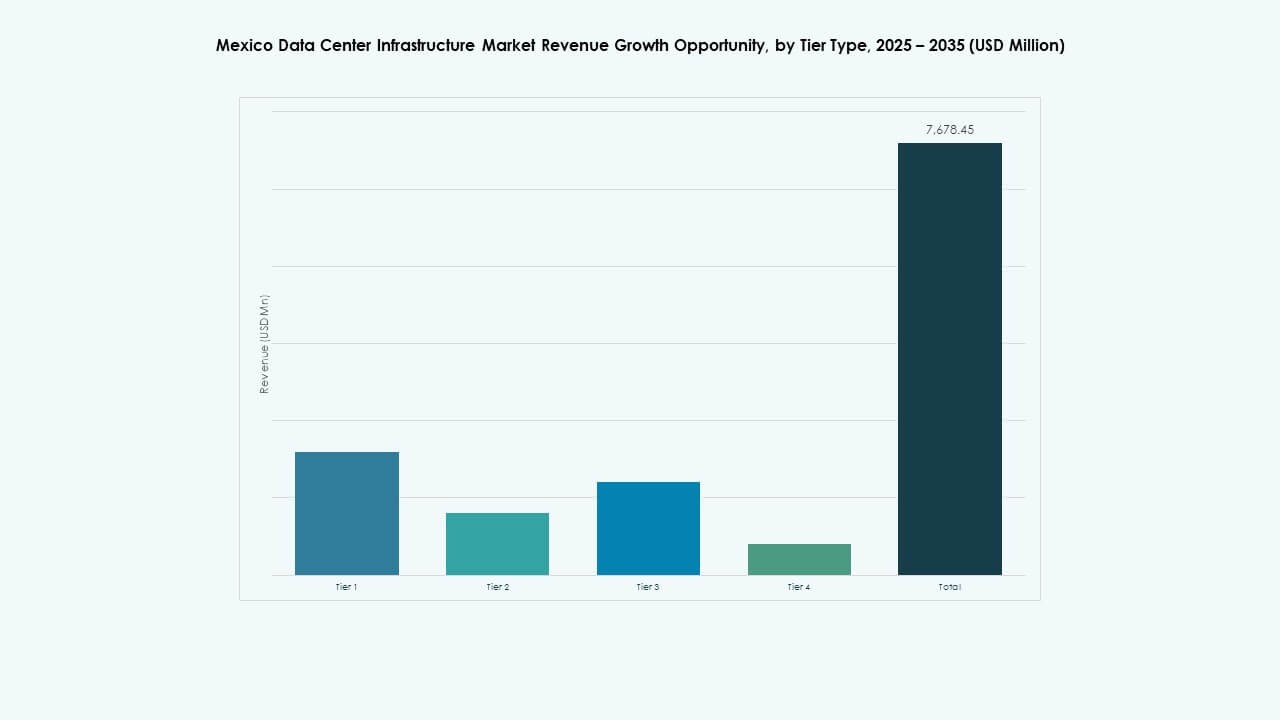

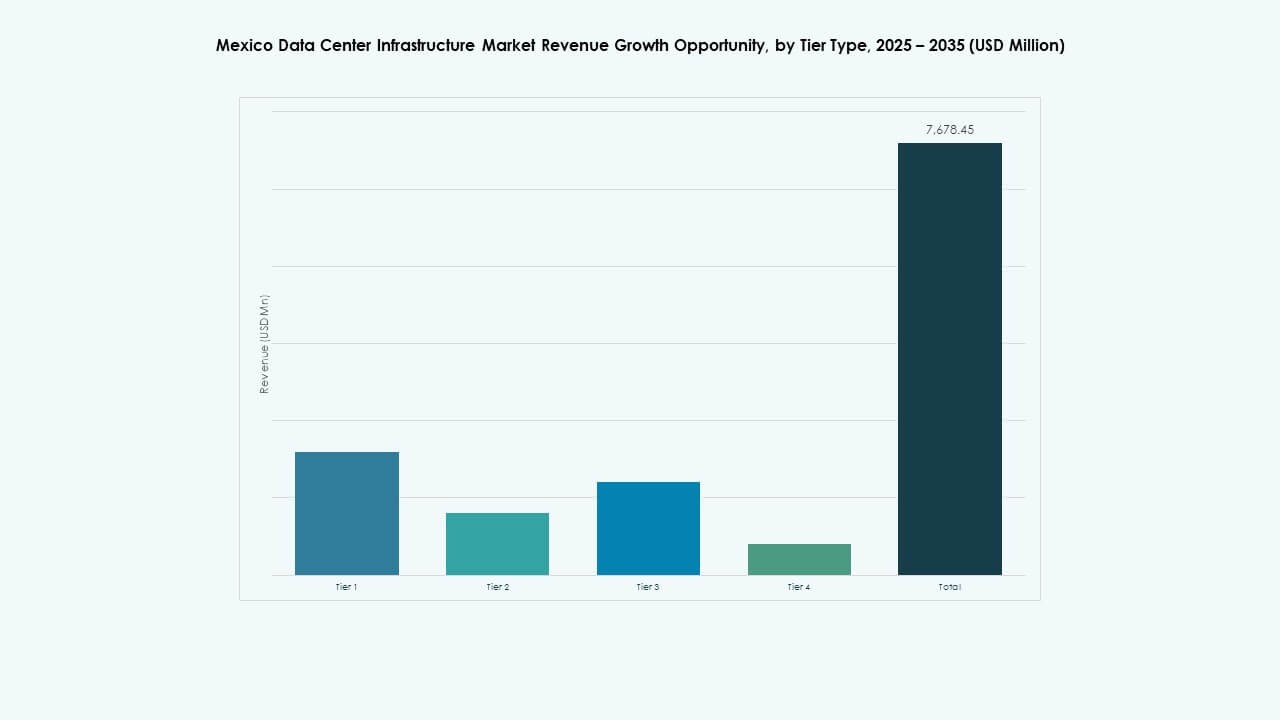

By Tier Type

Tier 3 data centers hold the largest market share due to strong uptime guarantees. The Mexico Data Center Infrastructure Market also witnesses growing adoption of Tier 4 systems offering fault tolerance. Tier 2 and Tier 1 centers support localized operations for smaller businesses. The market trend moves toward higher-tier certifications for compliance and reliability.

Regional Insights

Central Mexico Dominates the National Data Center Infrastructure Landscape

Central Mexico holds about 58% market share, driven by dense enterprise clusters and power access. The Mexico Data Center Infrastructure Market thrives around Mexico City due to strong network connectivity and fiber density. Hyperscale providers and colocation operators expand in this zone for proximity to clients. Industrial hubs nearby benefit from quick access to energy and logistics networks. It continues to attract the highest investment volumes across Latin America.

Northern Mexico Emerging as a Strategic Cross-Border Data Corridor

Northern Mexico commands roughly 25% market share due to its proximity to the U.S. border. The Mexico Data Center Infrastructure Market gains traction through cross-border connectivity and trade infrastructure. Monterrey and Chihuahua host growing industrial data parks. It supports nearshoring trends and enterprise relocation from North America. New fiber routes enhance redundancy for regional operations. The region’s low operational cost boosts long-term competitiveness.

- For example, Equinix operates a major data center in Monterrey, which serves as a key colocation and connectivity hub for cross-border enterprises. This supports the nearshoring trend, providing vendor-neutral interconnections to thousands of clouds and networks.

Southern and Western Regions Gaining Investment Through Renewable Integration

Southern and Western Mexico jointly account for nearly 17% of the market. The Mexico Data Center Infrastructure Market benefits from renewable power integration, including wind and solar. States such as Jalisco and Yucatán attract green data projects supported by incentives. It supports growing regional cloud service use. Improved transport and fiber access open new markets for development. This transition diversifies national capacity and enhances digital resilience.

- For example, in February 2025, ODATA, an Aligned Data Centers company, energized 200 MW of IT power at its DC QR03 campus in Querétaro, Mexico. The project represents an investment of over $3 billion and is planned to expand to 300 MW total capacity, making it one of the largest data center developments in Latin America.

Competitive Insights:

Competitive Insights:

- Ascenty

- Dell

- Equinix

- IBM

- ODATA (Aligned Data Centers)

- KIO Networks

- CloudHQ

- Telmex / Triara

- HostDime

- Alestra

- Vertiv

The Mexico Data Center Infrastructure Market includes both global giants and strong regional firms competing for capacity, connectivity, and service quality. Large providers such as Ascenty, Equinix and ODATA lead in hyperscale colocation and interconnection services supported by systemic fiber-optic networks and global cloud integration. Regional players like KIO Networks, CloudHQ, Telmex/Triara and HostDime focus on localized data centers, tailored connectivity and edge deployments to serve domestic enterprises. Alestra and similar telecom-backed providers offer integrated cloud and network services, expanding reach to SME and enterprise customers. Competition centers on facility reliability, energy efficiency, latency reduction and regulatory compliance. Growing demand for cloud, AI workloads and hybrid infrastructure drives firms to scale capacity quickly. The competitive mix creates a diversified ecosystem that attracts both global cloud players and local enterprises.

Recent Developments:

- In October 2025, Equinix Inc. launched a new flagship data center facility in Monterrey, northern Mexico, called Equinix MO2. This facility adds more than 30,000 square feet of colocation space, aiming to support the growing demand for modern data center infrastructure in the region.

- In September 2025, American IT company CloudHQ announced a significant $4.8 billion investment in Mexico, planning six new data centers in the state of Querétaro. This move is part of a broader effort to expand digital infrastructure with collaboration from local energy authorities to support grid expansion and renewable energy integration.

- In April 2025, ODATA, an Aligned Data Centers company, announced the launch of its largest data center facility in Mexico at the DC QR03 campus located in Querétaro. This new development represents over a $3 billion investment and will offer up to 300 megawatts of IT capacity when fully completed, featuring their proprietary Delta Cube cooling technology for improved efficiency and sustainability.

- In January 2025, Amazon Web Services (AWS) declared a $5 billion investment plan for Mexico, including the launch of a new server region in Querétaro. This initiative is part of a long-term commitment spanning 15 years to strengthen AWS’s infrastructure presence in the country and support cloud adoption.

Market Drivers

Market Drivers Market Trends

Market Trends Market Opportunities

Market Opportunities Competitive Insights:

Competitive Insights: